Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

For me, escaping the rat race involved creating a well-thought-out plan and then having the balls to actually execute it.

It requires a blend of mindset, aggressive saving, astute investment, and developing multiple income streams.

It’s also not solely about accumulating wealth, but also about attaining a lifestyle that prioritises freedom and choice over endless work.

A lot of it is mindset, belief and the energy to start creating a life that you want to live. Are you in?

If you’re weary of the daily grind and want to be less tied to the nine-to-five routine, then this blog post is tailor-made for you.

I’m going to lay out the exact blueprint I followed to escape myself and show you how you can replicate my success.

Remarkably, I managed to go from feeling trapped and dreaming of escape to actually breaking free in just 24 months.

While holding down a full-time job, I diligently took specific steps that laid the foundation for my newfound freedom.

These strategies aren’t mere theory; they’ve been tried and tested by me personally and are designed to set you up for a life of choice, away from the shackles of endless work.

So, ready to learn how to escape the rat race? Let’s get it.

Table of Contents

How To Escape the Rat Race?

If you’re serious about leaving the rat race, I’ll guide you through five critical steps to set you on your path to liberation.

In this post, you’ll learn:

Start with Why: Uncover your core reason for wanting a life beyond the 9-5 grind.

Financial Check-Up: Assess your income, spending, and debts to gauge your readiness for change.

Understand Money: Get the essentials on investing and financial planning.

Use Leverage: Learn how to amplify your income and resources.

Scale: Find out how to grow your side hustle into a full-fledged freedom machine.

What is rat race mentality?

At its core, the rat race mentality focuses on the perpetual cycle of working long hours to earn money, which you then spend—often on things that don’t bring long-term satisfaction—only to have to work even more hours to sustain the lifestyle you’ve created.

It’s a vicious circle that leaves little room for personal growth, meaningful experiences, or even just the simple joy of free time.

This mindset is often ingrained in us from an early age. Society, family expectations, and even the educational system condition us to equate success with material wealth and job titles.

The narrative of ‘study hard, work harder, and then you’ll be happy’ is so deeply embedded that we seldom question it, let alone challenge it.

It’s important to note that there’s no shame in having been caught up in the rat race. In many ways, it’s a byproduct of the environment we live in, one that constantly bombards us with images and ideas of what ‘success’ should look like.

But now that you’re aware of this cycle and the mentality that fuels it, what’s your next move?

Tomorrow, as you go about your day, try to be conscious of the choices you’re making.

Are you trading your time for money in a way that aligns with your deepest values and desires?

Are you working to live, or living to work?

Becoming aware of these decisions is the first crucial step in escaping the rat race.

In the sections to come, we’ll dive deeper into how you can break free, starting with identifying your ‘why,’ conducting a thorough financial check-up, and so forth.

Understanding the rat race mentality is the starting line; where you go from here is up to you.

5 Steps To Escape The Rat Race

Let’s unpack these 5 steps to learn how to escape the rat race. I personally used these tests and I’m still using them to this day.

Step 1 - Start with Why

Look, I’m not about to invent the next SpaceX or become the next Jeff Bezos. I don’t even have plans to run for Prime Minister. My ambitions are a bit more down-to-earth.

I want to start a family, live on my own terms, get stuck into projects that interest me, not have a panic attack at the checkout in Tesco, and maybe, just maybe, turn left on a plane once in a while.

To get to that place, I had to figure out my ‘Why.’ And let me tell you, this isn’t some airy-fairy concept you might here like ‘I just want to do what I want all day’ – I’m looking at you, Karen.

Your ‘Why’ is like your internal North Star—a constant, shining reminder of what you’re working towards.

For me, it’s about freedom of choice. I want to live a life filled with creativity, positive energy, and choices that aren’t dictated by the balance of my bank account. That’s my ‘Why.’

The problem is, society has programmed us to believe that life is a sprint. Get there faster, work quicker, accumulate more—fast is always better, right? Nah, not even close.

We’re so fixated on the flashy cars, the glamorous job titles, the Instagrammable lifestyles, that we often lose sight of what genuinely matters.

Think about the ways you can shift your money mindset.

And what's the cost?

Your happiness and freedom, traded in for a monthly salary that barely lets you breathe.

So, here’s your first task. Sit down and make a list of all the things you DON’T want.

For example, I didn’t want to slog my guts out just to retire with nothing in the bank.

I didn’t want to be in a job that saps the life out of me. I didn’t want to be in debt up to my eyeballs every month.

When you start eliminating what you don’t want, what you DO want becomes a lot clearer.

But don’t just stop at the material things—the house, the car, the 9-to-5. Dig deeper. What’s at the core of your desires?

For me, it was the freedom to be creative, to surround myself with positive energy, and to make choices on my own terms.

To achieve those intangibles, sure, there are tangibles like a profitable business and a supportive network of people who need me as much as I need them.

Take your time with this. Let it marinate. Live with your ‘Why’ for a bit.

Once you’re confident you’ve nailed it, then you’re ready for the next steps we’ll delve into. But for now, get that ‘Why’ solid. Trust me, it’s the foundation of everything that’s coming next.

Step 2 - Do A Financial Check Up

Once you’ve got your ‘Why’ locked in, it’s time to face the hard, cold numbers.

Trust me, I get it. Going through your finances with a fine-tooth comb is about as appealing as a root canal.

But if you’re serious about stepping off the never-ending treadmill of the rat race, this is non-negotiable.

For me, the financial check-up was a revelation. I took a long, hard look at my income, my expenses, and my debts.

For those struggling – check out our guide on how to create a household budget.

What I found wasn’t pretty, but it was necessary. To truly break free from my 9-to-5, I needed to bring in at least £3,000 a month.

That figure became my new target—a tangible goal I could work towards, all rooted back to my ‘Why.’

So why is this financial check-up so important? Simple. It gives you a realistic picture of what you need to achieve to bring your ‘Why’ to life.

You’ll suddenly see the chains that are actually holding you back: maybe it’s debt, maybe it’s your rent or mortgage, or maybe it’s those pesky subscriptions you forgot you even had.

By understanding these financial commitments, you’re better equipped to strategise how you’ll step out of the rat race.

Here’s what doing a financial check-up will give you: a roadmap. Once I knew I needed £3,000 a month to keep the lights on and give myself the freedom I craved, I could begin to plot how to get there.

Would it be a side hustle? Investing? Cutting back on expenses?

All these decisions were made easier once I had a clear financial picture.

So, get into the nitty-gritty of your finances. Know how much you need to earn to meet your basic needs and to align with your ‘Why.’

That number then becomes your benchmark. From there, you can create a plan to hit it and eventually exceed it.

Just like with your ‘Why,’ take your time.

Go through your bank statements, tally up your debts, and account for every last penny. When you have a full understanding of your financial situation, only then can you make informed decisions on how to proceed.

This check-up is not just an exercise; it’s a necessity for anyone serious about saying goodbye to the rat race for good.

Step 3 - Understanding Money

Now we have our why we can begin to move onto the vehicle that’ll take us from our current situation to where we want to get to. Money.

First off, let’s talk about financial literacy.

If you can’t read a balance sheet, analyse your own budget, save money for longer than a week or understand the basic principles of investing, then you’re basically driving in the dark.

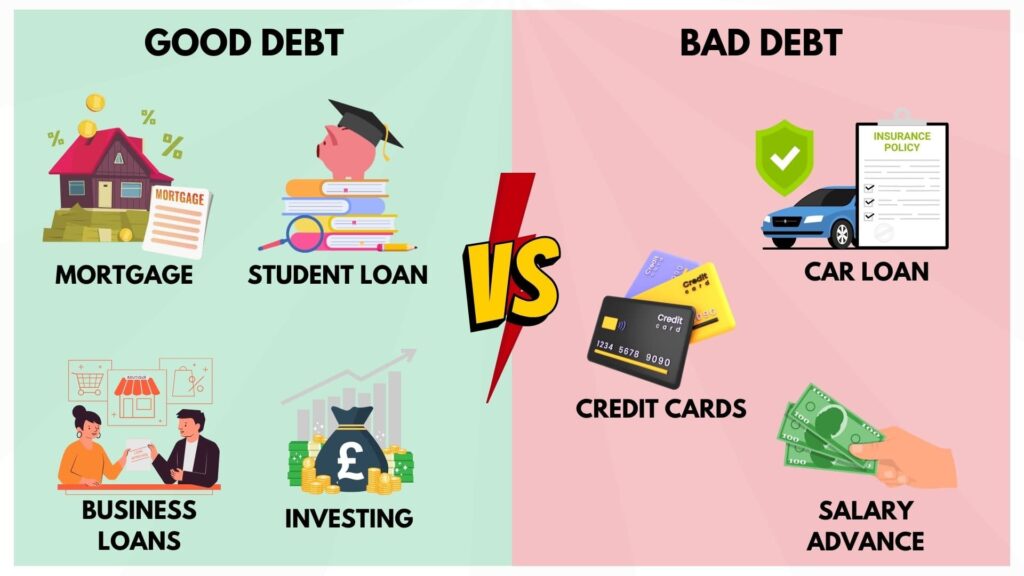

So before we dive into making more and diversifying, make sure you have your basics in place. Get educated on interest rates, inflation, assets and liabilities, and learn to discern good debt from bad.

Speaking of debt, let’s clear the air. Not all debt is created equal. Investing in education or property that will appreciate or generate income is often considered ‘good debt.’

Credit cards and car loans usually fall under ‘bad debt.’

Understanding the role of debt in your financial life is crucial for making the kind of decisions that inch you closer to freedom, rather than chaining you down further.

So, what next?

Now, skip the whole “spend less than you earn, invest the difference” bit. That’s money 101. We all understand it; we just don’t always act on it.

To grow exponentially at such a rate that frees you from your 9-5 not just in 15-20 years but perhaps within 5 or less is where we want to be sitting. So to do this, we have to move past the basics and get right to the sauce. Income.

Relying solely on one income stream is NEVER, I repeat is NEVER going to get you free in your lifetime. Somehow, someway we need to be bringing in income from multiple sources.

Diversification isn’t just a necessity here; it’s your ticket to freedom.

Things change. If your boss walks in tomorrow and pulls that table leg, are you a three-seater or a four? Because a four or more stays standing.

Justin Welsh dropped a quote that I loved:

“Treat your life like you’re a VC (venture capitalist). Invest in yourself and find your why.”

Use our financial independence calculators to help you understand more about how long it’ll take you to reach your goals. The best ones are the Barista FIRE calculator and Coast FIRE calculator.

How to create income streams?

Now, once you have your fundamentals down and understand the role of debt, we move on to income streams.

Usually, this is going to involve early mornings, evenings, and weekends. If you have kids, that’s going to be halved, and if you have regular hobbies, that’s even less.

But – what are you willing to sacrifice? If the answer is nothing then why are you even here?

You’ve got to give something up and create time to work on this. Just FACTS.

Once you have your amount of time, you can begin to fit a side hustle into your schedule. For example, if you only have 1-2 hours a week, then you could think of things like tutoring, freelancing, or starting a podcast.

But if you have more time, then you can look at increasing your clients if you’re freelancing, starting a digital business, blogs, YouTube channels, social media channels, and courses.

Only 18.4% of businesses fail, contrary to what your grandad or uncle will tell you.

Even the papers say it’s 66% in the 1st 3 years. It’s rubbish… it’s 18.4% and I’ll be happy to talk to anyone who wants to question that.

The idea behind our side hustles or new businesses is that we build them up enough so we can grow our net monthly income – ideally exponentially, but we don’t need to be the new Elon here, we just need enough to escape.

With that money comes the next step. Leverage.

Step 4 - Use Leverage

Firstly, understand this: leverage isn’t some Wall Street term reserved for stock market gurus and hedge fund managers.

It’s everywhere around you. Every time, skill, or pound you’ve got can be leveraged.

Leverage is your best mate in this game. It’s about taking what you already have—time, skills, money—and using it to get more of what you want.

This isn’t just one plus one equals two; this is one plus one equals five, or ten, or even a hundred if you play your cards right.

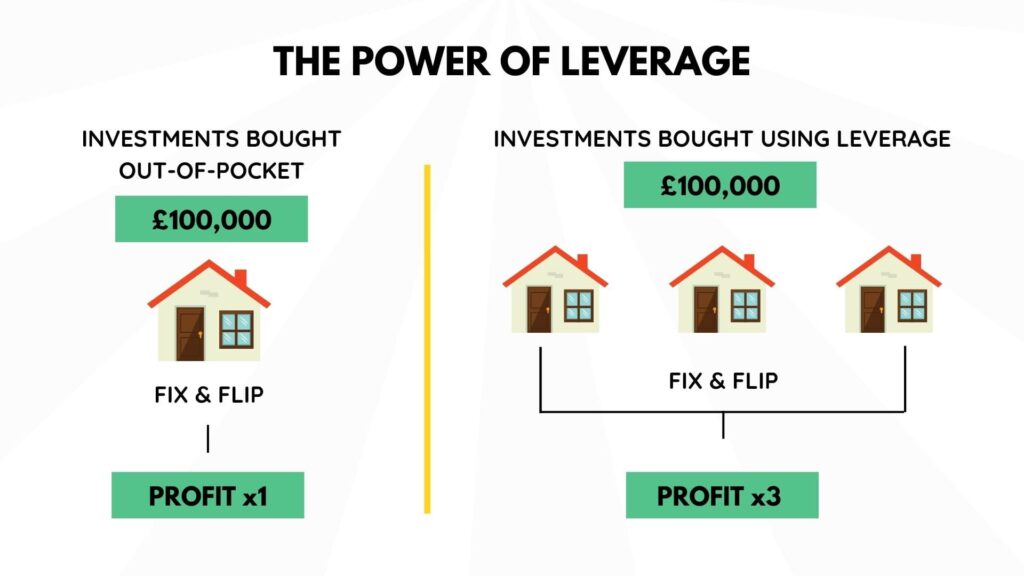

Let’s talk financial leverage. Imagine borrowing capital to invest, expecting the returns to trump the interest you’ll owe.

Now, I’m not telling you to go out and take a massive loan without knowing what you’re doing. That’s a one-way ticket to the poor house.

But if done wisely, this can be a fantastic tool. Invest in something like property, for example, and you can see some real gains.

But this isn’t just about finance; it’s a life philosophy. Say your side hustle starts booming—what are you going to do? Buy a flashy new car or squander it on holidays?

No, mate, you take that money and you reinvest it. Think of it as a catapult, launching you closer to your goals at warp speed.

Here’s the kicker: Your money starts working for you.

Imagine waking up every morning, not to the sound of your alarm, but to the sweet melody of your bank account growing on its own.

Your money’s out there hustling, even when you’re chilling with a G&T or having a laugh with your friends.

It never sleeps; it never takes a day off.

That’s the magnetic draw of leverage. It’s not about hoarding cash; it’s about changing your life. It’s about moving from a bit-part role in your own life story to the director’s chair.

You’re not just living anymore; you’re creating, you’re experiencing, you’re thriving, and you’re doing it on your terms.

Leverage is the fine line that separates the life you have from the life you want. It’s the pivot point between your now and your future. So, what can you leverage today?

Maybe you can learn new skills to up your earning potential, or maybe you’ve got a network that can open doors for you.

Get this right, and we’re not talking about financial freedom in 15-20 years; we’re talking five years or less.

So, take a moment. Think about it. What levers are hiding in plain sight, just waiting for you to pull them?

Get this step right, and you’re not just setting yourself up for success; you’re basically strapping a rocket to your back and lighting the fuse.

Step 5 - Scale

Scaling isn’t just any type of growth, it’s the kind that turns a tiny acorn into a sprawling oak tree.

If leverage is your starting point, the accelerator that turns one pound into two or three, then scaling is your long game. It’s what takes that small blog or side hustle of yours and turns it into a full-blown empire.

So you’ve got this blog, right? Or neat little side hustle business!

It’s gaining traction. You’re making some money from it, and that’s fantastic. But what now?

How do you take this and really turn up the volume?

The magic words here are systematic repetition and delegation.

How does that work then?

You’ve hit on something your audience loves—a certain type of blog post, a killer social media strategy, whatever it is.

You’ve found the formula; now it’s time to replicate it.

But unless you’ve found a way to clone yourself, you can’t do it all alone.

This is where delegation comes in. Think about hiring a writer who can capture your voice, or a virtual assistant to manage your social media.

Just like that, your solo operation morphs into a production line. And guess what? Now you’re free to think bigger—to strategise, to scout out new ventures, investments, and, yep, more forms of leverage.

Don’t get it twisted; scaling isn’t a one-man show. It’s a well-orchestrated performance, and you’re the conductor.

As you add more instruments to your orchestra—be it staff, systems, or investments—the sound doesn’t just get louder; it becomes richer, fuller, and infinitely more captivating.

Now, let’s talk about that 9-5 job of yours. Is it time to kick it to the curb? That’s a massive decision, and it shouldn’t be taken lightly.

But here’s the kicker: if you’ve scaled your side hustle and leveraged your way up, quitting your job isn’t the end of the world. It’s a new frontier, giving you the time and energy to scale even further.

The rivers of multiple income streams you’ve built? Now’s the time to turn them into oceans, vast and limitless.

So, in a nutshell, scaling is the point where systems, manpower, time, finances, and leverage all converge.

They join forces in this beautiful, chaotic mix, each amplifying the other, to create not just growth, but explosive, knock-your-socks-off growth.

It’s where you take that newfound freedom, your deeply personal ‘why,’ and use it to create a life—and a world—completely in sync with your dreams and values.

And that, my friends, is not just the definition of success. That’s a masterpiece; that’s a life truly well-lived.

What does it mean to escape the rat race?

This is a question that’s going to have as many answers as there are people pondering it.

You see, we all have our individual “whys,” and that means everyone’s vision of liberation is going to look different.

For some, escaping the rat race might mean early retirement, where you hang up your work boots before hitting the big 5-0—or even earlier.

For others, it could mean generating enough money from multiple income streams so you’re no longer living from paycheck to paycheck, desperately trying to save money while life slips through your fingers.

And let’s not forget the entrepreneurs among us. For them, breaking free might involve starting and running their own business, scaling it to the point where it no longer demands their constant attention.

They set things in motion so that they can step back and watch their empire flourish, all while they sip piña coladas on a remote beach.

But no matter the specifics, the underpinning theme here is freedom of choice. Imagine waking up every day knowing you don’t have to do anything you don’t want to do.

You don’t have to crawl into an office and plaster on a fake smile for eight hours. You don’t have to do soul-destroying work just to barely scrape by.

You’re not driven by external pressures but by your own goals and desires.

Freedom of choice doesn’t just give you the power to decide how to spend your days; it lets you craft those days in a way that brings you closer to your true self.

You get to invest time in relationships, in activities that enrich your soul, in travel, or in simply doing sweet nothing.

So how do you get to this point? Well, you’ll need enough money, for starters. Enough not just to pay the bills, but to give you options—to invest, to splurge, to save, to give, to live.

The trick is to go beyond merely surviving and to create a life where you’re thriving, where your finances are just another tool to unlock the life you’ve always dreamed of.

And that’s what escaping the rat race is truly about. It’s not just a financial goal; it’s a state of being.

It’s about attaining the kind of life where you’re the undisputed master of your destiny, living on your own terms.

Whether that involves early retirement, saving up a hefty nest egg, or running your own business, the objective remains the same: Freedom. Sweet, glorious freedom.

Ready to get out of the rat race?

If you’ve made it this far into the blog, I’d bet my last pound you’re at least thinking about it. You’re fed up with the monotony, the drudgery, the financial constraints.

You’re eyeing a future where passive income flows into your account, where you make more money while doing less of the work you loathe.

Don’t underestimate the power of scrutinising your spending habits either. If you’re spending everything you earn, you’re running on a financial treadmill—lots of effort, but you’re not going anywhere.

Look at your monthly expenses, and figure out what can be cut without sacrificing your quality of life. The money you save can be funnelled into investments that bring you closer to financial independence.

Financial independence doesn’t mean you’re loaded. It means you’re free. Free to make choices that align with your aspirations, not constrained by immediate financial obligations.

And let’s be real, that freedom starts with you getting more money and channelling it wisely—whether that’s into passive income sources, better spending habits, or investments that lower your monthly expenses.

FAQs

Is there a way to escape the rat race?

Yes, there absolutely is a way to escape the rat race, but it requires a strategic approach that combines understanding your “why,” diversifying your income streams, leveraging what you have, and scaling your efforts

It’s not just about making more money; it’s about making smarter financial decisions that compound over time.

Why is it hard to escape the rat race?

It’s hard to escape the rat race because many people are stuck in a cycle of earning and spending without a long-term plan.

You get comfortable with the status quo—your 9-5 job, monthly expenses, and lifestyle choices—all of which anchor you to a system that doesn’t foster rapid growth or financial independence.

Am I in the Rat Race?

If you’re trading your time for money, living paycheck to paycheck, and feel like you’re stuck in a never-ending loop of work and spending little room for growth or freedom, you’re in the rat race.

Being in the rat race is not just about your job or income; it’s a mindset that prioritises immediate gains over future prosperity.

How To Escape The Rat Race - Conclusion

So there we have it, the ultimate guide to ditching that monotonous 9-5 and escaping the rat race. Remember, it starts with your “why”—your reason for wanting to break free.

From there, it’s all about upskilling your financial literacy, conducting that essential financial check-up, and diversifying your income. And let’s not forget the magical elements of leverage and scaling.

Enough passive income is your endgame here. Whether it’s real estate investing, stock market investing, or some other venture, the aim is to have your money work so hard for you that you’re covering your living expenses without even lifting a finger.

Achieving financial success isn’t just about accumulating wealth; it’s about having the freedom to live on your terms.

So, go out there and make your money your most reliable employee. Equip yourself with the knowledge and skills needed to navigate through financial complexities and make informed decisions.

If you’re serious about your exit strategy, it won’t be long until you’re out of that rat race, not just surviving, but thriving.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.