Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

The FIRE movement is all about achieving financial independence and being able to retire early. The Lean FIRE lifestyle works towards these goals and requires you to be frugal along the way.

By adhering to the frugal lifestyle, an average person can achieve financial freedom and retires as early as their 30s or 40s.

It’s by relying on investment returns and passive income that Lean FIRE followers build their nest egg to a substantial level, allowing them to retire at a young age.

Unless you’ve been leading a secluded lifestyle, there’s a good chance that you’ll have come across the FIRE movement.

Standing for Financial Independence Retire Early, FIRE allows its devotees to stop working way before the traditional retirement age.

Lean FIRE is a variation of the FIRE movement. This approach allows more people to achieve FIRE, as the amount of money needed to retire early is less than some of the alternative ones.

Lean FIRE leads to a life where you work hard to save money.

This can mean cutting back on some of life’s luxuries so that enough money can be saved and invested to fund early retirement.

I’m going to be taking a closer look at the Lean FIRE movement.

I’ll be sharing more about what this involves, and the challenges that you could come up against during your Lean FIRE journey to financial independence.

Table of Contents

What is Lean FIRE?

Just like the other versions of the regular FIRE movement, Lean FIRE is focused on an attempt to achieve financial independence and retire early.

It relies on building a nest egg that is able to meet your living expenses during your retirement. This can be achieved through a mix of savings, investments and passive income.

The difference between Lean FIRE and the Fat FIRE lifestyle is that Lean FIRE places a massive onus on being frugal.

In fact, frugal living is necessary to succeed here and ensure that your annual expenses are met in your retirement.

Barista fire followers sit somewhere in between those who take the Fat FIRE approach and those who opt to aim for Lean FIRE, on the FIRE spectrum.

The FIRE community has grown over recent years, and Lean FIRE is the one that people view as the most achievable.

Part of the drive towards the FIRE movement is down to the fact that many people were forced to develop a saving habit during the pandemic.

COVID-19 also showed the world that when we rely on a job, we never know what’s around the corner that can take it away.

How to plan for Lean FIRE

If the idea of retiring early and achieving financial independence sounds appealing, here’s a look at how to plan to be part of the Lean FIRE movement:

Budgeting for Lean FIRE

If you want to achieve Lean FIRE and retire early, there are certain sacrifices to be made.

The Lean FIRE approach means reducing your living expenses as much as possible. The lower your annual expenses, the faster you can reach financial independence and early retirement.

Set your desired retirement age and goals

To know how much you’ll need to save and invest, you need to know the retirement age that you’re aiming for.

You’ll so need to be clear on your personal finance goals and the amount that you’ll need to cover yearly expenses and live a decent quality of life.

For example, knowing how to build wealth in your 20s will differ to your 30s and even building wealth in your 40s.

Calculate your nest egg value

Linking back to the previous point, you need to know how big your nest egg needs to be so that you can retire and cover living expenses.

If your nest egg leaves you needing more money then you need to explore passive income and passive investments to boost your retirement income.

Get the most from any savings rate

Placing money into savings accounts can assist with achieving long-term financial goals, but you need to make sure that you’re getting the best savings rate.

Compare providers and also compare account types. Instant access accounts tend to have lower rates of interest than Cash ISAs where you can get higher rates by agreeing to lock your funds away for a set time.

How to build a Lean FIRE portfolio

To achieve the principles of Financial Independence Retire Early, you’ll need an investment portfolio alongside any savings.

A solid portfolio is one that is diverse and has a balance of risk and reward. If you’re new to this, professional investment advice is the way to go before you put money into the stock market.

If you have some experience with investing or are willing to learn, there are investment apps worth exploring, such as Moneyfarm and Etoro.

Getting your portfolio right leaves your financial future in a great place as the right investments can generate dividends that provide an annual passive income.

How to maximise your Lean FIRE income

If you have a full-time job but need more money to help you with the goal of reaching FIRE, passive income is the answer. This is where you put the work in once and then the money keeps coming in.

Some of the methods to explore that can boost a low income and take you towards financial security include:

Generating passive income

Lean FIRE and financial independence require passive income to supplemental income from any job you may have.

The working hours that anyone has are limited so even if you have a full-time and part time job, you may need more money to reach financial independence and early retirement.

Passive income can be achieved through:

- Dividend returning stocks. You can maximise your earnings by reinvesting your returns and benefiting from compound interest

- Earning interest on savings

- Investing in peer-to-peer lending

The goal here is to boost your net worth as much as possible.

Seeking alternative income streams

To reach financial independence with Lean FIRE, you need to seek alternative ways of earning so that you have enough money to retire early.

Some of these alternatives are passive while others require a more hands-on approach:

- Set up a blog – initially, this takes hard work but it’ll lead to passive income

- Start a business or buy a business

- Start freelancing

- Rent out a room in your house

- Rent out a parking space

Reduce retirement expenses

You need to have enough in your retirement savings and enough passive income to fund your early retirement. A way to make the goal more achievable is to reduce your yearly expenses during your retirement years.

This requires you to embrace frugal living, but it also means that you will need to have focused on clearing your debts along the way.

Part of your FIRE plan could even involve moving to a low cost area so that you can save on living costs.

Facing Lean FIRE strategies and staying the course

Lean FIRE and the journey towards financial independence isn’t always easy. Those who have reached financial independence have overcome numerous challenges.

The biggest of these is generating a sustainable long term income and embracing a minimalist lifestyle.

The key to generating sufficient income is focus and a clear eye on what you want to achieve.

When it comes to the minimalist lifestyle, you need to remind yourself of the reasons behind the sacrifices you’re making: financial independence and early retirement.

Find forums that are filled with FIRE devotees and be inspired by their success stories and learn how they have overcome the challenges that FIRE can present.

Different types of FIRE

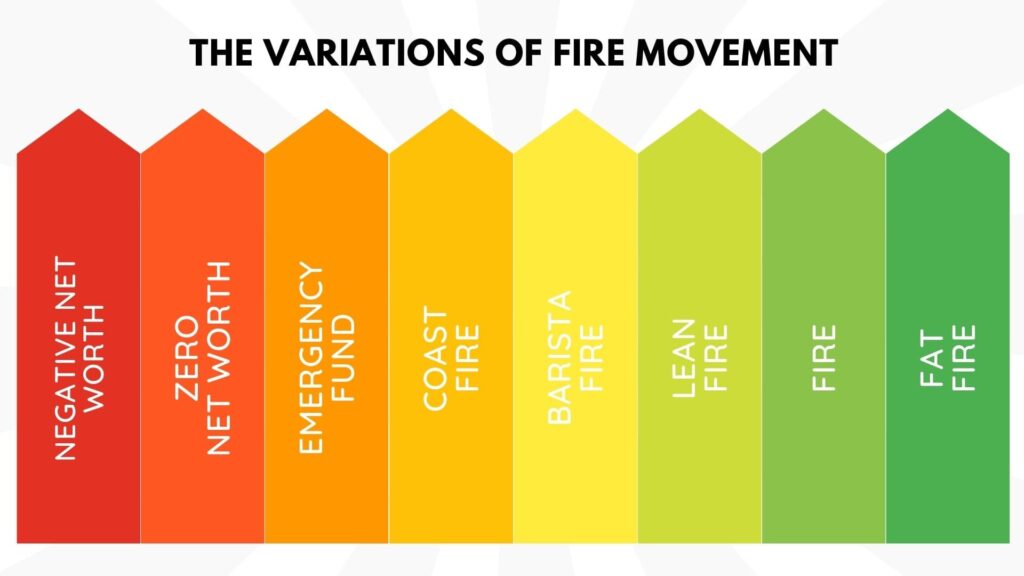

The FIRE movement, aimed at achieving financial independence and early retirement, is gaining momentum and attracting various subcategories.

The following list outlines the different types of FIRE, ordered from the easiest to the most challenging to attain:

- Coast FIRE, or CoastFIRE, entails accumulating enough funds to discontinue contributions and still achieve FIRE at a later point in time. Get access to our free Coast FIRE calculator.

- Barista FIRE, or BaristaFIRE, involves accumulating sufficient funds to retire early while concurrently working a part-time job for supplementary income and medical coverage. Get access to our free Barista FIRE calculator.

- Lean FIRE, or LeanFIRE, advocates the minimalist approach to attain FIRE, which means retiring with a meager budget.

- Traditional FIRE involves accumulating 25 times one’s annual expenses and retiring early, leveraging the 4% rule.

- Fat FIRE, or FatFIRE, on the other hand, refers to early retirement without adhering to frugality and opting to amass a more substantial nest egg.

Final thoughts on the Lean FIRE lifestyle

The Lean FIRE movement is one that can help you to achieve financial independence and retire early.

While traditional FIRE and Fat FIRE can seem out of reach, the Lean FIRE approach is more achievable.

That being said, this is only the case if you’re willing to embrace frugal living and make sacrifices along the way. Lean FIRE proponents will argue that the trade-off is worth it.

They’d say that managing on a low income, to ensure that you have enough money to retire early is something that we should all be doing.

I’d recommend that you explore the FIRE community as much as you possibly can.

Find examples of those that have succeeded with Lean FIRE, and replicate their success. Early retirement can be a reality for anyone who’s prepared to act.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.