Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

As a homeowner, you may find yourself in a situation where you have an interest-only mortgage and are considering switching to a repayment mortgage.

But you find yourself asking can I change my interest-only mortgage to repayment? Well, the good news is yes you can but there are things to consider.

This decision can have significant implications for your financial future, so it’s essential to have a clear understanding of the process and the benefits and considerations involved.

In this article, I will explore the steps you can take to change your interest-only mortgage to a repayment one, the reasons why people choose to do so, and some frequently asked questions related to this topic.

Key Takeaways:

- Yes, You Can Switch: Transitioning from an interest-only to a repayment mortgage is generally feasible, subject to lender approval and specific eligibility criteria.

- Eligibility Matters: A good credit score and proof of stable income are usually required to make the switch successfully.

- Start Early: The process can take a few weeks, so early planning and consultation with your lender or a financial advisor are essential.

Table of Contents

Can I Change My Interest Only Mortgage To Repayment?

Yes, you can and the process is relatively simple. However, it does depend on your reasons for the switch.

If you’re just switching as a normal person off an interest-only mortgage because your financial situation has changed then shop around to see if you can get a good deal.

If you’re a landlord then you may have to undergo a different process so be wary of that.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

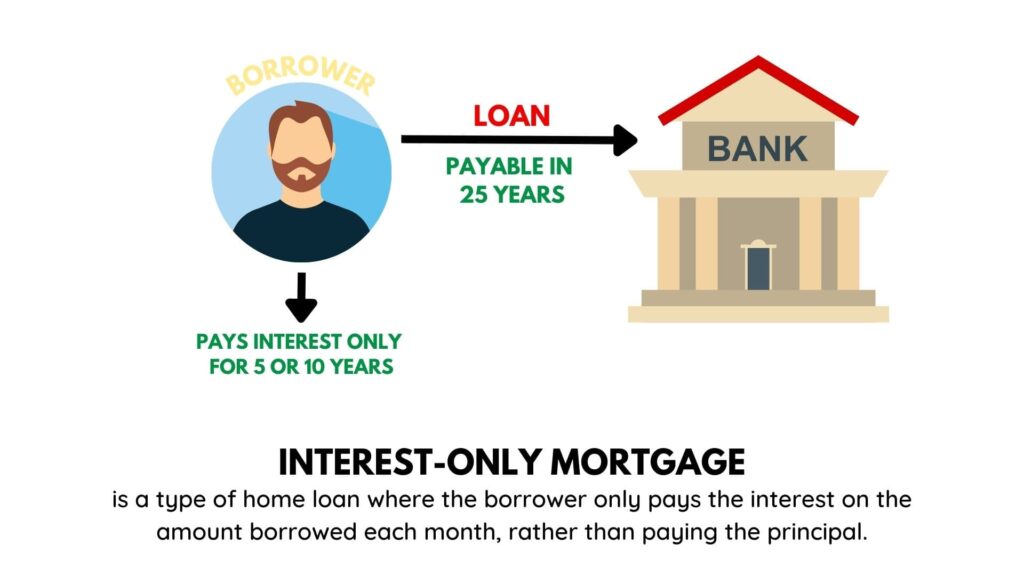

Understanding Interest-Only Mortgages

Before I delve into the process of changing an interest-only mortgage to a repayment one, let’s briefly discuss what an interest-only mortgage entails.

With an interest-only mortgage, you only pay the interest on the loan each month, rather than making payments towards the principal balance.

This type of mortgage allows for lower monthly payments during the term of the loan but requires a lump sum payment of the principal at the end.

You can have a fixed interest-only mortgage which is fixed for a term such as 2 or 5 years or you can have a variable interest-only mortgage meaning your payments can go up or down.

So if you’re looking to switch but are on fixed terms look out for early repayment charges which differ by provider, some have none others have one in place.

Interest-only mortgages can be an attractive option for some borrowers, especially during the initial years when financial obligations may be higher or interest rates are soaring like they are today.

However, it’s essential to recognise that the principal balance remains unchanged over the interest-only period, and you have to plan for repaying the borrowed amount at the end of the term.

Personally, I think interest-only mortgages should only be an option if you have no other choice so if you can make the switch financially then doing so far outweighs not doing so!

Why Change From Interest-Only to Repayment Mortgage?

There are several reasons why homeowners decide to change from an interest-only mortgage to a repayment mortgage.

Here are some common motivations:

1. Building Equity

I think this is the most important reason to consider. You didn’t buy the house to essentially be renting so by switching to a repayment mortgage, you start paying off the principal balance along with the interest.

With each payment made, you are building equity in your home, increasing your ownership stake which is exactly what you wanted in the first place.

This can provide a sense of security and financial stability, knowing that you are gradually reducing your debt and have a tangible asset.

2. More Favorable Future Lending

Switching to a can put you in a better position for future lending opportunities.

Lenders may view borrowers with repayment mortgages as less risky, as they are actively reducing the debt.

This improved profile may result in access to better interest rates, increased borrowing power, and a wider range of mortgage products.

3. Mitigating Financial Risk

With an interest-only mortgage, you are exposed to the risk of not having enough funds to repay the principal when the loan term ends.

By changing to a repayment mortgage, you eliminate this risk since you are gradually repaying the balance over time.

This can provide peace of mind and eliminate the added stress of having to come up with a substantial lump sum amount.

4. Long-Term Savings

While an interest-only mortgage can provide short-term financial relief with lower monthly payments, it may end up costing more in the long run.

With a repayment mortgage, you are paying off both the interest and the principal, reducing the overall balance and the amount of interest charged over time. This can result in considerable savings over the life of the loan.

Pros & Cons

Pros

| Interest-Only Mortgage | Repayment Mortgage |

|---|---|

| Lower Monthly Payments | Builds Equity |

| More Initial Cash Flow | Less Risk |

| Flexibility | Long-term Savings |

Cons

| Interest-Only Mortgage | Repayment Mortgage |

|---|---|

| Lump Sum Required at End | Higher Monthly Payments |

| No Equity Building | Less Initial Cash Flow |

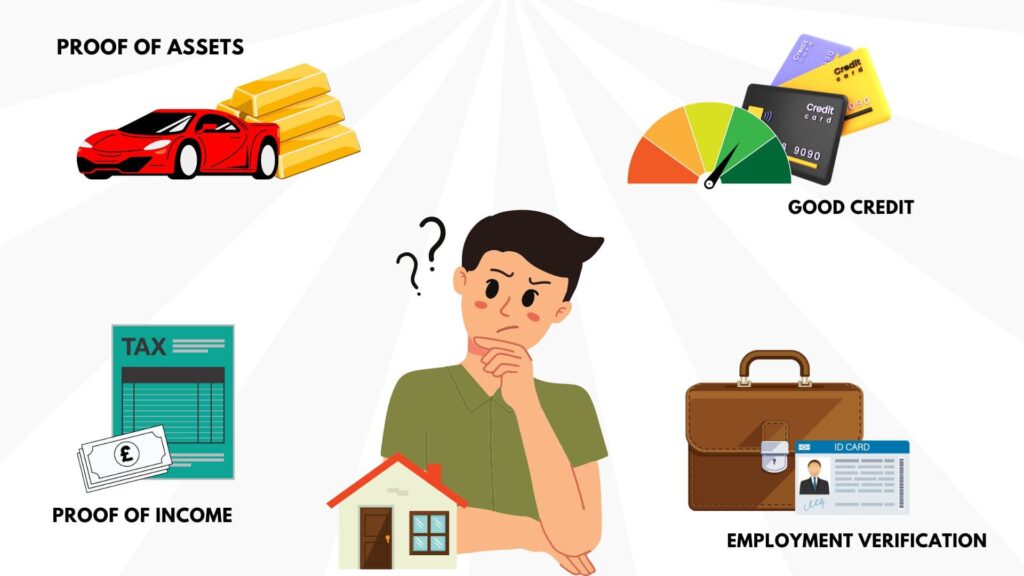

Eligibility Criteria

To switch from an interest-only to a repayment mortgage, you generally need to meet specific criteria, like a certain credit score and proof of a stable income.

If you have credit issues, making the switch may be challenging but not impossible.

The requirements can vary between lenders, so it’s crucial to get personalised advice based on your financial situation. It’s your responsibility to check out the fine print before making the leap.

Timeline to switch to repayment from interest only

When you switch from interest-only to a repayment mortgage the process usually takes a few weeks to complete.

This can vary depending on your lender’s efficiency, the complexity of your financial situation, and how quickly you can submit the required documents.

It’s always best to start early and ensure you have your mortgage advisor or broker if you’ve gone direct on your side and up to speed on the situation.

The last thing you need is a mortgage lender stopping you from getting the mortgage you want!

- Sammie’s Hot Tip

When considering a switch from an interest-only to a repayment mortgage, don’t just settle for the first offer your existing lender gives you.

Use the change as leverage to negotiate better terms. It’s an excellent time to shop around, either independently or with the help of a mortgage broker, to find a deal that not only lets you build equity but possibly also offers you a more favourable interest rate.

Can I switch my interest only mortgage before it ends?

Yes, you can switch your mortgage from interest only before it ends but beware of any early repayment charges you might face.

Check with your lender what the process is. Each lender is different and the amount will differ by your terms so it’s vital to check this so you don’t end up with a larger payment.

Exploring the Process of Changing Mortgage Type

Now that you understand some of the motivations for changing from an interest-only to a repayment mortgage, let’s dive into the process itself.

Here are the general steps involved:

1. Assess Your Finances

Before making any decisions, it’s crucial to assess your financial situation thoroughly. Review your income, expenses, and long-term financial goals.

Can you afford to make the payments if you switch up to repayment?

Consider how the switch from an interest-only to a repayment mortgage aligns with your overall financial strategy. It may be helpful to consult with a financial advisor to get a comprehensive view of your options.

2. Contact Your Existing Lender

Reach out to your current lender to inquire about the possibility of switching to a repayment mortgage.

Your lender may have specific requirements or limitations, so it’s important to understand their policies.

Ask about any fees or charges associated with the change and gather all the necessary information to make an informed decision.

3. Explore Other Lenders

While contacting your existing lender is a good starting point, it’s also worth exploring options with other lenders.

Different financial institutions may have different products, interest rates, and terms that could be more favourable to your situation.

Research mortgage brokers who can help you navigate the market and find the best deal for your needs.

You can also check online for a mortgage deal too.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

4. Calculate Affordability

Calculate your affordability by reviewing your income and expenses. As we know switching to a repayment mortgage means your monthly payments will likely increase compared to an interest-only mortgage.

Consider factors like potential future income changes, emergencies, and other financial commitments. Ensure that the new repayment mortgage aligns with your budget and long-term financial stability.

5. Apply for a New Mortgage

Once you have thoroughly assessed your financial situation, compared options, and calculated affordability, it’s time to apply for a new mortgage.

This step involves submitting all the necessary documentation to the chosen lender, such as proof of income, identification, and property valuation.

Be prepared for a thorough assessment of your creditworthiness and affordability during the application process.

6. Consider Mortgage Types

During the process of changing your mortgage, it may also be an opportune time to consider different mortgage types.

For example, you might explore the possibility of switching to a fixed-rate mortgage to provide stability and predictability in your monthly payments.

Discuss different mortgage types with your lender or mortgage broker to determine the best fit for your financial goals.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

FAQs

Can I switch from an interest-only mortgage to a repayment one at any time?

Yes, you can switch from an interest-only mortgage to a repayment mortgage at any time, subject to your lender’s policies and the terms of your current mortgage agreement.

It’s important to reach out to your lender to understand any restrictions or fees associated with early repayment or changing mortgage types.

Will switching to a repayment mortgage increase my monthly payments?

Switching to a repayment mortgage will likely increase your monthly payments compared to an interest-only mortgage.

With a repayment mortgage, you will be paying off both the interest and the principal, resulting in higher monthly instalments.

However, this change will also enable you to build equity and reduce the total amount of interest paid over time.

Can I change my interest-only mortgage to a repayment one if I have credit issues?

Having credit issues can make it more challenging to switch from an interest-only mortgage to a repayment one.

However, it is still possible, depending on the severity of the credit issues and the lenders’ policies.

You may need to work with a mortgage advisor or specialist who can guide you through the process and help you find lenders willing to consider your situation.

What is the role of a mortgage broker in changing mortgage types?

A mortgage broker can play a crucial role in the process of changing mortgage types. They have access to a range of lenders and mortgage products, allowing them to compare options and find the best deal for your specific needs.

Mortgage brokers can provide guidance, assess affordability, assist with paperwork, and negotiate terms on your behalf, making the entire process smoother and more efficient.

Are there any fees or charges associated with changing from an interest-only to a repayment mortgage?

Yes, there may be fees or charges associated with changing from an interest-only mortgage to a repayment mortgage. These fees can vary depending on your lender and the terms of your existing mortgage agreement.

Common fees may include early repayment charges, administrative fees, and valuation fees. It’s crucial to inquire about these costs and consider them in your decision-making process.

Conclusion

Switching from an interest-only mortgage to a repayment mortgage is a significant financial decision that requires careful consideration.

By understanding the process, reasons for switching, and exploring the different aspects involved, you can make an informed choice that aligns with your long-term financial goals.

Consult with professionals, assess your finances, and compare options to ensure you find the best solution for your individual circumstances.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.