Best Pension Providers 2024

DISCOVER THE BEST private pension providers IN THE UK RIGHT HERE

Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Best UK Personal Pensions

We’ve put together a list of the best pension providers available in UK right now.

For me the best pension provider available on the market right now is Moneyfarm, however they do require a £500 minimum deposit.

If you’re self-employed or are looking for something with a lower minimum deposit then Penfold are the ones!

All of our selections offer private pension options with access to the UK stock market and the opportunity to buy or sell exchange-traded funds (ETFs), stocks and shares, bonds and index funds.

We cover both expert managed and self-invested pensions so there’s a suitable option for everyone!

All of our selections are regulated by the Financial Conduct Authority (FCA) and the Pensions Regulator (TFR).

Disclaimer: Please note that when you invest your capital is at risk. Up the Gains takes no responsibility for the investment decisions you make and advise you to seek independent financial advice before making an investment choice.

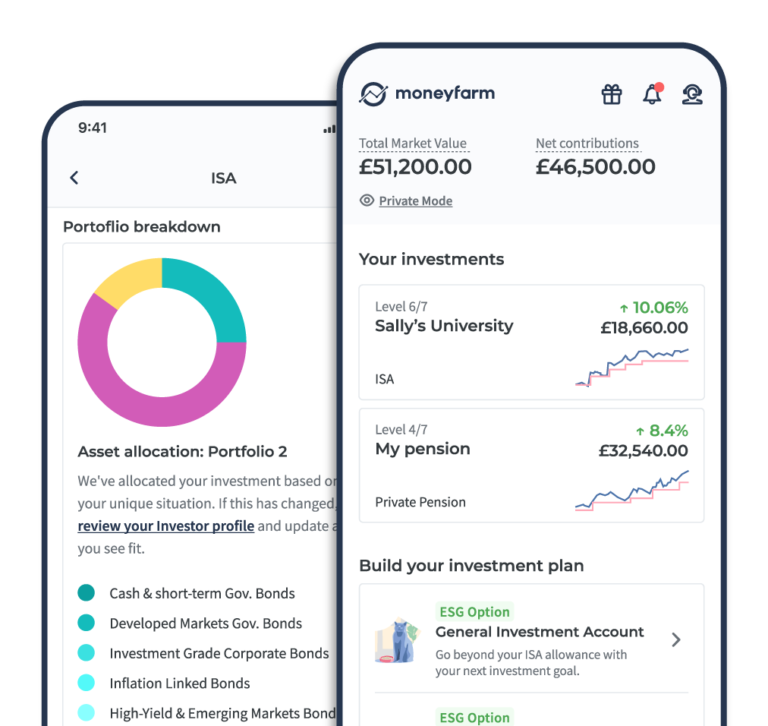

Moneyfarm

Key Features

- Expert managed personal pensions

- Platform Fee: 0.35-0.75%

- Minimum 1st deposit: £500

Moneyfarm is part of a new breed of investment platforms that offer robo-advisor services.

The initial deposit is higher than some of the other apps and this is because Moneyfarm wants to ensure you are serious about investing your money with them.

Moneyfarm provides free money advice to their users and an expert works with you when you sign up to select the right portfolio for you.

We’re big fans of Moneyfarm and make it our top personal pension provider right now.

T&C’s Apply. Capital is at risk

Wealthify

Key Features

- Easy to use personal pensions

- Platform Fee: 0.6%

- Mininum 1st deposit: £50

For those looking for a hands off but high quality pension provider look no further than Wealthify.

Wealthify really do keep it simple and are also part of the robo-advisor breed of investment brokers.

Their approach is to ask you questions based on your personal profile and tailor a strategy based on risk tolerance for you after this that you can change anytime.

Their personal pension also offers transfers with no hidden fees and just a fixed transfer fee which we liked.

T&C’s Apply. Capital is at risk

Hargreaves Lansdown

Key Features

- Established and trustworthy broker

- Platform Fee: 0.45%

- Min deposit: £100 lump sum or £25 a month

This award-winning broker has access to thousands of stocks, ETFs and index funds. HL is a widely used broker for retail investors and professionals.

We hold our own SIPP (private pension) with Hargreaves Lansdown as it has extensive research available for each asset.

They also offer fantastic customer service, with personal account management and financial planning available alongside a more comprehensive suite of services.

T&C’s Apply. Capital is at risk

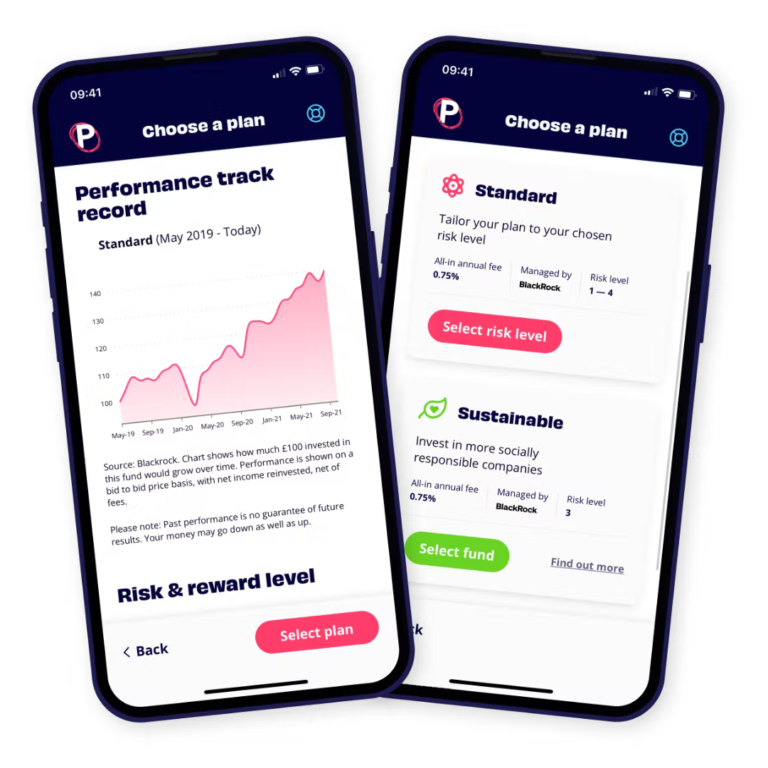

Penfold

Key Features

- Modern day pension pots

- Platform fee: 0.88% - 0.75%

- Min deposit: £10

Penfold makes pensions for everyone not just the self-employed. It’s got a super easy sign up process which takes just 5 minutes.

There are four investment options to choose from including lifetime, standard, sustainable and sharia.

Their pension transfer system has excellent reviews and can also track ones that might be lost or forgotten.

It really does keep things simple and allows you to get back to focusing on what’s important in life while increasing your pension pot.

T&C’s Apply. Capital is at risk

Moneybox

Key Features

- Over 6000+ assets to choose from

- Platform fee: 0.45%

- Minimum 1st deposit: £1

Moneybox is one of the most popular low cost ISA providers and investment apps in the UK. The app is fantastic and has so many great features to help savers and investors.

The investing arm of the business gives you access to some of the worlds best ETFs, funds and stocks so you have a suite of products to choose from.

They offer self and expert managed options so they really do cater for all types of investors.

They also offer the ability to round-up purchases directly into your chosen accounts alongside personal pensions and more!

T&C’s Apply. Capital is at risk

The Ultimate Guide to the best Pension Providers UK

What is a pension?

A pension is a pot of money that you can access when you retire. You build it up throughout your working life to ensure you live comfortably in your older years.

Although retirement is a long way off for many thinking forward now can help make those years much easier. Think of your pension as an income stream once you stop working.

It’s essentially a savings account that grows over time. You can invest it, save it and even receive tax relief from the government on your contributions.

The only difference to a standard investing or savings account is that it’s locked in until you reach 55 (soon to be 57) and cannot be touched unless there are exceptional circumstances.

Types of pensions

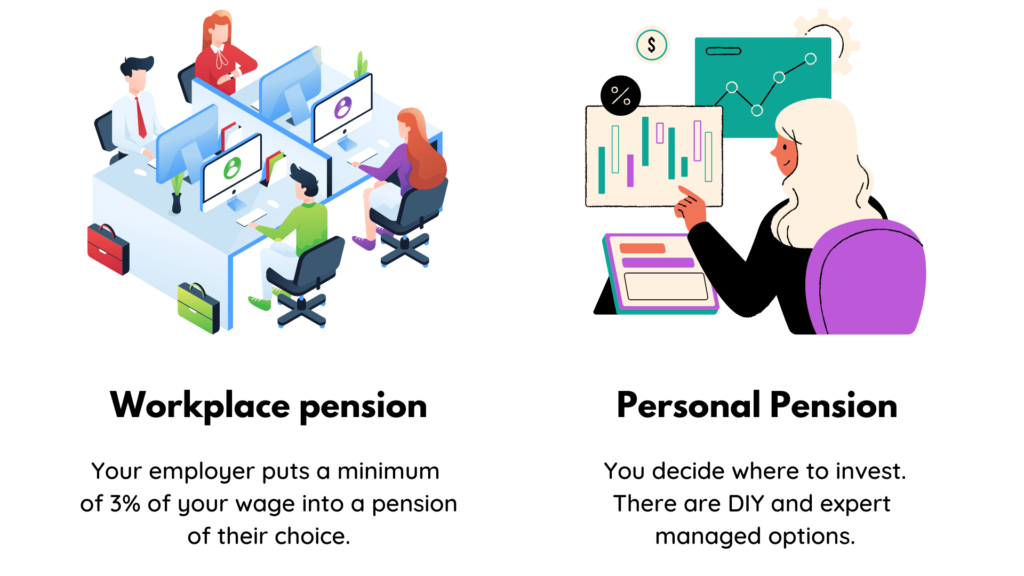

There are two main types of pensions. A private pension and a workplace pension.

Workplace pension

A workplace pension is a scheme set up by your employer that you both contribute to monthly. Yes, it’s literally free money!

By law, your employer must contribute at least 3% of your monthly salary and so if you matched that or even put 5% in you’re putting away a healthy amount.

Some employers also offer matched contributions up to certain amount. I’ve known some businesses go up to 10%, which is a handsome wedge going into your pension pot.

Workplace pensions’ downside is that your employer picks the provider, and 99% of the time, won’t pay directly into your personal pension.

You also get tax relief on your workplace pension, which is where you pay no income tax or national insurance on your pension payments. More on this shortly.

State Pension

The government will provide you with a state pension which is free income based on your national insurance contribution.

Depending on when you were born, you will be able to get your state pension at the age of 66-68. Essentially the threshold is increasing due to longer life expectancies (and a tight government – sssh, we didn’t say that).

The current state pension amount is £185.15 a week, and you are entitled to this money alongside a personal or workplace pension.

However, if you plan on solely relying on a state pension, this amount is unlikely to be enough to cover all your costs, so it’s wise to consider increasing your pension pot from an early age.

Personal Pensions Or Private Pensions

You can also set up a personal pension where you manage your own money and contributions in your own way.

What is a personal Pension?

A private pension or personal pension, as they’re also known, is something you set up, contribute to, and manage.

You decide where the money is invested and which pension providers you would like to do that with.

A personal pension differs from a workplace pension and state pension by having freedom and flexibility. With that control, however, can generate some risk, so it’s essential to understand your options to make sure you pick the right pension product.

The good thing about the freedom is you can shop around for the best rates, trustworthy private pension providers and the best performing.

Types of personal pension

A private pension or personal pension, as they’re also known, is something you set up, contribute to, and manage.

You decide where the money is invested and which pension providers you would like to do that with.

A personal pension differs from a workplace pension and state pension by having freedom and flexibility. With that control, however, can generate some risk, so it’s essential to understand your options to make sure you pick the right pension product.

The good thing about the freedom is you can shop around for the best rates, trustworthy private pension providers and the best performing.

Types of Personal Pension

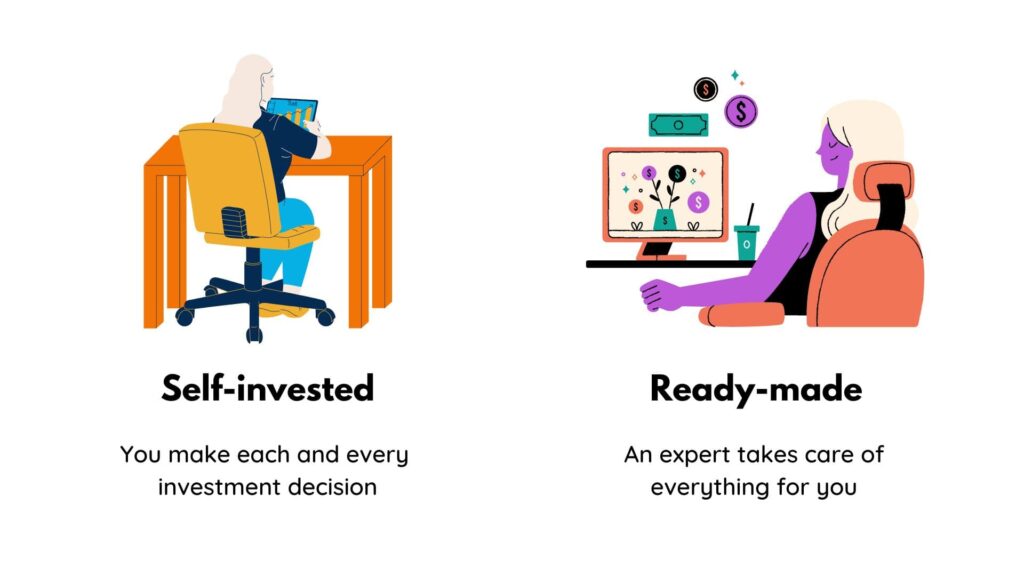

There are two types of personal pensions which are essential to understand.

Self-managed Pensions

SIPPs or self-invested personal pension, are where you have full control over where your money is going. Essentially, you decide where to invest, whether in stocks, bonds or funds – it’s 100% up to you.

It can also be cheaper this way as even though you’ll pay trading fees or fund management fees you will not be paying a professional for their time.

This option is also the riskiest. You have full control so bad investment decisions will impact you. Only take this route if you’re sure you know what you’re doing and are confident in your investment decisions.

Ready-made Pensions

This option is fantastic if you’re looking for a hands-off approach. These pension funds are expertly managed by a Pension Manager and invest in a diverse range of assets, including stocks, bonds, funds and trusts.

Each pension provider will invest differently and offer unique plans based on your risk tolerance, investing goals and financial situation.

Some providers will also offer you financial advice and help you plan for retirement, including when / how to withdraw or draw down your pension, as it’s also known.

Why should I choose a personal pension?

Sure, you might be putting away a nice amount into your workplace pension, but even that may well not be enough for you to live comfortably for the rest of your days truly.

They are also great if you are self-employed or do not qualify for a workplace pension.

When can you withdraw a pension?

You can access your personal pension much sooner than a state pension, and the current age is 55, which is set to increase to 57 in 2028.

You cannot withdraw your pension before 55 unless you are terminally ill or have exceptional circumstances like a shorter career from a pro athlete.

When it’s finally time, you can take 25% tax-free lump sum, and the rest would be subject to income tax, so check the thresholds.

If you need clarification about what to do when you reach or get near retirement, consult your pension provider or seek professional financial advice to ensure you maximise your money.

How long does it take to set up a private pension?

It doesn’t take long at all. A private pension can be set up in just a few minutes if you have the proper documentation ready.

Sometimes there will be a brief period while your information and identity are checked, but nowadays, this process is unbelievably quick.

In most cases, you can contribute to your new personal pension the same day.

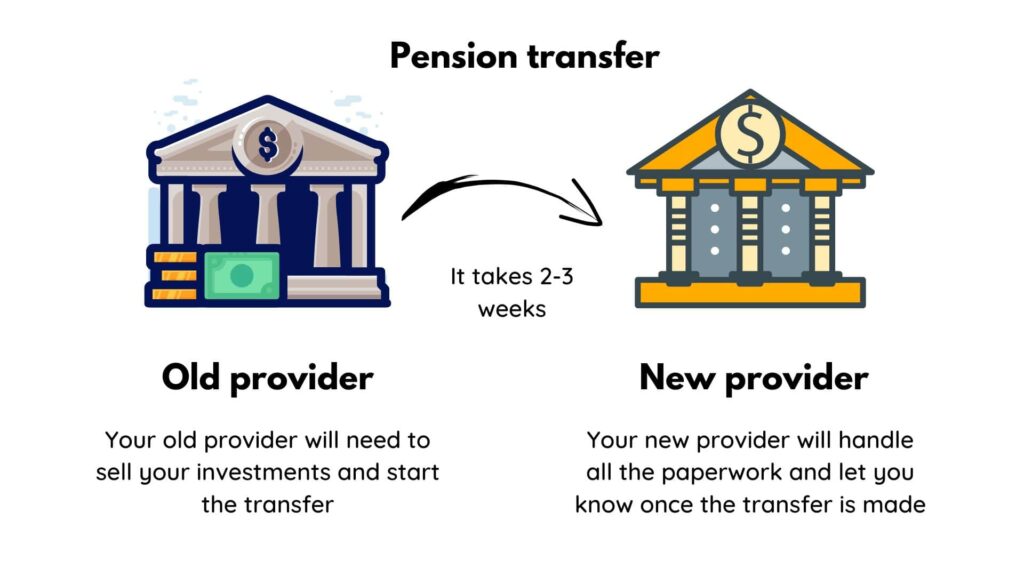

What about transferring my pension?

If you want to transfer a pension, this can take a little longer. I did this last year, switching my workplace pension after I left a role into my personal pension, and the whole process took about three weeks.

This is because your current pension provider will need to sell your investments before they can transfer anything over.

You need to request a release from your current pension, and often they need to send you a form to complete. Then it goes into a process and the transference of the money over.

What is the pension lifetime allowance?

The thought may cross your mind as you add to your pension. How much can I add to my pension, and is there a limit?

The answer is yes, there is a limit, but don’t worry, it’s pretty damn big. Your lifetime pension allowance is £1,073,000.

Most of us will never get to that number, but if you do, then fair play; you’ve done well with contributions and investments along the way.

If you’re getting near to the big million, then it’s an excellent time to take advice, as you can get a hefty bill and pay tax of 55% on anything over the threshold.

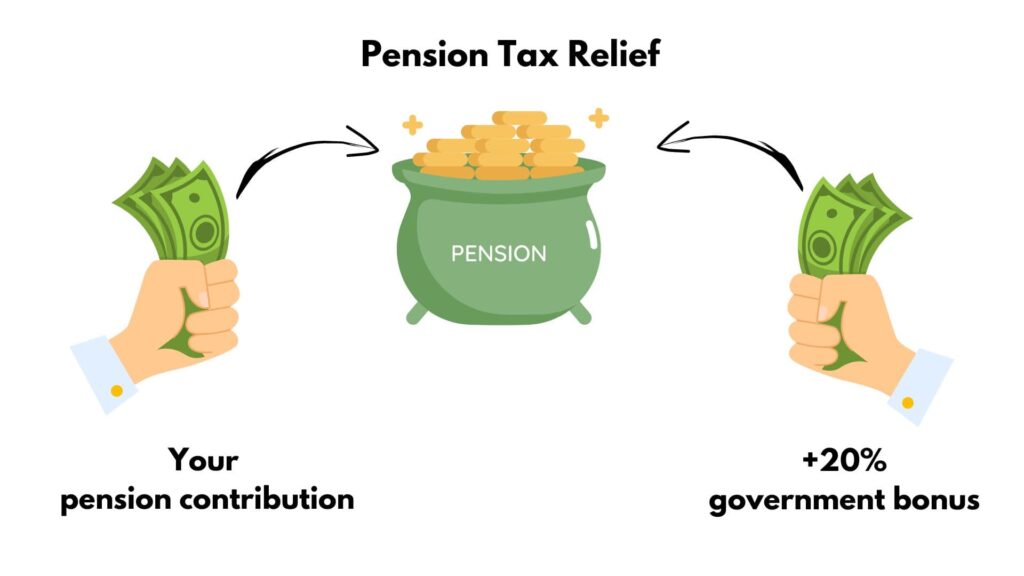

What is pension tax relief?

Simply put, the government pays 20% on top of your contributions to offset the tax you have already paid on the income.

This is called tax relief. It would help if you thought of tax relief like you do refunds.

Let’s take an example if you pay £80 into your pension, then the government will top you up by £20, making your total contribution £100.

If you fall into the higher tax bracket of 40% (earning over £50,270), you can claim a further 20% back on this money via a self-assessment tax return. And, if you are an additional rate tax payer, you can claim a further 25%!

It’s important to note that only the first 20% get automatic tax relief if you pay in via a personal or workplace pension. If you’re breaching into a higher tax bracket, that’s when you need the self-assessment to claim the extra cash!

How do pension fees work?

Unfortunately, you need to be aware of fees associated with pensions. Each provider is different and will charge you for additional items, although most will be similar in total costs.

You’ll find that most providers offer a one fee fits all model, making it a lot easier for you. Inside that fee will be what we’re about to cover as some providers make these separate charges.

What to look out for:

- Platform fees/service fees – these can range for annual fees of between 0.15 – 0.5 % of your total pension pot

- Fund Management Charge – these vary depending on the type of investment plan you take on and can go up to 1.5% per year although they usually sit around 0.2-0.5%.

- Transaction fees – this is where you get charged for buying and selling stocks. Usually, if a pension is expertly managed, this is incorporated in the overall price, but if you’re buying individual assets through SIPPs, then transaction fees are likely.

- Transfer fees – these are rare but some providers still charge transfer fees. Be sure to check before you make the jump.

Pensions vs Lifetime ISA

Once upon a time, pensions used to be the only real way to save towards retirement, but now you have Lifetime ISAs to add to the mix.

Key Lifetime ISA Points

- You can only invest £4,000 a year

- They provide you with a 25% bonus on everything up to the £4,000

- You can open an account aged 18 to 40

- The money is tax-free when you withdraw it

- You can only withdraw once you hit 60 or you’re buying your first home

- You can withdraw before 60 but you lose your bonus and could be charged fees

The main benefit is that withdrawals on Lifetime ISAs are tax-free, but the limits on the contributions make them less attractive.

You can have a lifetime ISA and a pension, so if you’re maxing out your pension contributions, you could look at contributing to both.

Workplace vs Private Pensions

Having a workplace pension does not mean you can’t contribute to a private pension. In fact, having both will increase your retirement pot.

Once you reach £10,000 a year in income, you are eligible for a workplace pension. Employers who offer pensions will auto-enrol you in their chosen pension scheme, and you can also opt-out if you wish.

If your workplace contributions are less than £40,000 (the annual pension contribution limit) then you can maximise your pension pot by owning a personal pension.

FAQs

Are personal pensions safe?

Yes, pensions are safe. It’s vital to check that your provider is authorised and regulated by the financial conduct authority.

Your provider should also be signed up to the financial services compensation scheme (FSCS) to protect your money up to the value of £85,000.

Due to their being a lot of money in people’s pension pots, you must stay vigilant and be careful of scams.

Can you transfer pensions?

Yes, you can transfer your pension. Most providers will ask you to complete a pension transfer form and then your new provider will contact your existing pensions provider e to start the process.

There is usually a 2-3 wait while your old provider sells your investments and initiates the pension transfer. Once the amount has been transferred, you’re free to re-invest that money and there are no tax implications for doing this.

Is there a limit to pension contribution?

Yes, you can contribute £40,000 per year or 100% of your salary, whatever it is smaller. If you’ve maxed out your contribution, look at ISAs and other investments to further your portfolios.

Over your lifetime, you can contribute £1,073,000 to your pension, so be wary of that if you’re regularly maxing out your contributions.

How much should you save into your pension?

You should build your retirement savings as much as necessary to live as comfortably as possible. This amount will vary per person, but an excellent way to work it out is to predict the amount you want to spend each year times by the number of years you want to live for after retirement.

This will give you a benchmark that you can then break down and use as a yearly savings goal.

How to find out if I have a workplace pension?

Very simply, you can ask your employer. Most employers will have some knowledge; if your direct line manager doesn’t know, your HR or senior team will.

When you join a new pension scheme, you’re sent emails and letters telling you what pension you’re a part of. Once you know, you can contact that brand directly, get access to your pension pot, check on your progress, or opt-out if you decide to.

Can you take a lump sum from your pension?

Yes, you can take a lump sum from your pension once you reach the age threshold. This can be up to 25% of your total pension tax-free.

The rest is then subject to income tax as you drawdown, so be sure to get professional advice through a financial advisor for the best method.

Each person will be different depending on their financial situation and other investments you may have, so it’s essential to understand the process to maximise your pension pot.

Do I need a financial advisor to open a pension?

No, you do not need a financial advisor to open a personal pension. You can do the entire process yourself and choose between a self-invested or expert-managed pension.

If you’re worried about anything, it would still be wise to seek financial advice, but nowadays, most information can be found online. Most top-tier providers will have in-house advisors to help you make the best decision.

Can I have a workplace pension and personal pension?

Yes, you can have both. You can max out your employer pension contributions and still pay into a personal pension.

This allows you to get the extra percentage into your pension pot that your employer provides.

When I was employed full-time I would pay into my SIPP and then receive my workplace pension. This allowed me to grow my pension pot a lot faster. Once I left I transferred my pension pot over to my personal pension so I could keep tabs on it.

Can I have two personal pensions at the same time?

There is no limit to the amount of pensions you can have. For example, you could have a SIPP and an expert-managed personal pension and pay into both each tax year.

The only factor is the overall yearly pension contribution which limits you to £40,000 or 100% of your salary per year.

What is a group personal pension?

A group personal pension is a selection of funds unique to you and provided by some employers.

What is a ready-made personal pension?

A ready-made personal pension is a pension fund that is managed by a Pension Manager that requires no effort from you as the contributor.

The Pension Manager is selecting all of the investments inside the fund and ensuring it’s performing as best it can. Each fund will perform differently but you can ask for performance reports before deciding whether it’s right for you.

What happens to my pension if I die?

If you pass away, your pension is left to your spouse or civil partner, which can also be defined in a will.

In some cases, private pension providers may opt to pay the pension to a financially dependant partner.

Pensions are considered to sit outside of the family estate, so if you’re worried about where it will go it’s always advised to leave a will to ensure money is paid to whom you choose.

Do you lose your state pension when you die?

Yes, in most cases, you will stop receiving your state pension when you die. However, in some cases your partner or wife can continue to receive some state pension payments.

What happens to my pension when I change jobs?

Your current workplace pension will be closed down until you begin contributions again. If your new employer has the same provider, then your account can be merged, and your new employer can continue contributing.

None of your investments are sold until you instruct your old provider to transfer a pension to a new one. This means if you do not open a new pension for a while, you still benefit from the investments made during your previous employment.

What is the best pension provider?

Right now, the best private pension providers in the UK are Moneyfarm and Wealthify.

Opening the right private pension is important, and getting onto the right pension scheme can be the difference between a comfortable retirement and a less comfortable retirement.

Roundup

We hope you’ve enjoyed our best private pension providers in the UK list!

Finding the best pension is so important and you want to know your money invested in safe!

MORE BEST OF CONTENT

Disclaimer: Your capital is at risk when you invest. Up the Gains accepts no responsibilities for your investment decisions and believes you should take professional financial advice.