Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Don’t want to pay tax? Who does?!

If you want to limit the money you must pay back to the government, an ISA or individual savings account wins this round over a traditional savings account all day.

Experts advise using a Stocks and Shares ISA to create long-term wealth and Cash ISAs for smaller savings goals or emergency funds.

We’re proud of you! Why you might ask?!

Looking into the best places to save money is the first step towards financial security, but making the right account choice is the 2nd.

There are many different savings account styles, which can be overwhelming when you first look into them.

This guide will help unpack where your money is best placed so you can make that final call comfortably.

So, ISA vs savings accounts? Which one is best for my money?

Table of Contents

ISA vs Savings Account

Before you get into where your money should go, you must understand what each account can offer you.

Once you’ve got that, you can feel safe knowing your money is invested in the right places.

First up – ISAs!

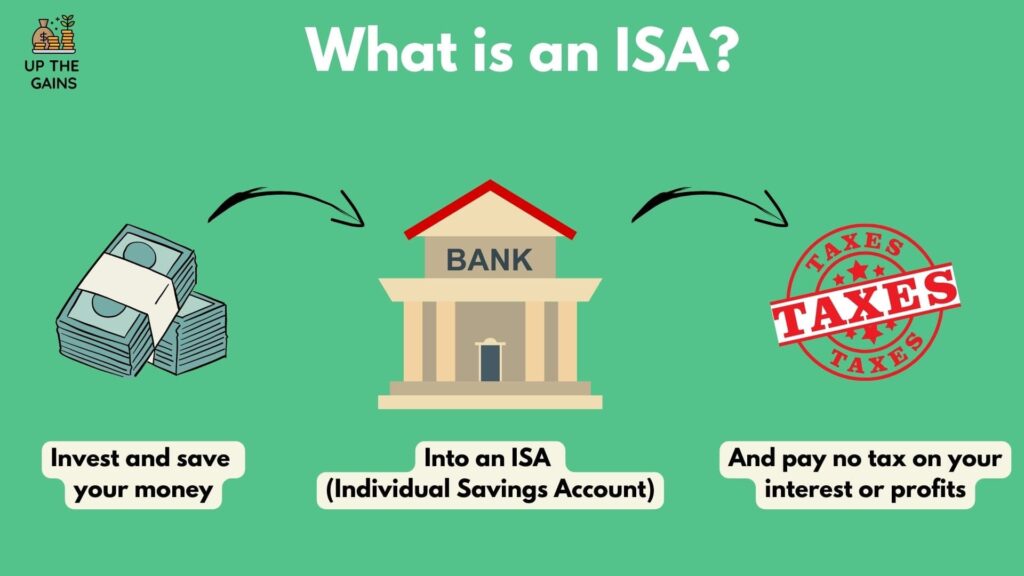

What is an ISA?

The wonderful ISAs, or individual savings accounts as they’re also known, allow completely tax-free saving and investing.

The government designed these accounts back in 1999 as a way to help the UK save for retirement.

Since then, they’ve fast become a staple for people looking to invest their money, have a comfortable retirement, save for house deposits or just put money aside for a rainy day.

ISAs allow you to put up to £20,000 a year in as your yearly ISA allowance.

This can be split across different account types but you can’t split your money into the same account type in that tax year. Your ISA allowance resets every April.

There are four main types of ISA:

Cash ISA

This type of ISA is the closest to standard savings accounts. Cash ISAs have two main types: easy access and fixed-rate Cash ISAs.

When you go for a fixed rate, you lock your money away for some time for a higher interest rate. These can range from 30 days up to 5 years.

Easy access tends to have a slightly lower interest rate but allows you to get your money out whenever you need it.

Stocks and Shares ISA

Have you ever wanted to be an investor? Well, with a Stocks and Shares ISA, you have full access to the stock market, where you can buy and sell shares of your favourite companies.

The returns you can generate with a Stocks and Shares ISA outweigh those in a Cash ISA. In fact, I wrote a post about Cash ISAs vs Stocks and Shares ISAs here.

You can expect between 8-10% returns a year from your investments, but please note this is an average over 10+ years, as investing should be considered a long-term game.

There are two main types of Stocks, and Shares ISAs, which are self-invested, where you choose your own holdings, or expert managed, where professionals do all the hard work for you (but with a small fee attached).

Lifetime ISA

Lifetime ISAs are there for you to save for a house deposit or set money aside for retirement.

They’re brilliant as you can put up to £4000 in each year, and the government will match it with a 25% contribution.

The good thing about these accounts is you can save like a Cash ISA or, if you’re going for higher returns, invest like a Stocks and Shares ISA.

Junior ISA

Junior ISAs allow you to set up your children with an investment or savings account. They cannot access the money until they’re 18, but you can put up to £9,000 a year into these accounts, which is separate from your personal allowance of £20k.

Other ISAs

There is also something known as an Innovative Finance ISA which allows you to lend money to others via peer-to-peer lending. These types of accounts are for more experienced investors.

Lastly, Ethical ISAs, are essentially Stocks and Shares ISAs but focus on environmentally friendly investments.

Want to know more check out our Beginners ISA Guide.

Savings Account

We’ve all been told at some point to stash some cash away for a rainy day.

In the old days, we used to have change jars, piggy banks and post office accounts, but these days savings accounts have evolved into a wide range of options.

What are savings accounts?

Traditional savings accounts are essentially just bank accounts. You add money and store it for use on a more significant purchase or when needed.

Your savings can grow over time in two ways. First, you add to it, which is the obvious one; the second is that the bank pays you interest to keep your money with them.

How does interest work?

An example of interest working could be a bank paying you 1% interest for having your money with them. If you have £100 saved with them, they will pay you £1 for the privilege.

This might not seem much, and let’s face it, it isn’t. The more you add to your savings accounts and the better the interest rates over time, the more you earn.

However, it is also important to understand what type of savings account you are opening and whether or not it’s right for you.

There are several different types of a savings accounts, but the most popular ones are:

Easy access

Easy access savings accounts tend to have lower interest rates because of their flexibility. You can move money in and out of these savings accounts with relative ease, often through an app and with no penalties or limits for moving your money.

Regular Savings Accounts

With a regular savings account, banks expect you to pay a monthly pre-agreed amount. In return, you receive a higher interest rate than those in an easy-access savings account.

These rates, however, are not fixed and will rise or fall each year with the current economic climate.

Fixed Rate

This savings account is similar to a fixed Cash ISA, where you lock your money in for a specific time for a higher interest.

The longer you fix your money, the higher the interest rate you will get, and if you want to withdraw your money early, there are usually fees involved.

Notice Accounts

This type of savings account is where you must give a fixed period of notice before you withdraw your funds. These accounts can be beneficial if you’re too great with money and require a buffer before withdrawing.

What is a Personal Savings Allowance?

Something which you do need to be aware of is your personal savings allowance or PSA. This resets each year and means that some of the interest in your savings account could be subject to income tax.

If we take a quick example of this for you – let’s say you have £30,000 saved and get 2.5% interest from your bank, which would be £750.

In this case, you are:

- A higher-rate taxpayer.

- You get a £500 personal savings allowance but would be subject to 40% tax on the remaining £250.

- Resulting in a tax payment of £100.

Not ideal. This would differ inside an ISA, where you could receive and withdraw the total amount.

What about tax outside of an ISA?

It’s worth noting that ISAs are attractive because they’re free of capital gains tax and dividend tax on any withdrawals you make.

If you withdraw from your ISA, it’s worth noting if you re-invest that money, then it’ll count towards your ISA allowance of £20,000 a year.

If you decide to invest inside what’s called a GIA or general investment account you may be subject to the following tax.

Capital Gains Tax

For those investing or receiving interest outside of an ISA, the capital gains tax amount is being reduced from £12,000 to £6,000 for the 2023/24 tax year.

This means you will be paying higher capital gains!

Dividend Tax

Equally, if you invest outside of an ISA in a GIA (general investment account) and receive dividends through your investments, you will be subject to dividend tax.

Dividend-free allowance also decreases for the tax year 23/24 from £2,000 to £1,000.

You will pay an 8.75% tax on dividend income over the £2,000 allowance if you are a basic-rate taxpayer. Higher-rate taxpayers pay 33.75%, and additional-rate taxpayers pay 39.35%

ISA or Savings Account - What's the best option?

The tax benefits you receive with an ISA if saving for the long term make ISAs a clear winner here.

That being said, some savings accounts will provide higher interest rates than ISAs if you do your digging but once you reach any sort of threshold from a personal saving allowance for me it makes them pointless.

When to use an ISA?

To grow your money, you should look at stocks and shares ISAs and put your money to work in the stock market.

Whilst this can be daunting when starting out, there are expert-managed stocks and shares ISAs that take all of the stress out of the process.

My split on my accounts is I own a Cash ISA for my emergency fund and short-term savings goals alongside a stocks and shares ISA to grow my net wealth.

I also put money into a SIPP or personal pension, which is solely for my retirement.

When to use a savings account?

As you can see, it’s difficult to argue for owning an ordinary savings account.

The only time that can be helpful is if you are learning how to save and want to stash away smaller amounts for a short time (1-2 years or less).

When you look at the bigger picture and want to grow your savings above an amount, it makes much more sense to open an ISA and start there.

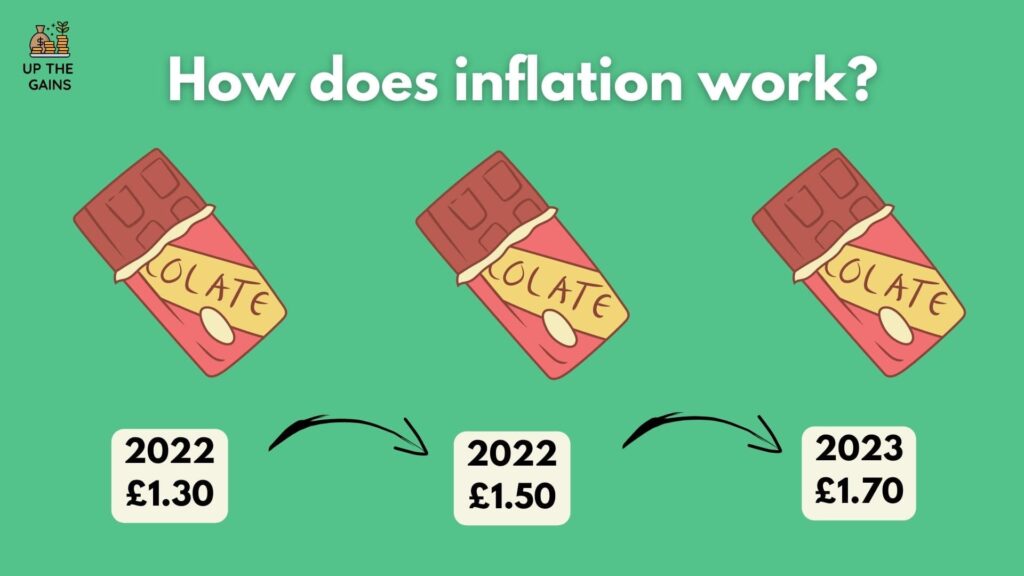

Why should I factor in inflation?

Inflation has been everywhere on the news recently, and you need to be aware of it. It essentially is the increase in the price of goods, but what that means for your savings is arguably more important.

If you are receiving a 2.5% interest rate from the bank and inflation is 3.5%, then your money becomes 1% less valuable every year you keep your money in that savings account.

One of the only real ways to beat inflation is by investing in a stocks and shares ISA for the long term.

On average, the stock market returns 8-10% a year, depending on where you invest, so you can see how this allows you to stay ahead.

FAQs

Are ISAs still worth it in 2023?

Yes, ISAs are 100% still worth it in 2023, and they should form a large part of any financial plan to use tax benefits, more significant returns and government bonuses.

What are the disadvantages of an ISA?

The disadvantage of an ISA is the ISA allowance of £20,000. If you’re looking to invest more than this each tax year, then you will need to look at other investing options, which could leave you open to capital gains tax.

Final Thoughts

Lastly, when it comes to choosing between an ISA vs savings account, we will always be in the ISA camp unless the personal savings allowance is drastically increased.

I certainly don’t want to pay tax if I can avoid it so utilise tax-free savings accounts like ISAs!

If you’re still unsure about what to do, I suggest taking financial advice to ensure you are comfortable with your decision.

You can do this through your bank or privately with a financial adviser.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.