Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quick Intro - eToro UK

I’ve held an eToro account for 4 years and use it almost everyday so there cannot be a better eToro review available on the internet right now.

I’ll show you a totally unbiased eToro app review!

For me, eToro is a fantastic place to learn how to trade and invest in the stock market.

I have used many investing apps and for me personally it’s one of the best out there.

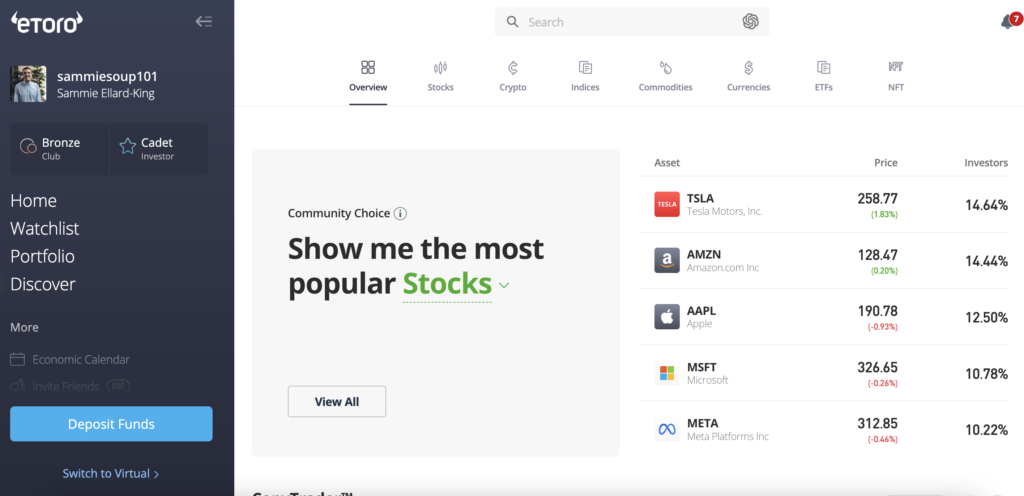

The app is quick, visually appealing and easy to navigate. It’s packed with over 3000 different assets to invest in plus is 0% commission when trading real stocks and ETFs.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

eToro Quickfire Roundup

- It’s simple to set up and open an account

- eToro is low cost with 0% commission on real stocks and ETFs

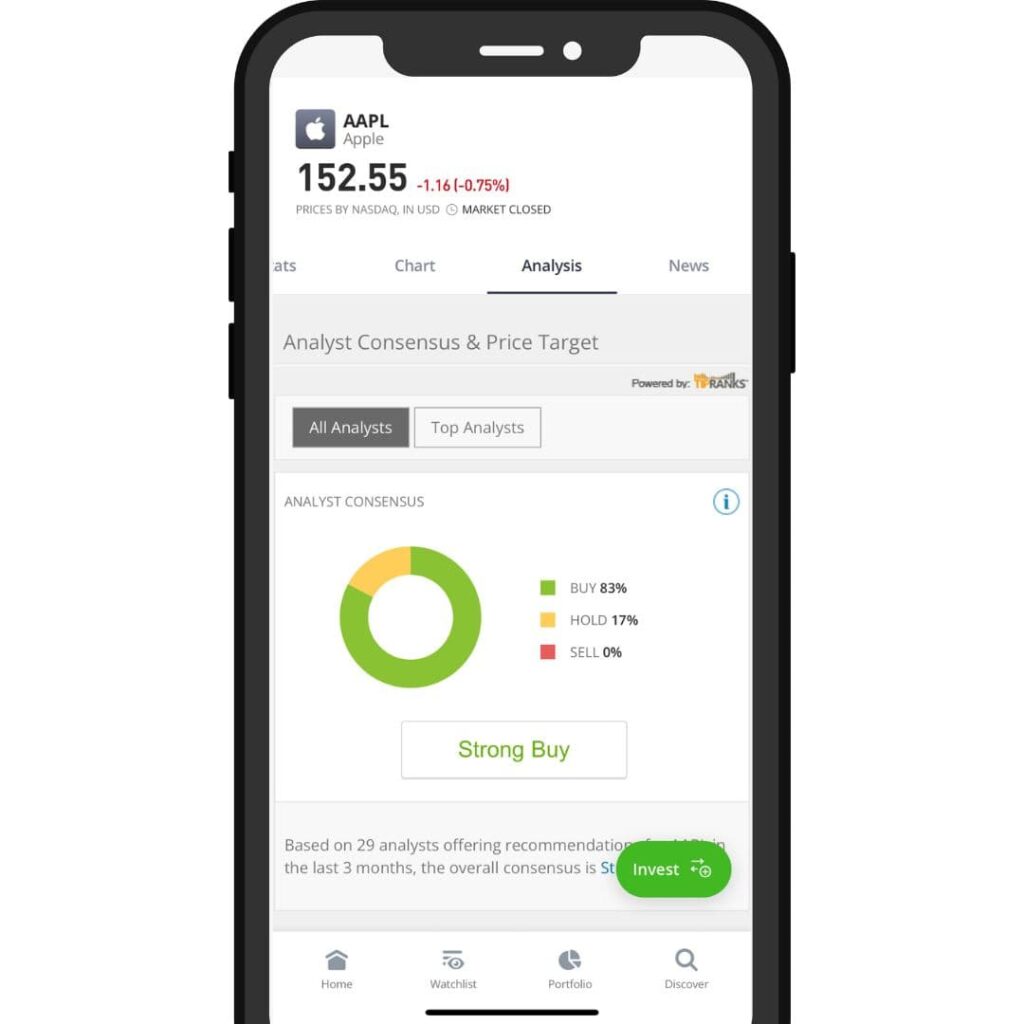

- The app has plenty of stock tools for beginners and more seasoned investors

- They have integrated analyst predictions to help with your research

- There’s access to top ETFs and funds by iShares, Vanguard and Fidelity.

eToro is suitable for both beginners and experienced investors with a wide range of stocks and tools to explore.

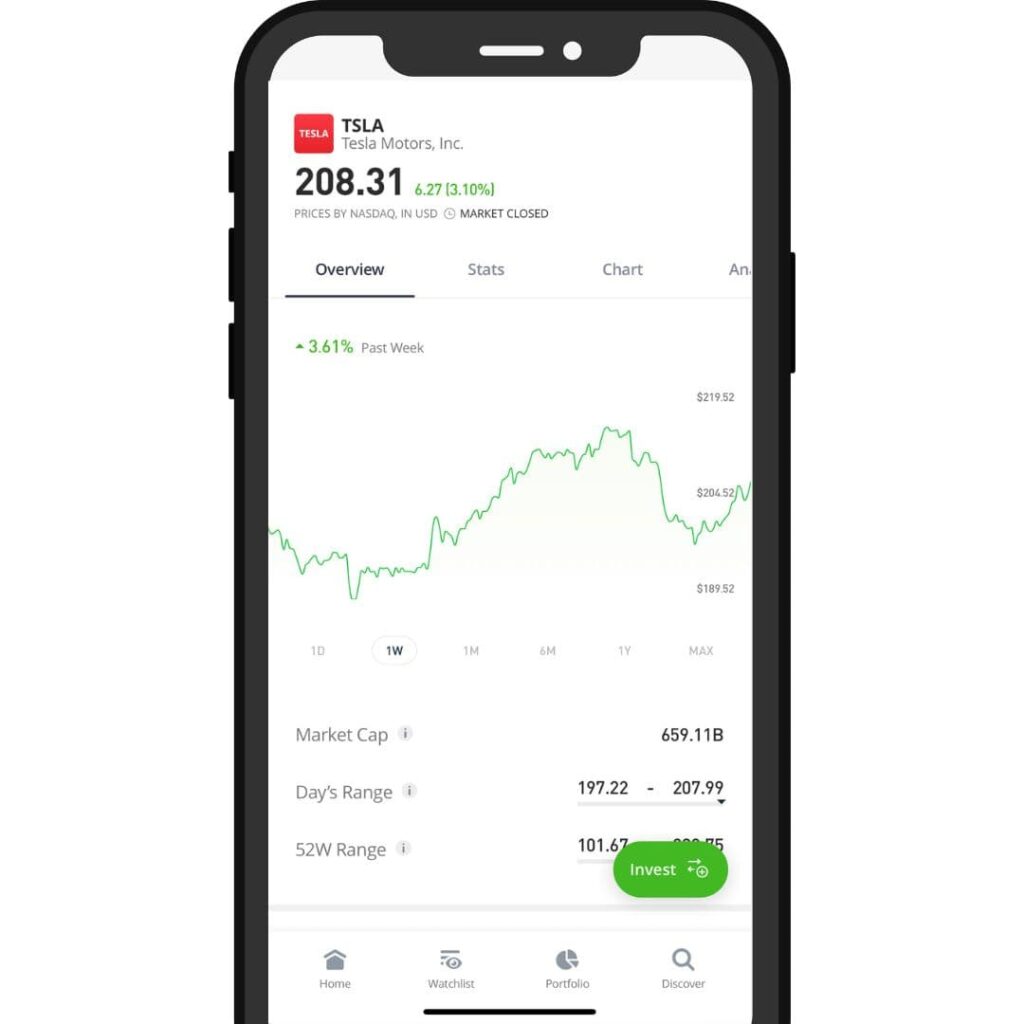

For beginners you can keep it simple using the basic visual charts but if you are a seasoned investor there is a full range of technical analysis tools also available.

For me the only thing that lets eToro down is the lack of an internal ISA (they have a partnered ISA with Moneyfarm) so you need to be aware of the capital gains tax implications of a general investment account.

Capital gains tax thresholds in the UK currently stand at profits on stocks of £6,000 in this current tax year so if you’re investing investing under £10-15k you should be totally fine.

If you decide to read on in the full eToro review, we unpack the brand, useful features, pros and cons, investing products, fees, and if you fancy it, open an account.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

eToro Rating

- Useful Features

- User Experience

- Price / Fees

- Suitable For Beginners

- Customer Feedback

- Customer Service

I’ve rated eToro 4.8 out of 5, which is extremely good for an investing app and is the highest score we have on Up the Gains.

eToro scored best on its useful features and user experience with 5 stars and scored lowest on its customer service even though this was 4.5.

If you’ve heard enough then head over to the eToro website or if you want more information let’s unpack it in more detail!

Is eToro good for beginners?

I think eToro is an excellent choice for beginners. Its academy has over 1000 hours of free content to help ensure you make the correct investment decisions, plus it has a wide array of investment options.

The app is fast, visual and easy to place trades plus has the social element where you can interact with other investors and even post your own thoughts.

There are over 3000 different assets available, including stocks, ETFs, cryptocurrencies and commodities.

eToro Competitor Analysis

| Platform | Fees | Asset Range | User Interface | Customer Support | Tools & Research |

|---|---|---|---|---|---|

| eToro | 4.5 | 4.5 | 5 | 3 | 4 |

| Freetrade | 5 | 2 | 1.5 | 3.5 | 0.5 |

| Trading 212 | 4.5 | 4.5 | 4.5 | 3.5 | 3 |

| Interactive Investor | 4 | 3.5 | 4.5 | 3.5 | 3 |

| Hargreaves Lansdown | 2 | 4.5 | 3.5 | 5 | 5 |

| InvestEngine | 4.5 | 4 | 4 | 5 | 4 |

eToro Pros & Cons

Pros

- 0% commission free trading on real stocks and ETFs

- Social trading and copy trading top investors

- Smooth and easy-to-use mobile app and desktop version

- Access to over 3000 assets, including stocks, funds, cryptocurrency and commodities

- eToro academy with videos and free courses

- Guides, analyst reports and research available on each asset

Cons

- $5 withdrawal fees can add up

- Very easy to trade which can lead to overtrading

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

My podcast episode with eToro

For this episode we welcomed Sam North, Head of Training and Market Analysis at eToro.

In this chat we speak about how to trade and invest on eToro, the app itself, eToro’s new features and some of his favourite things about working for eToro.

Sam also hosts the eToro Digest and Invest podcast with co-host Josh Gilbert which features in our top 10 investing podcasts list.

eToro Review - Company Overview

The company was founded in 2007 by co-founders Ronen Assia, David Ring, and Yoni Assia, with Yoni remaining CEO to this day.

eToro’s home is based in Tel-Aviv, with offices all over the world in the UK, USA and multiple European countries.

Later, the company pivoted its model and changed its name to eToro to allow users to trade in stocks, commodities, and indices.

In 2014, eToro was one of the first adopters of Bitcoin (BTC), enabling digital trading of the currency on their trading platform.

eToro has since grown to be one of the leading investment apps. They have made investing easy and with their low cost model it is highly attractive to those who want to trade quickly.

One cool feature is their patented products like social investing. You can see what others are investing in and even copy their exact portfolios if you wish.

This gives you access to some of the worlds best investors where you can engage with them in a Facebook like status update.

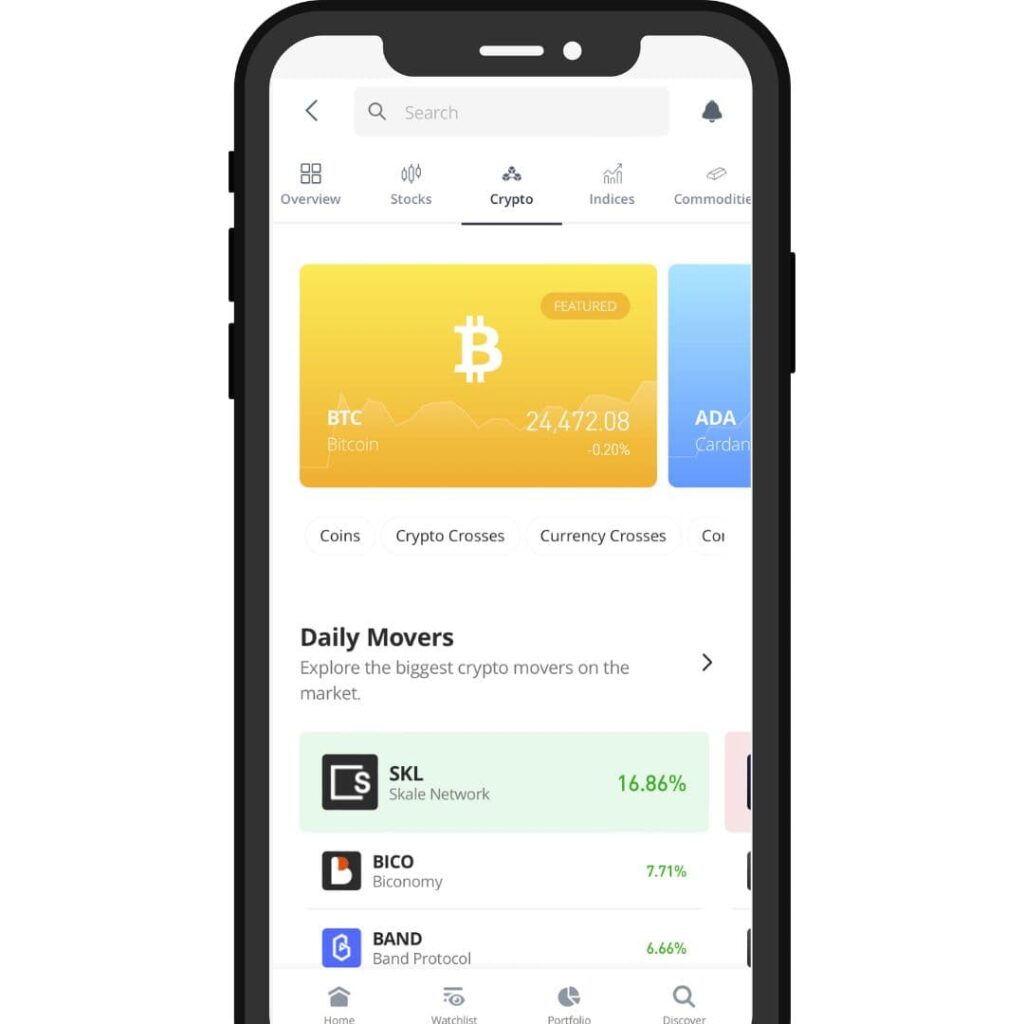

With the rise of cryptocurrency amongst retail investors, the company has expanded its offering in this area.

My personal experience with eToro

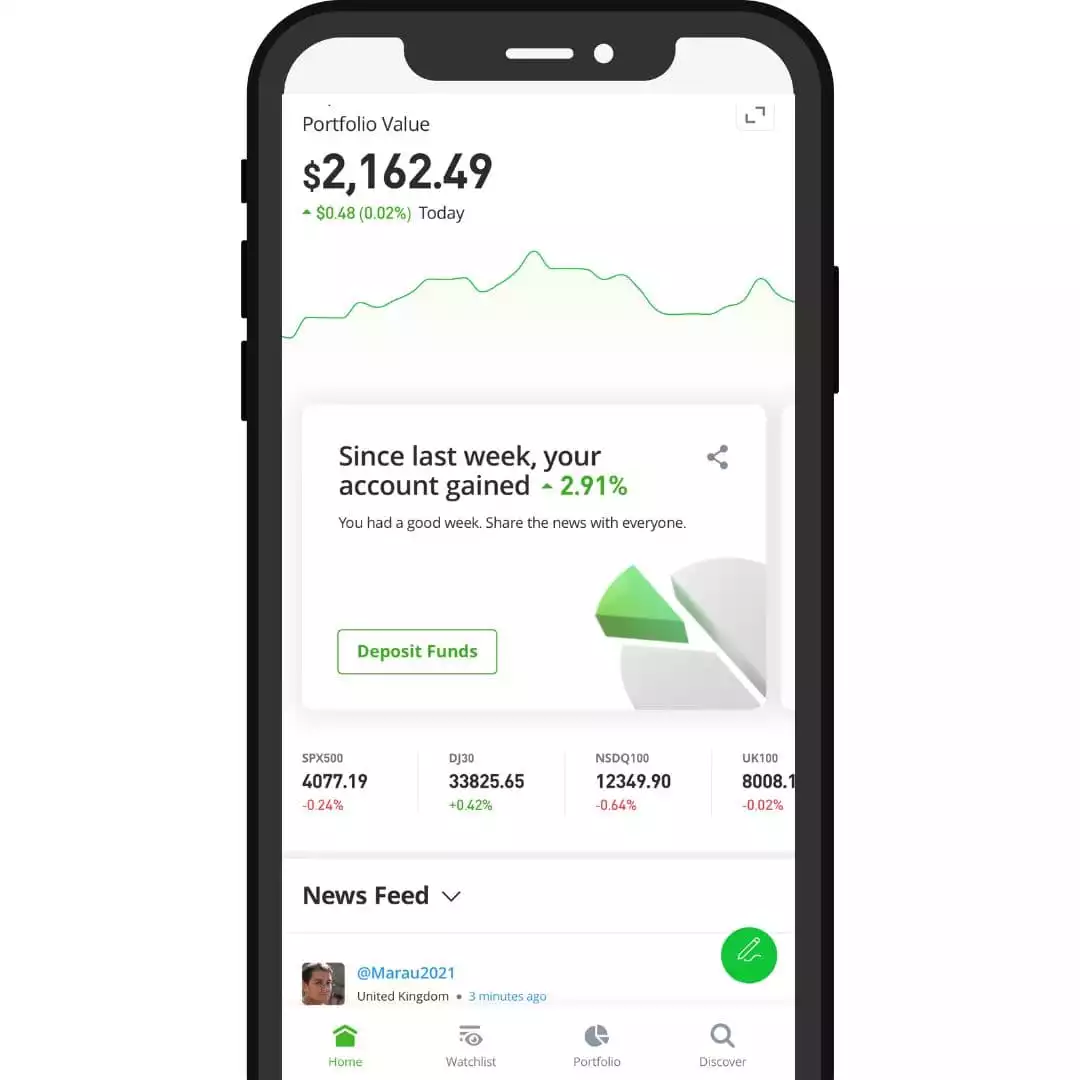

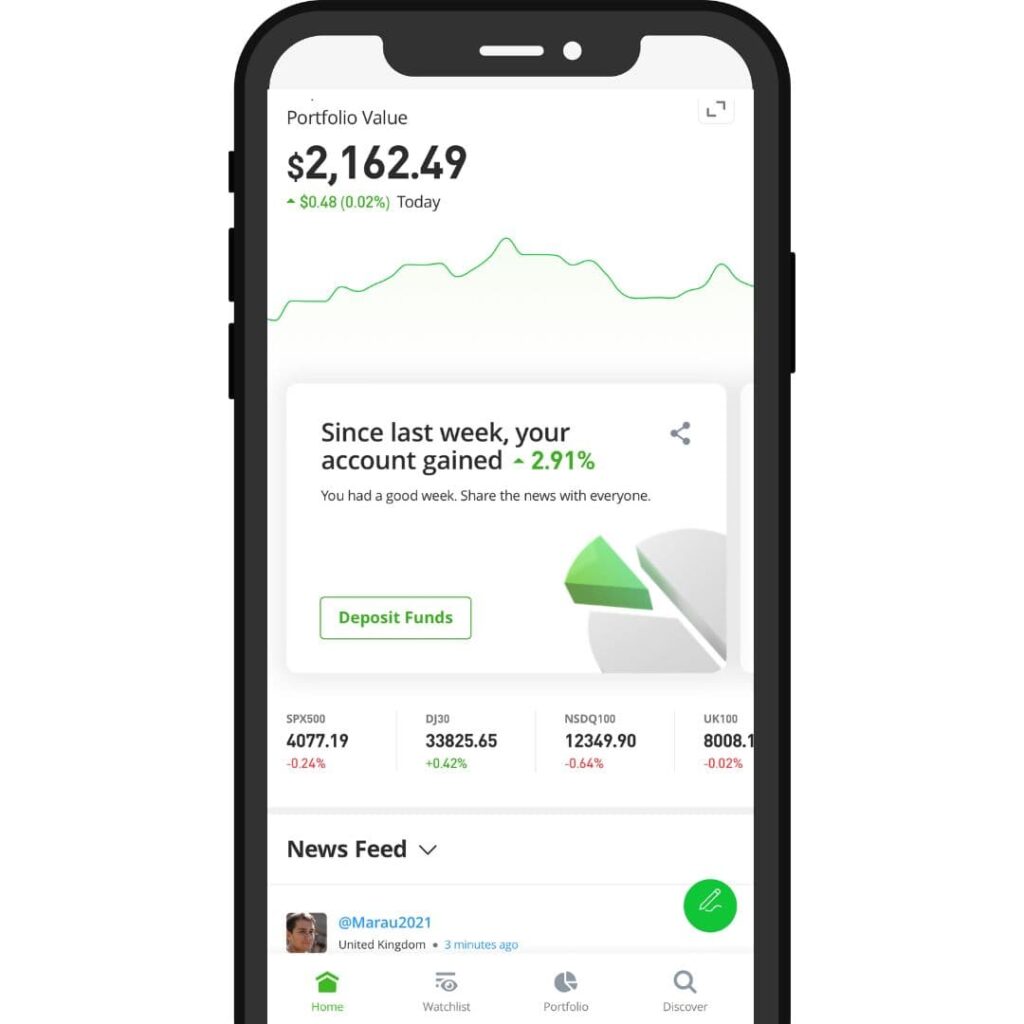

Having been an eToro user since December 2019, I have to say the platform is excellent. You can see the work they put into visuality, and for me, the experience gets better every year.

Since I’ve been a user, I’ve seen two significant overhauls in the app, with the user experience becoming more intuitive each time.

The mobile app is smooth to use, and I’m a big fan of the portfolio overview, where I can scan out and see precisely how my holdings are performing in a visual list.

The desktop version gives you a more comprehensive array of tools on individual asset charts such as RSI, trading volume, and more technical indicators.

It allows you to layer assets on charts to compare performance which I find very useful for an overall sector.

Investors can take advantage of financial reports, charts, analyst research, price targets, news and an individual social feed on each asset.

Cryptocurrency also offers technical indicators on whether to buy, sell or hold, although I’ve not used these features as I don’t invest for the short term.

With over 30 million users in over 140 countries worldwide, the platform is fully established. It recently entered the US market and is expanding, which gives me confidence that my money is safe.

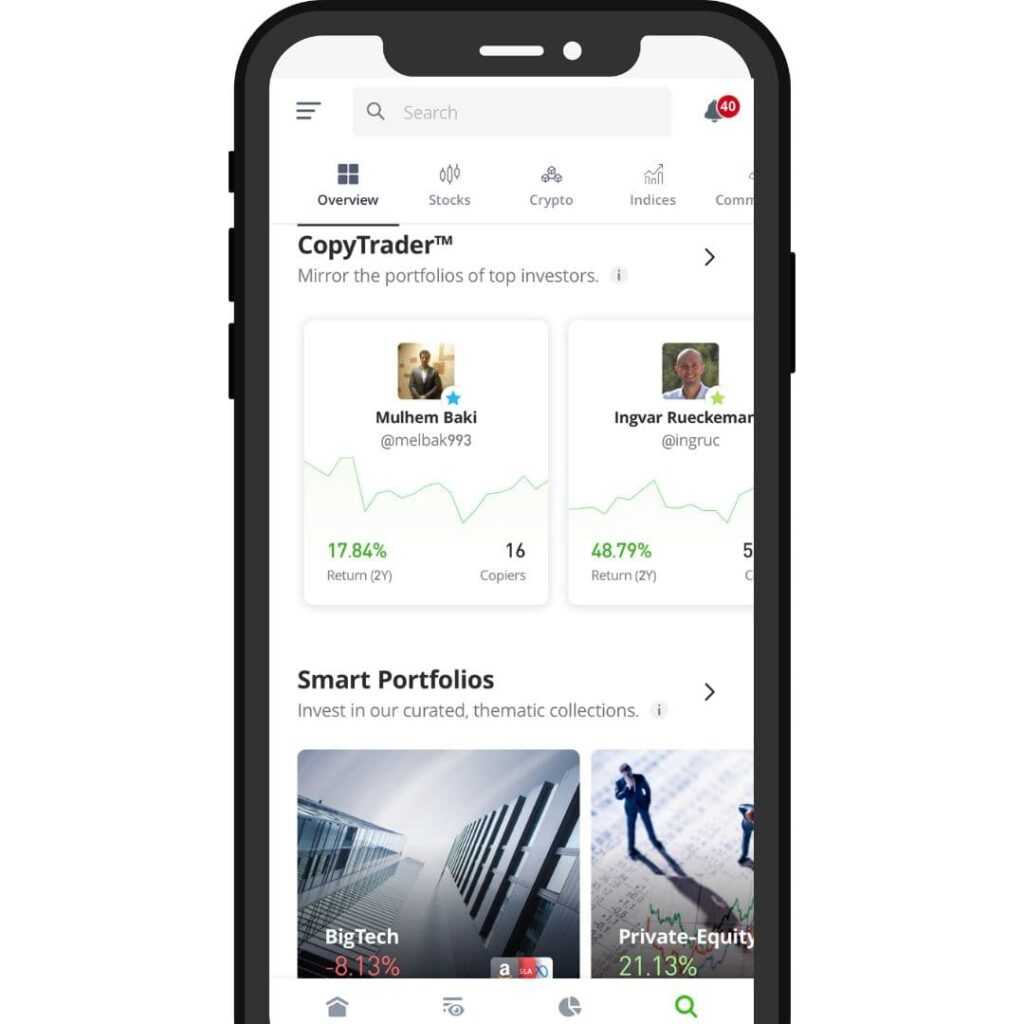

eToro Social Investing review

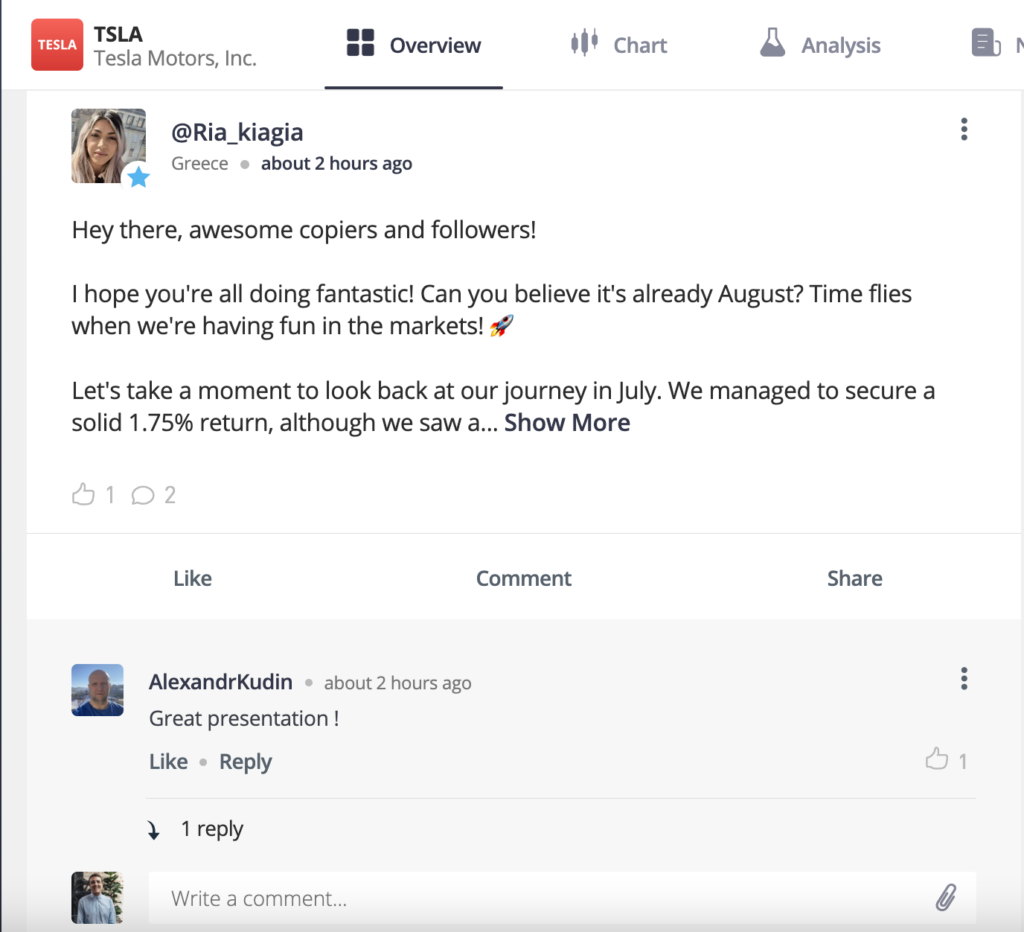

As we mentioned briefly earlier one of the coolest features of eToro is social investing.

Each investor can use their account to broadcast information tagging their chosen stock, just like a Facebook or Twitter feed.

Users can follow, like, and comment on posts from their favourite investors, and the more experienced investors can use it to write in-depth articles on specific topics or stocks.

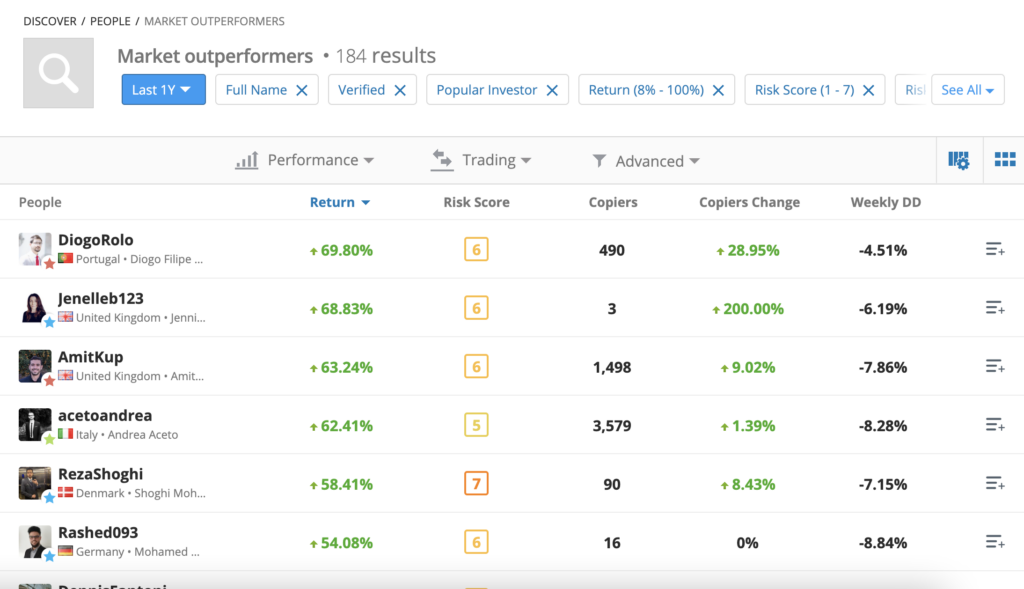

Perhaps the most unique feature on the platform is the copy trader tool. You can copy the trading patterns of the top investors identifying your chosen investor through their performance or social posts.

eToro Copy Trading review

The copy trading feature will buy and sell assets exactly as the investor you’ve copied places them.

This means you get to copy some of the world’s top investors’ exact trading patterns, hopefully benefitting from their market knowledge.

Using eToro’s social feed allows me to soak up knowledge from my favourite investors’ through their posts, videos and research pieces or deep dives, as they’re also known.

I follow some fantastic popular investors on the platform, such as Wesley Nolte, Robert Reynolds, Hugo Manetti, and Heloise Greeff.

Wesley is one of the top popular investors on eToro and has thousands of copiers and millions of dollars under his management.

Popular investors can make money from eToro by being successful so they have a duty to do well if they want to attract you.

It’s a highly lucrative business for the most copied popular investors so could you become one?

My personal gripes with the app

Whilst this doesn’t affect me, it’s effortless to make a trade on eToro. Placing a trade almost has an element of gamification to it which can be an issue for those who aren’t careful.

This can be very attractive and can result in users trading way more than they should because it feels fantastic. As we know, this doesn’t usually end well.

eToro is very transparent about this and warns retail investors with bold statements across its website, such as 81% of individuals trading CFDs lose money when trading with them.

The company actively encourages you to research and learn via their academy, and they also provide demo trading accounts so you can put your learnings into practice.

Etoro makes money by, small withdrawal fees that differs per country alongside a currency conversion fees when trading foreign assets.

This can be slightly annoying if you’re planning on withdrawing more frequently.

Other than perhaps further partnerships with the major news outlets like the Financial Times or Wall Street Journal to offer more extensive reading, I think eToro is one of the stand-out platforms available to retail investors.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

eToro Fees

Instead, the company takes what’s called a spread, which is a tiny portion of each investment you make and is very small in most cases when comparing to the rest of the industry.

Here are some of eToro’s fees:

- eToro Currency Conversion (FX) Fee: 0.5% per deposit.

- eToro Withdrawal Fee: US$5 (£4.15 approx) per withdrawal.

- eToro Crypto Trading Fee: 1% per trade (buy or sell) of the total amount

- eToro Inactivity Fee: US$10 (£8) per month after an inactivity period of a year.

- eToro CFDs Fee: CFDs attract a commission in addition to spreads, and users may also incur overnight and weekend fees.

- eToro Minimum Withdrawal Amount: US$30 (£24.90).

| Fee Type | Fee Charge | When is the fee charged? |

|---|---|---|

| Commission Fee | $0 | N/A |

| Currency Conversion Fee | 0.5% for UK Users | This is a fee on every deposit except for eToro Money deposits. |

| Overnight Fee | Different by asset | Daily - every weekday. Charged on CFDs that remain open overnight |

| Weekend Fee | Different by asset | This is an amount charged on CFDs held throughout the weekend. Days vary by asset |

| Withdrawal Fee | $5 USD | Every withdrawal (Minimum $30) |

| Inactivity Fee | $10 USD | Every month after an inactivity period of 1 year |

The eToro Trading Experience

Trading with eToro is a unique experience. One that I feel is slick and interactive.

It benefits from an exceptionally well designed, simple to understand and interactive user experience.

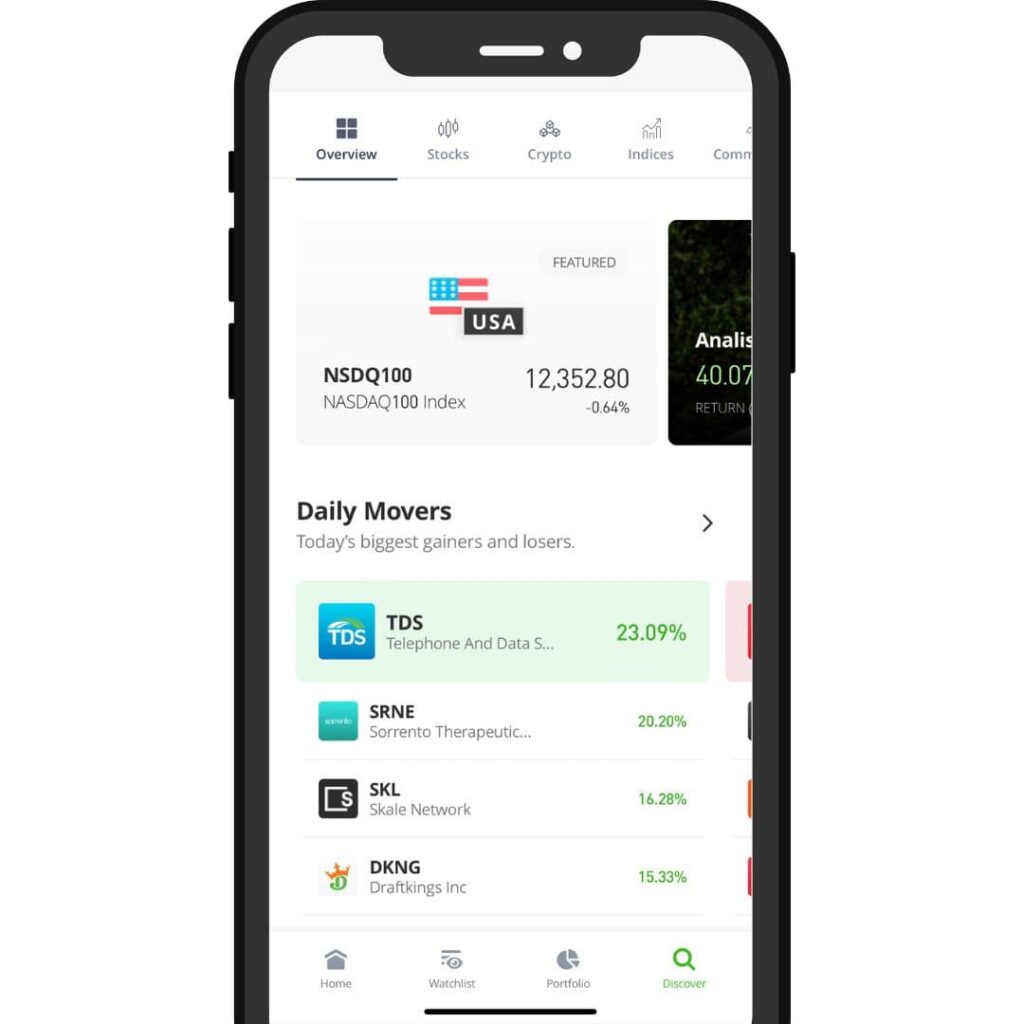

The app works seamlessly on IOS and Android devices, with each app tailor-made to suit your chosen operating system.

The desktop version also has more expansive features and follows the slick designs found in the app.

Key Points:

- You can quickly deposit funds into your eToro account via a debit card or bank transfer and start trading immediately.

- The minimum trade per asset is $10, which allows you to have a low entry point and a broad portfolio for a relatively low deposit.

- The trading platform uses screens that offers users access to stock prices allowing users to directly buy, sell and short assets.

- They also provide leverage but ensure you know what you are doing when using it

You can see from the image below that you can also put together your own watchlists of different assets and track their performance.

This tool is handy as I wait for specific prices to be hit before entering.

Leverage Trading

Think of leverage as the financial version of Popeye’s spinach – it gives you a trading boost that’s stronger than your original investment.

Here’s how it works: you put down your own cash as a deposit and eToro says, “Hey, how about we lend you up to 5x of that?”. So your modest £50 could turn into a whopping £250 investment.

Wait for it – say that share you’ve got your eye on soars by 10%. Your earnings are now £25, which is 10% of your total trade, rather than just 10% of your initial £50. That’s a smashing 50% return on your original investment!

But remember, just like rollercoasters, what goes up can come down. If that share drops by 10%, you’ve not lost £5 you’ve just lost £25. So, that’s a 50% loss from your original £50 investment.

Leverage trading is like a wild night out – high risk, high reward. It’s thrilling, but you need to know your limits. A word of caution, eToro reveals that 81% of their users lose money, largely due to leverage trading.

So please, please, please ensure you use it with the utmost caution!

How to open an eToro account?

It is easy to open an account with eToro and often takes around 5 minutes from start to finish.

Once you’ve clicked sign up, you’ll need to provide a range of personal information but nothing out of the ordinary.

You’ll also be asked to submit a small questionnaire to establish your trading and investing knowledge.

There’s also a small risk calculator you’ll complete, which you can use to find out what type of investor you are.

There’s nothing to worry about with your answers, so be sure to answer truthfully. After you’ve completed the above, you’ll be able to use your account.

You’ll need to go through a few more steps before you’re fully verified, so have these documents ready before you start to speed things up.

- Proof of identity (Passport or Driver’s License would be great)

- Proof of House Address (Bank statement or another official document such as a utility bill)

- Your Tax identification number (This will vary depending on your country, but it should be on your tax return on other social-related correspondence)

Once you’ve submitted all your documents, it usually takes roughly 24 hours to fully verify. Still, you can deposit and use your account (within a limit) right away in most cases.

The minimum deposit in eToro differs by location. For example, in the UK it is £50 but in some countries, the minimum is much higher and can be up to $200.

It’s important to check the minimum requirements on the website before signing up.

eToro deposit and withdrawals

eToro withdrawals into your bank can take 4-7 business days. Bank transfers are a lot faster. I’ve received money the next day but usually it’s 2-3 days.

eToro also allows deposits from a great range of providers. These include:

- MasterCard

- Visa

- PayPal

- Skrill

- Neteller

- Wire / Bank transfer

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

eToro Money

Launching in December 2021 eToro money is available in UK & EU. It’s essentially a banking service where you have access to a debit card and can use your eToro balance to make purchases.

We think it’s an interesting development where digital banking is coming into investing platforms as brands try to keep people using their services for all their finance needs.

Available Stock Investments

There are extensive options available to investors, and you will have access to over 3000 stocks across 17 international markets.

When searching for a stock, you can use the search function, which will bring up what you’re looking for. You can search for other users and popular investors like this too.

Contracts for differences are contracts between investors and institutions. Investors will take a position on the future value of an asset, such as shorting a stock (betting against it).

Some important things to note:

- If you buy an asset and don’t use any leverage, you will fully invest in the underlying stock.

- If you short-sell an asset, you will be trading CFDs

- Irrespective of whether you are long or short – applying leverage will mean that you are trading CFDs

Assets Available on eToro

| Investment Option | eToro | Interactive Investor | Hargreaves Lansdown |

|---|---|---|---|

| Stocks | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Funds | No | Yes | Yes |

| Forex | Yes | No | No |

| Bonds | No | Yes | Yes |

| Options | No | No | No |

| Futures | No | No | No |

| CFDs | Yes | No | Yes |

| Crypto | Yes | No | No |

| Commodities | Yes | Yes | Yes |

| Indices | Yes | No | No |

Cryptocurrency

You can trade all major cryptocurrencies, such as Bitcoin, Ethereum, Solana, Binance, and a handful more.

Stocks

There are thousands of possible options across many different markets. You’ll find all the majors there from the US, UK and European markets and Hong Kong.

ETFs (exchange traded funds)

There’s a wide array of ETFs available to choose from, including well-known funds like the Vanguard and iShares (Blackrock) products and popular ETFs such as ARK Funds by Cathie Wood.

For those who want to invest in items such as green energy, there’s also a range of sector-based ETFs to get stuck into.

Indices

eToro allows you to speculate on the futures of 16 significant indices, including the NASDAQ 100, FTSE 250 and France 40. A wide array of mutual funds are available on the platform that mirrors the indices.

Commodities

There are 19 commodities available as CFDs covering metals like gold and silver and agricultural commodities like cacao, wheat and sugar. You can also trade oil and natural gas.

eToro often charges a small daily fee to hold these commodities, so checking that out before investing is essential.

Forex or Currencies

Having first been a Forex-only company, eToro has kept this as part of the newer version. If you want to get involved with trading forex, eToro offers an expansive suite of tradable pairs, including some wider minor ones.

Ready-Made Portfolios

The eToro team have built a wide array of ready-made sector-based portfolios which they have selected and managed internally.

These include portfolios such as Big Tech, Streaming Services, Chinese Internet, Cannabis Care and many more. At the time of writing, you’d need at least $1000 to invest in these portfolios.

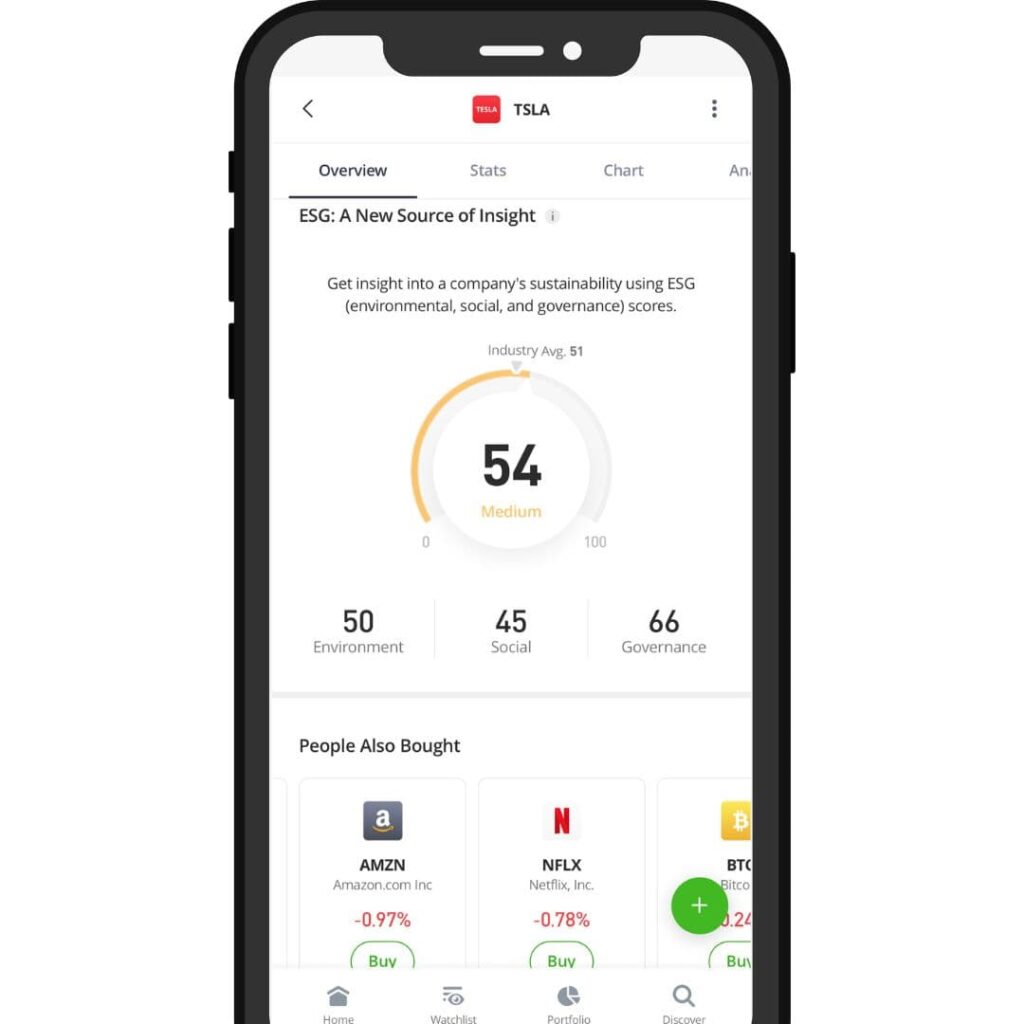

ESG

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

eToro Alternatives

If you’re looking for alternatives to eToro then we have reviewed a number of the apps below.

eToro vs Trading 212

Both of these investing apps are fantastic options for beginners. Where eToro differs and also for me just edges it ahead is it’s social investing and copy trading.

Trading 212 doesn’t offer this feature but does have a fantastic pies options which you can automatically invest into each month.

eToro vs Freetrade

eToro vs Interactive Investor

Both apps offer fantastic tools for both beginners and seasoned investors.

eToro has more cryptocurrencies available and research associated to this too.

Investors who are looking for a more traditional trading platform would be better off with Interactive Investor although eToro isn’t far behind.

eToro vs Hargreaves Lansdown

If you are making trades that are less than £5k Hargreaves’s fees are extremely high with £12 a trade in fees for buying and selling.

Hargreaves offers a much wider array of the best ETF’s and trusts on the market so I would look at them if thats what you’re interested in.

eToro vs InvestEngine

However, if you are solely interested in ETFs or looking for a safe way to diversify then InvestEngine is our top pick for this.

eToro vs Degiro

Degiro and eToro are similar trading platforms. Degiro is known for being more of a European broker for seasoned traders and has a very simple, easy-to-use app.

eToro caters for a worldwide audience and offers social investing alongside commission-free trading on real stocks and ETFs.

However, it is noted for having high spreads on some products.

FAQs

Can you actually make money from eToro?

Yes, you can use eToro to become a very profitable investor. However, you can also lose money if you make bad investment decisions.

It is essential to understand what you’re investing in, as your capital is at risk.

Can eToro be trusted?

Yes, eToro can be trusted. It has a good reputation with over 28 million customers worldwide.

Whilst eToro does not offer FSCS protection (financial services compensation scheme), it does hold your money in a 3rd party bank which is separated from company money and held in a trust.

However, it’s always important to do your own research before investing.

Do I actually own stocks on eToro?

No, you do not directly own the stock, but you own a CFD or contract for difference, as they’re also known.

This means you still benefit from the same price action and the profits, losses and dividend payments associated with the original stock.

Do I have to pay tax on profits from eToro?

eToro is regulated by the financial conduct authority, meaning that you are liable for capital gains tax on any profits over £12,300 per year.

These accounts are general investment accounts rather than ISAs, so they follow the same tax rules you would get from them.

Are eToro's fees high?

eToro is one of the cheapest trading platforms on the market, and its fees are not considered high.

It makes money through withdrawal fees, currency conversion fees and spreads on a trade.

Is eToro good for crypto?

Yes, eToro has access to over 70 different cryptocurrencies, including Bitcoin, Ethereum, and Cardano, alongside many funds that invest in blockchain technology.

Conclusion

I’m a big fan of eToro, and they have a great CEO. I believe they’ll continue to be one of the more popular investing apps.

The platform is the perfect starting place for beginners but also has enough to attract professional investors too.

An improvement I’d like to see is a broader selection of ETFs. I’d also like to see what holdings are inside an ETF without using search engines to do so.

Further integration with more news partners will mean you can fully use eToro as a one-stop shop without subscribing to other news outlets or apps like Yahoo Finance.

Lastly, if you’re in the market and looking for an easy-to-use, fun investment platform, eToro is undoubtedly a good one to explore.

Click the button below to check out the platform and get yourself set up. We hope you enjoyed our eToro review UK.

If you’d like to check out our best investing apps UK click here.

Legals from eToro

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.