Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

I’ve personally been using Trading 212 for over a year now and I honestly think it’s one of the best investing apps available on the market right now.

Why?

It’s user-friendly, offers commission-free trading, has a stocks and shares ISA, can trade in multiple currencies and has a wide range of investment options.

They also have over 14,000,000 customers worldwide and the account opening process takes under 2 minutes.

For me, this gives it all the elements of a fantastic trading platform and in this Trading 212 review, we’ll unpack everything you need to know to help you make a decision.

Trading 212 provides access to over 10,000 stocks, funds, ETFs and investment trusts.

They offer commission-free trading and their auto investing feature is excellent.

OUR OFFER - GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH OUR LINK

- Commission free trading

- Earn interest on uninvested cash

- Fantastic mobile app

- Award winning ISA

- No personal pension

To make this a fair review – I’ve been testing the entire app for 12 months so will show the good, bad and the ugly (albeit there’s not much to dislike).

Trust me, this will be the most in-depth, but easy-to-understand review you can find on the internet!

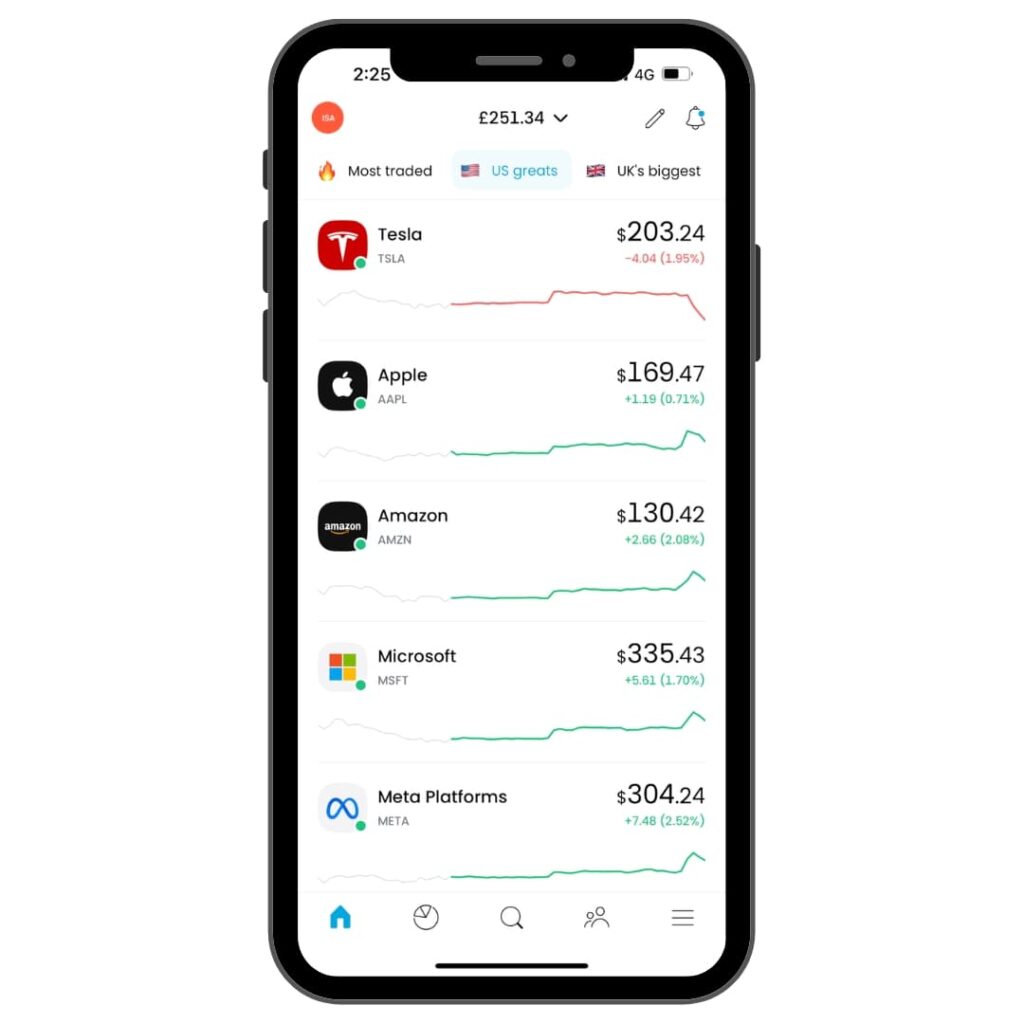

For me, what was great about Trading 212 was the fact the user experience on the mobile platform and web trading platform was the same.

Mix that in with commission-free investing with an ISA attached and you’re laughing.

Trading 212 – Main Features

- Commission free stocks

- No fees to open or hold a Stocks and Shares ISA Account

- Fractional Shares available to all investors

- Practice portfolio accounts

- Mobile app and web trading platform

- Investing pies – essentially create your own fund

- 24/7 live chat support

- Interest on uninvested cash

- Large choice of funds, ETFs and individual stocks

- No foreign exchange fee

Trading 212 Rating

- Price / Fees

- User Experience

- Useful Features

- Suitable For Beginners

- Customer Feedback

- Customer Service

I’ve given Trading 212 a 4.6 out of 5 using our six-pillar rating system which I use to test all investing apps.

Trading 212 scored best for its low fees, user experience and useful features.

Personally, where I would like to see improvements is from their academy which when compared with eToro doesn’t stack up and also on their research, seeing more analysis options and articles on the stock market.

That being said, I found they have extensive training videos and still offer enough for beginners to learn about investing.

If you’ve heard enough already you can head over to the Trading 212 Website and get started.

(Capital at risk when you invest)

Pros & Cons

Pros

- User friendly

- Free Trading

- Free share when you sign up worth up to £100 with code 'GAINS'

- Multiple Currencies

- Fantastic mobile app

- Excellent customer service

Cons

- No personal pension

- No cryptocurrency

- Its ease of trading can encourage over-trading

Trading 212 provides access to over 10,000 stocks, funds, ETFs and investment trusts.

They offer commission-free trading and their auto investing feature is excellent.

OUR OFFER - GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH OUR LINK

- Commission free trading

- Earn interest on uninvested cash

- Fantastic mobile app

- Award winning ISA

- No personal pension

Is Trading 212 good for beginners?

Trading 212 is an excellent option for beginners in my opinion. It’s put a lot of effort into creating a platform which is easy to use and get started quickly.

They have also developed a range of supporting videos and tutorials plus have a demo account available for those who are unsure about investing cash right off the bat.

I used my girlfriend as a guinea pig to test this. She has no trading or investing experience and what she said was that even she could understand how to buy and sell stocks.

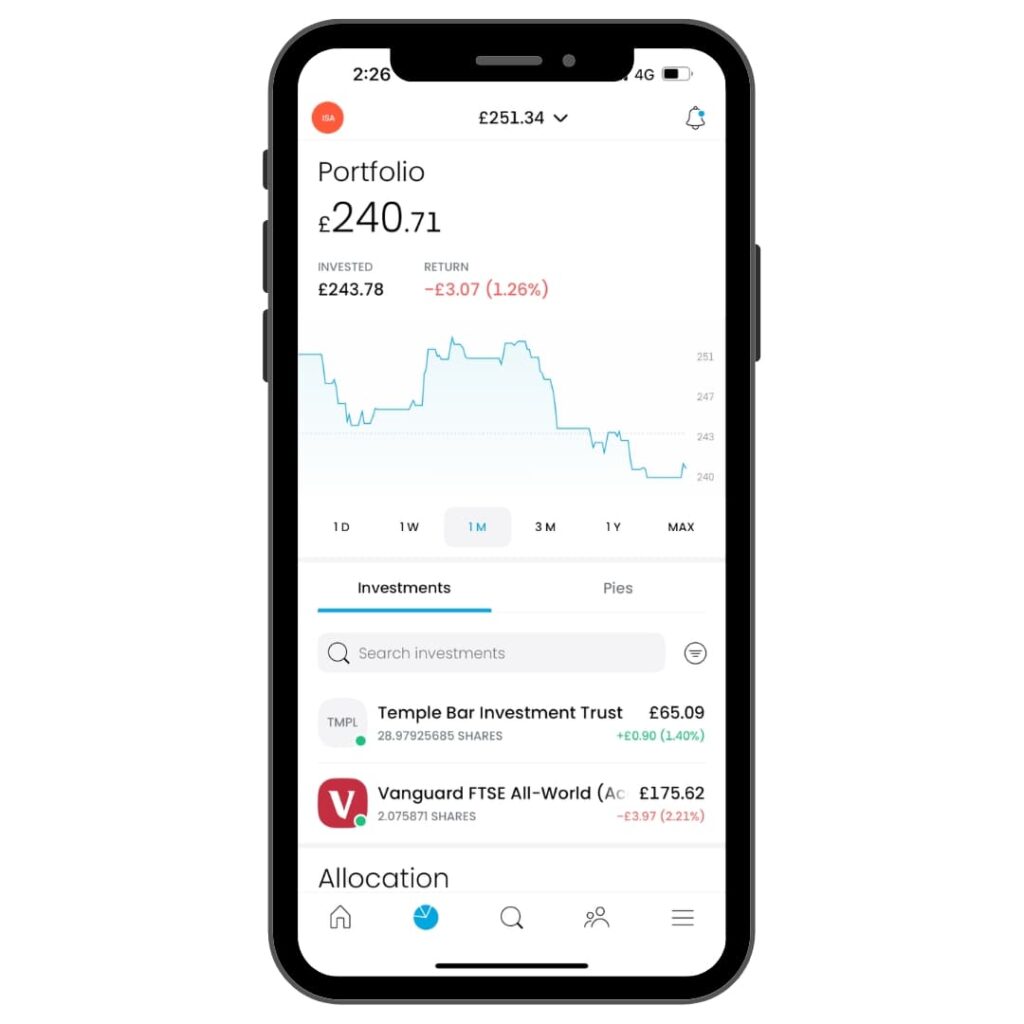

Navigating around the app was very easy and she liked the way you could see your entire portfolio’s performance in one click.

Her only issue was understanding what a CFD account was compared with an investing account – something which we’ll explain in more detail next.

Who is Trading 212?

Briefly, Trading 212 was originally a Bulgarian company started in 2005. They first arrived in the UK in 2016 and have seen enormous growth since then with over 350,000 UK users of the platform.

The leadership team starts with the original founders (which for me is awlays a good sign) Ivan Ashminov and Borisov Nedialkov, since expanding to bring in widely regarded Mukid Chowdhury as CEO.

Originally just a forex trading broker with retail CFD accounts, Trading 212 has evolved into the multi asset trading platform that it is today.

Trading 212 Review - Account Types

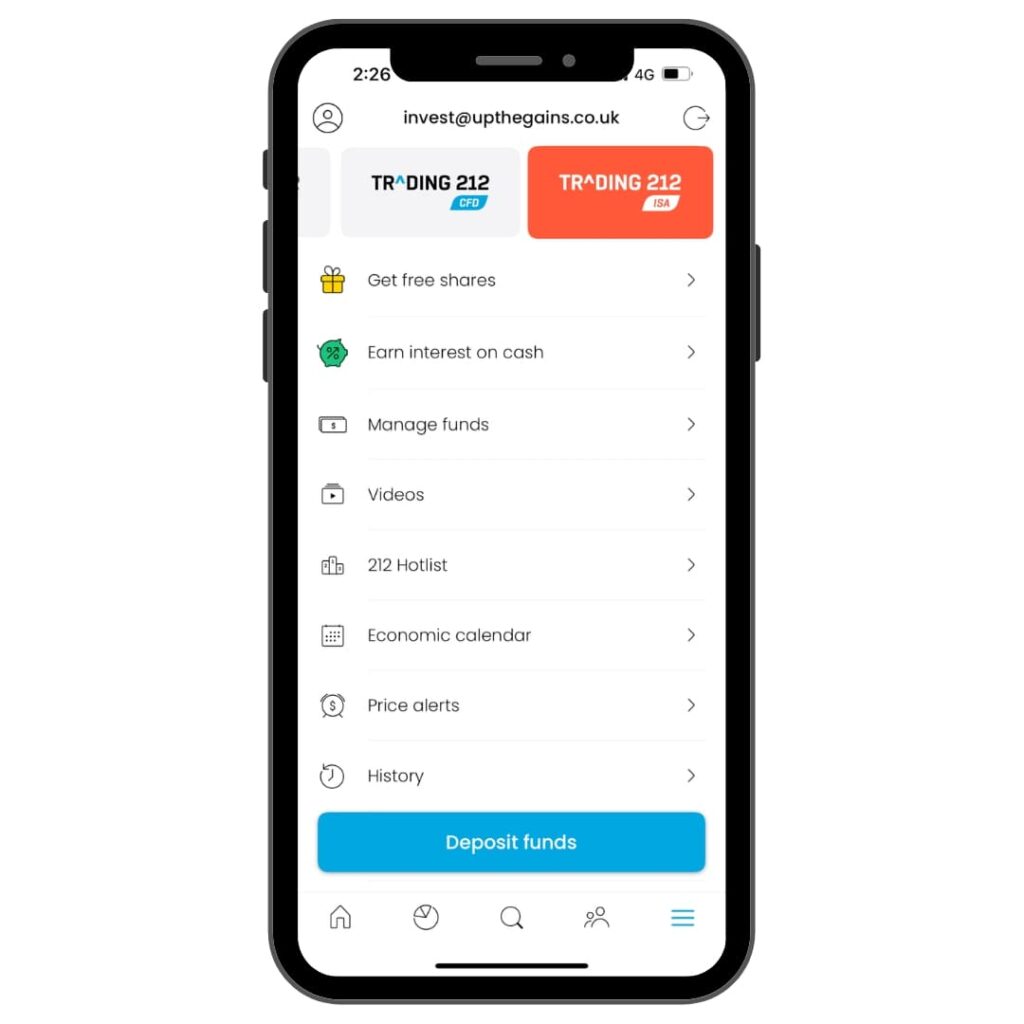

There 3 main investing account types with Trading 212. This keeps things streamlined and super easy to use.

When you navigate to the top of the app you can switch between them in less than a second which I liked.

To open an account it took me less than 2 minutes, you provide basic details, and national insurance and then you can deposit money and start trading right away.

You can deposit by card including Apple Pay or via bank transfer too!

Invest Account

The Trading 212 invest account is essentially what we know in the UK as a GIA or general investment account.

You can choose from over 10,000 shares and ETFs on the platform with a minimum investment size of £1 which is also the minimum deposit amount.

The great thing about this account is that you can trade for free unless you are trading in another currency to that country which you then incur a small currency conversion fee of 0.15% (much lower than the 0.5% at eToro).

You are however subject to capital gains tax on profits over £6,000 in a tax year from this account so if you don’t have an ISA provider already then start with an ISA account 1st, max out your limit there and then move into a GIA.

For me, I like to always use a GIA 1st and have a little play to see whether I like it or not.

That’s what I did with Trading 212 before moving onto opening an ISA with them afterwards.

GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH CODE ‘GAINS’ OR VISIT TRADING 212 HERE.

(Capital at risk when you invest)

Trading 212 Stocks and Shares ISA Review

The Trading 212 ISA has to be one of the best options for DIY investors on the market right now.

You can contribute up to £20,000 each tax year and all your profits, interest and dividends are not subject to capital gains tax.

Just like the invest account, you can trade for free but again there is a small currency conversion fee of 0.15% to contend with if say buying US stocks from the UK.

What I really like is how quick and easy it is to use. I also use the Trading 212 pies feature a lot which is essentially you making up your own fund.

You can pick a number of stocks, for example, I have 3 pies. One is technology-focused companies, one is UK-focused and another is green energy.

You can set your allocations by company so this could even or by any percentage you like as long as it adds up to 100%. An excellent feature in my opinion.

Lastly, you also get interest on uninvested cash so if you deposit and decide not to invest that money can still earn interest for you.

If you’re still wondering what account works best then read our GIAs vs Investment ISA guide.

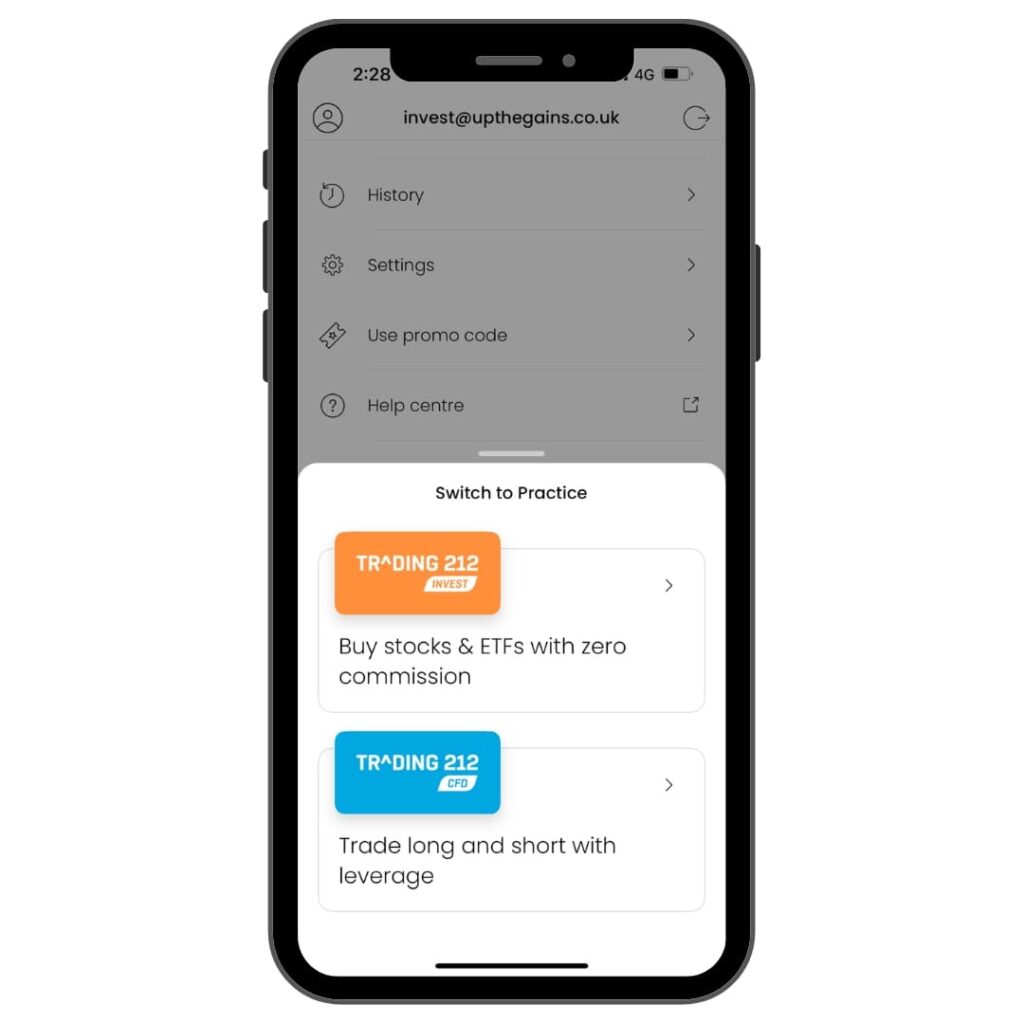

CFD Account

Trading 212 offers a CFD account for more sophisticated and experienced investors. Briefly, they are bets on whether an asset will rise or fall.

You can bet on a direction of a particular commodity, currency or indeed assets like stocks too but it is a high-risk strategy and requires expertise.

Trading 212 has warnings regarding CFDs stating that 78% of investors lose money trading CFDs so please be wary of this account type.

There is 0.5% fee when trading in other currencies just like the other accounts and also something called a spread fee which is the difference between the buy and sell (bid or ask) between the currency pairs.

Demo Account

The demo account or practice account as it’s known on Trading 212 is a great feature for those looking to test out the platform or indeed their investing strategies.

You are given £5,000 of ‘demo’ money to work with and can use the platform like you would with an invest or ISA account.

It’s very easy to access from the main menu just scroll down and look by the bottom for the words ‘switch to practice’.

You can also switch back to real money super easy via the big blue button.

Trading 212 Pro

Trading 212 Pro is for experienced investors looking for extra features for forex trading. You’ll need an account size of 500,000 euros and have worked in the financial sector for a minimum of 1 year.

Upgrading is completely free but please note this account option is not for new retail investor accounts – you need experience to be using the pro account.

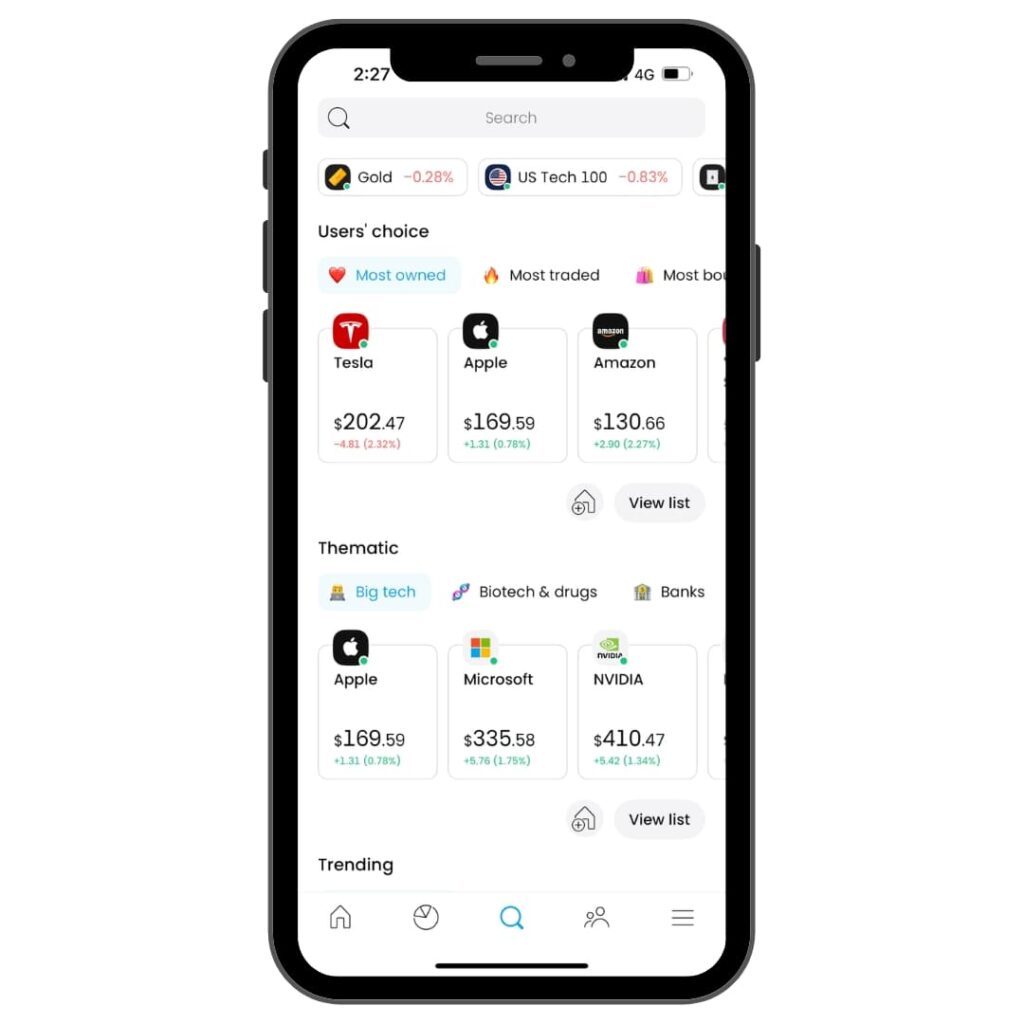

Trading 212 Review - Investment Options

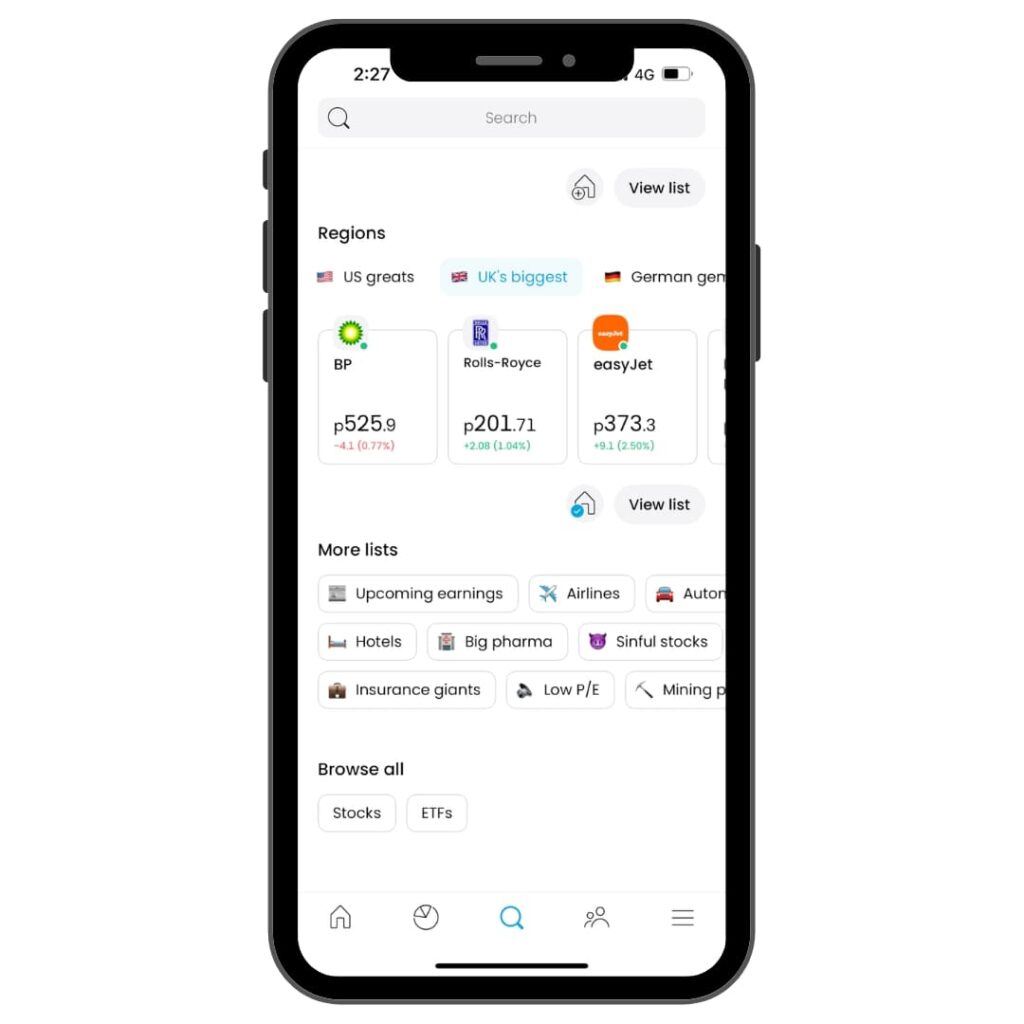

Trading 212s investment options are right up there. They have over 10,000 different assets from all corners of the world including a wide range of stocks and shares, ETFs, investment trusts, commodities, currencies and more.

The stocks and shares feature from the UK’s London Stock Exchange, NY Stock Exchange, and European, and Asian markets.

For me, they have everything a beginner and equally a more seasoned investor could be after.

They do however lack mutual funds options but for me, this is not a deal break unless you are specifically an investor in mutual funds.

Having used the app for over a year I have never been unable to find what I want and I invest in some pretty obscure financial technology brands in the US.

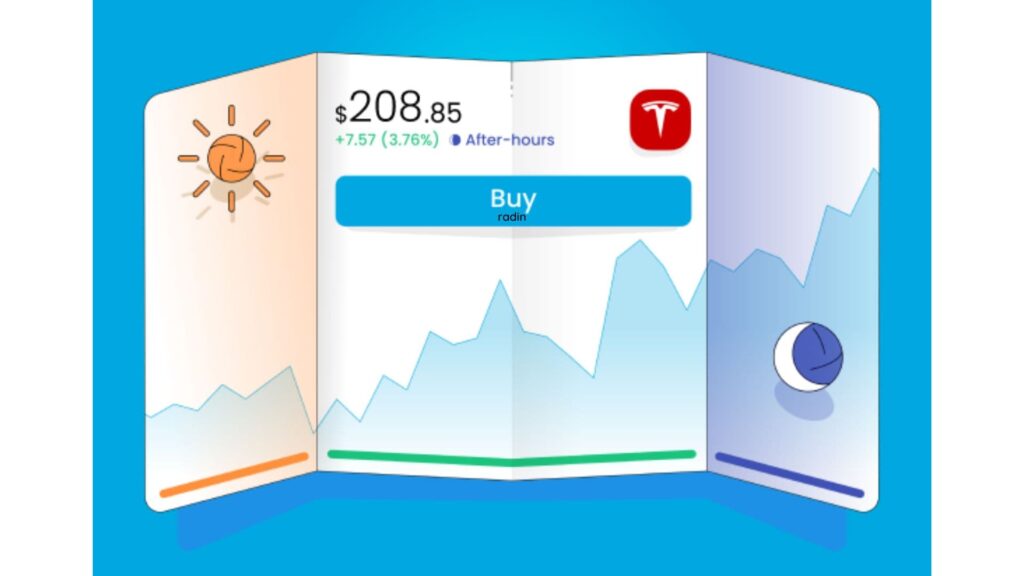

Trading 212 - New Feature Extended Trading Hours

In October 2023, Trading 212 released extended trading times for fractional shares.

This meant that usually the US markets would close at 9.30pm UK time but with extended trading hours you get access to US pre-market and after-hours sessions. This gives you 9hrs 30 mins of extra trading time!

GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH CODE ‘GAINS’ OR VISIT TRADING 212 HERE.

(Capital at risk when you invest)

Trading Features

Here is a roundup of the best features for traders on Trading 212 right now.

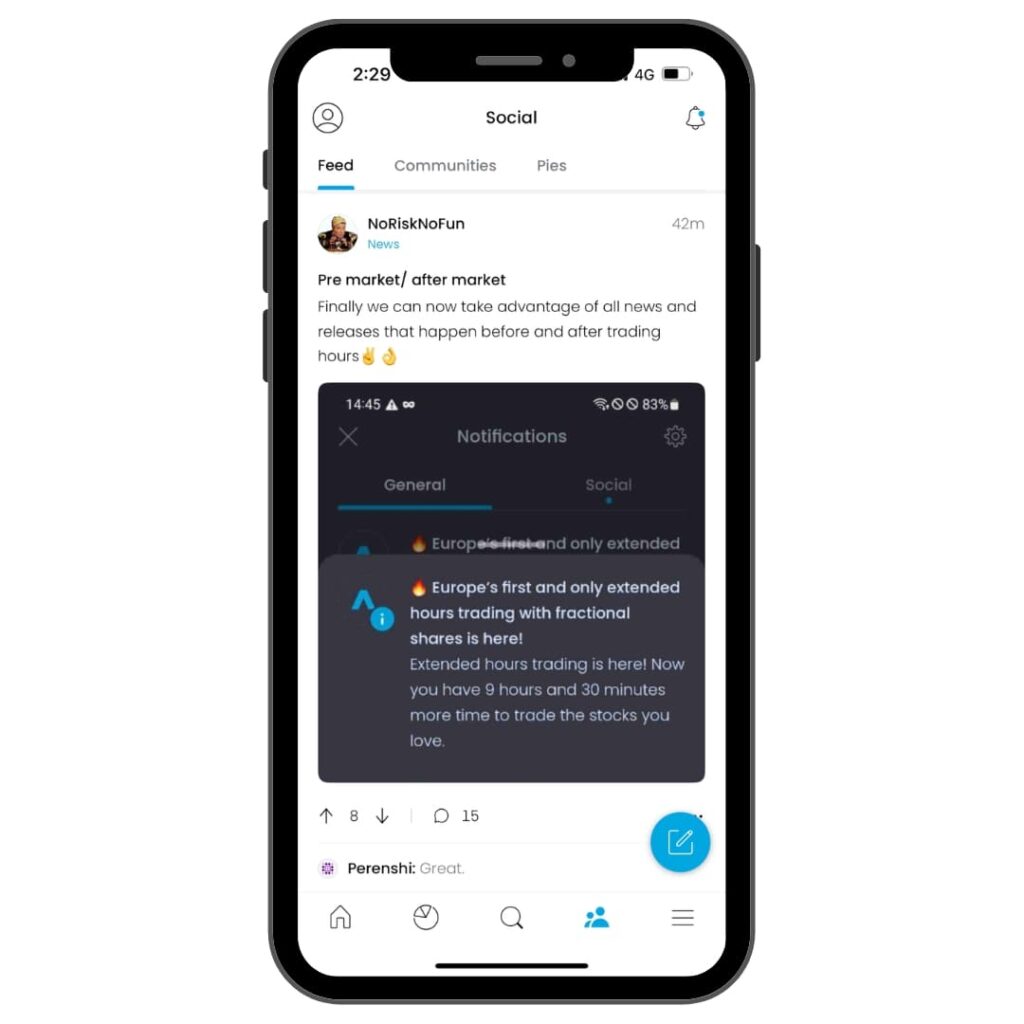

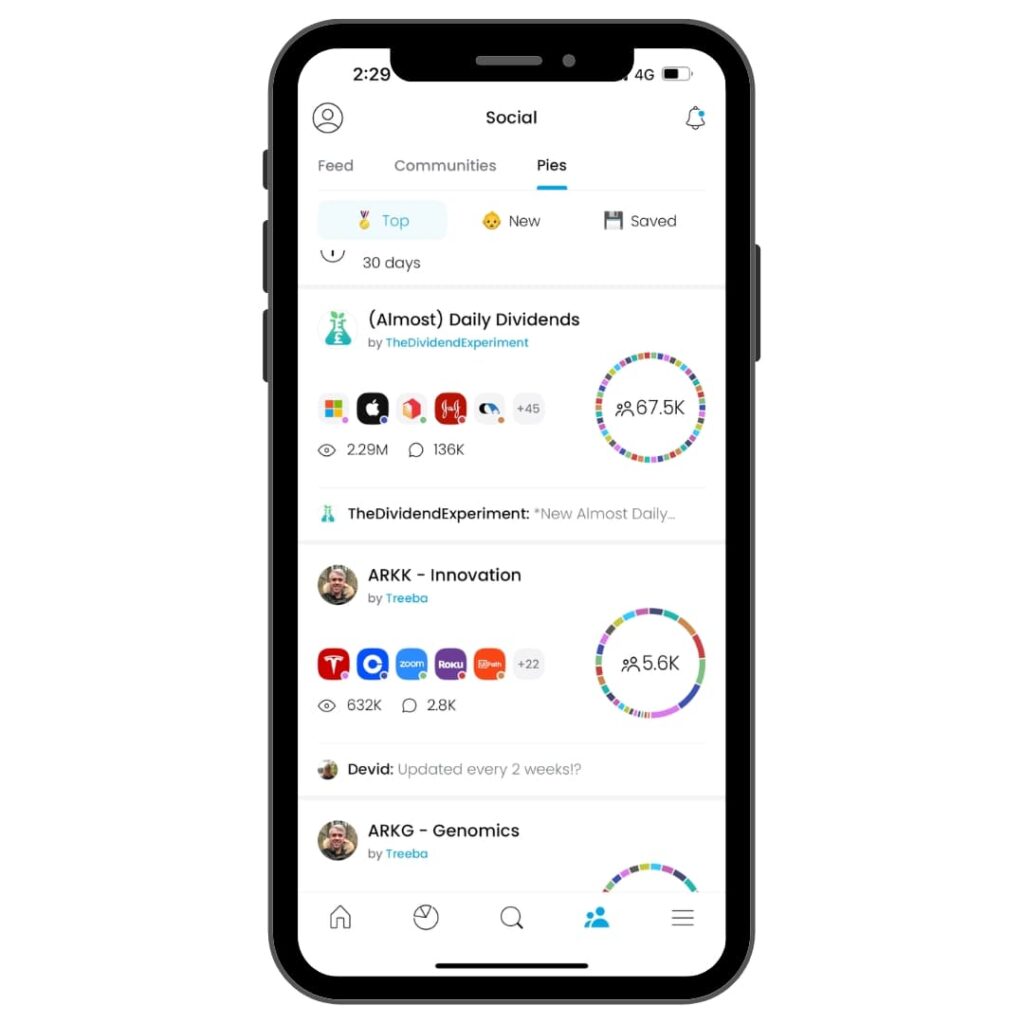

Social & Communities

Trading 212 also has a social feed which I would liken to a cross between Facebook and Twitter.

For me this is a great addition if you are interested in interacting with investors on the platform and sharing or indeed picking up strategies or tips.

You can post your own views if you set up a public profile (don’t worry they can’t see your portfolio) and interact with other posts via comments.

Secondly, there are 100s of community forum options ranging from dividends, news, memes, HMRC, pie discussions and more. Each community has it’s own feed and people can post, interact or just read through the chatter.

Pies

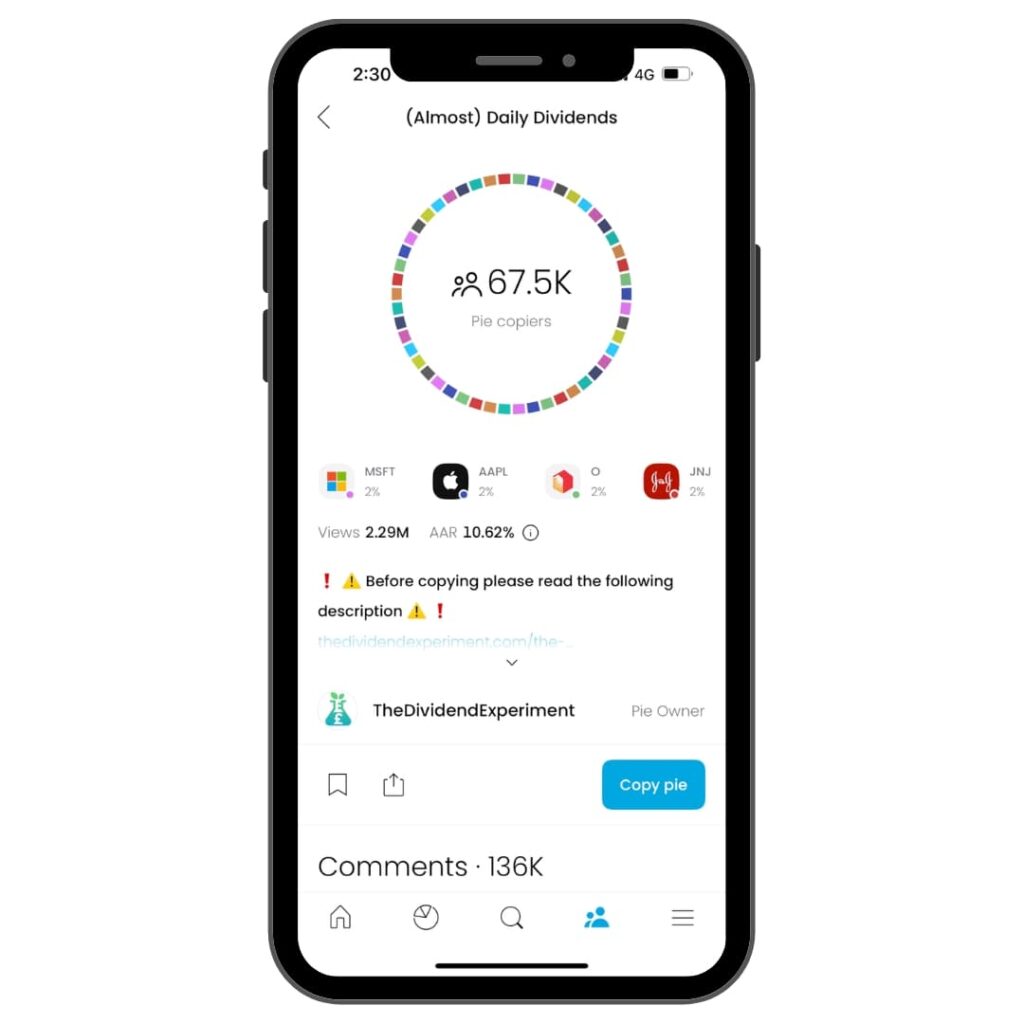

One of my favourite features on the app is the pies section. In the image below I have created a couple of options for you to visualise how they work.

It’s honestly so simple, you search for the stock you want to add, select its allocation within that pie, name it all and then you can auto-invest into the pie each month just like you would with an ETF.

It’s like creating your own funds which I think is a brilliant idea. You can also see other people’s pies (if they share them) on the socials section and copy those pies over to your own portfolio if you like what you see.

Economic Calendar

For those interested in global macroeconomic factors and important calendar dates such as interest rate decisions, CPI numbers, or even retail sales in certain countries Trading 212 has the economic calendar.

This is way beyond what I have found on any other platforms and provides investors with an excellent tool for those monitoring these important economic contributors to the markets.

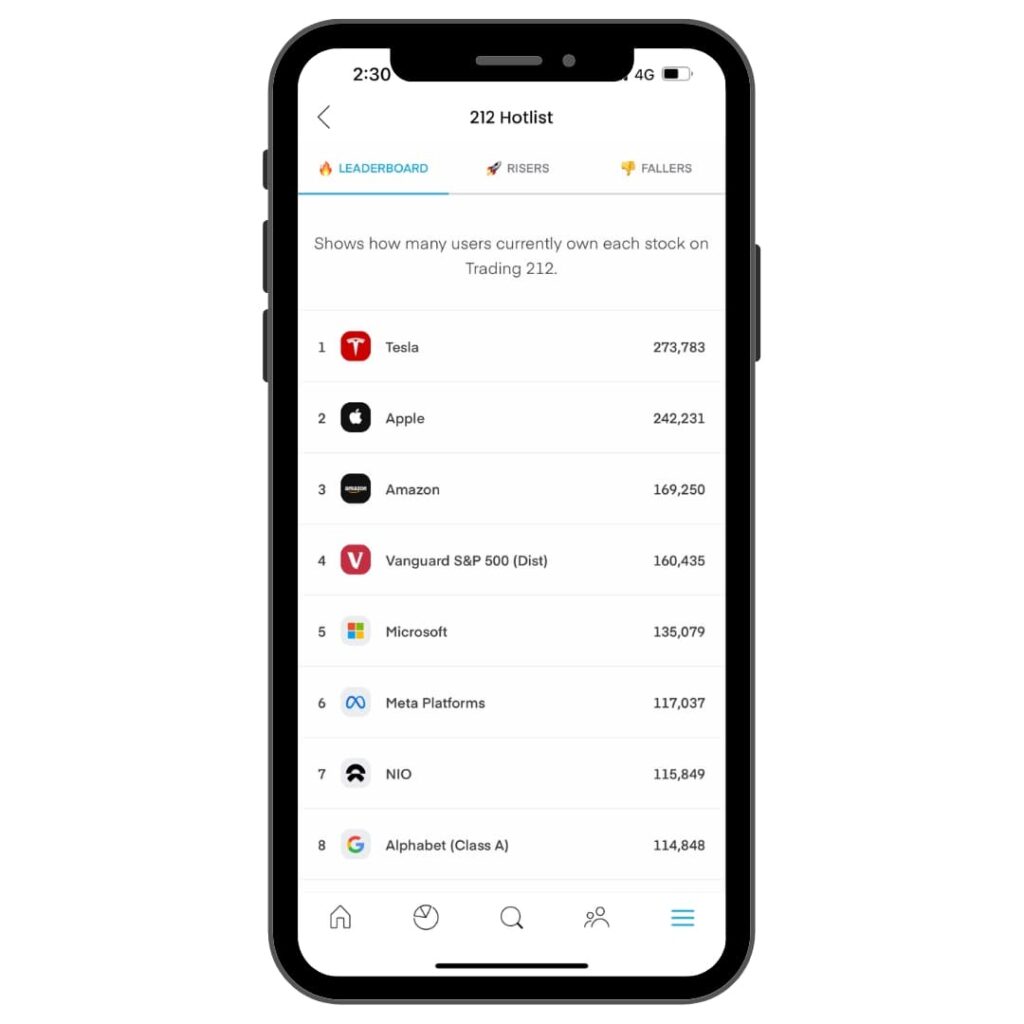

212 Hotlist

The Trading 212 hotlist is like a leaderboard of the top stocks which users on the app currently own.

I like how you can also see the risers and fallers and change this to suit by hour right up 30 days.

This is useful if you’re trying to spot trends or indeed just want to follow the crowds.

Price Alerts

Price alerts can be set up on any of the holdings on Trading 212. This will ping you a push notification and email when your chosen asset reaches the price you want.

Super useful if you’re waiting for a great entry point or indeed have a sell price that you’re looking to exit a position on.

Refer a friend

Trading 212s refer a friend scheme is excellent. You both get a free share worth up to £100 when you share the link. They usually open this once or twice a month and you can refer up to 5 friends during that timeframe.

Not a bad little earner if you make use of it. For example, I sent it round my WhatsApp group with my mates and got 5 sign-ups. They all earned and so did I!

Trading 212 Review - Fees

| Fees | |

|---|---|

| Trades in a different currency to the account | 0.15% |

| Share dealing/holding stocks in an ISA | 0% |

| Currency conversion of CFDs | 0.50% |

| Bank transfer deposits | 0% |

| Credit/Debit card deposits | 0.70% over £2,000 |

| Apple/Google pay deposits | 0.70% over £2,000 |

| Withdrawal fees | 0% |

How Much Does Trading 212 Cost?

Trading 212 has commission-free trading but it’s important to remember that nothing in life is free so there are always some costs to contend with.

That being said, I like how there are no hidden fees, Trading 212 is very upfront and showcases their fees very well across the app.

Please be aware that Trading 212 is not responsible for UK tax office costs such as capital gains tax and stamp duty.

GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH CODE ‘GAINS’ OR VISIT TRADING 212 HERE.

(Capital at risk when you invest)

Is Trading 212 Safe?

Yes, Trading 212 is safe to use. It’s regulated by the UK’s financial conduct authority (FCA) and the ISAs and GIAs are FSCS (financial services compensation scheme) protected up to the value of £85,000 should Trading 212 go bust.

They use banking-level encrypted security on your accounts to log in and have plenty of warning notices on high-risk products.

Please note when you invest your capital is at risk. Always do your own research before placing an investment.

Trading 212 Customer Reviews

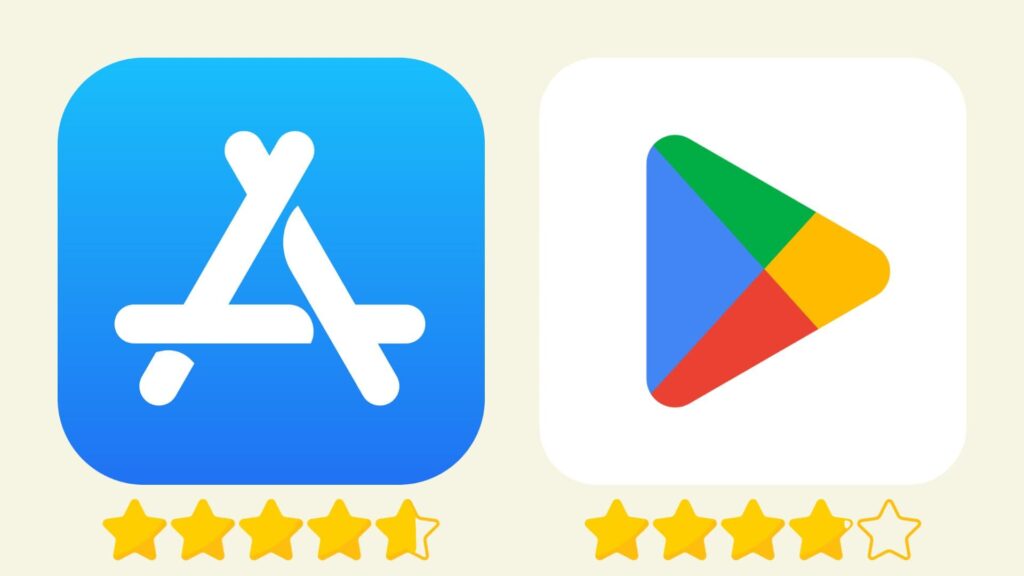

Trading 212 ranks very highly with customer reviews on the Apple store with a 4.6 out of 5 from over reviews.

It does however drop considerably on Android (who has an Android these days) to 3.9 out of 5 from over 142,000 reviews (clearly a lot of people!).

When I looked into the google play store reviews, they were mainly around the app crashing and perfromance issues which Trading 212 have come out and said they are solving. Interesting as I’ve never had an issue on my apple device.

Trading 212 trustpilot reviews are for me, the most important metric to look at and they have a 4.6 out of 5 rating which is scored excellent.

Very impressive for an app of this size to see such an incredible amount of high reviews.

Usually within finance, there are issues that people find and a good score in finance is above 4.2 so to see 4.6 is fantastic. People like Trading 212 and so do I!

Trading 212 Alternatives

Trading 212 vs eToro

For me, eToro and Trading 212 are extremely similar. The app experience on eToro is very similar and they do have wider features that Trading 212 do not have.

eToro’s patented copy trader feature is 1st class and does set it apart from Trading 212.

That being said, they’re so close in terms of their user experience and for me they are the top two trading apps I have reviewed.

eToro don’t however have an ISA so investments are subject to capital gains tax which means if you haven’t got an ISA yet then Trading 212 wins it.

I have unpacked this even more in our dedicated eToro vs Trading 212 review.

Trading 212 vs FreeTrade

Many say that FreeTrade is Trading 212’s biggest rival in the UK. I’d have to agree there but Freetrade recently put their ISA behind a monthly subscription and for me, this was a big no-no.

Both apps offer a user-friendly mobile app, and a large range of investment options although Trading 212 has over 4,000 more.

Personally, I wouldn’t be picking Freetrade over Trading 212 simply because of the paywall but they are close and you can find out more about Freetrade in our full review here.

Trading 212 vs Moneybox

Moneybox’s offering is very different to Trading 212. They offer a low-cost way to start investing but are much more funds based and are not or individual stock pickers.

For me, Moneybox is perfect for those who don’t want to be a DIY investors but still want to have access to the markets. Moneybox has award winning investment products and have over 1,000,000 users in the UK.

If you’re not interested in picking your own stocks and want to let the experts take care of the majority of it for you then Moneybox is a great option.

Find out more in our dedicated Moneybox review here.

Trading 212 vs Plum

Plum are slowly becoming quite close to Trading 212 as they expand their investing options. I would say that Plum are more of a personal finance app that handles everything from budgeting, saving and now investing.

They also have a personal pension (SIPP) which Trading 212 does not offer. They both have ISAs but for me I like to keep my savings separate to my investments.

This is why I use Plum for household savings and Trading 212 as my ISA. But, if you do just want 1 app for everything then Plum aren’t a bad option here.

Find our more in our dedicated Plum review here.

Trading 212 vs Chip

Chip are new on the investment scene but just like Plum are more known for their savings options rather than investing.

They are however, growing hugely in this area and offer an investment ISA alongside their savings products.

Again, if you want everything in one place, great but if you’re like me then I feel more comfortable separating my account.

Find out more in our dedicated Chip review here.

FAQs

Is Trading 212 Any Good?

Yes, Trading 212 is one of our highest-rated apps that we have reviewed.

It’s user experience is 1st class, they have plenty of investment options, are suitable for beginners and seasoned investors plus have an investment ISA to shield you from tax payments.

How Does Trading 212 Make Money?

Trading 212 makes money through a range of small fees on the app. Even though they’re commission-free when trading stocks, there are small fees for transfers, spreads, currency conversion fees and also an FX fee.

Does Trading 212 have hidden fees?

There is a 0.5% FX fee on CFD accounts and a small currency conversion fee of 0.15% when you trade in another country’s currency. Other than that there are no hidden fees and the app is very transparent if there is one so I wouldn’t say any of the fees were hidden.

Do I actually own shares on Trading 212?

Technically you’re not a direct owner of the share as Trading 212 holds shares through Interactive Investor, who then hold shares in a custody chain. All very complicated but put simply you don’t actually own the share slip like you do with traditional brokers.

Can I buy shares on Trading 212 with a debit card?

Yes, Trading 212 accept debit cards and Apple Pay on their accounts. There is a small fee of 0.6% when making transfers of £2,000 or more.

Is Trading 212 Regulated?

Yes, Trading 212 is regulated by the FCA.

Final Thoughts - Trading 212 Review

DIY investing has grown so much and for me Trading 212 is at the forefront of this movement.

I don’t expect to see a rollback here and can only see growth for Trading 212.

There’s so much to like and I really enjoyed reviewing them. The mobile app is excellent, with commission-free trading and a wide range of investment options.

Overall they’re a fantastic option for investors and if you’re interested open an account and have a play around with them on the demo account first.

GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH CODE ‘GAINS’ OR VISIT TRADING 212 HERE.

(Capital at risk when you invest)

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.