Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

When investing in the stock market, you set aside some of your monthly earnings and put them to work.

Investing 150 a month, pounds or dollars is where we’ll start and show you the value it can create.

There are many strategies for investing in the stock market, and I know that individuals have their preferences, but those who don’t have fortunes to commit, then slow and steady, can be just as powerful.

Key Takeaways

Investing will help you outpace inflation and earn more over time

Slow and steady wins the race. Time and patience are required.

Compound interest is your best friend

Invest small amounts even if that’s all you have

Table of Contents

Investing £150 a month...

You might already have some money saved up and wonder what to do. You might be looking to make some extra cash for a rainy day, a new car or a house deposit.

You might be looking to increase your retirement pot to aid your elder years or put money away for your children.

Whatever you’re looking to do can be achieved by investing in stocks and real estate. You’ve come to the right place if you’re looking for top tips for investing in the stock market.

The great thing these days is that you can begin investing for as little as £1.

When you buy a stock, you’re investing in a small part of a business. If you pick well, it will go up in time and earn you money. If you choose poorly, however, you could lose money, so that’s why it’s essential to research and buy great businesses that grow each year.

Investing has the potential to vastly outgrow the money you’re putting away into a savings account. Your savings over time are becoming less valuable as the yearly inflation rates rise higher than the interest you earn from the bank.

This year, it is more evident than ever, with inflation as high as 8.5% in the UK and even higher in the USA. It’s something we all need to put wary of because the value of your pound is diminishing by the day.

That being said, there’s a way to combat this, and that’s investing in the stock market. You can outpace inflation in the long run and earn a pretty penny doing it.

Investing isn’t without risk, however, but nobody achieves extraordinary results without risk-taking.

“In the long run, investing is not about the markets at all. Investing is about enjoying the returns earned by great businesses” — John C. Bogle

I started this website to help others learn how to invest in the stock market, and with blog posts like these, we hope to give you the belief that you can achieve your financial goals.

The goal is to retire early and be time free. The name for this goal or so-called movement is FIRE (financial independence retire early).

The stock market might seem like a daunting place, but with the changes in technology in recent years, online stockbrokers have sprung up from everywhere, making it easier than ever to get yourself started.

Nowadays, anyone with a smartphone can start investing in just a few clicks. You’ve probably heard about your friends dabbling in the latest crypto coin, and whilst we applaud those who have done well out of it, we prefer to take a much safer route with our own money.

There’s now a wealth of support and knowledge online, with many fantastic websites and apps available.

How does investing a small amount change your life?

Any amount invested will eventually change your life somehow, and it’s just about how aggressive you want to be.

Experts say you should invest up to 50% of your earnings each month, but I think somewhere around the 30% mark is an excellent place to start.

I call this the ‘Live a Little’ strategy where you put 40% into bills, 30% towards living a little and 30% into savings and investments. It’s not easy for most to do this on day one, but if you work towards these amounts you’ll reach your goals much faster.

I don’t want you to stretch yourself and be left holding the bucket, so to be 100% honest, you should only put away what you can afford, but you should always be putting something away, and that sweet spot is investing 150 a month. Let’s show you why!

Utilising Index Funds and ETFs

An excellent place to start investing is somewhere relatively safe and low volatility, like an index fund or ETF.

Once you’ve built up some confidence and knowledge, expand into individual stock picking. Still, you want to get some market exposure initially as it’s about time in the market, not timing the market.

An index fund is a portfolio of stocks already made for you and is constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500).

The S&P 500 holds the 500 largest companies in the US, including household names like Apple, Microsoft, Tesla and Amazon, alongside other not-so-sell-known companies.

An index fund will provide you broad market exposure and lower operating expenses meaning your risk is lower than individual stock picks.

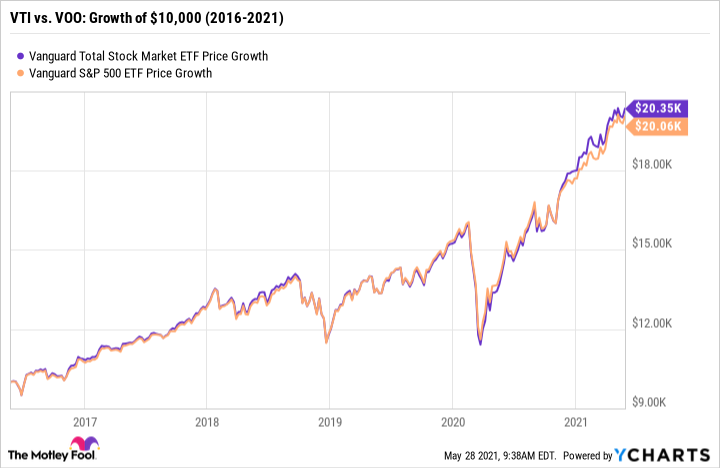

My favourite and largest holding are the Vanguard Total Stock Market Index Fund with the above in mind. The VTI, as it’s known on the stock market, is a combination of 5,000 stocks across the US, meaning when you invest in the fund, you own a tiny percentage of each company.

The beauty of this fund is that it tracks the 5,000 most extensive stocks, so if a company drops out due to underperformance in stock price, it’s replaced by another performing better.

Investing with a broker like Vanguard is also very safe as they’re one of the most well-respected fund creators and brokers in the industry.

Over time, you’re not as exposed to the ups and downs of individual stocks, which helps lower your overall risk and should provide stable returns over time. This is called diversification.

We’re here for a long time, not a short time, so we’ll be looking at least ten years or more into the future. The VTI, since its inception, has gained an average of 11-12% a year, so we’ll base our calculations slightly lower at 10% just for safety.

Now for the juicy bits investing 150 a month.

10 years investing 150 a month solely in the VTI could generate you £35,000

15 years investing 150 a month solely in the VTI could generate you £84,000

20 years investing 150 a month solely in the VTI could generate you £172,000

25 years investing 150 a month solely in the VTI could generate you £330,000

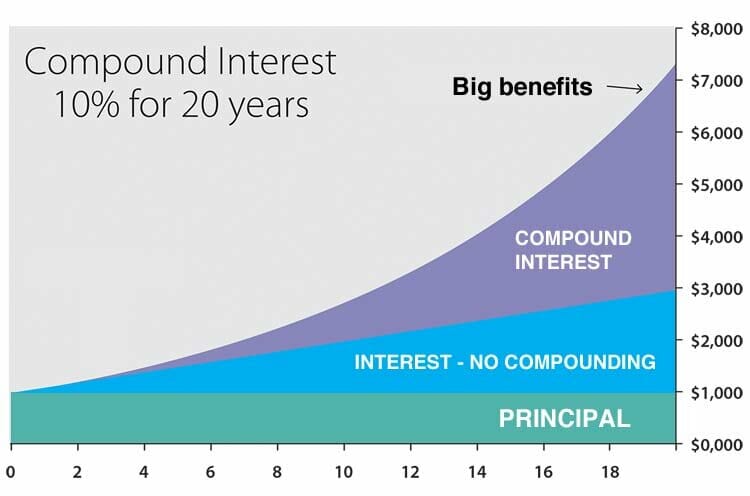

Crazy right?! But you’re probably asking how it increases so much the longer you’re invested?

Compound interest, that’s how!

Something to note is investing in your 40s is VERY different to investing in your 20s or 30s so thinking about your time horizon and adjust expectations accordingly.

Why doesn't everyone know about this?

After 25 years, you’re creating £33,000 just off the interest per year, which is an excellent yearly salary for most. You see how it’s possible to build up wealth now, and if you’re just slightly more aggressive, that number goes right up.

You can have a play on our free compound interest calculator if you want to see how it works with different amounts.

So why doesn’t everyone know about this? Simple really, the rich stay rich whilst the poor remain poor.

Unfortunately, our school system doesn’t have the stock market as part of the standard curriculum. The media portray investing as a high superpower, where bankers in big suits shout at each other across 50-storey high trading floors.

That’s certainly not the case anymore, it might have been in the ’80s and ’90s, but it’s not like the Wolf of Wall Street in 2022!

The rise of investing apps such as Plum, FreeTrade and Hargreaves Lansdown, to name a few, mean you can finally take control of your investments without the need for a personal stockbroker. They’re also great places to invest small amounts of money.

The rise of retail investors (small investors like you and I) has been tremendous over the past few years due to online trading. The pandemic propelled retail investing even further as people needed something to do with their spare time and furlough cash.

The retail investor is here to stay as many have dipped their toes in the market and done quite well. These days the retail investor has buying power, as seen with the recent GameStop phenomenon.

These apps do not come without their risks as they are so easy to make a trade quickly, so do not get sucked into trading 24-7 as it rarely works out very well.

We highly suggest doing some research and testing out a few platforms will help before choosing one to use for the long term.

Many of the apps mentioned above have virtual accounts which you can use to practice buying and selling stocks before parting with your hard-earned cash.

My preference is Plum which I use to put my monthly deposit in, and Hargreaves Lansdown for my private pension, which I top up separately. Every app has a different user experience, and each one is a personal preference.

Use robo-advisors

For those who don’t have the patience or even can’t be bothered to learn how to invest, you can use robo-advisors.

Robo advisors are apps or websites that Fund Managers or real-life individuals don’t operate, and high powered robots run them!

These accounts allow you to put small amounts away each month and invest them directly. They work by asking you a series of questions to establish your risk tolerance.

Once completed, they will automatically craft you a ready-made portfolio based on your answers.

These types have become hugely popular as they allow you to crack on with your daily tasks and still invest in the stock market. Some of the top websites in the UK include Nutmeg, Wealthify and MoneyFarm.

Whilst these websites are great, you need to consider the fees that can range between 0.4-0.7% of your total investment per annum.

I don’t think that’s very much in the grand scheme of things if you want to become an investor and not worry about anything else!

Now £150 is just a benchmark that I feel is a number many of us can achieve every month, but it’s not advice. If you can’t commit that and only have a spare £50, that’s better than nothing!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.