Best ETF Platforms UK 2024

DISCOVER THE BEST ETF PLATFORMS IN THE UK RIGHT HERE

Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Are you looking to invest in ETFs (exchange-traded funds) well you’ve come to the right place. ETFs have been gaining in popularity with beginner investors and more seasoned investors alike.

Why? Well, they offer investors a diversified portfolio and make it much easier to keep track of your investments. With an ETF you’re buying a basket of stocks for one price which is why they’re so attractive.

So let’s get into it, these are our best ETF platforms in the UK right now!

Best ETF Platforms List

InvestEngine - Best Pick Overall

Key Features

- Ready made & DIY ISAs

- Annual Platform Fees: 0% -0.25%

- Minimum deposit: £100

For ETF investing, we don't think you can get better than InvestEngine. It's literally what they do.

There are no fees on their DIY portfolios for 500+ exchange-traded funds from iShares, Vanguard and Blackrock.

They also have expert-managed options that manage your money for just 0.25% a year.

EXCLUSIVE OFFER - Get up to a £50 BONUS when you invest your first £100 (T&C's Apply)

- Lowest fees on the market

- Brilliant for beginners

- 4.5/5 Trustpilot score

- Does not pay interest on cash balances

- No pensions

What I like about InvestEngine

InvestEngine offers access to over 500 exchange-traded funds from leading brands like Vanguard and Blackrock (iShares).

They offer both ready-made portfolios depending on your personal risk tolerance and the opportunity to choose your investments yourself.

Their fees are very low compared to the other accounts here, and they are very easy to set up with an account online in minutes.

eToro - Best ETF Trading Platform For Beginners

Key Features

- A diverse range of assets

- 0% commission on stocks and ETFs

- Minimum Initial Deposit: £45 (£10 after)

eToro is a popular trading platform with over 28 million users worldwide. It's social trading at it's finest where you can interact with other investors and even copy their portfolios.

It's extremely easy to use and the app is my favourite investing app out there right now.

This one is highly recommended for beginners who are looking to get started. They also have a fantastic academy too.

- Little to no fees

- Copy trading features

- Highly engaging app

- Popular with millions of investors

- No ISA available just general investment accounts

What I like about eToro

Having been an eToro user for 6 six years, both as a desktop and mobile user, I was immediately struck by its sleek, modern interface.

For a beginner, this platform demystifies the trading realm with its user-friendly design. A standout feature? Their impressive array of assets ensures that even as a novice, you’re not limited in choice.

But it’s not merely about variety; eToro’s innovative Copy Trading system is a game-changer. It allows users to leverage the strategies of top-performing traders, a hands-on learning experience in real time.

While I’d appreciate an enhanced educational segment, they do offer extensive courses some are by my good friend Sam North, Head of Training at eToro who we interviewed on The Money Gains Podcast recently.

eToro’s specialised portfolios, like AI Revolution and BigTech, caught my eye – they offer thematic insights that resonate with contemporary market trends.

Also, the eToro Money app, a nifty solution for UK users, neatly sidesteps hefty foreign exchange costs. Although there are some fees, they’re transparent, with no hidden surprises.

Given my personal experience and its multifaceted offerings, it’s no wonder eToro stands tall as our highest-rated app on our best investment app page.

You can also read our full UK eToro review here.

Hargreaves Lansdown - Best Traditional ETF Broker

Key Features

- DIY & Ready made ISAs

- Annual Platform Fee: Varies by fund / £11.95 per trade (Single stocks)

- Min Deposit: £100 lump or £25 per month

Hargreaves Lansdown - they're a FTSE 100 heavyweight with over 1.7 million clients in the UK

If you're after a more traditional broker with a brilliant reputation then HL is the most trusted in the UK for retail investors like you and me.

They charge a trading fee of £11.95 per online ETF trade, but here's the twist: No platform fee for ETFs held in a Fund and Share Account. And if regular investing is your game, selected ETFs (we're talking over 280 of them) come with zero trading fees.

- Wide range of the top ETFs in the world

- Highly trusted, award winning broker

- Incredible extensive research available

- Fantastic customer support

- The app can take a bit of getting used to

What I like about Hargreaves Lansdown

My personal experience with Hargreaves Lansdown, especially their app, has largely been coloured by its reputation as the UK’s most trusted trading platform—and rightly so.

As a FTSE 100 giant, their commitment to financial security and nurturing long-term client relationships is palpable. Their expansive offering, granting access to over 15,000 instruments, sets them apart.

I’ve had the privilege of manoeuvring through an extensive menu of funds, UK and overseas shares, ETFs, and more.

Their detailed insights on fund compositions and performance data have been invaluable. I’ve trusted them enough to have our SIPP there, which speaks volumes.

Their ready-made portfolios also offer an element of simplicity and assurance for those not wanting to delve into the nuances of individual stock picking.

However, no platform is without its caveats. While their extensive offering and research tools make them a beacon for beginners and intermediate traders, the trading fees—especially on individual stocks—nudged me to relocate my Stocks and Shares ISA.

Seasoned traders looking to engage in high-frequency trading might find the fees burdensome unless you are trading with high amounts (1000s per trade).

But for those prioritising research depth, security, and an array of investment choices, Hargreaves Lansdown holds its ground as one of the best trading platforms in the UK, reflecting its deserved spot in the FTSE 100.

Trading 212 - Best ISA Available

Key Features

- DIY and Ready Made ISAs

- Annual Platform Fee: 0 - 0.25%

- Min Initial Deposit: £100

Trading 212 presents a fusion of affordability, versatility, and user-friendliness that's hard to beat. With over 2 million users that accommodates everyone from beginners to experienced traders with an easy to use app.

This platform has earned its reputation for being a beginner-friendly hub for dipping toes into the trading world, while also catering to seasoned traders seeking more advanced options like CFDs.

It's also one of the most affordable platforms out there. Trading 212 is all about commission-free trades, coupled with some of the lowest fees when buying foreign stocks, thanks to their minimal currency conversion fee.

- 4.6 Trustpilot score (Ranked Excellent)

- Easy to use app

- Commission-free Real Stocks and ETFs trading

- AutoInvest & Pies feature

- Limited product portfolio (No bonds or mutual funds)

What I like about Trading 212

From the moment I first logged into Trading 212, I felt a connection to its interface that I hadn’t experienced with other platforms.

Every time I executed a trade without being hit by commissions, I couldn’t help but think back to days where I’d begrudgingly pay anywhere from £3 to £11.95 per deal with other brokers.

Using Trading 212 was like a breath of fresh air. Their impressive selection of over 12,000 shares made me feel like a kid in a candy store, and the almost non-existent trading fees were the sweet deal I’d been searching for. Of course, no platform is perfect.

I did notice a few areas they could improve upon, like adding copy trading or delving into cryptocurrencies. But these were mere specks in an ocean of positives for me.

What solidified my fondness for Trading 212 wasn’t just its features but also the human touch behind the screen. The few times I reached out to their customer service, I felt genuinely heard and valued. They also provide access to CFD trading accounts.

For anyone on the fence about trying a newer platform, I can personally vouch for the enriching experience Trading 212 provides.

Fees: Commission Free – 0.15% FX fee

Instruments: Stocks, ETFs, CFDs, Investment Trusts

Account Type: Share Dealing Account, ISAs and CFD trading accounts

- Disclaimer:

Your capital is at risk when you invest. Trading can be highly volatile. Seek qualified advice if necessary and always do your research.

Plum - Best Mobile App

Key Features

- Ready made & DIY ISAs

- Annual plaform fee: £12 (first month free)

- Min Deposit: £1

Plum is a left-field option here if you're looking for a central place for your investments, savings and pension.

The app is incredible using smart AI to predict your saving and investment patterns and allocating them to your chosen pots.

They offer interest on your savings pots and access to over 3000 stocks and 21 leading funds.

- Smart AI to auto save and invest

- Incredible user experience in app

- ISAs available

- Limited selection of funds

What I like about Plum

We love Plum. It’s a super slick and easy to use app that’s also in the robo advisor category. Signing up took less than 5 minutes.

It connects all your banks, displaying a real-time view of your income and expenses alongside 21 investment funds and over 3000 individual stocks to choose from.

It can also make recommendations for your investing based on your income and spending habits and can then automatically invest into your chosen funds each month.

They have a free option which is brilliant and paid upgrade available too!

We particulary like the dashboard where you can see your savings pots and investment portfolio results.

Coming Up Next:

- How do I rank the Best ETF platforms? – Buyers Guide

- What Is An ETF?

- How does an ETF work?

- What Do ETF trading platforms mean?

- How to choose an ETF?

- Pros & Cons of ETF Investing

- Are ETFs the same as index funds?

- How To Buy An ETF in the UK?

- How Do ETF Trading Fees Work?

- How Do ETF Trading Platform Fees Work?

- Buying ETFs inside an ISA

- Buying ETFs inside a pension

- Frequently Asked Questions

- Recap the Best ETF Platforms In the UK

How do I rank the Best ETF platforms? - Buyers Guide

Investing in ETFs is a great way to start investing but how am I ranking these investing apps and why are they any good for you?

Well, great question and I want to be as open and transparent as I possibly can to ensure I have covered all of the most important bases for you.

I think there are 7 major factors you should consider when choosing the best platform for you.

These 7 key points are:

-

Fees – Nobody likes paying high fees so I’ve made it as clear as possible for you on our list of apps. Keeping as much of your money as possible is extremely important. After all the pennies make the pounds and all that!

-

Funds Available – It is important that you have a selection and not be limited to just a handful of ETFs. The range across sectors but equally country and continent is important so you have the options to cover most of the stock market.

-

ISAs available – I want you be as tax efficient as you can so investing inside a stocks and shares isa is a good way to start. It’s not essential for ETF investing but the less you pay the tax man the better!

-

User experience – Nobody likes a clunky, difficult-to-navigate app so user experience is paramount for me. One because I don’t want to spend ages finding the best ETF for me and two because I want the key info served up to me quickly!

-

Customer Reviews – Checking the reviews from current customers are a great way to assess an ETF broker. If it’s receiving good reviews across the board it’s the sign of a great place to trade ETFs.

-

Security – ETF trading platforms are storing your money so it’s vital they use banking-level security and equally are FCA regulated (financial conduct authority). Ideally, you also want FSCS protection which will mean should the company go bust your money is secured up to the value of £85,000.

-

Education and Resources – The best ETF trading platforms are the ones that help you make decisions. They don’t just take your money and invest it they look to help you grow as an investor.

What Is An ETF?

An Exchange-Traded Fund (ETF) is a specific type of investment vehicle that behaves like a single stock yet encompasses a broad array of distinct investments. The diversity within an ETF can span across a variety of sectors, asset classes, or commodities, depending on the structure and goal of the ETF.

The process of acquiring an ETF is akin to purchasing shares from a singular entity, such as Microsoft or Alphabet (Google). The prospective investor uses their preferred investment platform or trading application to connect with a stock exchange.

For instance, Microsoft’s shares are listed on NASDAQ, a prominent U.S. stock exchange. To acquire shares in Microsoft, you would place your order via your chosen application or platform, which then interfaces with NASDAQ to coordinate the transaction.

Now, consider an ETF as an umbrella that covers a multitude of individual investments. These assets are not limited to a single company or sector but can represent a broad spectrum of industries and geographies.

Therefore, when you purchase an ETF, you’re essentially acquiring a diverse portfolio encapsulated within a single investment vehicle.

How does an ETF work?

Before delving deeper into the ETF ecosystem, we must understand the fundamentals. Let’s focus on the ‘F’ in ETF, which stands for ‘Fund.’

Essentially, a fund is a reservoir of investments pooled from multiple investors and managed by a professional investment firm.

For example, if an investment manager initiates the ‘Automotive Titan Fund’ focused on car companies, they will collect capital from investors and distribute it across companies like Ford, Tesla, GM, and Volkswagen.

The fund not only specifies the kind of assets it will contain (like car companies in this case), but it also outlines the strategy to be employed to generate returns.

The strategies may focus on high-growth prospects, consistent dividend-yielding companies, or something else entirely.

There is a vast array of fund types catering to varying investment tastes. Some funds have a narrow focus like the automotive fund, while others might span across an entire nation’s stock market.

Some even encapsulate the entire global stock market.

While stocks constitute a major chunk of these funds, there are other asset classes represented, including bonds, real estate, precious metals, infrastructure, and even cryptocurrencies in some cases.

The nuts and bolts of this is you get to purchase a basket of stocks or asset class inside a fund for one single price. Most of these will be held on the London Stock Exchange or New York Stock Exchange.

What Do ETF trading platforms mean?

ETF trading platforms, essentially, are your personal gateway to the wide world of Exchange-Traded Funds. Hailing from the tech-savvy realms of brokerage firms, they’re user-friendly online services that enable you to trade ETFs with just a few clicks or taps.

These platforms are loaded with various features – from real-time price tracking that helps you keep an eye on market trends, to a suite of research tools that’ll make Sherlock Holmes proud.

You’ll also find portfolio management resources to keep your investments in check and a wealth of educational materials that’ll turn you into a seasoned investor in no time.

Household names in this arena include giants like Vanguard and Fidelity. And then we have the new kids on the block – fintech companies like eToro and InvestEngine, stirring things up with their innovative low fee offerings.

But, keep your wits about you. Each platform comes with its own fee structure (more on this shortly), which might include transaction fees, account fees, or management fees. So, it’s worth taking the time to shop around, compare the costs, and find a platform that doesn’t make your wallet wince.

Remember, the right platform for you hinges on your individual needs.

- Are you looking for specific ETFs?

- Do you need certain tools?

- What fees are you comfortable with?

These are the questions to ask yourself as ETF investors before choosing your ETF provider. So, roll up your sleeves, do a bit of homework and you’ll find the platform that’s the right cup of tea for your ETF trading needs!

How to choose an ETF?

Choosing an ETF involves several factors, which can vary based on your individual financial goals, risk tolerance, and investment horizon. Here are some key considerations to keep in mind:

Investment Objective: Understand your financial goals. Are you investing for long-term growth, income, or a combination of both? ETFs can cater to a variety of needs, such as growth, income, or even specific sectors or themes.

Asset Class: Decide on the type of asset you want exposure to. ETFs can be focused on a variety of asset classes including stocks, bonds, commodities, real estate, and even cryptocurrencies.

Index: ETFs typically track a specific index. Research the index and understand its constituents. If it’s a stock index, for example, know the sectors, industries, and specific companies it represents.

Diversification: Look at how diversified the ETF is. Some ETFs focus on specific sectors or regions, while others span multiple sectors or even countries. If you’re looking to reduce risk, an ETF with broad market exposure might be a better choice.

Cost: Consider the expense ratio, which is the annual fee that all funds or ETFs charge their shareholders. It’s deducted from the fund’s assets, thus reducing its returns. Lower cost ETFs typically passively track an index while higher cost ones are actively managed.

Liquidity: Look at the ETF’s trading volume. ETFs with higher trading volume generally have lower bid-ask spreads, making it easier for you to buy and sell without impacting the price too much.

Fund Size and Age: Consider the size and the age of the ETF. Larger, more established ETFs might offer more stability and liquidity.

Tracking Error: This refers to how much the ETF’s performance deviates from the index it’s supposed to track. A lower tracking error indicates the ETF is doing a good job replicating the index performance.

Tax Efficiency: ETFs are structured in a way that allows investors to minimise their capital gains taxes. However, the level of tax efficiency can vary from one ETF to another.

Dividend Yield: If you’re looking for income, you might want to consider the ETF’s yield – the income return on an investment, derived from the dividends received and expressed annually as a percentage based on the ETF’s current market price.

Pros & Cons of ETF Investing

Pros of ETF Investing

Diversification: ETFs usually represent a basket of different securities (stocks, bonds, commodities, etc.), offering a simple way to diversify your portfolio.

Accessibility: ETFs can be bought and sold like individual stocks through a brokerage account, allowing investors to trade them throughout the trading day at market prices.

Transparency: ETFs disclose their holdings daily, so you always know what assets you own.

Lower Costs: Most ETFs are passively managed and aim to track a specific index, resulting in lower operating expenses compared to actively managed funds.

Variety: There’s an ETF for almost every asset class, sector, or investment strategy, offering a broad array of investment options to suit different goals and risk profiles.

Dividends: Many ETFs pay out dividends to their shareholders from the income they earn from their underlying assets.

Tax Efficiency: ETFs are structured in a way that allows investors to minimise capital gains taxes compared to mutual funds.

Cons of ETF Investing

Trading Costs: While the expense ratios can be low, frequent trading of ETFs can lead to brokerage commissions that can add up (unless your broker offers commission-free trades).

Liquidity Issues: Some niche or less popular ETFs might have lower trading volumes, leading to wider bid-ask spreads which can increase your trading costs.

Tracking Error: Not all ETFs perfectly track the performance of their underlying index. Differences in performance are known as tracking errors and can be significant in some cases.

Leveraged and Inverse ETFs: These types of ETFs can be extremely risky and complex, making them unsuitable for inexperienced investors.

Market Risk: Like all investments, ETFs are subject to market risk, meaning the value of the assets they hold can go up or down.

Dividend Payment Timing: Unlike individual stocks that pay dividends, the timing of ETF dividend payouts can be less predictable, which might not suit all investors.

Are ETFs the same as index funds?

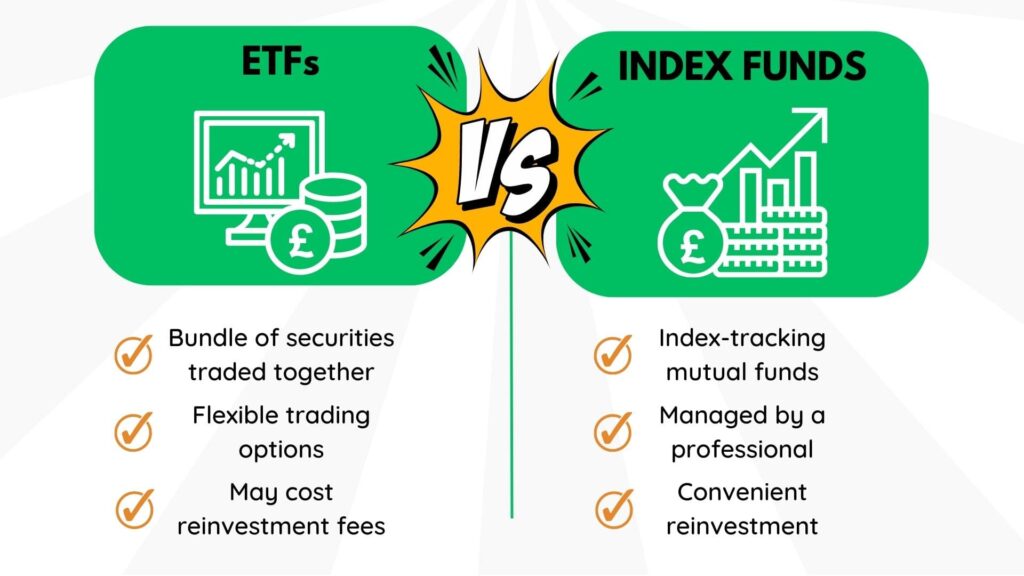

While ETFs (Exchange-Traded Funds) and index funds share similarities, they are not the same.

Both are types of investment funds, and many ETFs are indeed structured to track specific indices just like index funds. However, there are important differences in their structure, trading, and tax efficiency.

Here are some key distinctions:

Trading: ETF trades are like stocks on an exchange throughout the trading day at market prices which can fluctuate above or below the fund’s net asset value (NAV). Index funds, on the other hand, are a type of mutual fund. They are bought and sold through the fund company at the end of the trading day at the NAV price.

Investment Minimums: Index funds may require minimum investments, which could be a few thousand pounds/dollars, whereas ETFs can be purchased for the price of a single share, offering a potentially lower entry point.

Transaction Costs: When trading ETFs, you may incur brokerage commissions just like trading an individual stock (unless your broker offers commission-free trades). Index funds typically do not have transaction costs unless you’re buying a fund outside of your primary brokerage.

Management Style: Both ETFs and index funds can be passively managed (designed to track an index), but ETFs can also be actively managed. Most index funds are passively managed, aiming to match rather than beat market performance.

Dividend Handling: Index funds often give the option to automatically reinvest dividends, while with ETFs, the dividends are paid directly to investors, who can then decide whether to reinvest them.

Tax Efficiency: ETFs can have a tax advantage over index funds due to the “in-kind” creation and redemption process, which can help limit the capital gains distributions that investors must pay taxes on.

Both ETFs and index funds can be valuable components of a diversified portfolio, and the choice between them depends on individual investor preferences and circumstances.

How To Buy An ETF in the UK?

Buying an ETF in the UK is quite straightforward and follows a few simple steps.

Here’s a rundown of how to do it:

Open a Brokerage Account: The first step is to open an account with a brokerage that offers access to ETFs. These accounts are known to the everyday investor as retail investor accounts. There are plenty of options available, from traditional ETF brokers like Hargreaves Lansdown and Interactive Investor to newer platforms like eToro or InvestEngine.

Deposit Funds: After opening your account, you’ll need to deposit funds. This is typically done through a bank transfer, debit card, or a direct debit setup for regular investing.

Research ETFs: Before buying an ETF, do your research. Consider the ETF’s objective, the index it tracks, its costs, liquidity, the assets it holds, and its performance history. Online resources, financial news, and the ETF provider’s website can be helpful for this.

Place Your Order: Once you’ve decided which ETF you want to invest in, you can place your order. You’ll need to search for the ETF using its ticker symbol, specify how many shares you want to buy, and then submit your order. Most platforms offer different types of orders, like market orders (buy at the current market price) or limit orders (buy only at a certain price or better).

Monitor Your Investment: After buying your ETF, it’s important to keep track of your investment. Remember, investing should be for the long term, but it’s still essential to review your holdings periodically to ensure they’re meeting your expectations and fitting into your overall investment strategy.

How Do ETF Trading Fees Work?

ETF trading fees can come in several forms, and understanding how they work is crucial to making informed investment decisions. Here are the primary types of ETF trading fees you might encounter:

Brokerage Commissions: When you buy or sell an ETF, you may pay a commission to the broker that executes the trade. This fee can be a fixed amount per trade, a percentage of the trade value, or a combination of the two. However, many ETF brokers have started to offer commission-free trading for certain ETFs.

Bid-Ask Spread: This is the difference between the highest price that a buyer is willing to pay for an ETF (the bid) and the lowest price at which a seller is willing to sell it (the ask). This spread can be considered a cost associated with trading an ETF, particularly those that are less liquid.

Expense Ratio: This is an annual fee charged by all ETFs, expressed as a percentage of your investment. It covers the fund’s operating expenses, including management fees, administrative services, and other costs. Expense ratios can range from as low as 0.03% to over 1%, depending on the complexity and type of the ETF.

Premium or Discount: ETFs are traded on an exchange, just like stocks, and their market price can fluctuate throughout the day. Sometimes, the market price can differ from the net asset value (NAV) of the fund’s underlying assets, resulting in a premium (if the market price is higher than the NAV) or a discount (if the market price is lower than the NAV). Trading at a premium or discount can add to or reduce your effective trading costs.

Other Brokerage Fees: Some brokers may charge account maintenance fees, inactivity fees, or other charges that could indirectly affect the cost of trading ETFs.

How Do ETF Trading Platform Fees Work?

Trading Commissions: Quite a few platforms charge a commission every time you buy or sell an ETF. This fee can be a flat amount per trade or a percentage of the trade’s value, or it might be a combination of both. On the flip side, some brokers may offer commission-free trading on certain ETFs.

Platform Fees: Some trading platforms may charge you a recurring fee for using their services. This fee could be imposed monthly, quarterly, or annually, and could be a flat rate, a percentage of your account value, or both.

Account Maintenance Fees: This is a fee some platforms charge for maintaining your account. It might be a flat rate levied annually or a percentage of your account value.

Inactivity Fees: Some platforms charge an inactivity fee if you don’t make any trades for a certain period. The timeframe and the fee can vary considerably among platforms.

Data and Research Fees: Some platforms may offer additional research trading tools, premium data, or other valuable resources and charge extra for access to these services.

Currency Conversion Fees: If you’re purchasing an ETF in a currency different from your base currency (like buying a U.S.-based ETF from the U.K.), your platform may levy a currency conversion fee. This is a charge applied to convert your funds to the required currency. The rate can range from as low as 0.15% up to 1.5%.

Withdrawal Fees: Some platforms may charge a fee when you wish to withdraw money from your account.

Buying ETFs inside an ISA

Investing in an ETF within an Individual Savings Account (ISA) is a tax-efficient way to invest in the UK.

Here’s a step-by-step guide on how to go about it:

Select an ISA provider: There are many financial service companies in the UK that offer ISA accounts, including banks, investment brokers, and robo-advisors. Make sure to choose a provider that offers a stocks and shares ISA and has a wide range of ETFs to choose from. Also, take note of any account fees or trading commissions.

Open an ISA account: Once you’ve chosen your provider, you’ll need to open a stocks and shares ISA account. This process typically involves filling out an application form with your personal details and may involve a credit check or identity verification.

Fund your account: After your account is open, you’ll need to deposit funds. There are annual limits to how much you can deposit in an ISA. For the 2023/2024 tax year, the limit is £20,000.

Choose your ETFs: Now comes the fun part – picking your investments! Use your provider’s trading platform to browse available ETFs. Consider factors such as the ETF’s investment objective, underlying index, expense ratio, and past performance.

Buy your ETFs: Once you’ve selected an ETF to invest in, you’ll need to place a trade. This involves specifying how many shares of the ETF you want to buy and placing an order.

Monitor your investments: After your trade is executed, it’s important to regularly check on your investments. While ETFs are generally designed to be long-term investments, you should still keep an eye on their performance and adjust your portfolio as needed.

Buying ETFs inside a pension

Investing in ETFs within a pension scheme in the UK can provide a way to grow your retirement savings while also benefiting from certain tax advantages.

However, the process will largely depend on the type of pension you have. Here’s a general guide:

Choose a Pension Provider: In the UK, there are several types of pensions that allow investment in ETFs. These include self-invested personal pensions (SIPPs) and some workplace pensions. You’ll need to select a pension provider that offers the ability to invest in ETFs within their pension scheme.

Open a Pension Account: Once you’ve selected a provider, you’ll need to open an account with them. This typically involves providing personal details and agreeing to the terms and conditions of the pension scheme. If you’re setting up a SIPP, you’ll likely be responsible for managing your own investments within the account.

Fund Your Pension Account: Next, you’ll need to deposit funds into your pension account. These can be contributions from your income, employer contributions, or transfers from other pension schemes. Bear in mind, there are annual and lifetime limits to how much can be contributed to your pension to still receive tax relief.

Select Your ETFs: Now, you can choose the ETFs you want to invest in. You’ll want to consider a range of factors, including what assets the ETFs track, their past performance, expense ratios, and how they fit into your overall investment strategy.

Frequently Asked Questions

Most frequent questions and answers when it comes to the best investing apps UK

What are the best ETFs in the UK?

- Vanguard S&P 500 ETF

- iShares Dow Jones Industrial Average ETF

- iShares NASDAQ 100

- iShares Core FTSE 100

- iShares Index-Linked Gilts ETF

Do ETFs pay dividends?

Indeed they do! ETFs often pay dividends to their shareholders. These dividends come from the income generated by the assets they hold, such as stocks or bonds. It’s important to note that not all ETFs pay dividends and the frequency and amount can vary.

Can you make money with ETFs?

Absolutely! The primary way to earn money from ETFs is through capital appreciation, which is when the ETF’s price increases over time. Additionally, if the ETF pays dividends, this income can also contribute to overall returns. As always, remember that all investing involves risk, and it’s possible to lose money as well.

How many ETFs should I start with?

A good rule of thumb for beginners might be to start with a couple of diversified ETFs. This provides exposure to a wide range of assets, helping to spread risk. But always remember, investment decisions should align with your personal financial goals and risk tolerance.

What is the cheapest ETF broker in the UK?

Choosing a broker isn’t just about finding the cheapest option, it’s about finding the best value for your needs. Pricing structures vary among brokers and can include trading fees, account maintenance fees, and other costs. Some popular low-cost brokers in the UK include eToro and Trading 212, but it’s essential to research and compare.

How Often Should I Buy ETFs?

The frequency of buying ETFs can depend on your investment strategy. If you’re a long-term investor and using a strategy like dollar-cost averaging, you might make regular purchases, such as monthly. Always keep an eye on market conditions and adjust as needed.

How Often Should I Sell ETFs?

The decision to sell should be based on your investment goals and market conditions, not a set timeline. If an ETF no longer aligns with your strategy, or if market conditions change, it may be time to consider selling.

Can you trade ETF CFDs and spread bets?

Yes, you can! Both ETF CFDs and spread bets allow you to speculate on the price movement of ETFs without owning the underlying assets. Remember, trading CFDs and spread betting methods involve higher risk and are more suitable for experienced investors.

Recap the Best ETF Platforms In the UK

So, to recap the Best ETF platforms – our pick is InvestEngine for their low cost model that has access to 100s of different funds.

We also like eToro for sheer ease of use and how highly rated it is as a trading platforms. eToro also allows you to trade CFDs if this is something you’re interested in.

Good luck and happy investing!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.