Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

The house-buying process can be a frustrating one, things never move as quickly as you would like.

While you could find your dream home, arrange your mortgage and deal with the legal in around 12 weeks, there are always delays that come into play.

With numerous parties involved, you’re reliant on everyone doing what they need to at exactly the right pace. Unexpected delays can easily add weeks and sometimes even months to the whole process.

If you’re anything like me, then there’s a chance that you’ll be slightly on the impatient side. When I first looked at how long does it take to buy a house, everything seemed to take an age.

The entire process relied on the mortgage lender, conveyancing solicitor and the seller’s estate agents. While I wanted it all to happen overnight, that wasn’t possible.

While there are timescales for each part of the house-buying process, the reality is that establishing exactly how long it takes is not a precise science.

As you read on, you’ll learn about everything that needs to take place with a property purchase and you’ll at least have a rough idea of how long it all takes.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Table of Contents

How long does it take to buy a house - an overview

If you’re looking to buy a house in England, Wales, or Northern Ireland, you’ll find the process is the same. However, if you’re looking to move to Scotland, remember that the laws are different there.

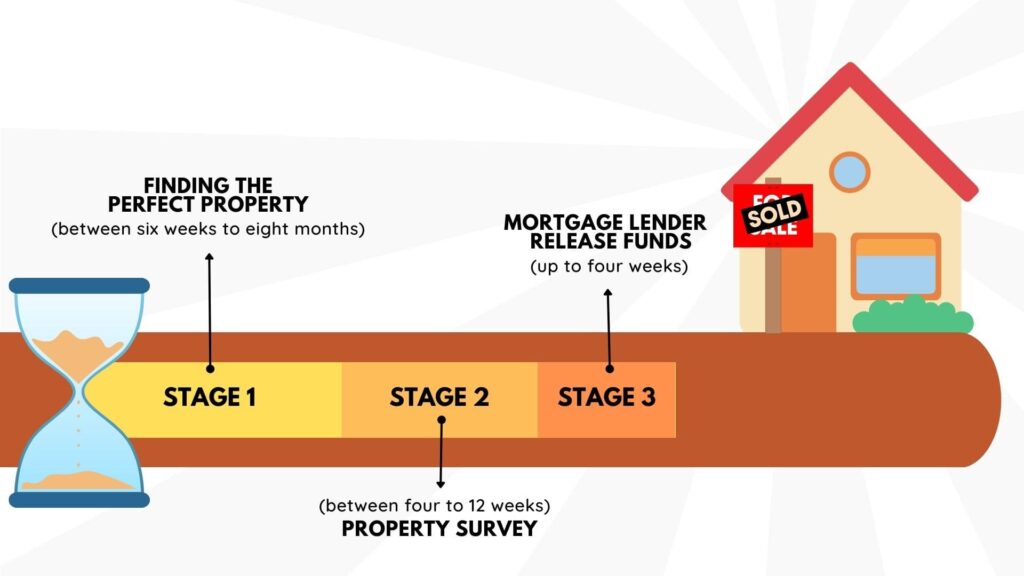

The home-buying process is made up of 3 stages. Each of these will vary with how long they take.

Let’s take a look at them in a bit more detail now:

Stage 1 - between six weeks and eight months

This has to be the longest part of the house-buying process. That’s because much of it is taken up trying to find the perfect property.

This means time online with an estate agent or two as well as carrying out local research.

You need to have some understanding of the local property market so that you know how much to offer when you find the house that you want. When you know this, it’s time to make put your offer to the seller’s estate agent.

Stage 2 - between four and 12 weeks

The offer you’ve put in is accepted so you now need a property survey. Your mortgage provider will insist on basic checks to ensure the house is worth what you’re paying for it and that there are no major issues.

At this point you need to pay your deposit and exchanging contracts means that you’re legally bound to complete the sale. If you back out now, it will cost you.

Stage 3 - up to four weeks

This is the completion stage. Your solicitor arranges for the funds from your mortgage lender to be released. This goes to the seller’s side. In return, you get the property keys and the title deeds. You’re now a homeowner.

As you read on, I’m going to cover the process in a little more detail.

Explore your mortgage options

It’s a good idea to have a look at what’s available, and what you can afford, in terms of mortgages at an early stage. No one wants to find their perfect property only to find out that they have no way of affording it.

Whether you’re a first-time buyer or a home mover, you need to know how much you can borrow and where your deposit is going to come from. Getting on board with a mortgage broker early on is a good idea.

Mortgage advisors can charge for their services, there are some free ones out there but if you do pay be sure that these costs don’t go above £1,000.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Time to go house hunting

When you have an idea of how much you can afford, it’s time to get out there are find the property that you really want.

I remember my first house-hunting experience and it involved walking for hours peering into estate agents’ windows. While that’s still an option today, the good news is that there’s now an online alternative.

Sites such as Rightmove and Zoopla make it super easy to browse houses in any part of the country that you want to. All of this without even stepping foot outside your house.

Put in an offer

Once you find a house that you like that’s at an affordable price, it’s time to make an offer. Of all the steps involved, this one can be a little tricky as you need to fix on a price that you’re willing to pay and hope that the seller will accept.

When the housing market is buoyant and houses are selling fast, you may find that you have no choice but to offer the asking price.

However, if the market is on the slow side, you may get away with offering less. Sometimes it can be tens of thousands less.

Making an offer usually involves liaising with the estate agent. They will pass your offer on to the seller and then get back to you with a response.

You're offer gets accepted

If you’ve pitched your offer at the right level the seller will say yes. From this point, the whole idea of property ownership gets that much more real.

However, bear in mind that property purchases can, and do, fall at this stage. In fact, according to Property Industry Eye, as many as one in three go this way. While it’s a little exciting at this stage, try not to get carried away.

Time to find a mortgage lender

Before you can go much further in the house-buying process, you’re going to need to get ready to submit a mortgage application.

While you could just go to your own bank or building society, this isn’t something that I’d recommend. Your best bet is to use a mortgage broker.

Mortgage brokers are worth their weight in gold when it comes to getting onto the property ladder. They will get to know all about you, your financial situation, and your credit history.

With this information, they will know the mortgage lenders that are more likely to accept you and give you the best deal possible.

It could take a couple of weeks or more to get a formal mortgage offer. What you really need at this stage is a decision in principle.

This shows what a lender is prepared to offer you and this document shows the estate agent that you’re a serious buyer who’s good to move forward.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Covering the legal aspects

A property purchase can’t complete without a solicitor to go through the conveyancing process. Your solicitor will be there to ensure that everything happens as it’s meant to.

They will provide a draft contract, liaise with the seller’s solicitor, carry out local council searches and deal with the money transfer when the time comes. They will also deal with land registry so that you’re shown as the new property owner.

When buying a house, your choice of solicitor matters. They can really drag their heels and make the process seem never-ending while others seem to be on the ball and get things done as fast as possible. It’s a good idea to get a solicitor who’s been recommended.

Of course, your solicitor isn’t going to act for free. This means that you need to factor in conveyancing fees when budgeting for your property purchase.

More checks from the lender

Before you get to the stage where you’re exchanging contracts, your mortgage lender will want to carry out some more checks.

They will want to make sure that you gave them accurate information when you put in your application, and they will need to see proof. This means providing bank statements so that you can clearly show your income and your regular spending.

As well as checks on you, the lender will also want to check the property. If for any reason, you miss your mortgage payments, the property is there as security.

The bank, or other lender, knows that they can recover what they’re owed by forcing a sale (in extreme circumstances). However, to have that security they need to know that the property is really worth what you’re paying for it.

An independent valuer will be appointed to report back. Assuming the value is agreed upon, you can move to the next stage. It could take a few days for the report to get back but, in some cases, it happens on the same day as the valuation.

Searches are carried out

At this stage, it’s your solicitor that you rely on. While you wait for a decision on your mortgage application, the solicitor will be carrying out searches. The mortgage provider will insist that certain ones take place. These include:

- Local authority searches – this looks at things such as building control issues, nearby road schemes and enforcement actions

- Drainage searches – this simply checks that the property is connected to the sewers

- Environmental searches – this ensures that the land isn’t contaminated

This is part of the process that your solicitor will charge you for early on. It could cost anywhere from £150 – £400 and you could be waiting a few weeks for the results.

Consider a property survey

When your mortgage provider has a valuation carried out, this is not the same as a survey.

You are responsible for carrying out more checks to ensure that the property is in good condition and that it’s not about to fall down. You’re not legally obligated to do this, but it could be a good idea.

The different kinds of surveys that you can request are:

- Homebuyer’s report

- Full structural survey

- Snagging survey (for new property builds)

Receive your mortgage offer

This is the stage when you get a formal offer, and you can see exactly what you can borrow.

While this is another exciting point in house-buying, you need to step back slightly and not get carried away! Now’s the time to check, check and check again.

Be sure that every detail in your mortgage offer is correct. Mistakes could, at worst, invalidate your loan or, at best, lead to unnecessary delays. When you’re sure it’s all correct it’s time to start thinking about a completion date.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Set a completion date

Completion day is the day that you get the keys, and the property is officially yours. If you’re a first-time buyer and moving into a new build, setting a date is straightforward as there are few parties involved. First-time buyers certainly have it good here.

It’s when there are property chains involved that it can get a little more complicated and there’s a need to compromise.

Exchange contracts

This is when your solicitor and the seller’s solicitor swap signed, legally binding contracts. If anyone pulls out now they would forfeit their deposit. This means that both you and the seller are now tied in.

It’s all fairly straightforward from here and the next stages may even complete in just a few days.

Here’s a look at what happens once you’ve exchanged contracts and enter the final stage:

- Completion statement – your solicitor will provide you with this. It shows the funds that you still need to send to the solicitor such as any outstanding solicitors fees, outstanding deposit and stamp duty

- More searches – your solicitor will confirm that you haven’t gone bankrupt since you got your mortgage offer and that the seller still owns the house

- Sign transfer deeds – this document shows that you want to take ownership of the property

- Pay for the house – your solicitor will receive funds from the lender and send full payment to the seller’s side. In return, your solicitor is sent the seller’s title deeds and proof that any outstanding mortgage has been cleared

You're now a homeowner

With the funds transferred and everything signed, the house is yours. Your solicitor will register you as the owner at the Land Registry, and you’re officially a homeowner.

FAQs

How long does it take to complete after you have a mortgage offer

It could take up to three months to complete the sale. Some house buyers are luckier and find that this only takes around 1 month.

Is buying a house quicker when there's no chain?

If there is no chain involved, the house-buying process should move quicker. That’s because your only waiting on one mortgage application and waiting for one set of searches.

Final thoughts

It could easily take up to six months to buy a property from start to finish. However, there are occasions when it can be much quicker.

Having a great mortgage broker and solicitor can certainly get things moving along at a faster pace. And there we have it, you’re now able to answer how long does it take to buy a house.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.