Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Full disclosure for this Plum App Review.

I downloaded Plum and ran some tests for six months before writing this article, and overall I was very impressed with it so much so that I’ve kept it and use it now almost everyday.

I now have automated savings each month that sits in one of my savings pots or pockets as Plum calls it.

Using this feature helps me save each month and it even predicts how much I can afford to put aside based on my income and monthly expenses. Nifty!

What an app! I utilise their smart AI to set money aside automatically every payday!

You can earn up to 4.21% AER with their Easy Access Interest Pocket, and begin investing in up to 3000 stocks and funds from as little as £1.

EXCLUSIVE OFFER: Get a free £5 cashback in your Plum account when you open an account through Up the Gains.

- Auto save and invest

- Savings pots with interest

- Low fees in comparison to Chip

- ISAs and free savings accounts available

- Easy to use mobile app

- Tiered fee levels to access all investment options

Plum has some fantastic features that help savers make that leap from saving the odd bit of cash here and there to finally making a real difference in people’s lives.

The best feature is the income and expenses AI tool, which can predict how much you can afford to save or invest based on your habits.

You can then alter its suggestions and frequency, which is handy if you struggle to save regularly.

The app is quick, easy to navigate, has a free version and is quick to join. You can head to Plum’s website here if you’ve already heard enough.

Below we’ll cover the app in more detail, discussing the main features, account types, fees and what its current customers think of it.

Let’s get cracking with this Plum Review!

Our Rating

- Suitable For Beginners

- Useful Features

- User Experience

- Price / Fees

- Customer Feedback

- Customer Service

Plum App Review

I rated Plum very highly with a total of 4.5 out of 5 stars using our six pillar method.

The six pillar method is a system I use to rank an app based on its useful features, user experience, customer service, suitable for beginners, customer feedback and price.

The highest scores for Plum are for its suitability for beginners and useful features including the highlight automatic round-up and investing feature.

It’s fees are simple but go up in price to access tall features. One thing we noted is that they could work slightly on their customer service but it’s a real minor nag for me.

If you’re looking for an app to improve your saving and investing habits you’d be hard pressed to find a better app than plum.

Watch our Plum review video

Plum is the award-wining ultimate smart money app, helping over 1 million people to invest, save and manage their spending with automation.

I'm personally using the app as part of my savings plan and absolutely love their automatic saving features.

Plum App Pros & Cons

Pros

- Fantastic for beginners and more seasoned hands-off investors

- Low fees

- Easy to open an accounts

- Good account selection, including ISAs and SIPPS

- A slick and easy-to-use app

- Budgeting and spending AI to help predict your spending habits

- Great selection of stocks and funds

- Cashback offers

- Great customer reviews

Cons

- Not good for short-term traders

- Lack of research on stocks and funds

- Lack of an academy or education tools

What Is Plum and How Does It Work?

Founded in 2016 by Alex Michael (ex-Tichtail) and Victor Trokoudes (ex-TransferWise), Plum is a saving and investment app with over 1.4 million users and over £1 billion saved.

The app connects your bank accounts and credit cards through open banking technology, which it then uses for the AI to analyse your saving and spending habits.

Then it can suggest saving and investing levels unique to you. This can be as frequent as you like and I liken it to when you used to put your spare change in a jar.

If you prefer, you don’t have to invest at all, and there’s an account where you can just save your money earning a little interest on the way.

The app is also available to download on Android (Google Play) and the iPhone app store.

Is the Plum App Safe?

Yes, Plum is safe. It has high street banking level security, including 256-bit face/fingerprint ID technology and is regulated by the Financial Conduct Authority as a registered account service provider.

The funds offered on the app include trusted brands like Blackrock and Vanguard.

Investec who deliver the pockets capability that are all FCSC-protected. If they should fail, your funds are protected up to £85,000, which is industry standard in the UK.

Plum is the award-wining ultimate smart money app, helping over 1 million people to invest, save and manage their spending with automation.

I'm personally using the app as part of my savings plan and absolutely love their automatic saving features.

Plum's Main features

To keep things simple, we’ve made a list of Plum’s main features so you can quickly skim through them.

- Open banking technology

- Automated deposits into your account

- Intelligent budgeting with AI suggestions

- Roundup purchases into saving pots (pockets) or investments

- Access to investing funds with Blackrock, Legal & General & Vanguard

- Withdraw as often as you like, with no extra fees

- Plum Interest – earn up to 4.94% (more on this below)

- Bills and offers pages aimed to save you money on household bills and purchases

- Personal pensions (SIPPs)

- 52-week saving challenges

- Cashback at retailers (Pro version)

- Plum Debit Card (Ultra Version)

These features differ by the product you choose and in places the account you open. Plum offer GIA (general investment accounts), Stocks and Shares ISAs and SIPPs (personal pensions).

Plum's Products and Accounts

There are four main types of products available. For this Plum app review, I’ll disclose I upgraded to the Ultra account as I didn’t feel the need to upgrade to premium, and you’ll see why in a moment.

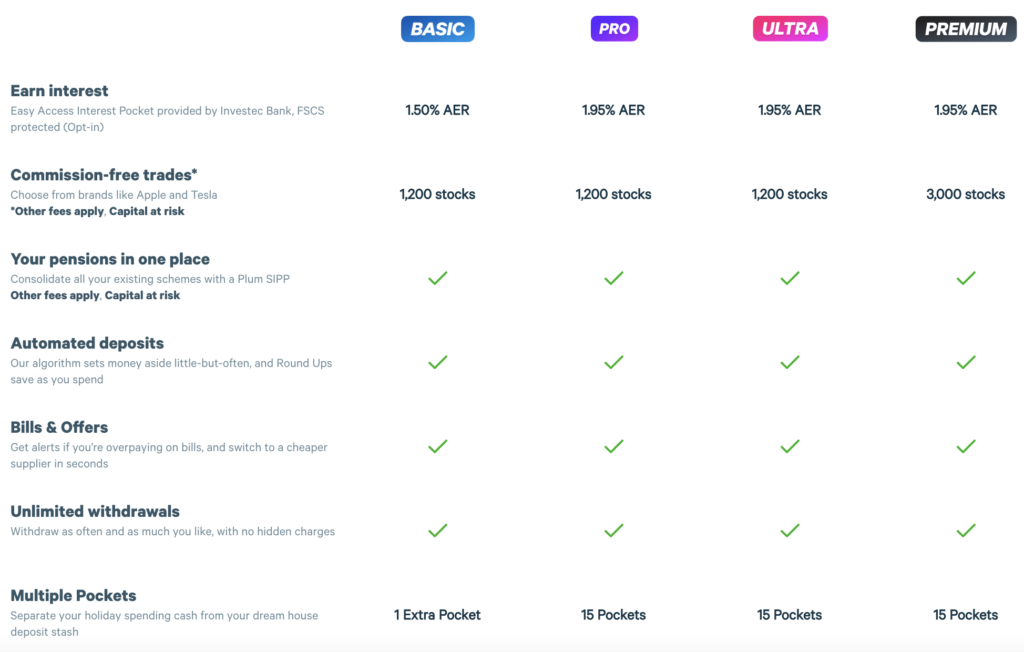

| Plum Basic | Plum Pro | Plum Ultra | Plum Premium | |

|---|---|---|---|---|

| Cost | FREE | £2.99 per month | £4.99 per month (30 days free) | £9.99 per month (30 days free) |

| Automatic Saver | ||||

| Roundups | ||||

| Pay Days | ||||

| Easy Access Saving Account (AER) | 3.51% | 3.72% AER | 3.72% AER | 4.21% AER |

| Stocks | 1,200 | 1,200 | 1,200 | 3,000 |

| Pension | ||||

| Investing | ||||

| Mutual Funds | 12 | 12 | 21 | |

| Rainy Days | ||||

| 52 Week Challenge | ||||

| Interest Pockets | 1 | 15 | 15 | 15 |

| Assign Pocket Goals | ||||

| Cashback | ||||

| Money Maximiser | ||||

| Plum Card | ||||

| Price Alerts | ||||

| Average Annual Asset Management Fee | 0.45% | 0.45% | 0.15% | |

| Priority Customer Support |

There are four main types of products available. For this Plum app review, I’ll disclose I upgraded to the Ultra account as I didn’t feel the need to upgrade to premium, and you’ll see why in a moment.

Plum Basic

(Monthly Cost – Free)

The Plum Basic account allows you to invest in two main pockets: the primary pocket and easy access.

The basic account is perfect for those who want to dip their toe into saving and investing or test the app before signing up for a monthly cost.

You have access to savings accounts provided by Investec PLC, a Stocks and Shares ISA or GIA (general investment accounts) and SIPPs all at this free level.

Plum Primary pocket

The primary pocket showcases the brilliance of Plum even at a free level. You can analyse your spending habits, and then through its incredible AI, it suggests for you to deposit every few days.

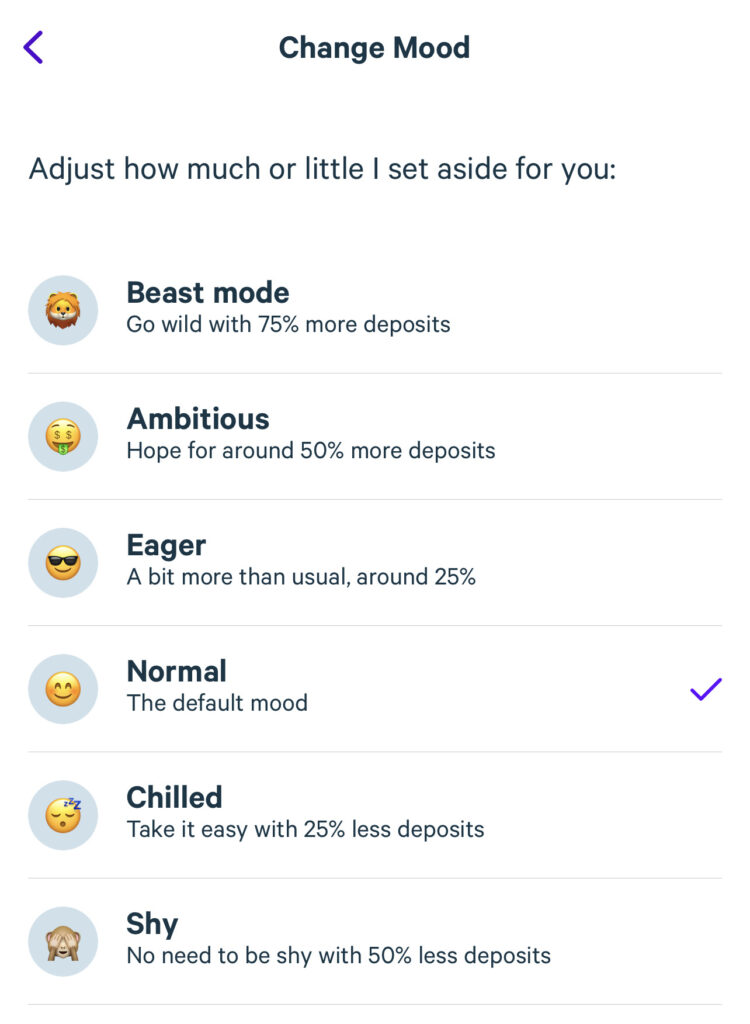

You control how much the algorithm deposits by selecting which mood, which is on a sliding scale.

I used the primary pocket for a couple of months to test the AI and better understand how it works. I found that this account is fantastic for short-term goals or putting money aside for one-off larger purchases.

This account doesn’t, however, offer any interest, and withdrawals can take up to 24 hours to process.

If you want something long term, use Easy Access or consider one of the upgraded account types below.

Plum Easy Access Interest Pocket

The Plum Easy Access interest pocket pays interest of 2.00% AER available on it’s basic tier.

There is also the option of investing via an ISA too, with over 1200 stocks to choose from at this level. Oddly it doesn’t allow fund investing, and you would need to upgrade to Plum Pro to get this feature.

One last feature of this account type is the household bills part, which will suggest savings and even new products if it can save you money.

What an app! I utilise their smart AI to set money aside automatically every payday!

You can earn up to 4.21% AER with their Easy Access Interest Pocket, and begin investing in up to 3000 stocks and funds from as little as £1.

EXCLUSIVE OFFER: Get a free £5 cashback in your Plum account when you open an account through Up the Gains.

- Auto save and invest

- Savings pots with interest

- Low fees in comparison to Chip

- ISAs and free savings accounts available

- Easy to use mobile app

- Tiered fee levels to access all investment options

Plum Pro

(Monthly cost – £2.99)

With the pro account, you can level up your savings and investing with wider account features. The interest on the savings accounts increases to 2.30% AER, and you also have Access to 12 funds that you can invest in with as little as £1.

You also get Access to up to 15 pockets which you can put your money away into.

This was particularly useful for splitting my emergency fund, Christmas presents, holiday funds and yearly purchase fund for things like car insurance.

There is also Access to the 52-week challenge, budgeting goals where you can assign yourself targets and cashback offers from a selection of retailers.

Plum Ultra

(Monthly cost – £4.99)

Stepping up a level to the Plum Ultra account keeps all of the features from the Pro account but also adds to them.

You are given Access to a Plum debit card for daily purchases and a 33% increase on your cashback offers from retailers.

But, by far the best feature at this level is the money maximiser which allows you to split your spending into weekly allowances allowing the rest of your money to earn interest before you use it.

This feature is brilliant as it’s moving your money around to get even more out of it.

Plum Premium

(Monthly cost – £9.99)

Now we step up even further in monthly cost, and it’s a big jump. You get everything we’ve mentioned from the lower tiers, but at this level, you have a much more comprehensive selection of investments.

The number of stocks you can choose from increases to 3000, and funds go up from 12 to 21.

Another added feature is the ‘repeat stock investments’ tool that allows you to set daily, weekly or monthly contributions directly into stocks of your choice.

Whilst this is great, the other levels offer good Access, so I’d only look to upgrade here if I was interested in the broader stocks.

Plum Stocks and Shares ISA review

As mentioned briefly, Plum offers Access to Stocks and Shares ISAs these account types allow you to invest up to £20,000 per year (ISA allowance), and the returns are not subject to capital gains tax.

Plums Stocks and Shares ISAs are held via the app with a 3rd party provider, but your money has FCSC protection, and all partners are FCA regulated.

You have full access to the great select of stocks and shares depending on the account type above.

Capital is at risk if you invest.

Plum SIPP review

Personal pensions are a great way to make your money work for your retirement. These are the types of funds available. Customers can choose from 17 funds with a SIPP.

These options also include:

- Target Retirement Date Fund – This fund adapts to your age and retirement date and lowers your risk automatically over time by re-investing your funds into other areas.

- Global Growth Fund – This is a general investment fund with a wide selection of top companies worldwide.

- Future Planet Fund – This fund has an environment-first focus, meaning your money is invested in companies looking to improve the world.

Plum is the award-wining ultimate smart money app, helping over 1 million people to invest, save and manage their spending with automation.

I'm personally using the app as part of my savings plan and absolutely love their automatic saving features.

Investing options & fees with Plum

There is a wide array of stocks and funds available to invest in on the Plum app. In fact you have Access to up to 3000 individual stocks and 21 funds depending on the account type you have.

With individual holdings, there is Access to some of the world’s most significant blue chip stocks from the US and the UK, Europe, Asia and Africa. Big names like Apple, Amazon, Tesla and Microsoft all feature.

The funds are provided by some of the world’s biggest providers, with Vanguard, Blackrock and Legal & General being the most notable. This means you’re picking products owned by vast swathes of investors worldwide.

Example funds available – Names differ to the official fund names

- Balanced Ethical (Blackrock)

- Clean & Green (Blackrock)

- American Dream (Vanguard)

- Best of British (Vanguard)

- Tech Giants (Legal & General)

- Slow & Steady (Vanguard)

- Growth Stack (Vanguard)

Investing fees

There is a platform provider fee which Plum charges of 0.45% per investment. Then there is a fund management fee ranging from 0.06% to 1.06%. These fees are on top of the monthly costs of you account type.

It’s important to note that you’ll pay these kinds of fees with any provider, and in fact, Plum is very cheap compared with other investing apps.

Capital is at risk if you invest.

Plum Interest

Plum launched a new feature called ‘Plum interest’ in September 2023.

It’s a new feature that allows you to get a variable rate of interest (currently 4.94%) with a Blackrock ICS Sterling Government Liquid Fund.

Simply put, it’s a type of investment account that guarantees a certain level of interest albeit the interest is subject to change.

Your capital is at risk but the rate tracks the Bank of Englands base rate.

On the Plum website, they have stated “Your money is held in an interest-earning fund holding government-backed assets, making it low-risk with stable returns”.

The cost of this account is 0.25% which is split with a 0.15% fee from Plum for managing the account and a 0.10% fee charged by Blackrock.

You can read more about Plum Interest here.

Plum user experience

The overall user experience on the app is fantastic. It’s super easy to navigate around to the sub-sections, and everything is hyper-visual, fast and responsive.

I particularly like the reminders for things like drinking water and checking in with yourself, which is a nice touch.

They also have the option to set money aside on rainy days, so every time it rains where you are, it deposits extra cash for you.

Plum has worked hard to make what can be a dull subject in saving investing both fun and engaging. The app makes you want to keep coming back and re-using it.

What are Plum customers saying?

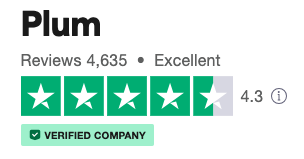

They are smashing it on Trustpilot for a financial product with a 4.4 out of 5 from over 4,635 reviews!

Looking at some of the more positive reviews, they are highly praised for helping people start saving and investing. There’s also a lot of chat about the app being really easy to use.

Plum App Alternatives

Plum has many similar features to other apps. When it comes to their round-up feature Monzo and Starling are also great candidates.

For the full suite we think Chip and Moneybox are the most similar in terms of products available.

Check out our Chip Review or our Moneybox Review.

FAQs

Does Plum affect my credit score?

No, Plum does not affect your credit score, although applying for a Stocks and Shares ISA will appear as a soft search.

Plum also offers partner offers for credit cards and loans via 3rd party partners, which would show up as a hard search should you go through with the application.

Is Plum a good investing app?

Yes, Plum is one of the top-rated investing apps. Its investing tools are very effective, with great options for accounts, including a Stocks and Shares ISA and a GIA (general investment account).

It has over 3000 individual stocks and 21 funds by some of the major institutions like Vanguard, BlackRock and Legal & General.

The app also uses its powerful AI to predict your spending patterns, allowing you to save and invest what you can afford.

Is Plum good for beginners?

Plum is built for beginners, and its slick visual appearance keeps you wanting to return to the app. Its original ethos was to get savers and investors to create wealth through innovative AI that can help suggest amounts that are affordable to each individual.

If you struggle to save or investing, the app can help you get started and show you results quickly in a visually impactful way.

Plum can make it easier for beginner investors to find the right investments to suit their strategy.

How to contact Plum?

Plum offers a chat function via the app and the opportunity to speak to a real human if you can’t find the answer.

You will need to leave a ticket, and someone will respond in up to 2-3 hours, depending on the level of enquiries that day.

If you prefer to email, then you can send one to [email protected]

How much does Plum cost?

Plum is free to download and has a free basic tier, providing some great features. Should you wish to access wider features, Plum charges a monthly subscription in three tiers.

The Plum Pro is £2.99, Plum Ultra is £4.99 and finally Plum Premium is £9.99, all fees are charged monthly.

What is the Plum Card?

The Plum card is available for Ultra and Premium users and can be loaded with funds from your linked bank account or your Plum primary pocket.

It’s a Visa card, so it can be used fee-free anywhere that accepts Visa users meaning you only need to cover the Visa daily. exchange rate.

Is the Plum app worth it?

Yes, we think the Plum app is worth it. It has such a wide range of features, suitable for beginners and the more savvy individual.

It’s round up feature is very useful, the app is fast and has a great user experience.

How to withdraw money from a Plum account?

Withdrawing from Plum is relatively straightforward. If you withdraw from your instant access primary pot the money will be in your account almost instantly but can take up to 30 minutes. For me it has only ever been within 10 seconds.

Moving money to withdraw can take longer and I’ve had to wait up to 24 hours for the funds to be available to be withdrawn.

This can be frustrating but also Plum is designed to help you save and invest so I believe you should use your current accounts to move money around.

How to close an account with Plum?

The process is very easy. You can withdraw your funds and then head to personal details and select close account.

All of your direct debits into Plum will be cancelled and they will send you an email to confirm.

What an app! I utilise their smart AI to set money aside automatically every payday!

You can earn up to 4.21% AER with their Easy Access Interest Pocket, and begin investing in up to 3000 stocks and funds from as little as £1.

EXCLUSIVE OFFER: Get a free £5 cashback in your Plum account when you open an account through Up the Gains.

- Auto save and invest

- Savings pots with interest

- Low fees in comparison to Chip

- ISAs and free savings accounts available

- Easy to use mobile app

- Tiered fee levels to access all investment options

Conclusion

Overall in this Plum app review, I’ve tried to give an honest opinion. I downloaded and spent a lot of time playing around with the features, testing their savings and investing capabilities.

If I were starting out, I would love how easy it was to use and the app’s capabilities. I could see myself using this long-term.

The fees are competitive when compared to other apps like it, and even though you can get lower fees elsewhere, the app’s superiority makes it a market leader in my eyes.

I suggest downloading it and having a play around. If it’s not for you, then it’s not cost you anything! If it is, the paid accounts are worthwhile if you plan on using the app for more than a few months.

Share with your friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.