Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

£70,000 is an excellent salary and is well above the median wage for the UK and London. Whether or not you find 70k to be a good salary will depend on your current financial and living situation.

If you live in London, you could expect £70,000 to go quite a long way but compared with places in the North which are often cheaper, £70,000 will go even further.

If you want to find out the answer to ‘is 70k a good salary in the UK’, then read on as we break it all down or watch the full video just below!

Table of Contents

Is 70k a good salary in the UK?

A 70k salary is above the nation’s average for a full-time employee. The average yearly wage for full-time workers in London in 2022, according to Statista, was £41,866, compared with £29,521 for workers in North East England.

A 70k salary is likely to be a senior management position; therefore, you will need the experience to warrant such a salary. Most people will naturally start much lower when starting out or leaving university.

Breaking down a 70k salary

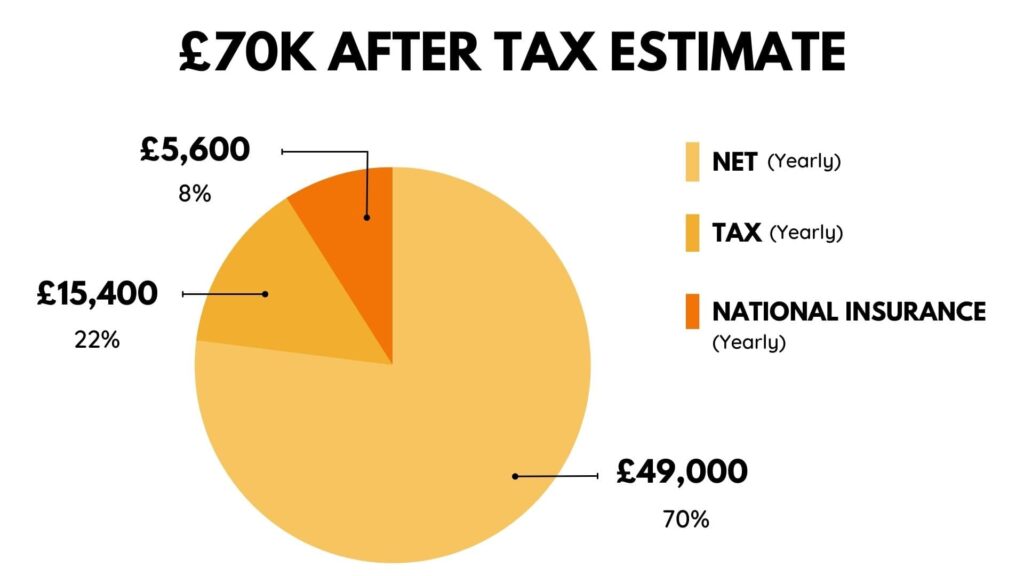

Right, so you could have landed a 70k salary. Nice work! But how does it break down?

This net wage is calculated based on you being younger than 65 with no student loan, pension deductions or benefits.

Gross income of £70k per year equals:

- £33.65 per hour

- £269.23 per day

- £1,346.15 per week

- £2,692.30 bi-weekly

- £5,833.33 per month

Estimated Net Income after income tax and national insurance contributions

- £23.87 per hour

- £190.96 per day

- £954.80 per week

- £1,909.6 bi-weekly

- £4,137.47 per month

It’s important to note that tax on your bonus will fall into the higher tax bracket here. If you’re worried about that, then there are options you can look into to lower the tax you pay.

Equally, if you’re moving roles, be sure to submit your P45 as early as possible to avoid emergency tax.

UK Salary Calculator

Results:

Can you live off a 70k salary?

The short answer is yes; you can comfortably live off 70k. You’re now venturing into the UK’s top 5% of paid people. This is an incredible stat, so if you’re at this stage, you should be proud of your achievements.

Many variables are in play regarding expenses, such as total household income, debt, dependents, and monthly payments.

This is unique to each person; therefore, we must stress that only you will know if you can live off 70k, but realistically, you shouldn’t have an issue.

If you’ve been on a higher salary and are taking a pay cut, you may be accustomed to a particular lifestyle. This could mean your outgoings may be much higher. In this case, you may not be able live off £70,000 and would need to rearrange your finances to suit your new salary.

Compared to the US for the same roles, generally, salaries in the US are higher, and UK salaries are lower for some reason, but not considerably.

How much rent can I afford on a 70k salary?

Renting is challenging to work out as it depends a lot on other expenses. You will also need to consider household bills like gas, electricity, council tax and water.

Remember things like the internet, mobile phone, insurance and transport bills. It all adds up, so it’s essential to budget for these costs before you work out your available cash for rent.

Usually, it’s around 30-40% of your salary for rent. Try to keep this as low as possible. If you have debt, I suggest reducing this accordingly, but you’ll find operating within this bracket leaves you some cash left over.

If you look at a 70k salary monthly, after tax, this bracket is around £1200-£1400. If you’re in London, or a major UK city, you could afford a one-bedroom flat, but sharing with others or a partner would give you more options.

In the North of England, this will go a lot further and, in some places, can even get you a three-bedroom house.

Can I buy a house with a 70k salary?

Yes, you could easily buy a house with a 70k salary. According to onlinemortgage.co.uk, you could afford somewhere between £300,000 – £370,000 if you have a 10% saved for a house deposit.

In the UK, your mortgage affordability is usually calculated at x5 your yearly income before tax. Your affordability would increase if you added someone like your partner, friend or sibling to a joint mortgage.

It’s important to note that if you’re freelance, this amount could change as lenders are often less favourable to people who work for themselves or own businesses. You will usually need 24 months’ worth of tax returns but having 3+ years makes it more accessible.

Depending on where you buy, £370,000 can go quite a long way. In London, you’d need to look around the outskirts to get a one-bedroom flat, but if you’re looking in more rural areas, this could turn into a two or three-bedroom house with a garden!

Tips for how to live off a 70k salary

How can you make your 70k a year go even further? This section looks for tips to help you do just that.

Budget

We know budgeting isn’t the most exciting thing in the world, but even on a 70k salary, you should have one! If you don’t, you’re playing the dark, and while that may work for some for most, it doesn’t!

Understanding your outgoings allows you to assess your current financial situation and plan for more significant purchases or life decisions. It will also allow you to allocate money for things like investing, saving and paying off debt.

You can find seriously great saving apps that can help using our list.

Pay off Debt

If you’re earning £70,000 a year, you should be looking to clear any debts you may have right away. A budget will be handy here as you can allocate money towards your debt and pay it down faster.

Targeting any high-interest debt first is vital to reduce your interest payments. The last thing you want is to offer up your hard-earned money to banks through interest payments as that’s cash you could have used elsewhere.

Many of us just pay off the minimum balance each month, and whilst this is contributing, you’re often just paying back interest and not reducing the balance. The key here is to overpay so you can get your debt down faster.

Consider investing

If you’ve never invested, you should seriously look into it. Earning 70k a year, you should be looking to invest so your money works for you.

You could invest via the stock market, businesses or property. There are plenty of options for you to look into.

There are risks when investing in the stock market, but if you invest for the long term, many of those risks become smaller. The stock market is built to rise over time, so if you stay invested in the right companies, you can do very well.

If you want to avoid learning about investing but still be an investor, let apps like Moneyfarm and Wealthify do the hard work for you.

These brands are called robo-advisors and are designed to take care of everything for you. They have built-in algorithms that create portfolios tailored to each individual.

Once you complete a questionnaire, you will have a portfolio ready-made for you and can begin investing what you can afford.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Always use credit cards correctly

Using credit cards correctly is something I could go on about all day. I pay them down immediately – don’t wait. That’s the trap they lure you in, and suddenly you are stuck paying down the interest every month. Don’t do this!

Try not to maximise all the credit you take out. Agencies like Experian, Equifax, and TransUnion will encourage you to keep under 30% of your total credit card balance. Bad credit doesn’t help anyone!

Doing this shows you’re responsible with debt and can clear it immediately if necessary.

My tip is to buy something on your credit card every month. Have a regular bill you pay, like a subscription. As soon as it comes out, pay it off. This will help maintain and even increase your credit score.

A balance transfer card can help stop any high interest you may be paying. You can find interest-free ones, but check out the transfer fees beforehand.

Build an emergency fund

Building yourself an emergency fund for rainy days is essential. Life happens at any corner, so financial security will make those moments much easier to deal with!

Experts say most emergency funds should be six months’ worth of pay, but three months is a great place to start working towards.

To help me, I use a round-up feature with my bank to help me put money aside. This takes any purchase and puts the loose change away for me.

For example, if I spend £2.20 on a coffee, my bank rounds up the purchase to £3.00, placing the 80p into a savings pot for me.

FAQs

Is 70k a year middle class?

It’s important to note that no official amount makes you into a class, it’s purely personal judgement, but £70,000 yearly is undoubtedly an excellent wage. 70k a year would see you by some as middle class and, in other cases, even upper class. It purely depends on the individual’s viewpoint.

Is 70k enough in London?

Yes, 70k is enough in London to live comfortably. Everyone knows things are more expensive in the capital, but if you keep your outgoings down, and budget correctly you will be able to enjoy all it offers on 70k a year.

Is a 70k salary good for a single person?

If you’re single and have relatively no debt, 70k is in the UK’s top 5% of salaries. This level of salary will allow you to pay your rent/mortgage and still have enough left to enjoy time with friends and family, invest and put money away.

Conclusion

So, Is 70k a good salary in the UK? We’ve established that it depends on where you live, your financial situation and many other variables.

You can make 70k work even in the capital, but it can become challenging if you’re supporting a large family or have large amounts of debt.

More like this

- Is 20k a good salary?

- Is 25k a good salary?

- Is 30k a good salary?

- Is 35k a good salary?

- Is 40k a good salary?

- Is 45k a good salary?

- Is 50k a good salary?

- Is 55k a good salary?

- Is 60k a good salary?

- Is 65k a good salary?

- Is 75k a good salary?

- Is 80k a good salary?

- Is 90k a good salary?

- Is 100k a good salary?

- Why are US salaries higher than the UK?

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.