Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

As a business owner myself, getting a mortgage at first seemed like a complex and challenging process.

However, with the right knowledge, preparation and help of a great mortgage advisor (shout out to Peter), I navigated through the mortgage application process and secured the loan that suited my needs.

I’ve documented the entire process of how to get a mortgage as a business owner below so you can walk away from this feeling a bit better about it.

In this article, we will explore the steps and considerations involved in obtaining a mortgage as a business owner, covering important topics such as income verification, credit requirements, lender options, and more.

Key Takeaways:

- Business Owner Challenge: Mortgages for UK business owners are intricate due to unique income patterns and heightened lender scrutiny. Still, many succeed with the right approach.

- Eligibility Essentials: Business owners should prioritise income verification via key documents, uphold a strong credit score, and be aware of their business’s legal implications.

- Choosing a Lender: Beyond high-street banks, there are lenders and brokers tailored for business owners, offering custom mortgage solutions.

Table of Contents

How to get a mortgage as a business owner - The Challenge!

As if starting your own small business was hard enough that they have to make getting a mortgage this way too!

But unfortunately, obtaining a mortgage as a business owner or indeed a self-employed mortgage is more complicated than applying as an employed individual. Anyone who tells you otherwise is lying.

Lenders just don’t favour you in the same way. Personally, I think this needs to be reviewed to allow wider access but that’s something I feel is way off!

Why is this?

Well, first you need to understand what mortgage lenders look for.

They will scrutinise the income and creditworthiness of business owners more carefully due to the potential volatility of self-employment income.

Additionally, business owners may face difficulty in proving a stable income stream compared to those with regular paychecks.

When I applied I was asked to send detailed income statements and business records. I was also asked to explain them in detail over the phone. Apparently, this isn’t normal but it just goes to show that sometimes it can be hard to get a mortgage as a business owner.

Despite the challenges I faced, many business owners successfully obtain mortgages every year.

Understanding the process and getting all of your documents ready can increase your chances of securing a mortgage deal that works for you.

That last thing you need is a mortgage lender stopping you from getting a mortgage!

Determining Your Eligibility

Before diving into the mortgage application process, it’s important to assess your eligibility for a loan.

Several factors will influence your eligibility as a business owner, including:

1. Income Verification

Income requirements for a mortgage are different when a business owner.

Instead of relying on payslips or P60s, lenders will consider business bank statements, HMRC tax calculations (often referred to as SA302 forms), company accounts, and personal bank statements when evaluating a business owner’s income.

To demonstrate your income, you may need to provide:

- Business bank statements: These documents offer an insight into your company’s financial health, helping lenders gauge your stability and profitability.

- SA302 forms: Issued by HMRC, the SA302 is a response to a request for a tax calculation. It shows the total income received and total tax due for a particular year. Both sole traders and directors of limited companies can use SA302 forms to prove their income when applying for a mortgage.

- Company Accounts: If you’re a director of a limited company, lenders may also ask for a set of your company’s most recent accounts. This includes profit and loss statements, balance sheets, and any associated accountant’s report. They help lenders understand the business’s overall health and how much you’re drawing as a director.

Finding a specialist mortgage broker like Boon Brokers that are familiar with the requirements of business owners can be beneficial in navigating the complexities of the mortgage application process in the UK.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

2. Credit Requirements

Creditworthiness is a pivotal factor for lenders when assessing mortgage applications.

For business owners in the UK, your personal credit score holds weight in a lender’s decision-making calculus.

A credit score above 600 is viewed positively, but a score of 700 or above could unlock more advantageous terms and interest rates.

- Sammie’s hot tip:

If your credit score hovers around 600 or dips below, consider dedicating the next six months to bolstering it. By the time you apply, your score will be in the best shape it can be.

Strategies to enhance your creditworthiness include:

- Timely Bill Payments: Ensure you consistently meet deadlines for personal and business bills. Punctual payments are pivotal in fostering a commendable credit history.

- Debt Reduction: By curtailing both personal and business debt, you improve your credit utilisation ratio — a clear testament to astute financial stewardship.

- Credit Report Vigilance: Routinely inspect your credit reports. This not only guarantees they’re accurate but also empowers you to swiftly rectify any anomalies or inaccuracies.

- Credit Card Usage: Aim to maintain credit card balances below 30% of your limit. Staying below this marker signals prudent financial conduct to lenders.

If any of the above is out of sort. Work on improving your credit score to get a mortgage before even thinking about applying for a mortgage.

3. Legal Status of Your Business

Lenders assess the legal status of your business to gauge its stability and credibility.

In the UK, your business might be registered as a sole trader, a partnership, or a limited company.

Understanding your business’s legal structure is vital when applying for a mortgage, as each comes with distinct prerequisites.

Make sure to have the necessary documentation on hand:

- Sole Trader: As a sole trader, you’ll likely need to provide personal bank statements and financial records, possibly including a self-assessment tax return, to demonstrate your income and creditworthiness.

- Partnership: If you’re part of a partnership, be ready with partnership agreements, profit and loss accounts, and potential partnership tax returns to showcase your proportion of the business earnings.

- Limited Company: As a director or shareholder, prepare your Confirmation Statement, Certificate of Incorporation, and annual financial statements. These documents will confirm your business’s legal status and offer insights into its financial health.

Researching Lender Options

After assessing your eligibility and collating the required documents, the next step is to investigate the lender options available.

Whilst high-street banks remain a popular option, your specific situation might be better served by specialist lenders or mortgage providers who offer bespoke solutions tailored for business owners.

Contemplate these lending avenues:

- High-street banks: The big names on the UK high street, like Barclays, HSBC, and NatWest, can offer competitive mortgage rates. They might have products specifically for business owners. However, their lending criteria can be stringent, and they may request a comprehensive set of documentation.

- Specialist lenders: Lenders such as Kensington Mortgages or Precise Mortgages cater specifically to niche segments, including self-employed individuals and company directors. They’re attuned to the unique financial scenarios that entrepreneurs frequently encounter and can often be more flexible when it comes to income assessment.

- Mortgage brokers: Leveraging a mortgage broker’s expertise was key for me when applying for my mortgage. They have access to what is called the ‘whole market’ so they can easily see what products are available and whether you will suit that lender’s requirements.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Begin the Mortgage Application Process

Having established your eligibility and scouted potential lenders, you’re ready to embark on the mortgage application journey.

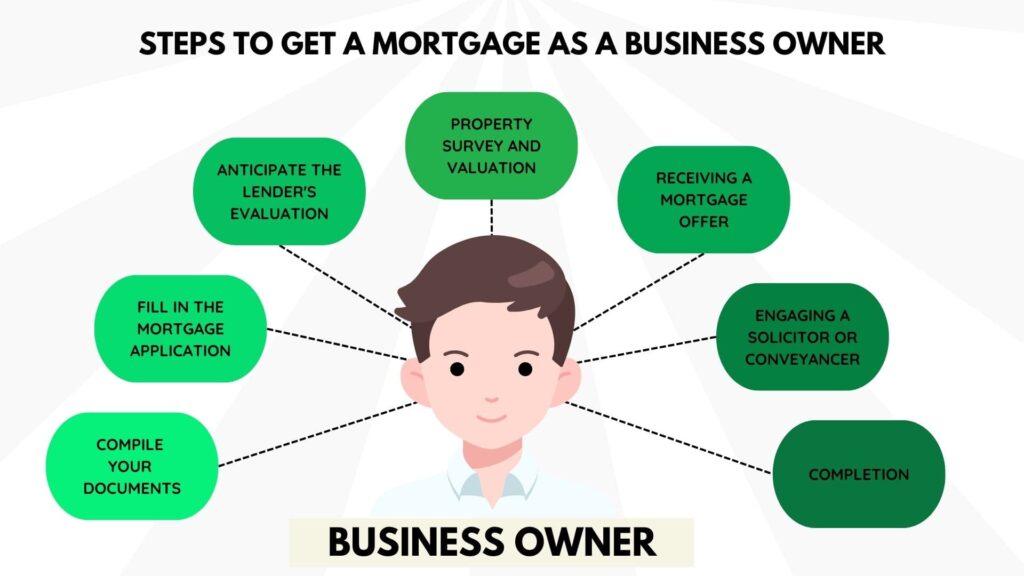

The exact process might differ from one lender to another, but generally, you can expect the following stages:

- Compile Your Documents: You’ll need a range of documents: personal ID, proof of address, bank statements, and evidence of earnings. For business owners, this often includes company accounts and possibly SA302s, which provide proof of your income as reported to HMRC.

- Fill in the Mortgage Application: Complete the lender’s mortgage application form, ensuring every detail matches your accompanying documents. Double-check everything; discrepancies can cause delays.

- Anticipate the Lender’s Evaluation: Upon receiving your application, lenders will scrutinise your credit history, verify your income, and assess your paperwork. It’s a detailed process, so expect some back and forth as they might request further information or clarification.

- Property Survey and Valuation: The lender will commission a survey of the property you’re purchasing. This is to gauge the property’s worth, ensuring it’s a viable security against your mortgage.

- Receiving a Mortgage Offer: Once satisfied, the lender will present you with a mortgage offer. This document will lay out the terms of your mortgage, including the interest rate, repayment period, and any associated fees. It’s crucial to go over this carefully.

- Engaging a Solicitor or Conveyancer: As you near the finish line, you’ll need a solicitor or conveyancer to manage the transaction’s legal aspects. They’ll handle property searches, and contract examinations to ensure the property’s seamless transfer into your name.

- Completion: Come completion day, your chosen legal representative will manage the funds’ transfer. Once this is done, congratulations are in order – you’re the proud owner of a new property! From this point, you’ll start your mortgage repayments as detailed in your agreement.

What happens if my business is growing?

If your business is showing steady growth, it can be advantageous when applying for a mortgage.

Lenders appreciate a trajectory of increasing profitability as it suggests financial stability and paints a positive picture of your future earning potential.

- Demonstrate Growth: You should be prepared to show evidence of this growth, typically through company accounts, SA302 forms, or tax returns over the past 2-3 years.

- Lender Flexibility: Some lenders might be flexible if you’ve experienced a particularly profitable year recently, taking the latest year’s figures into greater consideration rather than averaging out over multiple years.

- Financial Fluctuations: However, rapid growth can sometimes be viewed with caution if not paired with stability. For instance, if your income significantly fluctuates from year to year, lenders might be apprehensive about your ability to sustain mortgage repayments, especially during leaner periods.

What happens if I’ve changed my business's legal status recently?

Changing your business’s legal status, for example from a sole trader to a limited company, can complicate the mortgage application process, but it’s not insurmountable.

- Previous Financial History: Lenders usually prefer to see a consistent trading history under the same legal structure. If you’ve recently changed your business’s legal status, it might disrupt the continuity of financial records. Be prepared to provide financial documents for both the old and new legal statuses.

- Reason for Change: It’s beneficial to clearly communicate the rationale behind the change. If it’s a strategic move to facilitate growth or bring in additional shareholders, it could be seen in a positive light. On the other hand, if it was done to mitigate losses or manage debts, lenders might be more cautious.

- Lender’s Discretion: Different lenders have different policies regarding changes in business structure. Some may consider the income from your previous status in their assessment, especially if the nature of the business and your role in it haven’t drastically changed. Others might only consider income generated post the change in legal status.

What about remortgaging as a business owner?

If you want to remortgage when self-employed or as a business owner you follow the same steps as you would when you apply for a new mortgage.

Lenders will generally look at the business the same way but also take into account whether you’ve been paying your mortgage along the way.

If you stick with the same lender then this process is quite quick, but if you decide to move lenders it can be a bit lengthier depending on the circumstances of the case.

FAQs

What income documents do I need to provide as a business owner?

Lenders generally require business bank statements, tax returns (personal and business), and financial statements to verify your income as a business owner.

These documents help lenders assess your income stability and make an informed decision regarding your mortgage application.

How does my credit score affect my chances of getting a mortgage as a business owner?

Your credit score plays a significant role in determining your creditworthiness as a business owner.

A higher credit score generally increases your chances of obtaining favourable mortgage terms and interest rates.

Lenders will review your credit history to assess your financial responsibility and ability to meet repayment obligations.

Are there specific mortgage lenders for business owners?

Yes, there are mortgage lenders who specialise in providing mortgages to business owners and self-employed individuals.

These specialist lenders often have a deeper understanding of the challenges faced by business owners and may offer more flexible income verification options.

What is the role of a mortgage broker?

A mortgage broker acts as an intermediary between you, the borrower, and the lenders.

They have access to a wide range of lenders and can help you find the most suitable mortgage options for your needs.

Mortgage brokers can assist in navigating the complex mortgage application process, saving you time and potentially finding better mortgage terms.

What factors should I consider when choosing a lender?

When choosing a lender, consider factors such as interest rates, repayment terms, fees, and customer service.

Evaluate the lender’s experience with business owners and their willingness to work with self-employed individuals.

It’s also worth considering their track record of approving loans for business owners and their flexibility in income verification requirements.

Can I use my business accounts instead of personal accounts for income verification?

Yes, as a business owner, you can provide your business bank statements, tax returns, and financial statements to verify your income.

These documents provide lenders with a clear picture of your cash flow and financial stability as a business owner.

How long does the mortgage application process typically take?

The mortgage application process can vary depending on various factors, including the lender and the complexity of your financial situation.

On average, the process can take several weeks to a couple of months.

Being well-prepared with all the required documents and responding promptly to any additional requests from the lender can help expedite the process.

Conclusion

Navigating how to get a mortgage as a business owner in the UK requires careful preparation and a thorough understanding of the lending landscape.

With diligent financial documentation and a keen awareness of credit health, business owners can successfully secure their ideal mortgage.

Exploring a mix of mainstream and specialist lenders further enhances the chances of a favourable outcome.

If I can do it. So can you!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.