Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Budgeting is not something we are taught at school, so we generally learn from our parents and, in many cases, work out how to deal with money as we go.

It doesn’t matter where they come from, but we all need some money-saving tips and tricks to use in our arsenal.

This foundation for sound personal finances isn’t always the most solid, so it can be easy to get into a mess with money or not understand how to prioritise where your money should be going.

The good news is that plenty of apps, websites, and software can help you get a better grip on your finances and, in turn, help you be better with money management.

One of the best ways to get your finances back on track and keep them there is to consider how you are spending your income and where you might be able to save money.

Table of Contents

Money Saving Tricks and Tips

There are lots of gurus out there saying they have money tips and tricks that will help change your life.

Whilst some might be great, the rest are a load of rubbish.

So if you’re wondering how to get your finances back on track or how to get your money on track then I’m going to give you 7 money saving tricks and tips that you can actually use!

1. Creating & Sticks to a budget

One of the best money saving tips and tricks is creating a budget, and without a doubt, the first place anyone should start.

After all, how can you be better at money management if you don’t know your starting point?

To get started, you should look through your last three months’ spending activities, making sure you add to your spreadsheet what you have spent and where you spent it.

Although this process can be painful if you have previously spent without much thought, you must ensure this is accurate and write down everything you spend on a typical month.

Once you have three months’ worth of data, you can categorise your spending and work out where your salary generally goes.

Budget software does a lot of this for you and gives you a solid idea of what you are spending and where your money is going each month.

We’ve built an ultimate household budgeting sheet that saves you the hassle.

Once you have this, you can look at your spending and work out where you may be able to spend less and save more.

Writing down how much we spent in one month on coffee before work or Friday night takeaways motivates us to kick these habits to the kerb and save some money instead.

Money saving apps

If writing down lists isn’t your thing then utilise technology, we’re all on our phones 24-7 these days using a number of different apps.

Nowadays there’s some incredible savings apps that help you budget and in some cases even invest. One of our favourite is Chip.

These apps are great, and some even make suggestions for you, so you don’t have to work out the numbers yourself.

When creating a budget to move forward with, you mustn’t be too strict on yourself. Instead, create a realistic budget that you can live with.

If you are too stringent with what is and isn’t allowed, you’ll find that you want to break the rules more often, and before you know it, you have created a budget that is impossible to stick to.

However, I can’t stress enough if you want to nail our money-saving tips and tricks, then budgeting is the one you need to nail first.

Let the latest technology help get you there with the best money savings apps.

2. Creating a savings pot

Once you have created a budget, you will have an idea of how you will spend your money in the future.

Roundup apps are great to add a little to your savings pot every time you spend money without noticing.

Every time you spend, the amount you have spent is rounded up and the extra placed in your savings account.

I used this feature on Monzo to make an emergency fund for use on rainy days. Over six months, I built up over £600 just from roundups.

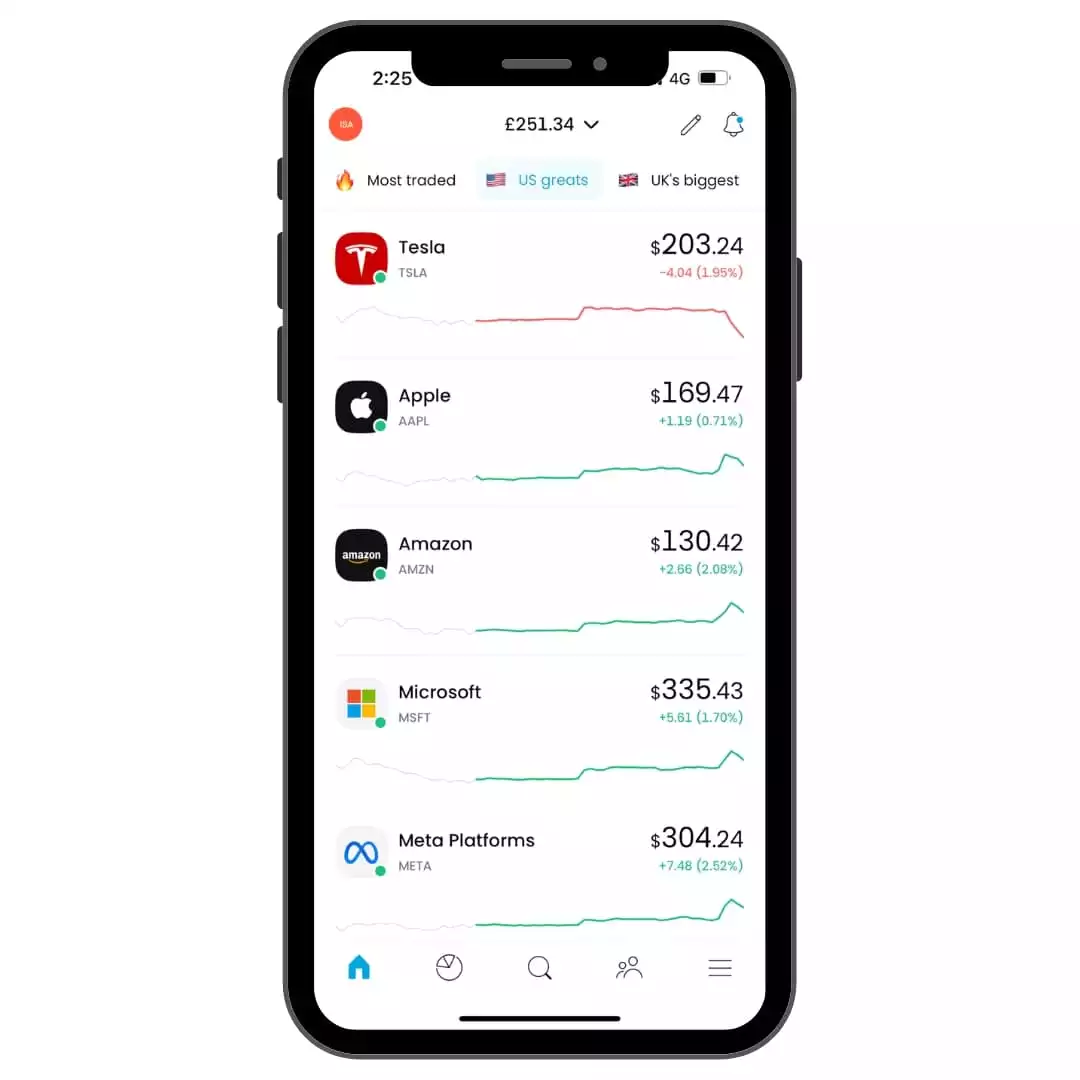

3. Getting into investing

When someone is new to investing, it is easy to assume that it is complicated and something they don’t want to get into.

You don’t have to have thousands of pounds to be an investor, and you can start an investment with just a few pounds to see how things go.

You don’t have to overcomplicate things by worrying about the best places to invest your money.

Instead, make small Index funds are a collection of stocks which you can buy or sell altogether for one price. If the stocks inside of that fund perform well on the whole then the overall price rises. This helps lower your risk.

Doing it this way will also help you to feel more confident that investing works you just need to give it time to flourish.

If you’re wondering how to make more money investing, the best advice is to get involved with industry forums and do what you can to keep up with industry news.

Instead, take small steps into investing via the right apps, research as much as possible, and learn.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

4. Looking after the money you have

All of this is great, as long as you do what you can to look after your finances. For example, have you checked your bank account and ensured that you have the best possible bank account?

There is money to be made from switching bank accounts, but they all have their pros and cons, so you should ensure that the type of bank account you have is the one that best suits you and your needs.

One of the best money saving tips and tricks is to shop around when buying expensive products or renewing things like car insurance.

People still fall into the trap of simply renewing their policy because it is the easy option, but this usually means you end up paying more than you need to.

Before you renew anything like car insurance, pet insurance, home and contents coverage and even breakdown cover, make sure to head to a comparison website and speak to your existing provider.

You can get the best possible deal by doing this, and you’ll be surprised at just how much money you can save each month.

5. How to save money when you shop?

When it comes to money saving tips and tricks for shopping, the best advice that I can give is to make sure you save money where you can.

In the past, people have been used to cutting out coupons and taking them with them to hand over to the cashier for a discount.

So why should online shopping be any different?

Cashback websites and apps such as TopCashBack and Quidco work with a range of retailers to offer a small amount of cash back into your account when you shop.

The amount you spend doesn’t change, but the money in your cashback website account adds up – and when you have reached the threshold for their payment, you can withdraw it to your bank account.

This technique is extra money you can spend on something that month or even place in your savings pot! When shopping online, it’s also worth looking out for online discount codes and vouchers because they can give you decent savings!

Don’t be tricked into spending more just because it feels like you are getting a significant discount – you’re only saving money if it was something you were going to buy anyway.

Spending money just because it seems cheap means you’re wasting money you otherwise would not have spent.

Another way could be looking to save when your yearly bills like insurance or tv deals come up. We’ve recently saved around £25 a month moving our monthly phone contract to sim only and renting a phone from Raylo.

It’s all about being smart and saving where you can.

6. Why you should regularly reassess?

With all of this in place, you should find that you are in a much better position financially and have a better understanding of your finances and where your money is going.

It would help if you didn’t assume that what you have put in place will work forever because our situations constantly change.

You need to find clever ways to save money and then keep track of your progress.

For example, you may change jobs, or one of your children may start school, which will change the money you have coming in and out each month.

If you have something that changes your monthly finances, this is a definite indicator that you should review your budget and make sure that it is still suitable for your needs.

On top of that, checking your finances against your budget should be a regular thing, especially if you find that it is harder to spend within your budget each month or that you have less money to save each month.

Struggling with your budgets? Use our budgeting calculator for your monthly expenses.

7. Seeing the benefits

Whether you want to create a savings pot or you feel you could be better with money, there are different ways that you can save money and help keep your finances on track.

It would help if you recognised the hard work you have put into keeping your finances on track and even turning around your finances for the positive.

Pat yourself on the back. You’ve made an enormous change to your spending habits and can see the differences!

Spending within a strict budget isn’t always easy, especially if you are putting all of your spare money into savings rather than being frivolous with it as you may have done in the past.

Make sure that you are benefiting from this hard work and that you do what you can to ensure that you can see the benefits.

For example, you could create a savings pot to save for a holiday or put money aside for a family day out that you may not have been able to afford in the past.

Set yourself some savings goals – this could save 5k in a year or two!

Although you can’t spend this money every month, knowing that you have something to look forward to directly from the hard work you put in is positive. These little moments you create from your hard work motivate you to continue saving.

The biggest takeaway is that organisation is critical to keep your finances on track when it comes to money-saving ups.

Creating a budget that you can access and stick to is essential. Being organised enough to look for voucher codes and shop via cashback websites helps, and dabbling in investing if you are interested in doing that.

Of course, there are also ways to make extra cash from home and various side hustles that you can look into, which can help bring in some extra pocket money to spend each month.

FAQs

How To Get Your Finances Back On Track?

The best way to get your finances back on track is by creating a budget and sticking to it. Audit your income and expenses, categorise them, and set goals for saving, spending, and investing. Consistency is key, and tracking your progress will give you the control you need.

What Is the 50/30/20 Rule For Savings?

The 50/30/20 rule is a simple budgeting method that divides your income into three categories: 50% for essentials like rent and groceries, 30% for discretionary spending like dining out, and 20% for savings and debt repayment. It’s a straightforward way to organise your finances and ensure you’re saving adequately.

What is the trick to saving money?

The trick to saving money is automating your savings. Set up a direct transfer that routes a portion of your income into a separate savings account as soon as you’re paid. This “pay yourself first” approach removes the temptation to spend before you save, making it easier to accumulate wealth over time.

Conclusion

In conclusion, mastering your finances doesn’t have to be a Herculean task.

By implementing these 7 money-saving tips and tricks, you’ll be well on your way to financial security and even abundance.

Whether it’s automating your savings, using the 50/30/20 rule, or being savvy with your shopping choices, these steps are designed to help you maximise your income and minimise your outgoings.

Remember, the journey to financial freedom starts with small, consistent actions.

So, why wait? Start employing these strategies today and watch your savings grow. Cheers to a brighter financial future!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.

Budgeting is clearly one of the hardest parts of my life as a freelancer, and I’ve tried to use savings pots on Monzo for instance, but it’s just not enough. Whenever I’m stressed, I take it out on shopping, so I guess keeping real good track of my finances with a spreadsheet can only help!!

Absolutely! We all have different ways that’ll help us and we just have to find the one that’s right for us!