Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

This one is a close call! Both apps have much to like, but eToro edges this one for us.

What swung it for us is the overall user experience, account opening speed, extensive training academy, plus the ability to buy cryptocurrency (if that’s your thing).

|

4.5

|

4.1

|

|

30 million users worldwide enjoy social investing with a wide selection of stocks, funds, trusts and cryptocurrencies available. Min deposit £10. |

With over 2 million users worldwide, Trading 212 offers commission-free trading. It provides access to thousands of assets and has a good customer reputation. Min deposit £10. |

|

|

|

|

|

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

|

Your capital is at risk.

|

30 million users worldwide enjoy social investing with a wide selection of stocks, funds, trusts and cryptocurrencies available. Min deposit £10.

- 0% commission on stocks and ETFs

- Social investing, including copy trading

- Extensive research and fast app

- 0.5% conversion fees

With over 2 million users worldwide, Trading 212 offers commission-free trading. It provides access to thousands of assets and has a good customer reputation. Min deposit £10.

- 0% commision-free trading

- ISAs and GIAs available

- Smart mobile app and desktop version

- Slightly Higher Fees

Both trading platforms operate with a 0% commission model on stocks and ETFs, helping them grow rapidly across the UK and worldwide.

It’s a retail investor’s dream to have access to the stock market in the palm of your hand, and that’s what both apps provide.

In this article, we put eToro vs Trading 212 and look into each app to help you make the right decision!

Table of Contents

eToro vs Trading 212 - Brand Introductions

eToro

eToro has close to 30 million users worldwide, and its model is based on social trading. This means you can interact with other investors, liking and commenting on their posts just like you do on social media.

This unique model allows you full access to some of the world’s best investors or popular investors, as they’re called on the platform.

Its copy trading feature sets it apart from any other trading platform. You can find a great investor, track their results and then copy their every move with your own money, which is pretty awesome, especially for beginners learning the markets.

Aside from this, you also have access to an incredibly diverse range of asset classes, such as stocks, funds, commodities and cryptocurrency.

You can buy stocks directly, but you can also get involved with CFD trading (contract for differences), where you are trading the price rather than owning the physical asset.

With a wide range of trading tools, this makes eToro perfect for beginners and more experienced investors. You can read our full eToro review here.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Trading 212

Trading 212 is also a fantastic app and is a popular investment service in the UK. It also offers commission-free trading, providing everyday people like you and me a low-cost entry to trade or invest in the stock market.

Trading 212 like eToro offers an ISA. This means you can invest up to £20,000 a year tax-free, with your profits not subject to capital gains tax.

As you’re beginning to see, both platforms are very similar, so let’s look at the pros and cons.

eToro Pros and Cons

Pros

- Commission free trading on real stocks and ETFs

- Social trading, including copy trading

- Stocks and Shares ISA available (New Feature)

- Advanced mobile app

- Excellent customer reviews

- Etoro academy

- Crypto trading

Cons

- Customer service could be improved

- Trade in dollars rather than the local currency

- Trading forex can be pricey

Trading 212 Pros and Cons

Pros

- Commission free investing

- Free share when you refer a friend

- Advanced mobile trading

- Excellent customer reviews

- Stocks and Shares ISA available

Cons

- Slightly limited products

- High forex fees

- High foreign exchange fees

Investment Options

There’s really not a lot of difference between the two trading platforms when it comes to the assets available.

What makes both eToro and Trading 212 so good is their wide selection. This includes pretty much every major stock, fund, commodity and currency.

A main difference is eToro offers traders access to cryptocurrency trading. eToro has an extensive array of crypto available on the platform, including the big ones like Bitcoin, Ethereum and Cardano.

This is a big reason eToro has over 28 million more users than Trading 212, as people often want some exposure to cryptocurrency.

What are the apps like to use?

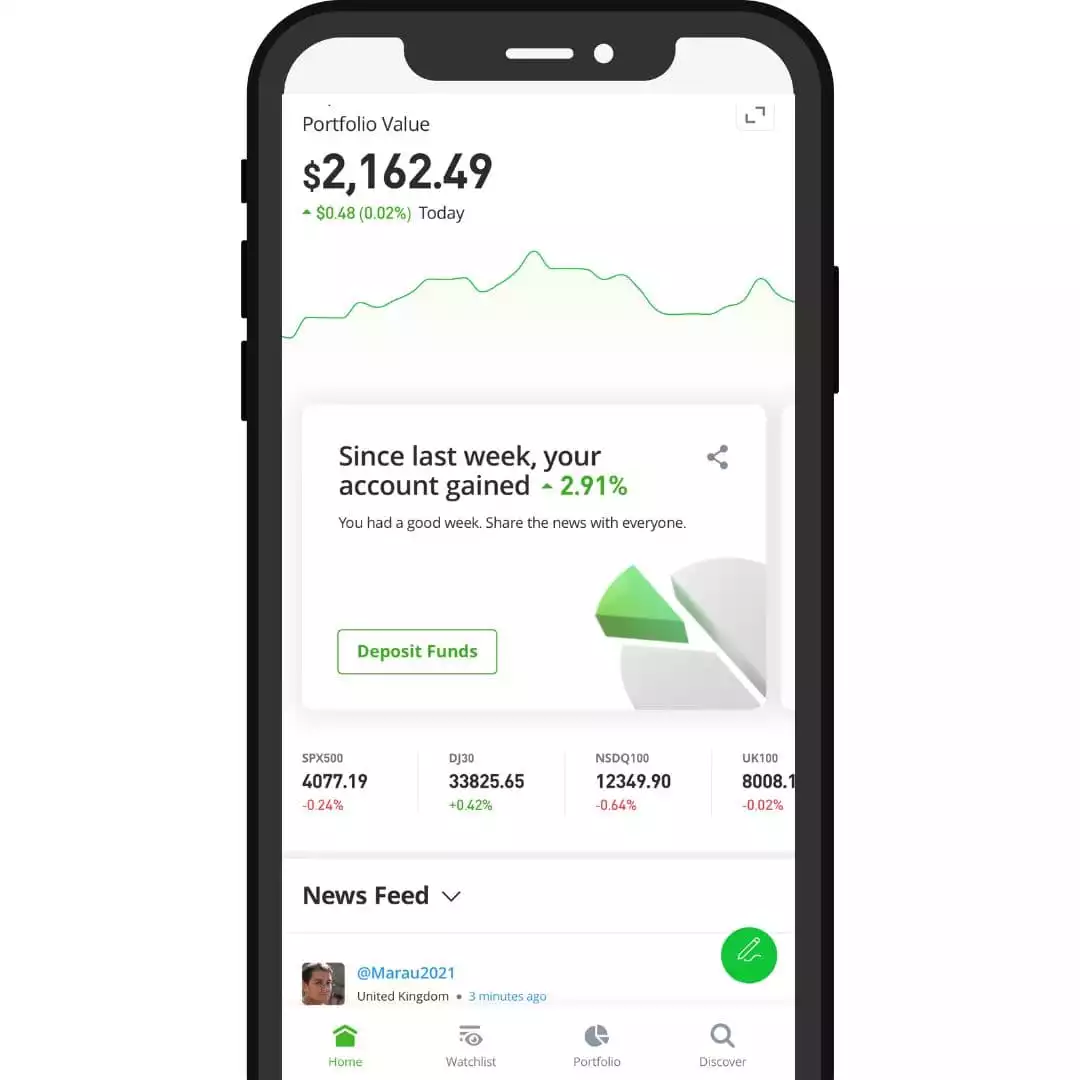

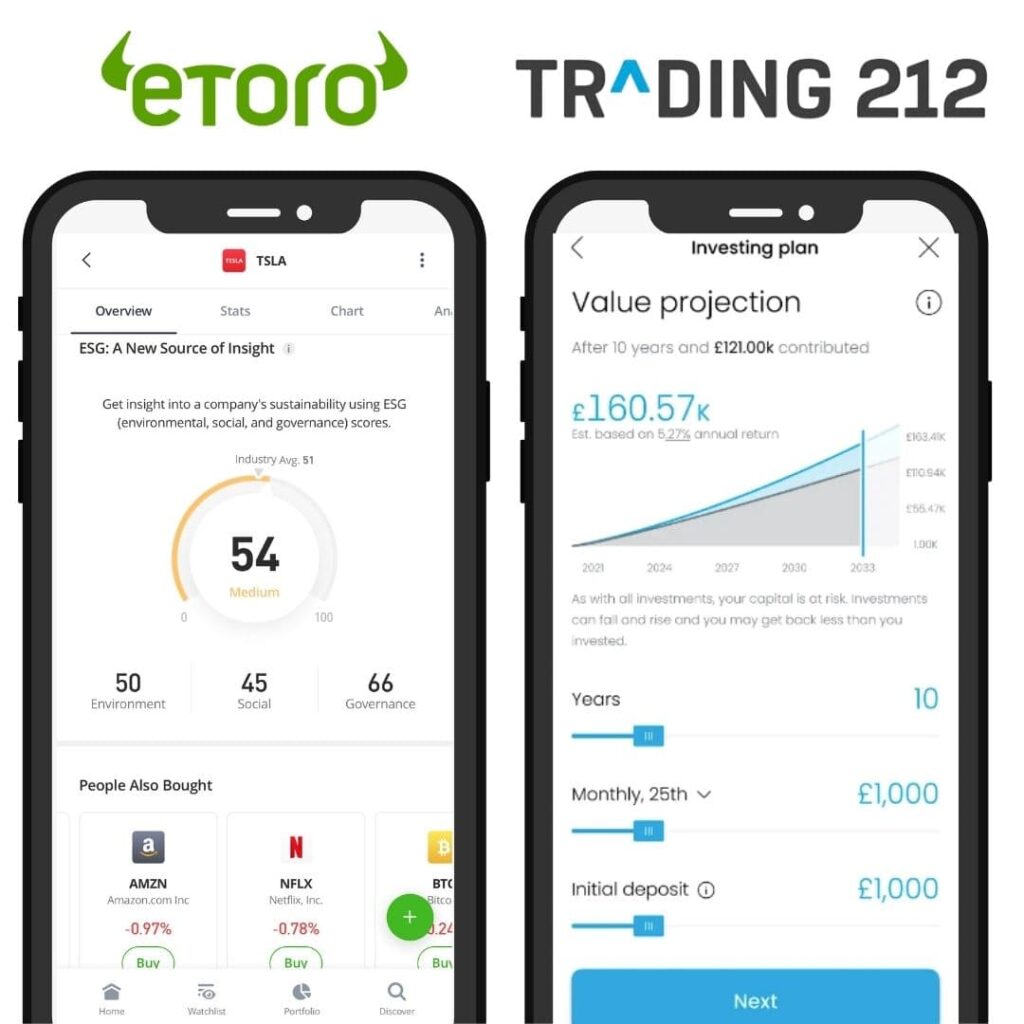

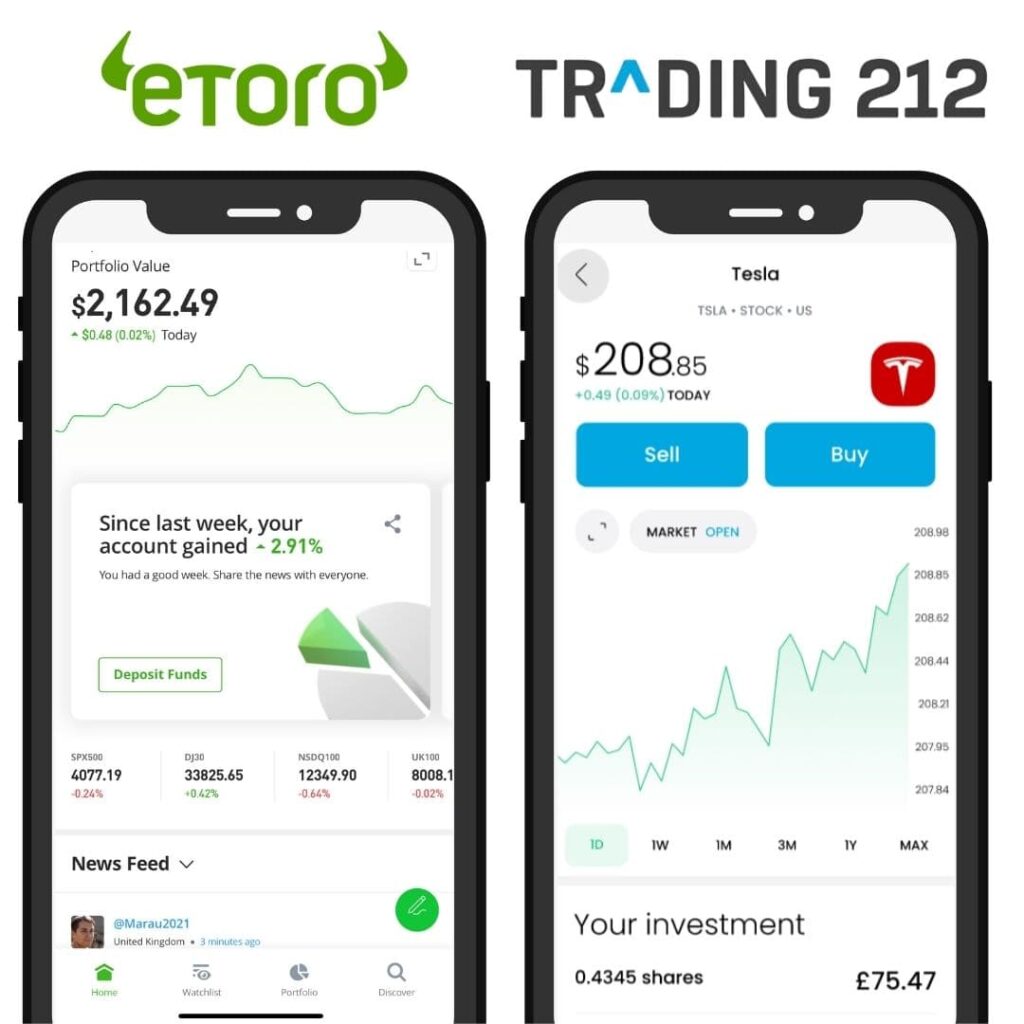

Both eToro and Trading 212 have fantastic mobile trading apps that are fast, intuitive and easy to navigate.

When I compare eToro vs Trading 212, I prefer eToro’s layout because it’s a bit easier to read and move around the app. Trading 212 uses a lot of icons, and if you’re new to the app, you need to learn how to move around before you actually know where everything is.

That being said, it is a minor thing when it comes to the apps, and of course, everyone has a personal preference.

One thing I like about Trading 212 for UK investors is the ability to trade in pounds, where eToro will convert your cash into dollars.

Both apps offer a demo account for users to play around with virtual money before committing their own capital. This is useful for both beginners and experienced investors who want to learn their way around.

Both platforms are highly visual, with excellent chart software allowing you to see past performance of asset classes in just a couple of clicks.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Fees

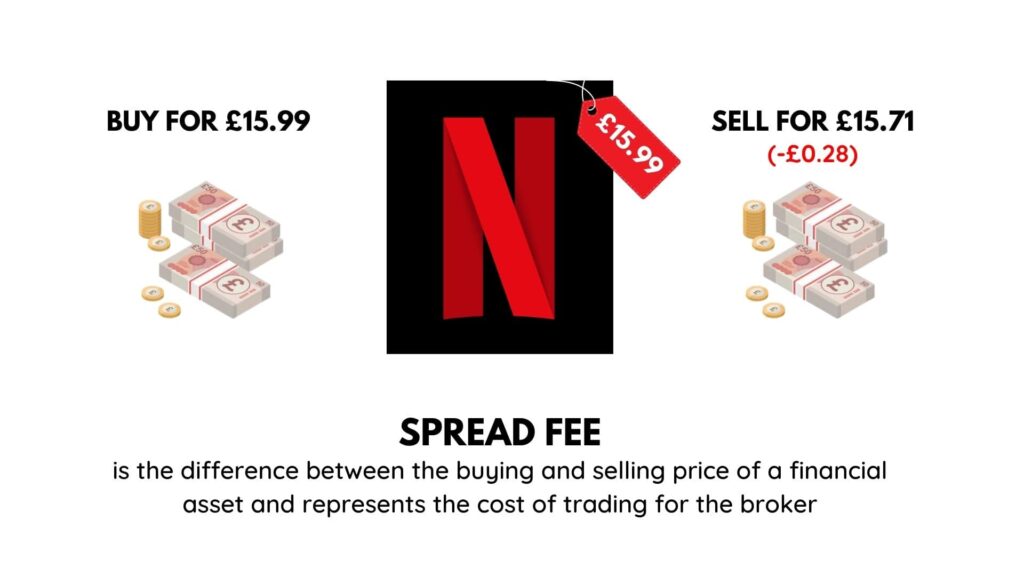

A main factor for you investors is the fees. Even though the apps are 0% commission-free trading, you still pay some fees, such as the spread and conversion fees.

What an earth is a spread fee, I hear you ask? Well, it’s a tiny fee that both apps make when you trade CFDs or Forex.

Essentially if you buy an asset for £100, the app may sell it to you at £99.90, taking the 10p as a spread which is how it makes its money. Both apps do this, but eToro’s spreads are slightly more favourable.

We mentioned eToro trading in dollars above, and because you put would be depositing in pounds, the app will charge a conversion fee of 0.5% for switching to a foreign currency. This isn’t the case with Trading 212.

Deposits and withdrawals

I tested withdrawing from both apps within a matter of minutes of each, and they were both pretty quick. Trading 212 landed the next day, and eToro the following morning after.

Trading 212 was faster, but really it’s nothing too crazy when comparing them.

Etoro minimum deposit – £10 (1st deposit £45)

Trading 212 minimum deposit – £10 (1st deposit £10)

eToro vs Trading 212 - Account Types

Both accounts offer GIA’s (general investment accounts) and Stocks and Shares ISA. eToro has just launched it’s ISA in 2023 which is a new feature to it’s arsenal.

Before Trading 212 was the only one with an ISA, which would have set it apart, but with this new addition, eToro is now edging ahead

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Opening an Account

Opening an account with both brokers is relatively hassle-free. When it came to Trading 212 I had to wait for extra verification mainly because I have a long name which was slightly frustrating. However, I’m used to it now!

You will need an ID to verify your identity and important details like your national insurance number.

In most cases, you’ll be set up and active on the same day but in some cases you may need to wait longer for extra checks to be completed.

In terms of security and safety – both apps are regulated by the FCA (financial conduct authority) plus offer FaceID and banking level 2FA (two-factor authentication).

Trading 212, however, does leave me logged in on my desktop, which I don’t like. When my money is involved with a trading platform, I would like to log in each time physically.

Research and Educational Resources

Now, this makes both apps very attractive to the beginner and more experienced investor.

Research

eToro offers an extensive array of research options on each asset class. This includes analyst predictions, the latest articles from top investing publications, and sentiment trends to see what other etoro customers and investors feel.

Trading 212 does lack in this department, and I would like to see some improvement here.

Education

eToro, as a trading platform, offers an extensive academy with access to videos, courses and blog posts that can guide you through their app and investment strategies. I personally used a lot of the academy when I was starting out to brush up on knowledge and alien terminology.

Trading 212 also has a great academy area with many videos and things to explore. It has everything you need, but they have slightly less when comparing it to eToro.

Customer Reviews

Trustpilot reviews from other eToro customers have a 4.3 out of 5. Trading 212 has a Trustpilot rating of 4.6 out of 5, which is a good couple of points higher.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

FAQs

Is Trading 212 good for a beginner?

Yes, Trading 212 is a great option for beginners. It has an extensive training academy and an easy to use mobile app.

As it is very much a do it yourself trading platform it’s important to do your research before you start trading or investing.

What are some Trading 212 alternatives?

There are some fantastic apps out there that are similar in many ways to Trading 212.

They include IG, Hargreaves Lansdown and FreeTrade.

Is Trading 212 safe in the UK?

Yes, Trading 212 is authorised and regulated by the FCA (financial conduct authority). They also store client money separate to their company accounts to ensure an added layer of safety is in place.

eToro vs Trading 212 - The Winner

When looking for a stock trading app, it’s important to assess the entire picture. As you can see, both apps are close in terms of their offering, but eToro wins this one for me.

The sheer inclusion of popular investment services, trading tools, and wider research makes eToro a slightly more attractive option. Though if you were to choose Trading 212 you would no doubt be very happy with it.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.