Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

A 90k salary is above the national average salary for a full-time employee.

The average UK salary can range quite vastly depending on the exact location in the UK, with full-time workers in London earning an average yearly wage of £41,866 and those in North East England earning an average of £29,521, according to Statista.

A 90k salary is likely to be earned by professionals such as doctors, lawyers, engineers, executives, and senior managers.

People with significant experience in their field, such as consultants or directors, can also earn this amount.

£90,000 is considered a high salary in the UK. With the average salary in the UK being around £30,000 per year, a 90k salary is significantly higher than what the average person earns.

However, while this is considered a “good salary” in the subjective sense, that all depends on your personal living expenses and financial responsibilities. For some, this may just be a starting salary which they wish to build upon.

Read on to learn more as I break down a 90k salary in the UK.

Table of Contents

Breaking down a 90k salary

Let’s break down your question: is 90k a good salary in the UK?

Below, I will take a look at your earnings by day, week, and month according to your yearly salary.

These estimations are based on the assumption that you are no older than 65, have no pension deductions or benefits and have no student loans.

Gross income of £90k per year equals:

£43.27 per hour

£346.15 per day

£1,730.77 per week

£3,461.54 bi-weekly

£7,500 per month

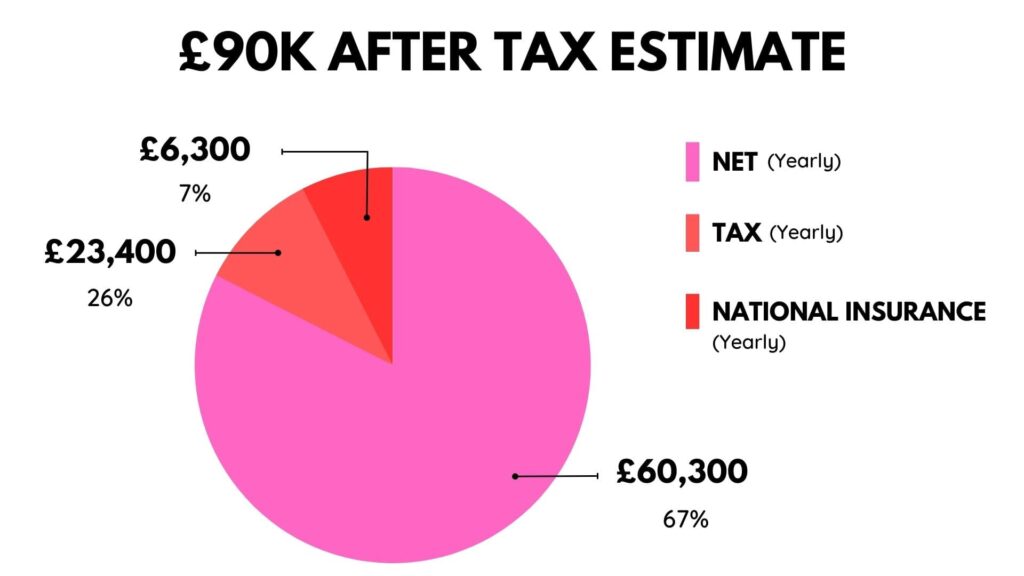

Estimated Net Income after income tax and national insurance contributions equals:

£29.45 per hour

£235.58 per day

£1177.88 per week

£2,355.76 bi-weekly

£5,104.14 per month

UK Salary Calculator

Results:

Listen to this podcast 🎙️

Join us for an episode with Carla Hoppe, Wealthbrite Founder and Ex Big Four Lawyer.

We discuss how having more money doesn’t necessarily mean you have cashflow, how to manage debts, and how to get the most out of your big salaries.

Hit the play button just below or for links to Spotify and Apple click Carla’s name just above.

Can you live off a 90k salary?

A £90,000 per year salary is above the median salary in the UK and should, therefore, be considered a good income that will be sufficient for most people to live comfortably.

However, the cost of living varies depending on where you live in the UK.

London is more expensive than other regions, so someone who lives here would find their money running low far more quickly than someone who lives outside of London.

Other factors such as your debt, dependents, and monthly payments also come into play – but it’s highly likely that you’ll be able to cover all these expenses easily with a 90k salary while still being able to afford a good quality of life.

How much rent can I afford on a 90k salary?

You should be able to afford a place to rent in the range of £1,500 – £2,000 with a 90k salary.

However, bear in mind that the amount of rent you can afford should always be calculated after considering all your other monthly expenses first.

As a general rule, 30-40% of your salary (after tax) should go toward rent. I suggest that you stay on the lower side of this bracket so that you still have a decent amount of cash left over after paying rent and all the bills.

In London, you should be able to afford a comfortable 2+ bedroom apartment. In other regions, such as in North East England, you would be able to afford a place with more space, more bedrooms, and perhaps even a garden.

Can I buy a house with a 90k salary?

Given that a 90k salary is well above the median household income in the UK, you should have no problem buying a house through a mortgage.

According to onlinemortgageadvisor.co.uk, you could buy a house within the range of £405,000 – £540,000.

In the UK, mortgage affordability is typically determined by multiplying your pre-tax annual income by a factor of five.

If you were to add a second person to a joint mortgage, your affordability would likely increase due to combined income.

It’s worth bearing in mind that if you work as a freelancer, this figure may differ. Lenders typically view sole traders or limited business owners less favourably.

Tips for how to live off a 90k salary

What are some tips for living off a 90k salary? I will discuss this below.

Budgeting strategies

The first step towards living off a 90k salary is to create a budget that is realistic and feasible. You may think that you’re stable enough to not bother with budgeting, but I would suggest avoiding this mistake!

Keeping track of your expenses is important for knowing where you stand financially and will help you plan and save money for future monetary decisions.

It could also save you in desperate times, such as if you need to pay for major car repairs or have unexpected medical expenses.

Start building an emergency fund

Speaking of the unexpected, consider putting money into an emergency fund. This will provide you with financial security when you need it most.

Try to work towards having at least 3 months’ worth of pay in your emergency fund. This would work out to £14,832 on a 90k salary. You can then build on this amount over time.

Think about investing

When living off a 90k salary, it’s essential to focus on saving and investing to secure your financial future.

You can explore various investment options such as stocks, bonds, and real estate.

Whatever you choose, just make sure to put your money in a company that’s guaranteed to grow over time despite occasional drops. Your future self will thank you for it!

Settle your debts

Debt management is a crucial part of financial planning. If you have any outstanding debts, it’s essential to come up with a plan to pay them off as quickly as possible.

Paying off your high-interest debt first is key to avoiding interest payments compounding over time. Once this is done, financial stress will be lifted off your shoulders.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

FAQs

Is 90k a year middle class?

A £90,000 salary is generally considered high as it’s above the nation’s average income. That being said, most people would view this as middle or even upper-class, depending on personal judgement.

Is 90k good for a family of four?

A family of four should be able to afford a decent standard of living on a 90k household salary.

This includes living in a comfortable home, the ability to pay off monthly expenses, and enough left over for vacations and leisure activities.

However, the cost of living can differ greatly depending on where you live, family spending habits, and housing costs.

What kind of lifestyle can I expect with a 90k salary in the UK?

An annual salary of £90,000 in the UK can provide a comfortable lifestyle.

You would have enough to support a family of four in a decent neighbourhood. You should also have enough to put aside for investment or retirement planning.

Conclusion

So, is 90k a good salary in the UK? I’ve established that you should be able to live a comfortable life with enough money to pay off expenses, put into savings, and spend on leisure activities.

Learn more on this subject

- Is 20k a good salary?

- Is 25k a good salary?

- Is 30k a good salary?

- Is 35k a good salary?

- Is 40k a good salary?

- Is 45k a good salary?

- Is 50k a good salary?

- Is 55k a good salary?

- Is 60k a good salary?

- Is 65k a good salary?

- Is 70k a good salary?

- Is 75k a good salary?

- Is 80k a good salary?

- Is 100k a good salary?

- Why are US salaries better than the UK?

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.