Rosemary Pearson

Rosemary Pearson is a freelance financial editor and writer with 12 years of experience. Her communications career includes writing roles at Coutts Bank and the fintech brand Scalable Capital. Rosemary is also studying for a degree in psychology.

Quickfire Roundup:

Ever wondered where to invest to get a monthly income? We have plenty of ideas for you, from stocks and shares to ETFs, bonds, and cash.

You’ll need to work out your priorities before spending a bit of time on dedicated research but after that, there’s no reason why you can’t bump up your monthly earnings.

Finally, the tables have turned. After years of toil and disciplined saving, you’ve amassed a decent amount of cash and your money can now start working for you.

But crucially you may be wondering: where to invest to get a monthly income?

Every month you’re just a few hundred short of the lifestyle of your dreams, and I’m here to explain how you can make up that shortfall and start investing for monthly income.

It all depends on how much time you have to spare, how much risk you want to take, and whether you’ll need access to that cash anytime soon.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Table of Contents

Where to invest to get a monthly income UK?

As I just mentioned, time, risk and access are your main starting points. If you have plenty of spare time to devote to your extra income and find investing interesting, then perhaps stocks and shares are right for you.

If you’re feeling apprehensive about entering the world of investing and want to start with a low-risk option, then something like a government or fixed-rate bond might be better.

As a general rule, the more risk you take, the higher the potential reward, and the more you lose.

If you’ve got plans to spend the money on a house purchase or anything else in the next couple of years, then it’s probably best not to enter the world of investing at all and use a high-interest savings account instead.

It’s also important to understand your budget. If you’re looking to invest small amounts be prepared for the monthly returns to be modest.

Where to find investments that pay a monthly income?

A great place to start is working out what you’re looking to achieve.

If you want hands on investing and are interested in business then the stock market is a good place to find investments that pay a monthly income.

If you’ve got entrepreneurial spirit or a nack for seeing good ideas then investing into start ups or taking equity in existing businesses can also be a good route to go down.

Honestly, the world isn’t short of investment opportunities and below we’re going to cover some of the more common ones.

6 Best Investments For Monthly Income

Stocks and shares

Stocks, shares, and equities all mean the same thing: taking a stake in a listed (or public) company.

Anyone can go onto a trading platform and buy a few stocks in any major company they’re interested in, and in theory, you could get some regular payouts via dividends.

There’s also the potential for your stocks to rise in value, so you get the benefit of regular income and an increase in your capital.

Sounds perfect, right? But sadly, it’s harder than it sounds. You’ll need to do a lot of research to find a reliable dividend-paying stock which will take time and careful ongoing monitoring.

Risk is also a factor as the value of your original investment will vary according to the performance of the company.

This means you could do well, and your stock could rise but it also means it could fall, possibly even losing you your entire investment, the greater the risk, the greater the potential reward and the potential losses.

Buying the stocks itself costs a bit too, so you’ll need to bear some trading expenses in mind.

Bonds

You may have heard of bonds also being referred to as fixed income – the terms mean the same thing.

They’re a way of lending money to governments or companies for a set period in return for regular (or fixed) income, and you get your original investment back when the term is up (providing the company or government hasn’t gone bust).

UK government bonds are referred to as gilts, and they’re lower risk than corporate bonds.

Bonds are much less risky than stocks and shares and they still provide that regular income you want.

The downside is that it’s generally sensible to keep your money tied up in the bond until the end of the term, and there’s no potential for uplift in the regular income paid out.

For example, if you sign up to a two-year gilt which pays 2% and the next day UK interest rates go up to 4%, you could be stuck in your low-rate bond until the end of the term.

If you don’t have loads of time to devote to research and don’t want to take much risk, a bond might be a good option for you.

At least you’ll (almost certainly) get your original investment back and you’ll earn some regular income too.

But that income might not transpire to be as high as you could have got elsewhere, plus it’s best to keep bonds until the end of their term so you won’t have quick access to your money.

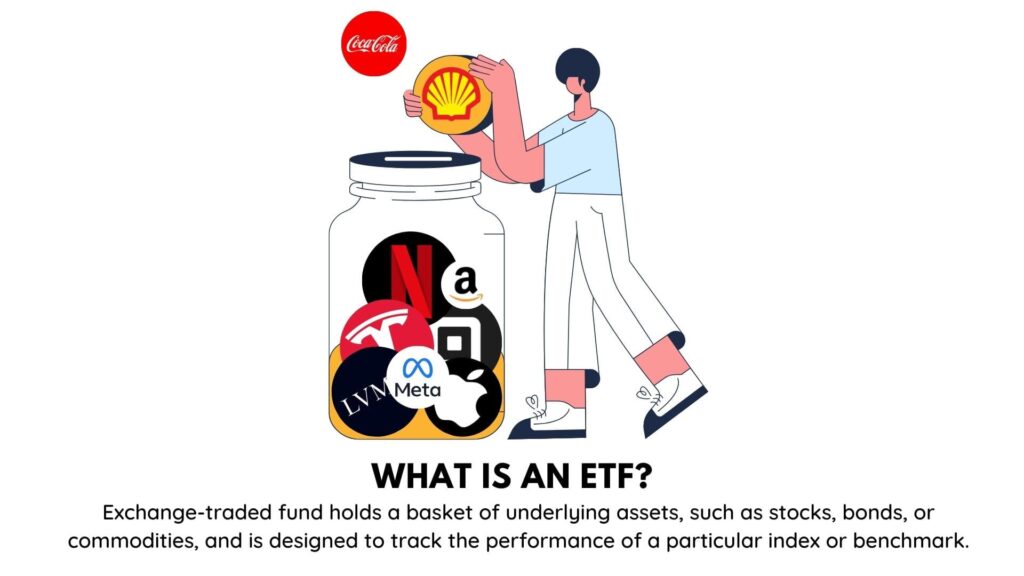

ETFs

Exchange-traded funds (ETFs) are another way of gaining exposure to bonds and stocks, but in a broadly diversified way.

You’re effectively buying a basket of stocks or bonds (or an index) and holding onto them.

The trading costs are far lower than buying individual stocks and you’ve got the benefits of diversification which means if one of your stocks falls dramatically, it might be compensated by another which has shot up in value.

They’re fairly liquid, so you’ll have easy access to your money if you need it and you should get a decent level of regular income.

The downside is that it will take some time and research to choose the right one for you, and like most investments, the value of your original investment may fall, and you may not get your full investment back.

We’ve written more about ETFs here.

Index Funds

Moving on to index funds, which are a boon for those seeking a steady income with a bit more gusto than bonds, yet still averse to the rollercoaster thrills of individual stock trading.

Index funds are collective investments that track the performance of a market index, like the FTSE 100. They’re designed to mimic the ebb and flow of the market, offering a broader exposure to a swath of companies without the hassle of picking each stock.

It’s like having a slice of the entire market cake, rather than betting on a single berry. This diversification inherently spreads out your risk, which can make for smoother sailing in turbulent economic waters.

Now, don’t expect the sky-high potential returns you might get from individual stocks. Index funds are more of a ‘slow and steady wins the race’ kind of investment. They aim to deliver consistent growth over time, capitalising on the general upward trajectory of the market.

The beauty here is simplicity and ease. You’re not locking horns with the complexities of market analysis or sweating over the financial news every morning. Instead, you’re relying on the broad back of the market itself to grow your investment.

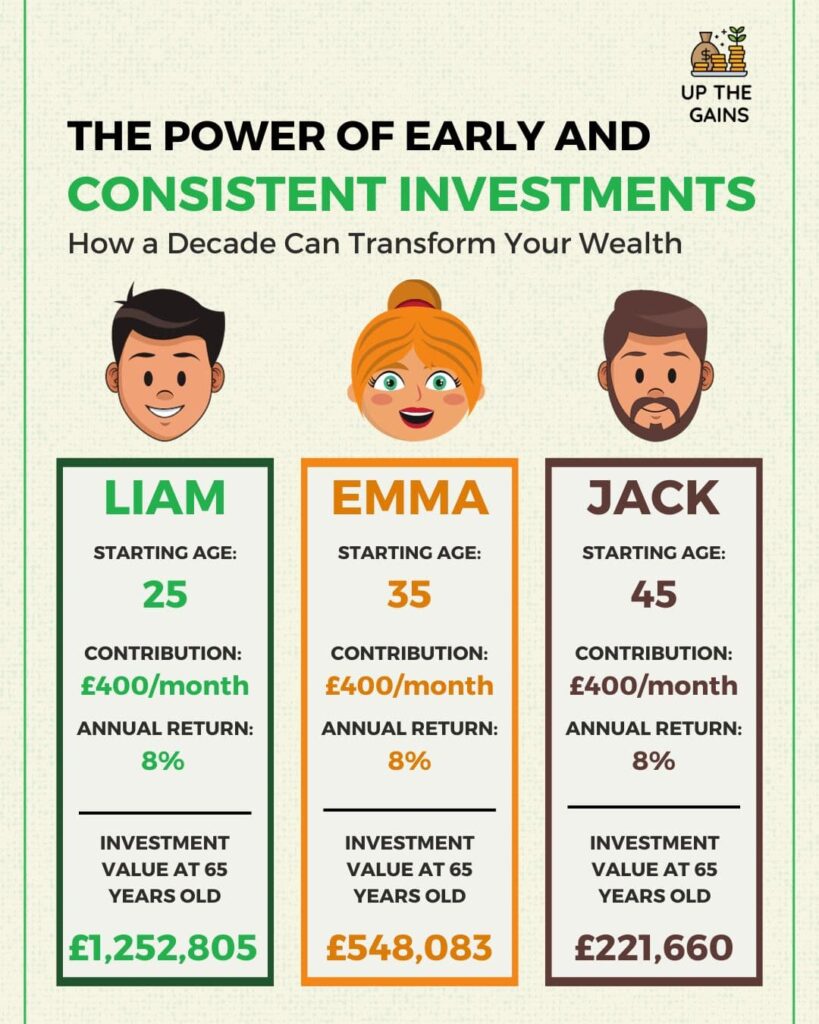

You also benefit from the compounding effect of reinvested dividends, which can provide a snowballing increase to your holdings – a compelling perk for long-term growth and income.

And if we’re talking about liquidity, index funds can be more forgiving than bonds. There’s typically no fixed term, so you can usually sell your shares in the fund if you need access to your cash, though it’s wise to think long-term to ride out market fluctuations.

Property

There are two main ways of investing in property.

You can either buy a place which you then rent out (buy-to-let) or you can invest in a property fund called a Real Estate Investment Trust (REIT) giving you exposure to the commercial property sector.

A buy-to-let will be hard work and expensive to get going but should then provide you with relatively stress-free regular income, that’s providing you find good tenants and the property doesn’t need too much upkeep.

In the past, buy-to-let has been a very attractive option, but as property prices are now so high for first-time buyers, the government has taken action, and the buy-to-let business model isn’t as profitable as it was.

Get a spreadsheet out before you go down this route and do the maths! The other downside is that your money is then seriously tied up should you need it quickly.

When it comes to REITs, you’ll need to spend a bit of time choosing the right one for you, but they’re known for paying fairly high dividends so they should provide you with a good level of regular income.

Just like stocks and shares, though, the value of your original investment could rise as the REIT does well, but there’s also a chance it could fall, losing you your original investment.

REITs are good for those who may need their cash out quickly, as they’re known for being fairly liquid.

If you want to learn more about REITs, there’s plenty of information here.

Cash

For anyone wanting to take as little risk as possible, cash might be your best investment, in either a savings account or a fixed rate bond.

But you’re unlikely to earn all that much: little risk generally equals little reward.

With interest rates where they currently are, if you stay in cash, you probably won’t be able to beat inflation, but you will get some regular income and you will get your original investment back.

To the consumer, savings accounts and fixed-rate bonds work similarly.

In both, your money will be tied up for a set period and in exchange, you’ll receive regular interest payments until the end of the term when you’ll receive your original investment back.

The difference between savings accounts and bonds is that you’ll find it easier to withdraw your cash from a savings account than a bond if you need it out for any reason.

If you’re tempted by a fixed-rate bond, think carefully about your future financial needs before signing up as you may lose interest if you withdraw your money before the end of the term.

If you look hard, you can find interest rates on savings accounts of about 4.5%, which is considerably more than you’ll be getting in your current account!

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Don’t forget about paying tax

Tax will be due on any extra income you’re earning, and you’ll need to declare it on your annual tax return.

An ISA will help you reduce your tax liability, so take advantage of the £20,000 annual allowance and try to keep as much as your investment sheltered in your ISA as you can. Have a look here to read more about ISAs.

FAQs

What is the best investment for a monthly income?

This completely depends on your appetite for risk, how much extra work you want to put in, and how long you are prepared to tie your money up for.

Once you’re clear on those three points, you can start to narrow down your options which are broadly cash, stocks and shares, bonds, property, or a fund like an ETF.

How much to invest to make £1,000 per month?

This completely depends on your appetite for risk, how much extra work you want to put in, and how long you are prepared to tie your money up for.

Once you’re clear on those three points, you can start to narrow down your options which are broadly cash, stocks and shares, bonds, property, or a fund like an ETF.

Can investing give me a monthly income?

Absolutely. You can receive income every month, but a lot of investments pay out every quarter or half year, so if you need the money every single month, make sure you choose an account, bond or stock that works for you.

Conclusion

If you’ve managed to accrue some savings and were wondering, where to invest to get a monthly income?

I hope you’ve now got a few ideas. It all starts with your risk appetite, how much time you have to dedicate to research and how quickly you want access to your money.

When you work those factors out, your options will become a lot clearer – from the higher risk stocks and shares to the lower risk cash and ETFs.

If you’re careful, all have the potential to provide you with some regular monthly income.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.