What is Investing?

When you invest, you’re potentially buying a day you don’t have to work!

By investing in something, you’re setting aside some of your money and putting it into an asset. Through this purchase, you’re hoping your investment’s value will grow so you can generate an income or sell it for a profit.

There are many types of investments, but some examples could be starting your own business, buying property, stocks or something of value.

The trick to investing is picking an asset that you believe has a higher resale value in the future.

Often there is risk associated with investing, and the value of your investment could also decrease over time.

That’s why it’s essential to do your research and place your capital somewhere you’re confident you’ll be able to limit potential downside risk.

Risk and reward are very closely linked, and high-risk investments are likely to increase more than those with a lower risk profile.

A high-risk investment could be something like an individual cryptocurrency or commodity with volatile price movement up and down.

Low-risk investments often come in the form of government or blue-chip bonds, stocks are considered riskier, but you’ll find each company will have their own risk profile.

For example, a blue-chip company like Apple or Mcdonald’s is considered a lower-risk investment than a hyper-growth stock like Tesla and Snapchat.

What different types of investments are there?

Stocks

A stock is a small portion of a company that has been sold publically or privately to raise capital for its business. Owning stock gives you part ownership of the company, and its value or price usually correlates with its performance.

Bonds

A bond is a loan with you acting as the banker. Corporations and/or countries issue debt through a bond that another individual or central bank then purchases. The lender will pay interest with a fixed rate of return each year plus the money you initially paid back in full.

Bonds are generally considered lower risk than stock, although not all are safe as the lender could still declare bankruptcy or close for business. Each bond has its risk ratio set out by vetted credit ratings. For example, credit agencies usually consider US government bonds low-risk and are often given a high rating.

Commodities

Commodities can be precious metals, agriculture, oil or energy. A physical commodity could be like buying a gold brick or a barrel of oil. You can also trade commodities with their price reflected on stock exchanges, and they’re often considered very high-risk.

ETFs and Mutual Funds

These two types of funds invest in multiple assets at once when you invest in them. Investing in one of these funds will give you broader diversification for your portfolio and equally can lower risk. Both will differ in size and can hold anything from a handful to thousands of assets.

An ETF will focus on their strategy, which could be owning stocks across a sector, country or continent and is usually passively managed. Mutual Funds differ from ETFs as they’re often trying to beat the market benchmark returns with actively managed portfolios.

Real Estate

Buying land, a house or a building will expose you to real estate. You can also invest in a REIT or real estate investment trust for exposure should you not have the capital to buy a property outright or fund a deposit.

REITs are built on investing in property and creating value for investors through increases in price or dividends. They can be focused on two sectors which are commercial and residential, or in some cases, both.

Popular Investing Strategies For Beginners

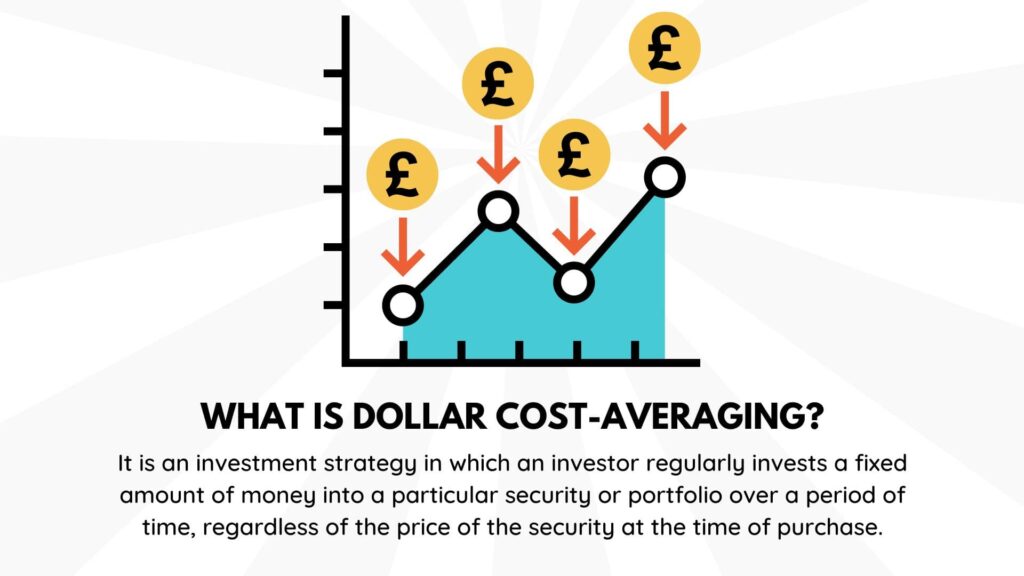

Dollar-Cost Averaging (Pound Cost Averaging)

Dollar-cost or pound cost averaging is essentially averaging into the market simultaneously every month through your chosen stocks, mutual funds or ETFs.

If you regularly invest each month, you benefit from compound interest by adding to your investments over time. This is perfect for those with little to no interest in the financial markets and who simply want to enjoy the returns that great businesses earn over the long term.

- Approximately 8-12% per annum subject to your chosen investments (a minimum of 5 years or more) – the effort required 2/10

Value Cost Averaging

Value Cost Averaging or VCA takes the dollar-cost averaging strategy above and adds a small technique. The goal is to lower the average cost over time by buying more when the market is low (buy low / sell high) and less when the needs are high.

Over time this enlarges your returns as, essentially, the average cost you paid was lower than if you put in the same amount each month simultaneously.

- Approximately 12-15% per annum subject to your chosen investments (a minimum of 5 years or more) – the effort required 5/10

Active Investing

Active investing, as its name implies, takes a hands-on approach and requires someone to act in the Portfolio Manager role. This person can decide when and where to invest their money by often rebalancing (buying and selling) their investments.

The goal of active money management is to beat the stock market’s average returns and take full advantage of the cycles the stock market will go through. It requires immense skill and knowledge of the markets, so if you’re starting, then work your way up to this over several years.

- Approximately 15% + per annum subject to your chosen investments (a minimum of 5 years or more) – the effort required 10/10

Investing for Beginners UK – Learn More

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.