Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

I’m a big fan of Moneyfarm. In fact, I was so impressed, I moved over my Stocks and Shares ISA to them and have not looked back.

Moneyfarm is one of a new breed of investment platforms that offer robo-advisor services.

These types of investment platforms provide financial products and advice by tailoring each portfolio to the individual.

For the casual investor, it can be a much more convenient and cost-effective than a traditional investment broker.

Essentially taking the stress out of investing with a hands off set it and forget it (while an expert takes care of it for you) style approach.

Award-winning investing app, offering handpicked expert-managed portfolios. Simple investing at its finest.

Min initial deposit £500

- Expert managed portfolios

- Free financial advice

- ISAs available

- Low fees

- Not for individual stock pickers

The £500 initial minimum deposit can be quite high for beginners but Moneyfarm wants to ensure you are serious about being an investor with them.

If you want a low cost option our suggestion would be to check out our Wealthify Review which offers similar services but with a £1 initial deposit.

But what you really want to know is if Moneyfarm actually any good, and worth using? We unpack it all in this dedicated Moneyfarm review.

Ratings

- Useful Features

- User Experience

- Customer Service

- Suitable For Beginners

- Customer Feedback

- Price / Fees

Moneyfarm Review

I rated Moneyfarm very highly with a total of 4.6 out of 5 stars using our six pillar method.

The six pillar method is a system I use to rank an app based on its useful features, user experience, customer service, suitable for beginners, customer feedback and price.

The highest scores for Moneyfarm are for it’s user experience, customer service which is expert managed by a human and range of products.

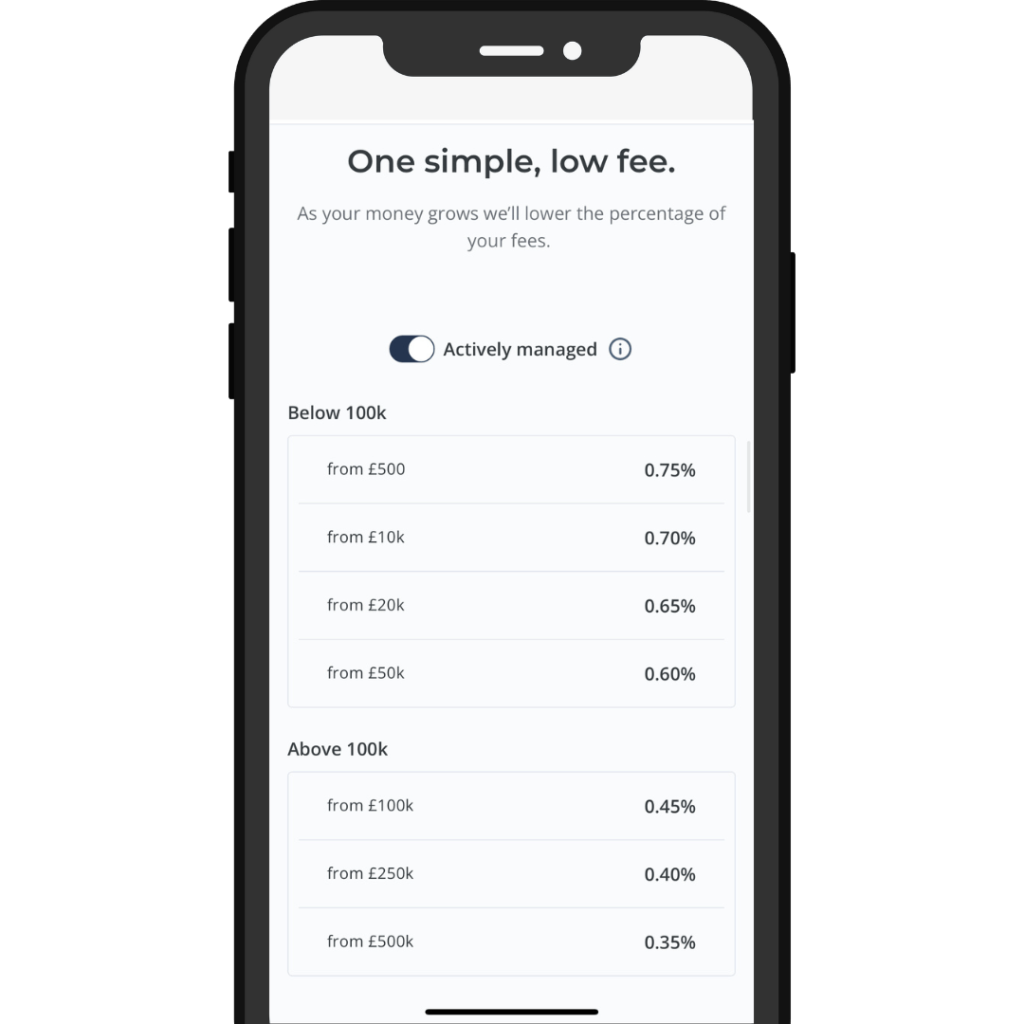

It’s fees start off on the mid range level when comparing them against similar apps but as you increase your account size the fees go down.

If you’ve heard enough already then you can visit Moneyfarm directly.

Moneyfarm Pros & Cons

Pros

- Free financial advice

- Expert managed portfolios

- Ethical investing options

- Risk tolerance tiered portfolios

- Great selection of accounts, including ISAs

- Fantastic for beginners and hands-off investors

Cons

- Complex fee structures

- No individual stock picking just expert managed funds

- Initial deposit is £500 or more

Is Moneyfarm good for beginners?

Moneyfarm is perfect for beginners and its main selling point is that it is supposed to make an investment as easy and hassle-free as possible.

The platform is slick and you can get started in minutes. Once you’re up and running, you can either set it up to be hands off.

That might frustrate more experienced investors who prefer to micro-manage their own portfolios but then Moneyfarm isn’t the platform for those individuals.

For the casual investor, only interested in Moneyfarm as a means to make some extra money, it’s a real attraction. As we say you can simply ‘set it and forget it’.

The thing we like most is you can actually have a real person helping you with your investment strategy if you want it.

This differs from other robo-advisors on the market and means you’ll always have someone to chat with if you don’t understand something.

Who are Moneyfarm?

Moneyfarm, launched in 2012 is a digital wealth management company and online investment advising tool. It has since grown to become one of the biggest investment companies in the whole of Europe.

Having broken into the UK market in 2016, the service was voted the ‘Best Online Direct to Consumer Investment Platform’ just two years later in 2018.

Moneyfarm, fuelled by its rapid growth, now offers an impressive range of products and services to its customers.

Pretty much all the financial services you can think of such as pensions, ISAs, general investment accounts, and socially responsible investing are all catered for.

They also have an investing app that is super easy to use and quick to navigate.

So far, over 80,000 active investors have entrusted Moneyfarm with their portfolios in the UK, and the company manages an impressive £1 billion+ in assets.

How Does Moneyfarm Work?

| Money Invested | Fee |

|---|---|

| On the first £10,000 | 0.75% |

| £10,001 - £20,000 | 0.70% |

| £20,001 - £50,000 | 0.65% |

| £50,001 - £100,000 | 0.60% |

| £100,001 - £250,000 | 0.45% |

| £250,001 - £500,000 | 0.40% |

| Over £500,000 | 0.35% |

Getting started with Moneyfarm is relatively simple, as it should be for a service that prides itself on ease of use.

Before starting your investment journey with Moneyfarm, you’ll have to set up an account. It’s a simple process, requiring standard personal details and verification.

At this stage, you should begin to think about what you’re looking for from Moneyfarm, including what type of product you’re interested in.

This would be from the following account types:

- Stocks & Shares ISA

- General Investment Account

- Junior ISA

- Personal Pension

- Self-employed Pension

A further necessary step before you can begin investing is successfully completing Moneyfarm’s in-house risk assessment.

It helps Moneyfarm to understand what you’re looking to get from the service and how much knowledge and experience you have regarding investment and financial matters.

Once you’ve completed the assessment, Moneyfarm’s algorithms will match you to a recommended risk portfolio.

Don’t worry, though. If you’d like to choose a different portfolio, you still can.

Then once you’re ready you can either transfer the funds via bank transfer or direct debit, or, if you already have an existing pension or ISA, you can transfer it over.

Key Benefits Of Moneyfarm

Moneyfarm, as the name suggests, is all about ‘farming’ money.

Okay, so you can’t really reliably farm money, but MoneyFarm’s USP is all about providing a service that can make you money passively, with little input.

Here are the key features that make that possible:

Investment Strategy

Moneyfarm is always making sure that your money is working as hard for you as it possibly can. There are various strategies that make this possible, including investing in assets from across the world.

Moneyfarm also looks ahead, planning for the future to make sure that any market fluctuations do not completely derail your portfolio.

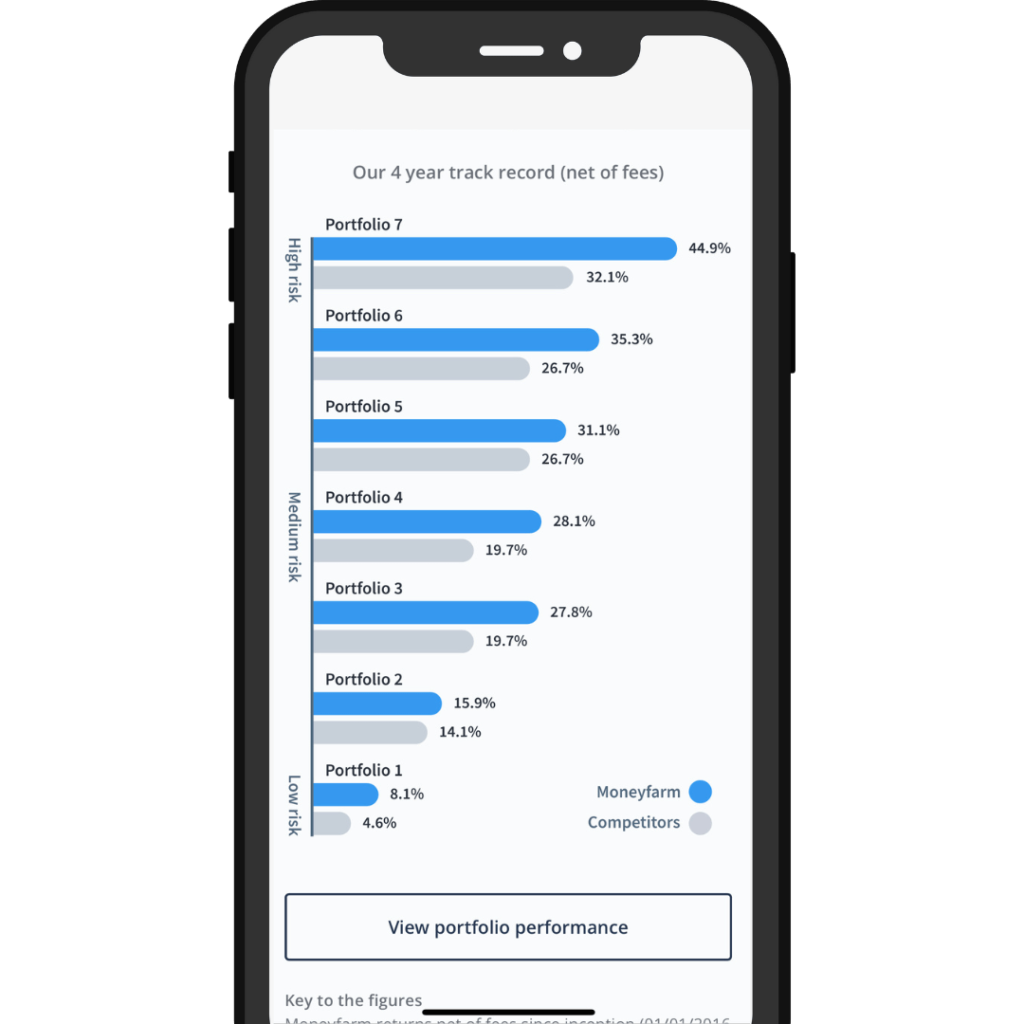

Their track record is very respectable beating the industry average by 2% a year, every year for the past five years. The average plan has made roughly 40% in 5 years which is very good considering the market conditions we have been facing since Covid.

Personalised Portfolio

Arguably Moneyfarm’s most attractive feature is its heavily personalised portfolios.

By filling out a questionnaire outlining your knowledge of the markets, comfort with potential market fluctuations, and overall goals, Moneyfarm will design you a portfolio that is tailored to you.

There are a total of seven portfolios available. A little less than some competitors, but more than enough.

Investment Advice

Although Moneyfarm mostly maximises your investment’s growth potential through its algorithms, that doesn’t mean human input is completely out of the window.

Where necessary, Moneyfarm uses expert advice to make sure your money is invested where it should be. This input is monthly, which keeps things relevant in our fast-paced modern world.

If you’re a first-time investor or someone with little investment experience, these features are really very beneficial.

However, serious investors and those who want to manage their money more closely might want to look elsewhere.

Moneyfarm Socially Responsible Portfolios

What Are Moneyfarm’s Account Options?

Moneyfarm offers investors three principal options. These are pensions, stocks and shares ISAs, and General investment accounts.

Let’s run through them each individually:

Moneyfarm Pension Review

The personal pension account or SIPP as it’s also known can be invested based on a number of factors.

These include your appetite for risk and your goals, but also includes other factors like the amount of money you have invested and your intended retirement date.

Using Moneyfarm’s pension calculator, you can also calculate how much money you need to save to fund your retirement plans.

If you already have a pension, you can transfer it to Moneyfarm in a relatively straightforward process that’ll take three weeks to a month.

Another neat feature of Moneyfarm’s pension service is that upon your retirement, you have the option to draw down your pension, allowing you to manage your savings and have access to them when you want to.

Moneyfarm Stocks And Shares ISA Review

This is similar to many other stocks and shares ISAs available these days.

The big difference, though, is that Moneyfarm’s investment advisors do the hard work, and manage your portfolio for you based on your preferences.

You can’t select the investments you’d like to make, even if you’d want to.

As with your pension, you can transfer money from an existing ISA, should you have one, to your Moneyfarm ISA.

By completing a simple form, you can shut down your previous ISA and transfer it across in its entirety to Moneyfarm.

If you choose to take this option, the whole process should take anywhere from two weeks to a month depending on your current provider.

Moneyfarm General Investment Account

A general investment account is a fantastic choice, particularly if you’ve used up your annual ISA allowance but would like to carry on investing.

This account provides you with the same hands-on advice and support you might expect from other options, but at a significantly lower cost.

Unlike with other options, there is no limit as to how much money you can invest, barring of course the minimum £500 initial investment you’ll need.

Be warned, though. You may have to pay capital gains tax on your profits.

Moneyfarm Junior ISA Review

This allows it’s users to further make use of an extra £9,000 tax free contributions per year.

You can invest your child’s money just like you can in a stocks and shares ISA and then when they turn 18 they have full access to the money. What a way to set you children up for life!

Alternatives to Moneyfarm

Moneyfarm forms part of the robo-advisor clan which is growing in popularity especially amongst beginner investors.

Other major robo advisors in the UK investment app space are Nutmeg and Wealthify.

Wealthify offers you the opportunity to sign up for just £1 but has less investment options.

Check out our Moneyfarm vs Wealthify review or our Moneyfarm vs Nutmeg review here.

Nutmeg is similar in a lot of ways but is more expensive and so far doesn’t perform anywhere near as good as Moneyfarms funds.

Moneyfarm Customer Service

I’ve been really impressed with Moneyfarm’s customer service. They are always very responsive and the live-chat feature is super helpful when you just have an easy query that doesn’t require a call.

I like the fact you can speak to a real human and their free financial advice offering is unrivalled across the industry in my point of view.

Their offices are open Monday to Friday 9-7pm finishing slightly earlier on a Friday at 6pm.

Frequently Asked Questions

What Are Moneyfarm's fees?

It’s difficult to give an exact figure for how much Moneyfarm costs to use, as it depends on a number of different factors.

However, as a general rule, the more you invest the cheaper it is.

For example, investing anything from the minimum amount of £500 upwards to £10,000 costs 0.75%, whilst anything between £10,001 and £50,000 costs 0.60%.

And of course, there are a couple of other fees to consider.

The market spread fee can be up to 0.09%, whilst the fund fee, charged by the providers, costs 0.20%.

Can I trust Moneyfarm?

Obviously, any investment carries an inherent risk. But as investment platforms go, Moneyfarm is as safe as any.

They’re a totally legit company, fully authorised and regulated by the relevant authorities, and they’re also backed up by the FSCS (Financial Services Compensation Scheme).

That means that your investment with them, up to a value of £85,000, is protected should the company go under.

What Do Current Users Think?

Moneyfarm generally receives very positive reviews from its users on respected review websites like Trustpilot, where the platform has a rating of 4.1 stars out of 5.

Most of the reviews praise the investment advice on offer, as well as the company’s great customer service.

Is Moneyfarm any good?

Yes, Moneyfarm is one of the top rated investing apps available on the UK market. It’s part of the robo-advisor groups of apps that provide tailored made for you portfolios alongside free financial advice.

As a user of Moneyfarm I’ve been very impressed with their customer service, offering and user experience on the app.

How to close your Moneyfarm account?

To close a Moneyfarm account you will need to sell all your investments at their current price. Then you can either speak to someone in their team via telephone or email them at [email protected]

How to contact Moneyfarm?

Freephone in the UK: 0800 433 4574 or From abroad you can call: +44 (0)20 3745 6990 or alternatively you can email [email protected].

Who owns Moneyfarm?

Moneyfarm has multiple investment partners including the likes of Allianz Asset Management and more recently M&G.

It’s Co-Founder and CEO Giovanni Daprà remains in charge to this day.

Conculsion

There’s a lot to commend about Moneyfarm, especially for casual investors that want to invest but don’t want to have to micromanage their portfolios.

The use of technology to create each user a personalised investment portfolio is great, and surely a sign of things to come in the industry.

If you’re an experienced investor, however, or maybe even just someone who prefers a hands-on approach, you may feel constricted by Moneyfarm’s ‘on the rails’ investment services.

We hope you’ve enjoyed our Moneyfarm Review.

MORE LIKE THIS

Share with your friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.

Just read your review on Money Farm (https://upthegains.co.uk/blog/moneyfarm-review-is-it-any-good). At the end it says “Hit the button below to head over to their website”. However, on my browser (Safari on an iPad Air IOS 14.7.1) there is no button…..

Thank you for flagging this Peter. I’ve taken a look, and it’s showing on our end but am asking our developer to look into this further.

I do hope you enjoyed our Moneyfarm review!