Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Have you been thinking about your investments? Maybe you’ve been researching the best possible places for you to put your money and have come up against some obstacles.

We all have questions, and getting the answers to them is imperative before we decide to shift our money into places. You need to fully understand where you’re putting your money so an ISA is a good place to start.

Where can I invest? What is a stocks and shares ISA? What are the stocks and shares ISA rules? Can I buy US stocks with my ISA?

If you have questions like that, this is the perfect article, as we’ll review everything you need to know. So, how does a stocks and shares ISA work? Let’s dive in!

Table of Contents

What is a stocks and shares ISA?

Firstly, we need to establish exactly what a stocks and shares ISA is. ISA stands for an individual savings account, and in this instance, the money you put into the account will be invested in stocks and shares.

It is, in basic terms, a tax-efficient investment account. Any money earned through the ISA is exempt from income or capital gains tax.

How does a stocks and shares ISA work?

A Stocks and Shares ISA is a tax wrapper investment account that you can put up to £20,000 a year into tax free. The interest or gains you receive from this account are not subject to capital gains tax.

Essentially you pay money into it like you would a bank but you can also buy financial instruments like stocks, bonds and funds. Some Stocks and Shares ISAs are ready-made for you and these are called robo-advisors.

Many providers offer different types of stocks and shares ISAs, so you need to compare what is available and find the right fit for you.

The main two types of Stocks and Shares ISAs are:

Self Invested – This type of account gives you full flexibility to choose your own stocks, funds and bond investments. Whilst this sounds great it is not recommended for beginners as it’s all on you and often no help is provided unless you ask for it.

Expert Managed – If you’re a beginner starting out this is the option for you. Take advantage of some of the best investors in the business and let them do the hard work for you. Often the fees are slightly higher here but that’s totally fine as your gains will be higher than if you do it yourself with no knowledge.

Once you have opened your stocks and shares ISA, you need to pay something in. This could be a lump sum, or you could make ad-hoc payments as and when you feel able to.

It is important to remember that up to £85k is protected by the Financial Services Compensation Scheme. When you look at the providers for stocks and shares ISAs, you need to check for any fees.

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

How much can I pay into my stocks and shares ISA?

The stocks and shares ISA rules are like any other ISA. You have an annual allowance of £20,000 to invest in ISAs. This is the total amount you can pay into ISAs.

You can have more than one type of the same ISA. However, you can’t pay into more than one type each tax year.

You can split your allowance between a cash ISA and a stocks and shares ISA, for example. Any unused allowance will be lost when that tax year is up, and the allowance renews.

This is why many people set notifications of when the allowance is coming to an end and top up their ISAs before the end of the tax year.

What about withdrawals?

With some investments, you cannot access your money for a certain amount of time. However, with stocks and shares ISAs, you can access your cash anytime.

It’s worth remembering, though, that if you withdraw money from your ISA and reinvest it later, it will count towards your allowance.

Depending on your provider, you might be able to get the money immediately, or it could take up to seven days.

How much could I make?

It is important to remember that the value of investments can both rise and fall. This could mean that you get back less than what you originally put in.

There’s always that risk and that’s why it’s important to know what you’re investing in and have goals that are longer than just a few months.

The amount that could be made from your stocks and shares ISA investment varies depending on how the markets perform. This can vary from year to year and even day to day. However, the average annual rate of return for stocks and shares ISAs over the past ten years is 9.64%.

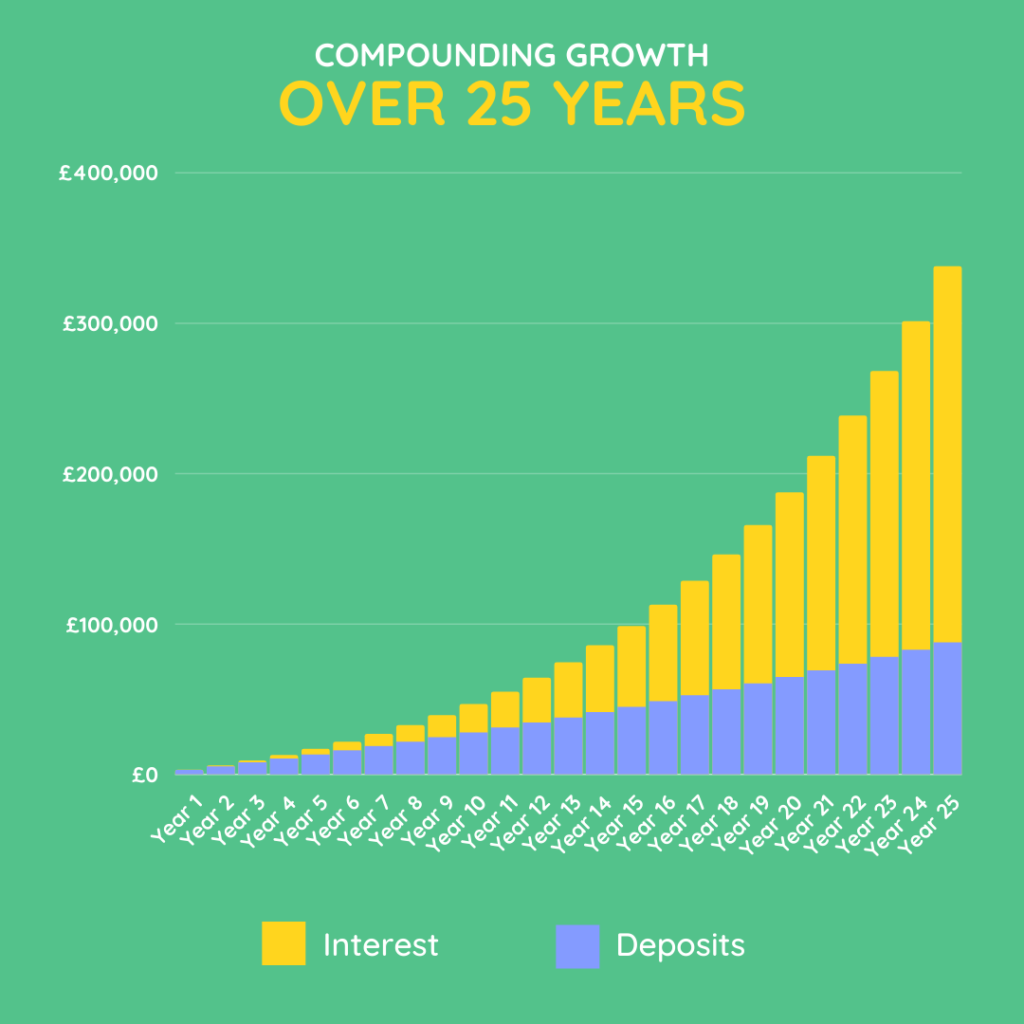

Let’s look at an example of a £20k investment at 9.64% over 20 years. This would give you £126,012 after the two decades.

That is the power of compound interest!

Over 30 years, it would be £316,301 and £793,946 over 40 years! This shows you that the earlier you invest, the more your money can make.

What stocks is my money in?

You’ll likely want to know where your money is invested when looking at how does a stocks and shares ISA work.

This varies from provider to provider; however, it is generally invested in a wide range of bonds, funds, shares, and investment trusts.

Most providers allow you to invest in stocks from all around the world so you’ll have access to the blue chip stocks from the US that are a staple of many portfolios.

If you’re concerned about where your money is being put then another option could be an ISA that has an ethical Stocks and Shares ISA available.

This could include avoiding investments in the likes of gambling, tobacco, nuclear power and animal testing.

This is called ESG investing.

Instead, companies with positive environmental impact and corporate ethics would be part of the investment. There are fantastic brands like Clim8 that solely focus on this.

There are also opportunities to invest in cryptocurrencies through your ISA. You can’t directly invest in the coins or tokens themselves but you can find and buy companies or funds that do.

View our list of the best stocks and shares ISAs.

What happens to my ISA if I die?

The inevitable will happen to all of us one day. But how does a stocks and shares ISA work when you die? What happens to the investment then?

Your provider can either be instructed to transfer an ISA to a spouse or civil partner or sell the investments, with the proceeds becoming part of your estate.

The executor of your will is in charge of organising this, so ensure that there are details about your investments written down.

How to open a stocks and shares ISA?

Opening a Stocks and Shares ISA is relatively simple. You can open one via the banks or providers app on your phone or via their website.

You will be asked basic information like name, address and contact details at first. Once set up you will be asked a series of questions about your experience and risk tolerance so they suggest the right products for you.

With there being many different types of Stocks and Shares ISA including expert managed and self invested. The best thing to do when you are considering opening stocks and shares ISA is to do your homework.

Take some time to look at potential providers and find the one that gives you what you need. Look at previous returns to get an idea of what your investment can achieve. Remember to compare the fees involved too.

You will also want to check where your money is going. What type of funds do they suggest and invest in? Do they have Ethical ISAs available to you if you’re focused on sustainable investing.

There’s lots of things to consider so take your time and read up on a few different options.

We have reviews on some fantastic brands listed below:

Final Thoughts

There are both pros and cons of stocks and shares ISAs. There is the potential to earn a lot more than a cash ISA can give you. However, there is also the risk that your investment could lose value.

Your stocks and shares ISA should be viewed as a medium to long-term investment. Taking advantage of compound interest, you should be prepared to invest for at least five to ten years.

The longer your investment stays in place, the more it could be worth down the track.

Of course, there are times when you will need to access money; however, if you take it from your ISA, you’ll lose interest and eat into your allowance.

With that in mind, it’s a good idea to put an emergency fund aside in easy-access savings account so your stocks and shares ISA can be left untouched.

Now we know the answer to ‘how a stocks and shares ISA work?’, we can go ahead and open one for your financial future.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.