Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

I think Chip is a fantastic option for beginners looking to save and invest.

Winner of the ‘Best Finance App 2022’, its primary selling point is to combine saving and investing all under one roof.

Saving and investing can be done automatically without having to lift a finger which is a big bonus and they’re currently offering 4.84% interest on their Easy Access Savings Accounts.

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

- Award winning mobile app

- Save automatically with AI

- Save loose change with their roundup feature

- Invest in funds and stocks

- Can only link one bank account

- Withdrawals could be quicker

Chip Bank Review - Main Features

I personally downloaded Chip and ran tests for 6 months to put together a comprehensive Chip savings review.

From my findings here is a list of the key features Chip offers to help you understand how does Chip work.

Here’s a summary of some of the things we found useful at Chip:

- Automated savings – Thanks to powerful AI, you don’t need to lift a finger the system can save automatically for you

- Analyse your spending – .By analysing your spending patterns with open banking and AI it knows precisely how much you can afford to save and invest each month

- Set saving goals – Set goals and then track your progress towards achieving them

- Withdrawals – Withdrawing money is easy, but can take two working days

- Earn Interest – The Chip interest accounts mean that you can earn interest on your savings

- Invest your money – By teaming up with BlackRock, Chip now allows its users the opportunity to invest in highly respectable funds worldwide

- Save every payday – Set up a function so that you automatically save every time that you reach payday

- Safety – Chip is regulated by the FCA and covered by the FSCS

Our Rating

- Suitable For Beginners

- Useful Features

- User Experience

- Customer Service

- Price / Fees

- Customer Feedback

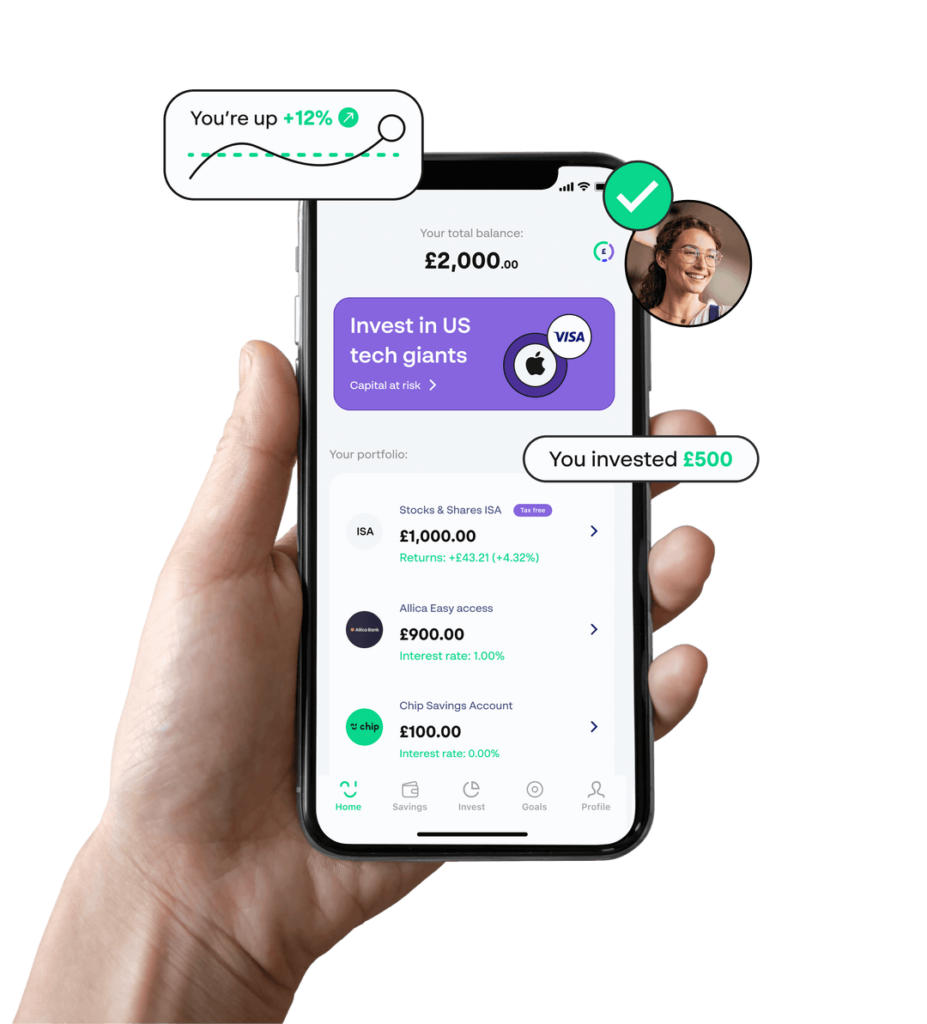

Chip App Review

I’ve rated Chip 4.46 out of 5 stars which is a very respectable score here on Up the Gains.

This is using our six pillar method, which assesses useful features, customer service, user experience, fees, feedback and suitability for beginners.

Chip scored best for it’s suitability for beginners and useful features however scored slightly lower for fees and current customer feedback.

I personally think Chip is a great app to put aside an emergency fund in a high interest savings account and get yourself into investing.

When comparing it to competitor apps like Plum and Snoop it scores very well. Scoring just under Plum but higher than Snoop.

If you want to get started with Chip you can head over to their website and open an account for free.

Is Chip good for beginners?

Yes, Chip was created for beginners in mind. Chip is an ideal tool specially created for those who find it difficult to save or invest.

The app is extremely easy to use and has many features that help you manage your money.

You have the option to store your money as cash and earn interest on it if you’re not up for investing. However, it’s worth noting that investing could yield considerably more returns in the long run.

For investing newbies, it’s important to recognise that some decisions need to be made regarding how your money is allocated. We’ve provided a breakdown of these options below, but don’t fret, as it’s a fairly simple process.

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

Chip Pros & Cons

Pros

- Earn 4.21% interest on your savings

- Award winning mobile app

- Save automatically with AI roundups

- Analyse your spending habits

- Investment platform offered by BlackRock

- Free account has plenty of features

Cons

- No standing order features

- Can only link one bank account

- Needs faster withdrawals

- Slightly limited investment options

Who Are Chip and How Does It Work?

Before we dive into our Chip app review, let’s take a moment to look at the company itself.

Founded in late 2017 by Simon Rabin and Nick Ustinov, this fintech company now has a team of 130 people and some 500,000 + registered users.

What has made Chip so popular is that it has a mission to help people create wealth.

It wants you to save and invest just as easily as you can spend (and we all know how easy spending can be!).

Like some of the other platforms that we’ve looked at like Snoop and Plum, the Chip app makes use of artificial intelligence and Open Banking.

This allows it to analyse your spending habits and make saving something that is both affordable and automatic.

Thanks to a partnership with BlackRock (one of the biggest investment companies in the world), Chip users also have access to an array of investment products.

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

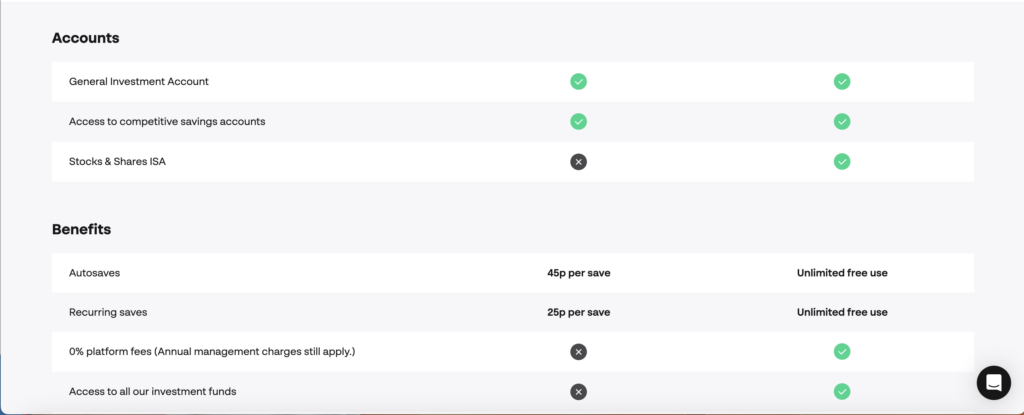

Chip App Review - Account Types

As we went through the sign up process there are currently two main account types that are available to users.

These are the Chip Basic account and the ChipX account.

They also have a selection of savings accounts too which we’ll touch one below but you are guided to sign up to the basic or the X accounts.

One of the major differences here comes down to the fees that are charged, but what else is there to differentiate between the two?

| Chip | ChipX | |

|---|---|---|

| Cost (payable every 28 days) | £0 | £5.99 every 28 days or £65.05 annually (works out at £4.99 every 28 days) |

| Autosaves | Optional extra | |

| Saving Goals | ||

| Interest Earnings | ||

| Autosave Fee | £0.45 | N/A |

| Recurring Saving Fee | £0.25 | N/A |

| Choice of Stocks & Shares ISA or General Investment Account | General Investment Account only | |

| Access to Basic Investment Funds | ||

| Access to Additional Investment Funds (e.g emerging markets or ethical funds) | ||

| Investment Platform Fee (collected monthly)* | 0.50% (£1 monthly minimum) | N/A |

| FSCS Eligible Savings Accounts |

Chip Basic

With the Chip basic account, this is what you are given access to:

- The ability to set up auto-saving

- No limit on the number of manual deposits that you make

- The chance to set up savings goals

- Interest when you choose to put funds into a savings account

- Payday put away so that funds are taken each time that you’re paid

- Access to a general investment account

- A choice between cautious, balanced, and adventurous investment funds via BlackRock

- FSCS cover

As you can see, the Chip basic account certainly has a lot to offer, so you may be wondering what the ChipX account has.

ChipX

ChipX offers everything that the basic account covers, but it also includes:

- As well as a general investment account, there is also the chance to use a stocks and shares ISA so that you can benefit from the tax advantages that an ISA brings

- There is access to other investment funds such as emerging markets and ethical funds

When it comes to the interest that can be earned on your savings, it doesn’t matter which account you have.

Personally having downloaded Chip X and used it myself I thought it was worth the upgrade simply because the stocks and shares ISA is key for me when looking at a provider like this.

It is Chip’s partnerships with Allica and Oak North banks that allows for interest payments, and it pays a pretty good rate compared with the rest of the industry.

The interest payments can be accessed with both the Chip basic account and the ChipX account and the following four accounts although rates do vary.

Yes, there are other options and these are the:

Instant Access Account

Competitive interest rates paid monthly into your account. This account aims to beat high street banks by keeping an eye on the Bank of England’s interest rates.

This account also has access to the auto saving tools. One thing to note is withdrawals are stated as ‘almost’ instant which isn’t really instant as the account is called.

Prize Savings Account

If you have ever heard of premium bonds then this account is similar and has monthly winnings.

There is a grand prize of £10,000 and lots of smaller cash prizes each month. Every £10 saved in this account is x1 entry. Chip says you’re x4 more likely to win than premium bonds.

I think this is a good idea and certainly something to explore if you’re into premium bonds already.

90-Notice Savings Account

Easy Access Savings Account

How much does it cost to download Chip?

Chip is free to download from the Apple store and Google Play store.

As discussed above you can either operate with a free plan or opt in for Chip X which is a paid plan.

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

Chip Review - User Experience

Something that Chip is really good at is offering ease of use. Once you’ve downloaded the Chip app, it is beyond easy to get started and be able to save and invest.

As you’d expect, when it comes to opening an account, you’ll first need to provide your personal details and then verify your identity.

The good news is that this verification takes place almost instantly. As soon as this is done, it’s then time to connect your bank account via Open Banking which can take up to 20 minutes (it took us 5).

One thing that is a little frustrating here is that Chip limits you to linking just one bank account.

That means that if you use more than one, Chip is unable to give you a true reflection of your spending habits, and so your savings goal may well be wrong.

How does Chip analyse my spending?

Chip uses a smart AI algorthim that assesses your spending patterns, income and balances.

From this Chip is able to make smart predictions to how much you can save and invest each month.

It does this through open banking software checking your transaction data. By using Chip you opt-in for open banking as part of the service.

Chip Fees - Is It Expensive?

As part of this Chip app review, it’s important to take a look at the costs. These fees will depend upon the account type that you have chosen and whether or not you’re choosing to invest.

Let’s take a look at how it works…

Chip basic

The basic account offered by Chip is free to download and is free to use.

However, if you then decide to access the general investment account offered by BlackRock, fees come into play:

- Annual platform fee – 0.50% and charged monthly

- Minimum monthly platform fee – £1

- Fund management fee – 0.21%

ChipX

The ChipX fee per account is charged £5.99 every 28 days. For this fee, you are given preferential rates and are also given access to a stocks and shares ISA.

The fees that you will be charged as a ChipX account holder investing are:

- Annual platform fee – 0.25% and charged monthly

- No minimum monthly platform fee

- Fund management fee – ranges from 0.175 to 0.97%

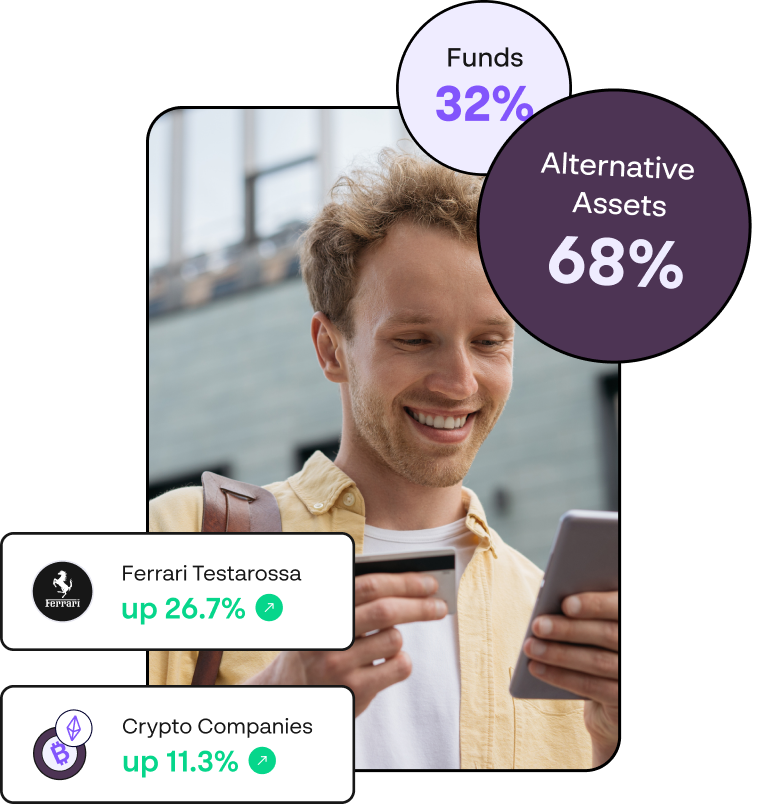

Investing with Chip

Chip is perfect for beginner investors looking to dip their toes into investing. You can start investing for as little as £1 and have access to 9 funds provided by Blackrock.

The basic tier does only provide access to two funds but these are arguable the biggest in the FTSE100 and S&P500 index funds.

With ChipX you get access to the stocks and shares ISA and also the full range of 7 funds which are shown below.

- FTSE 100 index fund

- S&P 500 tech fund

- Clean Energy fund

- Crypto Companies fund

- Emerging Markets fund

- Physical Gold fund

- Healthcare Innovation fund

- Ethical fund

- Global Companies fund

What I mean by this is you can invest in things like art, wine, whiskey and more via the app, even registering your interest for pieces of art you like.

That being said, don’t let that take you away from it’s main goal which is to get beginners investing and I found it super easy to get started.

How much does it cost to invest with Chip?

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

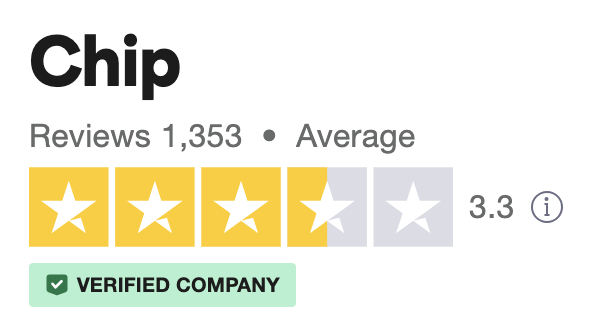

What are customers saying?

One thing that you can always bank on is the ability to find online reviews about any app and the Chip is no different.

Over on Trustpilot, there are over 1,353 reviews that have led to a 3.3 out of 5-star rating.

64% of people who have left reviews have praised Chip and rated it as excellent. They’ve mentioned how easy Chip makes it to save and invest, whereas they have previously struggled with other providers.

Alongside these reviews, 25% of people have referred to the app as being bad. The issue here seems to be around the time that it takes people to withdraw their money and connecting their account.

Chip had some issues a few months ago but a lot of the recent reviews have seen improvements. That being said, this is slightly worrying.

I have yet to experience some of the issues people have been facing myself but can understand frustrations.

Hopefully, this is something that Chip is able to address in the near future.

Alternatives to Chip

The major competitors to Chip are Plum and Snoop.

Chip vs Plum

Chip is very similar in a lot of ways to Plum however the Plum app has a bit more of an extensive back end offering than Chip does.

That being said Chip’s current rate of 4.84% interest rate is market beating and trumps Plums 4.31%.

These rates are changing all the time so please keep an eye on the latest ones!

Is Plum worth it? Well, we’re big fans of both apps but for us Plum just edges it.

Chip vs Snoop

If you compare the two apps though Chip has better rates and also a lot better investment options than Snoop!

Chip vs Moneybox

4.84% Interest Rates On Easy Access Savings Accounts. Automatically build your wealth using smart AI.

FAQs

Is Chip a bank account?

Chip uses open banking technology to connect your current accounts to it’s software so it is not directly a bank.

It doesn’t directly hold money through it’s savings accounts as they are powered by Allica and Oak North banks. This means your money is protected by the FCA up to £85,000.

Will Chip affect my credit rating?

No, there is no hard search on your credit file. When you sign up to Chip there is a soft search performed on your account but this should have no effect whatsoever on your overall score. If you’re worried about this speak to a Chip advisor who can talk you through the process.

Is the Chip app safe?

Yes, the Chip app is safe. The good news is that Chip is regulated by the Financial Conduct Authority (FCA) and is also covered by the Financial Services Compensation Scheme (FSCS).

The app itself has 256-bit security which makes it just as secure as any bank out there.

How to close a Chip account?

To close your Chip account, simply navigate to the Profile tab within your Chip app. From there, scroll down until you find the “Delete Account” option, and click it to connect with our dedicated Customer Success Team. They’ll be happy to assist you with the account closure process and answer any questions you may have.

What banks can Chip connect to?

Their Open Banking system supports a variety of banks including:

- Barclays

- Danske

- First Direct

- Halifax

- HSBC

- Lloyds Bank

- Monzo

- Nationwide

- Natwest

- RBS

- Revolut

- Santander

- Starling

- TSB

- Ulster Bank

- Bank of Scotland

However, the specific banks they’re able to connect to are dependent on several factors, such as Truelayer’s ability to establish a stable and secure connection, and whether the bank itself offers an Open Banking API.

Chip aims to provide a seamless experience across all their supported banks, and they say their team is constantly working to expand our list of partners.

How long does it take to withdraw money from Chip?

Withdrawing money from Chip typically takes 1-2 business days to process however the instant access accounts can be instant.

This can vary depending on a few factors, such as the time of day you initiate the withdrawal and the processing times of your bank.

Chip processes withdrawals every weekday, excluding bank holidays. If you make a withdrawal request before 3 pm on a weekday, it will usually be processed on the same day, and you can expect to receive the funds in your linked bank account within 1-2 business days.

How often does Chip pay interest?

Chip calculates interest daily and will pay it monthly.

Conclusion

We were highly impressed with Chip and all it has to offer.

We would like to see the fees for auto-saving removed or lowered alongside withdrawals sped up for customers.

The app also could be improved by adding more products to develop a full personal finance suite.

Some of these products for us could be developed lending, further funds/stock investments and wider access to financial products like mortgages.

This would, however, mean a lot of investment into Chip, so even though some of these things may well be on the horizon, we’ve yet to hear of any developments.

Overall though a lot to like about Chip and certainly one to consider.

We hope you enjoyed our Chip app review, and be sure to drop us a comment below to let us know about your own experiences with the app.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.

Was about to use their app to open a 3.15% easy access account but was confronted with accepting conditions for free prize draws! What on earth is that all about!

I gave up and sent a message of complaint to them.

and you think it is wonderfull !

Thanks for flagging this, David.

We’ve not encountered that on any other Chip app sign-up but we will speak with them directly to see what this is all about.

Once you get past this issue the app is great. I’m really enjoying using it.

Have been using Chip for a couple of years and have found them great, even better Aer just been raised to 4% #highfive

The interest rate increase to 4% is certainly enticing! Glad to hear you’re enjoying Chip – I think they’re a fantastic option for savers and investors!