Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

You’ve landed on this blog because you want to make some extra cash so I tip my hat to you for getting this far. We’re here to explore some ideas to make passive income.

Once upon a time, you had dreams of being uber-successful, living on a yacht, and enjoying life, but it didn’t pan out that way for reasons undisclosed. Who figured?!

Fear not, those dreams are still in reach and we’re going to show you why. This article will provide you with all the tools to kickstart those grand plans and be that lightbulb moment you needed.

Ladies and gentlemen let’s explore the best passive income ideas you can do from home.

Make passive income online by completing surveys and sharing your internet. Rated 4.5/5 on Trustpilot!

Offer - Get a bonus for signing up with Up the Gains.

Table of Contents

What is passive income?

Passive income or residual income as it’s also known as a form of revenue generated after the work is complete.

For example, you can create a passive income stream from dividends, royalties, property, investing or lending.

With most passive income streams, you do the work upfront, and if done correctly, you earn income with a small amount of continued work.

They’re essentially the same thing in many ways, the difference being that with side hustling, you earn a passive income from the work alongside your primary source of revenue or wage.

The passive income king and world-famous investor Warren Buffet famously said, ‘If you don’t find a way to earn whilst you sleep, you’ll be working until you die.’

So what are you waiting for?

Well, I think it’s crucial to eliminate the misconception that earning passive income is easy, so don’t beat yourself up for not having started just yet.

From first-hand experience, it’s been tough to develop a brand and attract an audience of readers, so thanks for being here!

Whatever you decide to be your passive income stream, know that it will require a bit of effort. In most cases, you’ll also need to give it time to grow into something that earns you some decent cash.

That being said, it can be your ticket to financial freedom, early retirement, or even just to help you stay ahead of the rising cost of living.

In some cases, passive income streams can vastly outweigh your monthly salary, forcing you to decide whether to keep your day job.

Are you bored of the 9 to 5? Looking for the best passive income ideas? Well, you’ve come to the right place.

In a moment we’re going to chat through 11 great ideas for passive income that you can get started on right away.

How can passive income help me?

One thing we all want is time freedom. How great would it be to wake up and think, what do I want to do today?

You may have dreams of travelling the world or buying your first home, but the day job barely gives enough to make ends meet.

That’s where an added side hustle or passive income stream can provide you the opportunity to get what you want from life.

Another great bonus is being your own boss. No more reporting for the sake of reporting or being sent down to the post office in the rain.

Let’s dig into our best passive income ideas!

🎙️ Listen To This Podcast Episode👇🏼

Join us with the king of side hustles, Mr Side Hustle Steven.

We discuss how to create passive income through a range of side hustles from freelancing to vending machines.

Press play to listen whilst you read or get access to the full back catalogue of Money Gains Podcast episodes here.

1. Sell Digital Products

This is one of the best passive income streams if you want to do all the work upfront and then sit back whilst it sells. Digital products are not physical, and they’re sold online.

The beauty of digital products is you don’t need a big warehouse to store everything. You make it once and can sell it an infinite number of times online.

Products range form ebooks, how to guides, courses, masterclasses and online events.

They’re perfect for beginners looking to make passive income on the side and potentially build it up into a fully fledged business.

Join over 1,000 others learning how to go from £0-5k with just 60 minutes work a day.

Includes everything you need to create, build and sell profitable digital products in a niche you're already passionate about.

2. Rental income

One of the most common ideas for passive income streams is buy-to-let.

If you have the money to put into action, you can buy a property or an apartment block and rent it out to tenants for commercial or residential use.

Being a landlord can be pretty full-on at times, especially if you have demanding tenants, so you’d need a Property Manager or Lettings Agency to take a hands-off approach.

The financial outlay required to buy a property requires cash flow which isn’t something we all having lying around.

Equally, owning multiple properties means you’re subject to different taxes, so it’s essential to research and find ways to get around it.

Contact a property accountant or mortgage professional who will be able to guide you through the best ways to invest your money.

3. Renting a Room

Another way to earn an income without the financial outlay is to rent out a spare room in your current property.

This might just be something you let to friends for a small amount, longer-term to a physical tenant or on weekends to travellers.

Sites like Airbnb can be great for helping you find temporary tenants and gives you the flexibility to decide how much you want to charge and when you would like someone over to crash.

My step-mother has a fantastic Airbnb business as she recently moved to a place with an annexe. She is taking nearly £100 a night and is booked up 22 days a month on average. That’s an extra £2000!

Renting out something you already have is possibly one of the best passive income investments.

4. Investing in REITs

What if you don’t have the income or space for either of the above? Can you still earn income from property? YES!

For example, you could club with a family member or group of friends for a deposit or invest in a real estate investment trust for an even lower entry amount.

A REIT or real estate investment trusts are a companies that own or finance real estate making an income from their investments.

REITs can be focused on either commercial or residential real estate.

Buying a REIT fund can pay you a handsome dividend. In some cases, investing in REITs like the NewRiver REIT fund pays you 7.4% back each year on your investment.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

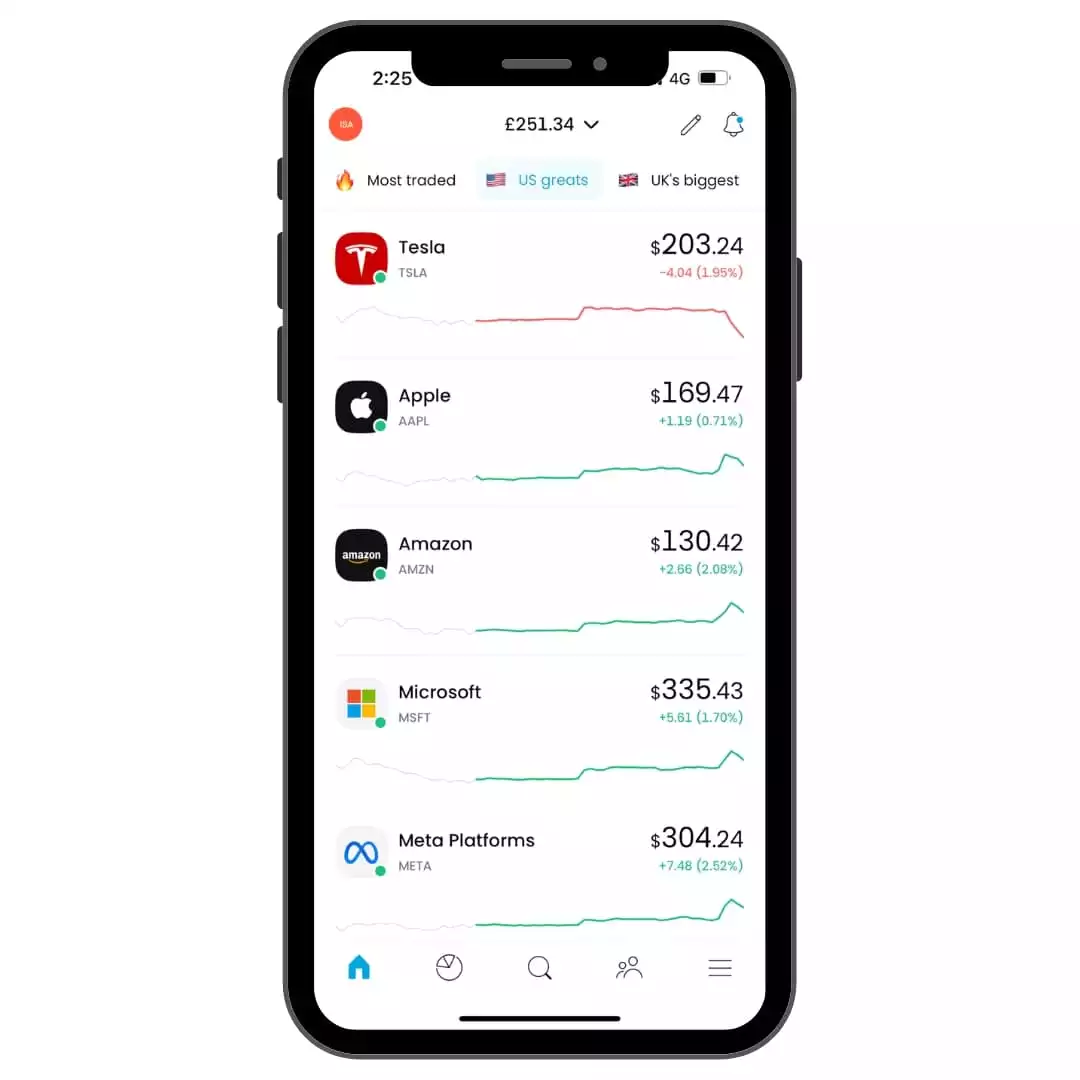

5. Dividend stocks

Passive income from investments is possibly the most popular revenue stream creation, especially in dividend stocks.

When you look at some of the world’s most prominent investors, they ALL have a portfolio of stocks that kick back massive amounts in passive income each year.

A dividend is a cash payment by a company to its shareholders for investing in their business.

Payments are made to stockholders at different frequencies but are mostly made quarterly or yearly.

We’re big fans of dividend stocks, but it’s important not to get wrapped up in the hype. A company paying a 10% dividend does not mean it’s growing.

If that stock drops 10% or more, you’ve lost money, so always pick growing stable companies.

6. Invest in the stock market

We’ve covered dividend stocks but having a performing portfolio kicking back profits each year is another one of our favourite ideas for passive income.

For example, you could invest in an index fund or a money market fund. For instance one that tracks a certain number of high-performing stocks, such as the S&P500 or the FTSE 250.

Since its inception, the S&P500 has returned on average 8-10% a year when you hold for 10 years or more.

You can earn a lot more than this with individual stock picking, but this requires at least some basic understanding of how stocks work.

It’s important to note that the stock market can be volatile and that sometimes you can get out less than you put in.

That being said, if you invest wisely and for the long term, the stock market is one of the best ways to create generational wealth.

If you’re interested in kick-starting your investing career today, you can open a stocks and shares ISA with Plum, a fantastic app for beginners.

Once you’ve built up enough of a pot you could sit back and earn passive income from your profits and dividends.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

7. Dropshipping

You might have seen the Amazon influencers lording it up on Instagram, telling you how much money they’ve made from selling other people’s products. It might be annoying to see them killing it, but they make good money from it.

There was worldwide growth in e-commerce sales of 29% in 2021, so it shows plenty of room left for new players.

Dropshipping is selling a product online but not holding the stock yourself. You can do this by signing up and creating your e-commerce store with someone like Shopify and then partnering with a wholesaler like Aliexpress to fulfil your orders.

Aliexpress has so many different products available to choose from it could send a circus ride dizzy, so pick something you like and start selling.

Please be aware it will take a bit of work to drive traffic to your store, but you can do this in a few ways, such as adding a blog to generate organic SEO (search engine optimisation) or social media.

If you want traffic from day one, you can invest in paid social or pay-per-click campaigns to drive traffic to your store. At the end of the day traffic = sales.ing.

8. P2P lending

If you’ve got some spare cash lying around that you want to put to work, P2P lending could be a way to go. This one is one of the riskier passive income ideas but we had to include it anyway.

P2P or peer-to-peer lending is where you lend money to another individual or small business, usually via a platform.

You then earn money from the interest on the loan which could generate you back a monthly income or yearly depending on the loan terms.

Sites like Lendingclub and Prosper will allow you to set this up, essentially cutting out the middle man, in this case, a financial institution, enabling you to connect directly with the lender.

The reasons for the person on the other end taking the loan could be many different things.

The most popular reason you’ll come across is refinancing debt, home improvements or crowdsourcing for a startup business.

You can check out where your money is going, who it’s going to and what it’s for, which allows you to assess the loan payment risk before agreeing. In most cases, P2P lending will generate 5-7% back on top of the original investment.

Is P2P lending safe?

P2P lending is far riskier than typical saving or investing, but the interest can be much higher in most cases. That’s why picking a lending site with a solid reputation and financial balance is vital, as you’re not afforded the same protection as banks.

What happens if the loan defaults?

With the help of the website, you can instigate legal action, but the financial services compensation scheme usually does not cover your loan. Getting your money back can be long, so bear that in mind when lending.

9. Make a YouTube Channel

Many of us possess unique skills and talents that can be shared with a global audience. That’s where creating a YouTube channel comes into play, offering an opportunity to monetise your expertise and interests through video content.

For instance, in the realm of content creation, we’ve turned to YouTube to showcase our skills in areas like graphic design, web development, and even personal finance.

The beauty of YouTube is that once you create and upload a video, it has the potential to generate passive income for years to come.

What is YouTube for Creators?

YouTube is a platform where you can create a channel and upload videos showcasing your skills, knowledge, or entertainment content. It allows you to engage with a vast audience, building a community around your shared interests or expertise.

You may find that starting your own YouTube channel is a great way to establish your online presence, especially if you’re considering setting up your own business or brand.

The remarkable aspect of YouTube is its potential for long-term passive income.

Learning how to make money on YouTube can be a skill that pays you for a long time and either becomes your full 9-5 or earns you a nice side income!

A single successful video can continue to attract views and generate income well after its initial publication.

Harnessing YouTube for Passive Income:

Create Engaging Content: Focus on topics you’re passionate about. This could range from tutorials, vlogs, reviews, or informative content.

Optimise for Search: Use relevant keywords, compelling titles, and descriptions to make your videos discoverable.

Monetise Your Channel: Once you meet YouTube’s eligibility criteria, you can start earning through ads. Additionally, explore affiliate marketing and sponsorships for extra income.

Consistent Uploads: Regularly uploading content helps in building and maintaining an audience, which is key to generating consistent passive income.

Engage Your Audience: Interact with your viewers through comments and live streams to build a loyal community.

By following these steps, you can turn your YouTube channel into a source of passive income, leveraging your unique talents and interests. Remember, success on YouTube requires patience and consistency, but the potential rewards are significant.

10. Rent out your driveway or garage

Put that empty drive to good use by renting out your driveway at work.

Some fantastic UK sites can earn you up to £10 a day just by renting out your driveway.

Renting a driveway is very location-dependent; the closer you live to a station, the busier you’ll be and the more you can charge.

To list your driveway, check out sites like yourparkingspace.co.uk or parkonmydrive.com.

What about storage solutions?

Another way to make money from your extra space is storage solutions. We all have enormous clutter and often need somewhere to store it for various reasons. Lending some space in your garage or even a loft could be a great way to create a passive income stream.

11. Rent out your car

Whilst we’re on the subject of driveways, you can rent the car that sits on it to make a double bubble! Sites like HiyaCar allow you to set up an account, select the days you want to make it available and the rental guide price.

You can then attract potential clients through the app and deal with all the legal paperwork and insurance.

If you’ve got a 2nd car that rarely moves except for an occasional family outing, this could be a fantastic way to make some extra cash.

12. Buy and flip goods

Are you a bargain hunter? Can you spot undervalued items? Well, if so, this one is for you.

If you take Facebook Marketplace as an example, countless listings are available for all different types of things.

If you have the patience to look through you can often spot a bargain.

For example, when I recently moved house, we bought a 200-year-old oak chest of drawers in mint condition for £25 from a well-off lady who was moving house, and she just wanted rid of it.

An antique dealer friend has since valued the chest for £1000.

You could create a business from this, as thousands of undervalued items are available online if you’re willing to look.

Some of them are literally being given away and still have decent resale value. Channel your inner Del Boy and get surfing those listings.

13. Sell trainers

This one is slightly left field, but I’ve had a lot of joy with it lately, so I’m sharing it with you as one of my best ideas for passive income.

We downloaded this super cool app, Heat Mvmnt, which gives you countdowns and alerts when rare trainers launch on usual websites like Nike, Addidas or Reebook.

For example, we picked up two pairs of Air Jordan’s for £110 ($135) each on the day they came out.

The trick is to wait until they sell out, which most of the trainers on Heat Mvmnt do. Once this happens, you can list your trainers on Stock X or eBay for a much higher price. I’ve been flipping trainers for £50-70 per pair for about a year.

Another way to get super-exclusive trainers is to enter the raffles for exclusive releases on trainer shops and the top retailers like Nike or Adidas.

We probably win 1 in 5 that we enter, and these can be rare trainers like Yeezy’s or Nike Lab. One pair of Yeezy’s that we won made us £300 on Stock

Postage and packaging require a bit of effort, but it’s an easy way to make extra money if you’re willing to do the work.

14. Cashback Apps

What could be better than earning money for shopping? People make money from shopping via cashback websites or apps which is a great way to create a passive income.

Most high-street and popular online retailers now use one or more cashback apps. Why? Because they get you buying. It’s such a simple marketing tactic, but it works!

So when you need a new shirt for an interview or products to spruce up your garden, why not get a few notes back when you buy what you need?

Apps like QuidCo and TopCashback are the leaders in the UK, and in the US, you can try apps like Swagbucks and Rakuten.

Or check out the full list of the best cashback apps in 2023.

There are free versions available of these and paid versions for even more deals, but honestly, don’t bother with the paid as you still get such a wide variety with the free options.

With the money you make back house it one of the a high yielding savings accounts like a Cash ISA and earn money on the interest too!

15. Invest in Business

We love this one. Investing in a business is a great way to create a passive income stream. Today we’re lucky enough to have websites that allow us to begin investing in startups for as little as £100.

Often you can get great returns on these investments earning up to 20-30%. With any investment, you can get back less than you put in, so assessing each business top to bottom is essential before investing.

With websites like seedrs.com, you can invest in 100s of different businesses and receive shares for your money.

If that company goes on to do well and even goes public, you could make a lot of money if you’ve invested well.

16. Get Blogging

If you’re interested in a particular subject, then starting a blog can be a fantastic way to create a passion-led passive income business.

Blogs can be highly profitable and, if monetised correctly, can generate income in multiple ways.

Firstly you need to pick a niche or subject. For example, this could be travelling, personal finance or photography. Choosing a niche that can generate traffic is crucial, so pick something people are likely to search for.

Once you’ve got your niche, it’s time to build your blog. You can use a platform like WordPress or a website full of templates like SquareSpace to create your site.

Next up, it’s time to get writing. You’ll want to generate at least 50 blogs but ideally 100+, roughly 1000-2000 words each, to have any chance of ranking on Google.

According to Income school, the average earnings for 100 blog posts of 1750 words long is $3400 (£3000) monthly.

That means you’re easily making £100 a day from a side hustle. Not bad right?!

Monetisation is key, and you’ll want to explore bringing revenue to your site in several different ways. These include:

- Ad revenue

- Affiliate marketing, where you earn commission from recommending products

- Selling products like ebooks, courses and webinars

- Coaching services

- Sponsorships and sponsored content

If done correctly, depending on your niche, blogs have been known to earn up to £30,000 a month but the average is £2000 a month.

Some blogs like NerdWallet have even gone public on the stock market recently!

If you want to read our ultimate guide to making money with blogging click here.

More Passive Income Ideas

- List your space on Airbnb

- Invest in farmland

- Open a high yielding savings account

- Renting your car

- Car wash

- Vending machines

- Angel investor

- Affiliate marketing

- eBook sales

- Get paid to have apps on your phone

- Print on demand business

- Create an app

Make passive income online by completing surveys and sharing your internet. Rated 4.5/5 on Trustpilot!

Offer - Get a bonus for signing up with Up the Gains.

FAQ’s

Where to start with passive income?

What I do is sit down and make a list of the things you are good at. Then once you have this, think of all the business ideas you could create around those things.

Once you start this process, you’ll begin coming up with ideas, and eventually, you’ll land on something you think is a winner. We’ve given you 13 ideas for passive income streams, but there are 100s more.

Lastly, so many failed businesses close down because the person behind them wasn’t passionate about the concept, so make sure you are.

How much money do I need to start a passive income business?

Usually, there’s a cost to set up the best passive income streams, but it depends on what type of business you want to create. As you’ve read above, some require next to nothing to set up, but others are more expensive.

For example, this website costs me £38 a month with hosting, tracking and email marketing subscriptions, and this is the bare minimum with no paid advertising included.

If you’re setting up something like a Fiverr profile, you might want to pay someone to create some excellent graphics for the display or help with your copy to sell yourself, but then again, you could do it all yourself.

How much passive income can I realistically earn?

For this one, I think examples are the easiest way of explaining this as, to be honest, how long is a piece of string!

Hayden Bowles

Shopify Dropshipper made $25,000 monthly from just one site in 2019.

Grant Sabatier

Financial Blogger made over $400,000 in his third year with Millenial Money.

Charmaine Pocek

Fiverr Freelancer, made over $440,000 in 2016, offering services like copywriting, resume writing and optimising LinkedIn profiles.

These people are obviously at the top of their game, but it just shows you what is possible. I’m pretty sure it would be life-changing for anyone if they were to get a 10th of that.

How to long to earn passive income from investments?

Like with anything beautiful, you need to give it time to grow. You can get lucky and make some money on day one, but you’ll need to be patient to make some serious money from adding passive income streams.

Personally, if you have this in your mind before you get started, the first few months of building your business aren’t so hard. In my head, I know I’m not making anything for the first, say, six months, so if you do make something, it’s a huge bonus.

Should I keep the money I earn separate from my main income?

Yes in most cases you definitely should look to split these apart. Essentially you’re running a business so you’ll need a company’s house certificate and a business account. This will help with tax and allow you to keep things separate.

If you want to set up a business account, we use Tide – they’re fantastic and integrate with QuickBooks for accounting.

How to make passive income from home?

Creating passive income from home is a smart strategy to diversify your revenue streams. Here are some effective methods:

Investing: This could be in the stock market, bonds, mutual funds, or real estate. Though it requires some upfront capital, the return on investments can generate a steady passive income.

Peer-to-Peer Lending: Platforms like Prosper or Lending Club allow you to lend money to individuals or small businesses in exchange for interest payments.

Rent Out Property: If you have an extra room or a second house, you can rent it out on platforms like Airbnb. If you have a car you don’t frequently use, you could rent it out through services like Turo.

Affiliate Marketing: This involves promoting other companies’ products and earning a commission. If you have a blog, YouTube channel, or large social media following, you could include affiliate links in your content.

Create a Blog or YouTube Channel: Once you have a significant following, you can make money through advertising, sponsorships, or selling products or services.

Create and Sell Online Courses: If you have expertise in a certain area, consider creating a course and selling it on platforms like Udemy or Teachable.

Write an eBook: If you enjoy writing, consider publishing your eBook on Amazon. Once your book is written and published, you’ll earn money each time it’s purchased.

Develop an App: If you have coding skills, you could create an app and earn money from downloads or in-app purchases.

Conclusion

If you’re looking to create passive income we hope our list of passive income ideas helps you.

While things are tough right now getting your side hustling on could help your financial future.

To generate passive income you will need to have put some effort in upfront to reep the rewards later down the line.

The thing is with passive income is it’s way more active income than people think. You often will need to maintain a lot of these ideas to keep revenue coming in.

Passive income ideas require you to be savvy, smell an opportunity and go for it!

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.