Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

On average it takes 6 weeks to remortgage however it can be done a lot quicker if everything is set in motion.

I’ve also known it to take up to 2 months and in some cases longer if your case is highly complicated.

As someone who has recently been through the remortgaging process myself, I understand how important it is to have a clear understanding of how long it takes.

When I went through this process it took us around 5 weeks in total but our mortgage broker advised us to get everything ready well in advance. I was discussing this with our broker almost 9 months out so was ready for it.

In this article, I will I’ll run through how long does a remortgage take and what you can do to keep the timeline to a bare minimum.

Key Takeaways:

Speed Matters: Speed it up by sticking with your current lender or having all your paperwork ready in advance.

Timing is Crucial: Minimise time on a Standard Variable Rate (SVR) by timing your remortgage well. Early repayment charges can apply if you switch too soon.

Complexity Costs Time: The more complex your remortgage case (like releasing equity or changing ownership), the longer it can take. Choose professionals who can navigate these complexities efficiently.

Table of Contents

Understanding the remortgage timeline

Before delving into the remortgage timeline, it’s essential to grasp what a remortgage is and how it works.

A remortgage involves switching your existing mortgage to a new lender or renegotiating terms with your existing lender. Many individuals choose to remortgage to secure a better deal, access additional funds for an extension, or consolidate debts.

The remortgaging process typically involves several crucial steps, including researching lenders and deals, submitting an application, undergoing affordability checks, valuing the property, and finalising the legal work.

Each of these steps contributes to the overall timeline of a remortgage.

What is the fastest way to remortgage?

The fastest way to remortgage is to remortgage with the same lender. The reason behind this is it’s much easier for your existing lender to switch you over in what’s called a product transfer.

If you’re remortgaging with a new lender then the fastest way is to ensure you have everything ready to go. Prep all your paperwork, credit report, bank statements, proof of address and ID in advance as often this is what holds people up.

How long does a remortgage take with the same lender?

It takes a week in most cases to remortgage with the same lender.

Sometimes this might be slightly higher but most of the time it’s a simple process of having a call with an internal mortgage broker at your current lender and they will take care of it for you.

Why is timing a remortgage important?

Timing a remortgage is important because you want to spend as little time as possible on an SVR (standard variable rate).

If you leave a fixed term early a lot of lenders will have early repayment charges so you need to try and time the switch to minimise the period in between.

Can you switch seamlessly from one mortgage lender to another?

Yes, you can switch seamlessly to a new provider.

For those remortgaging at the end of a fixed rate bear in mind your new mortgage lender will need to pay off your current lender so there you are relying on them to time it right.

The digital age has helped with the paperwork here and the transfer of funds however there are still plenty of bumps along the way that you may face.

Having a constant dialogue with both camps, your solicitors and your mortgage advisor will limit the amount of crossover time in between.

- Sammie's Hot Tip 🌶️

Use checkmyfile.com and their free 30-day trial. This gets you reports from the credit reference agencies including Experian, Equifax and TransUnion.

By doing this in advance you can check for any discrepancies and ensure your information is up to date. This will save money and time!

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Factors That Impact the Duration of a Remortgage

Several factors can affect how long it takes to complete a remortgage. These factors include:

1. Lender’s Processes and Efficiency: Different lenders have varying procedures and turnaround times. Some lenders are known for their efficiency and prompt responses, while others may take longer.

2. Documentation and Mortgage Application Completion: How quickly you gather and submit all the necessary documents when applying for a remortgage can significantly impact the overall timeline. It’s essential to be organised and proactive in providing the required paperwork to prevent delays.

3. Valuation and Property Survey: According to Yopa a valuation and survey processes can take some time, depending on various factors such as the property’s location and size. An accurate valuation is essential for lenders to determine the loan amount and interest rates.

4. Legal Work and Conveyancing: The legal work involved in remortgaging includes transferring the existing mortgage to a new lender, registering any changes with the Land Registry, and ensuring all legal obligations are fulfilled. The speed at which your solicitor handles these tasks can influence the overall timeline.

5. Complexity of the Case: Some remortgages may involve additional complexities, such as changing the ownership structure or dealing with leasehold properties. These situations may require more time and expertise to navigate.

6. Third-party Factors: External factors, such as the responsiveness of your current lender, the workload of solicitors and conveyancers, and unforeseen events (e.g., delays in property searches), can impact remortgage timelines.

Other slight factors that could complicate the process is remortgaging if newly self-employed or you’re on a fixed term contract.

The Average Timeline for a Remortgage

While each remortgage case is unique, the average time it takes to complete a remortgage falls within a certain range.

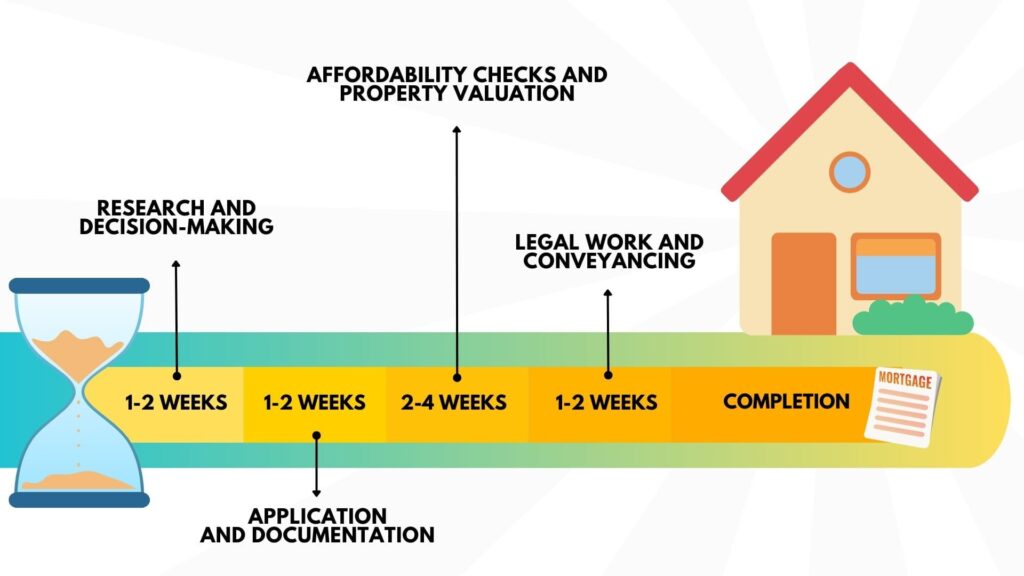

On average, a remortgage can take anywhere between 4 to 8 weeks from the initial application to the final completion.

Here’s a breakdown of the key stages and their approximate durations:

1. Research and Decision-Making: 1-2 weeks

– During this phase, you’ll research different lenders and their deals, compare interest rates, and select the most suitable option for your needs.

2. Application and Documentation: 1-2 weeks

– Once you’ve chosen a lender, you must complete the remortgage application and gather all the required supporting documents, such as bank statements, payslips, and identification.

3. Affordability Checks and Property Valuation: 2-4 weeks

– After submitting your application, the lender will conduct affordability checks to assess your ability to repay the loan. They will also arrange a valuation to determine the property’s worth and submit you a mortgage offer.

4. Legal Work and Conveyancing: 1-2 weeks

– This stage involves appointing a solicitor or conveyancer to handle the legal aspects of the remortgage, including transferring the mortgage to the new mortgage provider and conducting necessary searches and checks.

5. Completion: The final step of the remortgage process involves the legal transfer of the mortgage from the old lender to the new one. This step usually takes around 1-2 weeks.

It’s important to note that the duration of each stage can vary based on the factors mentioned earlier.

Delays at any step can extend the overall timeline, so it’s crucial to stay proactive and keep in touch with all parties involved.

How long does it take to remortgage and release equity?

It will take 4-8 weeks to remortgage and release your equity. There is only really one extra step in the process here.

Essentially your new lender will be paying both your current lender to get out of the term and you for the equity release.

There is some legal and paperwork required for this but your solicitor and mortgage advisor will be able to assist you here.

Another situation could also be remortgaging a help to buy property which adds a slight layer of complexitity as you’re releasing equity to pay back a loans company.

In this case, there’s a few more moving parts and it can take couple more weeks to remortgage.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

FAQs

To provide further clarity on how long does it take to remortgage a property, here are some frequently asked questions:

Is remortgaging as hard as getting a mortgage?

No, it’s not as hard as getting a new mortgage deal however many of the same factors will apply to your application such as credit history, income levels and financial commitments.

If you have been paying your mortgage on time and your situation hasn’t changed this process should be relatively quick and seamless.

How does the complexity of my case affect the remortgage timeline?

The complexity of your case can impact the remortgage timeline. Additional complexities, such as changes in property ownership structure or dealing with leasehold properties, may require more time for the necessary legal work and documentation.

Can the remortgage process be completed faster?

In some cases, it may be possible to expedite the remortgage process. However, it largely depends on various factors, including the efficiency of your chosen lender, the responsiveness of all parties involved, and your ability to complete the necessary documentation promptly.

What can I do to ensure a smooth and timely remortgage?

To ensure a smooth and timely remortgage, it’s essential to stay organised and proactive throughout the process. Here are a few tips:

– Choose a reputable and efficient lender.

– Gather and submit all required documents promptly.

– Stay in regular contact with your lender, solicitor, and any other professionals involved.

– Respond promptly to any requests or queries from the lender or solicitor.

– Keep track of deadlines and ensure monthly payments are made on time.

Can I remortgage while still under my current mortgage deal?

Remortgaging while still under your current mortgage deal is possible. However, you may need to consider any exit fees or penalties associated with ending your current mortgage early. It’s important to assess the potential costs and benefits before proceeding.

Can I apply for a remortgage if I have a low credit score?

Having a low credit score may make it more challenging to secure a remortgage. However, there are specialist lenders who cater to individuals with lower credit scores. It’s important to seek advice from mortgage brokers who can guide you through the process and help you find suitable options

Are there any additional costs associated with remortgaging?

Remortgaging may come with additional costs, such as valuation fees, legal fees, and arrangement fees. It’s crucial to consider these costs and factor them into your decision-making process.

Conclusion - How Long Does A Remortgage Take?

In conclusion, the duration of a remortgage can vary depending on various factors, including lender processes, documentation completion, property valuation, legal work, and any complexities involved.

On average, a remortgage can take between 4 to 8 weeks to complete. By understanding the process, staying proactive, and seeking advice when needed, you can navigate the remortgaging journey more smoothly and efficiently.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.