Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Fat FIRE is all about achieving financial independence and making the most of early retirement.

The difference between fat FIRE and traditional FIRE is that this approach to the FIRE movement goes away from the frugal lifestyle.

Instead, those who follow this get to indulge and enjoy a more luxurious lifestyle, while still achieving the aim of retiring early.

This approach needs more going into savings to support the desired lifestyle but can provide much more fun than the lean FIRE approach.

The FIRE movement has exploded in popularity over recent years. Standing for Financial Independence Retire Early, the aim is to have enough money to retire years before people typically do.

The right approach can lead to people giving up work in their 50s, 40s and even 30s. Fat FIRE has the same aim, but it’s a different way of achieving the ultimate goal.

The FAT fire lifestyle appeals to those who want to give up work as early as possible. This means way before the traditional retirement age. However, they don’t want to make the sacrifices that are often associated with saving.

In this article, I’m going to be sharing just how this is possible. I’ll be showing you all about your fat FIRE number, as well as the strategies that can help you achieve your goals.

Table of Contents

The basics of financial independence and retiring early

Financial independence is when you have sufficient passive income to meet all of your living needs.

The reason that people look to achieve financial independence is that they have no desire to rely on an employer, or on anyone else.

There is no such thing as a job for life anymore, and there is no guarantee of what a standard pension will deliver.

That means that there is a need to save, as well as generate supplemental income so that you can retire early.

The need to reach financial independence is perhaps bigger now than ever. The cost of living crisis, sky-high inflation and changes to the state pension mean that there is little security in relying on anybody else.

Security and financial freedom are something that individuals need to take control of.

Steps that can help you to reach financial independence include:

- Building a budget – know what you need to spend on your living expenses, set a monthly budget and then stick to it

- Savings and investing – build an investment portfolio and learn, at least, the basics of how the stock market works. Also, seek out the best savings rate so that you get more value from your money

- Managing debt – if your monthly expenses include servicing debt, work on bringing this down. You then have more to put towards your personal finance goals

- Increase income – to achieve financial independence one obvious step is to earn more money. Working alongside your day job can give your income a welcome boost

What is Fat FIRE?

Fat FIRE follows the principles of regular FIRE in so far as FIRE still stands for Financial Independence Retire Early. The aim is to gain extra income, of a passive nature, and to be able to enjoy the best life possible in retirement.

With this approach, you have a fatter nest egg for those years without work. With life expectancy growing, the more money available for retirement, the better.

With the regular FIRE movement, as well as with lean FIRE, the approach is all about being frugal. This means saving as much money as possible by sacrificing some of the better things in life.

The fat FIRE life is there to be enjoyed. Yes, there is still the need for retirement savings, but there is the chance to be much more indulgent along the way.

There are two major benefits of the fat FIRE lifestyle when compared to regular FIRE:

- Fat FIRE leaves wiggle room – lean FIRE and regular FIRE keep outgoings to a minimum. The assumption is that a year in retirement can be lived on maybe £20 – £25,000. The fat FIRE approach aims for a larger annual income, and that means that you can deal with unexpected expenses as they arise

- Fat FIRE means fun – lean FIRE can be tough. It means watching the pennies and reining it all in so that you can retire early. With fat FIRE, you still achieve early retirement, but you get to spend and enjoy yourself too

What is a fat FIRE number and how do you calculate it?

Your fat FIRE number refers to the annual income that you need in retirement. If you want to retire early, you need to reach this amount of money as soon as possible.

It’s the amount of money that covers your living expenses but also allows you to maintain your current spending habits. That means that your fat FIRE number accounts for all of your annual spending, including the luxuries and indulgencies that you enjoy.

To get a reliable look at your fat FIRE number, you’ll be able to find more than one fat FIRE calculator online.

The details that a fat FIRE calculator will ask for are:

- Your current age – this will take into account life expectancy and how many years you’re likely to rely on passive income for

- Your current takehome pay – this could be from a full-time job or other sources

- Current annual expenses – include all of your current expenses, such as mortgage payments, investments and day-to-day living expenses

- Proposed spending amount in retirement – with the correct financial planning, this should be less than your current spending as the likes of your mortgage should be cleared

- Your current net worth – includes anything you have in the stock market, retirement accounts and any other assets

- Investment rate of return – this looks at the annual growth rate from your investments. A fat FIRE calculator will look at the average return rate

- Inflation rate – a fat FIRE calculator will consider the impact on the average rate of inflation

- Safe withdrawal rate – your fat FIRE number also considers the amount of your net worth needed to be withdrawn so that your living expenses are covered in retirement

Generally, to achieve fat FIRE, people want to maintain a spending rate of around £100,000 per year. This means their fat FIRE number needs to be at 2.5 million pounds, at least.

Strategies to help you get to fat FIRE

To get to fat FIRE, and reach that all-important fat FIRE number of 2.5 million, take a look at these strategies:

Create a budget

It all starts and ends with a decent household budget. Without one you’re playing the money game in the dark and those that choose this way often will fall at the first hurdle.

Use technology to help you get ahead, there are some brilliant budgeting apps out there that use AI and do all the hard work for you.

They even connect to your bank account and make the predictions based on your spending patterns.

Get the most from your savings

A savings account will rarely be the best way of getting the most from your money.

However, it can sometimes offer a level of security. If you opt for this approach, you must look for the best savings rate so that you’re maximising your returns.

Cash ISAs are a great option here but you could also use an instant-access savings account too. My favourite one right now is the Chip Instant Access paying 3.55%.

Reach your financial independence number via investing

If you’re new to investing, it’s worth taking professional investment advice. When you invest wisely, you can receive a significant boost towards that 2.5 million fat FIRE number.

To get the most from your investments:

- Make the most of accounts that offer tax advantages

- Consider your asset allocation and ensure that you have a diverse investment portfolio

- While looking to maximise returns, be sure to achieve a balance between risk and reward

Explore passive income streams to meet your FIRE goals

Passive income can boost your nest egg and lead to an impressive fat stash. Options to consider are investing in property, benefiting from rental income, and investing in dividend stocks.

Remember your investing in your 20s to investing in your 40s so make sure what side hustle you really works for where you are on your journey.

What are the potential pitfalls of fat FIRE?

While a fat FIRE calculator can show you the number that you’re aiming for, there are certain watch-outs along your journey to early retirement:

- Fat FIRE goals take longer to achieve than those who pursue lean FIRE or regular

- There is a significant reliance on investing. If your asset allocation doesn’t work out, and if the growth rate falls short, you’re left with more work to do before you can retire

- Inflation can have an impact on the lifestyle that you want to live. Your income growth rate needs to keep up with inflation so that you can carry on enjoying the luxuries that you’re used to

- Unexpected expenses can play havoc with your plans

The best way to work around these pitfalls is to first use a fat FIRE calculator. The right calculator will account for inflation and how annual expenses may increase accordingly.

Secondly, professional advice from a financial adviser can help you to set up your investment portfolio and achieve your goals.

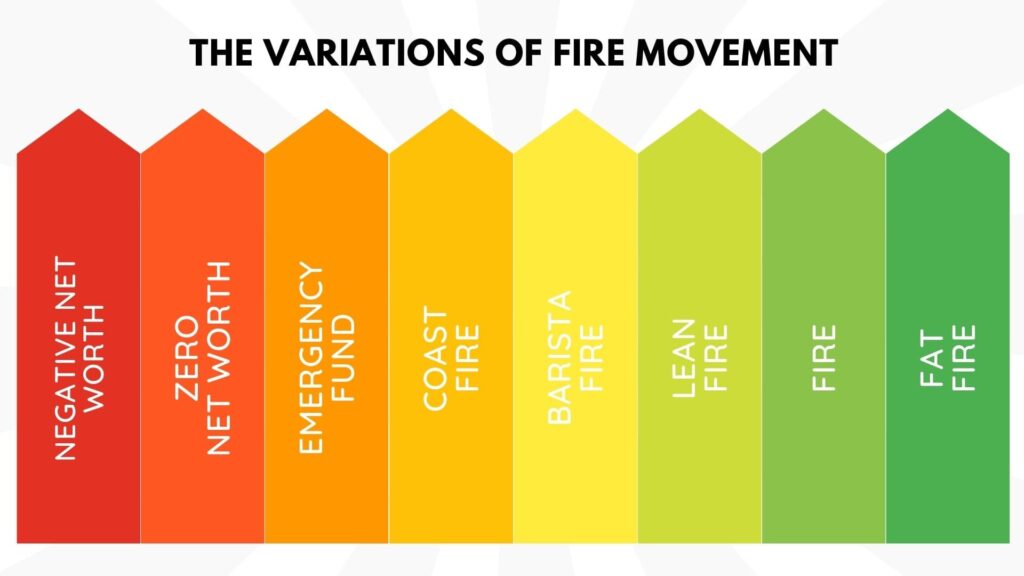

Different types of FIRE

The FIRE movement, aimed at achieving financial independence and early retirement, is gaining momentum and attracting various subcategories.

The following list outlines the different types of FIRE, ordered from the easiest to the most challenging to attain:

- Coast FIRE, or CoastFIRE, entails accumulating enough funds to discontinue contributions and still achieve FIRE at a later point in time. Have a play around with our CoastFIRE Calculator.

- Barista FIRE, or BaristaFIRE, involves accumulating sufficient funds to retire early while concurrently working a part-time job for supplementary income and medical coverage. Work out your Barista FIRE Number with our Barista FIRE Calculator.

- Lean FIRE or LeanFIRE, advocates the minimalist approach to attain FIRE, which means retiring with a meagre budget.

- Traditional FIRE involves accumulating 25 times one’s annual expenses and retiring early, leveraging the 4% rule.

- Fat FIRE, or FatFIRE, on the other hand, refers to early retirement without adhering to frugality and opting to amass a more substantial nest egg.

Final thoughts on fat FIRE and how to retire early

The fat FIRE approach offers a great way to stop work before the traditional retirement age without the need to cut back on your annual spending.

What’s considered fat FIRE leaves you with disposable income each month rather than saving every single penny.

There is a heavy reliance on investing, and investment advice is highly recommended if you want to get to fat FIRE.

The sooner you start to invest and the sooner you set up passive income streams, the earlier you can retire in style.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.