Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

St James’s Place Quickfire Roundup

St. James’s Place (SJP) is currently the UK’s largest wealth manager in UK. They match you with a qualified financial advisor who will tailor their advice with a personalised service and in theory could be your adviser for life

They have over 4,760 financial advisors across the UK who offer ongoing financial advice and access to a range of investment funds, tax-beneficial accounts and estate planning.

In the past, this service has been deemed relatively expensive, but SJP justified this with results for their clients and are making some changes to their pricing model in 2025.

I spoke directly with their team and one of their local advisors to put together this St. James’s Place review.

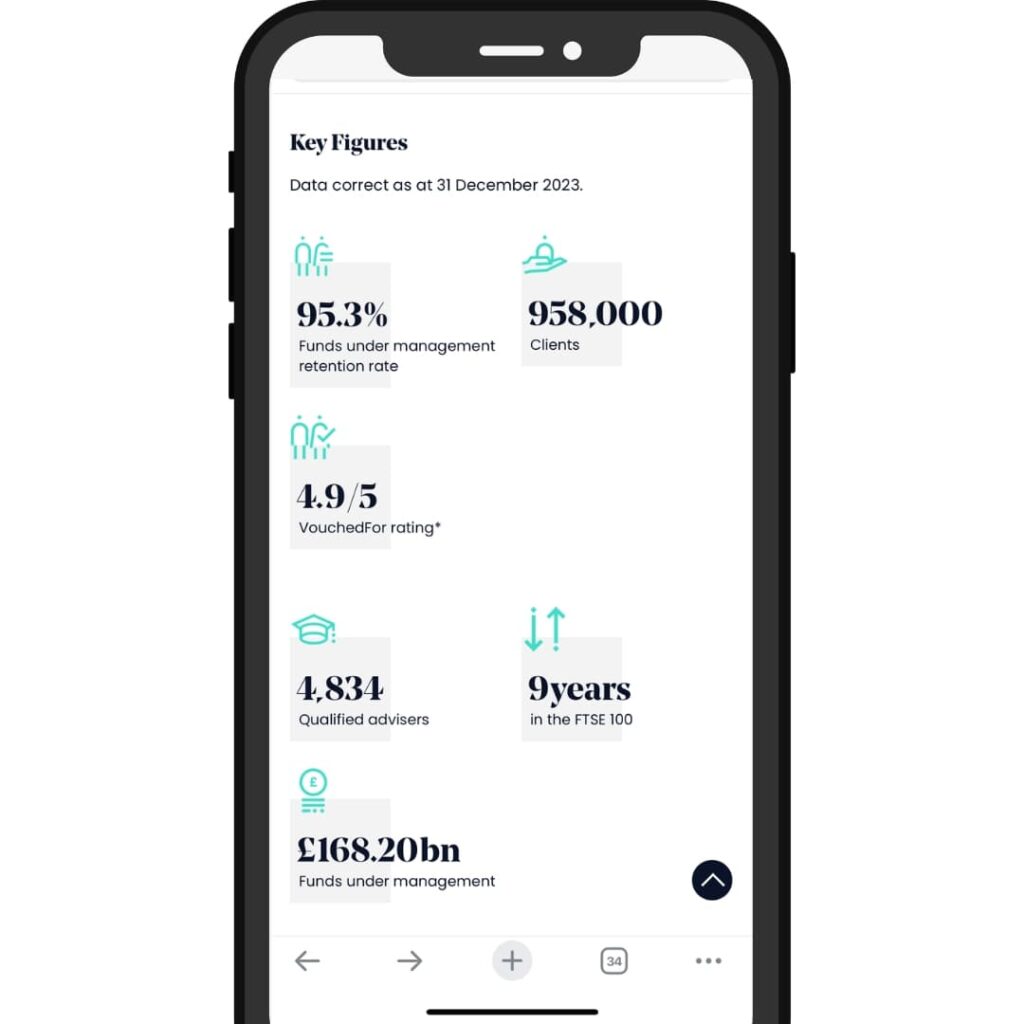

The business is very impressive with over 941,000 clients across the world and over £157 billion in assets under management at the time of writing. You don’t get to this level by providing a mediocre service. The company has publicly traded on the FTSE100 for over 8 years.

This would make me feel comfortable if I were to invest my own money with SJP.

SJP Rating

- User Experience

- Customer Service

- Useful Features

- Customer Feedback

- Suitable For Beginners

- Price / Fees

As part of our six-pillar system which we use to rank all investment providers, SJP scored a 4.3 out of 5 which is a good score.

They scored best for user experience and customer service which was exemplary and scored worst for their fees which are very reasonable when compared to other Wealth Managers, but there are cheaper DIY options out there. SJP is however, currently working on a new fee structure – more on this later in the review.

Now let’s get into the service a little more, answering your pressing questions and get to know their product offering.

Are St. James's Place any good?

Yes, their service is excellent. They provide face-to-face financial advice, allowing you to work with a local professional advisor that looks at your entire finances picture and goals.

You can also meet with your advisor at least once a year to discuss how your finances are going.

Once you have undergone an initial consultation you will be matched with accounts and funds that are suitable for your goals and financial situation.

You’ll then work directly with your financial advisor to create a financial plan based around your life goals.

They have a wide range of investment options plus a range of products to help investors grow their wealth, plan for retirement and protect those closest to them.

Are St James's Place good for beginners?

In my personal opinion, if you don’t already have substantial savings or investments (£10k+) then I would suggest somewhere with a lower fee structure, but if you do then SJP is a solid option.

If you fall under the 10k mark, I would probably look at one of their competitors like Hargreaves Lansdown or Interactive Investor. We have a list of our best investing apps here.

That being said, if you’re happy with one of their highly trained advisors taking care of things for you and working directly with the largest financial advice firm in the UK then SJP should be on your radar.

For example, SJP would advise you to clear debts or tax bills first before investing which is something that other providers do not offer.

Who are St. James's Place?

St. James’s Place Group was established in 1991 by Sir Mark Weinberg, Mike Wilson CBE and Lord Rothschild, and formally became St. James’s Place Capital in 1997.

In 2000 the Halifax Group PLC purchased a 60% stake in the company. After various mergers and acquisitions, the company is now wholly publicly owned and trading under the name St. James’s Place, dropping the word capital.

The business is a multi-award winning wealth management firm with offices all over the UK, Asia and Dubai.

How does St. James's Place work?

What I like about SJP is that for the client (you in this case) it’s actually quite simple.

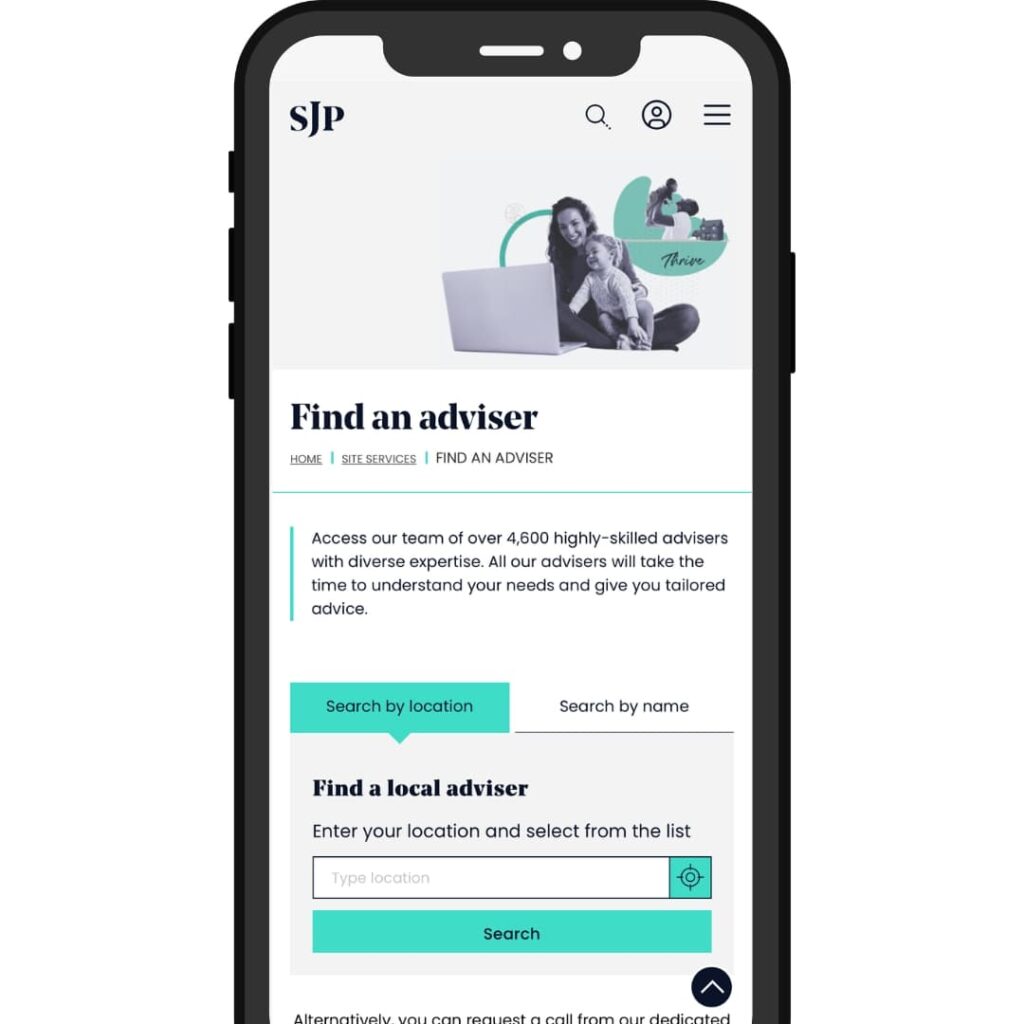

You’re locally matched with one of SJP’s advisors who will arrange either a face-to-face meeting with you at your home or locally (you can also do it by phone).

Financial Advice

Your SJP financial advisor will then work directly with you to understand your requirements, establish financial goals and understand your risk appetite.

They will look into your income, debt, family assets, tax liabilities, inheritance and businesses if required.

Once they have a deeper understanding of your 360 financial picture they can then suggest a plan of action.

Where St. James’s Place perhaps differs from some other wealth management firms is that they have built their range of investment funds. They have dedicated teams of external Fund Managers whose job it is to work on providing the best results for their client’s money.

The advisors are limited to only suggesting SJP funds however so this can be restrictive, but when you look at the sheer amount of options they have available there’s a high chance you’ll find something suitable.

Just to be clear here, SJP are not suitable for someone who wants to be a DIY investor or trader moving around their money and regularly investing in individual asset classes.

Their approach is about long-term financial advice.

Why is St. James’s Place’s financial advice useful?

The main reason is because they’re trained professionals and if you pick well, should have a track record of client results.

They can also provide you a deeper analysis of the markets than you will typically be able to get hold of or indeed understand.

Their strategy is about keeping you as a client and to do that they need to not only make you money but also save you money too.

That’s where their tax advice and financial advice will come in handy. Getting under the skin of your personal circumstances, making the most of the various allowances and carry forwards at your disposal.That being said, there are advice fees to be aware of on top of your investment fees (we’ll discuss more on that shortly).

Also to note is that your advisor will look at insurance options to protect your health and income alongside things like mortgages and banking providers too if you wish to go that far.

St. James's Place Services

Investments

SJP’s carefully crafted selection of investment funds is handpicked by their team. Then their advisors have access to these selections of funds to create the ‘perfect’ investment strategy.

The SJP funds are made of up a selection of stocks and shares, bonds, property and commodities. The allocations to these differ by fund, some being more adventurous and others more risk-adverse.

As always you should note that when you invest your capital is at risk and St. James’s Place do a great job of letting you know the risks.

There are 3 main investment account types.

Investment ISA

Essentially another name for a Stocks and Shares ISA, this is a tax-beneficial account allowing up to £20,000 tax-free investing per annum. Profits, dividends and interest are not subject to capital gains tax and are known to be the core of most investors’ portfolios because of this.

Unit Trust

A unit trust works by pooling an amount from a number of investors which is then assigned to a Fund Manager who will target an amount of profit by investing in a range of asset classes.

Simply put you give your money to the trust and it gets invested for you.

There aren’t the same tax benefits that an ISA provides but you do get some tax benefits such as a reduction in dividend tax.

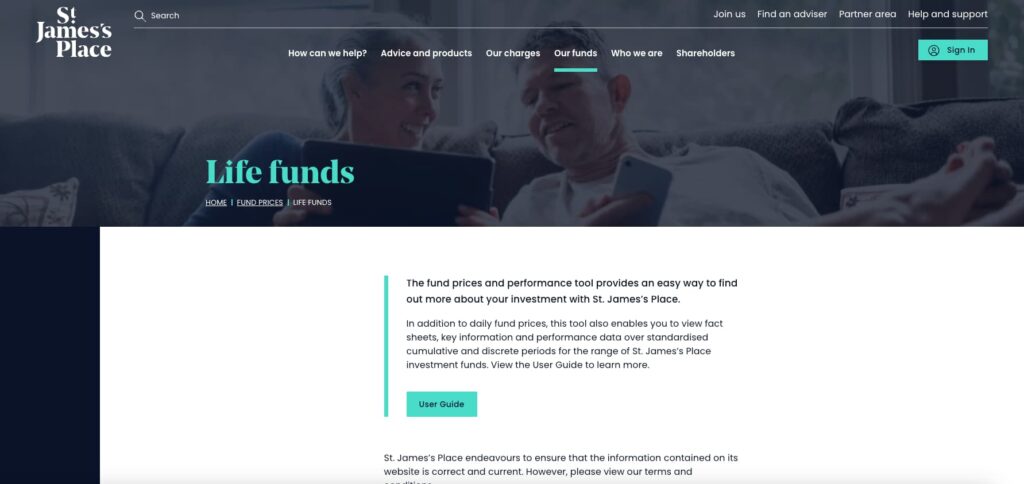

Looking on the SJP website there are 100s of different funds available to choose from.

Investment Bond

An investment bond is simply a way to invest. Similar to an ISA you can pay money in and take money out but there are some tax benefits to this account if you plan it right with your advisors.

Your investments will rise and fall just like you would experience in any of the other account types.

Junior ISA

SJP also offer a Junior ISA which allows up to £9,000 tax-free contributions outside of your £20,000 personal ISA allowance.

You can then invest the money and your child can access it once they reach 18. It’s very important to note that the money is not accessible at any point and once paid into the ISA it’s only withdrawable once your child reaches the threshold.

Choosing A Fund

As mentioned briefly your advisor will suggest a range of funds for you, but if you do want to take a look for yourself there’s an entire section available on the SJP website.

You first select by the product you have, then by investment type and finally by risk level. This will then give you a range of fund options based on those parameters which I like.

FUND SELECTION IMAGE HERE

Then you can click directly into the funds and look at past performance via the charting tools and look at the fund’s fact sheets which have details of the fund managers, fund fees, holdings, risks and cumulative performance since its inception.

Retirement Planning

Essentially this is a personal pension! Again, you’ll work with your advisor to appropriate some of your contributions (if you wish) into pension funds.

You can contribute a max of £60,000 tax-free into your pension. This gets 25% tax relief added to it by the government because you’ve already paid tax on your contribution plus if you’re a higher rate taxpayer you can claim further tax relief back too!

There’s a four-step process with SJP which includes:

Saving for retirement

Reviewing your savings

Drawing down your pension

Planning for later-life

The investment fees for a pension are similar to those found in an ISA but more on the fees shortly.

It’s also important to note that there are exit fees on the pension and bond products too.

Mortgages

A large part of your financial estate will no doubt be your mortgage and whether you’re employed or self-employed SJP offer mortgage advice with access to a range of selected partners.

This can be for both new mortgages for a sole dwelling, buy-to-let or holiday home and they can handle remortgaging advice too.

You also do this via the financial advisor assigned to you and SJP has a specialist team in-house that aims to get you a good mortgage offer.

You are not contractually obliged to use this service, but I personally think this is a nice touch as you can keep everything under one roof.

Banking

St James’s Place also offers a range of banking services as part of its wealth management arsenal.

These include services like:

Cash Management

Introduction to banks

Private banking

Foreign Exchange

For your cash savings, SJP offers a service called the SJP Cash Deposit Service. This allows you to see live interest rates from over 40 banks and build societies to make the best decision for your savings.

I think this is great because then you can easily move your money to another provider if the rates change and this ensures you’re always getting the best rates!

Equally, your money will be protected with these banks by the FSCS (financial services compensation scheme) up to the value of £85,000.

Multi-generational wealth management

SJP offers financial advice for entire families to help ensure every single one of your loved ones is covered.

This includes insurance, healthcare, safeguarding business ventures, investing for your children, property and a whole lot more.

Essentially St James’s Place aims to hold your hand throughout your entire financial life and help you make the most of every single possible opportunity.

For me this is something that medium to high net-worth families would look to take advantage of and is certainly a useful feature.

Private Clients

SJP Private Client Division is a dedicated team providing specialist services that go a lot deeper into your finances.

This is really for someone who is looking for ways to manage vast wealth made through businesses, inheritance or indeed through investing itself.

When you’re operating at this level there is a vast amount of tax planning, legal work and asset allocation to work through so having someone like SJP who can help with their team is very useful.

St James's Place Fee Structure

Ah, the fees! Well, SJP gets a bit of stick from the market for having high fees and yes, their fees aren’t the best, but for me, it really depends on how you’re investing.

If you’re a DIY investor who understands the markets and is dipping in and out of your investments then no SJP isn’t for you. Go to Hargreaves Lansdown.

But, if you want someone to hold your hand, provide advice and manage your portfolio for you giving you back time in your life which could be worth a lot more then yes SJP is worth it.

Looking at SJP against the market-leading wealth management services they fare very well and are on the cheaper side.

They are also reviewing their pricing and have stated they will be changing it in 2025 which you can read more about here.

The current fee structure is as follows.

Advice fees

The advice fees seem quite high at 4.5% of your initial investment, recommendations and account set up.

The ongoing management fee after this is 0.5% per year so year one will be 5% then down to 0.5% for advice fees moving forward.

Account fees

This is a management fee for looking after the money invested with SJP.

There is a 0.5% set-up fee for ISAs and Unit Trusts and a 1.5% set-up fee with a 1% yearly management fee for personal pensions.

For your pension, there is also an early withdrawal fee which is extremely high for the first year at 6% which then reduces by 1% each year from there. Not ideal if you’re retiring soon, but then don’t move your money!

Investment fee

Investment fees are pretty standard with any provider and depending on the funds you invest in will vary.

Customer Reviews

When I kicked off this St James’s place review I was surprised to see they were ranking so highly in Trustpilot which is 4.5.

Not because of any bias but as a reputable company in the finance industry it’s very difficult to maintain a rating above 4.

Looking into some of the reviews in more detail there’s lots of praise for individual financial advisors and the help they provide. There are also some complaints about the fees which we now know about.

SJP App

The SJP app is also available on Apple App Store and Google Play so you can login and see how your portfolio is performing.

Having downloaded it and had a play around it’s quick, visual and easy to use. All important features for investors who are on the move.

FAQs

Is SJP Safe?

Yes, SJP is regulated by the FCA (Financial Conduct Authority) and with it being a public company has to state company performance every quarter via a shareholders meeting which is available to read on their website.

They also offer FSCS protection on some account types meaning your money invested is protected up to the value of £85,000.

Is St James's Place a reputable company?

Yes, St James’s place is a reputable company that is publicly traded with over 947,000 clients and over 157 billion in assets under management.

Conclusion

In conclusion, St James’s Place emerges as a commendable choice for individuals seeking tailored financial advice services in the UK.

Their extensive network of over 4,760 financial advisors, combined with a diverse range of investment options, positions them well to cater to various investor needs.

While their fees have been a point of contention, the impending changes to their pricing model in 2025 may address these concerns, enhancing their appeal.

Their impressive portfolio, boasting over £157 billion in assets under management and a global clientele of over 941,000, underscores their competence and reliability. Their strong scores in user experience and customer service, coupled with a lower score in fees, reflect a balanced perspective on their offerings.

For beginners or those with smaller investments, alternatives such as Hargreaves Lansdown or Interactive Investor might be more suitable due to lower fee structures.

However, for those comfortable with expert management and seeking a robust, long-term investment approach, St. James’s Place stands as a solid option, especially with their focus on long-term financial advice.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.