How To Pick A Stock?

Let’s learn how to pick a stock with our seven tips and tricks.

Picking individual stocks requires a set of skills that are often harnessed often over a number of years.

Whilst many investors enjoy individual stock picking we believe it’s important for beginners to have a set of tools they can use to give them the best chance of being successful.

What is important before getting started?

Most people think stocks are picked by stock brokers sitting in a big bank somewhere within the city.

That may be true back in the 70s and 80s but these days retail investors like you and I are making use of technology to invest from our sofas!

Every investor in the world should have a checklist that they run through before picking a stock.

Is the business growing?

Growth is possibly the most prominent factor you should consider when thinking about how to pick a stock. Is the company getting larger each year?

Assessing growth can be found by looking at the company’s earnings reports. You can find a company’s earnings reports on its investor relations page or find digestible versions on applications such as Yahoo Finance, Seeking Alpha and The Motley Fool.

Earnings growth is pivotal to long-term price action.

For example, if Amazon has strong YoY growth and continually invests in new arms of its business, then you could assume that its stock price will rise over time. In the short term, the market is a voting system, but in the long term, it’s a weighing machine.

What we mean by that is a company might be getting some bad press, and so even though it’s performing very well in its quarterly earnings calls, the stock price could be taking a beating just based on the news.

If you believe in the company long-term, this could represent a buying opportunity, picking up a great business at a discount. The key here is to buy growing companies at the lowest possible price possible. Buy low, sell high.

How is the company doing compared with it's peers?

When thinking about how to buy a stock it’s important to be looking at similar companies within the sector and seeing how they’re fairing against each other.

Start by looking at the industry and how other companies in the same sector are growing. This can give you a good indicator of how the industry is growing as a whole.

After listing the companies, we like to assess each company and its key USPs (unique selling points).

What makes one different from another? Does it have an additional product coming to market that could be a gamechanger? How big is the company vs its competitors?

Once you’ve assessed this, you’ll have a good insight into each company and what they are up to. You may even find a better option whilst you’re searching.

Lastly, we like to look at the profits, debt, history of their stock prices, current PE ratio, and analysts’ target price before making an informed decision. This will give you further insight into whether the sector is performing well, undervalued or overvalued.

What is PE Ratio and why it is important?

When looking into how to pick a stock the Price-earnings ratio is an important metric for valuing a company often used by traders in the stock market when thinking about how to buy stock.

It measures businesses’ share price relative to their earnings per share. Investors use the PE ratio to decide whether the company is over or undervalued, amongst other tools. They do this by looking at their competitors and assessing how that particular company is performing relative to its peers.

A high PE ratio could mean that the company is overvalued, but it can also mean that high growth rates are expected. When there’s a high PE ratio, it’s essential to assess a company’s growth rates and their forecasting for the years to come.

You can calculate PE by taking the market value per share and dividing it by the earnings per share. Most stock screeners will have this information ready-made for you but use this formula if you cannot find it.

Using what we just learned, you can look at competitors’ current PE and the sector’s historical PE ratios to decide whether it’s an excellent time to buy.

Equally, suppose the PE ratio has risen to astronomical levels. In that case, it may be time to trim your holding if you already own it or decide not to enter the market until the price has dropped to a more agreeable level.

Who is running the company?

Management is what makes a company tick. It decides on future direction, product lines, debt levels and, most importantly, drives the growth of a business. It’s pivotal for successful companies to have incredible, forward-thinking management teams.

When looking into management teams, we tend to start with the CEO or Founder and work our way through the business, looking at each individual as closely as we can. We find that companies, where the Founder(s) are still there from the beginning are often well run. This isn’t always the case but this is just something we’ve found.

Often you can find interviews online with key personnel or watch earnings calls to get a feel for how they operate. LinkedIn can also be great by looking back at career history and the performance of the company they were at during their tenures.

For example, a new CEO might have very different views from their predecessor’s, and you might disagree with the direction they are looking to take the company. If you decide it’s not for the best of the business, this could be a red flag, and therefore, you look at another company within the sector management that align more with your values.

We also like to look at Glassdoor and Trust Pilot reviews as often you can get a good indication of company culture and consumer feedback.

For example, we were going to invest in a car insurance brand recently but found their Trust Pilot reviews to be awful. This turned out to be a good decision as six months later, the stock price had dropped by almost 80%, and their CEO was being sued.

Now when learning how to pick a stock assessing management is not like PE ratio where you can form a number. It’s all down to opinion, but if you do some digging, you’ll be able to find out how you feel pretty quickly.

Establish a margin of safety

Once you have come up with a fair valuation of a company, it’s always good to look at your margin of safety. We assess this by looking at what we feel the company’s intrinsic value is against its current share price.

The easiest way to explain the margin of safety would be to see a stock which is £100 intrinsic value vs a current stock price of £80. This means if you entered the market at the current price, then in your calculations, the margin of safety is 20%. In this situation, you might be comfortable with the stock price dropping lower as you feel it’s already undervalued, so in your eyes, that margin of safety is getting bigger.

By establishing some margin of safety, you’re essentially buying stocks at a lower price than what you feel the market values them. This approach allows you to potentially limit losses and buy companies for a better price than what the market values them.

The intrinsic value is an objective fundamental value of a stock. This is subjective to that person’s methods and can be established in several different ways, often with different results each time.

Another margin of safety comes from what’s called a stock moat which is where a company has a competitive advantage over it’s peers that will see it come out on top and grow in the future. This is so important to consider, growth = higher stock price over time.

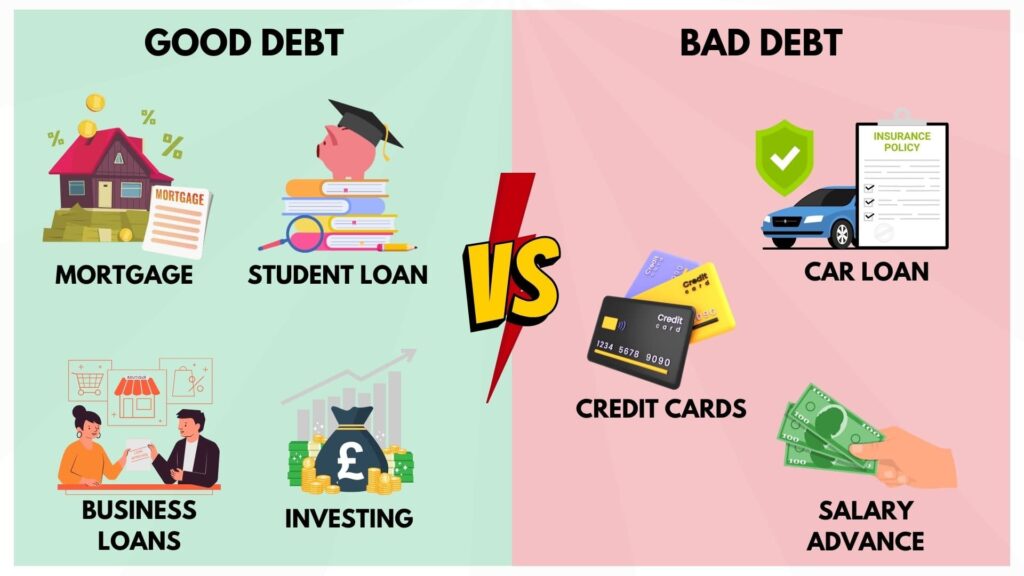

Good debt vs bad debt

Debt, if used in the right way, can be a powerful thing when looking at how to pick a stock. It is often given a bad light because we see ‘debt is bad’ and ‘pay off your debt’ everywhere we look. While that’s correct in most cases of personal debt, corporate debt is very different.

Be wary of companies with high debt levels compared to equity. You can assess a company’s debt-equity ratio by looking at all debt or liabilities vs market value. Take what we’ve learnt in previous sections and apply it here by comparing the debt-equity ratio against its peers.

There are examples of sectors with very high debt levels so if you come across them, then do not panic.

For example, house builders or railroad companies use a high level of debt to finance ongoing operations, balancing their books by projects that are coming to an end.

We hold a couple of house builders in our portfolio as we believe the sector is on the rise, but the two companies we own on paper have incredibly high debt. It’s about weighing up the future potential and whether or not the company is using debt for growth or debt to pay back bad mistakes.

Most companies will carry debt, even the most profitable ones like Amazon or Microsoft. These vast businesses use debt to help them fund growth and, due to their large balance sheets, often get favourable terms on loans that are far more beneficial than the ones provided by the everyday corporate banking system.

You need to assess debt correctly to understand whether or not the company is valuable or, in fact, in deep trouble.

Do you know what you're buying?

When looking at how to pick a stock if you don’t have a good indication of what the business is doing, then this is a HUGE red flag for us. This is out of all of the seven things we’ve discussed is probably the most important when learning how to pick a stock.

If, for example, someone knocked at your door selling cookies for a charity you’d never heard of, are you likely to give that person your hard-earned cash? However, if they have a compelling back story, you’d heard about their work in the local community and know someone who works there, you’re probably much more likely to give them some cash.

It’s the same with investing. Don’t pile your money on that outstanding stock your mate mentioned at your local bar. Do your research and feel comfortable that you’re making an informed buying decision. Trust us it’ll pay off in the long run.

Investing for Beginners UK – Learn More

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.