Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Essentially experts advice to have a minimum of 3-6 months worth of monthly income stashed away in your emergency fund.

Whilst this seems like a lot at first glance, if you add to it each month over a long period of time you can easily reach that goal.

The reason for this is if you lose your job or something terrible happens you have a financial blanket you can rely on to help through the harder times.

Things are a struggle for many of us right now. We have to prioritise our income so we can afford what we need, which takes a chunk out of the money we might have for the things we want.

At a time when everyone is struggling, it’s hard to see where savings can be made. Fortunately for most of us, we still have a job, we still have a regular income, and we still have a little bit of stability.

Have you thought about what would happen in an emergency, though? What if you were to lose your job? How would you manage to pay for everything you do on a monthly basis? How would you cover those utility bills and rent?

For many people, having an emergency fund allows them to have peace of mind.

To help you live, put food on the table and keep a roof over your head. If this is something you have been looking into, you might be asking how much should be in my emergency fund?

Let’s have a look at what you should work towards.

Table of Contents

Let the latest technology help get you there with the best money savings apps.

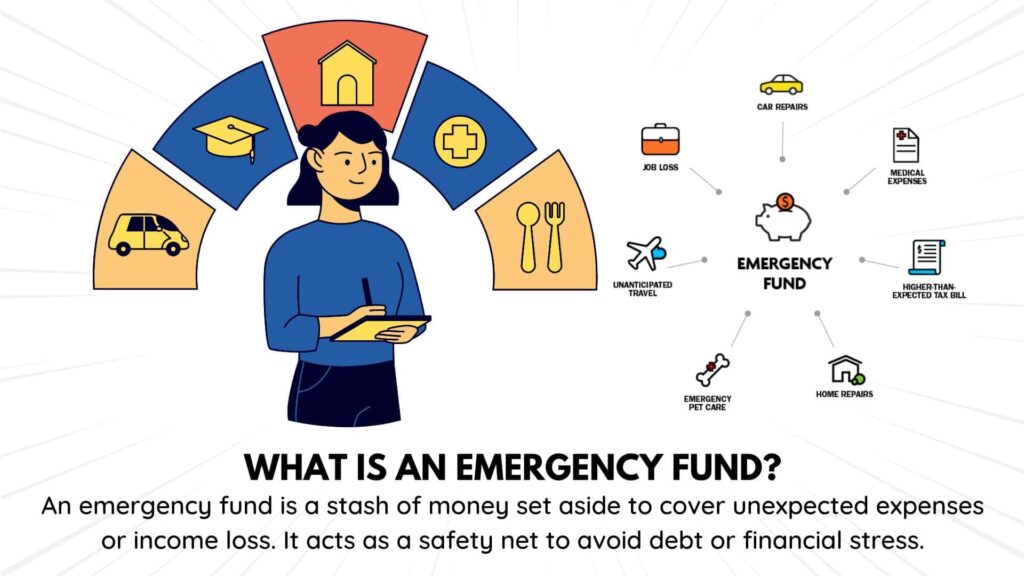

What is an emergency fund?

Firstly, before looking into how much should be in my emergency fund, let’s establish exactly what an emergency fund is.

An emergency fund is a pot of money set aside to help cover any financial surprised that come our way.

When the unknown and unforeseen happens, life is stressful so having some money put aside can help ease what could become a tough financial situation.

We worry, we cry, and we even argue with our loved ones. Having the financial side of any emergency taken care of means, we don’t even need to give that a second thought. The money is taken care of.

This means we can concentrate on getting life back on track. Having that stash of cash set aside in a bank account and earning a little bit of interest every month means you can enjoy life, knowing that if a hurdle is thrown in front of us, the finances are there to help overcome it.

Some of the most common emergencies that people prepare for include job loss, car trouble, household repairs and medical emergencies, including dental issues.

Why do people have emergency funds?

People work towards having an emergency fund because it is a safety net. We don’t know what life is going to throw our way, and if we can put things in place to help, we can rest easy, knowing that one part of it is taken care of.

When an emergency hits, we don’t have a lot of control. However, with finances taken care of, we can concentrate on other areas.

In times of chaos and crisis, having the money already set aside means we can be there for loved ones rather than worrying about where to find the mortgage payment.

We can be alongside the ones we care about whilst still being able to put food on plates. That new job can be searched for without too much urgency because the bills are going to be taken care of with that pot of cash we’ve put to one side.

There aren’t many things we can fix in this world but having some money set aside for when we really need it certainly helps.

What is an emergency fund used for?

An emergency fund is a crucial financial safety net that can help you weather unexpected financial storms.

Here are some reasons why you might need to dip into your emergency fund:

Job loss: If you lose your job or your income decreases unexpectedly, you can use your emergency fund to cover your basic living expenses until you find a new source of income.

Medical emergencies: If you or a family member experience a medical emergency, you may need to pay for unexpected medical bills or take time off work to care for them.

Car repairs: If your car breaks down and you need repairs to get it back on the road, your emergency fund can help cover the cost.

Home repairs: If your home needs unexpected repairs, such as a leaky roof or a broken water heater, your emergency fund can help cover the cost.

Unexpected travel: If you need to travel unexpectedly, such as to attend a funeral or take care of a family emergency, your emergency fund can help cover the cost of travel and lodging.

Legal fees: If you find yourself in a legal dispute or need to hire a lawyer for any reason, your emergency fund can help cover the cost.

Homelessness prevention: If you are at risk of becoming homeless due to financial difficulties, your emergency fund can help you pay rent or other bills to prevent eviction or foreclosure.

Natural disasters: If you are affected by a natural disaster, such as a hurricane, floods or earthquakes, your emergency fund can help cover expenses related to evacuation, temporary housing, and rebuilding.

It is also important to say that someone else’s emergency is not a reason to dip into your emergency fund. Yes, you might love someone, and they are having a hard time.

However, you need to consider what would happen should you hand over your emergency fund.

Are you going to get it back? What if you had an emergency of your own a couple of days later? Your emergency fund is used for your emergency.

Let the latest technology help get you there with the best money savings apps.

How much should be in my emergency fund?

One of the regular questions that crop up on this subject is how much should be in my emergency fund.

What is the key amount to see you through? Well, unfortunately, we aren’t all the same, and we can’t all plan for 100% of things that come up in life.

One person could have a car crash or a family emergency in another country and be demoted at work to be on less money over a couple of years.

With an emergency fund in place, they might be able to pay for each issue and rebuild the fund before the next situation arises.

What happens if various things crop up within the space of a few weeks?

We can only put aside how much we can afford to as well. If you have a limited budget for a month and your kids need new school shoes, you’re going to buy them ahead of putting money into an emergency fund. It makes sense because you need them there and then.

This is where having a handle on your budget helps. Knowing how much you have coming in every month and budgeting every penny of that into an area. You’ll have some money to pay the bills, some money for clothing, and more for running your car.

These are our bills, and we can segment our income into each area where we need to spend it. You should include your emergency fund as one of those segments.

The general rule of thumb is to put away somewhere between three and six months of full pay in your emergency fund. This would allow you to cover those emergency expenses whilst giving yourself time to get on top of the situation.

What does three to six months’ worth of income look like to you? That can become your answer to the question of how much should be in my emergency fund.

How to save for an emergency fund?

The other question is how to start saving into an emergency fund. Well, you need to view it as another bill. When you view it in that way, you will make the payments, and you don’t have to deposit them all at once.

When you know your target amount, you can figure out small weekly or monthly chunks that will get you to that goal.

It needs to be speedy enough for it to be in place should you need it but don’t push your other payments aside in order to reach that amount.

Set up a separate bank account. Maybe a savings account attached to your current account or another you can find with a high-interest rate. It needs to be an easy-access account, so you can get your hands on your ash when you need it.

You will see slightly higher rates in fixed accounts, but you will lock your money away for longer. Meaning you won’t be able to access your cash should you need it in an emergency.

Automatic payments can help you save time. Once you’ve figured out that savings amount for your emergency fund, you can set up automatic transfers, so you don’t even have to think about it.

Your fund will be building up without you having to do everything. You might be one of those who like physically transferring the money across, but if time is tight, automation is your friend.

Some people have accounts with more than one bank to make it even easier to separate their pots of cash. Maybe you could consider having three banks, not one, to help with your overall savings goals.

If you want to look at creating a budget check out our free basic budgeting calculator.

What to do in a financial emergency?

Having an emergency fund to turn to is a great asset. However, there are other things we can do if we are facing an emergency.

Making a new budget based on your unique circumstances is a significant first step, which will likely include cutting spending and making financial sacrifices.

Shopping around for new deals on utilities can be another way to bring down the amount you need to pay for monthly bills.

How are you spending any money that you need to spend? Can you earn cashback on spending, giving you a little back in your pocket? If you are using a credit card, are you getting rewarded for using it? Is it the best credit card for you in terms of repayments?

It would be best if you also informed anyone you owe money to. If you will struggle to pay the mortgage this month, talk to your mortgage provider. They have a department specifically for this and can likely help.

The same with your energy bills and council tax. People are available to help, and it’s much better to face it than bury your head in the sand.

If you need professional money help, turn to Citizens Advice or StepChange.

Start your emergency fund today

The top savings tip we can give you is to start simply. Deliberating about how much to put away can cause you to tread water for a while. Open that savings account and start putting some cash away.

Some people use the sinking fund method. Each pot, or savings account, should be labelled with what the money is for. It could be for the annual car insurance payment.

If you know it will be around £300, divide that by 12, and you have a monthly amount to put away. Perhaps you want to save throughout the year for Christmas.

Let’s say last Christmas you spent £400 on presents. Divide that by 52, and you have a weekly amount to set aside.

You can do this with your emergency fund too. Work out what you need for three to six months of living, and then give yourself a period of time to meet that goal. £3000 over a year is £250 a month.

Maybe you face an issue after two months of saving, and £500 can be used. It might take a while to build up, but it can be a lifesaver once it is there.

When you squirrel money into there, little and often, you might not even miss it. Make it a priority, and you’ll question yourself when you want to buy something new.

Avoid the purchase and put some cash into your emergency fund instead. It’s not about not living. It’s about making the most of what you have and putting things in place to make life easier.

Let the latest technology help get you there with the best money savings apps.

FAQs

Is 10k a good emergency fund?

It depends on your individual financial situation and needs. As a general rule, financial experts suggest having three to six months’ worth of expenses saved in an emergency fund.

For some people, £10,000 may be enough to cover this amount, while for others it may not be sufficient. Consider factors such as your monthly expenses, job security, and potential emergencies that could arise when determining how much to save in your emergency fund.

Is 12 month emergency fund too much?

Having a 12-month emergency fund may be excessive for most people, but it ultimately depends on your individual financial situation and comfort level.

While it’s important to have a sufficient emergency fund to cover unexpected expenses or job loss, keeping a full year’s worth of expenses in cash may not be the most efficient use of your money.

Consider balancing the need for emergency savings with other financial goals such as paying off debt, investing for retirement, or saving for a down payment on a home.

Why is it a 3 to 6 month emergency fund?

A 3 to 6 month emergency fund is recommended because it’s generally sufficient to cover unexpected expenses or a job loss, while still being manageable to save for most people.

This amount is also based on the assumption that most people can find a new job within 3 to 6 months if they lose their current one. Having an emergency fund of this size can provide peace of mind and help prevent reliance on high-interest debt or the need to sell investments during a financial crisis.

However, the actual amount needed may vary based on individual circumstances, such as job stability, expenses, and other factors.

Final thoughts

Facing a financial emergency can be hard. It can push us onto the back foot and fill us with anxiety. If we have an emergency fund put in place, a little pot we can turn to should something happen, and we can focus on the issue without worrying about finances.

An emergency fund turns a crisis into an inconvenience and can even downgrade it to a minor blip.

When understanding how much should be in my emergency fund. It really needs to be an amount to cover any major financial insignificance. Really if you’re searching for this try to work towards 3-6 months of your monthly income.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.