Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Looking for an investment platform that won’t break the bank?

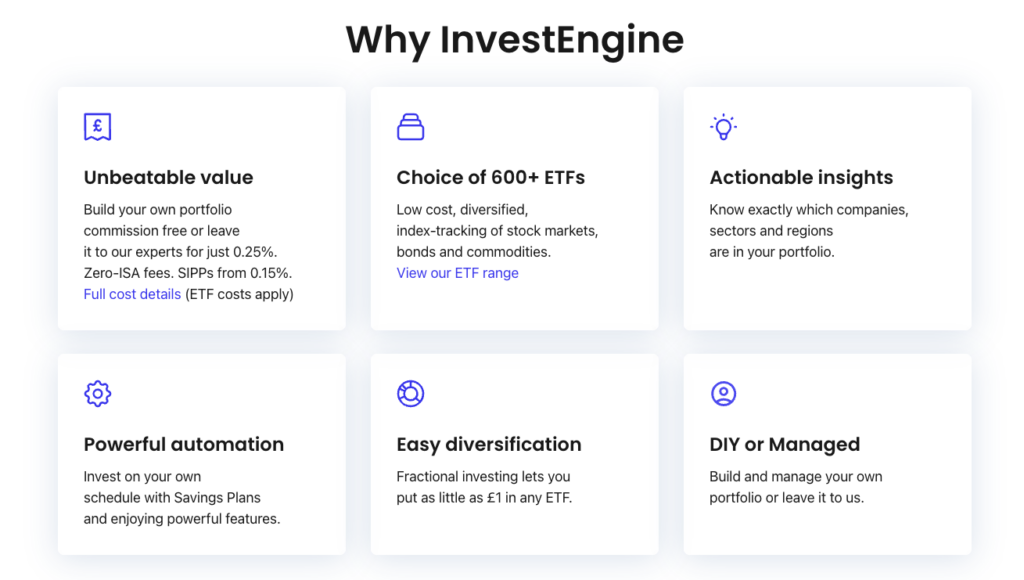

InvestEngine might be just what you need! With zero fees if you manage your investments yourself and a low fee of just 0.25% for expert managed portfolios, InvestEngine is as close to free investing as possible.

I really enjoyed testing the app and set up an account in just a few minutes.

Having tested the app for well over a year – I can safely say this is the perfect solution for beginners as they offer a managed option which is where the experts take care of everything for you.

InvestEngine isn’t like other apps – you can only invest into ETFs and not individual stocks which they’ve done on purpose.

BUT – if you’re a more seasoned investor, don’t be put off as InvestEngine also offers a DIY option where you can select the funds yourself.

Plus they have a stocks and shares ISA available and a brand new SIPP (self-invested personal pension) for 2024 too! Lots to like!

No buying and selling fees on their DIY portfolios for 500+ exchange-traded funds from iShares, Vanguard and Blackrock.

EXCLUSIVE OFFER - Get up to £50 BONUS when you invest your first £100 (T&C's Apply)

- One of the lowest fees on the market

- Brilliant for beginners and seasoned investors

- Fantastic customer service / 4.6/5 TrustPilot Score

- ISAs available

- Not for individual stock pickers

In this InvestEngine review I unpack why the app is growing from strength to strength and taking the investing scene by storm with it’s unique approach to investing.

What I found is that InvestEngine is not for individual stock pickers simply because they don’t offer them!

They encourage a long-term mindset and by solely investing in ETFs you’re already diversifying your investments.

What really are ETFs?

An exchange traded fund is just like a basket of stocks but bought for one price.

I like to use the chocolate box analogy – think of a box of celebrations. The chocolates represent the stocks and the box of celebrations is the ETF which you buy for one price just like you would for a box of chocolates.

You can get lots of different types of boxes of chocolates (ETFs) that focus on continents, countries, sectors and can hold lots of different assets within them.

Our Rating

- Price / Fees

- Suitable For Beginners

- User Experience

- Customer Feedback

- Customer Service

- Useful Features

I’ve rated InvestEngine 4.7 out of 5, which is excellent for an investing app.

They rank number 2 on Up the Gains and I think they’re one of the best investment platforms for beginners right now.

InvestEngine scored best on its fees and unsurprisingly its suitability for beginners, but scored lowest on it’s useful features even though this was still an 4.5 out of 5.

If you’ve heard enough already, then head over to their website to sign up for free just below or if you want to read on. Let’s unpack the app in more detail!

EXCLUSIVE OFFER - Get up to a £50 BONUS when you invest your first £100 (T&C's Apply)

Pros & Cons

Pros

As I’ve been exploring InvestEngine, I’ve found that there’s certainly plenty to like, and get excited about. Some of these things include:

- A website and app that are extremely easy to use

- The fact that DIY portfolios are completely free of platform fees

- Managed portfolios come with fees that are considerably lower than InvestEngine’s main competitors

- There is the chance to open both business and personal accounts

- The one-click rebalancing feature is a real plus

Cons

Of course, for this InvestEngine review to be balanced, I also need to take a look at some of the points that I wasn’t so impressed with.

- There is no access to Junior or Lifetime ISAs

- Whereas some platforms reduce fees the more that you invest, the fee structure here is flat

- While the £100 minimum investment is low, there are competitors that are even lower

- You can however once set up top-up for £1 minimum payment

Is InvestEngine good for beginners?

Yes, InvestEngine is a brilliant option for beginners. For those new to investing, I don’t advise to take on self-managed portfolios where you make all the investment decisions yourself.

Instead, at InvestEngine, you have the opportunity to benefit from the managed option which is where there are carefully selected ETFs based on your appetite to risk

InvestEngine also offers a wealth of resources on their website including a community section, which can be incredibly helpful for grasping the fundamentals of investing.

There are no fees associated with setting up an account with InvestEngine. You can also open and utilise a Stocks & Shares ISA at no cost, allowing you to invest in a tax-efficient manner alongside a brand new SIPP now as of January 2024.

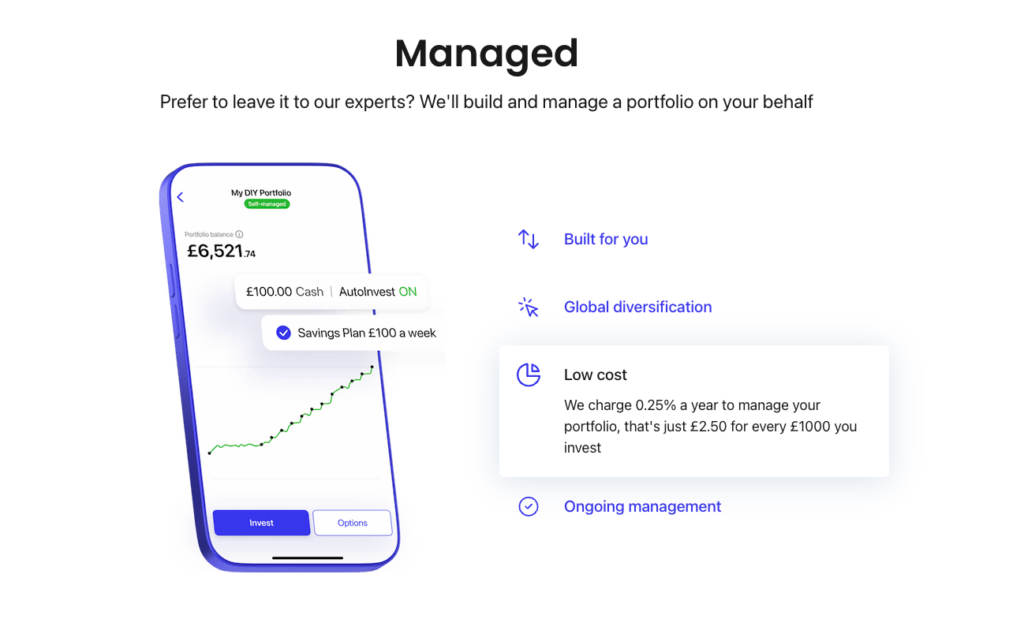

When it comes to the purchase and sale of investments, InvestEngine doesn’t charge any fees. The only expense you’ll incur is a modest management fee of 0.25% alongside ETF fees if you chose the managed option.

It’s important to be aware that there are additional costs associated with investing, regardless of the platform you select.

These costs are standard across the investment landscape and are not unique to InvestEngine although in comparison to it’s competitors you’ll find their fees are some of the lowest.

EXCLUSIVE OFFER - Get up to a £50 BONUS when you invest your first £100 (T&C's Apply)

InvestEngine Review - Company Overview

A great way to start this InvestEngine review is by looking at the company behind the platform.

Having only been launched in 2021, there’s not much history to look at. However, when you look at the founders, Simon Crookall and Andrey Dobrynin, you can see that the company is backed by a wealth of experience.

In fact, Crookall is the original founder of Gumtree, so he certainly knows a thing or two about mastering an online presence.

The aim of InvestEngine is to be a kind of one-stop shop for DIY investors. It claims that it is “Smarter, nimbler, far cheaper, and more accessible than a normal investment manager”.

What you tend to find with investment platforms is that they fall into one of two categories: they either offer a DIY experience or they harness robo-advisors to help clients build a portfolio.

What you get with InvestEngine is a hybrid option that covers both bases.

Main App Features

InvestEngine has plenty to offer. Here’s a look at some of the key features that you’ll come across:

- Stocks and shares ISA allowing you to invest up to £20,000 per year tax-free*

- General investment account

- SIPPs now available as of January 2024

- Business accounts so that businesses can benefit by investing any cash that they hold

- An easy-to-use app that’s available on both iOS and Android

- 10 Managed growth portfolios

- A DIY investing service that has no platform fees

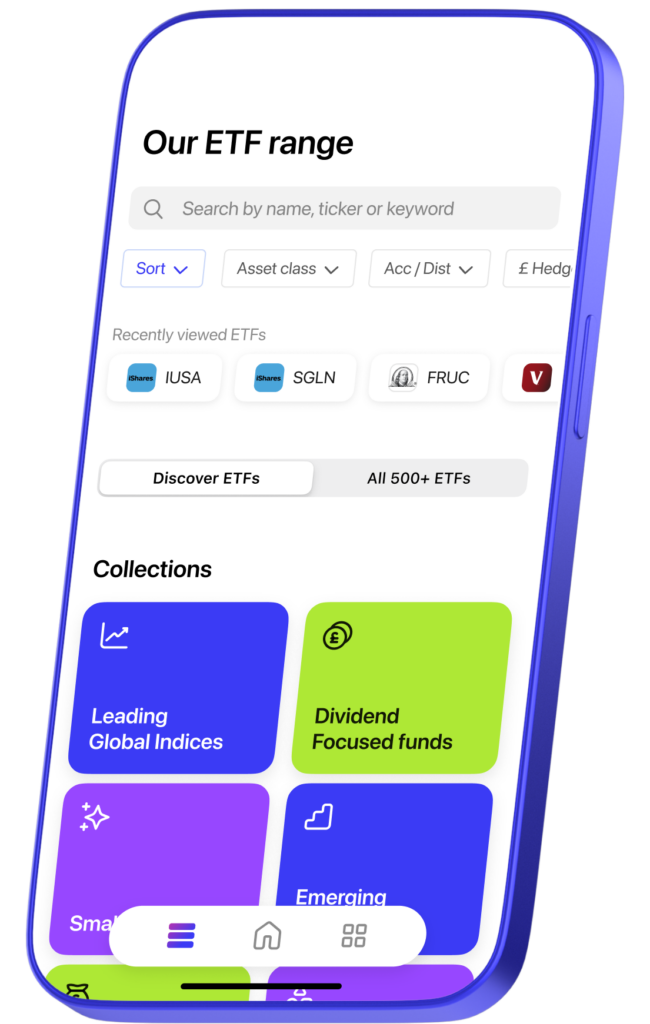

- Over 600 ETFs to choose from

- The ability to rebalance your portfolio to your predetermined ETF allocations with just a single click

- Automatic portfolio rebalancing so that you maintain your investment allocation even when you add funds or withdraw

- £100 minimum investment level

No buying and selling fees on their DIY portfolios for 500+ exchange-traded funds from iShares, Vanguard and Blackrock.

EXCLUSIVE OFFER - Get up to £50 BONUS when you invest your first £100 (T&C's Apply)

- One of the lowest fees on the market

- Brilliant for beginners and seasoned investors

- Fantastic customer service / 4.6/5 TrustPilot Score

- ISAs available

- Not for individual stock pickers

Account Types

As we have already seen, as part of this InvestEngine review, this is a platform that allows users to opt for either a stocks and shares ISA, so that they can make the most of tax-free allowances, or a general investment account.

InvestEngine now has a SIPP as of 2024 and this can be invested via the managed or the DIY option (more on this below).

They don’t offer yet offer a Junior ISA or a Lifetime ISA, but there are other fantastic providers for these types of accounts, so I wouldn’t say that is a deal breaker.

InvestEngine likes to keep things simple, which I like. It has either a DIY (do-it-yourself) option or a managed option.

Within those you can also do part DIY and part managed too so there’s a solid amount of flexibility.

Let’s take a look at these now:

Expert Managed

If you’re looking to grow your wealth but feel like you need a helping hand then InvestEngine’s expert managed option could well be for you.

Personally, I think this is a fantastic edition and makes IE really stand out against their competitors.

You essentially get to work with a human and go through a series of questions where they tailor a portfolio directly to you.

They even can manage it on your behalf and tweak it based on how markets are performing. Leaving it to the experts is now totally possible and it doesn’t cost much either with just a 0.25% management fee attached.

DIY portfolio

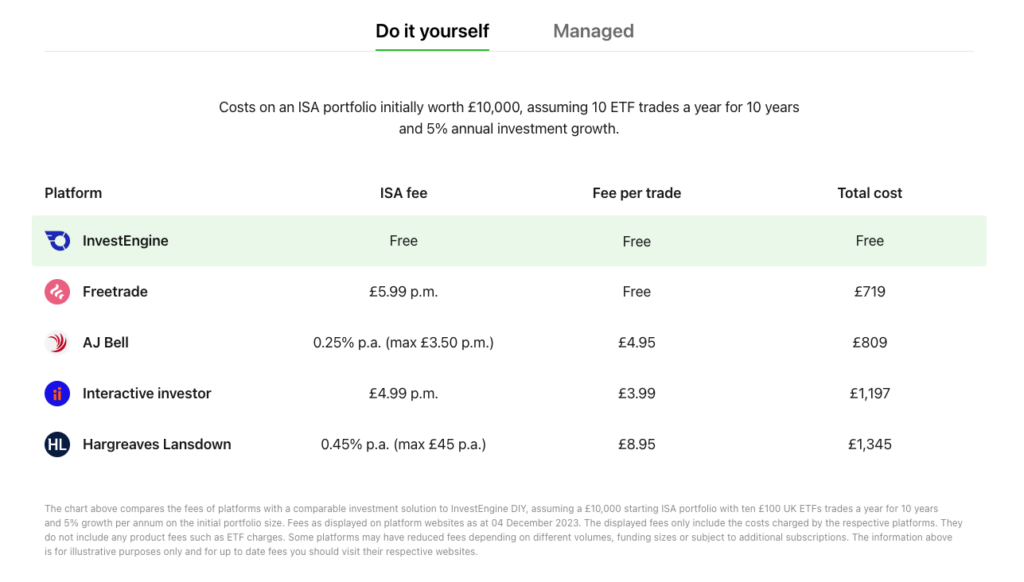

The big appeal of InvestEngine’s DIY portfolio is the fact that it comes lacking fees. There are no platform fees, no account fees, no dealing charges, and no set-up fees.

What you get is access to over 500 ETFs (from the likes of UBS, Vanguard, iShares, and HSBC) that you can use to create your own portfolio.

In truth, you’re likely to find a wider selection of ETFs elsewhere, but the lack of fees here means that this is perhaps the cheapest way possible to build your own portfolio.

It’s also important to note that DIY portfolios and ETFs have their own annual charges and buy/sell spread costs so check those out first before making an investment decision.

What's the user experience like?

When it comes to any investment platform, what’s needed is an environment that’s easy to navigate and simple to use. It’s fair to say that InvestEngine delivers on both of these fronts.

You can choose between using the website or the smartphone app, but either way, you’ll find that the experience is a pleasant one and that virtually anyone can get themselves set up.

One important point here is when looking at the expert managed option. To get to these, you’ll be led through a series of questions that assess your attitude to risk so that you can decide which portfolio best suits you.

However, all that you’re given is a suggestion: it’s not a regulated investment recommendation. This is a shame as the likes of Nutmeg and Wealthify are able to offer this.

EXCLUSIVE OFFER - Get up to a £50 BONUS when you invest your first £100 (T&C's Apply)

InvestEngine Fees

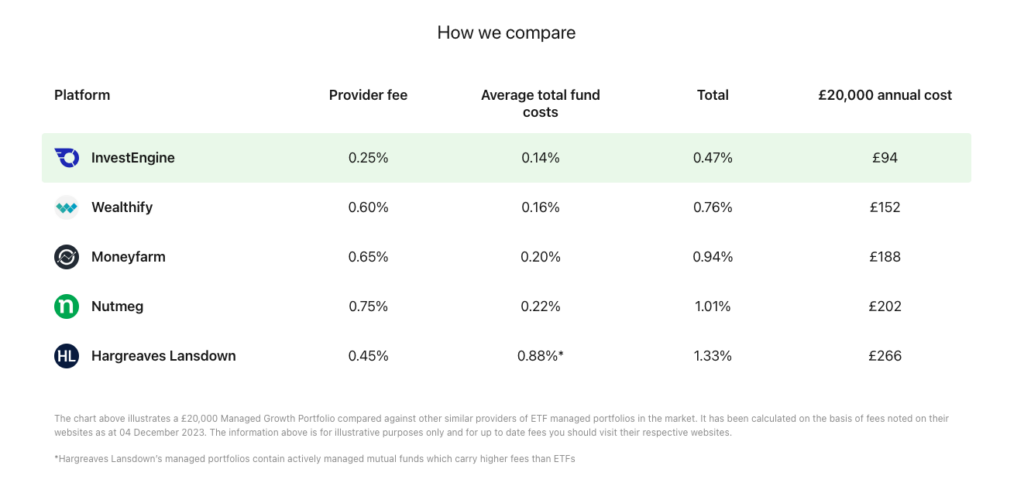

When looking at the expert managed option, InvestEngine is undoubtedly competitive.

The charges that you will find for the expert managed when investing up to £10,000, are:

- Annual management fee – 0.25%

- Average annual ETF charge – 0.15%

- Average annual ETF spread – 0.07%

This brings the total charges to 0.47%.

If you take a look at the likes of Nutmeg, Moneyfarm, and Wealthify, you’ll realise that InvestEngine is the cheapest option by far. Wealthify comes a distant second with charges of 0.76%.

The DIY portfolio is slightly different as it has no management fees. However, it does have its own ETF spread and charges. You’re essentially paying slightly more for the expert managed portfolio, which some people prefer.

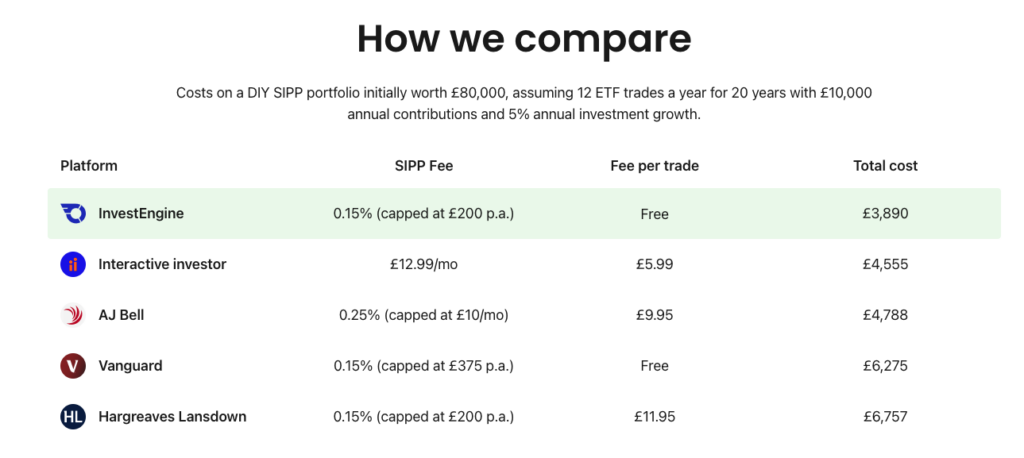

For the new InvestEngine SIPP you will pay 0.15% capped at £200 a year, plus the fund fees you normally get investing in their other accounts.

This makes their pension offering one of the lowest cost on the market right now.

You can find more information on the costs here and also see the expert managed costs vs some of their competitors in the image below.

What InvestEngine customer are saying?

A good measure of how any company is performing is what its customers have to say about it.

Bearing in mind that InvestEngine is still a relative newcomer, it now has around 730 reviews on Trustpilot.This has left it with 4.6 out of 5 stars which sees it classed as excellent.

You’ll find that users are full of praise when it comes to how easy the website and app are to use. There’s also plenty of praise when it comes to the low fees that are charged.

One thing that is always great to see is the fact that customers also speak very highly about the customer service provided.

What the experts say?

The Motley Fool – “InvestEngine is a breath of fresh air in the current investing solutions space. It’s an exciting option worth considering not only for passive investors, or novice investors, who may lack the time or knowledge to pick and manage their own investments, but also for more experienced investors who prefer a more hands-on approach.”

Finder – “Feedback included praise for low fees and excellent customer service, and many customers described InvestEngine as easy to use”.

Martin Lewis (Money Saving Expert) – Features number one in our stocks and shares ISA list.

What users say?

- Boring Money Rating – 4.5 out 5

- TrustPilot Rating – 4.6 out of 5

- Up the Gains Rating – 4.7 out of 5

- Finder Rating – 4.2 out of 5

- Google Rating – 4.5 out of 5

- Apple App Store Rating – 4.8 out of 5

Alternatives to InvestEngine

InvestEngine is difficult to compare because it offers both a DIY and Expert Managed option.

I think the main competitor is market leader Hargreaves Lansdown because they offer both ready-made and DIY portfolios but I would also put brands like Wealthify and Moneyfarm in the same bracket too with their managed portfolios.

Let’s have a look at the costs vs their competitors.

FAQS

Is InvestEngine Safe?

Yes, your money is safe. InvestEngine are regulated by the FCA (financial conduct authority) and also covered by the financial services compensation scheme (FSCS) meaning you’re covered up the value of £85,000 should the company ever go bust.

Is InvestEngine an ISA?

Yes, InvestEngine has a stocks and shares ISA meaning you have an ISA allowance of £20,000 per annum and any profits are not subject to capital gains tax.

Is InvestEngine any good?

I rated InvestEngine 4.7 out of 5 stars using our six pillar method. This is a very respectable score and it scored highest on it’s suitability for beginners.

I really like how they have a funds first focus which lowers risk and automatically diversifies peoples investments.

Can you buy individual Stocks on InvestEngine?

No you cant yet. If you want to own top stocks like Microsoft or Tesla you would need to buy them as part of a fund or ETF.

This is slightly restrictive but it’s the model that InvestEngine have chosen and I like how this differs to other providers.

Final Thoughts

Overall as you can gather from this InvestEngine review, I really like the brand and what they’re doing.

Any app that’s designed to help beginners invest safely with support gets a big tick from us.

If you’re interested in finding some other apps to compare it to then check out our best investing apps page.

Share this article with friends

When investing your capital is at risk. Tax treatment depends on personal circumstances and may be subject to change.

InvestEngine® is a trading name of InvestEngine (UK) Limited, a company incorporated in the UK with company number 10438231. InvestEngine (UK) Limited is Authorised and Regulated by the Financial Conduct Authority (FRN: 801128).