Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

If you’ve explored the FIRE movement but have been left a little uncertain as to if you can achieve this, Barista FIRE provides the perfect solution.

Sitting in between Fat FIRE and Lean FIRE, this approach allows you to retire early, with sufficient income to cover your living expenses.

However, with Barista FIRE, there is also the option to take on a part time job or agree that your partner continues to work, to fund the extras.

Being Barista FIRED is a great alternative route to early retirement and financial independence that provides a new approach to the work-life balance.

Standing for Financial Independence Retire Early, the FIRE movement has really gathered pace as more people look to retire early.

There are various approaches to achieve FIRE, and Barista FIRE can often feel more within reach than the likes of Fat FIRE.

There is also less frugality required when compared to the Lean FIRE method.

In this article, I’m going to explore everything related to Barista FIRE. I’ll be sharing how this compares to traditional FIRE and showing you how it can help you to retire early, with sufficient income to enjoy yourself.

Table of Contents

What is Barista FIRE?

The Barista FIRE movement is all about having retirement savings that allow you to move away from your full time job and retire early.

The concept means that your investment income has reached the level where the 4% rule covers your yearly expenses.

This means that you can walk away from your current job. However, to cover anything above and beyond your usual annual expenses, a part time job or a side hustle is used to bring in extra cash.

Meeting the 4% rule is an essential part of achieving Barista FIRE, as well as other FIRE movements. On a basic level, this means that by withdrawing 4% of your investment portfolio annually, you can cover your yearly expenses.

By treating the money invested this way, your retirement savings should be able to last you anywhere between 30 and 50 years.

The Barista FIRE approach is different to traditional FIRE in that you look for supplemental income.

Known as a Barista FIRE job, you seek something that offers the additional income that you need to live that much more comfortably.

The name Barista FIRE is used because Starbucks coffee shop offers health insurance to its part time employees.

This is a huge deal in the US, given the cost of health insurance, and it gave people the freedom to move to part time work.

Listen To This Podcast 🎙️👇🏼

Join us with Jon & David from The Debt Free Guys who went from 51k in debt to financially free in just 2 years!

How to achieve Barista FIRE

With your eye set on retiring early, there are certain steps that you’ll need to set your FIRE plan:

Reduce debt

If you want to leave your day before the traditional retirement age, it’s a good idea to bring your levels of debt down.

Good money management means that your yearly expenses will fall and your Barista FIRE number (the amount you need to retire early) will fall too.

Minimising debt is vital when looking to reach financial independence.

Savings and investments

The more money that you can save, the easier it will be to reach your Barista FIRE number.

You need to be looking at savings accounts that give the highest levels of interest. You also need to build your investments.

This will lead to the investment income that will cover your yearly expenses. A strong investment portfolio, that is well-balanced, can have a major impact on your net worth.

Remember investing in your 20s will be different to investing in your 30s or 40s so be sure to set your attitude to risk accordingly.

Side hustles and earning extra income

To achieve Barista FIRE, you can boost your income with a side hustle. This is something that’s done alongside your day job to bring in supplemental income.

Bringing in more money can help you to get to financial independence sooner and move away from your day job.

Examples of side hustles, some of which will generate passive income, include:

- Selling online

- Kindle Direct Publishing

- Blogging

- Online surveys

In truth, side hustles can be anything that helps you bring in more money alongside your full time job.

If you can tap into passive income streams, these can help to cover any remaining expenses that your investment income falls short of.

Living frugally

If you want to achieve Barista FIRE and have enough money for early retirement, you need to take control of your personal finance.

This means reviewing your spending and cutting back where you can.

If you want to leave the rat race sooner rather than later, you may need to make some compromises and cut things out.

Build a robust emergency fund

Life has a habit of throwing a spanner in the works. You need to ensure that you’re able to cover living expenses, but you also need to know that you can cope if things go wrong.

Ensure that you have enough money to see you through a minimum of 3 months should you find yourself unable to work.

How much money do you need for Barista FIRE?

The FIRE movement is all about Financial Independence Retire Early. To know how much money you need to do this, you need to know your Barista FIRE number.

The easiest way to establish your FIRE number is to use our Barista FIRE calculator.

The first step to getting to your number is working out your traditional fire number. This is easy to do if you use the 4% rule that we looked at earlier. You simply multiply your annual expenses by 25.

Let’s say that your living expenses were £40,000 per year. When this is multiplied by 25, you have a traditional fire number of £1,000,000.

To get to your Barista FIRE number, you need to know how much your part time Barista FIRE job will pay.

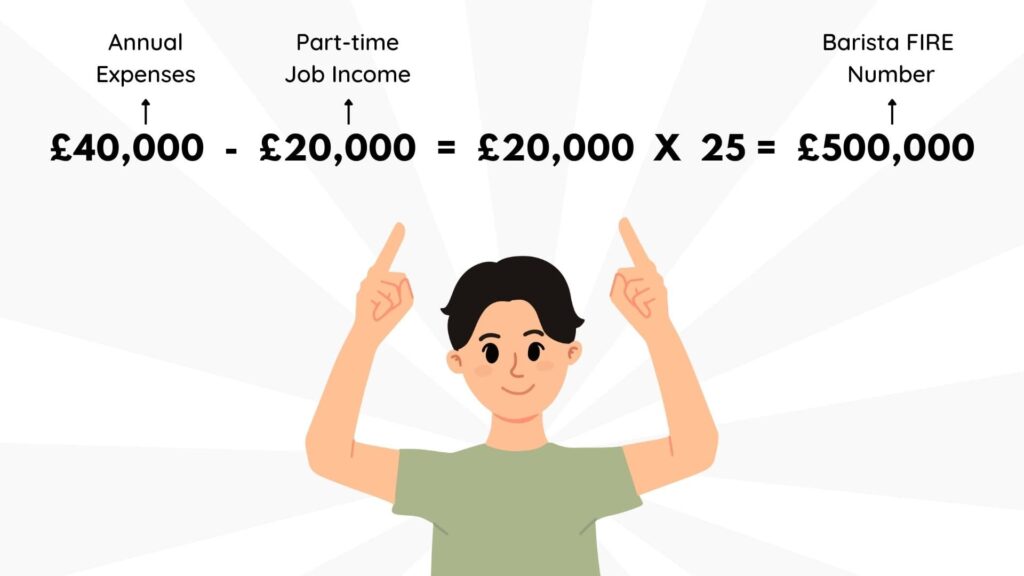

Let’s say that you can earn £20,000 from your part time job. Your calculation would then look like this:

Annual expense of £40,000 minus your Barista FI income of £20,000 = £20,000

To calculate your Barista FIRE number, you then take your annual expenses minus your part time job income, times 25.

In this case that looks like this:

This is half your traditional fire number, so you can see why Barista FIRE appears more achievable and is so attractive.

Setting out your Barista FIRE plan

Financial Independence Retire Early sounds great, but first, you need a plan. Here are the steps to get Barista FIRE ready:

Set realistic goals

Fat FIRE is about retiring early but without giving up any of the luxuries. With Barista FIRE, luxuries can still be within reach, but to pay for them you need additional income alongside passive income.

Be clear on the lifestyle that you want and be realistic about what can be achieved.

A simpler life can often be a happier lifestyle so don’t assume you need to save millions

Create a budget

Before you can fully retire you need to be able to meet your living expenses and create another income to pay for the extras.

You need to calculate how much you need to spend on the essentials, and then stick to this.

Spending less money will make your journey to Barista FIRE much quicker. A Barista FIRE calculator can show you the number you’re aiming for and you want to get there as fast as possible.

Have a contingency plan

On a journey to financial freedom, none of us can control outside influences. Interest rates could tumble again and see savings worth next to nothing, inflation could soar and stock markets could crash.

To keep your plan on track, and achieve as much money as you need, there has to be a backup plan.

Be prepared to tweak your Barista FIRE plan

The aim is to stop contributing to your investments so that the passive investment income is there for you to live on.

However, you need to monitor your investments and be prepared to make changes if things go off course.

The path to financial freedom is unlikely to be without its bumps and so you need to be able to respond accordingly.

Tips for successful Barista FIRE

Don’t allow yourself to be swayed from your FIRE plans. To stay on track consider:

- The need for motivation – remember why you’re doing this and the lifestyle that it will lead to. Join the FIRE community and surround yourself with positivity that can give you a boost when things get tough

- Manage risk – you need to protect your net worth and that means staying on top of your investments. Ensure that you have a balanced portfolio that isn’t overly exposed

- Protect your assets – anything that adds to your net worth needs protecting to allow you to reach Barista FIRE

- Planning for health care – while you’ll be taking on a part time job or working a side hustle, be sure that you’re health is taken care of. If you get too ill to work, this can seriously hinder your success

The pros and cons of Barista FIRE

Barista FIRE pros:

- You can leave your main job much quicker than you can with regular FIRE. A move to a part time job can lead to a happier lifestyle

- Barista FIRE allows for health insurance - even in the UK, with the NHS struggling, having access to private health care is increasingly becoming a must. With Barista FIRE you can budget for this and offer health insurance to yourself and your family

- A great lifestyle - if you're not ready to rest and fully retire, this option keeps your finger in the work market and can keep you engaged

Barista FIRE cons

- Reliance on an employer - as you not entering full retirement, you still rely on a 3rd party for a proportion of your income

- There is a need for a degree of frugality - this isn't as extreme as Lean FIRE, but nor is it as opulent as Fat FIRE. There is still a need to budget and be strict with your personal finance

Barista FIRE vs traditional retirement

The key differences between Barista FIRE and traditional retirement are:

- Traditional retirement leads to stopping work at the typical retirement age. With Barista FIRE, you get to step back from your main job sooner

- With traditional retirement, the plan is that by the time you reach retirement age, you stop working. Barista FIRE means that you use part time work to supplement your income

- Barista FIRE sees you taking an active interest in investments. With traditional retirement, you tend to leave your pension in the hands of others

What’s right for you depends heavily on your circumstances and what your goals are.

Moving away from the rat race at a young age is a huge bonus for many while they’re able to stay engaged by finding a part time job.

Different types of FIRE

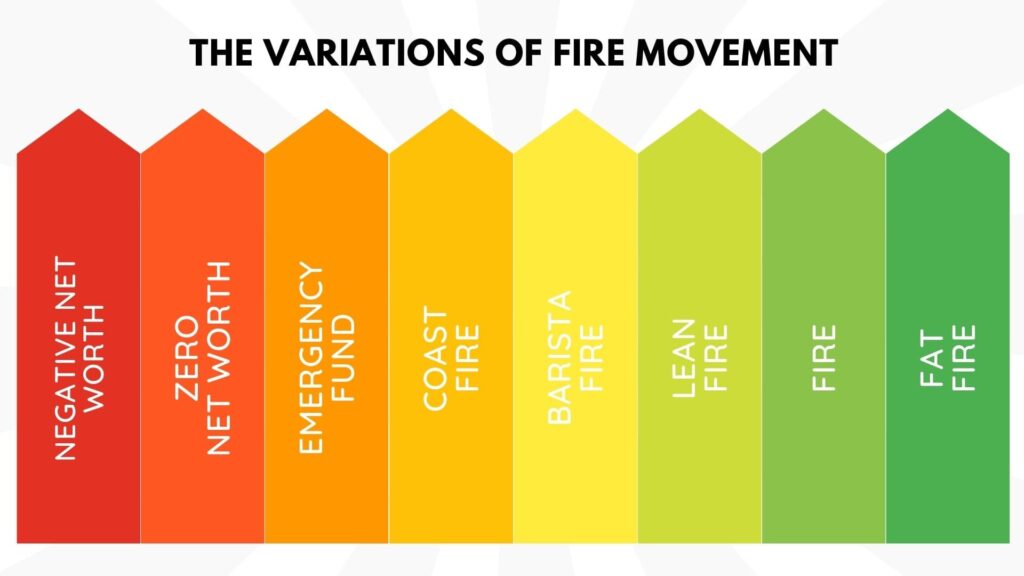

The FIRE movement, aimed at achieving financial independence and early retirement, is gaining momentum and attracting various subcategories.

The following list outlines the different types of FIRE, ordered from the easiest to the most challenging to attain:

- Coast FIRE or CoastFIRE, entails accumulating enough funds to discontinue contributions and still achieve FIRE at a later point in time. Check out our Coast FIRE Calculator.

- Barista FIRE or BaristaFIRE involves accumulating sufficient funds to retire early while concurrently working a part-time job for supplementary income and medical coverage.

- Lean FIRE or LeanFIRE, advocates the minimalist approach to attain FIRE, which means retiring with a meagre budget.

- Traditional FIRE involves accumulating 25 times one’s annual expenses and retiring early, leveraging the 4% rule.

- Fat FIRE or FatFIRE, on the other hand, refers to early retirement without adhering to frugality and opting to amass a more substantial nest egg.

Final thoughts on Barista FIRE

Barista FIRE provides a great alternative to Fat FIRE. It comes with a lower FIRE number that is much easier to reach.

While there is still a need to find supplemental income, you are free from the rat race at a much younger age than those who opt for traditional retirement.

With economic uncertainty abounding, financial independence is a must, and Barista FIRE offers an attractive way of achieving this.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.