Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

When you’re looking to apply for a mortgage, heading online makes things as straightforward as possible.

By finding an online mortgage adviser, you can be sure that you’re getting access to the best deals as well as a helping hand with the online mortgage application process.

The days of having to spend hours sitting in a bank or office are, thankfully, long behind us.

When looking at how to apply for a mortgage online, it has to be said that this approach brings a range of benefits.

It was once the case that you’d have to arrange face-to-face meetings with a mortgage adviser and booking a convenient appointment was challenging, to say the least.

Now, you can apply for a mortgage online from the comfort of your own home at whatever time you want to.

I clearly remember applying for a mortgage the first time. It was back in 2000 and I had no idea about how to find the right mortgage. I got myself suited and booted and arranged to meet with a mortgage advisor.

When the best mortgage product was found, it was then over to the bank for a meeting there. Of course, one meeting was never enough and the back and forth soon became time-consuming.

The online mortgage application process is so much easier and smoother. I’m going to share a step-by-step guide so that you can use online tools to find the best mortgage deal.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Table of Contents

How to apply for a mortgage online - step by step

So, you’ve found your dream home after months of house hunting, you’ve viewed via the estate agent and now you’re ready to move forward.

How do you move from enquiring to mortgage application to owning your own home? Let’s start at step 1!

1. Exploring how much you could borrow

The first step is to find out how much you could borrow. There’s little point in going much further with the application process if there’s no chance of securing the funds that you need.

Mortgage lenders will allow you to borrow a certain multiple of your salary so that’s your starting point.

Typically, a mortgage company will lend you 4.5 times your annual salary.

The average income in the UK is around the £32,000 mark so that means the typical person could apply for a mortgage of £144,000.

That being said, there are other things to consider too. These include:

- Deposit – before you can buy a house with a mortgage, you’ll need a house deposit. Typically the deposit will need to be at least 5% of the purchase price

- Other debts – the lender will consider your financial circumstances and other credit commitments that you have

- Stamp duty – depending on the valuation of the property you’re buying, you may need to factor in paying stamp duty

Using one of the many online mortgage calculators will give you a better idea of the amount that you could borrow.

What if I want to borrow more?

You may feel that you can comfortably afford the mortgage repayments, but a lender may not be prepared to lend the needed amount.

It could be that your income is too low or that checks with credit reference agencies cause concern.

If that’s the case, there are still options open to you. One of these options is to explore a guarantor mortgage.

This is when a family member supports your online mortgage application. If you fail to make payments going forward, your guarantor becomes liable.

2. Understand loan to value

Now you have an idea of how much you could borrow, before you go ahead and apply for a mortgage, you need to work out the loan to value (LTV).

All that this means is that you need to look at the amount you want to borrow and compare this to the property value. If you were offered 90% LTV, and the property was worth £100,000, you’d then be able to borrow £90,000

The LTV matters as it will have an impact on the mortgage rates that you’re offered. This means that there is an effect on your monthly payments.

Here’s a look at how to work out your LTV. I’ll assume that your deposit is £25,000 and you’re borrowing £100,000:

- First, add your deposit to the amount you want to borrow = £125,000

- Divide your deposit by the answer above = 20%

- Take that answer away from 100 = 80

- Your LTV is 80%

- Head online to find a mortgage deal

3. Explore current mortgage deals

Step 3 is all about exploring current mortgage deals that are out there. Mortgages vary from lender to lender, and you need to get a flavour of what’s out there.

Now’s not the time to submit a mortgage application. Instead, it’s about looking at what the monthly payments would be if you were able to borrow the amount that you want.

The best way of finding this information is by using an online mortgage comparison tool. These tools give you information such as:

- The name of the mortgage provider

- The interest rate

- Length of the initial deal (after this you tend to revert to a standard variable rate)

- The mortgage term (how long it lasts)

- Other costs and fees to consider (valuation fees etc)

- The overall cost

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

4. Explore online mortgage advisers

A mortgage adviser is worth their weight in gold. Just like the mortgage process has moved online, so have these mortgage advisers. Your job is to find a great one who will find the right mortgage for you.

They can tailor advice to your personal circumstances. They’ll know how your income, your job situation and your credit report will affect any applications.

They can ensure that you’re only applying to lenders with the best chance of being accepted.

Using a mortgage advisor when applying for a mortgage online has other benefits too. They deal with literally everything on your behalf, meaning that all the details are sorted, and you can pretty much sit back.

What does a mortgage advisor do?

Before they can offer you any advice, a mortgage advisor will need to get to know about you and your financial circumstances.

They’ll also need to know if you’re a first-time buyer, a home mover or looking to remortgage.

They also need the details of the property you’re hoping to buy or, at least, an idea of the amount that you’re looking to borrow.

To get the best out of a mortgage broker, you need to be 100% honest and upfront with them.

There are plenty of people who feel uncomfortable when it comes to talking about money, but this is one of those times when you really need to overcome this.

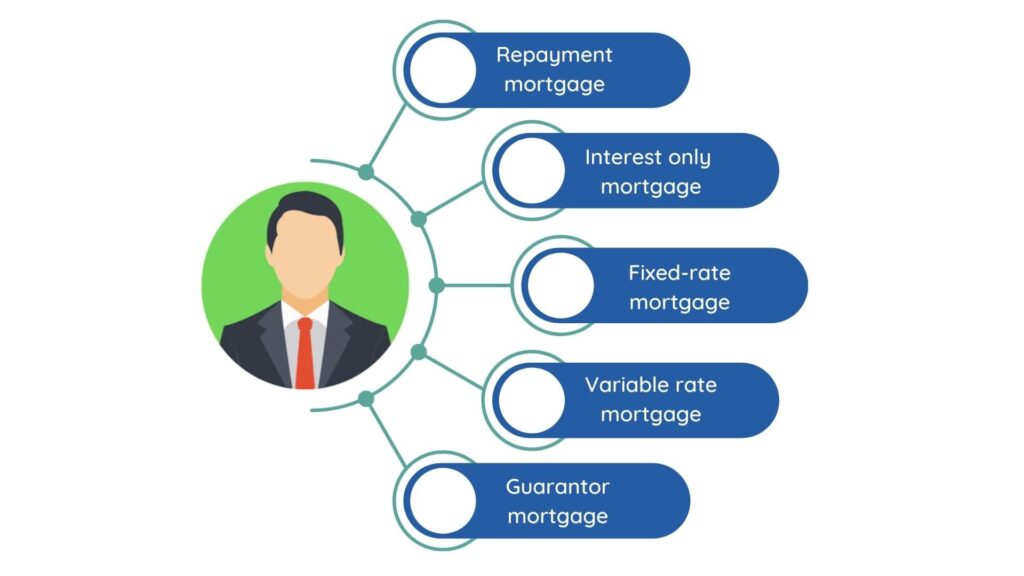

As well as helping you to find a cheap mortgage deal, the advice that they give will also be based on the type of mortgage that best suits you. The main types to choose from are:

- Repayment mortgage

- Interest only mortgage

- Fixed-rate mortgage

- Variable rate mortgage

- Discount rate

- Offset mortgage

- Guarantor mortgage

As well as offering advice on the best mortgage product for you, you’ll also be given advice when it comes to the mortgage provider that’s worth approaching.

You can also find an online mortgage advisor that does everything through a portal but to be honest I prefer having a call first and then taking it online.

The other benefits of using a mortgage broker

The great thing when you receive advice from a broker is that you have legal protection. That’s because they’re authorised and regulated by the Financial Conduct Authority (FCA).

This means that, based on the details you provide, they can only offer advice that’s right for your personal circumstances.

In the unlikely event of things going wrong, your agreement with a broker means that you may be able to get compensation via the Financial Services Compensation Scheme (FSCS).

5. Apply online and get your mortgage agreement in principle

Before you receive a formal mortgage offer, you first need the assistance of your broker to secure a mortgage agreement in principle.

This is a document that shows that you’re a serious buyer. You can use it to show the seller’s estate agent that you have an offer and that you’re able to move forward.

As part of getting your agreement in principle, the lender is likely to carry out credit checks. At this point, it will only be a soft credit check. That means that, if for any reason you’re turned down, it won’t affect your credit report.

The good news for you is that step 5 is dealt with by the broker on your behalf.

However, by the end of it, you’ll have the mortgage details that you need such as the interest rate, the mortgage repayments, any mortgage fees and the term.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

6. Your online mortgage application

This is when things start to feel a little more real. With your house chosen, a mortgage agreement in principle and you raring to go now’s the time to submit your mortgage application.

Don’t worry, your broker will offer advice and assistance with this step too.

Things to be aware of when you submit your full mortgage application are:

- Lenders will now carry out a hard credit check. This will show on your credit history going forward and can be seen by other lenders

- Lenders will want bank statements from your current account to show your regular income and outgoings. They need to see a steady income that’s reliable

- They will ask to see your driving licence as part of verifying your identity

- You’ll need to have utility bills ready to show your current address

- If you’re self-employed, most lenders will require years accounts

When the lender has all of the details that it needs, it will start to consider your application.

Mortgage applications aren’t always the quickest of things, but your broker will chase on your behalf if there are delays. Within a matter of weeks, you should receive your formal mortgage offer.

With your mortgage offer in hand, you’re good to go and secure the purchase of your property. Applying for a mortgage online is so much easier than how things used to be!

What happens next before you own your property?

Before your chosen property is yours, there are a couple of extra things to get out of the way. Firstly, the lender will want a property valuation to ensure that it is worth what you’re paying.

This valuation is basic and if you want a more detailed survey carried out, you can opt to pay for this.

After that, it’s over to your solicitor. Your solicitor will liaise with your lender and ensure that the funds are released at the right time.

FAQs

How long does the mortgage application process take?

Generally, from the time that you make an offer on a property to the time that you’re mortgage application is approved is around 2-6 weeks.

Once you have a mortgage offer, it will be valid for around 6 months. If you go over six months, you may need to apply again.

Do I have to use a mortgage broker?

No, you’re more than welcome to liaise directly with a bank or other lender to arrange your mortgage.

However, with a broker, you get access to a massive range of mortgages, and you get plenty of advice and hand-holding when required.

Final thoughts

Hopefully, you now understand how to apply for a mortgage online. The process may seem a little intimidating but it’s far more straightforward than many people think.

The ability to apply for mortgages from the comfort of your home has been a real game changer.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.