Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Coast fire is a subtype of the FIRE movement. Standing for Financial Independence Retire Early, FIRE is about leaving the rat race and stopping work before the traditional retirement age.

Coast FIRE differs from the usual FIRE approach as there is a need to keep working. However, the job tends to be low stress and low pay and is needed while an investment portfolio grows.

Coast FIRE is seen as a gentler approach to achieving FIRE and is easy to reach. You’ll find that your Coast FIRE number is significantly lower than your traditional FIRE number would be.

If you’re looking for a path to early retirement, Coast FIRE could well be the answer. When compared to traditional FIRE, it is much easier to reach Coast FIRE and enjoy life away from the stresses brought about by an all-in career.

While Lean FIRE requires a frugal lifestyle and Barista FIRE offers something similar to semi retirement, Coast FIRE is a somewhat slower journey to financial independence.

It allows people to be part of the FI community when other types of FIRE seem out of reach.

I’m going to be taking a closer look at just what Coast FIRE involves. I’ll be sharing how it can help you to achieve your financial goals, and how it works in terms of retiring early.

Table of Contents

What is Coast FIRE?

Coast FIRE, or Coast Financial Independence and Retire Early, is the concept of reaching financial independence and then coasting through work with a reduced income or part-time work to cover living expenses.

Essentially, learning how to escape the rat race and enjoy retirement as early as possible.

There are great similarities when looking at Coast FIRE and another type of FIRE called Barista FIRE. With Barista FIRE, you find a part-time job or even start your own business as a way to cover day-to-day expenses.

By this point, your investment portfolio is sufficient to cover your main annual expenses, and a job allows you to top up your income as you only semi-retire.

With Coast FIRE, you have enough money invested to allow for retirement, and you can stop contributing.

That’s because, with compound interest, your investment returns will be enough to cover your retirement.

However, you still need to work in the meantime to maintain your current expenses. The idea is that you look for an easier job that you can ‘coast’ through until you retire.

Coast FIRE is a less aggressive form of traditional FIRE. With the regular FIRE, you need to save as much money as possible and build a portfolio.

This portfolio allows you to achieve financial independence and retire long before the traditional retirement age. It’s not unheard of for people to achieve FIRE in their 20s or 30s.

Fat FIRE is an even more disciplined approach where you manage to save and invest, but you don’t go without life’s luxuries.

If you’d like to start your journey and achieve Coast FIRE, you need to be sure that it’s right for you.

You need to calculate your Coast FIRE number to establish how much you need to save and you then need to be happy to continue working longer than those who take the regular FIRE approach.

How to build your Coast FIRE strategy

There are several steps to take when pursuing Coast FIRE. These are:

Setting achievable financial goals

You first need to use a Coast FIRE calculator to establish your Coast FIRE number. This is based on how much money you’ll need to cover your living expenses in retirement.

You’ll need to continue working your regular job until you know your portfolio will deliver without further contributions.

It’s then time to review your household expenses and establish what you need to do to maintain your lifestyle until retirement.

An affluent lifestyle will clearly require a higher-paying job, but the idea is to find a job that’s as stress-free as possible. This means that you need to review what you need to enjoy life.

Any goals you set, should follow the acronym SMART, and be reviewed regularly. SMART stands for:

- Specific

- Measurable

- Achievable

- Relevant

- Timescale

Creating a sustainable budget

To achieve Coast FIRE, you need to have a clear understanding of your income and expenses. By reviewing your annual spending, you can identify areas where you can cut back so that you can achieve FIRE faster.

It all starts and finishes with the best budget template. I use technology these days alongside my trusted spreadsheet.

Remember, when your portfolio reaches a certain level, you can stop saving. The idea is that, as long as your investments meet their expected growth rate, your retirement will be taken care of.

In the meantime, it’s about finding a job that will cover your current expenses.

The lower your financial requirements, the more freedom you’ll have when it comes to working.

Maximising savings rate

To reach FIRE faster, you need to get the most from your savings. You could explore passive income streams to build your nest egg quicker and set up automated savings so that you are contributing every single month without fail.

By reducing your levels of debt, you’ll have more money to save and invest. This means that you can make additional contributions each month and reach Coast FIRE in the shortest time possible.

Investing for growth and income

To reach Coast FI and early retirement, you need to take the right approach to investing.

By investing in the stock market, there are always risks and you need to be sure that you reach your expected growth rate so that you can achieve financial independence.

This means:

- Seeking advice from a certified financial planner if you’re unsure of where and how to invest

- Ensuring that your portfolio is diversified

- Balancing risk and reward with your investment decisions

Living the Coast FIRE lifestyle

Reaching Coast FI means embracing a new approach to living so that you can reach financial independence.

To have an impact on your retirement age, you’ll need to consider:

Embracing a frugal mindset

To achieve your retirement plan, you need to be sure that you have enough money to build your nest egg and increase your net worth, while also earning sufficient to live in the meantime.

This is so much more achievable when you take a frugal approach.

This involves:

- Mindful consumption – this is simply considering what you consume and purchase rather than purely making automatic decisions

- Prioritising experience over possessions

- Avoiding lifestyle inflation

- Staying motivated

Building alternative income streams

- Explore passive income opportunities to earn more without working extra hours

- Investigate side hustles as a way of earning more money

- Consider freelancing as a way of boosting your income

- Start your own business – the internet and online opportunities have made this easier than ever

Pursuing meaningful work

Coast FIRE means finding a job that comes without the stress associated with a typical career.

The work that you choose will be something that you need to continue with until your investments have benefited from compound interest and you can achieve financial independence.

This means that you need work that has meaning and aligns with your values. It also needs to be something that won’t lead to burnout.

Balancing work and leisure

An essential element of Coast FIRE is work but you need to ensure that this isn’t all-consuming.

As you strive towards financial independence, you still need to have the freedom to enjoy life. This means getting the right work-life balance. You can achieve this by:

- Learning when to say no

- Ensuring that you take breaks

- Making sure that you make the most of annual leave

- Putting your health first

- Focusing on your relationships

- Making the most of tech so that you can be as productive as possible

- Steer clear of time-wasting activities

The challenges and risks of Coast FIRE

Any journey towards being financially independent comes with some degree of risk, and Coast FIRE is no different.

Here are the factors that you’ll need to be aware of:

Uncertainty of future income and expenses

No one can predict exactly how the economy, or the stock market, will look a decade or so down the line.

If your yearly expenses increase and/or your income falls, you could find yourself coming up short.

To avoid this issue, you need to focus on building an emergency fund and safety net.

You can also protect your income by diversifying your income streams rather than relying on just one.

Inflation risk

Rising inflation can hamper your efforts to achieve Coast FIRE. You can minimise the impact of this with the right investment portfolio.

Seek out investments that are known to be inflation resistant and be prepared to adjust your financial plans and goals if inflation spikes.

You need to be sure that your investments will still be sufficient to cover your yearly expenses once you retire.

Market volatility

The ups and downs of the stock market can impact your journey to Coast FIRE.

You can mitigate the risks by diversifying your investments and, to coin a cliche, ensuring that your eggs aren’t all in one basket. It’s important to remain disciplined and trust your plan.

It’s too easy to allow emotions to take over when you see the value of your portfolio falling.

Generally, emotional decisions will be poor decisions. If you’ve sought professional advice, have faith in the plan and remember that it’s long-term results that matter.

Lifestyle creep

This can seriously impact your Coast Fire ambitions. It is when you start to improve your standards of living as you find yourself with more disposable income.

This can lead to you blowing your budgeting plans and quickly increasing your yearly expenses.

The key here is to remain disciplined and to practice gratitude. Appreciate what you currently have in your life and don’t become obsessed with always chasing more.

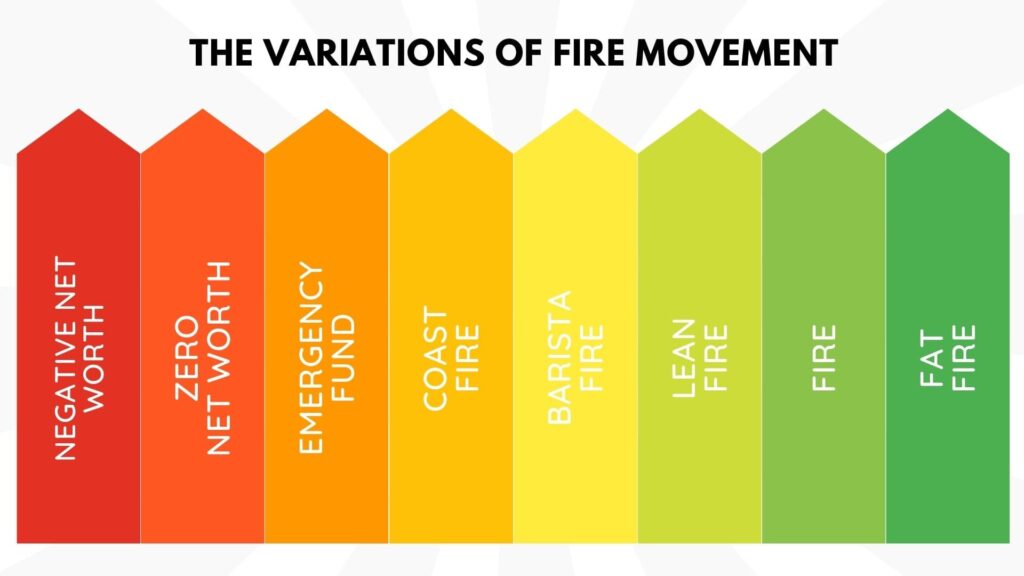

Different types of FIRE

The FIRE movement, aimed at achieving financial independence and early retirement, is gaining momentum and attracting various subcategories.

The following list outlines the different types of FIRE, ordered from the easiest to the most challenging to attain:

- Coast FIRE, or CoastFIRE, entails accumulating enough funds to discontinue contributions and still achieve FIRE at a later point in time. Calculate your FIRE number with the best Coast FIRE Calculator in the world!

- Barista FIRE, or BaristaFIRE, involves accumulating sufficient funds to retire early while concurrently working a part-time job for supplementary income and medical coverage. Get your Barista Fire on with the best Barista Fire calculator in the universe!

- Lean FIRE, or LeanFIRE, advocates the minimalist approach to attain FIRE, which means retiring with a meager budget.

- Traditional FIRE involves accumulating 25 times one’s annual expenses and retiring early, leveraging the 4% rule.

- Fat FIRE, or FatFIRE, on the other hand, refers to early retirement without adhering to frugality and opting to amass a more substantial nest egg.

Final thoughts on Coast FIRE and financial independence

When you calculate your Coast FIRE number, you’ll find that this is substantially lower than your regular FIRE number.

Rather than aiming for a traditional retirement, you focus on building your investments to a level where you can stop saving, knowing that compound interest will work its magic and allow you to meet your yearly expenses in retirement.

To check that Coast FIRE is right for you, the first step is to find your Coast FIRE number by using a calculator. When you have this number, seek out professional advice and get investing as soon as possible.

The sooner you start to build your nest egg and increase your net worth, the sooner you’ll hit that FIRE number and achieve financial independence.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.