Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

In the whirlwind of adulting, it’s crucial to kick-start your wealth-building journey in your 20s.

This comprehensive guide navigates you through understanding personal finance, creating an emergency fund, managing debt and credit, investing wisely, diversifying income, property investment, and adapting to financial changes.

Buckle up and let’s embark on this thrilling journey to financial freedom.

Firstly, massive pat on the back for thinking about building wealth in your 20s. In my early 20s all I was doing was maxing out credit cards, living paycheck to paycheck thinking I’d make all my money in my 50s.

I was wrong, it hit me hard mid twenties and I went from £24,000 in high-interest debt to debt free in 18 months. I now own multiple businesses, have a sizeable investment portfolio and own property with my partner.

You can learn the full story in my new ebook ‘How To Go About Investing‘.

This guide though is everything you need to know about building wealth in your 20s. I did it, and now I want you to!

Spoiler alert: this isn’t putting your money on some random cryptocurrency this is about building real, lasting wealth you can set yourself up for life with.

Table of Contents

Building Wealth In Your 20s - The Basics Of Personal Finance

Before you start, it’s essential to understand some basics of personal finance. Think of it as the ABCs of money management – you can’t get far without mastering them.

Importance of Financial Literacy

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.

Sounds duller than a rainy day in Blackpool, right? Once you’ve been on the Pepsi Max that’s it right? But trust me once you get the hang of it, you’ll realise it’s your ticket out of here!

Literally anyone can do it. I mean anyone.

Listen to this 🎙️

Join us with Niaz, Co-Founder of Millennial Money UK.

We discuss how your financial past will shape your future, how to build wealth early on, what it takes to succeed financially and SO MUCH MORE!

Hit play on the episode below or click here for the access to all The Money Gains Podcast episodes

Setting Financial Goals

Once you’re well-versed with the basics, it’s time to dream.

Want to own a house in London by 30? Aspire to retire early and enjoy your tea while gazing at the Cornish coast? Or maybe you just fancy the freedom to enjoy a daily dose of avocado toast without guilt.

Whatever your ambitions, they need to be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

For instance, instead of vaguely stating, “I want to be rich,” aim for something more tangible, like “I want to save £100,000 by 35.”

Budgeting and Saving

Now, let’s talk about budgeting and saving, the Lennon and McCartney of personal finance. Budgeting helps you allocate your income towards needs, wants, and savings, ensuring you don’t end up spending your retirement money on last-minute Ibiza trips.

Practical tools like Plum, Chip and Snoop can help you track your income and expenses, making budgeting less about maths and more about peace of mind. And remember, every penny saved is a penny earned!

Building an Emergency Fund

An emergency fund is your financial parachute. It’s that stash of cash ready to catch you when life decides to throw a curveball, from unexpected car repairs to sudden job loss.

How Much to Save

So, how thick should your safety net be? While the answer can vary, a good rule of thumb is to save enough to cover 3-6 months’ worth of living expenses.

This buffer can prevent you from spiralling into debt during challenging times. However, the exact amount should depend on your personal situation.

For instance, if you’re freelancing or have an irregular income, you might want to aim for a larger safety cushion.

Where to Keep Your Emergency Fund

Now, where to keep this precious fund? Somewhere safe, easily accessible, and preferably where it can earn a bit of interest.

A savings account with a reputable UK bank usually ticks these boxes. It might not be as exciting as finding treasure in your backyard, but it’s certainly safer and more reliable!

Learn more about emergency funds and how to build them in our article ‘How Much Should Be In An Emergency Fund‘

Managing Debt and Credit

Understanding Good Debt vs Bad Debt

In the world of debt, there are the good guys and the bad guys.

Good debt, like student loans or a mortgage, can add value over the long term. Bad debt, like that credit card bill from a luxury shopping spree, can drain your resources. Especially when it’s high interest debt.

This will kill your progress so only use credit if you can afford to pay it back twice over.

Managing Student Loans

If you’ve been through university in the UK, you’re likely familiar with student loans. While the figure might seem daunting, remember that it’s a form of ‘good’ debt, intended to enhance your future earning potential.

Ensure you’re clear on the repayment terms, which are typically income-based and only kick in once you’re earning over a certain threshold. It’s a bit like having a very patient friend who only wants their money back when you can afford it!

Building Good Credit

While we’re on the topic of debt, let’s talk about your credit score. This little number is a big deal when it comes to borrowing money. It’s like your financial footprint, showing lenders how reliable you are.

Paying your bills on time, not maxing out your credit cards, and not frequently applying for new credit are all ways to boost your score. Check your score annually through UK-based credit reference agencies like Experian, Equifax, or TransUnion.

Investing Early and Wisely

Importance of Investing

Investing is a powerful tool to build wealth, thanks to the magic of compound interest. Albert Einstein didn’t call it the eighth wonder of the world for no reason!

Essentially, it means your money makes more money, which then makes more money. It’s a snowball effect that can result in a hefty pile over time.

Understanding Different Investment Vehicles

Now, investing isn’t just about buying shares in the next Apple or Amazon. That might be a part of it but it certainly isn’t the whole cake.

It encompasses a variety of options, including stocks, bonds, ETFs (Exchange Traded Funds), and mutual funds. Each comes with its own risk and return profile.

A diversified portfolio can help spread the risk. Remember Warren Buffett’s advice: “Never invest in a business you cannot understand.” So, take time to learn about different investment vehicles before diving in.

If you’re interested in investing in ETFs we’ve made a list of the best ETF trading platforms in the UK right now.

Investing in Pension Schemes

While thinking about retirement might seem premature in your 20s, it’s the best time to start.

Contributing to your workplace pension or a Self-Invested Personal Pension (SIPP) can provide a solid foundation for your golden years. Besides, many employers offer pension matching, which is essentially free money!

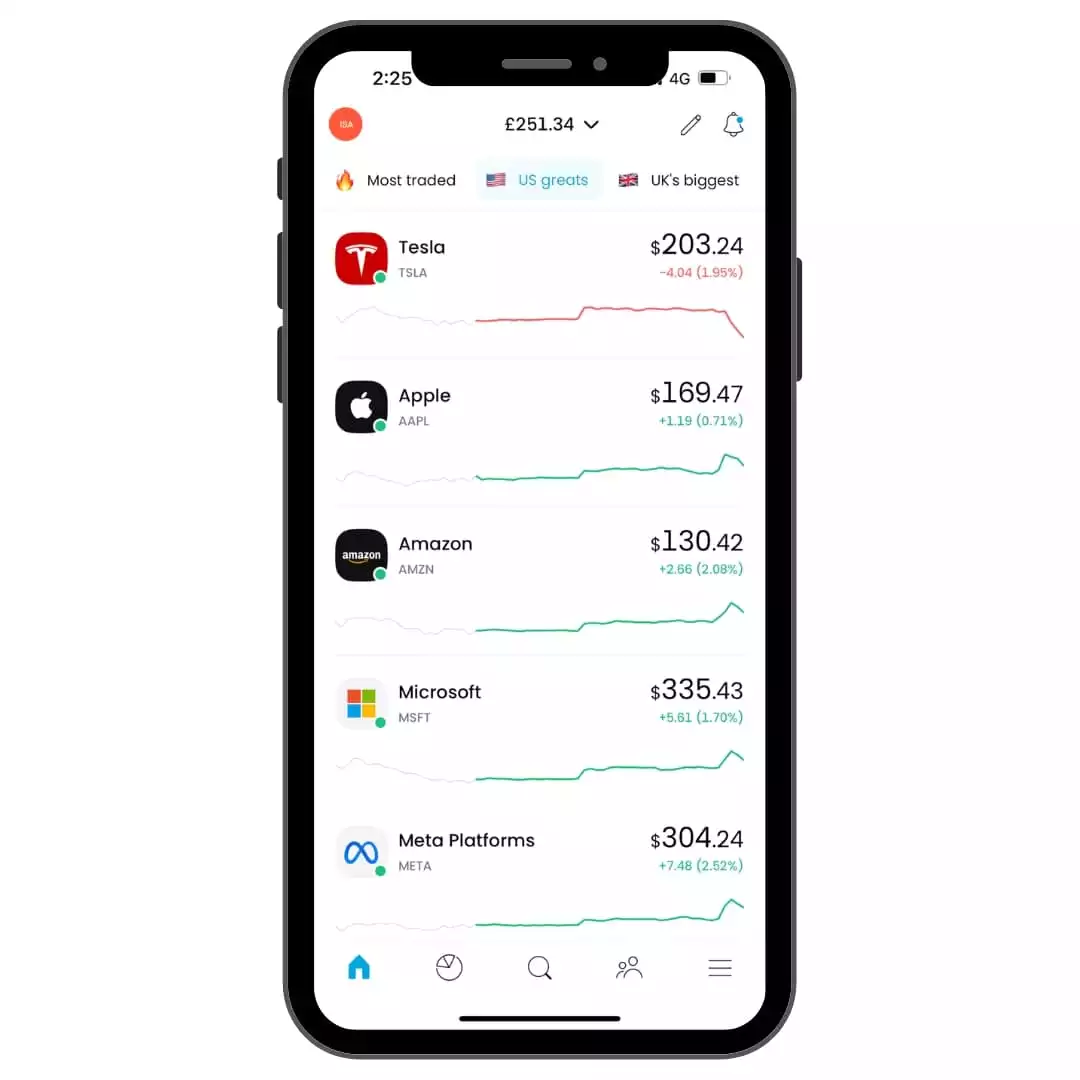

To invest you’ll need an brokerage account or investing app as they’re also known. We’ve made a list of the best ones below.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

The Uniqueness of Investing in Your 20s

Investing in your 20s comes with a unique set of advantages that are worth understanding. Let’s delve into why this stage of your life presents a golden opportunity for wealth creation and the management of risk.

The Luxury of Time

The concept of compound interest is best friends with time. Simply put, the longer your money is invested, the more potential it has to grow.

That’s why investing in your 20s gives you a fantastic runway ahead. Each pound invested now has a chance to grow exponentially over the years.

It’s highly different to building wealth in your 30s for example simply because of time. If you’re building wealth in your 40s you’re taking even less risks.

Time is on your side!

Imagine you’re planning to retire at 65. If you start investing at 25, your investments have 40 years to grow. But if you wait until 35, that’s a decade less of potential growth.

The difference can be substantial. So, the moral of the story? The early bird gets the compound interest worm!

Risk Tolerance and Its Role

Risk is inherent in investing. It’s a bit like the spice in your curry – you need a certain amount to make the meal interesting, but too much can leave you in tears.

Being young often means you’re in a better position to take on more risk. Why? Because you have more time to recoup any losses before you need to access your investments for retirement.

This could allow for a more aggressive investment strategy, potentially leading to higher returns over time.

It’s important to remember, however, that everyone’s risk tolerance is different. While your mate Dave might be comfortable investing heavily in volatile stocks, you might prefer a more balanced portfolio.

Mastering Risk

Taking on risk doesn’t mean throwing caution to the wind. It’s about understanding and managing risk.

Diversification, or spreading your investments across different types of assets, is one way to do this. Think of it as not putting all your eggs in one basket.

Regularly reviewing your portfolio and adjusting your investments based on changes in your life and financial goals is also important.

As you get older, you might want to shift to less risky investments to preserve your accumulated wealth.

Investing in your 20s offers a unique opportunity to harness the power of time and potentially take on more risk. But remember, it’s not just about taking risks; it’s about mastering them.

With a solid understanding of personal finance, the right tools, and a bit of patience, your 20s can be the springboard to long-term financial success.

Sale!

Sale! Investing For Beginners (eBook)

This book gives you everything you need to become a confident investor.

Together we’ll explore the types of investments available, different styles of investing, how to manage risk, common mistakes and how to build a portfolio with any amount.

Diversifying Your Income Streams

Importance of Multiple Income Streams

Putting all your eggs in one basket can be risky. Similarly, relying on a single income stream can be a gamble. Having multiple sources of income can provide financial stability and accelerate wealth building.

Passive Income Ideas

Passive income – the holy grail of financial freedom. It’s money that trickles in with minimal ongoing effort, like rent from a property, royalties from a book, or dividends from shares.

It’s work you do upfront, essentially creating an asset that pays you back over a period of time. Robert Kiyosaki’s “Rich Dad Poor Dad” is a must-read for understanding the power of passive income.

Side Hustles and Freelancing

Fancy turning your passion into profit? A side hustle or freelancing gig can supplement your income while allowing you to do what you love. UK-based platforms like PeoplePerHour can connect you with potential clients.

Property Investment

Buying vs Renting

To buy or to rent, that is the question. Each option has its pros and cons, and the decision should depend on your financial status, lifestyle, and long-term goals.

Understanding the UK Property Market

If you’re considering property investment, understanding the UK property market and buy-to-let opportunities is vital Look for regions with high rental demand and future growth potential, like Manchester or Birmingham.

Rural areas with access into the major cities for me in the biggest untapped market you can find. People love a bit of the country life on the weekends after working hard in the city all week. Myself included!

Financing a Property Investment

Getting a mortgage involves convincing lenders that you’re a safe bet. A steady income, a sizeable deposit, and a good credit score can help you secure a favourable deal.

A mortgage broker can guide you through the process, helping you find the best rates and terms.

Continual Learning and Adaptation

Keeping Up with Financial News

The financial world is a bit like a soap opera – always changing and full of dramatic twists and turns. Staying informed can help you make wise financial decisions.

Regularly checking reputable financial news sources like the Financial Times or BBC Business can keep you in the loop.

Regularly Reviewing and Adjusting Your Financial Plan

Your financial plan isn’t set in stone. Like a good cup of tea, it needs to be adjusted to taste. Major life changes like a new job, marriage, or children can significantly impact your finances.

When such changes occur, revisit your financial plan and adjust as necessary. Annual reviews are also a good practice, ensuring your plan remains aligned with your goals.

Let the latest technology help get you there with the best money savings apps.

FAQs

How to become a millionaire by 25?

Becoming a millionaire by 25 requires a blend of smart investing, entrepreneurial hustle, and financial discipline. Start with a solid understanding of personal finance, then put your money to work through high-return investments, ideally kicking off in your teens.

Strike out on your own by launching a startup or inventing a unique product – high risk, but high reward. Keep a tight rein on your finances, avoiding lifestyle inflation that could drain your resources.

Lastly, don’t forget good old fashioned hard work and a pinch of luck – as rare as a sunny day in London, when it comes, it changes everything!

Is it possible to become rich at 20?

Yes, it’s entirely possible to be rich at 20, although it’s not the norm and usually involves extraordinary circumstances.

For example, tech prodigy Mark Zuckerberg became a billionaire at 23 due to the unprecedented success of Facebook. Similarly, Kylie Jenner leveraged her massive social media following to build a billion-dollar cosmetic empire by the age of 21.

However, these outlier stories of extreme wealth highlight the power of unique ideas, entrepreneurial spirit, and sometimes, the advantage of a well-known family name.

Despite these examples, it’s important to note that building sustainable wealth usually takes time, financial literacy, and disciplined saving and investing habits.

How can I make passive income in my 20s?

Making passive income in your 20s is a smart way to bolster your finances while freeing up time for other pursuits. Here are some ideas:

- Investing in Stocks and Bonds: Purchase shares or bonds and earn dividends or interest over time.

- Real Estate Investment: Buying rental properties can provide a steady stream of income.

- Peer-to-Peer Lending: Platforms like Zopa or Funding Circle enable you to lend money to individuals or small businesses in return for interest payments.

- Creating a Blog or YouTube Channel: If you have a knack for creating engaging content, ad revenue and sponsorships can be a great source of passive income.

- Writing a Book or E-book: Once your book is available for purchase, every sale generates income.

- Affiliate Marketing: Promote products or services on your website or social media platforms and earn a commission on any sales made through your referral links.

- Creating an Online Course: If you’re knowledgeable in a specific area, you can create and sell online courses.

- Developing an App: If you have coding skills, creating a successful app can generate a significant income.

Conclusion

Building wealth in your 20s is more of a marathon than a sprint. It requires patience, discipline, and a good sense of humour when things don’t go exactly as planned.

Start early, stay consistent, and before you know it, you’ll be on your way to financial freedom.

References

For further reading, consider “The Total Money Makeover” by Dave Ramsey and “Your Money or Your Life” by Vicki Robin. The Money Gains Podcast – our weekly podcast is also a great place to learn.

Remember, knowledge is power – especially when it comes to building wealth. Happy saving, investing, and earning, chums!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.