Compound Interest Calculator

Compound interest calculator in UK Pounds

Compound interest refers to when you earn interest on the principal sum you also earn interest from the initial interest created.

For example, if I invest £100 for one year at 10% interest I would earn £110. In Year 2 at 10% that same £110 would then be worth £121 meaning I earned £21 in total from interest. The £1 extra was interest from the initial interest.

This means that over time your savings or investments will grow at a faster rate each year as they are compounding each year. To learn more read our blog post on the power of compound interest.

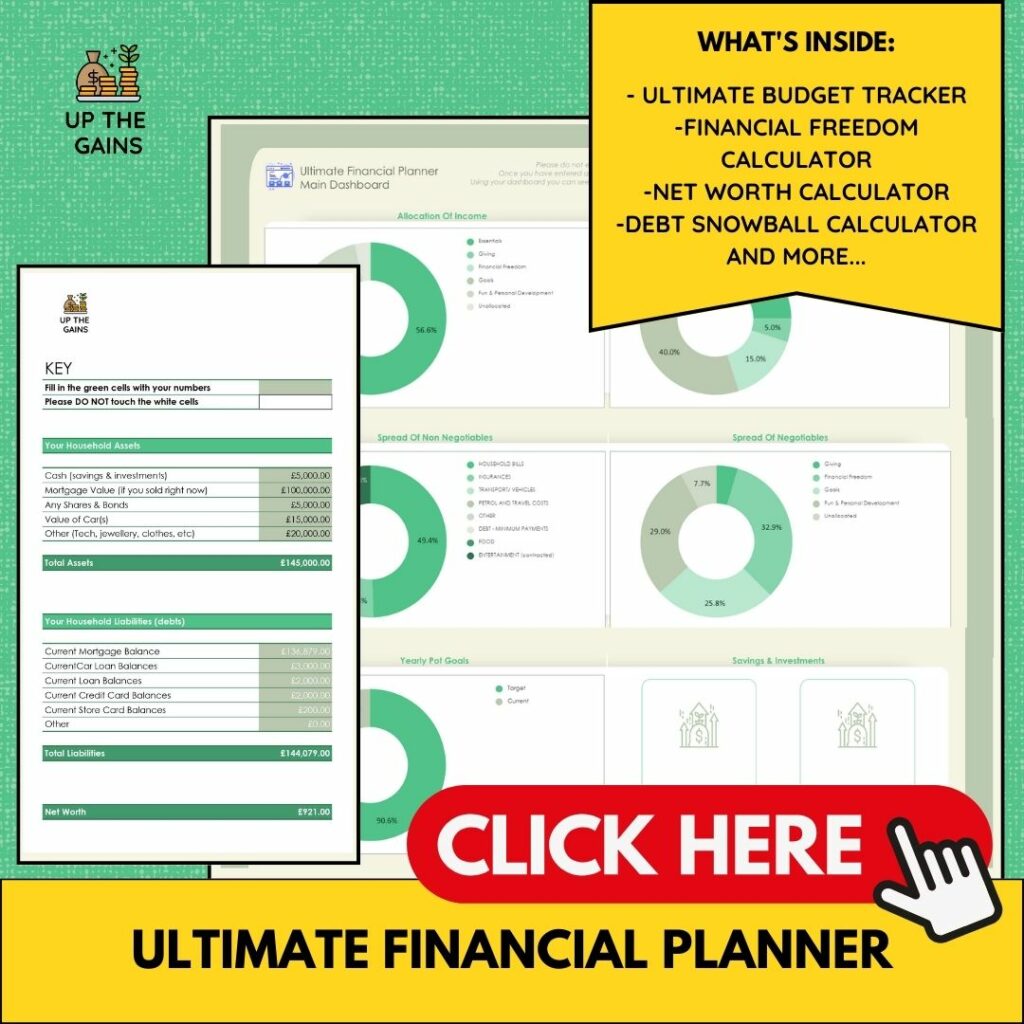

Start Budgeting Towards FIRE

Main Features Include:

- Innovative dashboard showing your full financial picture

- Templated scenarios for personal or household budgets

- Debt organiser and repayment planner

- Financial Freedom Calculator

- Pensions and Investments Dashboard

Personal Net Worth Calculator

How does a compound

interest calculator work?

Here is the formula for compound interest:

A = P (1 + r/n)^(nt)

where: A = the final amount P = the principal amount (the initial investment or loan amount) r = the annual interest rate (as a decimal) n = the number of times the interest is compounded per year t = the number of years

The formula can be used to calculate the amount of interest earned or the final balance of an investment over a given period of time. It takes into account the effect of compound interest, which means that the interest earned is added to the principal amount and then reinvested to earn more interest in subsequent periods.

Examples of Compound Interest

Let’s say you’ve got £15,000 that you want to put in a savings account that pays compound interest at a rate of 5% per year.

At the end of the first year, you’d earn £750 in interest, bringing your total balance up to £15,750. Now, in the second year, you’d earn interest on the new balance of £15,750, which means your interest earnings would be £787.50 (5% of £15,750) for the second year.

That might not sound like a huge difference, but over time, those interest earnings on the interest can really add up.

And if you leave that money in the account for, say, 10 years, you’d end up with a balance of over £24,000, assuming you didn’t add any more money to the account. So, compound interest can be a powerful tool for growing your savings and investments over time

Why I need to know about compound interest?

Albert Einstein is often attributed to saying that compound interest is the 8th wonder of the world. While there is no evidence that he actually said this, the sentiment is certainly true. Compound interest can turn small investments into substantial sums of money over time.

As a beginner investor, whether institutional or retail, it’s important to understand the concept of compound interest because it allows you to maximise your returns and achieve your financial goals faster.

By investing your money and allowing it to compound over time, you can take advantage of the power of exponential growth. Even small contributions made regularly can add up significantly over time, thanks to the effect of compound interest.

Understanding compound interest is also important when it comes to debt management. Loans, credit cards, and other forms of debt often accrue compound interest, which can quickly spiral out of control if left unchecked.

By understanding how compound interest works, you can make informed decisions about borrowing money and paying off debt in the most efficient way possible.

Money Calculators

Popular Reads

10 Best UK Personal Finance YouTubers & Channels – Must Follows For 2024

How To Sell Digital Products On Instagram – 6 Highly Effective Ways