Barista Fire Calculator

Unlocking financial freedom much earlier than expected is possible with side income after quitting your day job.

Enter Barista FIRE, a concept where the returns from your invested assets cover most of your living expenses, and you pursue work that you find enjoyable to make up for the rest.

With Barista FIRE, you can generate a relatively small amount of income on the side while doing something you love.

This can significantly reduce the net worth you need to quit your full-time job and exit the rat race, allowing you to achieve financial freedom much sooner than you would by waiting to reach your traditional Financial Independence/Retire Early (FIRE) milestone.

Plus, the ways to make “fun money” are endless – it doesn’t have to involve coffee-making!

Discover the exciting details and math behind Barista FIRE in my complete guide to unlocking early financial freedom. Check it out now!

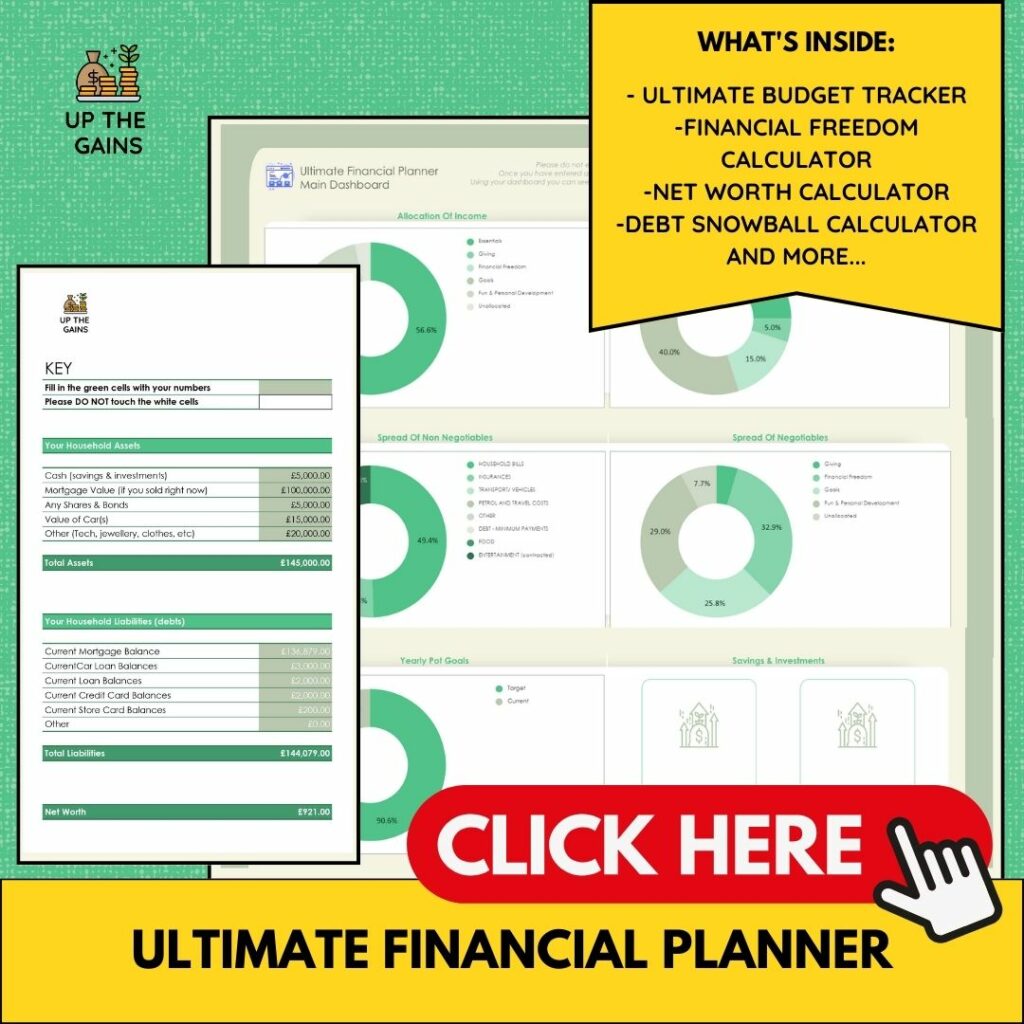

Start Budgeting Towards FIRE

Main Features Include:

- Innovative dashboard showing your full financial picture

- Templated scenarios for personal or household budgets

- Debt organiser and repayment planner

- Financial Freedom Calculator

- Pensions and Investments Dashboard

Personal Net Worth Calculator

How To Use The Barista FIRE Calculator

If you’re looking to achieve financial freedom earlier than expected, Barista FIRE might be the perfect solution for you. The idea behind it is to generate a side income doing something you enjoy while your invested assets cover most of your living expenses.

I’ve made this calculator to show you how Barista Fire is possible. Entering the correct fields will allow you to visualise how close you are to Barista FIRE and what it would take to get to full FIRE.

Follow this list below to understand how each section is interacting with each other.

- Start by selecting your currency this calculator is made for US dollars, British Pounds and Euros.

- Enter your current age

- Your current take home pay is everything that hits your bank account after tax and national insurance is taken.

- Then enter your annual expenses and the calculator will use your take-home pay minus your expenses.

- Then enter your current invested net worth so this is all the investments that you have in your ISA. This doesn’t include things like savings as the growth rate will be different.

- You can then change how much your investments are going to grow using the investment growth rate slider.

- Then you set your desired Barista FIRE age – this is when you will leave your job and go full-time BaristaFIRE.

- After this add in your expected annual spending in retirement this number should be what you need to live comfortably but

- Next up, remember you will likely have a side hustle or hobby income too. Enter that in the monthly income during Barista FIRE section.

- Then set the inflation rate, the average is 2.5-3%.

- And lastly, your safe withdrawal rate which most experts suggest to be around 4%.

Why does inflation affect Barista FIRE?

Inflation can impact Barista FIRE in a number of ways. As the cost of living rises, it can become more difficult to cover living expenses with just the returns from invested assets, which is a key part of the Barista FIRE strategy. This means that those pursuing Barista FIRE may need to generate a higher level of side income in order to maintain their standard of living.

In addition, inflation can erode the value of savings and investments over time, making it harder to accumulate the necessary assets to achieve financial freedom. This is especially true for those who are just starting out on their journey to financial independence, as they may not have had enough time to build up a large enough nest egg to withstand the effects of inflation.

While inflation is something that can impact all investors and savers, it is particularly important for those pursuing Barista FIRE and this is why we have it in the Barista FIRE calculator.

What else do I need to consider?

Aside from inflation, there are a number of other factors that can impact the success of a Barista FIRE strategy.

One key factor is the rate of return on investments. If returns are lower than expected, it can take longer to accumulate the necessary assets to achieve financial freedom, which can delay the transition to Barista FIRE. On the other hand, if returns are higher than expected, it may be possible to achieve financial freedom more quickly.

Another factor is the level of expenses. While Barista FIRE is designed to cover most, but not all, of your living expenses with investment returns, it’s still important to keep expenses under control. High levels of spending can quickly eat into investment returns and make it more difficult to achieve financial freedom.

The amount of side hustle income generated is another factor that can impact the success of Barista FIRE. While the idea is to generate a relatively small amount of income doing something enjoyable, the actual amount needed will depend on individual circumstances and the level of expenses that need to be covered.

One thing that’s not included here is your current savings. That’s because it’s extremely difficult to predict how the average savings will either grow or deplete. Therefore we suggest you add this number yourself separately.

Finally, unexpected events such as job loss, illness, or major expenses can impact the ability to maintain a Barista FIRE lifestyle. It’s important to have a contingency plan in place to deal with these types of situations, such as having emergency savings or a backup plan for generating additional income if needed.