Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Cash ISAs and Stocks and Shares ISAs are the two most popular types of ISAs available. They are both fantastic products but very different in how they work and the potential returns they provide.

ISAs, also known as individual savings accounts, are government-supported and aimed at helping you save and invest tax-free.

This ISA guide will show you how Cash ISAs are fantastic for short-term savings and deliver decent returns.

But, if you want to take a few more risks to invest your money, then the returns you can make with a Stocks and Shares ISA can be more significant.

Don’t panic though. Investing is easier than it is made out to be these days, and we’ll show you why.

Table of Contents

Cash ISA vs Stocks and Shares ISA - What's the difference?

Put simply, the only difference is how your money is used inside an ISA.

With a Cash ISA, you earn interest similar to your standard savings account, although there are many types (which we’ll explain in a sec).

But, with a Stocks and Shares ISA, your money is invested, and you may or may not have returns depending on your chosen investments. With this account, it’s crucial to invest wisely so you can create returns for the long term.

Both, however, are free from capital gains tax meaning the interest or the gains you create from either account are tax-free!

Spoiler alert: The returns you generate on average over five years or more from a Stocks and Shares ISA vastly outweigh those you can expect from the average Cash ISA.

The average returns for Stocks and Shares ISA have been 9.67% a year. If you invest £10,000, you could get an estimated £967 a year back vs £150 from a 1.5% Cash ISA.

The difference being one is at risk of losing money, whereas interest from Cash ISAs is primarily fixed. Read on to find out more about each ISA.

What is a Cash ISA?

A Cash ISA is a tax-wrapped savings account. There is no more to it than that. You save money as you do in a typical savings account, the only difference being you’re not liable for tax on any interest you receive.

On a standard savings account, you can receive up to £1000 a year tax year, and then you are subject to income tax, which can be pretty high if you’re in a higher bracket.

The differences in Cash ISAs come in the amount of interest and when you can and can’t remove your money.

Different types of Cash ISAs:

- Instant – you have access to your money at all times. These accounts generally pay the least due to flexibility. The rates you can expect would be between 0.6% – 1.5%.

- Flexible – this type allows you to withdraw money and put it back in the same tax year without affecting your ISA allowance of £20,000. Unfixed ISAs mean if you take money out and put it back in within the same tax year, it all contributes to your allowance.

- Fixed – You agree to put your money away for a period of time such as a year or 5 years (each account varies). The longer you lock it away for the higher interest rate you receive. The rates you can expect would be between 1% – 4.65%.

- Variable – the interest you receive will change with the base rate provided by the Bank of England. When interest rates are low these accounts aren’t worth bothering with but if they’re high then it could be a good place to put your money.

Even with the Bank of England changing rates faster than I change my draws at the moment, interest rates tend not to fluctuate in Cash ISAs much at all (unless you go for a flexible account).

A recent study by MoneyFarm, a popular investment platform, showed that interest rates in Cash ISAs only fluctuate by 0.08% a year on average over ten years.

Pros Cash ISA:

- Tax-free contributions up to £20,000 a year

- Interest over £1000 is tax free

- Increases savings habits

- They are excellent places to hold your emergency funds

- You can have multiple Cash ISAs

- Safety – The FCA regulates accounts

- No risk

- A spouse can inherit the money without it affecting their own ISA allowance

Cons Cash ISA:

- Inflation can outpace the returns

- Low returns in general when compared to the average Stocks and Shares ISA

- Most of the country earns less than £1000 in interest per annum meaning tax is not an issue

- Returns are fixed

What is a Stocks and Shares ISA?

A Stocks and Share ISA is a tax wrapper, and it’s an account that allows you to purchase assets from the stock market in the form of shares. Like a Cash ISA you can also put £20,000 a year in tax free.

Now, if you still need to get a Stocks and Shares ISA, you should open one today. It’s simple, and they are your exit vehicle for tax-free income and wealth.

Anyone can set one up, and often with the support of fantastic organisations that charge very little to help you invest in the right businesses.

There are self-invested Stocks and Shares ISAs where you have more choice over your investments but if you’re starting out, let a professional do it for you. More on this in a little while.

You are subject to capital gains tax if you buy stocks outside of an ISA in a general investment account. Essentially without an ISA, the more you earn from investing, the more Westminster takes off you!

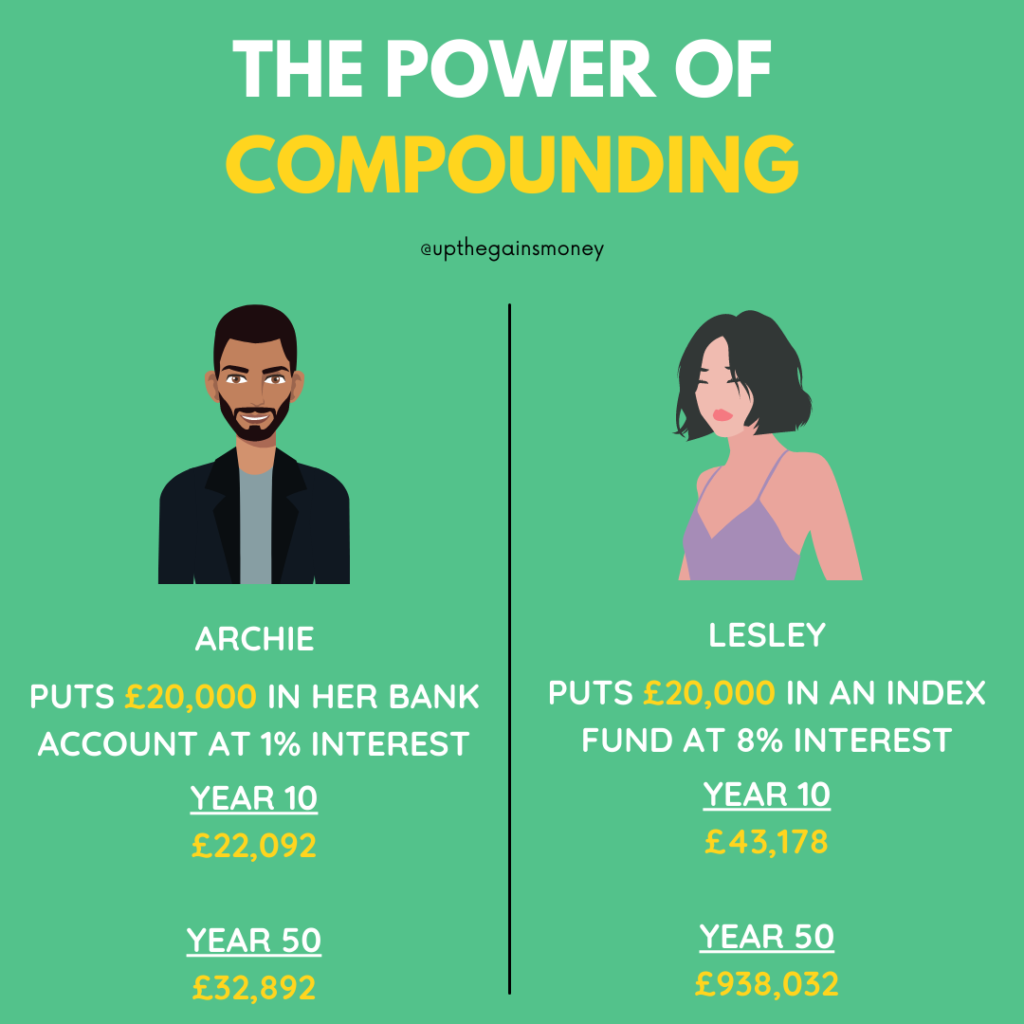

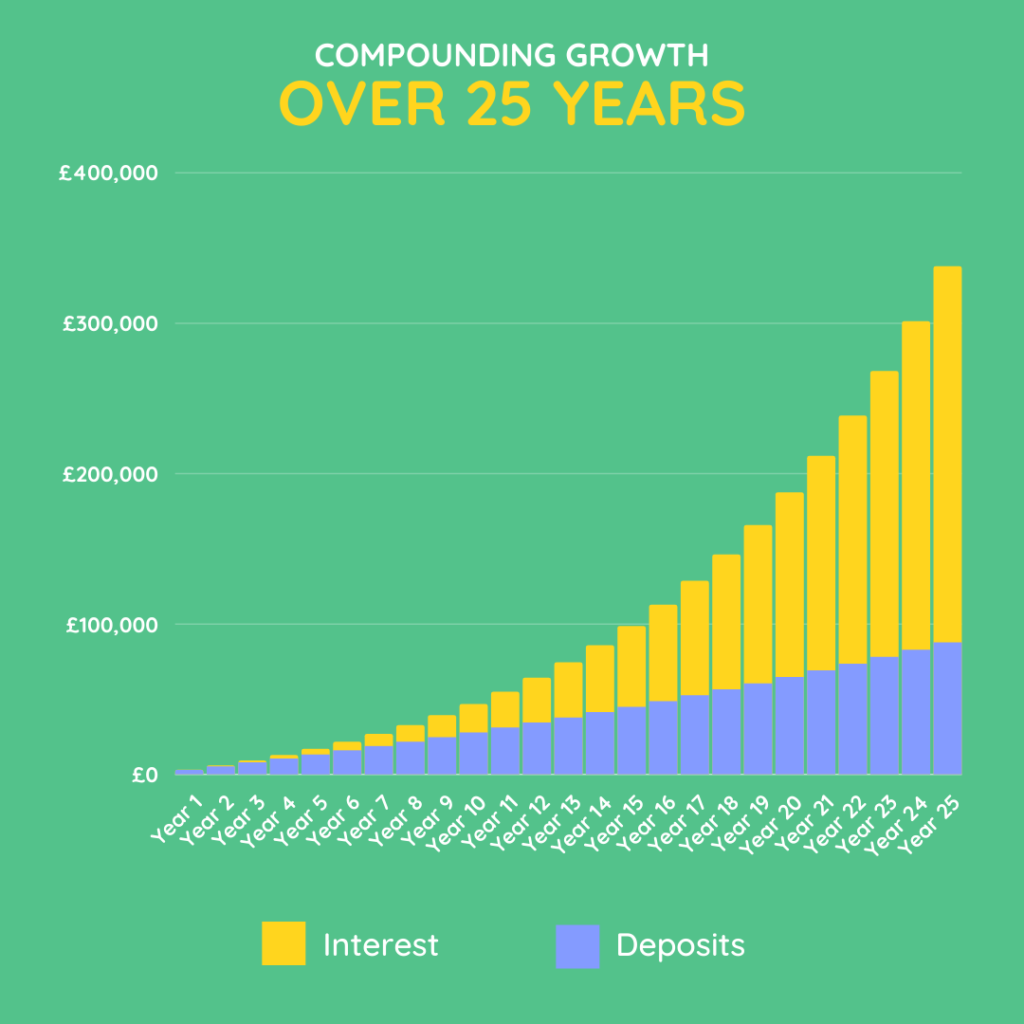

The beauty of the Stocks and Shares ISA is the gift of time. As your money grows and you re-invest, it begins to spiral like a snowball gathering snow as it rolls down a hill, getting bigger and bigger.

This is called compound interest and it is your best friend.

Trading 212 provides access to over 10,000 stocks, funds, ETFs and investment trusts.

They offer commission-free trading and their auto investing feature is excellent.

OUR OFFER - GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH OUR LINK

- Commission free trading

- Earn interest on uninvested cash

- Fantastic mobile app

- Award winning ISA

- No personal pension

How does a Stocks and Shares ISA work?

I can hear you saying but what is investing and how does an average joe like me even start thinking about stocks and shares.

Well, fear not. Most ISA providers will have investment funds pre-made to suit a person’s risk tolerance and investment preferences.

When you open an account, they take you through a series of questions and set you up with suitable funds.

These funds will be a mixture of stocks, ETFs (exchange traded funds), ethical ISA funds, bonds and property. Each fund will be different, and you can easily find out what’s in them.

How many Stocks and Shares ISAs can I have? Technically there is no limit to the amount of ISAs you can have but you can only contribute to one each tax year.

More information about this can be found in our extended Stocks and Shares ISA article.

Pros for a Stocks and Shares ISA

- Tax-free contributions of up to £20,000 a year

- Unlimited returns

- You can withdraw your money

- Diversifies your investments and savings

- Safety – Accounts are regulated by the FCA up to £80,000

- A spouse can inherit the money without it affecting their own ISA allowance

Cons for a Stocks and Shares ISA

- You can get back less than you put in

- Volatility in the stock market means returns vary

- No tax-relief contributions – meaning you can’t pay money in that hasn’t been subject to tax

- Charges and fees to hold investments (variable)

What type of Stocks and Shares ISA do I choose?

We’ve touched on it briefly, but there are just two types of Stocks and Shares ISA to choose from. These are:

Self-invested

These types of ISAs give you full control. You decide what to buy and sell, when, and how much for.

This option is great if you know what you’re doing and are willing to put time and effort into researching new investment opportunities. It does, however, mean it’s all on you.

If you’re new to investing, I wouldn’t start here. I would go into a managed fund, learn all I can and slowly transition into self-invested.

Expert Managed

This option is perfect for beginner investors as you rely on experts with lots of experience and skin in the game. You can put your money in and let someone else take care of it.

The fees here can be slightly higher than self-invested, but you get what you pay for at the end of the day.

Robo-advisors (AI-managed services) would also fall into expert managed because even though an algorithm manages the initial question and answer process, someone is still choosing what goes into the funds it spits out.

Can you have multiple Stocks and Shares ISAs?

From April 2024 for the new tax year the Chancellor has shaken things up. You can now open as many ISA types as you like as long as you stay within the 20k ISA allowance.

This changes things and allows customers to have a wide array of choices plus go for new customer offers / benefits with multiple providers.

Personally, I see this as a good move but I won’t be having more than 2 or 3 accounts as it’ll just get too difficult to manage.

Trading 212 provides access to over 10,000 stocks, funds, ETFs and investment trusts.

They offer commission-free trading and their auto investing feature is excellent.

OUR OFFER - GET A FREE SHARE WORTH UP TO £100 WHEN YOU DEPOSIT £1 WITH OUR LINK

- Commission free trading

- Earn interest on uninvested cash

- Fantastic mobile app

- Award winning ISA

- No personal pension

Can I have Cash ISA and Stocks And Shares ISA?

If you want to build wealth long term and outpace inflation, then a Stocks and Shares ISA is likely the better move.

That being said, Cash ISAs have a lot of benefits, and we always believe that keeping your options open is essential.

Cash ISAs are great for short-term savings and money you may need to access in the next year to five years. Don’t expect them to make you rich because they won’t.

Over the past 30 years, the stock market has risen 10.6%, so you can see the difference immediately.

Can I have Cash ISA and Stocks And Shares ISA?

I personally have both a Cash ISA and a Stocks and Shares ISA.

Why? Well, our household emergency fund is placed in a flexible Cash ISA, and our savings pot is placed in a fixed Cash ISA (this isn’t much).

I want access to my money if something goes horribly wrong like a car breaks down or my roof is struck by lightning. This is the flexible Cash ISA.

Our savings pot is just a hedge or protection should the entire stock market crash and burn. This is placed in a five-year fixed ISA so we can get maximum interest.

Everything else is placed inside a Stocks and Shares ISA as we want long-term gains and the benefits of compound interest give you if you regularly contribute to your account.

Our short-term goal is to have access, and our long-term goal is to have financial freedom.

What about inflation?

Inflation is the rise of prices in our everyday living costs. Essentially all the essential stuff like food, energy, petrol, clothes, you name it – it all increases over time with inflation.

On average, inflation increases around 2.6% a year, so if you’re receiving interest that’s lower than this, your money is decreasing in value.

That’s why it’s so important to have a long-term plan, invest, and look to beat inflation’s ugly head over a number of years.

You do this by opening a Stocks and Shares ISA and putting in as much money as possible for your future self. Every time you invest, you buy yourself a day to enjoy later in life.

FAQs

Can you have both a Cash ISA and stocks and shares ISA?

Yes, you can have both. Your contributions to both account types will go towards your £20,000 ISA allowance. Experts suggest having both for short term and long term goals.

Are Cash ISAs safer than a Stocks and Shares ISA?

Cash ISAs are much safer than a Stocks and Shares ISA. This is because Cash ISAs have fixed returns and a Stocks and Shares ISAs returns are variable due to price changes on the stock market. Both, however, are protected by the FCA up to £80,000.

Is it worth having an ISA in 2023?

Absolutely it is. It would be best if you had both a Cash ISA and a Stocks and Shares ISA as part of a solid financial plan. Use your Cash ISA for short-term savings goals and your Stocks and Shares ISA to work towards financial freedom.

Stocks and Shares ISA vs Cash ISA - Conclusion

Depending on what you use it for, both Cash ISAs and Stocks and Shares ISAs have their uses.

If you want safety and access in the short term, open a Cash ISA and invest in a Stocks and Shares ISA when you want to think about your future.

Stop worrying about the risks and get investing right away. You can open an ISA with some of the top providers for as little as £1, and even if that’s all you contribute each month, it’s better than nothing.

Over time compound interest will kick in, and you’ll be making money on the initial interest every year.

MORE LIKE THIS

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.