Best Stock Trading App For Beginners

Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Right now, the best stock trading app for beginners are eToro, Trading 212 and WeBull.

They offer low-cost trading, plenty of useful tools, a wide range of investment options and excellent mobile apps.

Trading platforms have exploded in the last few years with the rise of mobile investing.

Technology has allowed anyone to become an investor from practically anywhere in the world with an internet connection.

Given the sheer range of options available to investors, it can be quite overwhelming for beginners to find one that’s suitable for them.

The last thing you need when starting out is a complex trading platform.

For me when I was starting out, I wanted something which removed the jargon and made it simple to start investing.

I’ve personally tested each app below and provided scores based on their suitability for beginners.

Each app is given a score based on six key categories to help rank it.

Up the Gains – 6 Pillar System

- Investing Fees

- User experience and mobile app

- Overall suitability for beginners

- Customer reviews and ratings

- Investing options

- Useful features

Now this isn’t always enough and that’s why I spend over 3 months using an app every day before it makes it onto this list.

Trading platforms have exploded in the last few years with the rise of mobile investing.

Technology has allowed anyone to become an investor from practically anywhere in the world with an internet connection.

Given the sheer range of options available to investors, it can be quite overwhelming for beginners to find one that’s suitable for them.

Best stock trading apps

The last thing you need when starting out is a complex trading platform.

For me when I was starting out, I wanted something which removed the jargon and made it simple to start investing.

I’ve personally tested each app below and provided scores based on their suitability for beginners.

Each app is given a score based on six key categories to help rank it.

Up the Gains – 6 Pillar System

- Investing Fees

- User experience and mobile app

- Overall suitability for beginners

- Customer reviews and ratings

- Investing options

- Useful features

Now this isn’t always enough and that’s why I spend over 3 months using an app every day before it makes it onto this list.

All of the apps reviewed below are regulated by the FCA (Financial Conduct Authority) and are licensed in the UK.

ISA, Pension and Tax rules also apply. Capital at risk when you invest.

Best Stock Trading App For Beginners - Quick List

- eToro* – Best Overall

- Trading 212* – Best Investment ISA

- WeBull – Best For Free Shares

- IG* – Best Traditional Stock Trading App

- LightYear* – Best Mobile App

- Hargreaves Lansdown* – Best Trust Ratings

App Ratings

| App Name | Investing Fees | User experience and mobile app | Overall suitability for beginners | Customer reviews and ratings | Investing options | Useful features |

|---|---|---|---|---|---|---|

| eToro* | 5 | 5 | 5 | 4 | 5 | 5 |

| Trading 212* | 5 | 5 | 4.5 | 4 | 4.5 | 4.5 |

| WeBull* | 4.5 | 5 | 5 | 4 | 3 | 4 |

| IG* | 3 | 5 | 5 | 4.5 | 5 | 4.5 |

| Lightyear* | 3.5 | 5 | 4.5 | 4 | 3.5 | 4 |

| Hargreaves Lansdown* | 2 | 3.5 | 4 | 5 | 5 | 5 |

Apps Features and Fees

| App Name | Minimum Deposit | US Stock Fee | Demo Account | Time To Open Account | Inactivity Fee |

|---|---|---|---|---|---|

| eToro* | $50 | $0.0 | 1 day | Yes | |

| Trading 212* | $1 | $0.0 | 1 day | No | |

| WeBull | $0 | $0.0 | 1 day | No | |

| IG* | $0 | $0.02 per share with $15 min | 1-3 days | Yes | |

| Lightyear* | $0 | $1.0 | 1 day | No | |

| Hargreaves Lansdown* | $0 | Based on previous month's activity.* | 1 day | No |

Please note apps may have other fees which are outlined in the full descriptions below and equally fees are subject to change without notice.

We update and check these prices regularly but please do check directly with the provider.

Best Stock Trading App For Beginners - Full List

I’m now going to unpack each of the stock trading apps in more detail to give you some wider context and help you make a decision.

eToro - Best Overall For Beginner Investors

Key Features

- Multi-asset platform stocks, funds, crypto and more

- Low trading fees and social investing

- Min 1st deposit – £45 (£10 thereafter)

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

Why eToro is good for beginners?

eToro is the best app I tested. It ticks a lot of boxes.

The app has over 30 million users worldwide and is widely regarded as a great place for beginners to start. It’s highly visual, has a demo account to help you practice stock trading and the academy is extensive plus free to use.

It provides access to 1000s of stocks listed on the London Stock Exchange and New York Stock Exchange.

The technical tools available on the desktop version are excellent for more seasoned investors too but almost have two modes – beginner-focused charts and then the ability to go deeper with more technical investing if that’s your thing.

The trading tools also recently had an upgrade with an integration with Trading View. Good move in my opinion.

- Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Trading 212 - Best Investment ISA

Key Features

- ISAs and GIAs available (Free share when you sign up)

- 0% commission on stocks

- Min Deposit: £1

Trading 212 presents a fusion of affordability, versatility, and user-friendliness that's hard to beat. With over 2 million users that accommodates everyone from beginners to experienced traders with an easy to use app.

This platform has earned its reputation for being a beginner-friendly hub for dipping toes into the trading world, while also catering to seasoned traders seeking more advanced options like CFDs.

It's also one of the most affordable platforms out there. Trading 212 is all about commission-free trades, coupled with some of the lowest fees when buying foreign stocks, thanks to their minimal currency conversion fee.

- 4.6 Trustpilot score (Ranked Excellent)

- Easy to use app

- Commission-free Real Stocks and ETFs trading

- AutoInvest & Pies feature

- Limited product portfolio (No bonds or mutual funds)

Why Trading 212 is good for beginners?

Trading 212 is actually where I hold my own Stocks and Shares ISA.

The reason it’s not top for me is because its most similar app eToro offers copy trading but it doesn’t offer an ISA like Trading 212 does. Who wants to pay capital gains tax?

In my opinion, Trading 212 is the best stock trading app for those who want low-cost trading and access to individual stocks, funds and ETFs inside of an ISA.

There simply isn’t a better option out there for me right now.

The mobile app is 1st class It’s so easy to understand for beginners and you get a free share worth up to £100 when you sign up!

This is backed up by incredible reviews on Trustpilot with a 4.6 out of 5 giving it a rating of ‘Excellent’.

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

WeBull - Best For Free Shares

Key Features

- Wide range of US stocks

- Low commission

- Min Deposit: £1

Why WeBull is good for beginners?

WeBull landed in the UK in October 2022 and has been attracting a lot of rave reviews.

During testing, I was hesitant at first but found the social aspect of the app very appealing. The ability to create posts kind of like a Facebook feed was really cool and there’s a poll feature too which allows you to rank a stock.

As they grow they’re adding more assets to the platform and having spoken at length with their team they want to provide global access to the stock market including funds in the near future.

The trading tools and analysis section of the app is right up there and I think this is one to add to your watchlist!

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

IG - Best Traditional Stock Trading App

Key Features

- Extensive range of investment options

- Award-winning platform

- Min Deposit: £1

Trade over 17,000 markets with spread bets, CFDs and invest in stocks and ETFs.

Won Best Trading Platform 2022 and has an excellent trading platform.

- Award winning trading platform

- First class app and desktop versions

- Great educational and research tools

- Fast account opening

- High CFD fees

Why IG is good for beginners?

Having used IG extensively, its top-notch efficiency is evident, making it an ideal choice for beginners and experienced traders.

What sets it apart is not just its cost-effectiveness—particularly for those who trade frequently—but also its user-friendly interface.

Moreover, IG goes beyond mere cost considerations. Its 24/7 customer support and active trading community contribute to a well-rounded and enriched trading experience.

Even if it’s designed with veteran traders in mind, the IG Academy offers an excellent primer for those new to the game.

When IG was named the ‘Best Broker in the U.K.’ for 2022, I wasn’t the least bit surprised.

Fees: Share trading: 0-9 deals/month £3 to £8

Instruments: Stocks, ETFs, Stock CFDs, Index CFDs, ETF CFDs, Forex, and Commodities.

Account Type: Share dealing account, ISAs and SIPPs (self-invested personal pension)

- Disclaimer:

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Lightyear - Best Mobile App

Key Features

- Trade in multiple currencies

- Over 3000 stocks and ETFs

- Min Deposit: £1

Lightyear has over 3,500 trading instruments available for investors with a smart mobile app and web version.

You can earn interest on your uninvested cash which is highly attractive for larger investors.

Richard Branson is one of the key investors.

- Fantastic mobile app

- Commission free trading on ETFs (other fees may apply)

- Interest on uninvested cash

- Easy account opening

- Customer support is email only

- Minimal educational tools

Why Lightyear is good for beginners?

After a three-month test run, I can say that Lightyear offers a superb user experience with its modern, well-designed app that’s a breeze to navigate.

This low-cost investing and stock trading platform doesn’t skimp on the range of investment options, offering access to over 3,000 stocks and ETFs.

When it comes to fees, Lightyear is impressively economical. ETF trading is entirely free, and stock trades are fixed at a mere £1/$1/€1 per order. Plus, the currency conversion fees are a low 0.35%.

For those who prefer to hold onto their currency, the platform even allows you to sidestep these fees entirely.

Adding to its appeal, Lightyear also offers interest on uninvested cash, making it an all-around strong choice for investors looking for a feature-rich, low-cost trading platform.

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

Hargreaves Lansdown - Best Trust Ratings

Key Features

- Established and trustworthy broker

- Annual Platform Fee: Varies by fund / £11.95 per trade (Single stocks)

- Min Deposit: £100 lump sum or £25 per month

One of the most popular investing platforms in the UK. With a range of ISAs, SIPPs and share dealing accounts.

They have over 15,000 instruments available but I think it's more suited to larger investors for individual trading and for fund investing for lower income investors.

If you have a small amount to trade with you might be better suited with another lower commission provider.

- Award winning investment and trading provider

- First class educational and research tools

- FTSE100 company and highly trusted in the UK

- Fantastic customer service

- Over 5000 5 star reviews on Trustpilot

- High individual trading fees

- Only in GBP currency

Why Hargreaves Lansdown is good for beginners?

With its status as the UK’s largest and most trusted trading platform, Hargreaves Lansdown is a go-to choice for both novice and seasoned investors.

The platform’s extensive selection of stocks, ETFs, and index funds—coupled with its top-notch research capabilities—makes it a compelling option. Personally, I have my SIPP (Self-Invested Personal Pension) with Hargreaves due to its comprehensive fund research offerings.

While the platform’s accolades are well-deserved, it’s worth noting that trading fees can reach up to £9.99 per trade. This fee structure can be a hurdle for those who are not frequent traders or who are investing smaller sums.

However, where Hargreaves Lansdown may be wanting in terms of cost-effectiveness, it more than compensates with its excellent customer service. You can expect personal account management, financial planning services, and a diverse array of ISA options—including Cash ISAs, Lifetime ISAs, and Junior ISAs.

Though the fees are on the higher end, the broker’s reputation as the most trusted platform in the UK certainly lends it a level of credibility that’s hard to match.

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

Coming Up Next:

- How we rate our apps – Buyers Guide

- What’s the best trading app for beginners?

- What’s the best free stock trading app?

- What Does Trading Stocks Mean?

- What is a Trading App?

- How Does the Stock Market Work?

- What Are the Different Types of Trading?

- How Do I Start Trading for Beginners?

- What Type of Accounts Are There to Trade Stocks?

- What about taxes when investing?

- Key Trading Terms Glossary

- What about fees to look out for?

- Round Up – The Best Trading Apps For Beginners

How we rate our apps - Buyers Guide

Trading platforms have become increasingly popular among UK investors due to their convenience and accessibility. If you’re looking to start investing using an app, there are several factors to consider to ensure you choose the right one for your needs.

Here are six reasons why you might choose an investing app:

1. Low Fees

One of the biggest advantages of investing through an app is the low fees. Many investing apps offer lower fees compared to traditional brokers, which can help you save money over the long-term. Look for an app that offers low fees on trades, deposits, and withdrawals.

The Winner: If you value low fees then our suggestion would be eToro for it’s very low fees.

2. User Experience

A good investing app should have an intuitive and user-friendly interface. Look for an app that makes it easy to navigate the platform, place trades or investments, and also provides access to research and educational materials.

We meticulously test all the apps we review to ensure they suit our readers.

The Winner: In terms of user experience, our favourite by some way was Lightyear. It’s slick, fast and very visual, making the experience of being on the app a lot of fun.

3. Suitability for beginners

If you’re new to investing, you’ll want to look for investment platforms that are suitable for beginners. Look for an investing app that offers educational resources, such as tutorials and videos, to help you learn the basics of investing.

The Winner: This would be Trading 212 and we say this because of the pure simplicity of the app.

4. Customer Reviews

Before choosing an investing app, read customer reviews to get an idea of other users’ experiences. Look for apps with positive reviews and high ratings, as this indicates that users have had a good experience with the app.

The Winner: The most highly rated out of all our apps that we’ve reviewed is eToro with 4.3 on Trustpilot, closely followed by Hargreaves Lansdown which has 4.2.

5. Investing Options

It’s vital not to just be pigeonholed into a handful of stocks to choose from. For example, if you catch wind of an opportunity in another market but your provider doesn’t allow trading in that region or even list that stock it can become problematic.

The Winner: For the sheer range of account types available and equally for the awards they have won in each account category we have selected Hargreaves Lansdown.

6. Useful Features

Look for an investing app that offers useful features, such as real-time market data, stock alerts, and investment tracking.

The Winner: This has to be eToro again and this is because their charts on both mobile and desktop are fantastic. You can also set up stock alerts and track your investments with a dashboard style view of your portfolio with live results.

Our System

We call this system our six-pillar method and it allows us to rank each of the apps with a score system. In this list of the best trading platforms for beginners, we have listed them by overall score downwards.

These features can help you make informed investment decisions and stay on top of your portfolio.

When first choosing a stock trading platform, it’s important to consider your investment goals, experience level, and budget.

By considering these factors, you can choose an app that meets your needs and helps you achieve your investment goals.

What's the best trading app for beginners?

The best trading app for beginner investors right now is eToro overall.

It has an extensive range of investments, a trading academy to learn for free, a demo account, a wide range of analysis tools and commission-free trading on real stocks.

Lastly it also has it’s widely renowned copy trading feature which allows you to directly follow and invest with the platform’s best-performing investors.

The next best investing app right now that’s also low cost and is popular amongst beginners is Trading 212.

What's the best free stock trading app?

The best free stock trading apps for beginners right now are eToro and Trading 212. They’re free to download but no trading app is entirely free.

There are small fees to contend with on every single trading platform in the world so just be sure to understand those.

What Does Trading Stocks Mean?

Trading stocks is a bit like playing a game of chess; it requires strategy, timing, and a keen understanding of the board—or in this case, the market.

When you trade stocks, you’re buying and selling pieces of companies, often called “shares,” in the hope of making a profit.

You’re essentially betting that the companies you invest in will do well, making their stock more valuable over time.

Alternatively, you might predict a stock will perform poorly and “short” it, aiming to profit if its value decreases.

So, in a nutshell, trading stocks is the art of buying low and selling high—or sometimes doing the exact opposite.

What is a Trading App?

Imagine being able to trade stocks while sipping a cuppa on your sofa. That’s exactly what a trading app allows you to do. These apps are designed to bring the stock market to your fingertips, literally.

You can buy, sell, and manage your investment portfolio right from your smartphone or tablet. These apps often offer various tools to help you make informed decisions, like news feeds, price alerts, and analytic features.

Ideal for beginners, they break down complex trading jargon into plain English. In other words, a trading app is your pocket-sized stock market guru.

How Does the Stock Market Work?

The stock market, at first glance, may look like a chaotic hive of numbers, but it’s actually a well-oiled machine.

It’s where buyers and sellers come together to trade shares. But I can still hear you saying well, how does the stock market work exactly?

Well, companies go public to raise capital, offering pieces of their business, known as shares, to people like you and me.

These shares fluctuate in value based on a myriad of factors, including company performance, global events, and market sentiment.

When you trade stocks, you’re participating in this grand financial theatre, aiming to buy shares that will increase in value and sell those you think might be heading for a nosedive.

Stock Exchanges

Ah, the heart of it all. Stock Exchanges are like the grand stages where the drama of the stock market unfolds. They are platforms where stock buyers connect with sellers.

Exchanges like the London Stock Exchange (LSE) or the New York Stock Exchange (NYSE) set the rules of the game, ensuring that trading is carried out fairly and transparently.

These exchanges list thousands of companies, providing a marketplace that helps investors make their moves and companies raise much-needed capital.

What Are the Different Types of Trading?

So, you’re getting the hang of it, eh? But here’s where it gets even more interesting. You see, trading isn’t a one-size-fits-all kind of deal.

There are various types of trading, each with its own set of rules, risks, and rewards. Let’s unravel this jigsaw puzzle, one piece at a time.

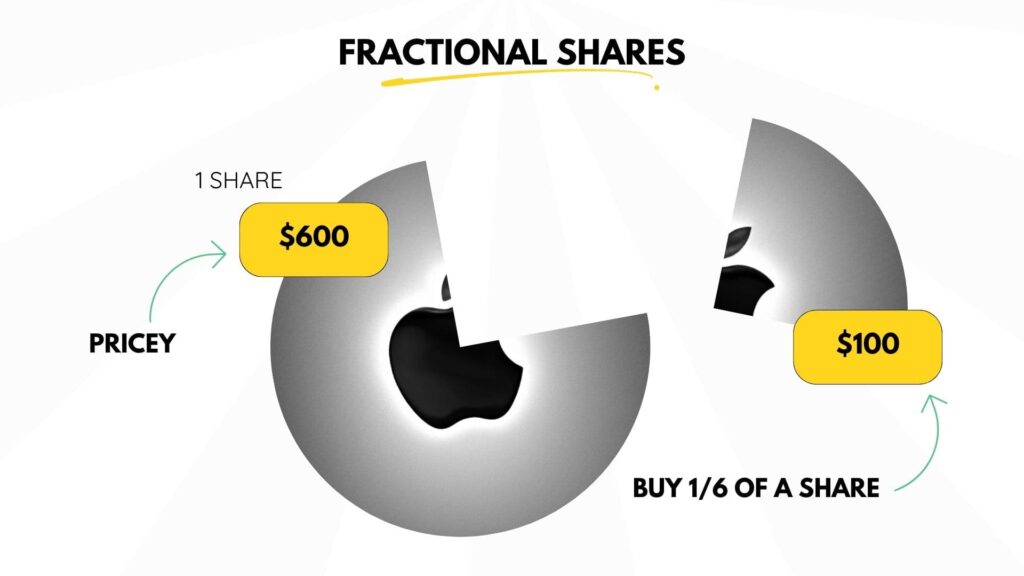

Fractional Shares

Think you can’t afford to buy shares of that big, swanky company? Enter Fractional Shares. Instead of buying an entire share, you buy a piece of it.

It’s like buying a slice of cake instead of the whole thing, but still getting a taste of the action.

Fractional shares allow you to invest with as little as a few quid, making it easier to diversify your portfolio. Handy, right?

Standard Shares

Now, these are the bread and butter of stock trading. When you buy Standard Shares, you’re buying a piece of ownership in a company.

If the company does well, your shares go up in value. It’s like owning a tiny slice of a business, with the perks (dividends) and the risks (share prices can go down) that come along with it.

US Shares When In the UK

Buying US stocks whilst in the UK will require a W8-BEN form to be completed which states you are not a US citizen and therefore not required to pay tax on US companies.

99% of brokers will have this integrated with their apps and it literally takes less than a minute to fill out but you will need to do it before you buy US stock.

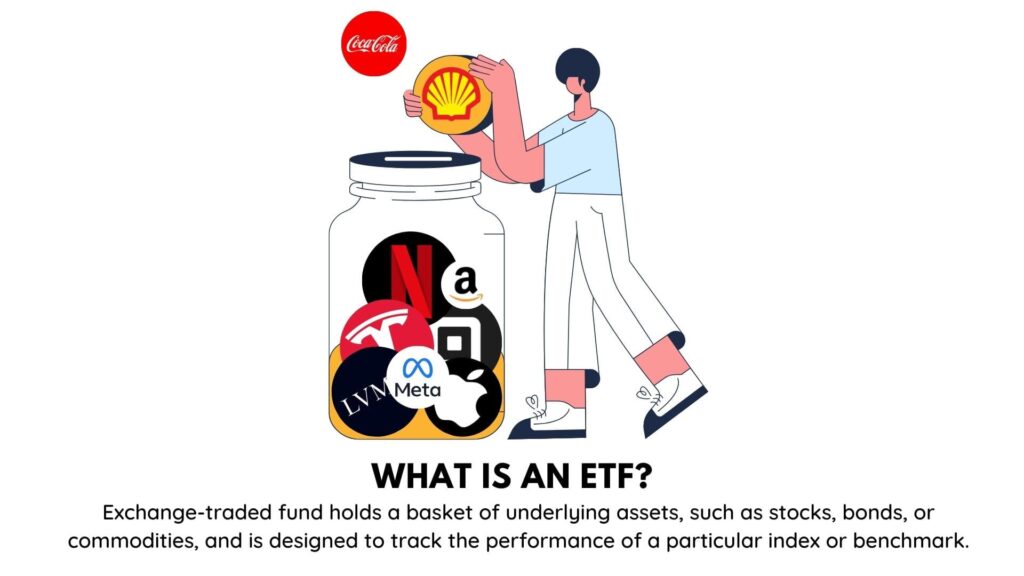

Exchange-Traded Funds

Exchange-traded funds, or ETFs if you’re into abbreviations, are a basket of various stocks or other types of investments.

They’re a great option for diversification since you’re not putting all your eggs—or in this case, your hard-earned cash—in one basket.

ETFs usually track an index, like the FTSE 100, so they give you a good snapshot of how a sector or market is doing.

Forex

Forex is short for “foreign exchange,” and it’s the world’s largest financial market. In Forex trading, you’re buying and selling currencies instead of shares.

Picture yourself at an airport currency exchange, but supercharged and without the annoying fees.

Forex markets are open 24 hours, five days a week, offering plenty of opportunities but also a higher degree of risk.

Bonds

Bonds are the “slow and steady wins the race” of the trading world. When you buy a bond, you’re essentially lending money to a government or a company.

In return, they pay you interest over a fixed period. Bonds are generally considered less risky than stocks, but the returns are often lower.

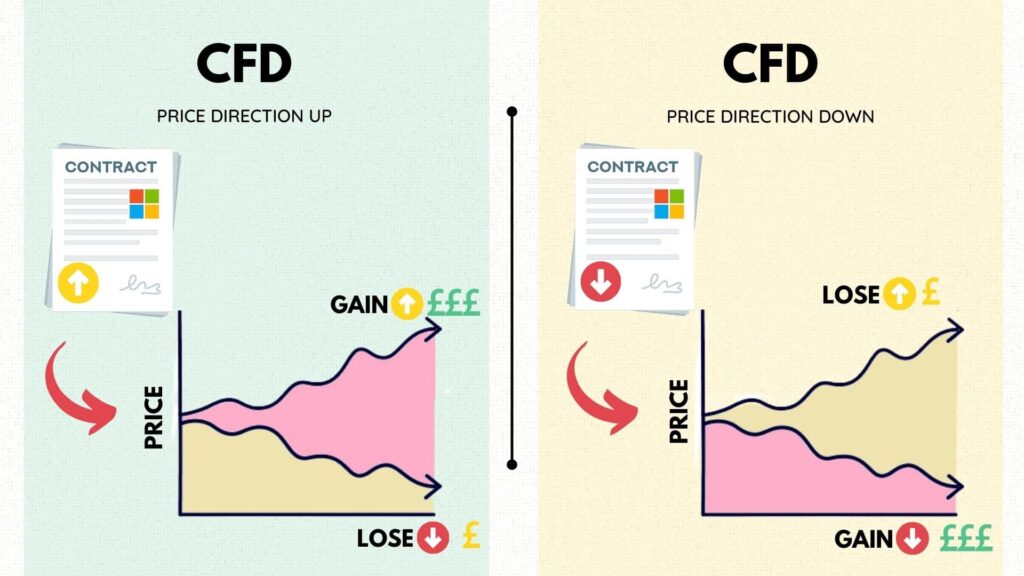

CFDs

CFDs, or Contracts for Difference, are a bit of a wild card. When you trade CFDs, you’re not buying the underlying asset, like a share or commodity.

Instead, you’re entering into a contract with a broker to exchange the difference in value between when you opened the position and when you close it. Sounds complicated?

It can be, and it’s riskier than other forms of trading, so it’s best left to those who really know what they’re doing.

Cryptocurrency

Last but certainly not least, there’s the buzzword that’s got everyone talking: Cryptocurrency. It’s the new kid on the block(chain), and it’s making waves.

Cryptocurrencies like Bitcoin, Ethereum, and many others are digital or virtual currencies that use cryptography for security. Unlike traditional currencies, they’re not tied to any country’s government or central bank.

When you trade cryptocurrencies, you’re buying and selling digital assets on a decentralised network. Sounds futuristic, right?

It is, and it comes with its own set of perks, like the ability to trade 24/7 and the potential for astronomical gains.

But be warned, the crypto market is notoriously volatile. Prices can skyrocket, but they can plummet just as quickly. Plus, the lack of regulation can make it a playground for scammers.

So if you’re going to wade into these waters, make sure you’ve done your homework and are prepared for a rollercoaster ride.

How Do I Start Trading for Beginners?

Venturing into the world of trading can feel like stepping into a maze, but it doesn’t have to be daunting.

Here’s a step-by-step guide to get you started:

Do Your Research

Before diving in, educate yourself. Understand basic trading concepts, the types of assets you can trade, and the risks involved.

There are plenty of resources available, from online tutorials to trading books, that can help you grasp the fundamentals.

Choose Your Trading Style

Traders often have different styles—day trading, swing trading, or long-term investing. Knowing what suits you can help narrow down the kind of assets you’ll trade and the trading app that’s best for you.

Select the Right Stock Trading App

Once you have a basic idea of what you’re looking for, it’s time to choose your trading app.

Consider things like fees, the range of assets available, user interface, and customer reviews. Some apps offer demo accounts where you can practise trading with virtual money.

Open an Account

After selecting your app, you’ll need to open an account. This usually involves providing some identification and financial documents.

Make sure to understand the different types of accounts available, such as Individual or Joint Accounts, ISAs, GIAs, Retirement Accounts like SIPPs, and Margin Accounts.

Start with a Demo Account

If you’re a complete beginner, start with a demo account to get a feel for the platform and to practise your trading strategies without risking real money.

Fund Your Account

Once you’re comfortable, it’s time to fund your trading account. Depending on the app, you may be able to start with as little as £10.

Develop a Trading Plan

Before hitting the ‘Buy’ or ‘Sell’ button, develop a trading plan. Decide in advance how much you’re willing to invest and at what price point you aim to buy or sell.

Make Your First Trade

With your account funded and your plan in hand, you’re now ready to make your first trade. Start small and continue learning through both successes and failures.

Monitor and Adjust

Keep an eye on your investments and the market conditions. Your initial strategy might need adjustments as you go along, based on your performance and changes in the market.

Be Mindful of Taxes

Trading isn’t just about raking in profits; it also has tax implications. In the UK, you’ll be subject to Capital Gains Tax, Income Tax, and Dividends Tax, based on your earnings and the types of trades you make.

The capital gains tax allowance for the tax year 2023/24 is £6,000, so plan accordingly.

What Type of Accounts Are There to Trade Stocks?

When it comes to trading accounts, you’ve got options aplenty. One size definitely doesn’t fit all here, so let’s walk you through the main types you’re likely to come across:

Individual or Joint Accounts: The bread and butter of trading platforms. You can operate one just for yourself or share the responsibility (and the gains or losses) with someone else.

ISAs (Individual Savings Accounts): These are tax-efficient accounts that allow UK residents to trade stocks without worrying about Capital Gains Tax or Income Tax on the profits. You have an annual ISA allowance, and any gains within the account are tax-free. How great is that?

GIAs (General Investment Accounts): These accounts are more like a free-for-all. You can invest as much as you like, but the taxman will take his share of the profits through Capital Gains Tax, and possibly Income Tax, depending on your trading activity.

Retirement Accounts: Specifically, in the UK, this would be a Self-Invested Personal Pension (SIPP). A retirement-focused account comes with some tax perks, but you can’t just withdraw your money whenever you fancy.

Margin Accounts: A bit more on the adventurous side, these accounts allow you to borrow money to buy stocks. Higher potential rewards, but remember, the risks are elevated too.

Demo Accounts: Consider this your trading playground. These accounts are loaded with pretend money, letting you practice without the risk of real financial loss.

Managed Accounts: Want to keep your hands clean? These accounts are managed by financial pros who make all the trading decisions for you. Sit back and hope they know what they’re doing! What about taxes when investing?

What about taxes when investing?

When it comes to investing, the saying “nothing is certain except death and taxes” couldn’t be more accurate. Yes, the taxman cometh, even for your investments.

Here’s what you need to know:

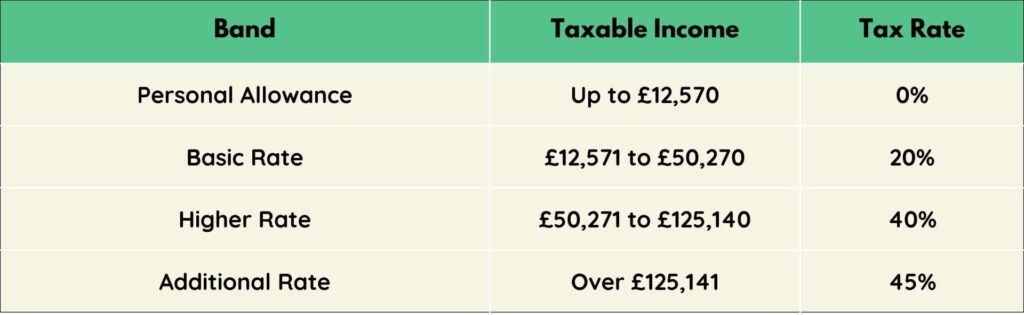

Capital Gains Tax

In layman’s terms, when you sell an asset like shares for a profit, that’s when Capital Gains Tax comes knocking.

Imagine you acquired shares for £1,000 and later sold them for £1,500. Your capital gain, in this case, would be £500.

Now, for the 2023/2024 tax year, the UK has a “Capital Gains Tax Allowance” of £6,000. This means that if your total gains throughout the year fall under this amount, you won’t owe any Capital Gains Tax.

But for any gains above that £6,000 threshold, you’ll be taxed at rates between 10% and 20%, depending on your income tax band.

Income Tax

Now, this is a slightly tricky one. If you’re trading very frequently and it becomes your primary source of income, HM Revenue & Customs (HMRC) might decide you’re actually a “trader” rather than an “investor.” Why does this matter? B

ecause as a trader, your profits might be subject to Income Tax instead of Capital Gains Tax.

Income Tax rates in the UK range from 20% to 45% based on how much you earn in total. It’s a grey area, so if you’re planning to trade frequently, consulting a tax advisor is highly recommended.

Dividends Tax

Dividends are like little thank-you notes from companies to their shareholders. If you own shares in a company that has done well, they might distribute some of the profits back to you.

Lovely, isn’t it? But, of course, HMRC wants its share too.

In the UK, you have a Dividend Allowance of £2,000 per year that’s tax-free. Anything above that is taxed at rates ranging from 7.5% to 38.1%, depending on your overall income.

Key Trading Terms Glossary

Market Capitalisation

Market capitalisation, often called “market cap,” gives you the overall worth of a company in the eyes of the stock market. It’s calculated by taking the current stock price and multiplying it by the total number of shares outstanding.

Companies are often categorised as small-cap, mid-cap, or large-cap depending on their market cap. It’s a quick way to gauge a company’s size and investment risk.

Market Order

A market order is a bit like saying, “I want this now, no matter the cost!” You place an order to buy or sell a stock immediately at the current market price. It’s speedy, but the downside is you might not get the most favourable price, especially in a volatile market.

Limit Order

In contrast to a market order, a limit order is more like saying, “I want this, but only at the right price.” You specify the maximum or minimum price at which you’re willing to buy or sell.

This approach gives you control over the price, but there’s no guarantee the order will be executed.

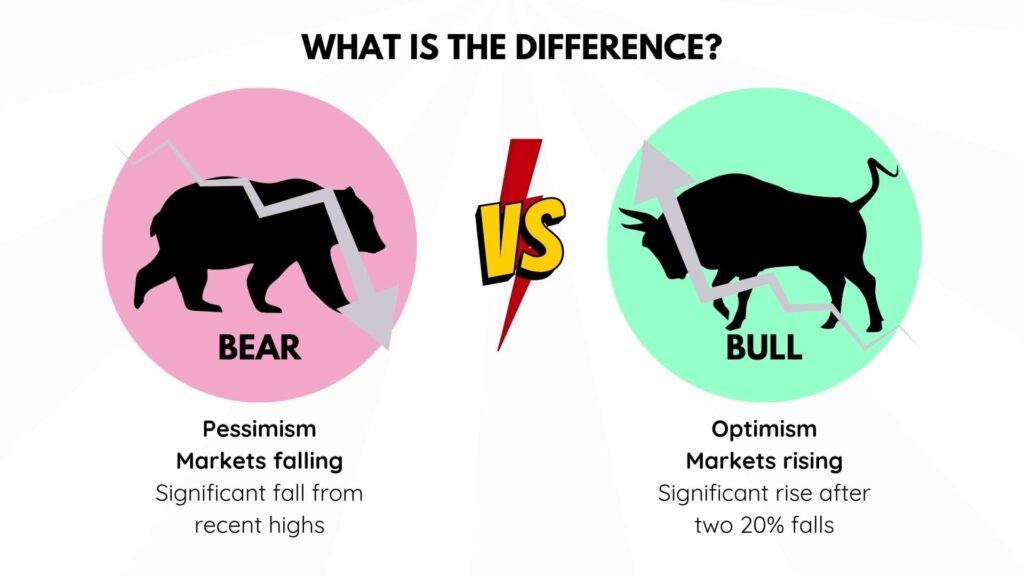

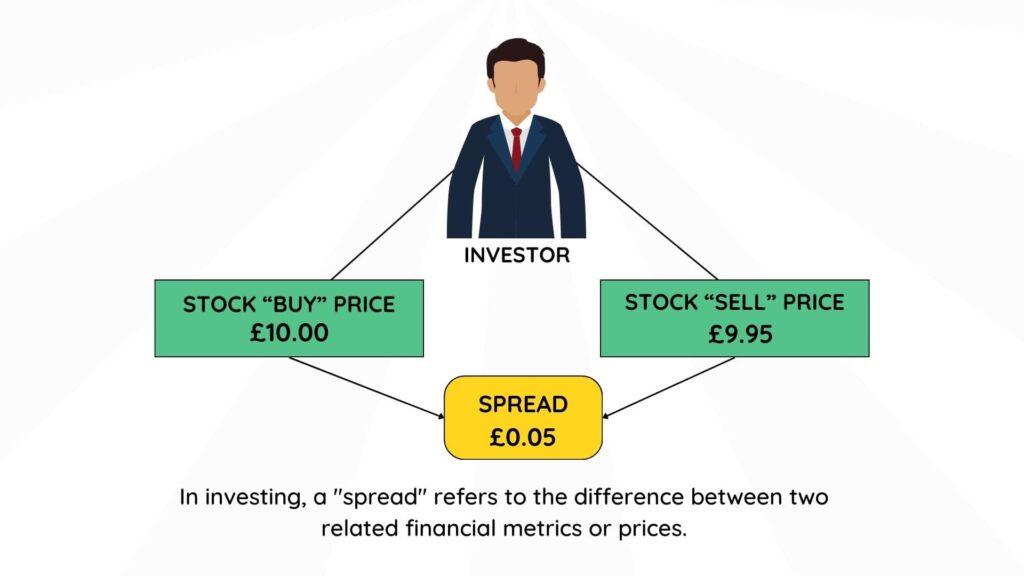

Spreads

The term “spread” refers to the gap between the highest price someone is willing to pay for a stock (the bid) and the lowest price someone is willing to sell it for (the ask).

A smaller spread often indicates high liquidity, while a larger spread can signify lower liquidity.

Shares Outstanding

Shares outstanding are all the shares a company has issued, bought, and held by all shareholders. This figure is critical because it’s used in calculations like market cap and earnings per share (EPS), giving you a sense of the company’s size and health.

Earnings Per Share (EPS)

EPS tells you how much of a company’s profit is assigned to each share of stock. It’s a popular metric for gauging a company’s profitability and is often used by investors to compare the financial performance of different companies.

Dividend

A dividend is a share of a company’s earnings that’s paid out to shareholders. Not all companies issue dividends; some prefer to reinvest their earnings. For investors, dividends can be a steady income stream and a sign of a company’s financial health.

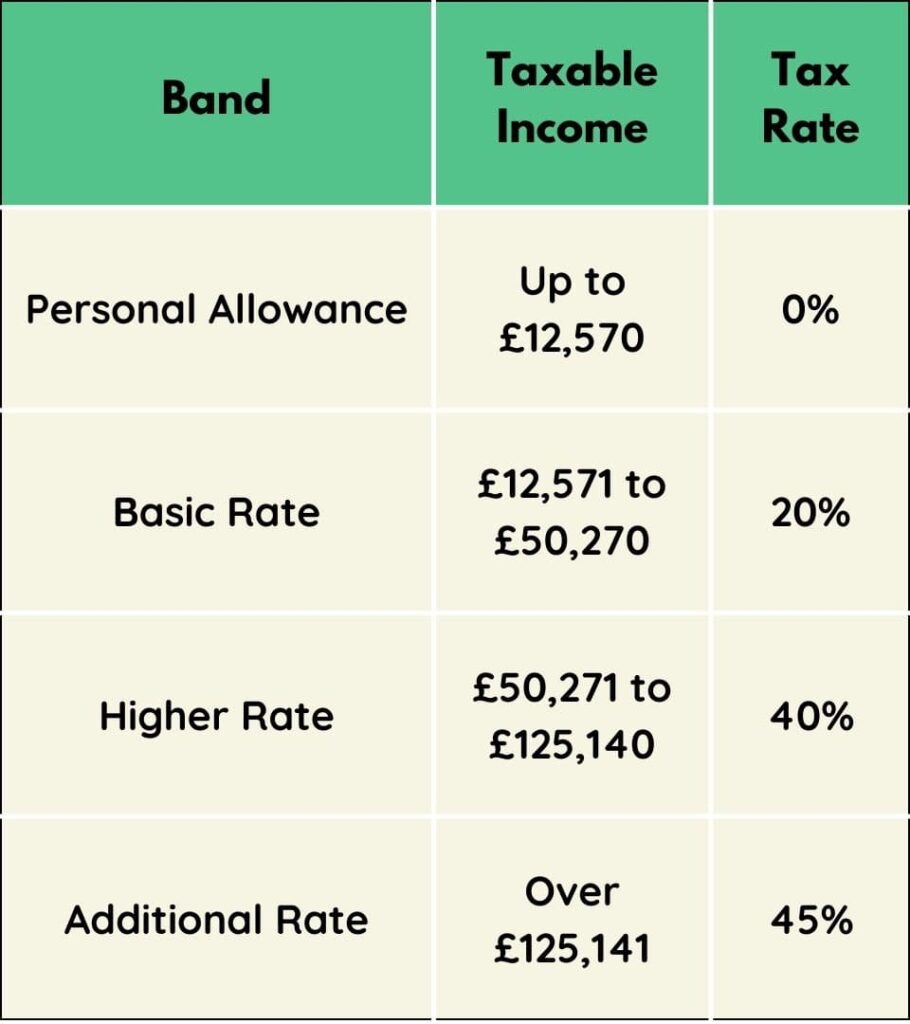

Bull & Bear Markets

“Bull” and “bear” markets define the direction of market prices. A bull market is optimistic, characterised by rising prices and investor confidence. Conversely, a bear market is all doom and gloom, with falling prices and a lack of confidence.

PE Ratio (Price to Earnings)

The Price-to-Earnings (PE) ratio tells you how much you’re paying for each pound of a company’s earnings. To work it out, simply divide the current share price by the company’s Earnings Per Share (EPS).

PE Ratio = Current Share Price / Earnings Per Share (EPS)

A high PE ratio could mean the stock is overvalued, while a low one could indicate it’s undervalued. It’s a quick way to gauge a stock’s value relative to its earnings.

IPO (Initial Public Offering)

An IPO is a company’s debut on the stock market, where it offers its shares to the public for the first time.

While it’s an opportunity for companies to raise funds, it’s also a chance for investors to buy shares of a company that could be the next big thing.

Most stock trading apps don’t offer IPOs but some do. IPOs can be highly volatile so be careful and make sure you do your research on your trading platform.

Day Trading

Day trading is the fast-paced buying and selling of stocks within the same trading day.

While the potential for high returns is there, the risk is equally high. It requires a deep understanding of market trends and a well-planned strategy.

Bid & Ask Price

The bid and ask prices are the heart of a stock trade. The bid price is what a buyer is willing to pay for a stock, while the ask price is what a seller is willing to accept.

Knowing the bid and ask prices can help you make smarter trading decisions.

Retail Investors

Retail investors are everyday individuals who trade stocks for their personal portfolios, unlike institutional investors who trade large volumes on behalf of funds or corporations.

While they may not move markets like institutional investors, retail investors are a vital part of the stock market ecosystem.

What about fees to look out for?

You have a number of fees to look out for when identifying the best stock trading apps. It’s vital to understand the stock trading apps fees and look to keep these as low as possible.

Here are some of the biggest ones:

Trading Fees

While it may be exciting to buy or sell a stock, keep in mind that most trading apps will charge you a fee for the privilege.

These can come in different forms—either a fixed sum per transaction or a percentage of the transaction size.

The fee structure varies among apps, making it crucial to review and understand these costs before diving into trades.

For example, some apps offer a low-cost or even commission-free trading model but may make up for it with other fees.

Account Maintenance Fees

Whether you’re a frequent trader or a casual investor, some platforms levy a maintenance fee to keep your account open.

These charges can vary widely—some platforms offer free account maintenance, while others might charge a monthly or annual fee.

It’s crucial to read the terms and conditions to understand how these fees are structured and when they apply, as they can erode your returns over time.

Withdrawal Fees

Your money is yours to keep, but accessing it can sometimes incur a fee. This is particularly important if you foresee needing to move money frequently between your trading account and your bank.

Various apps have different policies, ranging from free withdrawals to fixed fees per transaction. Knowing these in advance can help you strategise your cash flow more effectively.

Currency Conversion Fees

For those interested in dabbling in international stocks, currency conversion becomes an unavoidable aspect. Trading apps often charge a fee for converting your pounds to another currency, like dollars or euros.

The cost can vary significantly between apps and could include a flat fee, a percentage of the transaction, or even a combination of both. Keep a keen eye on these rates, especially if you are exploring global investment opportunities.

Inactivity Fees

Planning a break from trading? Some platforms might penalise you for your absence. If your account remains dormant for a certain period—say, three months or more—you may incur an inactivity fee.

This is something to bear in mind if you’re considering a long-term investment strategy that involves less frequent trading.

Spreads

When trading, especially in fast-moving markets, you’ll often see two prices listed: the buy price and the sell price.

The difference between these two prices is known as the “spread,” and it’s another form of cost you need to be aware of. In essence, the spread is a hidden charge that brokers automatically apply when you enter or exit a trade.

For example, if you’re looking to buy a stock priced at £10.00 and the sell price is £9.95, the spread would be £0.05.

While this might not seem like much, frequent trading can make spreads add up, eating into your potential profits or exacerbating your losses.

The size of the spread can vary depending on the trading app you use, the liquidity of the asset you’re trading, and current market conditions.

Some apps offer fixed spreads, while others have variable spreads that can widen or narrow depending on market volatility. Either way, understanding the impact of spreads on your trades is crucial for effective cost management.

Adding spreads to your fee considerations provides a more complete picture of the costs associated with trading. Always keep an eye on the spread, as it can influence your trading strategy and affect your overall profitability.

Are Trading Apps Safe for Beginner Investors?

If you’re new to the world of trading, safety is probably one of your top concerns.

Reputable trading apps usually offer robust security features, including encryption and two-factor authentication, to protect your account and personal data.

However, trading inherently comes with risk, and even the safest app can’t protect you from market volatility or poor investment choices.

As a beginner, start with low-risk investments, and consider using a demo account to practice without financial risk.

What Happens if a Trading App Goes Bust?

The mere thought can be unsettling, but it’s good to know your options.

In the UK, if a trading app that is authorised by the Financial Conduct Authority (FCA) goes bust, the Financial Services Compensation Scheme (FSCS) can protect up to £85,000 of your investments.

Assets like shares are often held in a separate account, which means they’re not considered company assets and are usually safe. However, it’s crucial to understand the terms and conditions of your trading app to know exactly how your investments are protected.

Are Some Trading Apps Better Than Others?

The short answer is yes, but the best stock trading app largely depends on your individual needs and experience level. Some apps are designed with beginners in mind, offering user-friendly interfaces and educational resources.

Others cater to more experienced traders by offering a wide range of assets and advanced analytical tools. When choosing an app, consider factors like fees, the range of available assets, user reviews, and the app’s reliability.

It’s also worth looking into additional features like real-time news updates, advanced charting capabilities, and customer support.

Round Up - The Best Trading Apps For Beginners

I hope this page has helped make everything a little clearer. It can be so daunting when getting started with investing as there’s so much to learn.

That being said, these apps will give you a great starting point.

My personal tip is to keep things simple until you’ve built up your confidence. Take it easy for the 1st year or two and learn the tricks of the trade as they would say.