Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

What is a retail Investor?

People like you and me investing their own money!

It’s non institutional investors that have access to the stock market through retail investing products.

Not so long ago, looking at how to trade or invest in the stock market wasn’t something that many of us would concern ourselves with.

Why? Well, as much as we’d all have loved to get in on the action, and cash in on the returns, it always seemed out of reach and then came technology.

Back in the day you probably found that owning a single share in the likes of Apple, Amazon, and Tesla was just a pipe dream or totally unaffordable.

That’s something that has, thankfully changed. Today, with technology it has never been easier to invest.

By reading on, you’re going to discover all about what retail investors are and how you can become one yourself. We’ll also give you the heads up when it comes to some of the risks that are involved, and how you can avoid them.

As you’ll see, if you decide to go down this route, you certainly won’t be alone there are millions of investors like you out there and you’re joining a new movement that’s increasing in popularity.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

Table of Contents

So, what is a retail investor?

When you look at the traditional approach to investing, it tends to have a certain image attached to it. It brings up thoughts of the likes of Warren Buffet and other members of the super-rich elite.

There are often news stories about the huge institutional money managers who invest unbelievable sums of money (and make just as unbelievable returns).

When looking at retail investors, or as they’re also known as DIY investors, you’d need to start by exploring hedge funds, as this is where we’ve all come from.

A hedge fund is generally considered as an investment vehicle for high net worth individuals.

A retail investor isn’t involved with hedge funds or big financial institutions. Indeed, retail investors don’t even need to be particularly wealthy.

Instead, they look for opportunities to trade or invest in stocks by using platforms that can be accessed by private individuals.

It may take retail investors a little while to grasp the stock market basics, but once they do, they have access to some great opportunities.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

The key differences between institutional and retail investors

We’ve already hinted at some of the differences between retail and institutional investors, but it’s important to look at this a little further.

Why? Well, if you’re wanting to know how to start investing, it’s worth knowing the position that you’re starting from compared to professional investors.

This will have an impact on what you’re likely to achieve and what aims you should be pursuing.

Let’s take a look at the key differences now:

A retail investor

Generally, with retail investors, you will find that:

- They are using their own money to invest. This is likely to come from savings or disposable income that they have

- Investments are usually made via online trading platforms. We’ll be exploring some of these a little later

- Using an online platform can often expose retail investors to minimum fees. This is usually because the platforms have many members and can leverage this to their benefit

- As a retail investor, there is not the same level of reporting requirements that institutional investors face.

Institutional investors

In contrast, institutional investors will usually:

- Have money pooled together by the likes of hedge funds, endurance companies, and pension funds. This money is then invested on their behalf

- Be behind some of the biggest trades made. These are so large, and significant, that they can have a huge impact on share prices

- Have access to low fees because of how regularly they trade, and how much money is involved

- Analyse more data mainly because of the fact that they have access to more than a retail investor does

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Who are the retail investors in the UK?

You may be wondering what type of people have taken the steps to learn about stock market basics in the UK.

The truth is that these are just average people. There is nothing unique. They are just people who have made a decision and then acted upon it.

The platform, Freetrade, carried out its own research to find out more about its users, and this is what it found out:

- 61.57% of users are under 35 years old

- 21.92% of these are aged 18 to 25

- Just over 23% of investors on the platform are female

- Around 67% of users have no financial dependants

- Only 5.39% of investors class themselves as experienced

- Almost 60% said that they were first-time investors

What can be taken away from this research is that Millennials and Generation Z make up most of the retail investors in the UK.

It also shows that females’ attitudes have changed as, according to Freetrade, in 2019 females users only made up 10% of their customer base.

Why the boom in retail investing?

There has been a significant rise in the number of retail investors in the UK since 2020.

When you look at the year that this boom started, it is perhaps unsurprising. The year that Covid-19 began to take hold saw many people reassessing their lives and their finances.

The work-from-home culture meant that people had more time to explore how to start investing.

Also, with no one sure how the job market would be at the end of lockdowns, some wanted to create a financial cushion should the worst happen.

Of course, there is more to this boom than just the pandemic. Technology has played its part too!

Financial technology companies (Fintechs) have developed websites and mobile apps that have brought investing to the masses rather than the select few.

We’re going to explore some of these shortly but, without a doubt, they are behind the retail investing boom.

While the pandemic may have opened people’s eyes to what is on offer, now the technology has been experienced, it is unlikely that people will now turn away from retail investing.

In fact, even traditional financial institutions, such as Barclays, state that the uptake in retail investing is here to stay and even grow.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

How are retail investors impacting the market as a whole?

We’ve seen the rise in retail investors but they are now having a sizeable impact on the marketplace too.

In the not too distant past, a look at who held shares would have revealed that they were all owned by financial institutions such as pension funds, hedge fund managers, and other investment firms.

The growth in the number of investing platforms has led to significant change.

Research by Finder shows that individual retail investors now own 13.5% of UK shares. Its report reveals that as many as 33% of those in the UK now own shares.

It also reaffirms the opinion shared by Barclays that retail investing is set to experience continued growth.

It states that 75% of Gen Z and 74% of Millennials are geared up to continue investing.

Gen Z was born with smartphones and iPads stuck to their hands so they often are more drawn to fun trading platforms and tend to be more financially aware of their futures.

Investing is now so available you can begin investing with as little as £1 in places. We’ve written a post about the effects of investing as little as £150 a month can have over 10 years.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Are there any risk for retail investors?

When you first start looking into how to trade or invest in a stock, you will probably have come across the same warnings on every website.

Certainly, those that offer trading and investing are obliged by law to point out that trading carries risks.

The warning will usually be along the lines of stating that you need to be aware that values can go up as well as down.

You will also see warnings around contract for differences (CFDs). These warnings make clear that the majority of retail investors lose money within CFDs. We’ve listed the best platforms for CFDs here.

Something that retail investors need to be aware of when looking at how to start investing, is hype! Investing can be a dangerous experience if you get drawn in by all of the hype surrounding it.

Getting carried away with the excitement of investing can see emotional, rather than logical, decisions being made. Invariably, this will lead to losses.

We don’t want to see you experience what other retail investors have!

It is too easy to jump into an investment because you’ve read a post on Reddit or Twitter. Often these posts won’t contain the information that you really need to make an investment decision.

You can explore our investing for beginners page and pick up the knowledge you’ll need on how to pick stocks. We also have a new ebook ‘How to go About Investing’ available to download too.

Below we explore some of the best retail investing products available on the market today.

Example retail brokers

If you want to invest, then you’re going to need to at least learn the basics. You’re also going to need to find a decent platform that you can use.

You need to ensure that any investment platform that you look into is safe and secure. A must is that they are regulated by the Financial Conduct Authority (FCA).

Here’s a brief look at three of our favourite platforms that are well worth you taking the time to explore:

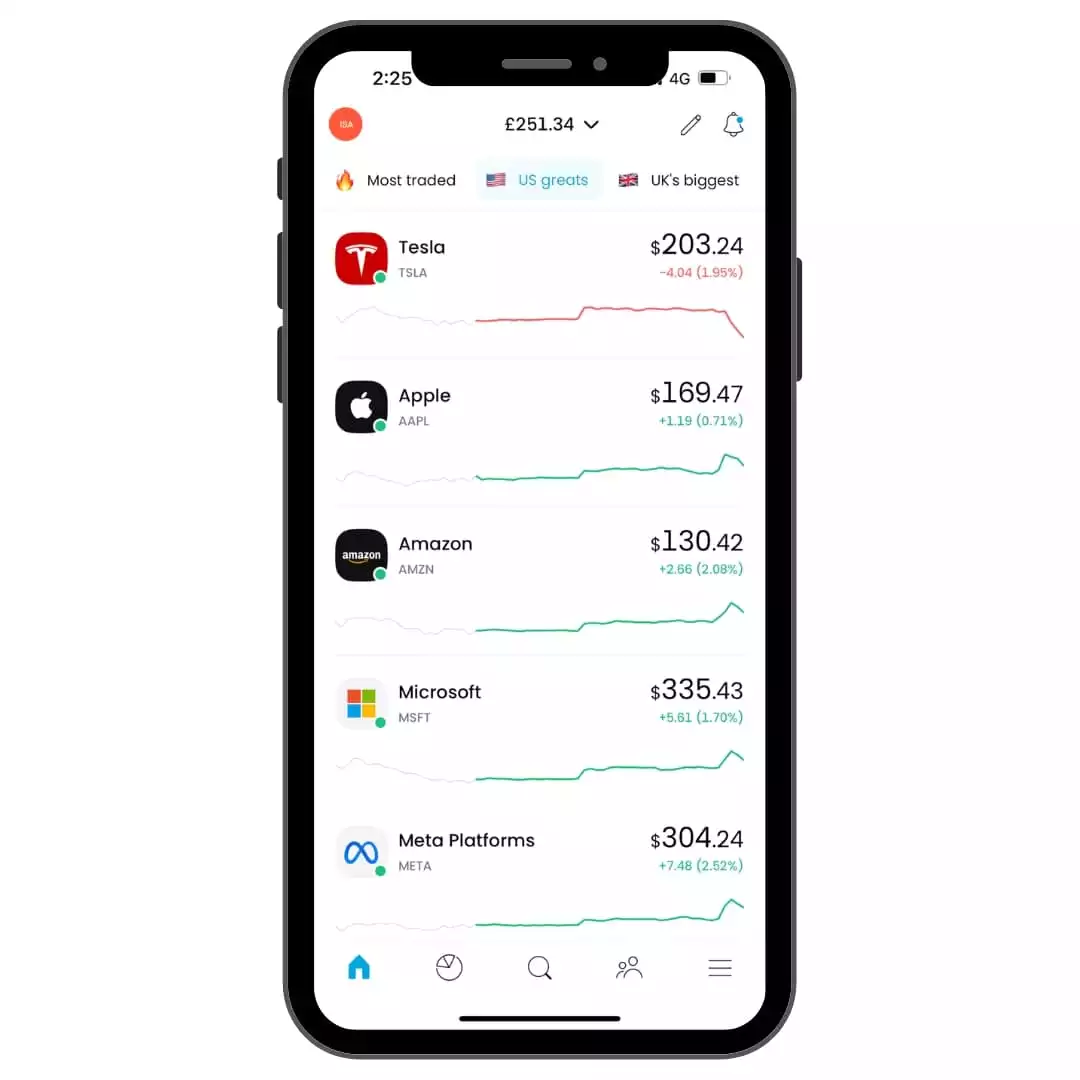

1. Freetrade

You will have seen us refer to Freetrade earlier when we referred to the research that this platform had carried out. It is extremely popular with UK individual investors, and for good reason.

For a start, Freetrade is regulated by the FCA and it is also covered by the Financial Services Compensation Scheme (FSCS).

This means that, should Freetrade cease to exist, up to £85,000 of your funds are protected. This is the same protection offered by banks.

The other great feature here is that you can invest in fractional shares. This means that you get the chance to own shares in a true giant.

While buying shares in Apple may be out of reach, you can buy just part of a share. You can invest with as little as £2 and choose from a huge selection of companies.

Freetrade allows the vast majority of trades to be made without any fees being charged. You are able to invest in UK stocks, stocks in the US, exchange-traded funds (ETFs), mutual funds, and investment trusts.

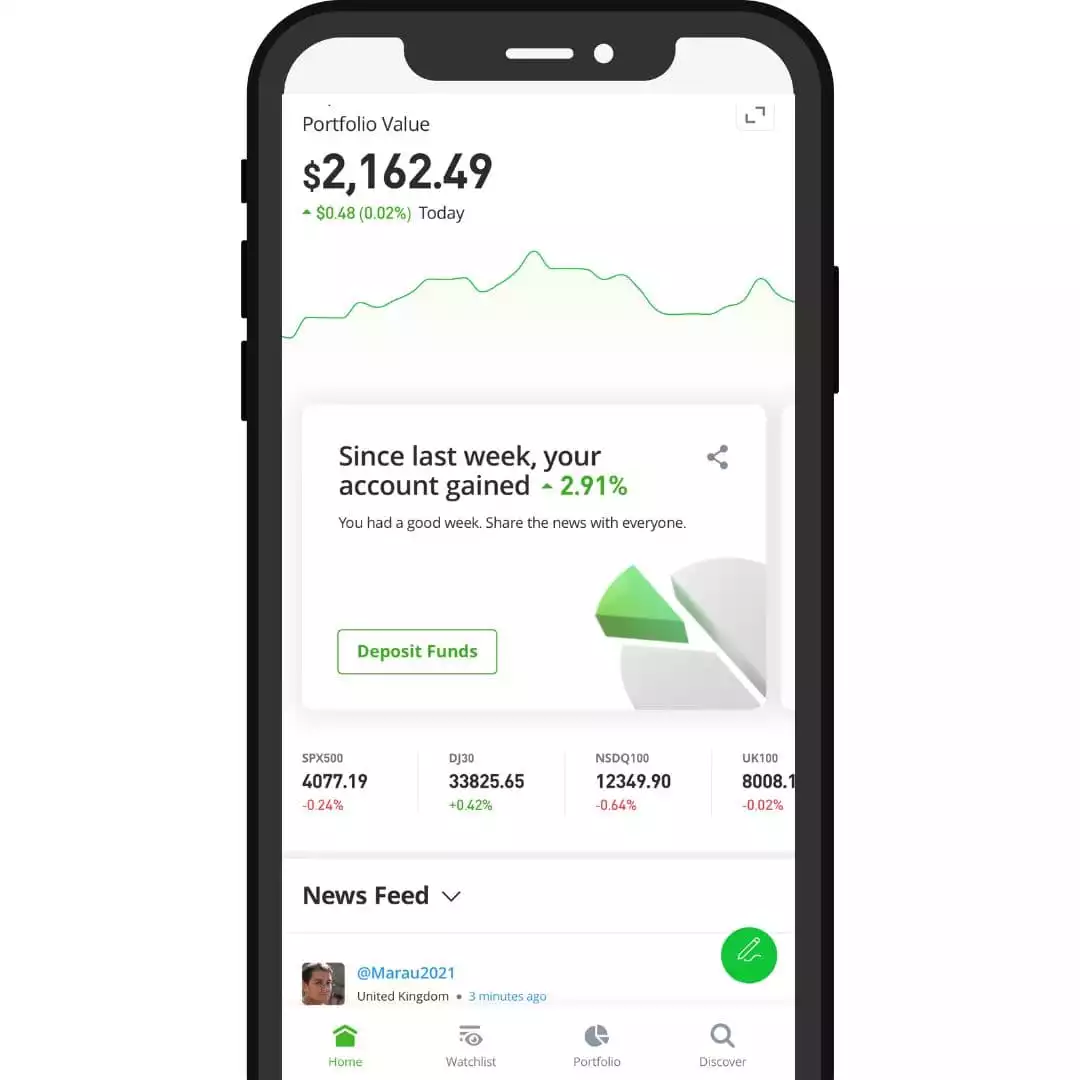

2. eToro

This is another platform that is extremely popular. Like Freetrade, eToro is also regulated by the FCA and FCSC.

It also allows investors to trade commission-free and this is one of the reasons that it is so popular with investors. Both UK and international stocks can be traded on both app and desktop versions.

A major attraction of eToro is the fact that it offers a copy trading feature. This allows others to see what other, successful, investors are doing.

You can then simply copy the investments that are being made. Of course, this still doesn’t guarantee that you will make money, but it can certainly help to increase your chances.

They also have an internal social media platform where users can follow their favourite investors or friends. It allows you to write posts, like and comment just like a Facebook or Twitter Feed.

eToro is one of the best examples on the market right now.

Something to be wary about at eToro is that it allows you to get involved with CFDs (we mentioned these earlier) and forex trading (buying and selling foreign currencies). While these activities have their place, they can be risky for beginners.

Read our full eToro review HERE.

3. Trading 212

Trading 212 is certainly worth a look. Since 2016, this platform has provided an easy to use mobile app that is perfect for beginners and those who are more experienced alike.

Something that we really like about Trading 212 is the demo account that it offers. With this, you can sign up and start investing with a virtual £50,000.

When looking at learning stock market basics in the UK, this is a great way of doing this without the risk of losing any money.

As you’d expect, seeing as how we’re recommending it, Trading 212 comes with the same protections in place. This means that you are covered by the FCA and FCSC just as you are with eToro and Freetrade.

As well as offering commission-free trading, this platform also comes with an auto-invest feature.

By setting up a plan, along with your goals, Trading 212 will automatically invest your funds and create a portfolio for you. This is a great feature for those who want to be a little more hands-off.

You can check out our best investing apps for the UK here.

FAQs

Do retail investors make money?

Yes, many retail investors deliver above average results, however, over half trade too often looking for short term gains which in turn can lead to heavy losses.

If you’re planning on investing always seek financial advice or educate yourself on basic investing decisions.

Is retail investing a job?

No, it is not a registered job as such but you can make it your primary source of income if you perform well over time. Most individuals will be retail investors alongside their day jobs.

Do retail investors lose money?

A recent study by eToro found that over 80% of individuals that day trade lose money. That’s why it’s hugely important to do your research and seek professional help before investing your money.

Conclusion

Most retail investors want to make change to their life now they can easily buy and sell stocks.

That’s where it’s important to take investment advice because there is risk when investing your money.

A financial professional can you reach your own personal finance goals and set you up to do well from the financial markets.

That’s why I think it’s vital that companies do what they can to protect retail investors by showing them what it means to buy and sell alongside setting them up with a diversified portfolio that can grow over the long term.

MORE LIKE THIS

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.