Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

I know that when you’re looking to buy a new house and take out a mortgage, one of the big questions on your mind is how much do you need to earn to get a mortgage.

In this article, I’ll dive into the factors that mortgage lenders consider when determining your eligibility for a mortgage and how your income plays a crucial role in the decision.

So, let’s explore everything you need to know about how much you need to earn to get a mortgage.

Key Takeaways:

- In the UK, the general rule of thumb is that you may be able to borrow 4-4.5 times your pre-tax yearly income for a mortgage, but individual circumstances such as credit history and deposit size can impact this.

- Lenders assess mortgage affordability through key metrics like Loan-to-Income (LTI) and Debt-to-Income (DTI) ratios, making both your income and existing debts crucial in the eligibility process.

- Even with a bad credit history, specialised lenders may offer mortgage options, although they often come with higher interest rates and stricter income requirements.

Table of Contents

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

How much you need to earn to get a mortgage?

How much you need to earn to get a mortgage is simply calculated in the UK as 4-4.5 times your pre-tax yearly income.

Some lenders will stretch this to x5 and it’s also known to be up to x6 times your pre-tax yearly income but this is rare.

This really depends on your financial situation as if you’re a favourable candidate and have a sizeable deposit your more likely to be viewed as a trustworthy person to lend to.

When it comes to getting a mortgage, your income is one of the most important factors that lenders consider. In simple terms, lenders want to ensure that you have a stable and sufficient income to make the monthly mortgage repayments.

This helps them assess your ability to handle the financial responsibility of homeownership.

How Lenders Calculate Your Mortgage Affordability

To determine how much you need to earn to get a mortgage, lenders evaluate your affordability. This assessment involves comparing your income against your expenses and outstanding debts.

- Sammie’s Hot Tip

In my opinion, don’t underestimate the power of stress testing your own finances before approaching lenders.

Knowing your limits in a worst-case interest rate scenario not only prepares you for the lender’s assessments, but it can also give you peace of mind.

It’s a step too many people skip, and it can make all the difference in your mortgage journey.

Here’s a breakdown of how lenders typically calculate affordability:

Loan-to-Income Ratio (LTI)

The loan-to-income ratio is a cornerstone of mortgage affordability assessments in the UK.

Lenders commonly use this ratio to gauge your eligibility for a mortgage by comparing the size of the loan you’re seeking to your annual income.

Here are some additional points you may want to consider:

- Benchmark Rates: Typically, lenders aim for a loan-to-income ratio of around 4-4.5 times your income. However, these ratios can differ based on the lender’s own policies and market conditions.

- Exceptions: Some lenders may offer greater flexibility, especially if you have a significant deposit or an exemplary credit record. It’s also known for some lenders to go up to 5 or even 6 times your pre-tax yearly income.

- Joint Applications: If you’re applying for a mortgage jointly with another person, lenders will usually look at both incomes to establish a combined LTI. This can increase the mortgage amount you’re eligible for.

- Implications: A higher LTI ratio often signifies a greater risk for the lender, which could translate to higher interest rates on your mortgage.

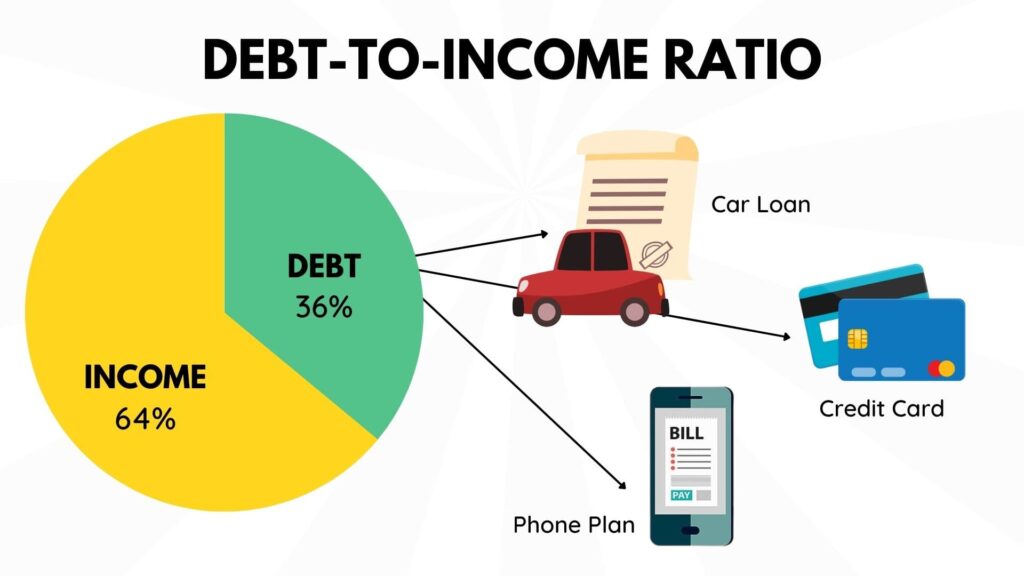

Debt-to-Income Ratio (DTI)

The debt-to-income ratio is another key metric that lenders use to assess your affordability.

This ratio measures the proportion of your monthly income that is already committed to debt repayments, such as credit card payments, car loans, and other personal debts.

Here’s what else you need to know:

- Benchmark Ratios: The general guideline is to keep your DTI ratio at 36% or lower, as this is considered a financially healthy debt load.

- Types of Debts: This includes all kinds of debt, such as credit cards, existing loans, and any other financial commitments. Some lenders may also include ongoing expenses like child support or alimony.

- DTI and Interest Rates: A lower DTI is generally preferable because it could lead to better mortgage terms, including a lower interest rate.

- Financial Health: A high DTI ratio can indicate financial stress and may deter lenders from offering a mortgage, or at least limit the amount they are willing to lend.

Types of Income

When it comes to assessing your income, lenders don’t just look at your basic salary.

Different types of income can be considered, each with varying levels of acceptance by lenders:

- Basic Salary: This is your primary income, and it’s generally viewed as the most stable.

- Bonuses, Overtime, and Commission: These income types may be considered but are often given less weight compared to your basic salary. Lenders might average out these earnings over several years to determine their stability.

- Freelance or Contractual Income: If you’re self-employed, freelance, or on a contract, lenders typically consider the average of your income over the past two to three years. Documentation such as tax returns will be required.

- Investment Income: Things like dividends from shares or rental income from property can also contribute to your affordability. However, the lender may want to see a consistent history of these earnings.

- Other Income: Some lenders also consider government benefits, alimony, or child support as valid forms of income, although these may not be given the same weight as a basic salary.

Stress Testing

Stress testing is a key element of the mortgage application process that ensures you can handle any future increase in interest rates.

The main objective is to ascertain your financial resilience and ensure you won’t default on payments if conditions become less favourable.

During a stress test, lenders assess your ability to make repayments based on higher interest rates than the current market rate.

They typically simulate scenarios where the interest rate increases by 2-3 percentage points, to understand how that would affect your average monthly mortgage payments.

Mortgage salary requirements will vary by person and that’s literally why lenders have to test you.

Here’s what you need to know:

- Importance of Stress Testing: The Bank of England sets guidelines for stress testing, aiming to protect both the borrower and the lender from default risks. Given the economic uncertainties, such as inflation or recessions, stress tests are crucial to gauge the long-term affordability of a loan.

- Potential Impacts: Failing a stress test doesn’t necessarily mean you won’t be granted a mortgage. However, it could limit the amount you’re allowed to borrow or result in less favourable loan terms, such as a higher interest rate.

- Preparation: It’s advisable to conduct your own stress test before applying for a mortgage. By estimating your budget at higher interest rates, you can adjust your desired loan amount to ensure you’re applying for a mortgage you can realistically afford.

- Additional Financial Scrutiny: Some lenders may even consider ‘life changes’ such as potential maternity/paternity leaves, career changes, or planned significant expenditures as part of their stress test to better gauge your long-term affordability.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Factors That Affect Your Mortgage Eligibility

Before we get into the specific income requirements, it’s crucial to understand other elements that lenders consider when determining your eligibility for a mortgage.

Here’s an expanded list of key considerations:

Credit History and Score

- Credit Bureaus: In the UK, lenders often consult credit reference agencies like Experian, Equifax, or TransUnion to gauge your creditworthiness.

- Implications: Not only does a poor credit score make it more difficult to secure a mortgage, but it may also result in higher interest rates if you do get approved.

Deposit

- Loan-to-Value (LTV) Ratio: The size of your deposit impacts the Loan-to-Value ratio, which is the mortgage amount divided by the appraised value of the property. A lower LTV often translates into more favourable terms.

- Help-to-Buy Schemes: It’s important to note that the Help to Buy: Equity Loan closed to new applications on 31 October 2022. If you’ve already secured this equity loan, be aware that you must legally complete the purchase of your home by 31 May 2023 to remain eligible.

- Lifetime ISA: Another option to consider aside from the help to buy ISA is the Lifetime ISA, which can be used either for buying your first home or for retirement savings. The government contributes a 25% bonus on savings up to £4,000 a year, providing a useful boost to your deposit.

Affordability Assessment

- Living Expenses: Beyond debt and income, lenders also account for basic living expenses such as utilities, groceries, and transportation to ensure you can maintain your lifestyle while servicing a mortgage.

- Future Planning: Some lenders may also factor in future life events such as planned career changes, maternity/paternity leaves, or impending retirement.

Interest Rates

- Fixed vs Variable Rates: The type of interest rate you choose can affect your mortgage affordability. Fixed rates provide predictability, while variable rates might offer initial savings but come with the risk of rate increases.

- Bank of England Rate: Keep an eye on the Bank of England’s base rate as it often influences lender interest rates, affecting your monthly repayments and overall affordability.

Employment Stability

- Job Security: Lenders often look at the stability of your employment. Contract workers or those with irregular income might find it more challenging to secure a mortgage compared to those with stable, full-time employment.

- Multiple Income Streams: If you have additional income sources such as freelancing, investments, or bonuses, these could also be considered by some lenders in their affordability assessment.

Income Requirements for Different Types of Mortgages

Different mortgage types come with varying income considerations, but they all aim to assess your ability to make consistent repayments.

Below are some common mortgage types and how your income might be evaluated:

- Fixed-Rate Mortgages: Ideal for those with a stable income. The interest rate remains constant, making budgeting easier.

- Variable-Rate Mortgages: Require you to prove you could afford repayments even if interest rates rise, hence needing a higher or more flexible income.

- Self-Employed Borrowers: If you’re your own boss, you’ll likely need to show tax returns and financial statements as proof of income. The lenders may consider income averages over multiple years.

- First-Time Homebuyers: Lenders can be more flexible with income requirements, especially if you have a strong credit history.

- Buy-to-Let Mortgages: Expect to need a minimum annual income of around £25,000 and proof that rental income will exceed mortgage repayments by at least 125%.

- Guarantor Mortgages: An option if you fall short of income requirements. A guarantor can back you, but they need to have a robust financial standing.

- High Net Worth Individuals: Bespoke mortgage options may be available, often requiring specialised income verification.

Mortgages With Bad Credit

If you have a less-than-stellar credit history, you may think a mortgage is out of reach. However, some lenders specialise in mortgages for applicants with poor credit.

Keep in mind, these generally come with higher interest rates and may require a larger deposit to secure. The income requirements might also be stricter, necessitating a higher income-to-loan ratio to offset the credit risk.

Lenders will typically conduct a thorough affordability assessment, evaluating not only your credit score but also your income stability, existing debts, and overall financial behaviour.

It’s crucial to consult with a mortgage advisor who can guide you through the process if you’re navigating the mortgage landscape with bad credit.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

How Much Do You Need For A Mortgage?

You need to have at least 5% these days but ideally 10% deposit to get a mortgage that’s actually worthwhile.

Once you get beyond 15-20% in equity your rates drop considerably as lenders aren’t taking on as much risk.

So, the more you can get together before you apply for a mortgage the better.

FAQs

How do lenders assess my income for a mortgage?

Lenders typically assess your income by reviewing your payslips, tax returns, bank statements, and other relevant financial documents. They may also consider any additional sources of income you have.

Can I include my partner's income when applying for a mortgage?

Yes, if you’re purchasing a property jointly, lenders usually allow you to combine your income with your partner’s. This can boost your borrowing capacity and increase your chances of mortgage approval.

How much deposit do I need to save?

The deposit requirements vary depending on the lender and the mortgage product. Generally, larger deposits can lead to better loan terms. However, there are options available for those with smaller deposits, such as government-backed schemes and assistance programs.

Can I get a mortgage with bad credit?

It may be more challenging to secure a mortgage with bad credit, but it’s not impossible. Some lenders specialise in offering mortgages to individuals with a less-than-perfect credit history. However, you may face higher interest rates and stricter requirements.

How can I improve my chances of getting a mortgage?

To improve your chances of getting a mortgage, you can focus on improving your credit score, saving for a larger deposit, and reducing your overall debt. Additionally, maintaining a stable employment history and demonstrating a consistent income can also strengthen your mortgage application.

How Much Do You Need To Earn To Get A Mortgage - Conclusion

When it comes to getting a mortgage, your income plays a crucial role. Lenders assess your income to determine your affordability, considering factors such as debt-to-income ratios and stress tests.

By understanding the income requirements, along with other key factors like credit history and deposit size, you can better prepare yourself for the mortgage application process.

Remember to always consult with a mortgage advisor or a financial professional to get personalised advice based on your specific circumstances.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.