Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

It’s possible to earn money from the comfort of your home if you invest in income-generating assets.

From personal experience, I learned that by diversifying your investments through a variety of these assets, you’re likely to gain some passive income in no time.

My top picks for the best income generating assets include digital products, dividend stocks, P2P lending and money markets.

Just always do your research before you invest money and make sure you understand the risks involv

Are you searching for ways to make money from home? You’re not alone. I’ve also grappled with making some extra money outside of the traditional workplace.

Most successful entrepreneurs diversify their income. One way they do this is by utilising income-generating assets.

If you’re not yet investing, it might be time to get your priorities straight.

This article aims to provide information for those interested in exploring different aspects of financial management and investment options.

Read on for my guide to the best income-generating assets that will help you step up your financial game without ever leaving your home.

The Best Income Generating Assets: At A Glance

Income-generating assets are investments that generate profits. There are a lot of different profit-earning assets on the market, and where you invest your money will depend on your preferences and financial goals.

Before you get started, you need to consider the following for each option:

The risks involved

The returns

The time commitment to invest and manage the asset

The minimum investment required

Your current financial situation

Be sure you have assessed all of these things as each person is unique!

The 11 Best Income-Generating Assets That Can Be Managed From Home

1. Digital Products

Digital products are anything that you make once but can be purchased an infinite amount of times online.

Products include items like ebooks, worksheets, mini courses, planners, Notion templates and so many more.

Learn how to create and sell digital products with our full guide.

They are housed on an online store for example like Shopify or StanStore and sold through Stripe or Paypal.

You can be up and running within a matter of days and use social media to promote your products. I’ve personally been selling an enormous amount of digital products this year with over £20,000 in sales.

The bulk of the money comes from social media but a good 30% of it comes from a mailing list.

It’s key to build this up but we have a course coming on it where you can learn how to go from idea to product launch in just a week and be making money in 21 days!

Join over 1,000 others learning how to go from £0-5k with just 60 minutes work a day.

Includes everything you need to create, build and sell profitable digital products in a niche you're already passionate about.

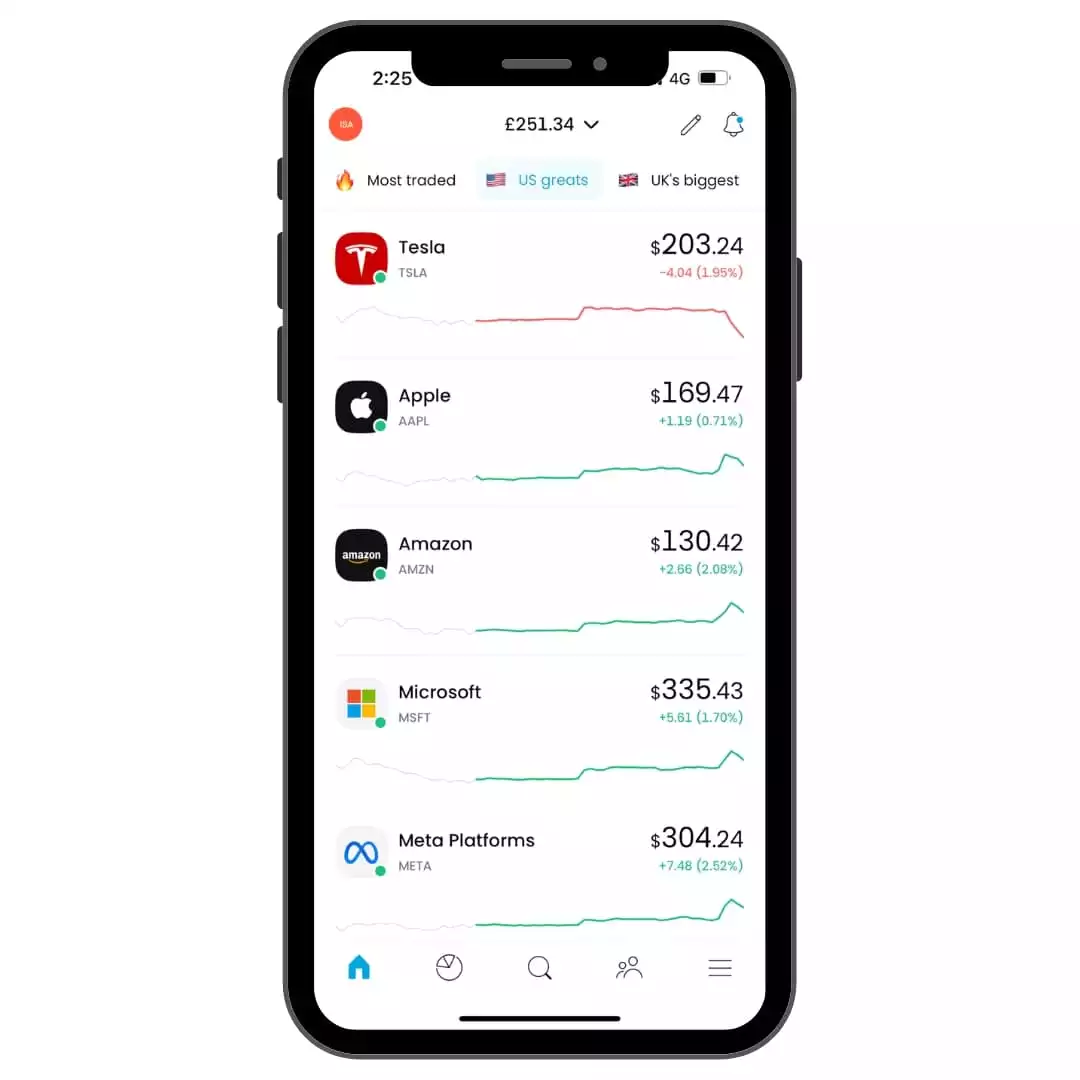

2. Dividend Stocks

In case it’s not evident from the name, dividend-paying stocks are stocks that pay dividends to investors or shareholders in specific intervals. These payments are either cash or more shares of the stock.

Regular stocks only pay out when sold, but some large blue-chip companies (like Imperial Brands or Lloyds Banking Group) regularly pay profits to shareholders as dividends.

Learning how to invest in dividend stocks is very simple. You just need to check whether the company pays one and purchase the stock as normal. The stock will pay out at certain times on the year based on the amount you’ve invested.

Let’s take a look at an example.

A company is offering a 5% dividend yield. Its stock holds at £20/share for the year. If you own 100 shares in the stock, you’ll either receive £1/share in cash or buy five more shares through reinvestment over the year.

Just note that you can’t just pick stocks based on the dividend payments. You also need to consider:

Price-to-earnings ratio

Dept-to-equity ratio

Price-to-book ratio

Price/earnings-to-growth ratio

Some sectors are known to have higher dividend yields, like utilities and consumer goods. These sectors are good places to start your investment journey.

As an added bonus, you don’t pay tax on dividend income as part of your Personal Allowance (the amount of money you can earn each year before paying tax).

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

3. Physical real estate properties

I should begin by saying that real estate investing is very different from simply buying a house. This investment is an income-generating asset that can take several shapes:

Rental property: A rental property is a real estate asset that you buy with the sole purpose of renting it to tenants. You don’t plan on living in it yourself.

This kind of income-generating asset results in residual income each time your tenants pay rent. Long-term rentals ensure you have a steady income stream, but short-term rentals (like renting your property through Airbnb) can bring in more cash.Commercial property: Shopfronts, offices, co-working spaces… these are all great options for investors to purchase. You can either purchase a property through a realtor or use a real estate crowdfunding platform to help you with your investment.

And, if you don’t feel like managing your rental properties yourself, you can always hire a property manager for a true hands-off investment.

However, there are some risks.

The success of rental properties often hinges on location and market trends. Properties in high-demand areas can yield significant rental income and appreciate in value, while those in less desirable areas may not perform as well.

Then there’s the volatility of the market. Any changes in demand for rental properties, economic downturns or local developments can impact rental prospects. Selling a property is also not always straightforward if you wish to quickly access additional funds.

You also need to be aware of taxes. If you own rental properties, the first £1,000 you earn from rental income is tax-free, thereafter you have to pay income tax.

Something else you can consider to get your foot in the real estate door is to rent out a room in your house (if you own it) to generate income without massive upfront investments.

4. Peer-to-peer lending

If you have some money to spare, then peer-to-peer (P2P) lending can be a great way to boost your income and make money.

P2P lending is aimed at borrowers who, for whatever reason, don’t want to take out a bank loan.

You can lend money to these individuals and earn income through interest on the loan repayments. Depending on the loans, you can earn annual returns between 4% and 10%.

Of course, there are some risks associated with P2P lending – the biggest one being that the borrower never repays their loan.

Most P2P lending platforms are regulated by the Financial Conduct Authority, which offers some protection to the lender but always be sure to check this and don’t deal with unregulated providers.

The best way to negate this risk of not receiving your money is to spread your investment across several loans.

5. Local small business investing

Have you always had lofty dreams of being a business owner, but never had the inspiration to get started? One shape that income-generating assets can take is to invest in someone else’s small business.

You can approach business owners directly or use crowdfunding websites and filter by businesses close to you.

By investing in local businesses, you are contributing to the local economy. However, it’s important to carefully assess the potential risks.

There is one realistic downside to investing in small businesses: failure. Start-ups can be risky as they’re not yet established; however, if the business succeeds, the payouts can be incredible.

There are different types of small business investments you can make:

Equity investments: You buy a share in the company and earn a portion of the profits.

Debt investments: You can lend money to the start-up and the loan is repaid with interest.

Convertible investments: A combination of the two types above. Your loan can be converted into business shares.

Before you take on this kind of income-generating asset, you’ll have to do your due diligence. Analyse the company’s financial statements, make sure you understand the business model, consider the expertise of the management team, and make your decisions from there.

6. High-yield savings account

If you’re looking for straightforward income-generating assets, then you can’t really go wrong with high-yield savings accounts.

By opening a savings account at your bank, you can earn interest on your own money, which can either be reinvested in the savings account or paid out as cash.

There is a minor difference between regular and high-yield savings accounts:

As the name suggests, high-yield accounts offer much higher interest rates than regular accounts.

Some high-yield savings accounts require minimum deposits to open the account or earn the highest interest rates. If your balance drops below the minimum, you could incur fees. Regular savings accounts have much lower minimum balance requirements.

High-yield accounts have much stricter withdrawal limits.

The interest rate will depend on the type of savings account. Some banks offer incredible interest rates, ranging from 5% to 8%. Check out some of our best savings apps!

These high-yield accounts are most often offered by online banks. This means that money can only be placed in the account through an online transfer, which can sometimes be a hassle if website problems crop up.

Another downside is that you’re not able to immediately access the funds in a savings account.

7. Certificates of Deposits

Certificates of Deposits (CDs) are kind of like a piggy bank that you give to the bank to keep for you over a certain time period. And because you’re trusting them with your piggy bank, they’ll add money to it each month.

When you invest your money in a CD, you are depositing money for a set amount of time. It could be a couple of months, a year, or much longer.

You then earn interest on your money, like you would with traditional savings accounts. You’ll only be able to access your money after the time period has lapsed, otherwise, you can incur a penalty.

Because of the timeframes, CDs typically have higher interest rates. For example, Barclays offers 5.5% for a 12-month deposit.

Another great thing about Certificate of Deposits is that there are no minimum investment requirements. This makes them incredibly accessible to those new to income-producing assets.

You can make use of what is called a “laddering strategy” to maximise your investments. To do this, you can put your money in several CDs with different maturity dates (e.g. one matures in a year, one in three years).

That way, when one matures and you can withdraw money without penalties, you can either take the money or reinvest it into another CD.

8. Private equity investing

Don’t run away when you hear the words “private equity” – it’s not just for the incredibly wealthy!

Private equity investing is when you invest in private companies. A lot of these companies are just starting to become established. It is very similar to the small business investing I discussed above. However, the main difference is that when you invest in small businesses, it’s often a local company and you directly interact with the owner.

When it comes to private equity, you invest in companies through a private equity firm. The firm will pool money from a variety of investors, and that money is then used to buy, manage and sell companies.

By working through a firm, you are able to spread your risk. You also don’t have to do your own research on which companies to invest in (which can be very difficult if you have no idea where to start).

9. Farmland

Most of us have not really considered buying a farm. But, land is a finite resource, making farms valuable income-producing assets. There will almost certainly always be demand for land to grow crops.

Even though the yields may not be as high as some of the other income-generating assets on my list, you can expect steady annual returns ranging from 1.5% (in 2022) to as high as 8.8% for livestock land.

Farmland is also much less volatile than stocks. Farmland was the highest-performing asset class in the UK in 2022, outperforming gold, residential property and equities.

And, you don’t have to know anything about farming to make this investment. You can simply invest in the property (either personally or through a firm) and the farmland will be managed and generate income without you having to lift a finger.

There are actually two approaches you can take:

Purchase the farmland and then lease it to a farmer or company.

Invest in a real estate investment trust (discussed below) or crowdsourcing platform that focuses specifically on farmland.

So interesting this one! Oink!

10. Real estate investment trusts

Before telling you why you should consider a real estate investment trust (REIT), let me first briefly explain what it is.

A REIT is a company that buys, sells, maintains and manages commercial real estate properties. By investing in a REIT, an investor (i.e. you) earns passive income from rent collected.

REITs can cover a variety of property types, including:

Shopping malls

Office buildings

Apartments and apartment complexes

Hotels

Hospitals

Having this variety of properties results in a diversified portfolio. Actually, investing in REITs is a good way to diversify your portfolio if you’re also investing in dividend stocks, mutual funds and bonds.

REITs are perfect for those who don’t want to buy and manage their own properties. This way, you’ll also forego the massive downpayment on a property.

Usually, REITs pay high dividends. Some are traded on the stock market, while others are not. If you’re new to investing, you’re going to want to stick to publicly traded REITs because of better governance standards and transparency. You can purchase these through online brokers.

The biggest risk when investing in a REIT is market fluctuations. Economic downturns can cause property values – and rental income – to drop.

REITs themselves are exempt from corporation tax on their profits earned from rental income.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

11. Money market accounts

Sticking to my piggy bank example from before: A money market account is like a special piggy bank where the piggy bank gives you extra money for saving your money in it, in the form of interest.

Sounds similar to savings accounts, right? Well, there are some slight differences:

Earn more interest: Money market accounts pay out more interest than savings accounts.

Easy to use: You are able to withdraw money (although not as often as you can with a traditional bank account). There may be limits on how often you can withdraw money each month, but there are no early withdrawal penalties.

Safe and secure: Your money will be protected up to a certain amount even if something bad were to happen to the bank.

Money spending: Depending on the bank, you might be able to write cheques or use a debit card directly tied to your account.

As you can see from the benefits above, these accounts are kind of like a cross between savings accounts and cheque accounts. You’ll earn higher interest rates, are able to withdraw money on occasion and use a debit card.

Just note that money market accounts have variable interest rates, meaning you will earn interest based on market fluctuations.

FAQs

Why should I invest in income-generating assets?

Investing in an income-generating asset offers you the following benefits:

- Regular cash flow

- Financial freedom

- Increase your net worth

- Change your lifestyle

- Start building generational wealth

Where do I start if I want to buy an income-generating asset?

The best step for complete beginners is to invest in low-risk options. This way you can learn as you go. These include money market accounts, high-yield savings accounts and short-term Certificates of Deposit.

Once you get a bit more comfortable in the world of investing, you can move on to REITs, stocks and even rental properties.

How much money do I need to start investing?

You don’t need to have a fortune to start investing. A lot of income-generating assets can be started with modest amounts of money.

The key is to begin investing with what you’re comfortable with and make sure you still have enough money to survive. You can always increase your investment as you improve your investment knowledge.

How can I balance risk and reward when investing in income-generating assets?

Knowing how to balance risk and reward is key when you begin investing. The best option is to start with low-risk investments, like Certificates of Deposit or savings accounts.

You also need to research your risks before investing. As you become more confident, you can diversify into higher-risk investments like stocks and real estate assets.

Final Thoughts

Here’s my secret: The smartest financial decision you’ll ever make is to invest in any of the best income-generating assets listed above.

An income-producing asset can earn you passive income, as long as you put your money in the right place. You may have to make some initial investments – like putting a minimum amount in a savings account or purchasing a property – but income-producing assets will ensure you receive a steady stream of money.

I truly believe that investing will be one of the best decisions of your life when it comes to your personal finances.

For beginners, it is key to build a diverse investment portfolio. REITs, rental income and blue-chip stocks can all be low-risk options with high annual returns. Now, all you need to do is get started.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.