Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

In your 40s, it’s prime time to secure your financial future by assessing your current standing, setting well-defined short and long-term goals, smartly managing debts, diversifying income streams, and making calculated investments.

Compared to the risk-prone playground of your 20s and 30s, your 40s offer higher income and stability but require shrewder decisions due to limited time and increased responsibilities.

Periodic reviews, adjusting to life’s ever-changing script, not hesitating to seek professional financial advice when needed and understanding your retirement savings goal will steer you towards a prosperous future.

Welcome to the prime time of your life – your 40s! This stage is often where you’ll find yourself asking big questions and making significant decisions in your financial life.

Whether you’re a financial newbie or a seasoned player, this guide will navigate you towards the path of financial independence.

I know first-hand what it’s like having that moment when you realise retirement is probably closer than your teens but it’s totally fine as long as you’re here addressing it now!

Table of Contents

How to build wealth in your 40s?

Building wealth in your 40s is vital. However, the best way to build wealth at 40 is debatable.

It will depend on many varying factors such as dependants, financial situation and debts etc.

Your retirement savings should have been slightly built up from your workplace pension in your 20s and 30s, but if you really want to achieve financial freedom before the average retirement age of 65 then this is crunch time.

I don’t want to put the pressure on but time is everything so let’s get into how you can maximise your estate plan and learn how to build wealth in your 40s.

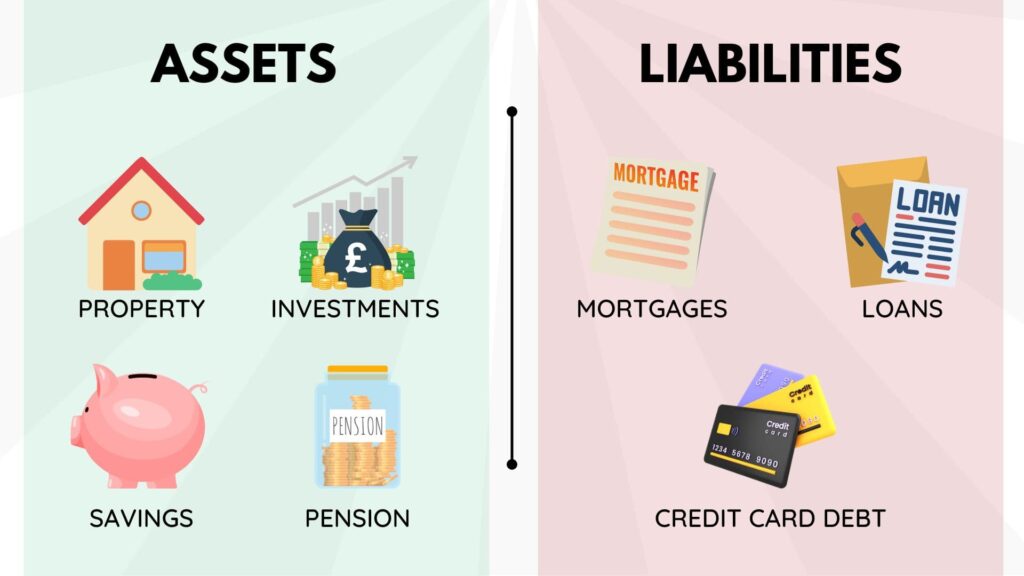

Understanding Your Current Financial Position

Before we get into the nitty-gritty, it’s essential to gauge where you stand financially. The cornerstone of any financial plan is a solid understanding of your assets and liabilities.

Evaluating Your Assets

Your assets include everything you own that has financial value. At this point in your life, they might include:

Property: According to the ONS, over 63% of people in the UK own their homes. If you’re part of this percentage, remember that a property’s value can be a significant portion of your net worth.

Savings: This could be cash in your bank account, term deposits or other short-term liquid assets. The average savings in the UK varies hugely by age but by 40 you should look to have £15,000+ stashed away. (Don’t panic if you don’t – today is the day to make that change)

Investments: These might be stocks, bonds, mutual funds or real estate investments.

Pension: Your pension pot is a vital part of your assets, ensuring you have income during retirement.

Analysing Your Liabilities

On the flip side, we have liabilities – everything you owe. This could include:

Mortgages: In the UK, the average mortgage debt stands at £137,934 as of 2022.

Loans: This can be personal loans, car loans, education loans.

Credit card debt: The average credit card debt per household in the UK was £2,595 in 2022.

The goal here is to give you a snapshot of your net worth (assets – liabilities), providing a foundation for the next steps in your wealth-building journey.

Setting Your Financial Goals

After evaluating your current financial position, it’s time to determine your goals. Goals are like the North Star in your financial journey; they guide you in the right direction and give you a clear focus.

There are generally two categories of financial goals – short-term and long-term.

Short-Term Financial Goals

Creating an emergency fund: Having an emergency fund means setting aside money that is easily accessible for unexpected expenses – this could be anything from an urgent car repair to unexpected healthcare costs. In your 40s, as responsibilities mount, having an emergency cushion can be the difference between a minor financial inconvenience and a catastrophe.

Paying off a specific debt: Whether it’s that lingering credit card bill or a personal loan, paying off a debt can provide relief and a sense of achievement. It’s about picking a target and knocking it down, which can also improve your credit rating!

Saving for a holiday or a car: Sometimes it’s the smaller joys in life that can keep us motivated. Maybe it’s that trip to the Maldives you’ve always dreamed of, or a new car to replace the old one. Saving towards these goals not only ensures you don’t slip into debt but can be a great motivator in your overall wealth-building journey.

Long-Term Financial Goals

Paying off your mortgage

For most people, this is the most significant debt of their lives. Can you imagine the feeling of making that last mortgage payment?

It’s not just about saying goodbye to a monthly instalment, but also potentially freeing up a significant portion of your income. In your 40s, this can become an increasingly achievable and attractive goal.

Building a sizeable retirement nest

Though it might seem far off, retirement has a habit of sneaking up on us. Building a sizeable nest egg is crucial.

According to a report by Pension Works, you need a pension pot of approximately £300,000 for a comfortable retirement in the UK.

Start asking yourself questions like ‘What kind of lifestyle do I want in retirement?’.

Your 40s are a great time to ramp up pension contributions, especially as you’re likely to be in some of your peak earning years.

Funding your child’s education

With the cost of university education on the rise, funding your child’s education requires planning and saving.

The average cost for an undergraduate degree in the UK can be over £9,000 per year. Consider opening a savings account or investing in a Junior ISA to build a fund for your child’s education.

Remember, these goals aren’t set in stone and will evolve with your life circumstances. The important thing is to have them, to begin with. They serve as a compass that guides your financial decisions and keeps you focused on what you truly want to achieve.

Crafting Your Wealth-Building Strategy

With a clear understanding of your current situation and goals, it’s time to develop a game plan.

Building an Emergency Fund

An emergency fund is a financial safety net. Money Advice Service recommends saving three months’ worth of expenses as a good starting point.

That being said, a lot of other experts recommend up to 6 months so what I suggest is looking at your other income streams and assessing what you feel comfortable with.

Paying Off High-Interest Debts

High-interest debts such as credit card debts can significantly hamper your wealth-building process. Consider strategies such as debt snowball or debt avalanche methods to tackle this issue.

How To Invest In Your 40s

Investing in your 40s is a pivotal stage in financial planning. It’s a time when you should assess your current financial landscape and make calculated moves to ensure your investments align with your long-term objectives.

Here are some tailored strategies for financial planning in your 40s:

Individual Stocks: Part of a robust investment portfolio could include individual stocks from the FTSE 100 or S&P500, which offer the potential for growth as you monitor the performance and make adjustments in line with your financial goals.

Index Funds: When considering investing in your 40s, index funds present a strong case for inclusion due to their diversified nature and lower costs, contributing to a balanced and strategic approach to wealth accumulation.

Property: Within the framework of financial planning in your 40s, the property market in the UK can provide a stable investment channel, appealing for its dual benefits of potential rental yields and capital growth.

Bonds: Tailoring your investment towards bonds can add a layer of security to your portfolio, essential for sound financial planning in your 40s.

Pensions: Ensuring that your pension is on track is a cornerstone of financial planning in your 40s, as it’s crucial to maximise these years for compounding your retirement savings.

ISAs: Utilising Stocks and Shares ISAs should form part of your strategy when investing in your 40s, thanks to their tax-efficient status, aligning to maximise returns while minimising tax liabilities.

Peer-to-Peer Lending: As part of a diversified investment approach in your 40s, peer-to-peer lending platforms might be considered to potentially enhance your investment portfolio’s yield.

The key to investing in your 40s is a balance between risk and security, reflecting an informed and strategic approach to financial planning.

Always consider diversifying your investments to spread risk and consult with a financial adviser to tailor your portfolio to your specific needs and goals.

This decade is critical, as it offers the opportunity to significantly impact your financial comfort in later life.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Increasing Your Income Streams

Having multiple income streams provides extra financial security and can accelerate wealth accumulation.

Essentially upping your game so you have more money coming in and have income-producing assets that you can leverage.

Here are a few options:

- Freelancing or Consulting: If you’re proficient in a particular field such as marketing, design, IT, or even project management, you could offer your services as a freelancer or consultant. This can be a great way to use your skills to earn more money, and it offers the flexibility to work on your own terms.

- Investment Income: Investing in your 40s with dividend-paying stocks or bonds can be an excellent way to build wealth and provide you with a steady stream of income. This strategy requires understanding the market and should align with your overall risk tolerance and investment goals.

- Rental Properties: Renting out property can be one of the more passive income streams, especially in high-demand areas. However, it’s important to note that being a landlord comes with responsibilities like property maintenance, tenant issues, and understanding property law.

- Peer-to-Peer Lending or Crowdfunding: Online platforms enable you to lend directly to individuals or businesses in return for interest payments, offering an alternative way to earn income. Crowdfunding involves funding a project or venture by raising small amounts of money from a large number of people and can sometimes offer financial returns.

- Online Business: E-commerce has exploded in recent years. Setting up an online store or offering a digital product or service can become a profitable venture. It could be something as simple as selling handmade crafts or offering online courses in a subject you’re well-versed in.

- Royalties from Creative Works: If you’re creatively inclined, you could earn royalties from books, music, photography, or digital designs. With the proliferation of digital platforms, it’s become easier to self-publish your works and earn a share of the profits.

When comparing wealth-building strategies across different life stages, it’s important to recognise that each decade comes with its unique opportunities and challenges.

The Financial Landscape in Your 20s and 30s

Building wealth in your 20s and 30s, you’re often at the beginning of your career, maybe single or just starting a family, and generally have fewer financial burdens.

Risk Tolerance: At this stage, you have time on your side, which allows you to take more risks. The theory is that if an investment tanks, you have more years ahead to recoup those losses. People often invest in riskier assets like stocks which, while volatile, can offer higher returns.

Investment Horizons: You have a longer runway before retirement. This allows for a strategy that can afford to play the long game – you can invest in assets that may take longer to mature, knowing that you have time to wait them out.

Financial Responsibilities: Generally, you might have fewer financial responsibilities. Without a mortgage or family to support, you can afford to save and invest a higher percentage of your income.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Advantages of Wealth Building in Your 40s

As you enter your 40s, your career is likely in full swing, you might have a family, and you might be more established in your financial life.

Higher Income: According to the Office for National Statistics, in the UK, people in their 40s earn on average 53% more than those in their 20s. This can be due to career progression, promotions, or multiple streams of income. This extra income can be a powerful tool in wealth-building if utilised wisely.

Financial Stability: In your 40s, you’re likely to have built a financial foundation. This stability can afford you the confidence to make investments or financial moves that you wouldn’t have considered a decade ago.

Better Financial Decisions: The mistakes and successes of your 20s and 30s have taught you valuable lessons. These experiences often lead to more informed, and therefore better, financial decisions.

Challenges and Strategies for Wealth Building in Your 40s

However, it’s not all rosy in your 40s, there are some unique challenges as well.

Limited Time: The clock starts ticking louder. There’s less time for your investments to grow, which might necessitate a more conservative approach compared to your earlier years.

Higher Expenses: Family expenses, mortgage payments, and perhaps even supporting aging parents can mean that despite earning more, you have higher outgoings. This is where having a well-thought-out budget becomes essential.

So your 40s should be about optimising the opportunities that come with higher income and financial stability while adapting your strategies to address the challenges of limited time and increased expenses.

It’s a juggling act but with informed decisions and perhaps some professional advice, it can be the decade that sets you up for long-term financial success.

Regular Review and Adjustments

Constant change is a fact of life, and your financial plan should evolve with it. Everyone will have different financial priorities and that’s totally fine, it’s knowing what they are and reviewing them!

Importance of Regular Financial Reviews

Stay on Track: Regular reviews ensure you are on track to achieve your financial goals. Assess your spending habits and make sure you’re still in line with your goals.

Adapt to Life Changes: Marriage, children, career changes, inheritance, living expenses, health insurance, all these can affect your financial plan.

Adapting to Changes

Adjusting Investments: Your investment portfolio may need rebalancing to match your changing risk tolerance.

Reviewing Goals: As life changes, your goals might too. Maybe early retirement becomes a priority.

Leveraging Professional Financial Advice

Sometimes, it’s wise to seek the counsel of a professional.

When to Seek Professional Advice

Complex Financial Situations: If your financial situation is complicated, it might be beneficial to get professional advice.

Lack of Expertise: If you aren’t comfortable making financial decisions on your own.

Choosing the Right Financial Advisor

Certifications and Credentials: Look for credentials such as Chartered Financial Planner (CFP).

Fiduciary Duty: Make sure the advisor has a fiduciary duty, meaning they have your best interests at heart.

Conclusion

Your 40s represent a dynamic chapter in your financial narrative. With typically higher earnings, a wealth of experience, and often greater financial obligations, this decade is critical for building wealth at 40 and making astute investment choices.

The ultimate aim is to bolster your nest egg and expand your retirement portfolio to a level where it can sustain your future lifestyle.

Building wealth for retirement transcends mere numbers; it’s about crafting the lifestyle you envision for your post-working years. Establish your financial targets, devise a plan that’s flexible enough to evolve with your changing circumstances, and never hesitate to seek expert advice.

In pursuing the best investments in your 40s, consider options that strike a balance between immediate income generation and long-term capital growth. This is not just about how to make money in your 40s, but also about ensuring these funds can support you down the line.

Strategically navigating your 40s can set a solid foundation for the retirement you aspire to, so take this time seriously and make your investments count.

RESOURCES:

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.