Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Moneybox is a highly-rated saving and investment app. Its round-up feature allows you to invest your spare change or even save towards your first home.

The award-winning app is highly functional, and engaging and they have a wide suite of products available too.

I personally ran tests on Moneybox over a 6 month period to write this Moneybox review and I have to say I was very impressed.

I’m now a proud owner of a Moneybox Cash ISA and I can see why they’ve now got over 1 million UK customers because the app is very well designed.

In this honest Moneybox review, I’ll go through Moneybox’s main features, account types, the pros and cons, plus unpack some of the customer reviews.

But first, here’s Moneybox unpacked.

The award-winning personal finance app Moneybox is a one-stop shop for your personal finances with over 1 million users in the UK.

They also offer a range of products including Stocks and Shares ISA, personal pensions, Lifetime ISAs and Cash ISAs.

- Easy to use, slick mobile app

- Roundup feature through open banking

- Start with just £1

- Excellent customer ratings (Trustpilot 4.5/5)

- FCA regulated + FSCS Protected

- Small monthly subscription fee

I think if you’re a beginner investor, looking for a reliable ISA, savings account or personal pension then for me Moneybox is hard to beat.

I recently interviewed Brian Byrnes, Head of Personal Finance at Moneybox on The Money Gains Podcast and he spoke at length about the Moneybox pension product and how they have a team which can combine your old pensions together. Handy!

I was really impressed by their approach. Brian spoke about how Moneybox put a lot of emphasis on user experience and create useful tools for their users like their savings, mortgage and pension calculators.

Moneybox is NOT for those who want to trade a lot or pick a wide range of individual stocks.

You can also get slightly higher savings rates elsewhere, but if you’re looking for a trusted provider and interested in building wealth and growing your savings then that’s where Moneybox can help.

The round up feature is also brilliant tool, connecting to your cards through Open Banking allowing you to save and invest your loose your change.

If you’ve heard enough you can head over to Moneybox.

(Capital at risk before you invest)

Moneybox Rating

- Suitable For Beginners

- Useful Features

- User Experience

- Customer Feedback

- Customer Service

- Price / Fees

Using my six-pillar system which I use to rate financial apps I have rated Moneybox 4.6 out of 5.

Moneybox scores best on its suitability for beginners and useful features.

Moneybox key features

- Easy-to-use mobile app

- Range of award-winning ISA products, savings and investing accounts available

- Personal pensions alongside a team which helps combine your old pensions

- Mortgage advice and broker product

- Round up features available to save or invest your spare change

- Open accounts from as little as £1

- A range of calculators and useful tools

- A learning hub for beginners to understand personal finance

- Moneybox is regulated by FCA

- Moneybox has FSCS (financial services compensation scheme) protection – up to £85,000

Choose from a range of award-winning ISA products to save, invest and grow your wealth.

Invest and save from as little as £1.

Is Moneybox good for beginners?

Yes, Moneybox is good for beginners. It’s specifically designed for that reason and they have features which can help you go from a terrible saver to a good one.

The ability to open an account with just £1 means that there’s a very low barrier to entry.

You can download the app via the Apple IOS or Google Play store in minutes and be investing or saving inside an ISA in just a few minutes.

What Is Moneybox?

Moneybox is an award winning, savings and investment app available on both Apple and Android devices.

It is literally what it says on the tin. A money box. It’s a similar concept to when you used to keep spare change in a jar or piggy bank but modernised.

Moneybox’s goal is to make saving and investing part of everyday life.

You can save up automatically, by setting up a regular deposit, such as a weekly or monthly one, depending on how often you get paid, and as mentioned briefly before you can start saving and investing from as little as £1.

The concept of throwing money into a piggy bank lives on as Moneybox connects your bank accounts and allows you to round up purchases to save or invest them automatically.

They do this through Open Banking and you can pause or stop this at any time if you need to.

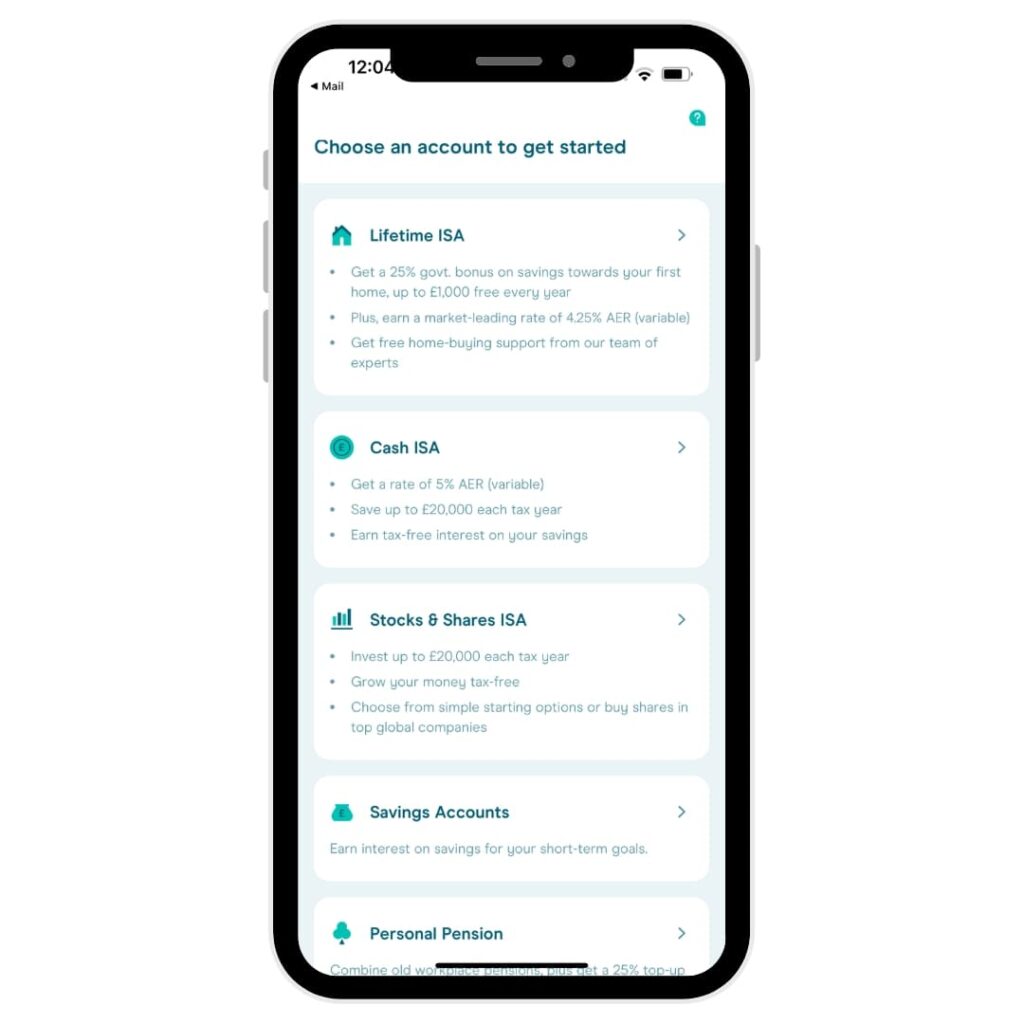

How to open a Moneybox account?

I downloaded the app via Apple’s app store. You are then taken to a page that showcases the different features available before being invited to sign up.

Signing up was easy, entering a few personal details, National Insurance number and verifying my email. I was then given five options to choose from to open an account, all of which we listed below.

Choose from a range of award-winning ISA products to save, invest and grow your wealth.

Invest and save from as little as £1.

Accounts And Features Available On Moneybox

Here follows a list of savings and investment accounts available on Moneybox:

- Lifetime ISAs

- Junior ISAs

- Stocks & Shares ISAs

- Stocks & Shares Lifetime ISA

- General Investment Account (GIA)

- Personal Pension

- Savings Accounts

Moneybox Stocks And Shares ISA Review

The Moneybox Stocks and Shares ISA allows you to invest up to £20,000 which is your full yearly ISA allowance.

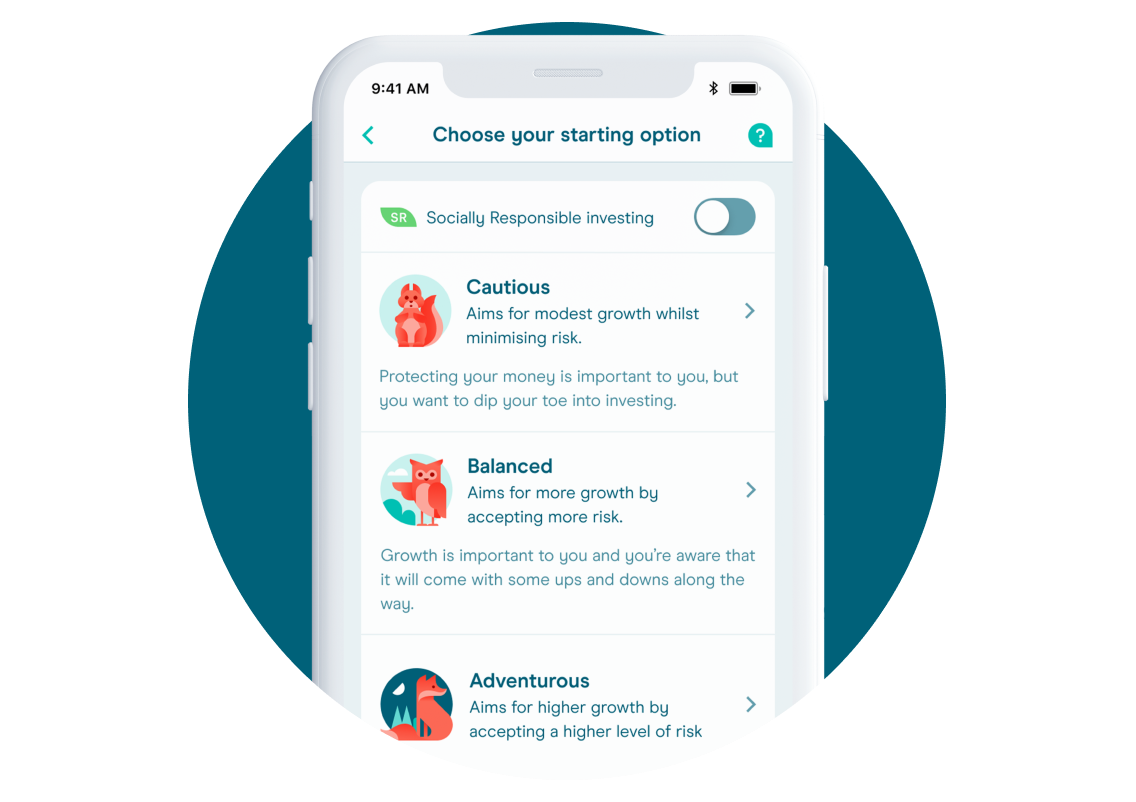

There are 3 investment options available inside the ISA which are cautious, balanced and adventurous.

Each of the investment funds provides access to Fidelity funds alongside bonds too. These are essentially tracker funds.

They also provide further access to a small range of US stocks which you can purchase individually too.

You will have the opportunity to invest in big name brands, such as the likes of Disney, Facebook, Netflix, and many more.

I also liked the fact they have a range of top ETFs (exchange traded funds) and funds from brands like Fidelity, iShares and Legal & General.

There is no financial advice offered as part of the service so be sure to read into the offerings a bit more before you pick.

One thing we really liked is the investment opportunities also include a socially responsible option or ESG option which is certainly a hot topic right now, and rightly so…

Money from these funds only goes to companies and organisations that are classified as meeting high environmental, social and governance standards.

This makes it the perfect option for those of you who are environmentally conscious and don’t want their money going towards fossil fuel, or anything else that’s detrimental to the environment or climate change.

Moneybox recently won Best Investment Provider at the British Banking Awards 2023 so this puts you in good hands!

Read more about Stocks and Shares ISAs here.

MONEYBOX PORTFOLIO PERFORMANCE

| Portfolio Option | 2016 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Cautious | 15.2% | 6.9% | 3.7% | 4.6% | -5.3% |

| Balanced | 27.1% | 18.0% | 8.4% | 18.1% | -8.6% |

| Adventurous | 27.5% | 20.6% | 8.6% | 22.6% | -9.2% |

Moneybox Pension Review

The Moneybox Pension has undergone a significant upgrade in recent times.

If you wish to have all your accounts run through the same app, you may want to consider having your Personal Pension with Moneybox to help you live more comfortably in later life.

They have dedicated pension detectives that will help you to track down all of your old workplace pensions from previous stints of employment, and combine them into one single pot.

The Moneybox SIPP (self-invested personal pension) allows you to invest your full pension allowance of £60,000 each tax year.

Moneybox Lifetime ISA Review

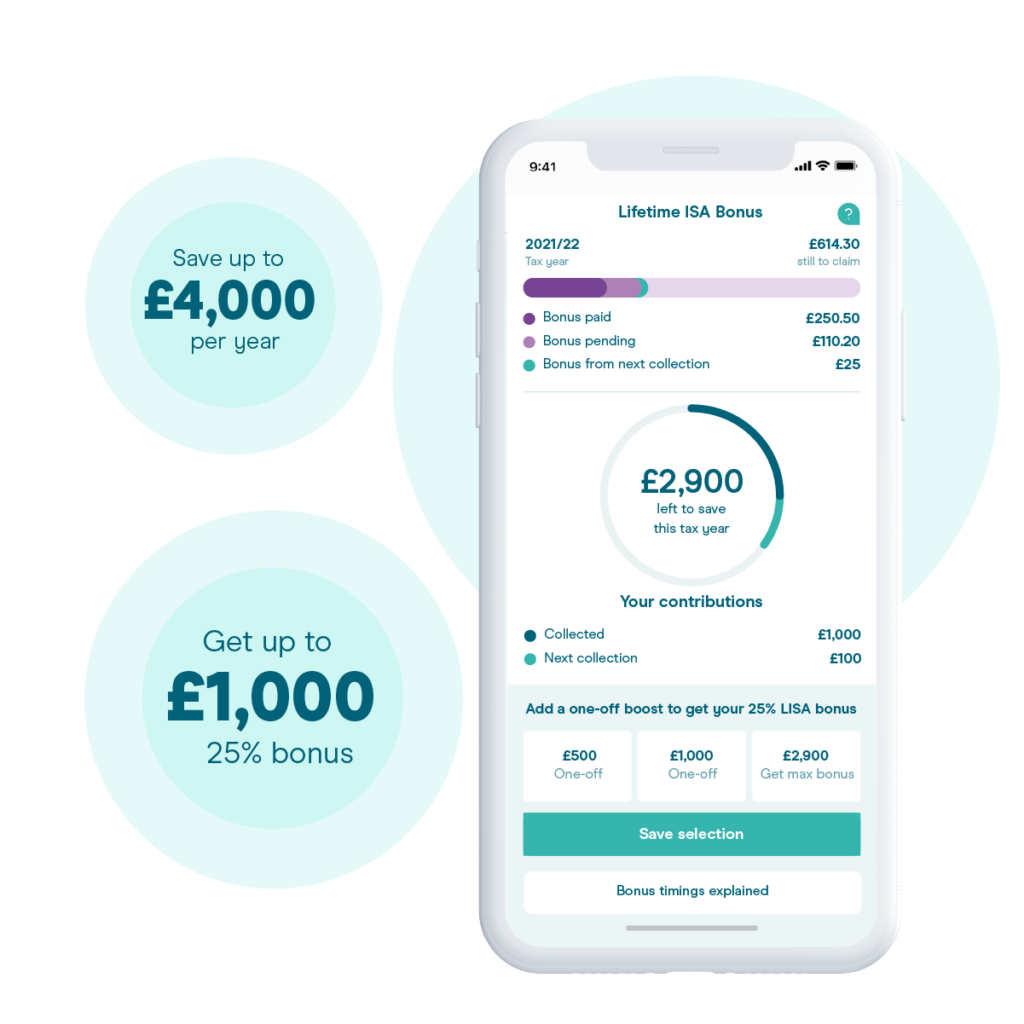

Lifetime ISAs are one of Moneybox’s most popular accounts, and they are predominantly used by first-time buyers who wish to save up for a home but they can also be used to save towards retirement too.

You can open a Lifetime ISA with Moneybox between the ages of 18-39 and pay into it until you’re 50.

Moneybox has won multiple awards for this product and rightly so as for me, it’s one of the best lifetime ISAs on the market right now.

But better yet, with a Moneybox Cash Lifetime ISA, you can save up to £4,000 every year, AND get a whopping 25% bonus from the government.

This effectively means you can get £1,000 a year towards your new home or retirement if you max it out. NOT BAD!

(Capital is at risk if you invest your Lifetime ISA)

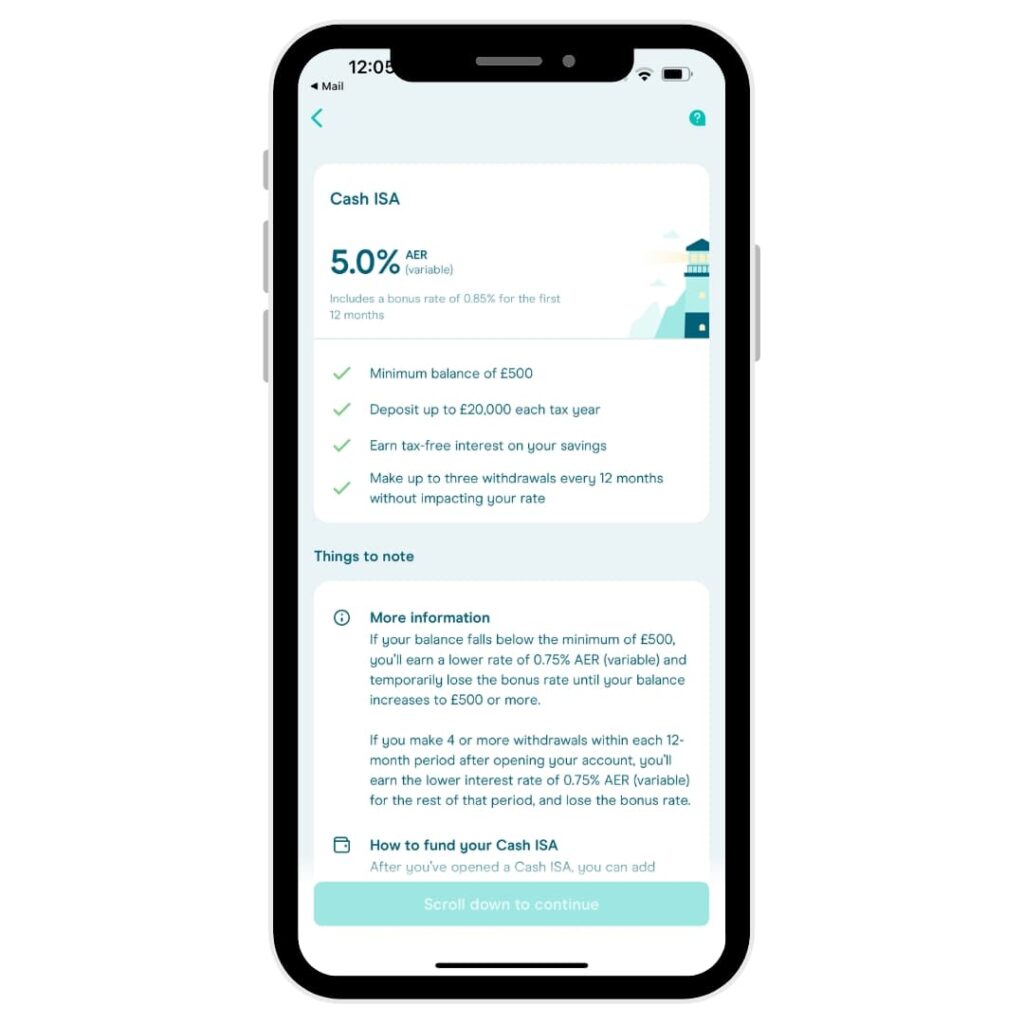

Moneybox Cash ISA Review

Moneybox recently launched a Cash ISA in 2023 to add to their range of ISA products.

You need to deposit a minimum of £500 to open a Moneybox Cash ISA and you currently receive 5% AER variable interest rate (correct at the time of writing).

The Cash ISA falls into the £20,000 ISA allowance you get each tax year across various ISA types.

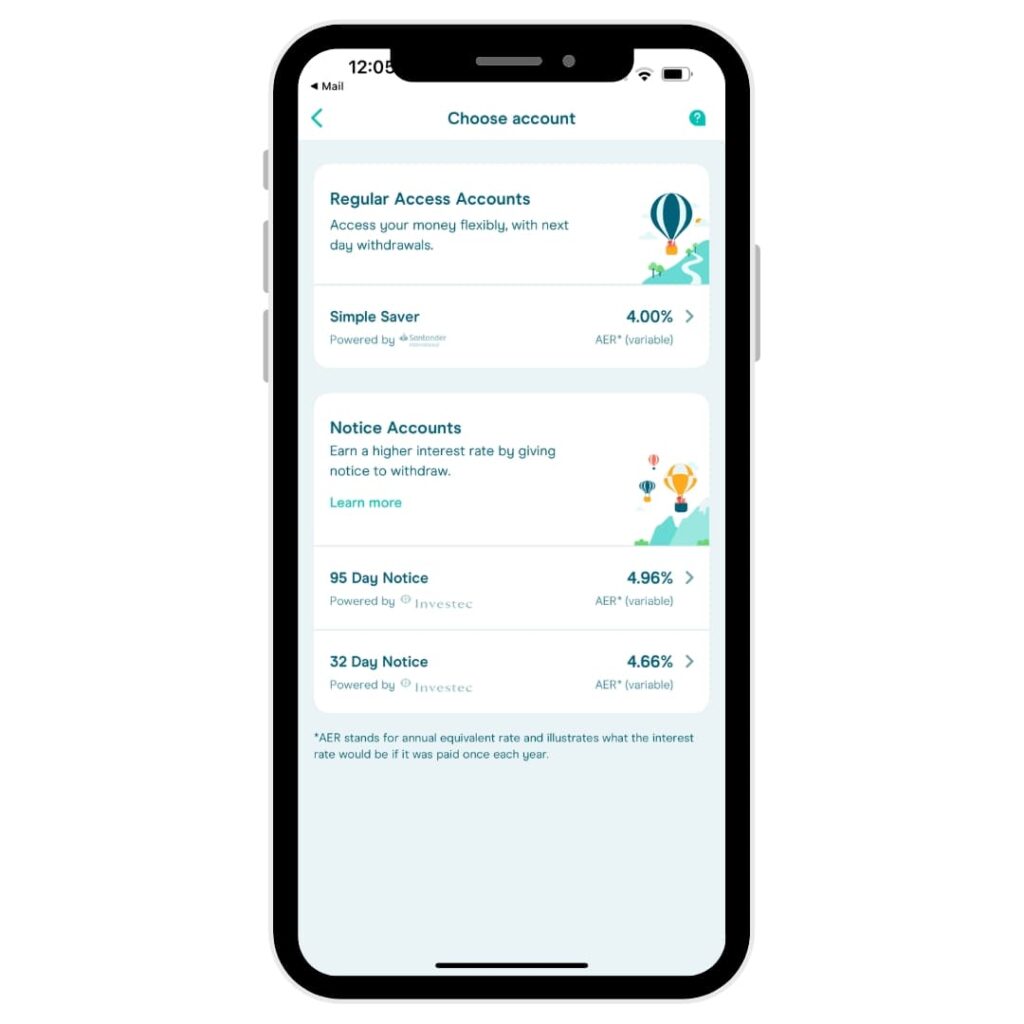

Moneybox Savings Account Review

Moneybox offers a range of savings accounts in contrast to the Cash ISA which can be useful for different short term savings goals and indeed any who struggle to save money.

Alongside their Simple Saver account which is just a regular savings account they offer fixed notice savings accounts too.

This means you can lock up your money with their notice accounts for a period of time earning interest by doing so.

The fix notice periods include:

- 32 days

- 45 days

- 95 days

- 120 days

The longer you save can get your a better interest rate but it is important to check this beforehand.

Notice accounts are a great option for savers as they discourage you from withdrawing.

Moneybox Investing Account Review (GIA)

Choose from a range of award-winning ISA products to save, invest and grow your wealth.

Invest and save from as little as £1.

Moneybox Mortgages

Moneybox now offers mortgage broker services and really comes into its own with first-time home buyers.

They recently won Best First-time Buyer App at the What Mortgage Awards 2022.

When you use their products they offer a free mortgage advice service and this can be invaluable in the current landscape.

Included in the free mortgage advice is an opportunity to browse over 90 mortgage lenders to find the mortgage that best suits your needs.

They also have mortgage calculators you can make use of so you can see what your repayments are likely to be.

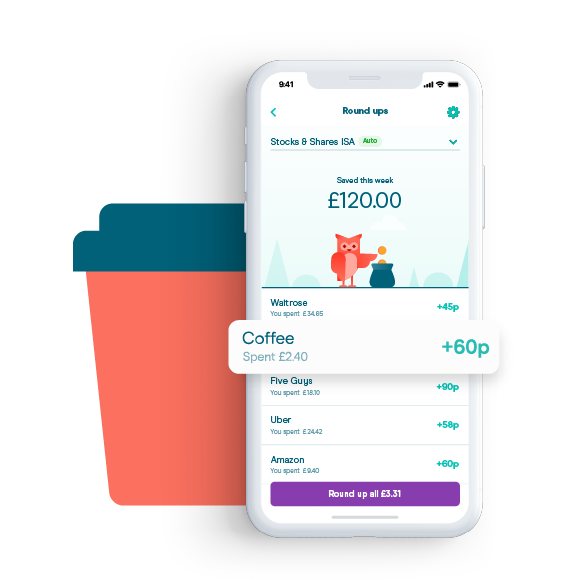

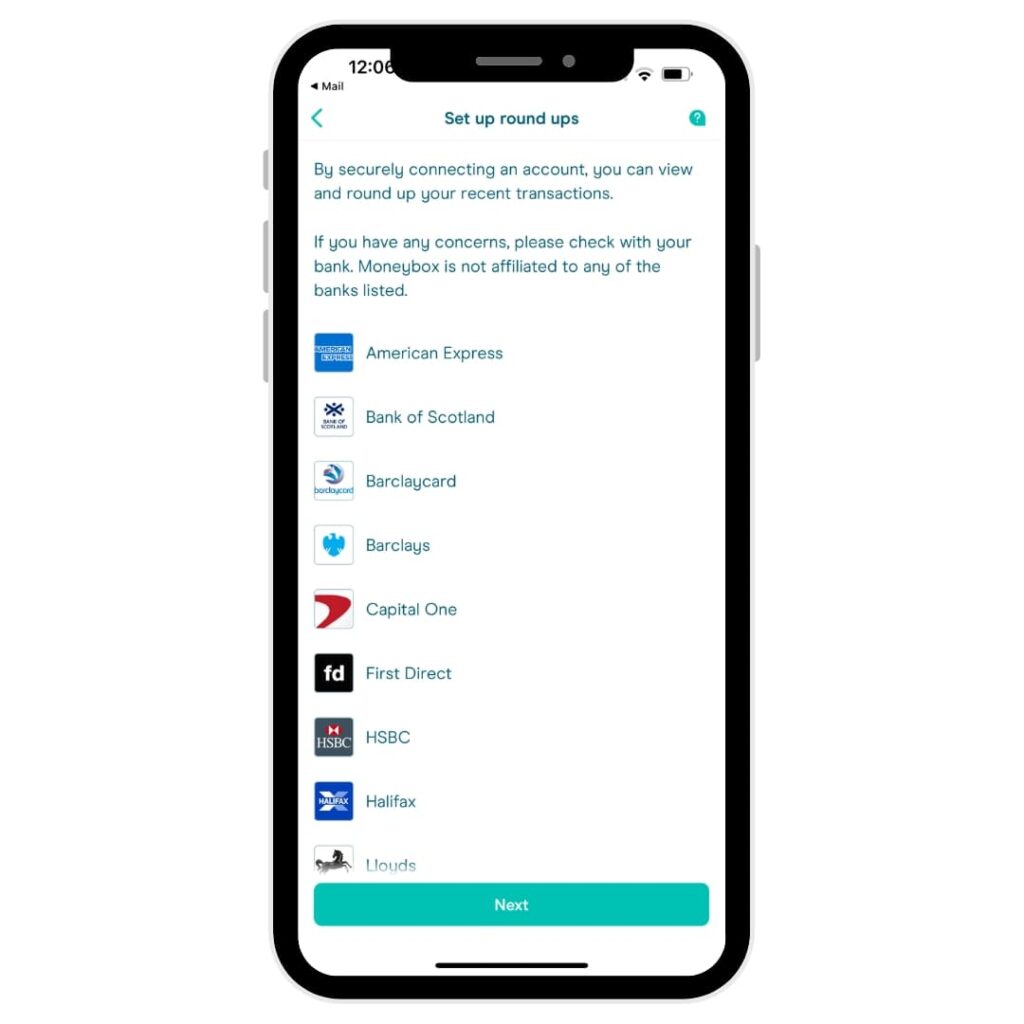

Moneybox Round ups

Moneybox’s round ups deserved it’s own section as I think it’s a big deal.

As mentioned earlier, Moneybox’s aim is to make saving and investing part of the consumer’s everyday life. And one of the ways they aim to do this is allowing you to do this through everyday purchases.

For example, whenever you make a purchase on your card, you can tell it to round up the amount to the nearest pound and invest the spare change.

They do this through Open Banking which connects to your bank account and allows them to view your purchases. The money is then taken via Direct Debit.

Take your morning coffee, for example. If you spend £2.60, you can round it up to £3 and invest the 40p change.

I’ve been testing this out recently and in my first month I invested £38.90 and in my second month £64.30 (I was spending more as I was on holiday).

The main thing here was that I barely noticed it. One of the things I loved as a kid was building up a change pot, so getting back to some sense of this was a pretty cool experience for me.

Moneybox Customer Reviews

The majority of the reviews of this app are on Apple’s App Store where they’ve had over 42,300 reviews, and impressively still managed to earn an average customer rating of 4.8 stars out of 5.

On Google Play there have been over 10,700 customer reviews, and the average customer rating comes out at 4.3 stars out of 5, which is only slightly less than the rating on Apple’s App Store.

On TrustPilot, there are 1,546 reviews so far, and an average customer rating of 4.5 stars out of 5.

Looking at the reviews the common theme is praise of the user interface and how easy it is to track your money. They also praise how helpful it is when making investment decisions with clarity being a big deal for users.

When customers do complain it is usually because they have lost money when investing, which can happen, and because the money can take a couple of days to come through when you want to withdraw it.

Famous money saving expert, Martin Lewis, has praised Moneybox’s market-leading Lifetime ISAs, but has advised viewers not to use them as pension pots, and to use them primarily for saving to buy a home.

Although Moneybox does have the tag line “Turn your money into something greater”, it does concede that investing money has an element of risk, and they clearly state in their blurb that:

“All investing should be regarded as longer term. The value of your investments can go up and down, and you may get back less than you invest.”

Moneybox Fees

Moneybox’s fees are pretty straightforward. They have a subscription fee for the majority of account types which is just £1 a month – this is free for the first 3 months.

You also get charged a yearly platform fee when you invest which is 0.45% – the fee is charged monthly but split up.

Also if you invest in funds which you kind of have to on Moneybox there’s fund fees depending on what you choose which are between 0.12 – 0.58%.

Lastly if you have a pension the Moneybox fees are slightly different. There’s no subscription fee but the 0.45% platform fee is in place and so is the fund fees too depending on where you invest.

This does however reduce to 0.15% if your pension is above £100,000.

Alternatives to Moneybox

Moneybox vs Moneyfarm

Moneybox is a very different product overall to Moneyfarm so they’re difficult to compare and for very different investors.

Moneyfarm is investing focused only and is what’s called a robo-advisor where they take care of everything for you.

You also need a £500 deposit to open an account.

You can read our Moneybox vs Moneyfarm review here and our Moneyfarm investing review here.

Moneybox vs Plum

I would say Plum and Moneybox are very similar. Plum is excellent for those who want insights into their spending.

It uses AI to anaylse your savings and will deposit money into your savings pots based on what you can actually afford.

Plum doesn’t have as wide a range of ISAs and only offers a Stocks and Shares ISA at this time.

You can read our Plum review here.

Moneybox vs Nutmeg

Moneybox is similar in some ways with their cautious, balanced and adventurous approach but you can still DIY some investments alongside this which you can’t do on Nutmeg.

You can read our Nutmeg review here.

Moneybox vs Chip

Chip is also very similar to Moneybox in a lot of ways.

They offer a range of ISA products and have high interest rates on their easy access savings accounts.

Like Plum they also use AI to analyse your income and spending to predict how much you can afford to save and invest.

You can read our full Chip review here.

Pros & Cons

Pros

- Fantastic for beginners

- User friendly mobile app

- Regulated by the FCA

- High level security

- Interest on uninvested cash

- Combine your pensions

- Excellent customer reviews

- Quick and easy to set up

Cons

- Lack of investment options

- Small subscription fee

- Lack of account transfer

- Can be expensive

FAQs

Is Moneybox Safe?

Keeping your savings and investments with Moneybox is completely safe and secure. It is also regulated by the Financial Conduct Authority.

What’s more, your savings and investments are also covered by the UK government’s Financial Services Compensation Scheme up to the value of £85,000. This is there if a fund or savings account provider goes bust.

Moreover, Moneybox uses bank level 256-bit TLS encryption for all your personal information. So when asking if Moneybox is safe we can safely answer yes.

Are Moneybox Fees High?

The investment fees are relatively painless, albeit slightly on the high side when looking at their competitors, coming to just £1 a month app subscription, plus 0.45% of the value of your investments each year.

There are also fund provider costs, and these can range between 0.12% and 0.58%. These aren’t rates that Moneybox controls and varies between the funds you select.

The good news is that you don’t have to pay any subscription fee for the first 3 months, and there are no account fees whatsoever for the Cash Lifetime ISA.

Who owns Moneybox?

What does Martin Lewis say about Moneybox?

Martin Lewis likes Moneybox, recently stating that their Lifetime ISA is a great product for first-time buyers.

His blog Money Saving Expert is also very complimentary of Moneybox.

How much can you pay into Moneybox?

You can pay up to £20,000 per tax year into Moneybox’s ISAs.

There is a limit of £85,000 on the savings accounts which is also the maximum you can pay in at once.

Moneybox Review - Summary

So, in summary, the Moneybox app has a lot going for it, especially when it comes to convenience.

We have only played around on the platform for a couple of months but have enjoyed the experience so far.

I think it’s doing a great job of attracting beginners and showing them the possibilities. Any company that is doing its bit to teach others about investing earns a big tick in our books.

It’s also good how the investment options put the level of risk in your own hands, so you can be as cautious or daring as you like.

It’s important to note that investing does come with it’s own risks so be sure to be comfortable with that before making any investment.

Moneybox does have some fees, but the excellent customer ratings and app experience really do speak for themselves and perhaps justifies the fee.

We hope you enjoyed our Moneybox review, and be sure to let us know your thoughts in the comments below.

Similar brands for you to check out before you decide.

Or you can check out our best investing apps page or best money saving apps page for a wider selection.

Share with your friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.