Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

The FIRE movement.

Is it some cult or jumped-up fad? Well, cult might actually be close enough, but really the FIRE movement is much more than that.

It’s easy to think about what could have been, but realistically it is hard work putting aside chunks of your money each month to save for something that’s not happening right now.

Rather than just hoping it falls into place, it’s best to set a monthly budget and take charge of your finances. Easier said than done.

However, without even a basic budget in place, you are simply guessing how much you will have left, which doesn’t lead to solid foundations when you want to retire.

FIRE is different. Instead of just having a simple budget for each month to ensure you have a little money to save, people who follow FIRE which by the way stands for ‘Finance Independent, Retire Early’ have a much more stringent plan.

They believe in saving and investing as much as possible, as early as possible, to retire as soon as they can.

In this article, we’re going to dive into the movement and why it’s long been so popular among the more financially savvy.

Table of Contents

What is the FIRE movement?

Financial Independence, Retire Early was a phrase first coined in 1992 by Vicki Robin and Joe Dominguez in their best-selling book Your Money or Your Life.

Since then the FIRE movement has sprung up into a powerful belief system for those looking to retire early.

Its followers do everything they can to ensure they make themselves financially free as quickly as possible and at times make huge sacrifices in their spending to do so.

When you think about it, starting work at 18 and retiring at 65 isn’t exactly living your best life.

Working for someone else is a strange concept – you get told when you are expected to work and even have to ask permission to take a break or holiday. When you think you will be doing this five days a week until the age of 65, it can be pretty depressing.

However, there is no law to say you have to retire at that age (and the Government keeps raising this too!), but it isn’t going to be financially possible to do so unless you’ve got some backing.

Everyone involved in the movement do things slightly differently depending on their current financial situation. In general, people aim to save and/or invest at least 50% of their income.

In some cases, people in the movement put aside 70% of their monthly salary. You’re probably thinking that’s impossible, but this is the aim, save and invest now, and retire as soon as you can.

That being said, you still need to know how to be a successful investor otherwise it won’t matter how much you put in.

FIRE followers also believe that by living frugally in the here and now they’ll have a better quality of life later down the line. Those who start early are pushing to be in a position to retire in their 40s and, in some cases, even sooner!

Of course, with the rising cost of living, it isn’t as simple as committing to saving that much each month; it’s something that you need to do aggressively and consistently to get there.

You can caluculate your very own FIRE number with our full FIRE calculator here.

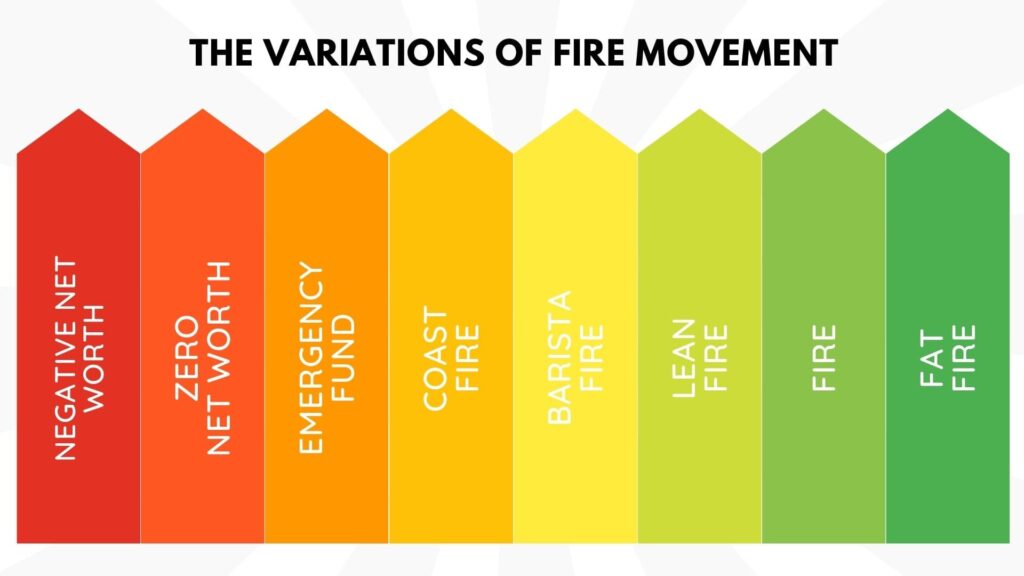

Different types of FIRE

The movement towards Financial Independence Retire Early (FIRE) is gaining momentum and attracting a diverse range of followers.

Outlined below are the various types of FIRE, presented in order from the easiest to the most challenging to achieve:

- Coast FIRE (also known as CoastFIRE) involves accumulating sufficient funds to stop contributing while still attaining FIRE at a later date.

- Barista FIRE (or BaristaFIRE) requires amassing enough funds to retire early and work part-time for additional income and healthcare coverage.

- Lean FIRE (also referred to as LeanFIRE) encourages a minimalist approach to FIRE, which means retiring with a modest budget.

- Traditional FIRE necessitates amassing 25 times one’s annual expenses and retiring early, utilising the 4% rule.

- Fat FIRE (or FatFIRE) advocates for early retirement without emphasising frugality and instead focuses on accumulating a larger nest egg.

What can be learnt from the FIRE movement?

Following the FIRE movement can be intense at times. If you get heavily involved you’re required to meticulously track your spending.

You’re require to constantly search for ways to save and invest your money, so it isn’t something for everyone.

However, whether you are interested or not, saving a little extra month each month and making some money from investing is certainly something we all should embrace, so even if you don’t go the whole hog I wouldn’t run away just yet.

Dream Big

While retiring at the age of 30 is nothing more than a pipe dream for most, there is something to be said for dreaming big.

Even saving a little each month can mean that you have a nice pot for yourself and your family when it comes to retiring.

Personally, I’d be very happy shaving a couple of years of my working life and be able to kick my feet up with an ice-cold beer on a hot beach somewhere.

Recognising that anything you put aside now helps you prepare for that makes it much easier to make small sacrifices to your spending each month.

Keeping Your Expenses Low

One of the main things that the FIRE movement believes in is keeping your monthly expenses as low as possible because the less you spend each month, the more you can save and invest.

Even if you aren’t strictly following the FIRE movement yourself, you can certainly take away plenty of their tips about saving money on your outgoings each month.

Spend a lazy Sunday getting your finances in order. Do a budget, negotiate some better deals on your household bills, prep a packed lunch for the Monday or buy a coffee machine that’s on offer to help cut down your daily Pret pitstops.

There are 1000s of ways you can cut out minor expenses which will have a huge impact over the course of a year and in reality, very little effect on you.

The majority of our habits are formed because it’s too easy to do something, but once you’ve broken the mould you’ll find you always adapt pretty quickly.

Boosting Your Income Isn’t As Hard As You Think.

On top of saving as much money as possible each month, the FIRE movement looks to do what it can to boost its income.

Reading a Financial Independence Retire Early Guide is likely to point you in the direction of various side hustles and ways to make a passive income that’ll boost your monthly income – and therefore have more to put towards your savings pot and investments for later life.

You can check out our top 10 side hustles right HERE.

Invest Wisely

The movement is also about making sure the money you save each month works as hard for you as possible. It isn’t just about putting 50-70% of your income into a savings account each month and waiting for retirement to access it.

Instead, people who follow this way of life make use of all of their tax allowances. Being diligent on tax means looking into stocks and shares ISAs, pension pots, cash ISAs and lifetime ISAs.

All of these accounts provide something different but all how allowances for tax and in some cases free cash bonuses provided by the UK government, sometimes up to 25% a year!

Have you heard of Robo-advisors?

There are some really easy ways to start investing even for those with little or no knowledge.

Robo-advisors were built for those who want to invest but also just want to get on with their lives and have someone (or something) do it for them.

Robo-advisors ask you a series of questions based on your personal risk tolerance and time horizons.

Once completed they automatically create you an investment portfolio based on your answers, you pop a bit of money in and boom you’re an investor. It’s that easy!

There are some great brands out there like Nutmeg, Wealthify and MoneyFarm.

Other types of robo-advisors are platforms like eToro who offer a slightly different version with the ability to directly copy some of the best investors in the world with their patented copy trading feature.

Again you can set it up, contribute regularly and let someone else do it for you.

I personally use eToro for my general investment account and even though I chose my own investments rather than copy I know people who have done very well off this tool.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

How to become part of the FIRE movement?

If you’re interested in retiring early (and realistically, if it was possible, then who wouldn’t be), the first thing you need to do is set up a plan on how you will make this happen.

Road mapping, your way to retirement, is a big part of the FIRE movement & the best way to get started.

The first thing the movement tells you is that you need to do what you can to get out of debt as soon as possible. So concentrate on this rather than setting up any retirement fund or worrying about investing.

Once you are debt-free, your next step is to set yourself up with an emergency savings fund. Generally, people put around 3-6 months of their expenses in this pot so that they know that whatever happens, they are prepared.

Any unexpected expenses aren’t going to throw them entirely off track. Once they have done this, it is time to start looking at what you will do to move faster towards more desirable retirement age.

Thanks to social media and internet forums, it isn’t hard to find communities of people attempting to live this way of life and sharing their experiences.

If you are interested in becoming part of the FIRE movement, then seeking these out, reading posts and joining in can be a great way to get started and also to pick up any tips from people sharing their experiences.

Some of the first things people do include starting to save a smaller amount each month to ease themselves into it.

For example, someone might opt to save 15% of their monthly income and make some payments towards their mortgage to get this paid off sooner.

It is always worth checking with your mortgage lender about the implications of making one-off payments and/or paying off the outstanding balance sooner to work out what is best for your personal financial circumstances.

Once you have all of this in place, it is time to start thinking about saving more each month and what you will do with your savings.

Getting professional financial advice can be worthwhile at this stage, especially if you want to make the most out of any tax allowances, pension schemes and ISAs, which is always recommended.

Why is FIRE so popular?

The rising cost of living certainly has people investigating how they can save money each month and even boost their income.

This, alongside the growth of social media influencers and people who choose to set up platforms to share their stories and experiences, has undoubtedly contributed to the increase in popularity of the FIRE movement.

With places like The New York Times sharing stories of those who have managed to retire before the age of 40, people are becoming interested in how they can have the same success and whether it is possible.

Social media influencers sharing affiliate links, people catching on to side hustles to earn money, and talking about passive income streams have people feeling confident that things like the FIRE movement aren’t entirely out of reach.

Of course, we all know that social media should be taken with a pinch of salt and that not everyone shares a true reflection of their lives, but that doesn’t stop people from looking up to role models and hoping for a similar lifestyle.

It is hard to pinpoint one thing that has caused a rise in its popularity. Still, indeed, the ability for people to talk about it to large audiences online will have helped raise awareness of this movement and way of living.

That in itself will have undoubtedly helped it become more popular.

Is the FIRE movement for everyone?

Anything that is around strict budgeting and saving will have a mixed audience. It’s not for everyone.

If you’re living paycheck to paycheck, then thinking about putting aside a large chunk of that for retirement seems entirely out of reach – and for some, the realism is that it just isn’t possible.

To make the FIRE movement work for you, you have to be really good with money and strict with how you use your credit.

For example, lots of people within this movement use things like credit cards to benefit from free balance transfers, cashback offers and loyalty points.

If you use this line of credit correctly, then there are some benefits to be had, but you really do need to keep on top of things.

If you start dipping into your credit card balance or spending money on the card and not paying it back, you could end up in debt which is certainly not very FIRE of you.

Is the FIRE movement here to stay?

Although the FIRE movement UK is relatively new in terms of popularity, there will be people that have been doing similar for very many years.

Social media has allowed people a platform to talk about living this way and raise awareness, which will cause more people to become interested in this way of life.

The FIRE movement UK is unlikely to be going anywhere anytime soon, especially as those that have been successful in making early retirement happen to become more vocal in sharing their success stories and encouraging others to try and do the same.

However, with the cost of living increasing and wages generally not matching this, it is becoming harder for many people to consider following a strict movement.

That said, anything that encourages people to save money for retiring and even having money put aside for a rainy day pot can only be a good thing, so things like downshifting lifestyles and living more frugally are certainly going to be around for the foreseeable.

Conclusion

Becoming part of the FIRE movement certainly requires a lot of commitment. It is certainly like to be a big change compared with what you’re used to.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.