Top 5 Steps To Consider Before Investing In The UK

1. What is your timeline when investing in the UK or around the world?

When investing in the UK everyone is different. It totally depends on your age and your goals. We suggest taking some time to think about this carefully and work out exactly what it is you’re hoping to achieve.

For some it could be retiring early, providing a source of passive income, a new car, house extension or travel pot. There’s 100’s of reasons why you might be looking to invest and each one is unique to you. Anything is possible if you put your mind to it and have the discipline to stick to your target monthly amount.

For example, you could be looking to save up to £40,000 for a house deposit. What we would do here is break down the amount you can put towards investing, something like 30% of your monthly earnings.

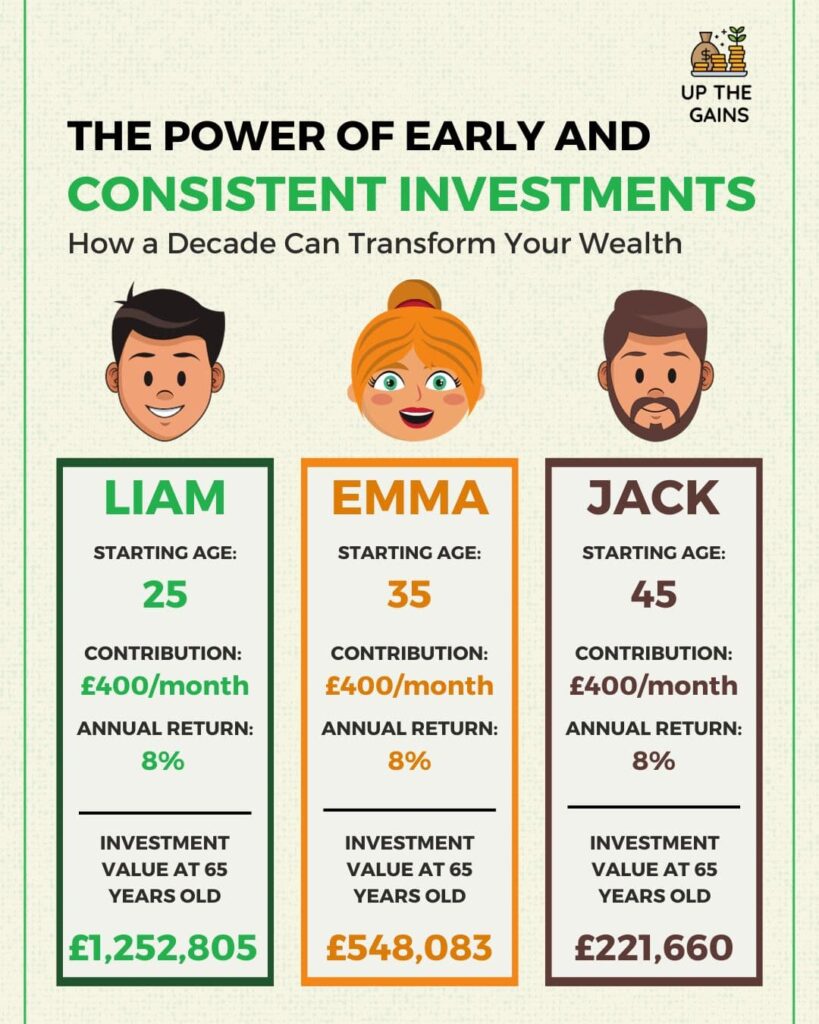

If you invest in something like the S&P 500 or Vanguard Total Stock Market Index then on average over say 10 years it increases by 12% a year. Use a simple compound interest calculator found HERE and find out exactly how long it would take you to get there.

2. What kind of investor are you?

Understanding yourself and how you might handle risk is THE most important thing you can establish before investing in the UK. By garnishing this you can relatively easily build out a portfolio of funds and stocks based on their past performance.

In your younger years, you have a much longer time horizon than other investors so often would have a larger appetite for risk. This means you might want to allocate more to things like growth stocks, startups and/or blockchain technology but perhaps not, everyone is different.

You could be closer to retirement so you might be looking to preserve your capital and establish some regular income to aid your elder years. An example of this would be investing in high yielding dividend stocks that grow small amounts each year but again perhaps not.

Once you’ve established your appetite for risk you then need to allocate this down into percentages. It’s easier to start categorising your investment portfolio into high, medium and low quantities.

An example portfolio could be:

- A 25-year old that’s looking to build capital quickly to purchase 1st home.

70% higher risk investments / 20% medium risk / 10% low-risk - A 35-year old that’s looking to retire early and put away money for their children’s university.

25% higher risk investments / 50% medium risk / 25% low-risk - A 55-year old that’s coming up to retirement and looking to add some extra money to their savings

5% higher risk investments / 30% medium risk / 65% low-risk

3. Stick to your interests

When you’ve got your risk portfolio laid out it’s time to start researching what you’re going to invest in. There are thousands of possible options across the world and so we find a good place to start is to write a list of the things you use every day and the brands you like the most. You should get a list of 40-50 companies which you can begin to look into.

We suggest having a large portion of your portfolio in stocks you know, use and/or love. The reason for this is you’re already a part of this business, you know their product, you know the brand, you often know how the company is doing from a top-down level. It gives you a head start that might take you a few days worth of research to find for another company.

Another way of looking at this is to think about what will change the world in the coming years. For example, if you had invested in Amazon or Netflix (or any of the FAANG’s) when it first came onto the market you would have done very well for yourself. Future-focused sectors could also include things like electric vehicles, financial technology, artificial intelligence and clean energy.

At the end of the day it’s about making money, but if you want a great place to start then everyday items you use at home will give you a great starting list.

4. Diversify your investments

We value this just as highly as risk when investing in the UK. Don’t put all your eggs in one basket and you don’t want to be left holding the bag when it breaks.

Diversifying your portfolio is owning stocks, bonds, real estate and commodities from a wide variety of sectors or geographies. Splitting your assets reduces your risk exposure to a particular theme such as technology stocks and will help limit downside risk to your portfolio.

Depending on the type of investor you become we suggest you hold at least 25-30 stocks. This can be achieved by holding funds, ETF’s that branch out across sectors, countries or continents. You can also individually pick stocks to achieve the same result essentially creating your own fund.

In our portfolio, we hold at least 30 individual holdings, 4 ETF’s and 2 funds. Overall we have small ownership of over 2000 different stocks that are all weighted based on our risk tolerance.

5. Don't allow emotions to drive your buy and sell decisions

The key to investing is patience and calmness. The fastest way to lose your money is to invest with emotion. It rarely ends well. Often you could get too excited seeing a stock reach its all-time high and think it’s going to continue on its skyward trajectory. It might well do that, but equally a stock at its peak has a long way to fall.

We suggested always taking your time with your choices. There’s no rush to make a good decision. It’s about time in the market not timing the market. Even the best investors in the world can’t time the market. Nobody knows what tomorrow will bring so why make that bet.

Using simple strategies such as regular monthly investing will take out the emotion you might feel when a stock is sky high or the market has crashed. We all hate seeing our stocks go through a correction or through a down period and you’ll need to fight every ounce of your being not to sell. The best thing we could suggest is to ignore the news and go about your lives in an orderly manner. For example, Netflix has risen nearly 20,000% since it came onto the market, but over that time it has dropped 70% of its entire value six times. Imagine if you had sold at one of its lows!

We’re not saying however you should just set it up and leave it forever. It’s important to review your portfolios at least 3-4 times a year. There may be things that change during this time. You could decide you want to increase or lower your risk so you buy or sell accordingly to change your holding size. It’s important to have your finger on the pulse but make sensible decisions based on multiple sources of advice.

Remember growth = higher stock price longer term. Companies need a moat (competitive advantage) to succeed! Investing in the UK is a great place to start but remember there’s opportunity all over the world.

Investing for Beginners UK – Learn More

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.