Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

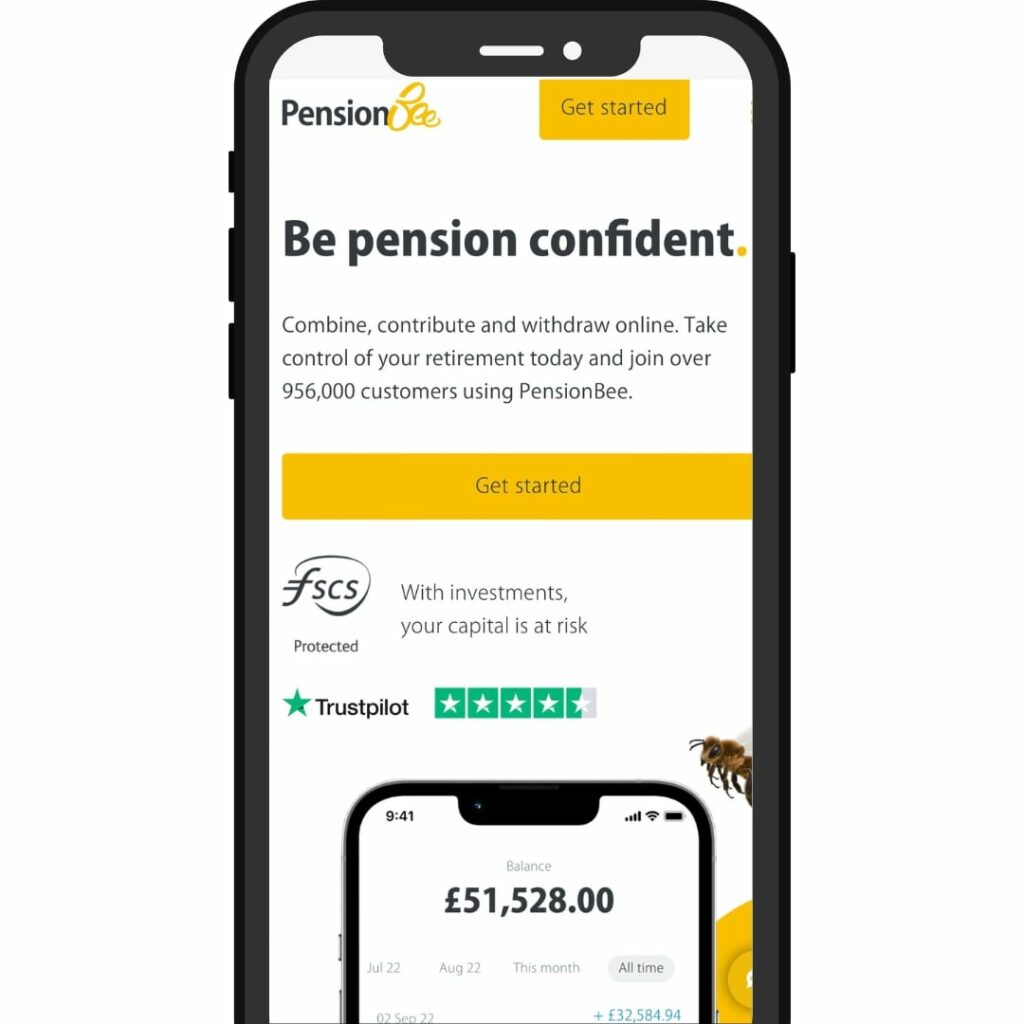

PensionBee is making pensions simple. Not only do they offer fantastic customer service their plans make it easy for individuals to set themselves up.

Their expert team helps nurture your money and help you work towards setting up a comfortable retirement.

This PensionBee review is unlikely to be the first time you’ve encountered this company.

As one of the best-known companies for bringing your pensions together, we wanted to look closely at what’s on offer.

When it comes to pensions, let’s be honest, they’re not necessarily something that we get that excited about. As retirement creeps ever closer, we start to focus that bit more and wonder what funds we will have available.

The problem is that the landscape of work has changed. Whereas once people were in a job for life, there is now a good chance that they have numerous job and career changes.

With each new position comes a new pension, and with each new pension comes something else to keep track of.

Keeping track becomes a little tricky, and the fact that 3.6 million of us in the UK have no idea where our pensions are attesting to this fact.

That’s where PensionBee can help: you can trace your pension pots, bring them all together, and take advantage of low fees (we’ll be exploring these later).

So, does a PensionBee transfer spell an end to your pension woes and worries, or is this an overrated service? Are there pension plans better than what I can get at the local high street bank?

Well let’s take a look.

Table of Contents

PensionBee Review - Company Overview

Before we get into the detail of what’s on offer, we wanted to take the time in this PensionBee review to look at the company itself and who’s behind it.

Having been launched back in 2014, PensionBee is a UK-based company that set about with the aim of innovating the industry. Based close to the financial centre of London, PensionBee was formed with the desire to simplify everything.

It wanted to make it easier to locate and consolidate existing pensions and to put them to work to bring the best possible returns.

The brains behind PensionBee is the founder and CEO, Romi Savova. With a wealth of experience from working for the likes of Goldman Sachs, Morgan Stanley, and Credit Benchmark, her own less-than-great pension experience saw her launch the company.

Main Features

As part of this PensionBee review, we wanted to take a look at the main features that were on offer, as well as the ease of use that was offered. We have to say that, in both areas, we were suitably impressed.

As we have already seen, what PensionBee offers is a chance to bring your existing pensions together in the same place.

Tracking numerous pensions with numerous providers can get a little complex, and it’s difficult to see how your funds are performing.

When you use a PensionBee transfer, you bring your existing pensions across. This could include, thanks to the technology used by PensionBee, ones that you’d lost track of or even forgotten about.

As you bring them across, you’re given a choice of the type of plan that you want to invest in. These plans are something that we’ll be looking at soon.

What’s really attractive about PensionBee is the smartphone app. Yes, you can also access your information via the website, but we found the app particularly appealing.

From here, you can clearly see how your pension is performing. As well as viewing, you can also make ad hoc top-ups if you want to. There are limitations, but these are down to regulations rather than being a fault of PensionBee.

The big thing to note is that if you have a final salary pension or one where you have £30,000 of guaranteed benefits, you can’t carry out a PensionBee transfer without financial advice.

The rules state that you can’t transfer your pension anywhere without such advice. PensionBee doesn’t offer financial advice, so you’d have to seek this elsewhere.

While this PensionBee review has shown that the main focus is on consolidating existing pensions, that is not all that’s on offer.

Nothing can stop you from signing up and starting a brand new pension, even if you don’t have an existing one elsewhere.

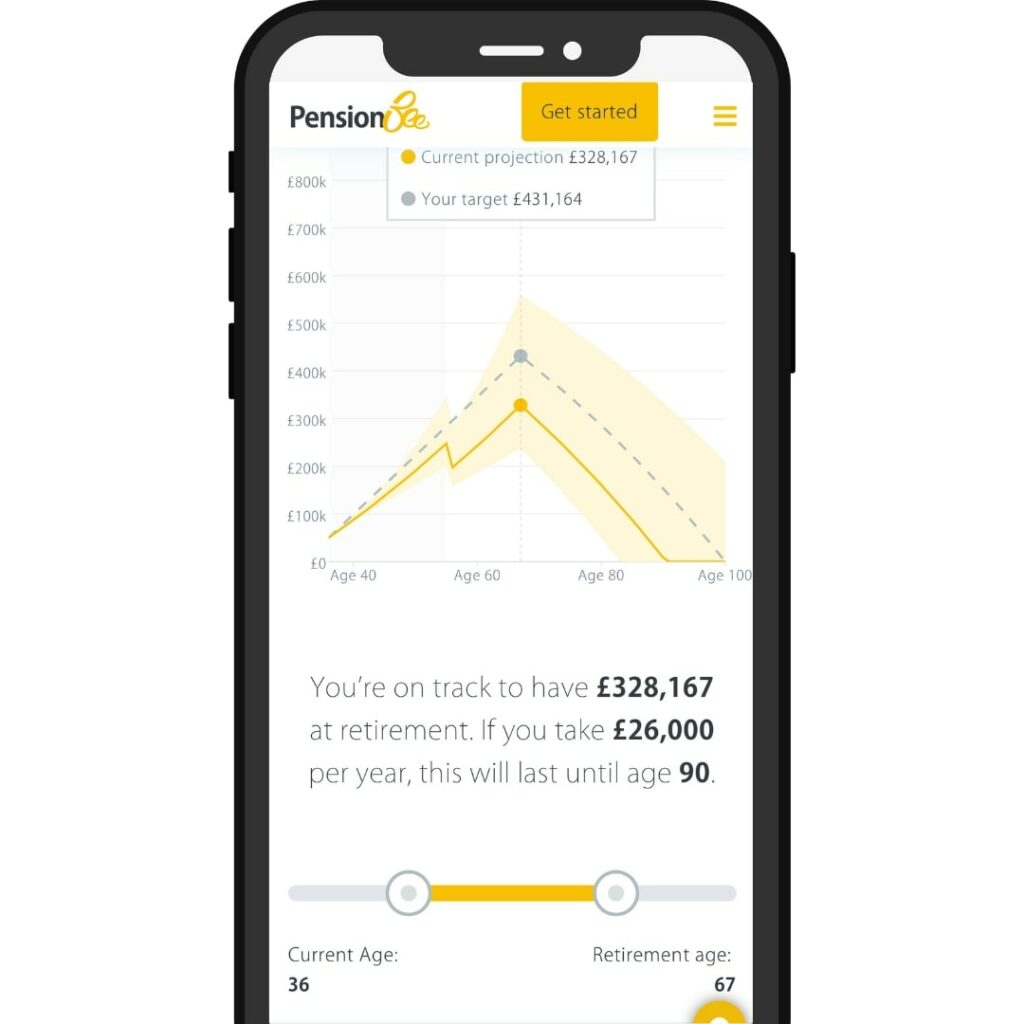

When you get to retirement, PensionBee is up there with some of the best pensions for drawing down. They provide you support and calculations to help you make the best decisions.

Pension Types

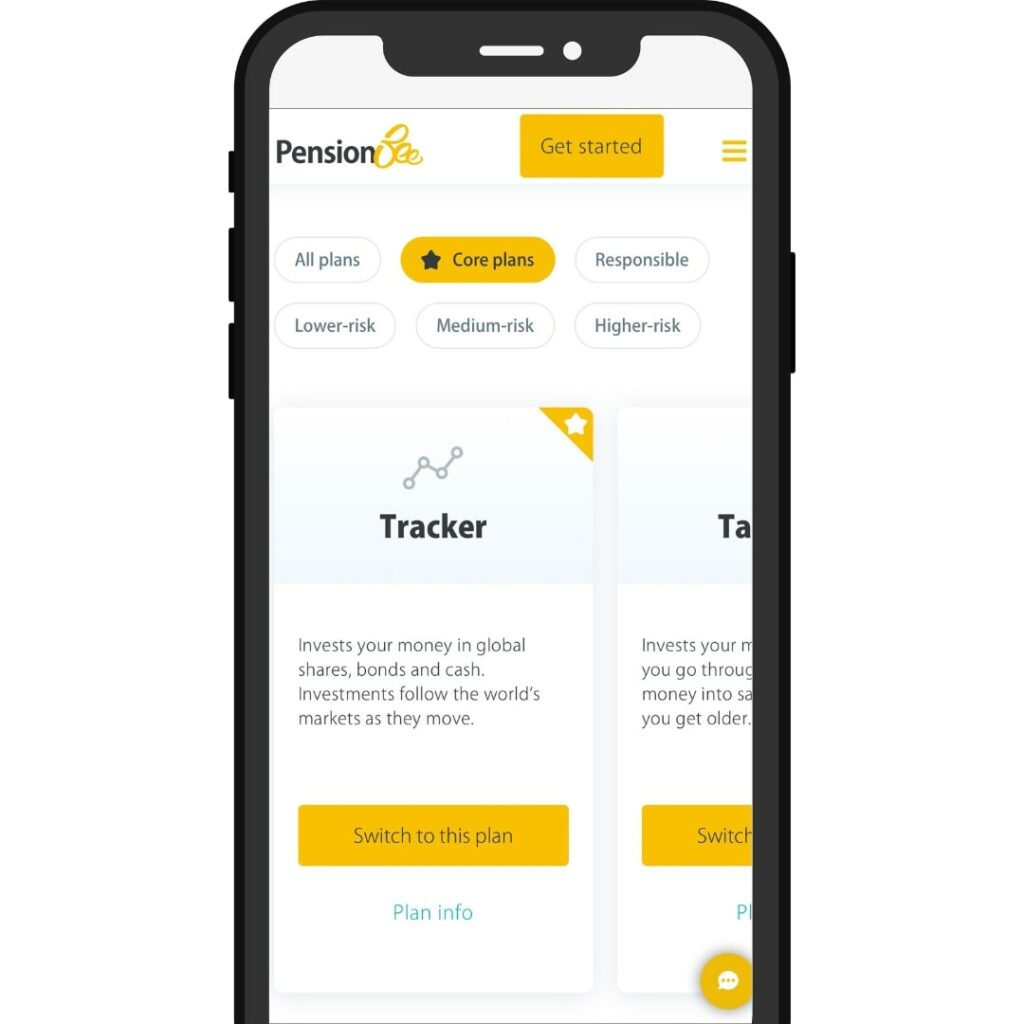

With this PensionBee review, we wanted to explore the different types of pensions that were on offer.

We found that there were seven different types and that the only difference between them was the funds in which your pension pot is invested. Let’s take a look at these types in turn:

PensionBee tracker plan

State Street Global Advisers manage this PensionBee pension. It invests your money in global shares, bonds, and cash. Being a tracker, it follows the markets as they move.

When it comes to the risk level, this plan is classed as medium and is targeted at those who want a set-and-forget investment.

PensionBee tailored plan

Managed by BlackRock, this is a plan that reacts according to your age. The further away from retirement you are, the more risks you can afford to take purely because there is time for things to correct themselves should they go wrong.

As you get older, this pension fund will become more conservative with the risks being taken. This way of managing a pension is usually referred to as life styling.

PensionBee fossil fuel-free plan

As the name suggests, this plan is a socially responsible one. It won’t invest funds into companies where there are reserves of coal, oil, or gas.

It also steers clear of companies that are involved with tobacco products and with the manufacturing of controversial weapons. This plan is managed by Legal and General.

PensionBee Shariah plan

This plan is self-explanatory, allowing people to invest according to their faith in companies that are compatible and compliant with Shariah law. The Shariah Plan is managed by HSBC Global Asset Management and State Street Global Advisers.

PensionBee 4 Plus plan

Managed by State Street Global Advisers, the aim here is to achieve long-term growth of 4% each year. The invested assets are reviewed weekly to ensure that they are performing in line with expectations.

PensionBee Preserve plan

If you want to play it safe, this is your pension. The focus here is all on reducing risk and preserving your funds. Of course, the trade-off will usually be a lower return, but this is acceptable for risk-averse people.

PensionBee Pre-Annuity plan

Managed by State Street Global Advisers, this plan invests money in bonds. It provides investors with returns corresponding to the cost of buying an annuity.

What are the PensionBee fees?

Of course, no PensionBee review would be complete without looking at the fees involved. The first thing to note is that there are no fees to carry out a PensionBee transfer.

That means that bringing your existing pensions across, or even later taking them away, doesn’t incur any charges.

An annual management fee is to be paid, which is decussated from your pension daily. The good news is that this fee is competitive.

Depending on your chosen plan, you’ll find yourself being charged between 0.50% and 0.95% per year. However, if your investments go above £100,000, anything above this amount is subjected to fees that are reduced by 50%.

What we like about PensionBee

As we’ve gone through this PensionBee review, we’ve seen plenty of things we’ve liked. These include:

- The low fees involved

- The fact that the charges are transparent and easy to understand

- There is no charge to move your pension elsewhere if you choose to

- You are not locked in for a set amount of time

- It’s a great way to consolidate all of your existing pensions into one pot

- The customer service is great

- The app is neat and clever, providing a great way to stay on top of your pensions

- Everything is as simple and easy as possible – something that is quite rare where pensions are involved

- The pension calculators are easy to use and visual enough to understand quickly

- They are great for self-employed pensions allowing you to create your own personal or company pension

What don't we like?

We like to make sure that we provide a balanced option whenever we carry out a review. With that in mind, here are some of the things that we weren’t so keen on:

- There is no financial advice, so PensionBee can’t assist if you want to transfer a final salary pension

- The plans on offer only have one fund, so this limits your investment choice

What are customers saying?

What a company’s current customers have to say really reveals a lot about it. When it comes to PensionBee, you’ll find that its customers are certainly satisfied with what’s on offer and with how they’re treated.

If you look at Trustpilot, there are over 8,000 reviews, and PensionBee is rated 4.6 out of 5.

The most recent reviews, as of today, refer to how easy and stress-free the experience is and how amazing the app is. Because 81% of reviews rate PensionBee as excellent, you can certainly have confidence in its services.

FAQs

Can PensionBee be trusted?

Yes, PensionBee can be trusted. PensionBee pensions are protected via the Financial Services Compensation Scheme (FSCS). They also use trusted partners to house your funds, such as HSBC, BlackRock and State Street Bank.

What happens if PensionBee goes bust?

The FSCS protects your money. This would be that you would receive 100% of your pension back should PensionBee go bust. If your employer goes bust, your pension is unaffected, but future contributions from your employer would be.

Can I take my money out of PensionBee?

You can transfer your pension at any time. Withdrawing a pension before 55 (soon to be 57) is not available through PensionBee unless you’re severely ill or have less than 1 year to live. You would need to speak with PensionBee directly to discuss your options.

Conclusion

We’re big fans of PensionBee and there refreshing approach to what was a very stale pension market before they came along.

The technology to find your mysterious missing pension pots is so helpful.

With a wide range of products available, they really do cater for everyone from high-risk to risk-averse.