How Much To Invest Per Month?

Everyone is different. It comes down to your situation and financial goals. When working out how much to invest per month we need to cover a few things off first.

Before you start investing, you should work out your net worth. You do this by adding up your assets and taking away your debt, leaving you with a number.

Due to many different reasons, your net worth might be in the plus, but most often, it’s in the minus. Reducing your liabilities and expensive debt is the first step to start; by doing so, you’ll see your net worth increase.

We suggest you put aside an emergency fund equivalent to 3-6 months of full pay. If your pay increases, increase your emergency fund to match this amount.

We also add a small amount each year to our emergency fund to match the rising inflation rates. For example, this year, I will add around 2% to my emergency fund to ensure it keeps up with the cost of living.

Once you’re financially stable, we suggest following our live a little strategy. The ‘live a little‘ strategy requires you to do exactly that.

Don’t be a hermit and miss out on your prime years by saving every penny you earn for a retirement that could be years off.

We’re here to enjoy ourselves and live a little, so buy that pint, get your wife those flowers, and go on a holiday, but do a basic budget and stick to it.

The whole point of investing is to further your financial situation and allow you the freedom of choice in the years to come.

Setting your financial goals early and the length of time you want to achieve them will help you put together your monthly investment budget.

Our’ live a little‘ strategy is set out in the following way. 40% of your earnings are put towards fixed costs like rent, mortgage, car loans, insurance, mobile phone and petrol.

You should put 30% towards living your life, food, drink, clothes, Netflix subscriptions and haircuts. The last 30% should be set aside for monthly investments and savings.

Now, this might mean you might need to make some changes to your life, but these percentages are just guidelines, so if you fall outside of this by just a little, it doesn’t matter too much.

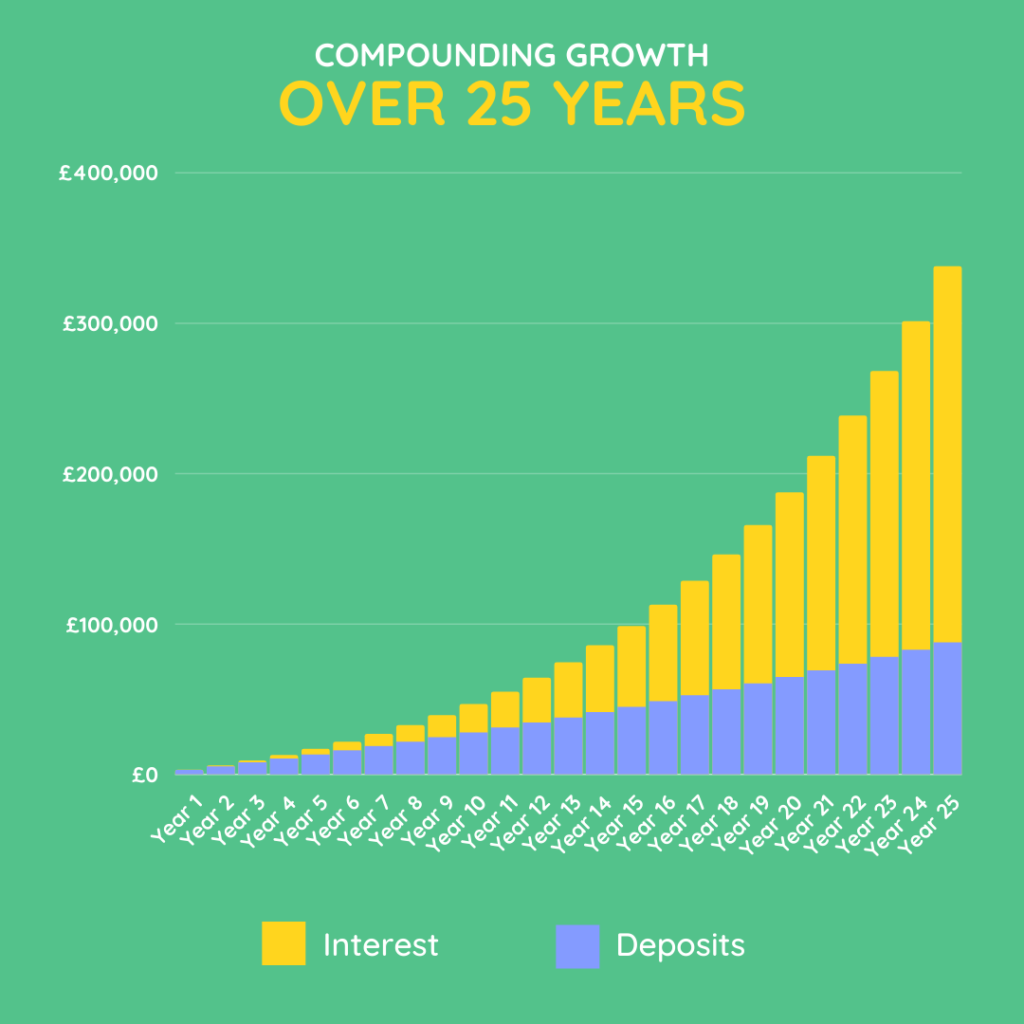

Essentially, you’re trying to achieve a change in your habits and putting even a tiny amount into investments will help you in the long run.

It’s important to only invest what you can afford to lose. If you’re not willing to risk a penny then investing isn’t for you.

For example, £100 a month would be a sensible place to start if that’s all the disposable cash you have to put aside each month.

We suggest putting at least 30% of your monthly earnings into investments and always having an emergency fund separated from your investments just in case disaster strikes.

What happens if my investments go down?

We won’t sugarcoat it. They might, but more often than not they come back and go higher. For example, if you bought Microsoft at the height of the .com bubble it took nearly 14 years for it to break its all-time highs.

However, if you bought a small piece of Microsoft every month during those 14 years you would have made a small fortune.

It totally depends on what you pick, when and how long you’re willing to hold them for. Bear markets are something that every investor will go through during their investing career.

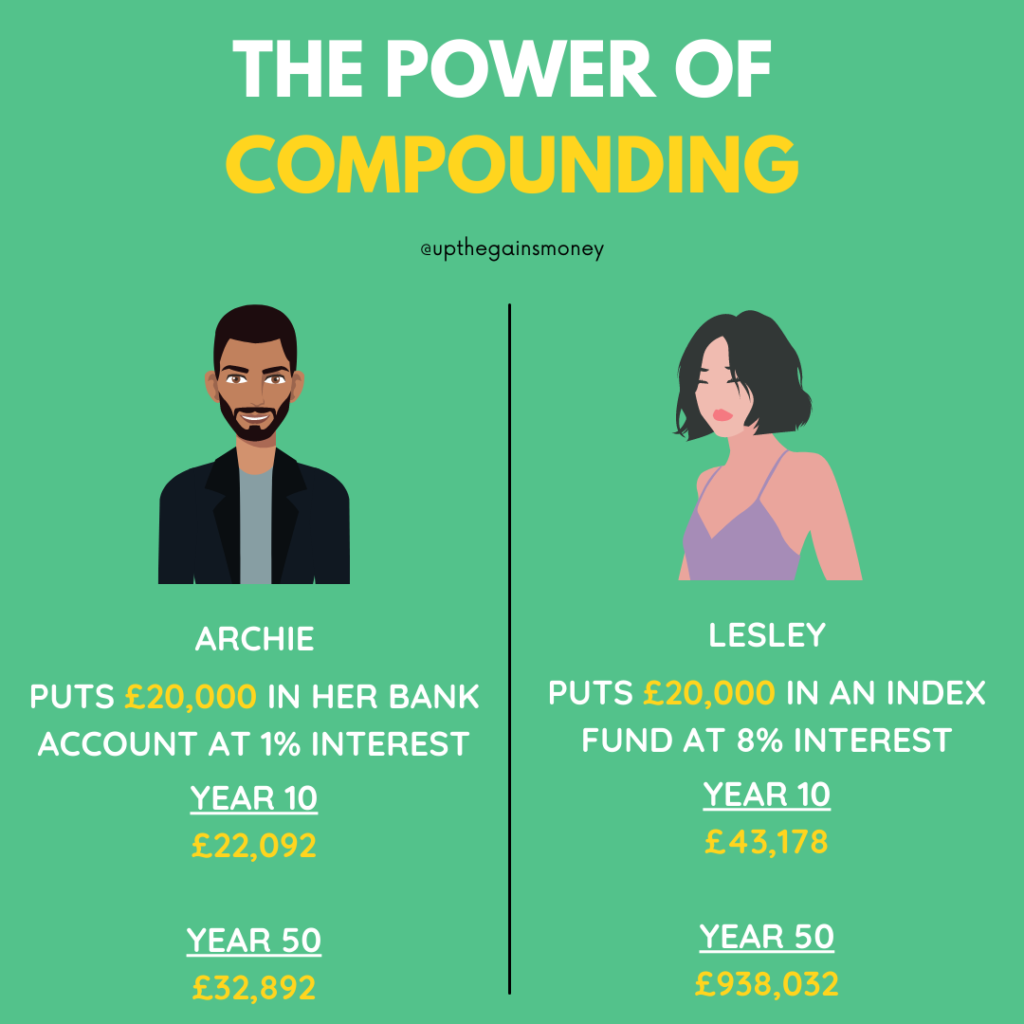

Unfortunately, it’s just part of what makes the stock market tick but over long periods of time, you’ll see the market goes higher overall.

For example, if you trade the S&P 500 index for one day you have a 52% chance of making a small profit. If you hold it for at least 10 years that number increases to 98%. That’s why it’s always better to invest long term.

Buying great businesses and holding them until they’ve reached the end of their growth run is the oldest and most profitable way for beginners to make money in the markets.

We don’t suggest putting all your money in at once. Use a dollar-cost average or pound-cost average strategy to spread the amounts that you’re buying for. This will lower your potential risk and give you a much wider spread.

For example, if you had £10,000 saved up we suggest splitting that into 4 and putting £2,500 in each month or even better x10 £1000 payments.

How do I choose what to invest in?

This is the oldest question in the book. We suggest doing your research and taking advice from a number of sources before investing your hard-earned cash. We have plenty of advice available in our blog ‘How investing £150 a month can literally change your life?’

Investing for Beginners – Learn More

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.