Best Trading Platforms UK 2024

Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Looking to trade but need some help finding the right platform? With so many to choose from it can be difficult to know where to start.

I’ve been there myself and that’s why I’ve built the most helpful guide on the best trading platforms available in the UK so you can find the right one.

My job here is to stay up to date on the latest investing tech and trading platforms so I’ve personally used and tested every trading platform below for a minimum of 3 months to ensure a fair and honest review.

I look at everything from fees, user experience, ease of use, trader suitability (beginners or experienced investors), technical analysis, educational tools, research tools and customer service.

Best trading platforms list

- Important Notice

When you trade the value of your shares can go up or down. If you are unsure about your investment decision you should always seek investment advice. Past performance is not a future indicator and always do your own research. Trading CFDs, FX and spread betting is volatile and it’s vital to do your due diligence.

My Top Picks

|

|

|

|

|

|

|

|

A global CFD broker regulated by the FCA. Excellent site and app, easy to use and very fast. Demo account also available.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

Other best online trading platforms UK

- Interactive Investor – Best For Real Shares & Funds

- Hargreaves Lansdown – Best Trust Ratings

- Pepperstone – Best Low-Cost Option

- AJ Bell – Best Online Trading App

- XTB – Best Forex Broker

- Trading 212 – Best ISA Available

I have also tested all of the best trading platforms on Windows and Mac computers plus on mobile across IOS and Android versions too.

For beginner traders, I encourage you to head down to our beginner academy section to understand everything there is to know about trading before getting started.

Now we’re going to unpack the UKs best trading platforms in more detail. Strap in!

Best UK Trading Platform Comparison Table

| App Name | Dealing Fees | ISAs | GIA or Share Dealing | Minimum Deposit | Demo Account |

|---|---|---|---|---|---|

| Plus 500 | 0% | No | Yes | £100 | Yes |

| IG | £3-£8 | Yes | Yes | £250 | Yes |

| eToro | 0% (Real stocks and ETFs) | Yes | Yes | $10 | Yes |

| Hargreaves Lansdown | Up to £11.95 (£5.95 FT) | Yes | Yes | £0 | No |

| Pepperstone | Variable | No | Yes | £0 | Yes |

| AJ Bell | £9.95 (£4.95 FT) | Yes | Yes | £0 | No |

| Interactive Investor | £5.99 | Yes | Yes | £0 | No |

| XTB | 0% up to £85k | No | Yes | £0 | Yes |

| Trading 212 | 0% or 0.15% FX Fees | Yes | Yes | £10 | Yes |

(FT) stands for frequent trader.

Please note platforms may have other fees which are outlined in the full descriptions below and equally fees are subject to change without notice. We update and check these prices regularly but please do check directly with the provider.

Plus 500 - Best For CFD Trading

A global CFD broker regulated by the FCA. Excellent site and app, easy to use and very fast. Demo account also available.

- Easy to use platform

- Quick account opening

- Great customer support

- Fantastic range of investments

- Lack of research

What I like about Plus500

Plus500 has truly set itself apart in the CFD trading realm, and there are several reasons why I and 24 millions others consider it the best trading platform for trading CFDs.

First and foremost, their unique tool, Insights, is nothing short of revolutionary. It’s not just another analytical tool – it goes beyond by providing an analysis of millions of trades in real-time.

While other platforms might allow copy trading, which is essentially mirroring one trader’s moves, Insights offers a panoramic view of the trading landscape, helping users gauge high-yielding trades and sense the pulse of trader sentiment. This invaluable perspective is something I haven’t found anywhere else.

I’ve always found a reliable ally in their live chat customer service. Immediate, informed, and genuinely helpful, it’s a refreshing experience in an industry where swift assistance can be crucial.

On the flip side, while the absence of a MetaTrader platform and sparse educational resources may be a sore point for some, beginners will certainly appreciate the platform’s intuitive design.

Yes, it has its limitations, especially for the hyper-active trader, but I think for those venturing into the world of CFDs, Plus500 provides a solid, user-friendly foundation.

Fees: Zero commission and tight spreads, $10 inactivity fee

Instruments: Stock CFDs, Index CFDs, ETF CFDs, Forex, Options, Cryptocurrency CFDs and Commodities.

Account Type: General Investment Account (GIA)

- Disclaimer:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro - Best For Beginners

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

What I like about eToro

Having been an eToro user for 6 six years, both as a desktop and mobile user, I was immediately struck by its sleek, modern interface.

For a beginner, this platform demystifies the trading realm with its user-friendly design. A standout feature? Their impressive array of assets ensures that even as a novice, you’re not limited in choice.

But it’s not merely about variety; eToro’s innovative Copy Trading system is a game-changer. It allows users to leverage the strategies of top-performing traders, a hands-on learning experience in real time.

While I’d appreciate an enhanced educational segment, they do offer extensive courses some are by my good friend Sam North, Head of Training at eToro who we interviewed on The Money Gains Podcast recently.

eToro’s specialised portfolios, like AI Revolution and BigTech, caught my eye – they offer thematic insights that resonate with contemporary market trends.

Also, the eToro Money app, a nifty solution for UK users, neatly sidesteps hefty foreign exchange costs. Although there are some fees, they’re transparent, with no hidden surprises.

Given my personal experience and its multifaceted offerings, it’s no wonder eToro stands tall as our highest-rated app on our best investment app page.

You can also read our full UK eToro review here.

Fees: 0% on real stocks and ETFs – withdrawal fees $5 per withdrawal + high forex fees

Instruments: Stocks, Stock CFDs, Index CFDs, ETF CFDs, Investment Trusts, Forex, and Commodities.

Account Type: GIA, ISAs (through 3rd party provider)

- Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

IG - Best For Experienced Traders

Trade over 17,000 markets with spread bets, CFDs and invest in stocks and ETFs.

Won Best Trading Platform 2022 and has an excellent trading platform.

- Award winning trading platform

- First class app and desktop versions

- Great educational and research tools

- Fast account opening

- High CFD fees

What I like about IG

Having used IG extensively, I can vouch for its unparalleled efficiency explicitly tailored for seasoned traders. The blend of cost-effectiveness, especially for frequent traders, and the platform’s ease stands out.

But it’s not just about costs; IG’s 24-hour support and bustling community make trading a shared, enriching experience. While it caters to experienced traders, I was pleasantly surprised by the IG Academy, offering novices a brilliant head-start.

The 2022 title of ‘best broker in the U.K.’ didn’t surprise me at all.

IG seamlessly combines diverse market offerings, powerful research tools, and intuitive app design. There are areas to polish, like the fees on stock CFDs, but for a comprehensive trading experience, IG is hard to beat.

Fees: Share trading: 0-9 deals/month £3 to £8

Instruments: Stocks, ETFs, Stock CFDs, Index CFDs, ETF CFDs, Forex, and Commodities.

Account Type: Share dealing account, ISAs and SIPPs (self-invested personal pension)

- Disclaimer:

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Interactive Investor - Best For Real Shares and Funds

One of the UK largest investment platforms Interactive Investor has over 400,000 users in the UK.

It also has over 40,000 global instruments to invest in and has ISAs available.

- Rated 4.7/5 on Trustpilot

- User friendly platform

- Incredible customer service

- Wide range of investment options

- Monthly account fee

What I like about Interactive investor

I’ve been genuinely impressed with Interactive Investor’s user-friendly interface across all platforms, from web to mobile and tablet.

I particularly appreciate how effortlessly I can set alerts for price movements and navigate the platform’s search functions.

I found their fixed pricing structure especially beneficial for larger investments, eliminating the hefty fees that often come with percentage-based platforms. Plus, the inclusion of both ISAs and SIPPs means Capital Gains Tax worries are a thing of the past.

What truly sets Interactive Investor apart for me is the sheer breadth of investment options. With access to over 40,000 funds, shares, ETFs, and trusts from 17 global exchanges, I never feel restricted in my choices.

While I believe there’s room for improvement in their charting tools, the overall trading experience, especially the monthly free trade and expansive international market access, positions Interactive Investor as a top contender for those with substantial portfolios.

Fees: £5.99 per trade

Extra Fees: Annual Platform Fee | £120 – £240

Instruments: Stocks, Bonds, Funds, ETFs, and Investment Trusts.

Account Type: ISAs, SIPPs, and share dealing accounts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

Hargreaves Lansdown - Best Trust Ratings

One of the most popular investing platforms in the UK. With a range of ISAs, SIPPs and share dealing accounts.

They have over 15,000 instruments available but I think it's more suited to larger investors for individual trading and for fund investing for lower income investors.

If you have a small amount to trade with you might be better suited with another lower commission provider.

- Award winning investment and trading provider

- First class educational and research tools

- FTSE100 company and highly trusted in the UK

- Fantastic customer service

- Over 5000 5 star reviews on Trustpilot

- High individual trading fees

- Only in GBP currency

What I like about Hargreaves Lansdown

My personal experience with Hargreaves Lansdown, especially their app, has largely been coloured by its reputation as the UK’s most trusted trading platform—and rightly so.

As a FTSE 100 giant, their commitment to financial security and nurturing long-term client relationships is palpable. Their expansive offering, granting access to over 15,000 instruments, sets them apart.

I’ve had the privilege of manoeuvring through an extensive menu of funds, UK and overseas shares, ETFs, and more.

Their detailed insights on fund compositions and performance data have been invaluable. I’ve trusted them enough to have our SIPP there, which speaks volumes.

Their ready-made portfolios also offer an element of simplicity and assurance for those not wanting to delve into the nuances of individual stock picking.

However, no platform is without its caveats. While their extensive offering and research tools make them a beacon for beginners and intermediate traders, the trading fees—especially on individual stocks—nudged me to relocate my Stocks and Shares ISA.

Seasoned traders looking to engage in high-frequency trading might find the fees burdensome unless you are trading with high amounts (1000s per trade).

But for those prioritising research depth, security, and an array of investment choices, Hargreaves Lansdown holds its ground as one of the best trading platforms in the UK, reflecting its deserved spot in the FTSE 100.

Fees: Up to £11.95 dealing fee or a frequent trader fee of £5.95

Instruments: Stocks, Bonds, Funds, ETFs, and Investment Trusts.

Account Type: ISAs, SIPPs, Junior ISAs, Share Dealing Account, Active Savings, Lifetime ISA

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

Pepperstone - Best Low-Cost Option

I really like Pepperstone for a no thrills low-cost trading platform.

Mainly centred around trading CFDs they have very low spreads, no commission on their standard account option and also no minimum deposit.

- Quick and easy to open an account

- Fast withdrawal process

- Low fees

- Lack of research

- Mainly just CFDs

What I like about Pepperstone

In my experience with Pepperstone, it’s clear they excel as a low-cost CFD and forex broker.

Navigating their platform, I’ve been impressed by the combination of swift execution speeds and competitively low spreads across a vast array of over 1,200 trading instruments.

The availability of platforms like MetaTrader 4 and TradingView gives me flexibility, while their educational resources cater to traders at every level.

Pepperstone’s remarkable customer service, evident by their 4.7 rating on Trustpilot, complements the technical benefits they offer.

While I had a hiccup with the 30-day demo limit, the overall trading experience and their community-driven approach make Pepperstone my top choice for a low-cost option.

Fees: Variable fees and commissions

Instruments: Stock CFDs, Index CFDs, ETF CFDs, Forex, and Commodities.

Account Type: General investment account

- Disclaimer:

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.8% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

AJ Bell - Best Online Trading App

An award-winning investment platform with over 15,000 instruments to choose from.

The mobile app is awesome to use but they could do with some more technical tools for the more experienced traders.

What I like about AJ Bell

Having used AJ Bell’s app for a few months, I can confidently state it’s one of the most intuitive online trading platforms I’ve encountered.

The sheer breadth of investment options is staggering, ranging from shares to ETFs. What truly stands out is their investment ideas feature, catering to both novice and seasoned investors.

These curated, ready-made baskets, backed by specialist insights, simplify the investment process, particularly for those looking to grow their assets or achieve a balanced income-growth approach.

AJ Bell’s streamlined interface combined with its award-winning reputation (including ‘Best Platform 2021’) makes it a compelling choice for those who prefer a hands-off investing style.

However, it’s not just the tools and accolades that impress me. The app’s design is not only sleek but user-friendly, making trading feel effortless. Their customer service is remarkably responsive, always at the ready to assist, further enhancing the user experience.

While I appreciate the cost benefits of conducting over 10 trades a month, I must admit their fee structure can be a bit challenging for frequent traders. Nonetheless, for those new to investing or those with a moderate portfolio size, AJ Bell provides an unmatched app-centric trading experience.

Fees: Cost per trade £9.95, Frequent trader £4.95

Instruments: Stocks, Bonds, Funds, ETFs, Investment Trusts, and Warrants.

Account Type: ISAs, Shares Dealing Accounts, Junior ISAs,SIPPs and Junior SIPPs

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

XTB - Best Forex Broker

Leading European FX & CFDs brokerage with over 2,200 instruments to trade with.

Real stocks and ETFs also available making it a solid selection for investors as well as traders.

- Commission free stocks and ETFs (under 100k)

- Excellent and fast platform

- Fantastic technical tools

- Great academy and demo account

- Limited real stocks and ETFs

What I like about XTB

From the moment I began using XTB, I was genuinely impressed. Their platform immediately struck me as more user-friendly than others I’ve tried, which is essential for my daily forex trading activities.

I love how I can tailor my trading experience with XTB; whether I’m diving deep into their vast selection of over 5,600 instruments or simply fine-tuning my strategies. Their in-house xStation software, which I’ve accessed on both my desktop and mobile, feels like it was designed with traders like me in mind.

I’ve frequently made use of their intuitive charting tools and the built-in trading calculator, which allows me to gauge potential profits or losses at a glance.

But what really sets XTB apart for me are their remarkably low forex spreads. I’ve dabbled with several platforms over the years, but none have offered me the kind of value in forex trading that I’ve found here.

On top of that, the comprehensive educational materials they offer have been a personal boon. I can’t tell you how many times I’ve delved into their resources to sharpen my skills further.

Their 24-hour support has also come to my rescue more than once, making me feel confident in every trade. For someone like me, who truly values both cost-effectiveness and a supportive trading environment, XTB is simply unparalleled.

Fees: Zero commission trading up to £85,000 monthly turnover

Instruments: Stocks, ETFs, Stock CFDs, Index CFDs, ETF CFDs, Forex, and Commodities.

Account Type: Share Dealing Account

- Disclaimer:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading 212 - Best ISA Available

Trading 212 presents a fusion of affordability, versatility, and user-friendliness that's hard to beat. With over 2 million users that accommodates everyone from beginners to experienced traders with an easy to use app.

This platform has earned its reputation for being a beginner-friendly hub for dipping toes into the trading world, while also catering to seasoned traders seeking more advanced options like CFDs.

It's also one of the most affordable platforms out there. Trading 212 is all about commission-free trades, coupled with some of the lowest fees when buying foreign stocks, thanks to their minimal currency conversion fee.

- 4.6 Trustpilot score (Ranked Excellent)

- Easy to use app

- Commission-free Real Stocks and ETFs trading

- AutoInvest & Pies feature

- Limited product portfolio (No bonds or mutual funds)

What I like about Trading 212

From the moment I first logged into Trading 212, I felt a connection to its interface that I hadn’t experienced with other platforms.

Every time I executed a trade without being hit by commissions, I couldn’t help but think back to days where I’d begrudgingly pay anywhere from £3 to £11.95 per deal with other brokers.

Using Trading 212 was like a breath of fresh air. Their impressive selection of over 12,000 shares made me feel like a kid in a candy store, and the almost non-existent trading fees were the sweet deal I’d been searching for. Of course, no platform is perfect.

I did notice a few areas they could improve upon, like adding copy trading or delving into cryptocurrencies. But these were mere specks in an ocean of positives for me.

What solidified my fondness for Trading 212 wasn’t just its features but also the human touch behind the screen. The few times I reached out to their customer service, I felt genuinely heard and valued. They also provide access to CFD trading accounts.

For anyone on the fence about trying a newer platform, I can personally vouch for the enriching experience Trading 212 provides.

Fees: Commission Free – 0.15% FX fee

Instruments: Stocks, ETFs, CFDs, Investment Trusts

Account Type: Share Dealing Account, ISAs and CFD trading accounts

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

How To Choose The Best Trading Platform UK

When I tested each app I created 8 pillars which helped me rank and score each app fairly.

Each trader and investor are different in terms of their levels, available capital and requirements meaning that they will find different value in each of the 8 pillars below.

The first step when picking a trading platform is understanding yourself. What is it you are looking for that will be most beneficial to you and what kind of securities are you looking to trade?

Fees & Charges

The key fees you need to look out for when looking for the best trading platforms are:

Cost Per Trade – This is the fee you pay for buying and selling shares on the stock market. You’ll find some platforms offer zero commission trading but be sure to look out for other fees as often they will make them up elsewhere.

Platform Fee – Some trading platforms in the uk will charge you a yearly or monthly fee for using their service.

Frequent Trader Fee – This is reduced fee from the cost per trade for trading more frequently. Each trading platform will decide what that threshold looks like but most of the time its a significant reduction.

Management or Custody Fee – This is when experts or experienced traders from the platform manage your money for you. This isn’t on all platforms but is a trading fee on some!

Withdrawal Fee – Most platforms do not charge a withdrawal fees but some do to cover things like zero trading fees or added features.

User Experience

Your trading platform should feel intuitive. Fast access to charts, research, and tools is paramount, and a visually engaging interface can significantly enhance your trading journey.

Trader Suitability

Understand the platform’s target audience. While some cater to novices, others are tailored for seasoned traders. Your choice should match your proficiency level.

Technical Tools

These are vital for those who base their trades on technical analysis. Ensure your platform offers advanced charting, indicators, and other relevant tools.

Educational Tools

Especially crucial for beginners, these tools should offer comprehensive insights into trading basics, strategies, and market updates.

Research Tools

A good platform provides access to research reports, market news, and analysis, helping traders make informed decisions.

Customer Service

Efficient and responsive customer support can be a lifesaver, especially during volatile market conditions or technical glitches.

Safety & Security

Prioritise platforms with robust security protocols, including encryption and two-factor authentication. Also, check for regulatory adherence, like FCA or FSCS certification.

What is the best trading platform for beginners in the UK?

The best trading platform for beginners is definitely eToro, followed closely by Trading 212 and Interactive investor.

eToro offers commission free trading on real stocks and ETFs as well as access to copy trading and social investing. It has a wide range of tools useful for beginners such as charting tools, research, the eToro academy, a free demo account and access to fractional trading so you can invest lower amounts if you require.

Interactive Investor is the second biggest trading platform in the UK. It’s app is easy to navigate and has a large amount of securities to choose from making it beneficial to beginners who want choice.

Trading 212 is a fantastic app which offers ISAs and also automatic investing through their pie feature. The app is brilliant and very easy to use which is a key trait for beginners when opening a trading account.

What is the best free trading platform in the UK

The best free trading platform is also eToro but is closely followed by Freetrade and InvestEngine.

Traditional brokers in the UK can be quite expensive and if you’re planning on trading frequently then these fees can rack up.

It’s important to note that while these platforms advertise as commission free trading platforms there are fees to factor in such as spreads and platform fees and/or withdrawal fees.

What trading platforms offer a free demo account?

From the list of trading platforms above the ones who offer a free demo account are eToro, IG, XTB, and Pepperstone.

A demo account allows you to have all of the benefits and features of a trading account but you are not trading real money. This is useful for those looking to shop around for the best uk trading platforms before choosing which one they like and for testing out your strategies or trading styles.

What’s the difference between a trading platform and an online broker?

At first glance, the terms “trading platform” and “online broker” might seem interchangeable, but they refer to distinct elements of the trading process.

Here’s a simple breakdown:

Trading Platform

Definition: A software application or interface that allows traders to place trades on different assets such as stocks, bonds, commodities, or currencies. It offers tools to analyse, monitor, and manage one’s portfolio in real-time.

Features: Typically includes real-time price feeds, charting tools, news feeds, and technical analysis functions.

Examples: MetaTrader 4 and Tradingview are popular examples globally, but there are many platforms tailored for specific markets or user preferences.

Online Broker

Definition: A firm or company that facilitates the buying and selling of financial instruments. They act as the middleman between the trader/investor and the market, executing trades on behalf of their clients.

Features: Apart from facilitating trades, brokers might offer research, education, account management, customer service, and more. They’ll typically charge fees or commissions for their services.

Examples: In the UK, some familiar online brokers include Hargreaves Lansdown, IG Group, and Interactive Investor.

In Essence: Think of a trading platform as the tool or software you use to view and analyse markets, and execute trades. The online broker, on the other hand, is the service provider that connects you to these markets and facilitates the actual transactions.

It’s worth noting that many online brokers offer their own proprietary trading platforms, but they can also provide access to third-party platforms.

When choosing the “best trading platform UK,” consider the combination of both platform functionality and broker services that best suits your needs.

Beginners Academy

What is Stock Trading?

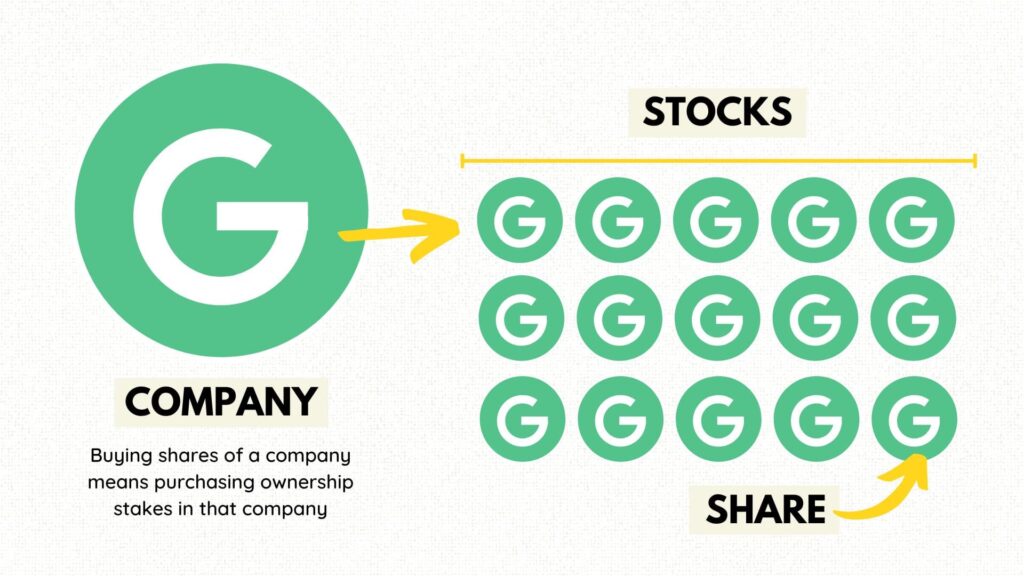

Stock trading refers to the buying and selling of shares (or ‘stocks’) of a company on a stock exchange. The aim is typically to buy at a low price and sell at a higher price, capitalising on market fluctuations to make a profit.

Alternatively, investors might purchase stocks to hold long-term, benefiting from both the potential appreciation of the stock’s value and dividends paid by the company.

How Does The Stock Market Work?

The stock market is a marketplace where buyers and sellers come together to trade shares of publicly-listed companies.

Here’s a simplified overview:

Companies Go Public: Companies decide to ‘go public’ to raise capital. They do this by conducting an Initial Public Offering (IPO), where they sell a portion of their shares to the public for the first time.

Exchange Listing: Once public, a company’s shares are listed on a stock exchange, such as the London Stock Exchange (LSE) in the UK.

Buyers and Sellers: Traders and investors buy and sell these shares on the exchange. Their decisions can be influenced by a range of factors including company performance, economic data, global events, and market speculation.

Price Determination: The price of a stock at any given moment is determined by supply (selling) and demand (buying). If more people want to buy a stock than sell it, the price moves up. Conversely, if more people want to sell a stock than buy it, the price moves down.

Brokers Facilitate Trades: Individual traders and investors usually access the stock market through brokers. Brokers execute trades on behalf of their clients and, in return, earn a commission for their services.

Settlement: Once a trade is executed, there’s a settlement process where the actual shares are exchanged for money. In the UK, the standard settlement period is two working days after the trade is placed but for online trading it’s almost instant in most cases.

The stock market plays a crucial role in the health of the economy. It gives companies access to capital in exchange for giving investors a slice of ownership in the company. Over time, the stock market tends to rise in value, although prices can fluctuate dramatically in the short term.

Different Types of Stocks

Common Stock:

Description: This is what people generally refer to when they talk about ‘stocks’. When you buy common stock, you’re buying ownership in the company.

Features: Common stockholders have the right to vote on certain company decisions and may receive dividends. However, in the event of bankruptcy, they are the last to receive any remaining assets, after creditors and preferred stockholders.

Preferred Stock:

Description: Preferred stock is a type of stock that has properties of both an equity (like common stock) and a debt instrument (like a bond).

Features: Preferred stockholders usually receive dividends before common stockholders and have a higher claim on assets if the company goes bankrupt. However, they typically don’t have voting rights in the company.

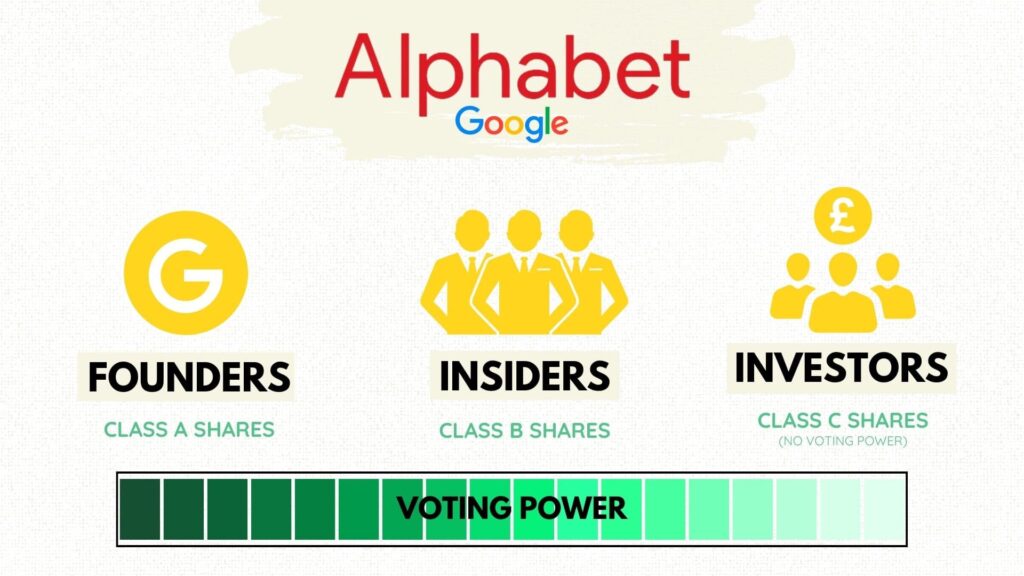

Dual-Class Stock:

Description: Some companies issue different classes of stock, often designated as Class A, Class B, etc. This is known as a dual-class (or multi-class) stock system.

Features: Each class may have different voting rights and dividend payouts. For example, a founder might hold Class A shares with 10 votes per share, while selling Class B shares to the public with 1 vote per share. This structure allows certain groups (like company founders) to retain control over the company even if they own a smaller percentage of the total shares.

Other Types:

Growth Stocks:

Description: These stocks belong to companies that are expected to grow at an above-average rate compared to other companies in the market.

Features: They generally do not pay dividends, as the companies typically reinvest their earnings to fuel further growth. Investors buy these stocks with the hope that their prices will rise.

Dividend (or Income) Stocks:

Description: These stocks belong to companies that return value to shareholders by regularly paying dividends.

Features: Often found in more stable and established companies, they provide income to investors along with potential for capital appreciation.

Value Stocks:

Description: These are stocks that appear to be trading for less than their intrinsic or book value.

Features: Investors believe that the market undervalues these companies, and they buy these stocks hoping for a price increase.

In essence, when looking at stocks, it’s vital to understand the type of stock and the rights or benefits it confers. This helps in aligning investment choices with one’s financial goals and risk tolerance.

Stock Market Indices

A stock market index is a measurement of a portion of the stock market.

It’s computed from the prices of selected stocks and is designed to represent the behaviour and performance of the market or a specific segment of the market. In essence, indices give an overall snapshot of the market’s health and direction.

Here are explanations for five of the most popular stock market indices globally:

1. Dow Jones Industrial Average (DJIA)

Origin: United States

Description: Often referred to as “the Dow,” this index consists of 30 significant publicly owned companies based in the United States. Established in 1896, it’s one of the oldest stock indices.

Characteristics: The DJIA is price-weighted, meaning stocks with higher prices have more influence on the index’s movement.

2. S&P 500

Origin: United States

Description: The Standard & Poor’s 500 is an index consisting of 500 of the largest publicly traded companies in the U.S. by market capitalization.

Characteristics: Often used as a proxy for the overall U.S. stock market, it covers a significant portion of the market and is widely regarded as the best indicator of large-cap stocks’ performance.

3. NASDAQ Composite

Origin: United States

Description: This index includes all the companies listed on the NASDAQ stock exchange, which tend to be technology-oriented firms.

Characteristics: Notable for its large proportion of tech companies, including giants like Apple, Amazon, and Microsoft.

4. FTSE 100

Origin: United Kingdom

Description: Often referred to as “the Footsie”, the Financial Times Stock Exchange 100 Index comprises the 100 largest publicly traded companies (by market cap) listed on the London Stock Exchange.

Characteristics: It represents about 80% of the London Stock Exchange’s market capitalisation, making it a good indicator of the health of the UK stock market.

5. Nikkei 225

Origin: Japan

Description: Represents the 225 top-rated companies listed on the Tokyo Stock Exchange.

Characteristics: Often used as a proxy for the performance of Japanese stocks. Like the DJIA, it’s a price-weighted inde

These indices are frequently cited in news and financial reports as they give a quick overview of market trends and performances. Each index, depending on its construction, gives a perspective on a particular segment or a broader view of the market.

Investors and analysts often use them as benchmarks against which individual stock performances or portfolio performances can be measured.

How To Pick Stocks?

Set Clear Goals:

Determine why you’re investing. Understand if it’s for long-term growth, short-term gains, or regular income, as this will guide your subsequent steps.

Stay Educated:

Equip yourself with basic knowledge about the stock market and investing. Familiarise yourself with essential terms and concepts. The financial world is vast and constantly evolving.

Understanding Macroeconomic Cycles:

Get a grasp on the broader economy. Recognise where we might be in terms of economic cycles to understand which sectors could be primed for growth or contraction.

The best places to find charts for technical analysis are Tradingview, SeekingAlpha, Nasdaq and the London Stock Exchange.

The best places to find data for fundamental analysis are The Financial Times, Bloomberg, Morningstar, The Motley Fool and Benzinga.

The best investing newsletters are Stocktwits, eToro’s daily newsletter and SeekingAlpha

The best Twitter accounts for economics and investing are Marketwatch, Paul Krugman, Barry Ritholtz

Shut Out the Noise:

With a basic foundation in place, be selective about the information you take in. Focus on credible sources and facts, filtering out unnecessary noise and opinions.

Diving into Company Financials:

Research potential companies to invest in. Examine their balance sheet, income statement, and cash flow statement to gauge their financial health.

Identifying Potential Opportunities:

Use your research to spot promising sectors or companies. Consider factors like innovations, regulatory changes, and market dynamics.

Reading Charts:

Complement your fundamental analysis with technical analysis. Study stock price charts to identify trends and potential buy or sell points.

Key Terminology For Chart Reading

As you delve deeper into chart reading, familiarise yourself with specific terms and tools used in technical analysis:

- Moving Averages: Averages of past prices, indicating trend direction.

- Stochastic Oscillators: Indicators that compare a stock’s closing price to its price range over a specific period.

- Moving Average Convergence Divergence (MACD): Highlights changes in the strength, direction, momentum, and duration of a stock’s price trend.

- Standard Deviation: Measures price volatility. The greater the standard deviation, the higher the price volatility.

- Bollinger Bands: A volatility indicator that uses standard deviation to define high and low price range levels.

- Relative Strength Index (RSI): Measures the speed and change of price movements, often used to identify overbought or oversold conditions.

- Fibonacci Retracement: A tool used to identify potential support and resistance levels based on a set of ratios derived from the Fibonacci sequence.

Predicting Future Patterns:

Using your knowledge, try to anticipate where the stock or sector might be headed. Remember, it’s about probability, not certainty.

Diversification:

Once you’ve identified stocks to buy, diversify your investments. Spread your funds across various stocks or sectors to mitigate risk.

Avoid Emotions:

Stay disciplined. It’s easy to get swayed by short-term market movements. Stick to your strategy and avoid making decisions purely based on fear or greed.

Consult Experts:

If unsure, consider seeking advice from financial advisors or experienced investors. They can provide valuable insights or validate your choices.

Review and Adjust:

Investing isn’t a set-and-forget activity. Periodically evaluate your portfolio’s performance, and adjust based on changes in the companies, the market, or your personal goals.

By following this structured approach, you’ll be in a better position to make informed decisions and navigate the complexities of stock market investing.

Different Ways to Trade

Day Trading:

Description: Buying and selling securities within a single trading day. The goal is to capitalise on short-term price movements.

Characteristics: Requires quick decisions, and traders often use technical analysis to guide their choices. It’s essential to stay updated on intra-day market news.

Swing Trading:

Description: Positions are held for several days to several weeks to capitalise on expected upward or downward market swings.

Characteristics: Based on technical analysis, but also considers broader market trends. It doesn’t require constant monitoring like day trading.

Position Trading:

Description: Based on long-term price movements, traders hold positions for weeks, months, or even years.

Characteristics: Typically uses fundamental analysis of a company’s value, growth potential, and market conditions.

Scalping:

Description: A form of ultra-short-term day trading, where traders aim to profit from tiny price movements by quickly entering and exiting trades.

Characteristics: Requires a keen eye for minute market movements and often involves high volumes of trade.

Momentum Trading:

Description: Traders look for stocks moving significantly in one direction on high volume and try to jump on board to ride the momentum train.

Characteristics: Often involves news-driven events. A momentum trader might buy on news releases and ride a trend until it exhibits signs of reversal.

Algorithmic or Automated Trading:

Description: Uses advanced mathematical models and computer programs to make high-speed trading decisions.

Characteristics: Can process vast amounts of data quickly and execute trades at lightning speeds. Useful for systematic trading without emotional interference.

Forex Trading (Foreign Exchange Trading):

Description: The buying and selling of currencies to capitalise on fluctuations in their value. It’s the largest financial market in the world but also extremely difficult to trade forex.

Characteristics: Forex operates 24 hours a day, five days a week, and involves pairs of currencies (e.g., EUR/USD). Factors like geopolitical events, interest rates, and macroeconomic data can influence currency values. It’s known for its liquidity and offers various trading opportunities, but it’s essential to understand the risks involved.

Value Investing:

Description: Buying undervalued stocks and holding them for a long time, expecting them to rise to their true value.

Characteristics: Requires deep fundamental analysis to determine undervalued assets. Popularised by Warren Buffett.

Growth Investing:

Description: Focuses on companies expected to grow at an above-average rate compared to other companies in the market.

Characteristics: Less concerned about the stock’s current price and more about its potential future growth.

Ways to trade stocks in the UK

Direct Investment:

Description: This is the most straightforward method where investors directly purchase shares of a company through a stock exchange.

Characteristics: By owning shares, you become a shareholder and have rights associated with the stock, like voting at annual meetings and receiving dividends (if offered).

Margin Trading:

Description: Buying stocks using borrowed money from a broker. This method allows you to buy more shares than you’d be able to with your available cash.

Characteristics: Offers the potential for higher returns due to the leveraged nature of the investment. However, it also comes with increased risk. If the investment doesn’t go as planned, you’ll owe the borrowed money plus interest to the broker.

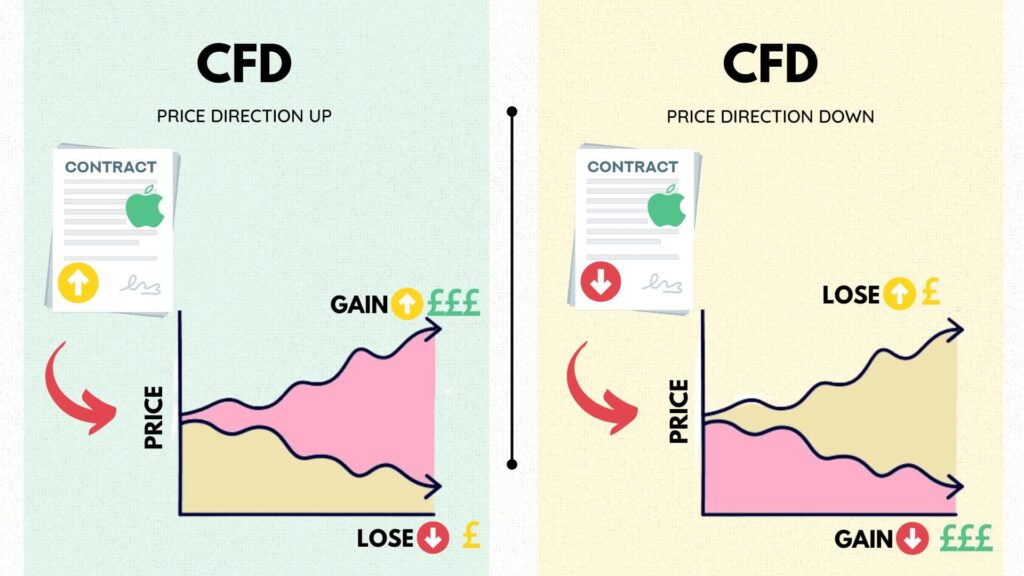

Contracts for Difference (CFDs):

Description: A financial contract that pays the differences in the settlement price between the open and closing trades. Rather than owning the actual stock, you’re speculating on its price movement.

Characteristics: CFDs can be used to bet on price movements in either direction, allowing potential profit from rising and falling markets. They are also typically leveraged products, magnifying both potential gains and losses.

Spread Betting:

Description: A form of derivatives trading where you bet on the direction of a particular market’s price movement.

Characteristics: Like CFDs, you don’t own the underlying asset. Profits are tax-free in the UK, but losses cannot be used to offset tax liabilities.

Foreign Exchange (Forex):

Description: Trading currencies, where you’re betting on the movement of one currency relative to another.

Characteristics: Forex trading involves pairs (like GBP/USD). Factors such as interest rates, geopolitical events, and macroeconomic data can influence currency pairs. It’s a highly liquid market, operating 24 hours on weekdays.

Options and Futures:

Description: Financial contracts that derive their value from an underlying asset, like a stock.

Characteristics: Options give you the right, but not the obligation, to buy or sell at a certain price before a specific date. Futures are similar but come with the obligation to buy or sell.

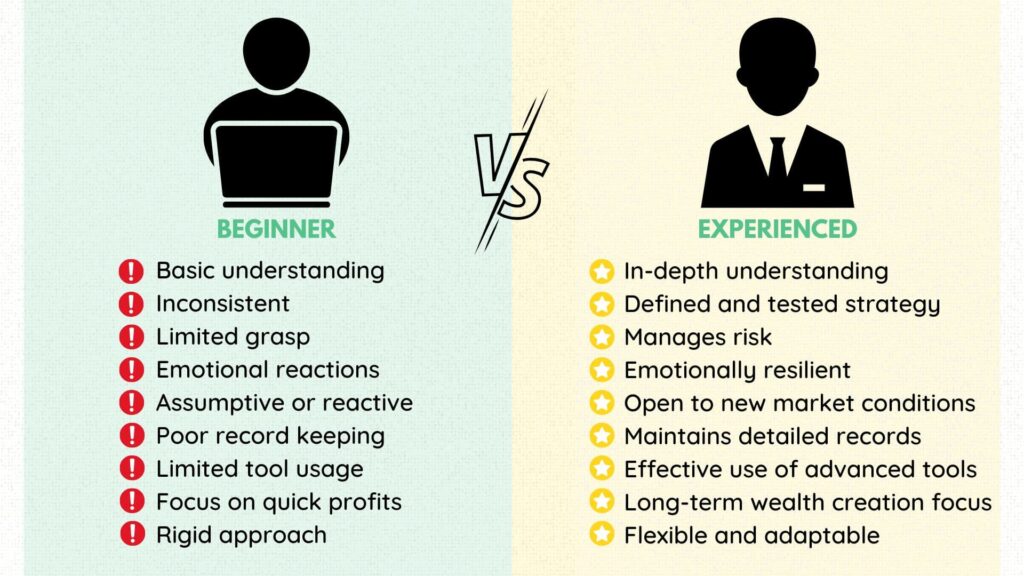

The difference between a beginner and experienced traders

The journey from a beginner to an experienced trader involves a steep learning curve, encompassing knowledge acquisition, skill development, and emotional growth.

Here are some of the key differences between a beginner and an experienced trader:

Knowledge Base:

Beginner: Typically has a basic or rudimentary understanding of markets, instruments, and trading strategies. Relies heavily on external advice.

Experienced: Possesses a deep and broad understanding of various markets, financial instruments, and both fundamental and technical analysis.

Trading Strategy:

Beginner: Often lacks a consistent strategy and may jump from one method to another. May be prone to chasing market trends or “hot tips.”

Experienced: Has a well-defined and tested trading strategy that they stick to. They understand the importance of consistency and discipline.

Risk Management:

Beginner: Might not fully comprehend the importance of risk management. May stake too much capital on a single trade or fail to use stop losses effectively.

Experienced: Understands and respects the importance of risk management. Uses tools like stop losses, take profit orders, and position sizing to manage risk meticulously.

Emotional Control:

Beginner: More likely to be influenced by emotions such as fear and greed. Might panic-sell during a market downturn or become overconfident after a few wins.

Experienced: Has learnt to control emotions and remains calm under pressure. Recognises the dangers of emotional trading and makes decisions based on logic and strategy.

Learning Attitude:

Beginner: Might assume they know enough after a few initial successes or might get disheartened easily after losses.

Experienced: Understands that the financial markets are constantly evolving. Continuously seeks to learn and adapt to new market conditions.

Record Keeping:

Beginner: May not maintain detailed records of trades, making it difficult to review and learn from past actions.

Experienced: Keeps meticulous records of all trades, analyses outcomes, and learns from both successes and failures.

Tools and Resources:

Beginner: Might rely on a limited set of tools or might get overwhelmed by trying too many tools without fully understanding them.

Experienced: Knows which tools and resources work best for their strategy. Uses advanced platforms, charts, and indicators effectively.

Market Perspective:

Beginner: Often sees the market as a place to make quick profits.

Experienced: Views the market as a platform for systematic wealth creation and understands the importance of patience and long-term perspective.

Adaptability:

Beginner: Might be rigid in their approach, struggling to adapt to changing market conditions.

Experienced: Flexible and ready to adjust strategies based on market feedback. Recognises the importance of adaptability in trading success.

While these are some general distinctions, it’s essential to note that every trader’s journey is unique.

Experience comes not just from the passage of time but from active learning, self-reflection, and a commitment to continuous improvement.

Tax On UK Stock Trading

When diving into the UK stock market, it’s essential to be informed about the various taxes related to stocks and shares:

Stamp Duty Reserve Tax (SDRT) on Share Purchases:

For electronically bought UK shares, you’ll be charged 0.5% SDRT.

For shares bought with a stock transfer form exceeding £1,000, Stamp Duty is applicable.

Irish registered stocks come with a 1% Stamp Duty.

However, AIM stocks and Exchange-Traded Funds (ETFs) are exempt from Stamp Duty.

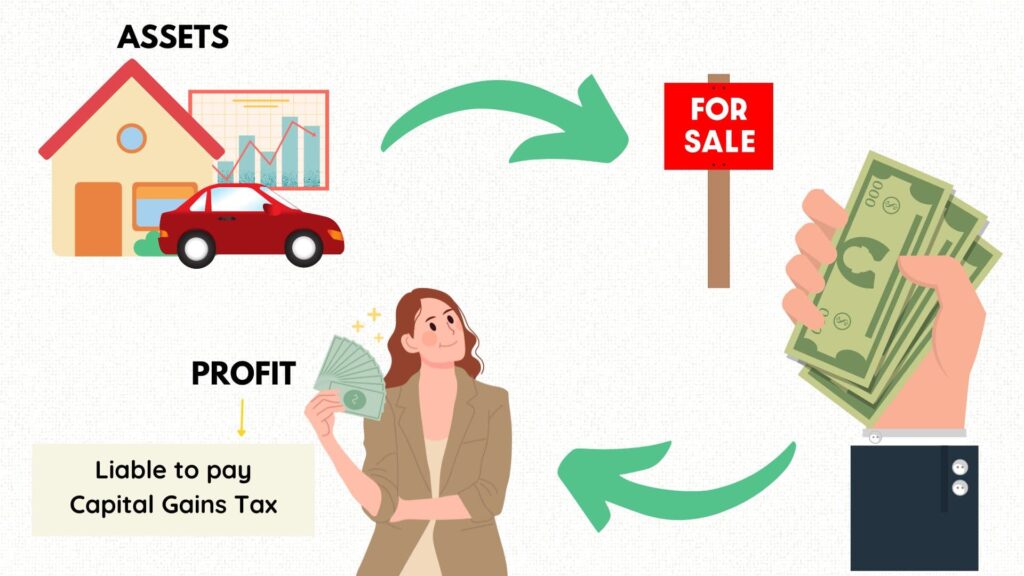

Capital Gains Tax (CGT) on Share Sales:

Profits made from selling shares or other investments, regardless of the country or currency they’re associated with, may attract CGT.

CGT is applicable on:

Shares outside of an ISA or PEP.

Units in a unit trust.

Certain bonds (excluding premium bonds and qualifying corporate bonds).

Your annual tax-free CGT allowance is £6,000 (£3,000 for trusts). If you haven’t exhausted this on other assets like cryptocurrency gains, you won’t be taxed on the initial £6,000 profit from share sales.

You can also enjoy £1,000 in dividend payments tax-free.

Remember, potential reliefs or deductible losses might reduce your tax bill. Leveraged products might offer another route to tax savings, but ensure you consult a tax adviser.

Income Tax on Stock Profits:

Profits from stock trading fall under income tax. The amount you owe is influenced by your total personal allowance, encompassing interest, wages, pensions, etc.

The annual tax-free limit is £12,500. Beyond this, the CGT rate depends on your tax bracket: 10% for basic rate taxpayers and 20% for higher/additional rate taxpayers.

Stocks and Shares ISA Exception:

Investments within a stocks and shares ISA are exempted from tax, provided they adhere to ISA limits. Still stuck on what type of account to choose from check our our post on GIAs vs ISAs.

Further Stamp Duty:

Purchasing stocks and shares via a stock transfer form, including online paperless transactions, attracts 0.5% duty for purchases over £1,000. This is rounded up to the nearest £5.

- Hot Tip:

Always stay updated with GOV.UK or consult a tax adviser, as tax rules can frequently change. Moreover, consider tax implications as a part of your overall investment strategy, not as an afterthought. Efficient tax planning can significantly boost your net returns. Remember, it’s not just about how much you earn, but also how much you get to keep after taxes!

Best Online Broker For ISAs

FAQs

What does a diversified portfolio mean?

A diversified portfolio refers to the strategic allocation of investments across various asset classes, sectors, or regions to reduce risk.

By spreading funds across different types of investments, such as stocks, bonds, real estate, and commodities, investors aim to mitigate potential losses from any single asset’s underperformance.

In essence, it’s the financial embodiment of the adage, “Don’t put all your eggs in one basket,” ensuring that market downturns in one area don’t devastate one’s entire investment.

Which platform is best for day trading in UK?

The best online trading platform for day trading is eToro or Plus500.

Both provide access to thousands or instruments and offer advanced trading tools suitable for trading the global markets.

What is a brokerage account?

A brokerage account is a financial account set up with a brokerage firm that allows you to buy, sell, and hold various investment assets, such as stocks, bonds, mutual funds, and ETFs.

Think of it as a gateway to the financial markets, where you deposit funds to make investments, potentially grow your wealth, and access your assets when needed. It’s the essential tool for anyone aiming to actively engage with the world of investing.

What is an ETF?

An ETF, or Exchange-Traded Fund, is a type of investment fund that’s traded on stock exchanges, much like individual stocks. It typically tracks an index, commodity, or a collection of assets, allowing investors to diversify their holdings with a single purchase.

What is a stockbroker?

A stockbroker is a professional or firm that acts as an intermediary between buyers and sellers of stocks, facilitating trades on behalf of clients and often providing advice, research, and other financial services.

What is a stop-loss order?

A stop-loss order is a trading directive that instructs a broker to sell a security once it reaches a specific price, helping investors limit potential losses in volatile market conditions.

What are retail investor accounts?

Retail investor accounts refer to financial accounts owned by individual, non-professional investors. These accounts are contrasted with institutional accounts, which are managed for large entities like mutual funds, pension funds, or corporations.

How much starting capital do you need to start investing?

Starting capital for investing varies based on goals, risk tolerance, and the chosen platform, but thanks to modern online brokers and micro-investing apps, one can begin with as little as £1 to £100, making investing accessible to nearly everyone.

Why do traders lose money?

Traders often lose money due to a combination of factors: lack of research, inadequate risk management, emotional decision-making, market volatility, and sometimes, sheer bad luck. Proper strategy, discipline, and continuous learning are key to navigating these challenges.

Which is the best online broker in the UK?

- eToro – 0% commission on real stocks

- XTB – 0% commission on real stocks

- Plus500 – Low cost, best for CFD trading

- Lightyear – Multi-currency and low cost

- Hargreaves Lansdown – Most trusted, thousands of instruments avialable

- IG – Award winning trading platform

Who has the cheapest online trading platform?

eToro, Trading 212 and Freetrade are all commission-free trading on real stocks and ETFs. This provides investors with smaller amounts the ability to access the stock market and use high-quality trading tools for low costs.

Personally I think the best online trading platform is eToro for it’s ability to cater for both beginners and more advanced traders alike.

Check out our eToro vs Trading 212 Review and our eToro vs FreeTrade Review

Does my stock trading platform have FSCS protection?

If your stock trading platform is based in the UK and is regulated by the Financial Conduct Authority (FCA), then it should typically be covered by the Financial Services Compensation Scheme (FSCS).

The FSCS provides compensation to customers if a regulated firm is unable to pay claims against it, usually when the firm stops operating or declares bankruptcy.

For investments, the FSCS covers up to £85,000 per person, per firm. It’s worth noting, however, that this doesn’t cover losses due to market movements or bad investment decisions, but rather issues like the firm’s insolvency.

To be sure of the coverage, you should:

Check if your trading platform is FCA regulated. This can be verified on the FCA’s online register.

Visit the platform’s terms and conditions or FAQ section where they usually mention FSCS protection.

Contact their customer support or your financial adviser for clarity.

Always ensure you’re familiar with the protections in place and the limits of such protections when choosing a platform for trading or investing.