Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Buying a house is a major commitment. You have to pull together a deposit, fill in the paperwork to apply for a mortgage online plus then go through the lengthy process of contracts, surveys and solicitors.

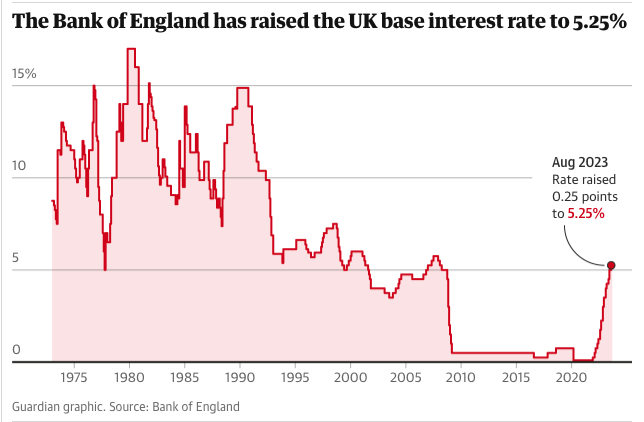

Besides this interest rates are at the highest they’ve been for 15 years making mortgages unaffordable for lots of us right now.

After that, there is a lot of stuff that many people forget they will need to do as a homeowner, from paying council tax to increasing energy bills, along with maintenance on your property.

It can all seem a bit of a hassle. Maybe you’d be better off renting? Or staying at home with Mum & Dad? So is buying a house worth it in 2024?

Let’s look at all the pros and cons and come to a conclusion you can actually move forward with.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Table of Contents

Is buying a house worth it in 2024?

Yes, it’s still worth it but everything is going to be more expensive and is not likely to come down much.

Inflation is still higher than the governments 2% target which means that interest rates will remain at a relatively high level in 2024.

So, you need to run the affordability checks and see whether you can afford a mortgage.

If you can then yes, in my opinion getting on the property ladder is a fantastic investment but DO NOT stretch yourself.

Is owning a house worth it?

Yes, owning a house can be worth it but there are lots of things to consider.

Firstly, you need to ask yourself the question of where you want to live. There are lots of reasons to stay near where you grew up, family for example.

However, many of us have jobs in other places and moving closer to where we work cuts down commuting time and also money spent on that travel.

It’s important to weigh up the perhaps increased cost of living closer to where you work against the cost of travel if you lived further away.

You might also need to look at schools. Are there any good ones nearby? What about secondary schools and colleges?

How about other facilities such as doctors, parks, high streets and independent retailers you can support? Perhaps you have a specific hobby that you want to enjoy?

It could be that you need to be close to the beach, some woodland or mountains. How about roads? Easy connections to the motorway might be on your list or a nearby train station or airport.

We all have different requirements for where we want to live. List them down, and you can start to figure out what part of the country and specifically want towns, cities and villages, you want to be near.

Pros and cons of renting

When trying to answer the question of is buying a house worth it, we must look at the pros and cons of all possible options.

People tend to look at buying a house vs renting. With that in mind, let’s start with some advantages and disadvantages of renting.

Advantages

Flexibility – Renting a home can be for different lengths of time. You might be able to get a rolling contract on a property, which continues month by month until you end it.

Some people rent rooms out for a couple of months at a time whilst they find where they want to live. There is flexibility with renting as you can move out pretty quickly should you need to. This can be ideal if you are working temporary jobs or you aren’t quite sure where to settle down yet.

Working out how much rent you can afford is difficult but experts say that you should aim for 30-40% of your entire salary.

Maintenance – Any maintenance of the property is down to the landlord. This includes broken ovens, leaking pipes, drafty windows, dampness, storm damage and anything else you can imagine.

You don’t have to worry about house insurance premiums, and some landlords even have third parties mow the lawn and cut the hedges.

Disadvantages

Expensive – Renting can be expensive. There is the well-known phrase that when you are renting, you are paying for someone else’s mortgage.

The average mortgage payment in the UK is around £750 a month. The average rental price per month is over £820. You can clearly see how renting is more expensive than your own mortgage payments.

Insecurity – What do you do if the landlord suddenly gives you the required two months’ notice to vacate the property? This can be without malice, although some landlords and tenants do have troubles.

Maybe the landlord’s cash flow is worrying them, and they want to sell the property. Living in someone else’s house can be insecure and leave you not feeling like you can put your roots down.

Pros and cons of buying

Of course, there are positives and negatives of buying your own property as well. Is buying a house worth it?

In the buying a house vs renting debate, we must look at both sides with an open mind. Let’s explore some pros and cons of buying a property.

Advantages

Your home – One of the biggest advantages of having your own home is that it is yours. You might have a mortgage on the property, yes, but you can paint the walls the colour you wish.

You can upgrade the bathroom, so the shower actually works. The garden is your own space to enjoy and do what you want. It is all yours, and this can be a huge relief and stress off your shoulders.

Put down roots – Buying a house shows commitment. To your loved ones, to your neighbourhood, to your community. This is a long-term thing, and you can truly call this place your home. It can also bring a sense of belonging and permanency.

For first-time homebuyers in England or Northern Ireland, properties priced up to £425,000 are exempt from Stamp Duty.

If a property costs between £425,001 and £625,000, no Stamp Duty is charged on the initial £425,000. The remainder, up to £200,000, is subject to a 5% Stamp Duty rate.

Disadvantages

Constant payments – Owning a house comes with a lot of payments. Not only do you need the deposit and monthly mortgage payments, but you also have council tax to pay, insurance premiums to pay, energy bills (that are increasing), broadband, and property maintenance.

This is on top of the extra fees you might not take into account at the beginning – estate agents, solicitors, and stamp duty.

Hard to move – Is buying a house worth it? It can be extremely difficult to move to another part of the country when you have purchased a property.

All your money is likely tied up in that house, and if you want to move, it’s not a quick process. You will need to market the property, sell the property and then maybe you’ll be part of a chain of people, which can be a nightmare.

Why do you want to buy a house?

When asking is buying a house worth it, for many, the desire to have their own home can stem from events earlier in life.

If someone grew up in hardship, moving from one place to another every couple of months, maybe even living on the streets, they would have aspirations to have a stable and secure place for themselves and their family.

Some people want that sense of pride and accomplishment by owning their own home. It does feel great completing on a property and being able to properly relax, knowing your surroundings are your own.

Maybe it’s the next natural step that you think happens in life. Perhaps you’ve done school and university, got a job and found someone to be with.

Of course, plenty of people buy properties by themselves, but whatever you see as your own life plan, your own house could be the next step on it.

It could be that you have lost a loved one and gained an inheritance. Investing in property could be something you think is worth doing with your newfound wealth. Using a gift to help yourself and your future.

When you know why you want to have your own property to call home, it can help you focus and work towards your goals.

If you’re a first time buyer and you’d like the ultimate guide to buying your first home then click here. It’ll open a new window and you can get stuck into that later!

Factor in rising interest rates

Mortgage interest rates substantially shape the long-term cost of purchasing a house through financing. For prospective homeowners with top-notch credit history, securing a mortgage at lower interest rates is achievable.

However, lenders balance risk via the interest rates they charge, influenced by borrower’s financial health and economic conditions.

Understanding the recent Bank of England’s interest rate hikes is vital for anyone considering property investment.

The Bank raised interest rates by 0.25 percentage points, the 14th consecutive increase since December 2021, pushing the base rate to 5.25%.

This rise directly impacts the 1.4 million UK residents on a variable-rate residential mortgage. If you hold a £150,000 repayment mortgage with 20 years remaining and a tracker mortgage rate at 6%, the new hike lifts your rate to 6.25%.

Your monthly payments will increase from £1,075 to £1,096. This hike might seem modest but can add up significantly over time.

Before deciding to buy, it’s prudent to assess your financial situation, the mortgage rate environment, and the potential for future rate increases.

Understanding the impact of these changes on your mortgage payments is crucial to making informed property investment decisions.

Source: The Guardian

It's an investment

We’ve mentioned above that buying property can be an investment. However, buying a home is an investment more than money. It really is an investment in your future and something which you can grow in value and sell for profits.

It can also be a wonderfully secure feeling for any children you have. A childhood home to make amazing memories in. Somewhere that, at the end of your mortgage, you will own outright.

Property can go up in value, and your house might be worth 20% more than what you bought it for in ten years’ time. However, turning a profit is secondary to the security of having your own four walls and a roof to call your own.

Saving for a house deposit

Pulling together money for a house deposit can be one of the hardest yet most empowering things you can do.

Making sacrifices of all sizes, from cutting out holidays to saying no to nights out, allows you to direct your money towards your house deposit fund.

The amount of deposit you need will depend on the mortgages available to you. However, it is usually at least 10%.

There are some lenders who will only require 5% and others where a minimum might be more like 20%. The more deposit you put down, the better rates you are likely to get.

To figure out how much you need, you should first look at the average cost of houses where you want to buy. Look for the types of houses you are going to want to move into.

It could be a townhouse in the local area or a new build property on an estate. This should give you a ballpark figure of how much the house is going to be. From that figure, you can work out the 10% deposit amount.

For example, for a £250,000 house, £25k would be 10%. However, if you could push this to £30k, that would be an extra 2%, so it might open you up to better mortgage deals.

These figures seem huge, and they may vary depending on the type of house you are buying or where in the country you want to live.

You will be surprised at just how quickly you can start saving into a house deposit fund when you put your mind to it and make it a priority. The stats say that it takes, on average, eight years to save a house deposit. What will your goal be?

A great way of getting there a little faster is to look at starting a side hustle that you can use the profits from. One of our favourite ways to make money is online via blogging and developing websites.

Is renting really dead money?

Many people rent for a long time. When people find out that you are renting, they usually say the same thing. Calling it dead money or saying that you are paying someone else’s mortgage. Is it really dead money though?

At the end of the day, you are paying for a service. No business operates by simply breaking even.

A landlord wouldn’t be able to turn a profit if they were just charging you how much their mortgage is every month. Renting is important for many people.

Paying those rent payments puts a roof over your head. Be sure your rent is fair, and talk to your landlord if you think it is too high.

Perhaps you don’t want to be shackled to one property for the rest of your life or simply want to explore different parts of the world before putting your roots down. This is when renting can be perfect.

Sure, you’re paying for something which you don’t see the financial benefits of later down the line. However, later down the line is just that, later.

Things you might not have thought about

Getting that set of keys from the estate agent on completion day can feel amazing.

However, this is just the beginning of things, and there are other things you have to do as a homeowner that you might not have thought about and hadn’t even considered if you’ve been renting.

Not only do you need to keep up with your monthly mortgage payments, but you must also maintain your property, including any landscaping and general upkeep. You don’t want to upset your new neighbours by letting your garden overgrown.

There are other bills that need settling, including water and even green waste bin charges to your local council. If there are pests on your property, you will need to pay to get rid of them.

Home repairs can get expensive, and whilst regular services to your boiler will enhance its lifespan of it, they need paying for. Owning a house comes with a lot of responsibilities.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

FAQs

Is home ownership worth it UK?

While the rising interest rates and complexities of Stamp Duty might seem daunting, home ownership in the UK, in my view, remains a worthwhile investment.

The feeling of security and independence that comes with owning a home is invaluable. Additionally, with strategic financial planning and a solid understanding of the property market, you can navigate the shifting landscape of interest rates and taxes, turning the challenge into an opportunity.

Ultimately, the benefits of owning your own property, both financial and emotional, far outweigh the initial hurdles.

Is buying a house worth the stress?

Navigating the world of property investment, particularly with the complexities of fluctuating interest rates and intricate tax systems like Stamp Duty, may induce stress for many.

In my view, the journey to home ownership, albeit challenging, is a journey worth undertaking. The end reward, a place you can call your own, can offer immense emotional satisfaction and financial stability that rent simply can’t match.

Remember, with careful planning, sound advice, and a dash of patience, the stress becomes a stepping stone to the gratifying milestone of home ownership.

What's the most stressful part of buying a house?

Arguably, the most stressful part of buying a house is securing the right mortgage amidst fluctuating interest rates. The commitment of borrowing a substantial sum of money and navigating the complex financial landscape can be daunting.

This, coupled with the pressures of finding a property that suits both your budget and lifestyle needs, can often seem overwhelming.

Nevertheless, with thorough research, trusted advice, and a clear understanding of your financial capabilities, this major financial decision can also become one of the most rewarding.

Should I buy a house now or wait until 2024 UK?

The question of whether to buy a house now or wait until 2024 largely depends on your personal financial situation and tolerance for risk.

While interest rates are currently high, they may ease in 2024, but this isn’t a certainty. Therefore, if you’re financially ready and find a home that fits your needs and budget, it might be worth taking the plunge now, with the understanding that any future interest rate relief would only sweeten the deal.

Ultimately, there’s no ‘perfect’ time to buy, and the decision should primarily align with your personal needs, budget, and long-term financial goals.

What's the best age to buy a house?

Determining the ‘best’ age to buy a house is less about a specific number and more about your personal circumstances and financial readiness.

It hinges on factors like stable income, credit history, savings for a down payment, and readiness for the responsibilities of homeownership.

That could be at 25 for one person, 35 for another, or even later. The key is to ensure that when you decide to buy, it aligns with your life goals and financial capabilities, rather than being driven by societal expectations or pressure.

Is buying a house worth it? Conclusion...

So, is buying a house worth it right now? When we weigh it all up, we can get the feeling that Beatrix Potter alluded to in The Tale of Johnny Town-Mouse.

“One place suits one person, another place suits another person.”

Everyone is different, and whilst there can be great financial and security benefits of having your own home, some people enjoy the flexibility of renting.

Right now we’re facing the prospects of higher interest rates and therefore more expensive mortgage payments so it’s worth taking into consideration.

So if you’re wondering ‘Should I buy a house now or wait until 2023’ it might be worth contacting a mortgage advisor to see what their thoughts are.

If you have the deposit and want the commitment of a mortgage, long-term investment in your own home can be a wonderful thing.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.