Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

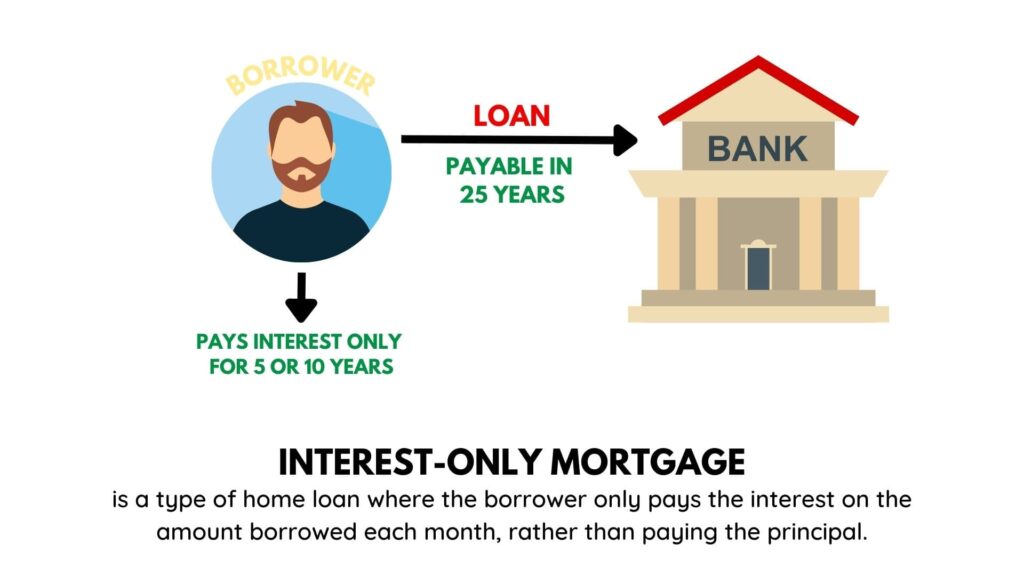

If you’re looking to buy your own home and to keep your monthly payments to a minimum, then an interest-only mortgage could be right for you.

While you only pay interest on your loan, you need to have a plan in place when you reach the end of the term. This is when you’ll need to find a way to make a lump sum payment.

While an interest only mortgage has appeal, there are plenty of risks too. The input of mortgage advisers is a must to make sure that this solution can work for you.

There are various options if you’re looking to buy your own home, either as a first-time buyer or as a home mover.

Throughout this article, I want to guide you through everything interest-only mortgage-related. By the end, you’ll clearly understand what interest-only mortgages are and how these impact your mortgage payments.

Please remember that this is not financial advice, and you may benefit from liaising with a mortgage broker.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Table of Contents

What is an interest only mortgage?

An interest-only mortgage is fairly straightforward to understand. As the name suggests, you pay the interest on the loan amount, but you’re not paying down the capital originally borrowed.

When you compare mortgage deals, you’ll find that an interest-only mortgage will come with lower monthly payments.

However, you must remember that these repayments on your mortgage are not lowering your actual debt.

When you reach the end of the term of your mortgage, you face paying back the capital you owe.

That’s why you must enter into an interest-only mortgage with your eyes wide open and keep switching from interest only to a repayment mortgage in mind.

You’ll find that mortgage lenders are wary of approving interest-only mortgages. That’s because they know that at the end of the mortgage, people can face serious issues regarding repaying what they owe.

For this reason, repayment mortgages are far more common.

Interest only mortgages vs repayment mortgages

The difference between interest an interest-only mortgage and a repayment mortgage is all about what you repay. Let’s take a look at these in turn:

Repayment mortgage

With a repayment mortgage, your mortgage repayments have two elements. Each month, you pay back part of the original mortgage plus interest.

As long as you go on to make all of your monthly payments, at the end of the term, your mortgage ends. You then own the house, and your mortgage is clear.

For example, you may approach a mortgage lender hoping to borrow £200,000. Let’s assume the loan-to-value is all okay, and you have the deposit you need.

Your mortgage application is approved, and your mortgage rate is 3%. This would mean that you repay your loan amount at the rate of £948 per month.

Let’s look at how an interest-only mortgage compares.

Interest only mortgages

An interest-only mortgage means that your monthly repayments only pay the interest that’s owed on the mortgage loan.

That means that when your mortgage term ends, you still owe the amount that you originally borrowed.

If we use the same example as we did with a capital repayment mortgage, you can clearly see what a difference this makes to monthly payments.

With the same £200,000, the same 3% interest rate and the same 25-year term, your monthly payments would be £500. That’s £448 less than what you’d be paying with a repayment mortgage.

While having your mortgage on an interest-only basis makes your monthly repayments more affordable, it leaves you with one challenge.

You’re left with an outstanding mortgage and the need to repay the capital with one lump sum.

Why lenders are wary of interest-only mortgages

Securing an interest-only mortgage is no longer as easy as it used to be. The number of interest-only customers has fallen significantly since the financial crisis of 2008.

Before this, practically anyone could secure an interest-only mortgage and there was never a need to show that you had a solid repayment plan in place.

The financial crash revealed that hundreds of thousands of homeowners had interest-only mortgages but had no plan in place for the end of the term.

Figures today from Citizens Advice suggest that there are around 1 million people in this situation.

As you can probably understand, this means that when you apply for an interest-only mortgage, there are now strict eligibility requirements.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

How can I secure an interest-only mortgage?

If you’ve looked at the mortgage options that exist, you may think that an interest-only mortgage is the right solution for you.

To get an interest-only mortgage these are the things that you’ll need to consider:

- Mortgage providers are far less likely to approve an application when compared to a decade or more ago

- You’ll need to demonstrate that you have a mortgage repayment plan in place

- You’ll need to show that you have other assets that could be used at the end of the term

- A higher deposit will be needed

- There will be strict criteria to meet in relation to your personal circumstances

- Your home may be repossessed at the end of the mortgage term, even if you’ve paid every month for 25 years plus

The exact requirements will vary depending on the lender that you approach. However, no matter which one you use, mortgage experts agree that securing an interest-only mortgage is far from easy.

Interest-only mortgages and buy to let

Many mortgage providers will treat buy-to-let properties as an exception. This means that landlords are far more likely to secure an interest-only mortgage when compared to someone who is looking to buy a new property to live in.

Lenders are happier to offer interest-only mortgages in this circumstance because they understand that the property is being used to generate an income and that it’s an investment.

This means that they’ll consider cash flow and if there is enough money coming in from the rent, alongside the value of the property.

Interest rates offered to landlords will vary based on their financial situation and the size of their portfolios.

The advantages of an interest-only mortgage

There are some great advantages if you’re able to get an interest-only mortgage. Here’s a look at just some of them:

Lower monthly payments

When you compare interest-only and repayment mortgages, the former will lead to smaller monthly repayments. If you input figures into any UK mortgage calculator, you’ll instantly see that this is the case.

That’s because throughout the mortgage term, you only pay interest and you’re not actually clearing the loan.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

A great option for buy to let

Landlords can take advantage of lower payments while showing that they have a repayment plan in place for when the mortgage term ends.

As landlords are using their properties to generate an income, they’re able to you part of this to repay the capital part of the mortgage loan.

A chance to add value

With lower payments to make each month, those with an interest-only mortgage have the chance to put money back into their property.

This means that they can make improvements that would potentially increase the value of their home.

The disadvantages of interest-only mortgages

There are also a variety of downsides to be aware of:

It can be more expensive

With a repayment mortgage, you’re bringing down the amount that you owe. With an interest-only mortgage, you’re always paying interest on the entire loan amount. This means that you could end up paying more overall.

Shortfalls are a real possibility

With a repayment mortgage, your debt is cleared at the end of the term. With an interest-only mortgage, you still need to repay the capital.

Issues such as negative equity mean that even selling your home at the end of the term might not be enough.

Another option if you’re looking for options is guarantor mortgages. Where someone can secure the mortgage payments for you.

FAQs

Can I sell my home if I have an interest-only mortgage?

Yes, you can still sell your house with an interest-only mortgage. This sees you paying your mortgage early, usually with the proceeds of the sale.

You should bear in mind that there are likely to be early repayment charges to pay.

Can older borrowers get an interest-only basis mortgage?

Yes, there are retirement interest mortgages that suit those who are aged 60 or over.

These mortgages see borrowers paying interest initially. When the borrower dies or moves into a care home, the house is sold and used to pay back the capital.

Final thoughts

An interest-only mortgage can be a useful tool for those who are looking to keep their monthly payments down.

However, without a repayment plan, there are real risks when the mortgage term comes to an end. If you have no way to pay back the capital, the lender may well repossess your home.

You will find it difficult to secure an interest-only mortgage to buy your own home. If you find yourself in a position where you can, I strongly suggest that you get financial advice to ensure that you have a strong repayment strategy in place.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.