Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

I was chatting with one of our readers recently, and one of the questions they asked me was ‘which is better saving or investing?’

It got me thinking about the topic, so I began looking into it because, in my mind, the answer isn’t just a straight choice. This article looks into both the pros and cons of saving and investing, plus the returns each could bring you in ten years.

Why ten years, you might ask? If you’re saving or investing, you’re usually looking to build wealth for something in the not-so-distant future.

When I started the piece, I had some idea about what the results would show, but the findings were genuinely staggering. Read on to find out what I found about saving or investing.

Saving and investing have a common goal: to accumulate wealth. Both have value, but it’s essential to understand the differences and why they are helpful for different situations.

The main difference between saving and investing is the risk you take with your money.

Saving usually offers savings interest, with minimal risk of losing your money, but the returns are much lower. Investing puts your money to work into riskier assets such as stocks, funds or property.

However, the returns can be much higher if you choose your investments wisely.

Table of Contents

Saving or Investing?

Saving and investing are similar when it comes down to the individual’s mindset. The commonality is both are geared toward aspirations of growth and security.

"Do not save what is left after spending, spend what is left after saving"

Warren Buffett

Unless you’re stashing cash under a mattress, saving and investing will offer interest on your deposits. While the interest can differ between the two, you aim for both to grow over time.

Both require a specialised account with a bank or financial product. Savers tend to use high street or digital banks to offer easy access to their money and security.

If you’re wondering what is investing? It is the purchase of assets like stocks or property in the hope that they will rise in value.

Stock market investors must open accounts with brokerage firms such as Fidelity, Vanguard or even digital versions like eToro.

If you’re looking for tips for how to save money then check out our article on exactly that right here.

Saving Pros & Cons

Your money is protected to the value of £85,000 by the FSCS, and the FSCS covers the cash held by the financial institution itself, but not for each bank account held with them.

- If your bank were to fail, the FSCS would try to get your money back within seven days.

- Your funds are liquid depending on your chosen product, meaning you can access them quickly.

- It’s straightforward to save, all that’s required is a portion of your funds, and no education is needed.

- You know what you’re getting. Banks will have set rates applied to your account, meaning your returns do not fluctuate unless the rate is changed.

- There are minimal fees involved meaning you’re not handing over large portions of your money each time you save.

Cons

- The returns on most regular saving accounts are low, meaning you could be earning a lot more by investing your money in things like stocks and property.

Investing Pros & Cons

Pros

You can generate more significant returns than you can from saving or keeping cash. For example, the S&P500, the 500 largest US stocks, has generated an average return of 10% annually, but this number fluctuates each year.

-

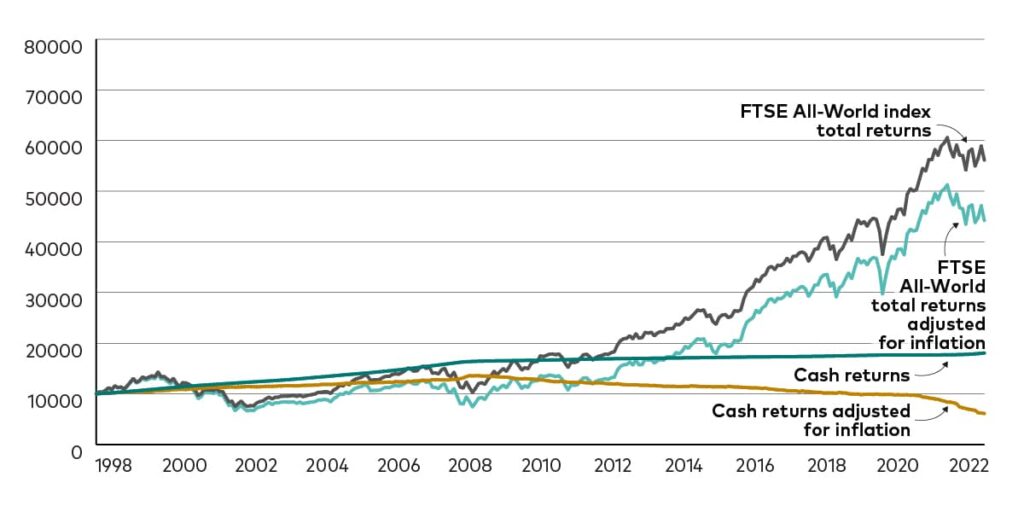

You can save on tax by investing in a You can beat inflation over the longer term. This is key to preserving the value of your money as inflation eats away at its worth of it each year. By investing, you’re hoping to beat this number each year.

-

You can use professional financial advisors to help you pick the suitable investments, understand your risk tolerance and plan for the future

Cons

The returns are not guaranteed, so you could get out less than you put in

-

The stock market fluctuates in price levels daily, and at times your investments may be down and, at others, in profit. Investing is not for the faint-hearted and requires resilience and patience.

-

Brokerage accounts take fees each time you place a trade. These days you’ll find some commission-free platforms, but they often charge for withdrawing money or a subscription fee to use their product.

Which is better saving or investing?

The answer to saving or investing can be pretty complex, but with our strategy they both have value. It depends on a few factors that we’ll explain below, but mainly, it comes down to your financial situation.

When are savings useful?

- Having an emergency fund, usually 3-6 months of pay that you can use in the event of a financial inconvenience such as losing your job, emergency home repairs, medical bills and unexpected travel costs

- Having a sinking fund which you can use for yearly purchases such as your car or house insurance, mobile phone bill or subscriptions. Often you save money by paying more upfront. In some cases, this can be hundreds of pounds.

- If you want a portion of your money quickly and are not willing to risk it long term

- When you’re not great with money and need to create new saving habits

When is investing useful?

You’re looking to create wealth for early retirement, a house deposit or a passive income stream

You want to set up your children for their university funding, first home or car

You’re willing to take more risk by creating greater returns than you find in a low-yielding savings account

As you can see, there are benefits to both, but equally, none are the same. That being said, there is an order to the above, which I believe is essential to follow.

If you don’t have an emergency fund or a sizeable savings account, investing your money is not advisable. I save to protect myself from unexpected financial inconveniences, but not as my source of wealth accumulation. To do that, I invest.

For example, one of our readers had £3,000 in credit card debt and asked me about the best ways to invest his money. My reply was I suggest you clear your debt first and build up a pot of money before you look to invest.

The last thing I would want to happen is that person lost their job, had no savings, and the stock market decided to crash simultaneously. What then?

You wouldn’t want to dip into your investments as they’ll be down, and there’s no backup in place for you. Not ideal.

So to answer “How much savings should I have?” the answer is what you feel most comfortable with, but we recommend having at least a minimum of 3 months’ pay put aside.

Investing my money will always come later, so if my roof blows off tomorrow and I need to empty my emergency fund, I will always replenish it before investing again.

How do the returns differ?

We all want to make more money, and as we’ve discussed, the returns are very different with saving or investing.

There are many factors at play here, but if you’re committed to growing your money, you might be better off putting that money to work. Let’s dig into why?

The saving rate of interest differs in different types of savings accounts:

Fixed Saving Rates Accounts

This type of savings account offers the best rate on the markets, which is product depending and around 2.5 – 2.8% a year.

Fixed saving rates accounts means you cannot withdraw your money for the time it’s fixed. They offer you more interest, but your money is locked in for the period you select.

Notice Saving Accounts

These types of accounts are great for people who want a slightly better rate but are happy to allow a period of 3 or 4 months to get their money out.

People select these types of accounts when they are saving for larger purchases or don’t trust themselves with money. You can expect rates between 1.3-1.6% a year.

Easy Access Savings Accounts

These are your everyday savings accounts with high street or digital banks. You can withdraw right away, but you get even lower interest rates spanning anywhere from 0.5 – 1.5% a year.

You might be thinking those rates aren’t that bad, but unfortunately, when you factor in inflation (currently 6% at the time of writing), your savings are lowering in value each year.

Average yearly inflation has sat at 2.53% over the past 20 years, so you’re still losing money even when things are finally back to normal again! But then again what is normal these days!

That doesn’t mean I discourage using savings accounts mainly for the reasons I mentioned above.

I top up my savings accounts each year to match the inflation rate so the value stays the same, so I do use them but only for specific reasons.

The only way to beat inflation with your own money is by investing. Some choose to buy property, but most invest in the stock market.

Investing over saving

An excellent yearly return from the stock market is 8% or more, and those who achieve these numbers are considered amongst the best.

It’s not easy to consistently generate 8% or more on average, so it’s important to know what you’re getting yourself into.

Learning how investing in stocks work could be highly fruitful for you. Many investors get by learning only the stock market basics but most know how to assess a corporation’s financials as a minimum.

The safest way to invest is via index funds such as the Vanguard Total Stock Market Index (the most prominent 5000 stocks in the US market). Index funds track a range of selected stocks, such as those found on the S&P500 or the FTSE 250.

Investing with Vanguard, a market-leading broker, is a sensible approach, but there are many others like it, such as BlackRock and Fidelity.

These market leaders often require you to have a substantial initial deposit of £1000 or more to access their funds.

However, the rise of digital, commission-free brokers has given retail investors access to markets for as little as £1. Most digital brokers will offer you access to the major funds alongside individual stock picks without the high deposits or fees.

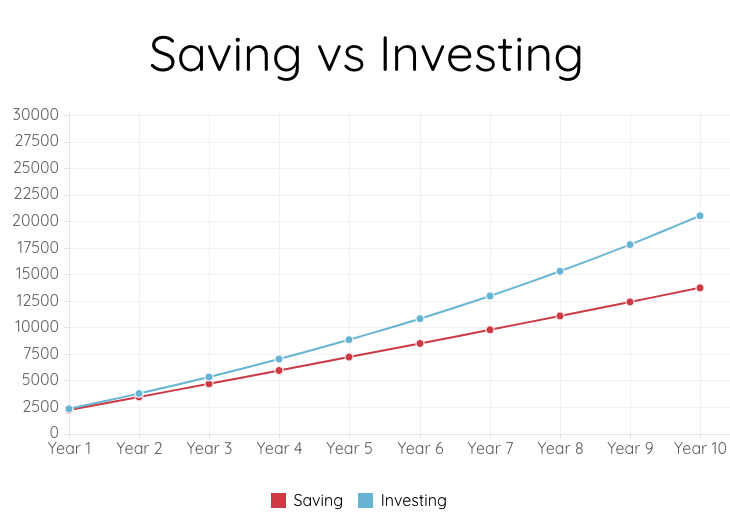

Now let’s look into some visual representations showing you what return you can expect to make when you save or invest over ten years.

We’ll assume you have £1000 to start and plan to save or invest £100 each month for the whole period. We picked 1% for the saving rate and 8% for the investment rate.

The savings rate is slowly creeping up at almost the same pace each year. However, the investment rate is slowly creeping away from the savings rate each year, earning you much more over time.

Why is this happening?

The answer is compound interest, your new best friend. Compound interest works by earning interest from the initial interest you create each year.

As an example, £100 at a 10% interest rate at the end of the year would be worth £110. You earned £10 of interest. In year 2 that £110 earns you £11 from the interest. You made more because of the interest you created in year 1, and this is compound interest.

Over time with a higher amount of interest and continued deposits, you earn a lot more because your interest is compounding at a higher rate. If you want to learn more about the power of compound interest have a go yourself on our calculator here.

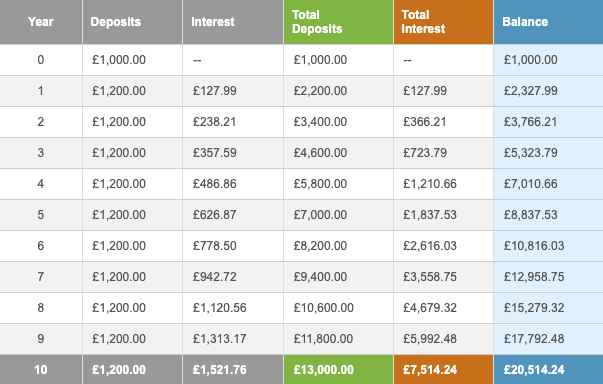

Below we’ve included two tables which show you exactly how much you earn each year from continually investing £100 a month from a £1000 start.

FAQs

Should I save or invest in my 20s?

Invest, without a doubt. Your 20s are the prime time to take calculated risks for higher returns. With the power of compound interest and time on your side, investing can set you on the path to long-term wealth.

Is it really worth it to save money?

Absolutely, yes. Saving money provides you with a financial safety net for life’s unexpected turns and gives you the freedom to make choices that align with your goals.

What is the 50 30 20 rule?

It’s a budgeting lifesaver. Allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and investments. This rule ensures you live well today while preparing for tomorrow.

Should I save or enjoy life?

Save, but don’t forget to live. Striking a balance is key. While it’s crucial to prepare for the future, you shouldn’t sacrifice all of life’s present joys.

Allocate funds for both and enjoy the best of both worlds.

Conclusion

To wrap this up, you can see the different returns saving or investing could generate for you. Investing over ten years has the potential to earn you nearly £7000 more.

I think they both have their benefits in a wealth accumulation strategy, and therefore one is not better than the other, but one certainly can make you a lot more money!

Investing just a small amount can have a huge difference on your lives later down the line so we suggest getting started early to make the most of compound interest. Check out our post on how investing as little as £150 a month could literally change your life.

It all comes down to how much risk you’re willing to take and where you are on your financial journey. Happy hunting!

Resources

Please note this is not financial advice but a factual piece based on averages. It’s important to do your own research and consult a professional if you feel the need to do so.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.