Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

The big question that’s on most of our minds today is how to make a million pounds?

If you’ve not won the lottery or have a rich family member most of the time you’ll need to work for it or get lucky.

In this article we discuss how to make a million and what it takes to get there from nothing.

Key Takeaways

Set yourself some goals and have a plan

Invest for the long term – it doesn’t happen overnight

Use our ‘live a little’ strategy to create a budget you can maximise

It all begins and ends with you

Table of Contents

How to make a million pounds?

To get there you’ll need to:

- Increase your income

- Invest in buying a business, property, stocks and bonds

- Budget like a total pro

- Live within your means

- Lower your outgoings

Now you might not need to to all of these things but combining them one by one can see you absolutely fly towards to your targets.

I’m sure you’ve all come across an advert, website or YouTube video promising to make you a millionaire overnight.

They sound great right?! I mean, of course, they do because who doesn’t want to be a millionaire? I certainly do!

Unfortunately, these promises to make you a millionaire in 30 days are 99.99% of the time lying to you. Yes, I’ve said it, lies, they’re all lying to you.

I’ve yet to hear a success story to date and don’t expect I ever will, but if you do hear of one then please do let me know!

The pathway to a million is not complex. Contrary to what you read in the media you do not need a million-dollar idea or to work yourself into the ground or even win the lottery.

It certainly helps, but there are easier ways to create wealth. All you need to do is follow the above and you’ll get there.

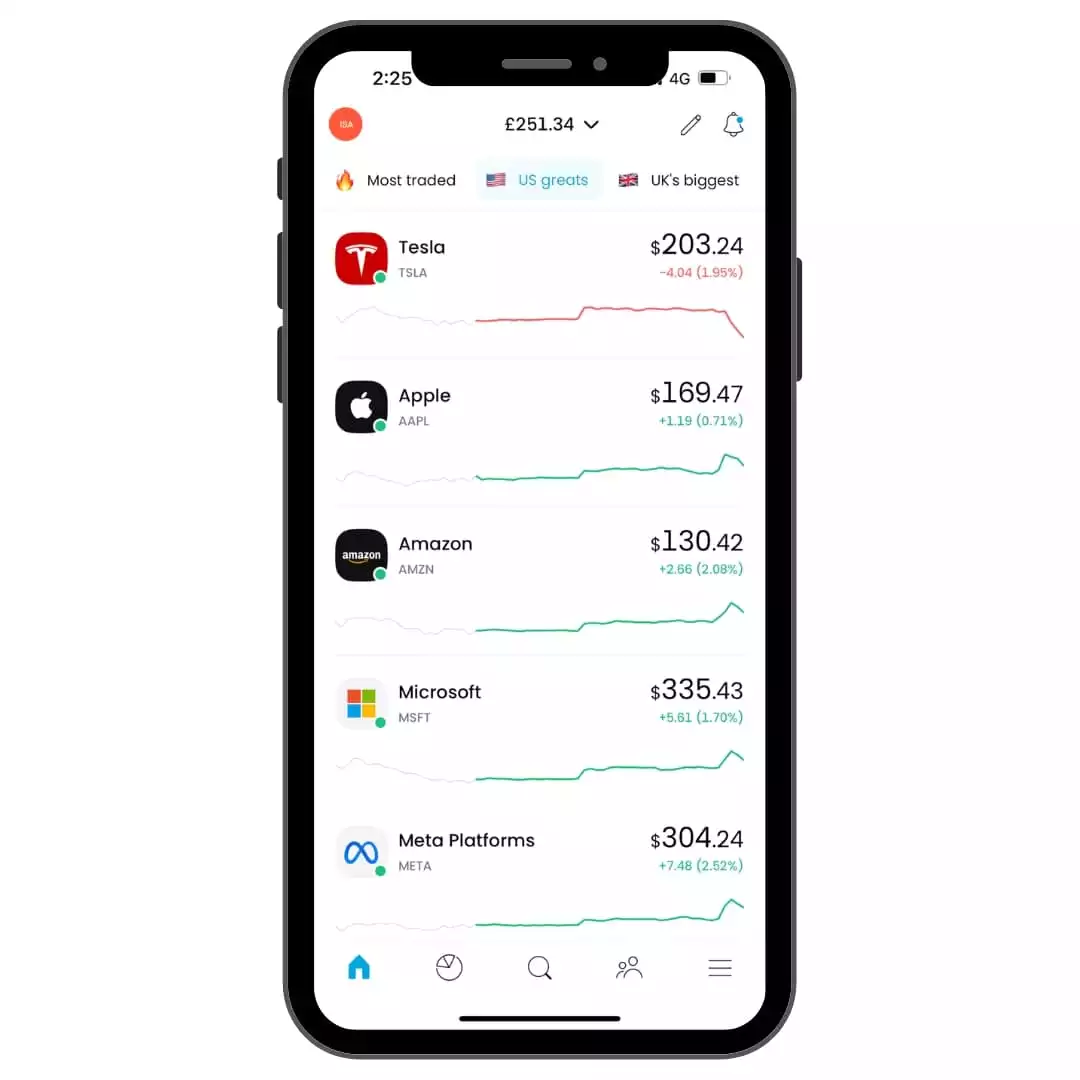

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Improving your income

To make a million pounds somehow, somewhere you’re going to need to increase your income. If you don’t then the timeframes for you will be very different.

In most cases this comes from ownership or equity in a business. This would come from owning shares of that business either via direct ownership or the stock market.

Businesses are working around the clock and if you don’t earn whilst you’re asleep then you’ll have to work a lot harder to make a million.

Ways you can make a million:

- Start or buy a profitable business

- Develop a side hustle that turns into high value income

- Invest in property or flip your own home multiple times

- Buy stocks and bonds

- Receive equity where you currently work

Value creation and improving your income is the fastest way to make a million pounds.

How to make a million pounds from nothing?

Many side hustles and small businesses can be started from almost nothing and combining this with some strong investments will shorten the length of time it takes to get to a million.

Really it’s like pushing a snowball off a mountain and watching it gather snow (wealth) on the way down which results in a ball of cash.

That being said, you don’t need to start a business, it just helps, so another way without setting up a business or side hustle is by investing in the stock market but this would require some capital.

To make a million from nothing you’ll need to be savvy and smart with your business and investing decisions as building something up from the ground up is a lot harder.

How to start investing to make a million pounds?

That’s the issue I find when speaking to the majority of beginner investors. Where an earth do you start?

There’s too much information around to process about the stock market and it can often be difficult to decipher the good stuff which will actually make a difference.

If you master just the basics you can actually be hugely successful.

Most of my close friends and family have had a go at investing, dabbled a bit, failed and never went back to it. Why, because in most cases they traded a lot and lost their money. Investing is an art, the art of patience.

So what’s the secret? Well, long term investing!

What we mean by this is putting your money into stocks via reputable businesses that are continually growing over a number of years, normally 10 or more.

You don’t need to make investing hard. Following basic strategies like investing in index funds or blue chip stocks means you’re just investing in the largest businesses in the world at all times.

That’s really it. You can read a million books about investing strategies, but in the end, picking plain old index funds usually beats individual stock picking.

Why you might ask? Well,

If you want, you can get technical and earn a lot faster, but for those who are just interested in making some money whilst they carry on living then trust me it’s more than possible to do it like this.

We touch more on this style of investing later in the post.

Here’s a little survey I ran with 100 people on our most recent monthly newsletter. The questions I asked were as follows:

SURVEY RESULTS

Have you ever tried a get rich quick scheme?

87% said yes.

If they answered yes, did you make any money?

All but one person said no. I emailed that one person and they had pressed the wrong button! It wasn’t my lucky day.

When you began investing for the first time did you lose money?

72% said yes.

Is this time your first time getting into investing?

46% said yes.

If they answered no, I asked. Did you stop investing because you lost money through trading too often?

98% said yes.

On average how often do you trade / invest now?

Everyday – 27% / A few times a week – 48% / Once a month – 22% / A few times a year – 3%

Now you can see a clear pattern emerging here. Those who trade often are more likely to lose money. Those who knee jerk react to news, blogs or inadequate advice are investing using their emotions and not sound advice that we’ll go through in a moment.

So, what’s the magic answer well as we’ve spoken about earlier. Increase your income through business ventures, side hustles and property, then invest that income with a long view.

Next we touch on how to do this.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

How to make a million overnight?

Unfortunately there aren’t many way to make a million overnight. Some ways could include the lottery, inheritance, selling your businesses or home.

It’s so important not to get sucked into any get rich quick scheme. They lure you in with the promise of riches when really in most cases they’re just scams.

We would love to help show you something that can make you a million pounds overnight, but realistically for 99% of us we’re going to need to take the longer road.

How often should beginners invest?

I’ll let you in on a little secret. It’s once a month. Time after time we’ve run into people who try to do what’s called timing the market. This is when they’re trying to buy when the stock market is at its lowest and selling when the market is at its highest.

Whilst this sounds great in theory. There isn’t one person in the world who can tell you what the stock market is going to do tomorrow. There’s informed decisions made, but there’s million of variables at play which affect it that make it almost impossible to predict.

Therefore why play with so many variables. By doing what’s called dollar cost averaging into the market you’ll eventually win out.

Dollar cost averaging is buying with the same amount or more each month into your chosen investments. Same time, same place. Every month.

If you can build up enough capital to retire early, then you’ve nailed it! Trust me just by doing that it’s more than possible to make a million!

How to buy stocks that make me a million?

There are a thousand different ways but as a beginner, you can easily invest in what’s called an Index Fund or ETF without needing tonnes of experience.

This style of investing (if you pick funds/indexes correctly) can earn you over 10+ years an average of 11-12% every year.

The markets have risen each year by this much on average since the ’20s. The proof is in the pudding just a simple Google search can show you that.

Index funds track the top 100, 500 or even 5000 of the biggest stocks in a particular country. The beauty of these funds is they’re managed for you and automatically follow the top companies.

For example, if one of those 500 stocks underperforms, it’s simply replaced by another that’s doing much better. You don’t need to lift a finger or worry about what the markets are doing, it’s all done for you.

ETFs are a selection of handpicked stocks managed by a Fund Manager. The Fund Manager will buy and sell stocks in the best interest of the investor and their funds’ principles or rules. This is what’s called active management.

Both indexes and ETFs are super easy to invest in and require little to no effort from you at all.

The reason we say 10+ years is because over one year, the market might underperform or even crash and it could take a year or more to recover. It’s normal for the stock market to go down, but don’t let that stop you from investing each month.

The Live a Little Strategy - How to make a million?

We have a strategy to help us get ourselves to a million pounds in the fastest but we feel safest way possible. We call it the ‘live a little’ strategy.

A lot has been written about the 50/30/20 rule to split your money and whilst that is certainly a fantastic way to create financial freedom, we’re talking about how to make a million pounds here so we need to up our game!

What is the 50/30/20 rule?

The 50/30/20 rule is a split of income based on creating financial freedom and security. 50% is for your non-negotiable outgoings, 30% on your wants and 20% towards saving, debts and investing.

The ‘live a little’ strategy follows a very similar vein but we’re aiming to lower our outgoings so we have 30% to invest rather than 20%. Over time this can lower the time is takes to make a million pounds by over a third.

We’re here for a short while in the grand scheme of things and so it’s very important we make the most of it and that’s why we’ve kept the wants at 30%. Life is to enjoy!

Although, whilst it’s important to have fun and live your life to the fullest, we recognise equal importance in setting yourself up for an easier life later down the line and allowing yourself some financial freedom when you get there.

Write down your monthly earnings and then list out your outgoings. Once you’ve done this you’ll need to break down your outgoings into three segments. Give them each a number to keep it simple.

Key Steps

Your non-negotiable costs such as your mortgage, rent, monthly bills and debt payments.

Your negotiable costs such as your food bills, Netflix subscription, clothes, haircuts, morning coffees and dining out.

Lastly with whatever is left put that amount into segment 3

Running this simple exercise will help you evaluate exactly what’s important and what isn’t. There are often things you can cut down on from number 2.

For example, you could save a lot of money by making your morning coffee at home or simply bringing in a packed lunch for a couple of days a week. Trust me there’s always something on there you can cut down that often won’t affect you in the slightest.

Once you’ve nailed this, we aim to follow a 40/30/30 split from your three segments.

40% of your salary should go on your expenses such as your mortgage, rent, household bills and petrol. If you can get that figure down below 40%, then fantastic. More to invest!

Often renegotiating any deals you have in places such as your mortgage, electricity bills or car loans can help free up some much-needed cash.

30% on your wants, this is for food, clothes, a Friday night beer, a hot date, Netflix or those new trainers you’ve had on your wish list.

The last 30% you should try to put aside into your savings and investments. Don’t beat yourself up if it’s only 5 or 10% for now, but do your best to work it up to a number you’re comfortable with.

Keep trying to raise this section, put things like bonuses or unexpected windfalls into this section. It’ll pay off!

You can put the ‘live a little’ strategy into action in just a few short minutes and also use the ultimate master spreadsheet that I’ve built especially.

Help me calculate how long to a make a million

I don’t want to be that guy telling you to ‘STAY AT HOME’, don’t breathe, don’t even move a muscle. Rubbish.

Don’t listen to those guys. It’s important we enjoy ourselves otherwise seriously what is the point?

Moderation and knowing your limits, well, that’s something only you can teach yourself.

If you want to be a successful investor and learn how to make a million then this is the section that needs the most thought.

So you’ve got your magic number written down. Now you can calculate the length it’ll take you to make a million pounds using a simple compound interest calculator.

For this example, 30% of your salary could add up to £500 a month.

If you invest £500 a month every month with an average gain of 11% per annum, it’ll take you 25 years and one month to get to a million. If you want to get there faster, you need to put away more. That’s the reality.

However, if you’re happier with a much lower amount you could easily be a successful investor putting away low amounts. You just need to re-align your goals to match this.

If you start picking individual stocks, you might see higher increases than what you might get from an index fund or ETF.

That, however, requires time, research, effort, luck and a constant finger on the pulse. The majority of us don’t have that time and want to enjoy our lives as much as we can. I’d ask you why get involved when you can let someone else with more experience do it for you?

You could for example just employ a professional financial planner to do everything for you. They have their benefits and experience, which of course is great if you really don’t have the time or patience to learn.

That being said, we prefer not to hand over any unnecessary fees to others when just learning the basics can provide you with similar returns.

If you do want to find out more then visit our investing for beginners page where you can learn all about the stock market, how to invest safely and top tips to get started.

In our free monthly newsletter, we provide top tips, how-to guides and reviews on our favourite funds and of course stocks. You can subscribe for free below